Many large companies have separate divisions. In the process of activity, various situations arise when branches, representative offices and other “separate units” change their location. Such a change is subject to state registration and in order to make it, the organization must follow a certain procedure.

The process for making changes depends on the specific type of separate unit. One procedure applies for representative offices and branches, and another for other types of separate divisions. This procedure is regulated by the provisions of federal laws No. 14-FZ of 02/08/1998 “On Limited Liability Companies”, No. 129-FZ of 08/08/2001 “On State Registration of Legal Entities and Individual Entrepreneurs”, the Tax Code of the Russian Federation, as well as by-laws - by order of the Ministry of Finance Russia on the approval of Administrative Regulation No. 169n dated September 30, 2016. Let’s consider how the address of a separate division is changed, and the company’s procedure for doing so.

How the rules for registration at the location of separate divisions have changed

A new division is opening

Let us recall that in accordance with the previous edition of Articles 23, 83 and 84 of the Tax Code of the Russian Federation, several actions were required to be taken to register at the location of any separate unit. Namely: within one month, inform your inspection about the opening of a new unit (form No. S-09-3, approved by order of the Federal Tax Service of the Russian Federation dated April 21, 2009 No. MM-7-6 / [email protected] ). Within the same period, submit to the Federal Tax Service at the location of the new unit an application for registration (form No. 1-2 Accounting, approved by order of the Federal Tax Service of the Russian Federation dated December 1, 2006 No. SAE-3-09 / [email protected] ). Among other things, the application was required to include documents confirming the creation of the unit.

Thanks to the amendments, companies will no longer have to take actions that the tax authorities themselves can perform. Thus, according to the new rules, registration of a company at the location of the branch or representative office must occur without its participation. The organization is only required to make the necessary changes to the Unified State Register of Legal Entities. Let us remind you that according to the Federal Law of 08.08.01 No. 129-FZ on registration, tax authorities must be informed about the creation of a new branch or representative office within three working days (Clause 5, Article 5 of Law No. 129-FZ). After this, the inspectors themselves must register the company at the location of the branch or representative office based on data from the Unified State Register of Legal Entities (clauses 3, 4, article 83, clause 2, article 84 of the Tax Code of the Russian Federation *). Additionally, you do not need to notify your tax office about the opening of a branch or representative office (subclause 3, clause 2, article 23 of the Tax Code of the Russian Federation).

If an organization creates another separate division (not a branch or representative office), the inspectorate with which the company is registered must be informed about this within a month (Clause 2 of Article 23 of the Tax Code of the Russian Federation). Based on this message, tax authorities must register the company at the location of the unit within five working days (clause 4 of article 83, clause 2 of article 84 of the Tax Code of the Russian Federation). In this case, inspectors do not have the right to demand any other documents.

Let us note that the new version of paragraph 1 of Article 83 of the Tax Code of the Russian Federation obliges companies to register for tax purposes at the location of each separate division. Previously, this was not required if the company, for some other reason, was already registered with the inspectorate to which the new division belonged.

Let us mention one more addition. It concerns the case when a company has several separate divisions in one municipality. In such a situation, the organization can register at the location of one of them. The law being commented on clarified that a company must submit a notification of its choice to the inspectorate at the location of its head office (Clause 4 of Article 83 of the Tax Code of the Russian Federation).

The address of the department and other information changes

Until now, changing the address of a separate division meant the emergence of a new problem for an accountant. Since the Tax Code did not stipulate the procedure for “re-registration” of separate divisions, inspectors demanded that the division be first deregistered at the old address and then registered at the new address. And this had to be done even if the unit moved within the territory under the jurisdiction of the same tax office (letter of the Ministry of Finance of Russia dated June 18, 2010 No. 03-02-07/1-282).

Now the procedure will be significantly simplified. If the address of a separate division that is not a branch or representative office changes, it will be sufficient to inform the Federal Tax Service Inspectorate at the location of the company. This must be done within three working days (subclause 3, clause 2, article 23 of the Tax Code of the Russian Federation). Based on this message, tax authorities will make changes to their databases and, if necessary, will register the company at the new location of the unit (clauses 3, 4 of Article 84 of the Tax Code of the Russian Federation). Please note that it is necessary to notify tax authorities not only about a change in the address of a separate division, but also about changes in other information contained in the message about the creation of a division (name of the division, details of the head, contact information, etc.).

As for changing the address or other information about a branch or representative office, then, as in the case of the creation of such divisions, inspectors will take all the data they need from the Unified State Register of Legal Entities. The company is only required to submit an application to update the information in this state register on time. Additionally, there is no need to report a new branch address or changes in other data in accordance with Article 23 of the Tax Code of the Russian Federation. Based on the information entered into the Unified State Register of Legal Entities, tax authorities will deregister the company at the previous address of the branch and register it with the inspectorate at the new address of this division (clauses 3, 4 of Article 84 of the Tax Code of the Russian Federation).

Separate division is closing

If an organization decides to close a separate division (including a branch or representative office), it will need to be reported to the tax authorities within three working days (subclause 3.1, clause 2, article 23 of the Tax Code of the Russian Federation). This period is counted from the date of the decision to terminate activities through a branch or representative office. And if another separate division is closed, then the period is counted from the day when it actually stopped working. The message is submitted to the inspectorate at the location of the head office. The Tax Code does not require any additional documents to be attached to such a message.

The legislator did not specify when the tax authorities will deregister the company at the location of the former branch or representative office. But this will not happen before the corresponding changes are made to the Unified State Register of Legal Entities, and not before the on-site audit of the company is completed (if the tax authorities decide to conduct one).

The period during which tax authorities must deregister a company at the location of another separate division has not changed. It is 10 working days from the date of receipt of the message about the closure of the unit, but can be extended if the tax authorities organized an on-site audit (clause 5 of Article 84 of the Tax Code of the Russian Federation).

Note that previously the deadline for informing tax authorities about the liquidation of any division was one month (previous wording of subclause 3, clause 2, article 23 of the Tax Code of the Russian Federation). But at the same time, it was also necessary to submit an application to deregister the company at the location of the closed division.

Messages can be sent electronically

Please note there is an important change regarding the reporting of detached units (meaning all reports mentioned in this material). According to the new rules, such information can be transmitted in three ways: by submitting it in person; send by regular mail by registered mail; transmit electronically via telecommunication channels. In the latter case, the document is signed with an electronic digital signature of the person who sent the information or his representative (Clause 7 of Article 23 of the Tax Code of the Russian Federation).

New forms and formats of messages, as well as the procedure for sending them, must be adopted by the Federal Tax Service. Drafts of these documents are posted on the official website of the Federal Tax Service of Russia, however, there is no information about their official approval yet.

*Here and below, new editions of articles of the Tax Code of the Russian Federation are indicated.

Changing the address of a separate division within one tax office

The legislation clearly states that a change in the address of a legal entity or its separate divisions must be registered by an authorized government agency. Therefore, a change in the location of a separate division, even within the territory under the jurisdiction of one tax inspectorate, entails the need to notify the Federal Tax Service. This requirement also applies if the head office and a separate division fall under the competence of one territorial division of the tax service.

At the same time, in practice there are situations when such notification is not required. For example, information about a branch indicates only the building number, without indicating the specific premises where the branch is located. In this case, moving to a new premises within the same building does not entail the need to declare changes to the tax office.

Documents on changing the address of a separate division are submitted directly to the tax service division at the place of registration of the organization, or are sent there via telecommunication channels, or by registered mail.

Changing the address of a separate division - the procedure for calculating income tax

Tax returns continue to be compiled for a separate division on a cumulative basis from the beginning of the year

02/10/2020Russian tax portal

Prepared answer:

Expert of the Legal Consulting Service GARANT

auditor, member of RSA Elena Melnikova

The answer has passed quality control

The separate division changed its address in the middle of the year; the division was not closed. How to correctly calculate income tax for this division?

On this issue we take the following position:

Since in the situation under consideration there was a change in the location of the separate division, and not its closure or liquidation, tax returns continue to be compiled for the separate division on an accrual basis from the beginning of the year.

Justification for the position:

If an organization has separate divisions (hereinafter also referred to as OP), payment of income tax (including advance payments) is carried out in accordance with Art. 288 Tax Code of the Russian Federation.

Based on paragraph 1 of Art. 288 of the Tax Code of the Russian Federation, organizations that have an OP, calculate and pay the amounts of advance payments to the federal budget, as well as the amounts of tax calculated based on the results of the tax period, at their location without distributing the indicated amounts according to the OP.

Payment of advance payments, as well as tax amounts subject to credit to the revenue side of the budgets of the constituent entities of the Russian Federation, is made by Russian organizations at the location of the organization, as well as at the location of each of its OPs based on the share of profit attributable to these OPs, defined as the arithmetic average the share of the average number of employees (labor costs) and the share of the residual value of the depreciable property of this OP, respectively, in the average number of employees (labor costs) and the residual value of the depreciable property, determined in accordance with paragraph 1 of Art. 257 of the Tax Code of the Russian Federation, in general for the organization (clause 2 of Article 288 of the Tax Code of the Russian Federation, see also letters of the Ministry of Finance of Russia dated 01/23/2017 N 03-03-06/1/3007, dated 02/01/2016 N 03-07-11/4411 , dated 05/19/2016 N 03-01-11/28826).

In accordance with paragraph 1 of Art. 289 of the Tax Code of the Russian Federation, taxpayers, regardless of whether they have an obligation to pay tax and (or) advance payments for tax, the specifics of calculation and payment of tax, are required, at the end of each reporting and tax period, to submit the relevant tax documents to the tax authorities at the place of their location and the location of each OP declarations in the manner prescribed by this article.

The organization, which includes the OP, at the end of each reporting and tax period, submits to the tax authorities at its location a tax return for the organization as a whole, with distribution among separate divisions (clause 5 of Article 289 of the Tax Code of the Russian Federation).

Advance payments for income tax, calculated based on the results of the reporting period (first quarter, half-year, nine months of the calendar year), and income tax, calculated based on the results of the tax period, are paid to the budget of the constituent entity of the Russian Federation at the location of the EP no later than 28 calendar days after the end of the corresponding reporting period (for advance payments) and March 28 of the year following the expired tax period (Article 285, paragraph 4 of Article 288, paragraphs 3, 4 of Article 289 of the Tax Code of the Russian Federation).

Thus, at the end of each reporting period, corporate income tax is calculated based on the profit subject to taxation, calculated on an accrual basis from the beginning of the tax period to the end of the reporting period. The procedure for calculating tax does not depend on a change in the location of the organization and a change in the place of registration of the organization with the tax authority (letter of the Ministry of Finance of Russia dated March 15, 2018 N 03-02-07/1/16043).

The form, presentation format and procedure for filling out (hereinafter referred to as the Procedure) the tax return for corporate income tax are established by order of the Federal Tax Service of Russia dated October 19, 2016 N ММВ-7-3/ [email protected]

Paragraph 1 of clause 1.4 of the Procedure states that the organization, which includes OPs, at the end of each reporting and tax period submits to the tax authority at its location a Declaration drawn up for the organization as a whole with the distribution of profits among the OPs in accordance with Art. 289 Tax Code of the Russian Federation. The distribution of profits according to the OP is carried out in Appendix No. 5 to Sheet 02 of the declaration “Calculation of the distribution of advance payments and corporate income tax to the budget of a constituent entity of the Russian Federation by an organization that has separate divisions.”

At the same time, based on clause 4.1.5 of the Procedure, when submitting an income tax return after changing the location of a separate division, OKTMO at the new location of the organization should be indicated.

If the location of a separate division changes, the activities of the organization through the separate division do not cease and tax returns (including updated tax returns for previous reporting and tax periods) are submitted to the tax authority at the new location of this separate division, see letter of the Federal Tax Service of Russia dated November 20, 2015 N SD-4 -3/20373. The same letter states that if the location of a separate division of an organization changes, the tax authority at its previous location transfers documents to the tax authority at the new location of this separate division.

In relation to the situation under consideration, the letter of the Federal Tax Service of Russia dated March 18, 2011 N KE-4-3 / [email protected] explains that since when the location of a separate division changes, the activities of the organization through this separate division do not stop, then, accordingly, tax returns continue compiled for this separate division on an accrual basis from the beginning of the year. Payment of tax to the budget of a constituent entity of the Russian Federation after a change of location must be continued at the location of the separate division at the new address (see also letters of the Federal Tax Service of Russia for Moscow dated August 28, 2012 N 16-15/ [email protected] , Federal Tax Service of Russia dated August 31 .2015 N PA-4-6/15235, Information from the Federal Tax Service of Russia for the Vladimir Region dated September 30, 2015 “When the location of a separate unit changes, the checkpoint does not change”).

Thus, since in the situation under consideration there was a change in the location of the separate division, and not its liquidation, tax returns continue to be compiled for the separate division on an accrual basis from the beginning of the year.

Subscribe Post:

The separate unit has changed its address. Algorithm of actions

Our company has opened a branch in Chelyabinsk.

The branch, on behalf of the enterprise, enters into contracts with clients for the provision of services, has its own current account, pays salaries to its employees and pays the corresponding taxes, and independently submits declarations on accrued salaries. Now, due to production reasons, there is a need to change the address of the branch, and this is a different area of the city and, accordingly, a different Federal Tax Service. What is the best way to carry out operations to register a branch at a new address, while maintaining the current account and contracts with clients? —————————

An enterprise is a branch of an organization located in another city. The legal address of the branch, which is indicated in the regulations on the branch and constituent documents, does not coincide with the actual address; in addition, due to the crisis, it was decided to rent a new office with a lower rent, but in the same administrative area. In connection with the above, the question arises: is it necessary and in what form to notify the tax authority, the Pension Fund of the Russian Federation, the Social Insurance Fund (after all, a branch can still change its office more than once)?

In accordance with paragraphs. "n" clause 1 art. 5 of the Federal Law of the Russian Federation dated 08.08.2001 No. 129-FZ “On state registration of legal entities and individual entrepreneurs” information about branches

and representative offices of a legal entity

are contained

in the unified state register of legal entities.

According to paragraph 5 of Art. 5 of the Federal Law of the Russian Federation dated 02/08/1998 No. 14-FZ “On Limited Liability Companies” charter

the company must contain information about its branches and representative offices.

Notifications of changes to the charter

of the company, information about its branches and representative offices is submitted to the body that carries out state registration of legal entities.

The specified changes in the company's charter come into force for third parties from the moment of notification of such changes to the body carrying out state registration of legal entities.

A similar rule is contained in paragraph 6 of Art. 5 of the Federal Law of the Russian Federation of December 26, 1995 No. 208-FZ “On Joint Stock Companies”

.

Art. 19 of Law No. 129-FZ

It has been established that in cases established by federal laws (Law on LLC, Law on JSC),

a legal entity submits to the registration authority

at its location

a notice

about amendments to the constituent documents, a decision to amend the constituent documents and changes.

When making changes to the constituent documents of a legal entity, the registering authority within a period of no more than five days

from the moment of receipt of the specified notification, makes a corresponding entry in the unified state register of legal entities, which is reported to the legal entity in writing.

At the same time, changes made to the constituent documents become effective for third parties from the moment the registration authority is notified of such changes.

On sheet A of the Notification form on amendments to the constituent documents of a legal entity

, which was approved by Decree of the Government of the Russian Federation dated June 19, 2002 No. 439,

the address (location) of a branch of

a legal entity on the territory of the Russian Federation is indicated, including postal code, subject of the Russian Federation, district, city, settlement, street (avenue, lane, etc.), house number (possession), building (building), apartment (office).

The Ministry of Finance of the Russian Federation in a letter dated April 21, 2008 No. 03-02-07/2-73 noted that in accordance with the legislation of the Russian Federation, the location of

The organization, its

separate divisions in the form of branches

and representative offices

are determined through the corresponding addresses

.

For tax accounting purposes, Art. 83

and

84 of the Tax Code of the Russian Federation

establishes the procedure for registering and deregistering an organization when the organization carries out activities in the Russian Federation through a separate division.

Let us remind you that Art. 11 Tax Code of the Russian Federation

recognizes as a separate division of an organization any division territorially isolated from it, at the location of which stationary workplaces are equipped.

Recognition of a separate division of an organization as such is carried out regardless of whether its creation is reflected or not reflected in the constituent or other organizational and administrative documents of the organization, and on the powers vested in the specified division.

At the same time, the Tax Code of the Russian Federation does not establish a procedure for recording separate divisions with tax authorities

organizations

due to changes in their locations

.

In addition, the Tax Code of the Russian Federation and the civil legislation of the Russian Federation do not define what is meant by a change in the location of a branch

, representative office or other separate division of the organization.

The Ministry of Finance notes that the Tax Code of the Russian Federation does not provide for the recognition of a division of an organization as separate without connection with a specific place of activity of the organization, territorially isolated from its location, and depending on the jurisdiction of the tax authorities of the territory in which this separate division is located, and also does not establish an accounting procedure in tax authorities of separate divisions of organizations in connection with a change in their location.

In this regard, the regulatory authorities believe that in the event of a change in the location of a separate division, the organization must carry out the procedure for closing and opening a separate division

.

In accordance with paragraph 1 of Art. 83 Tax Code of the Russian Federation

An organization that includes separate divisions located on the territory of the Russian Federation

is obliged to register

with the tax authority at the location of each of its separate divisions, if it is not registered with the tax authority at the location of this separate division on the grounds provided for by the Tax Code. RF.

Within one month from the date of termination of activity

organization through a separate division (closing a separate division), the organization is obliged to notify the tax authority at the location of the organization about this in writing.

Form No. S-09-3

“Notice on the creation (closing) of a separate division of an organization on the territory of the Russian Federation” was approved by order of the Federal Tax Service of the Russian Federation dated April 21, 2009 No. MM-7-6/ [email protected]

If an organization makes a decision to terminate the activities (closing) of its separate division, deregistration of the organization at the location of this separate division is carried out by the tax authority at the request of the taxpayer

within 10 days from the date of filing such an application, but not earlier than the end of the on-site tax audit if it is carried out (

clause 5 of Article 84 of the Tax Code of the Russian Federation

).

Consequently, the organization must submit an Application for deregistration of the Russian organization with the tax authority at the location of its separate division

on the territory of the Russian Federation

according to form No. 1-4-Accounting

, approved by order of the Federal Tax Service of the Russian Federation dated December 1, 2006 No. SAE-3-09/ [email protected]

Next, the organization must submit an Application for registration of a Russian organization with the tax authority at the location of its separate division

on the territory of the Russian Federation (

Form No. 1-2-Accounting

) within one month from the date of creation of a separate division to the tax authority at the location of this separate division, if the organization is not registered on the grounds provided for by the Tax Code of the Russian Federation with the tax authorities in the territory municipal formation in which a separate division has been created (

clause 4 of article 83 of the Tax Code of the Russian Federation

).

The Federal Tax Service of the Russian Federation believes that simultaneously with the Application

in one copy, copies of the certificate of registration with the tax authority of the organization at its location, certified in the prescribed manner, documents confirming the creation of a separate division. When an organization vests a separate division with the authority to pay taxes at its location, a document is submitted confirming the said authority (letter dated March 15, 2007 No. 09-2-03/ [email protected] ).

Let us remind you that all these rules apply if the organization is not registered

on the grounds provided for by the Tax Code of the Russian Federation, with the tax authorities in the territory of the municipality in which this separate division was created.

In other cases

registration of an organization with the tax authorities at the location of its separate divisions is carried out by the tax authorities

on the basis of messages in writing, that is, in form No. S-09-3

.

Moreover, if several separate divisions

organizations are located

in the same municipality in territories under the jurisdiction of different tax authorities

; registration of the organization can be carried out by the tax authority at the location of one of its separate divisions, determined by the organization independently.

According to paragraph 1 of Art.

83 of the Tax Code of the Russian Federation, organizations are subject to registration

with the tax authorities, respectively, at the location of the organization, the location of its separate divisions, as well as

at the location of the real estate and vehicles owned by them

.

Thus, if an organization is registered on at least one of the above grounds with the tax authority on the territory of a municipal entity, the organization’s registration with the tax authorities at the location of its separate divisions on the territory of this municipal entity is carried out by tax authorities only on the basis of messages in the form No. S-09-3

.

The Ministry of Finance of the Russian Federation believes that the procedure for making changes to the information available to the tax authority about a separate division of an organization in the event of a change in the organization’s place of activity (address) should be simplified, and in letter dated 05/08/2009 No. 03-02-07/1-236 reported that at present the Ministry of Finance of the Russian Federation, with the participation of the Federal Tax Service of the Russian Federation, has developed a draft order approving the procedure for registering organizations at the location of their separate divisions, which, in particular, provides for the possibility of registering an organization with the tax authorities at the location of its branch (representative office) ) on the basis of an application for registration, which is submitted by the organization to the registering tax authority, simultaneously with the submission of an application for amendments to the constituent documents of the legal entity in relation to the corresponding branch (representative office).

In addition, it is planned to prepare a draft federal law on amendments to the Tax Code of the Russian Federation in order to improve the accounting procedure for organizations and individuals with tax authorities. At the same time, it is intended to simplify the procedure for accounting with tax authorities of organizations at the location of their separate divisions.

However, pending the introduction of appropriate changes to part one of the Tax Code of the Russian Federation, tax authorities ensure registration of organizations at the location of their separate divisions based on a study of actual circumstances, guided by current legislation

Russian Federation.

That is, every time the branch address changes

the organization must carry out the procedure for closing and opening a separate unit.

In accordance with clause 19 of the Rules for maintaining a unified state register of legal entities and providing the information contained therein, approved by Decree of the Government of the Russian Federation of June 19, 2002 No. 438 (as amended on December 8, 2008), the registration authority

within a period of no more than 5 working days from the date of state registration of a legal entity and (or) making changes to the state register,

provides information

about the legal entity free of charge to the territorial bodies of the Federal Agency for Federal Property Management, territorial bodies of the Pension Fund of the Russian Federation, regional branches of the Social Insurance Fund of the Russian Federation , military commissariats, territorial compulsory health insurance funds and territorial bodies of the Federal State Statistics Service and in cases established by federal laws - to other bodies.

The specified information is provided in electronic form.

However, this does not mean

that, based on the information provided, the funds will independently re-register the organization in the event of a change in the location of the branch.

According to clause 6 of the Procedure for registering legal entities as insurers at the location of separate divisions

and individuals in the executive bodies of the Social Insurance Fund of the Russian Federation, approved by Resolution of the Federal Insurance Fund of the Russian Federation dated March 23, 2004 No. 27 (as amended on January 25, 2007),

in the event of a change in the location of a separate division

of a legal entity that is an insured, specified

the person submits an application for registration

as an insurer to the regional office of the Fund (branch of the regional office of the Fund)

at the new location

within a month from the date of such changes.

An organization that has separate divisions must notify the TFOMS in writing

(with a copy of the decision to liquidate a separate subdivision attached)

on changes in the information specified when registering

this organization in the territorial fund at the location of the separate subdivision, or when deregistering it, the territorial fund within 10 days from the date of making such changes in relation to these divisions in the Unified State Register of Legal Entities by the federal executive body carrying out state registration of legal entities and individual entrepreneurs (clause 18 of the

Rules for registration of policyholders in the territorial compulsory health insurance fund

for compulsory health insurance, approved by Decree of the Government of the Russian Federation of September 15, 2005 No. 570 ).

The situation with the Pension Fund of the Russian Federation is not entirely clear.

Clause 18 of the Procedure for registration and deregistration in the territorial bodies of the Pension Fund of the Russian Federation

insurers making payments to individuals, approved by Resolution of the Board of the Pension Fund of October 13, 2008 No. 296p, it is established that the deregistration of an organization at the location of a separate division if it makes a

decision to terminate the activities of its separate division

or a decision to switch to a centralized Payment of the unified social tax and insurance contributions for compulsory pension insurance is carried out by the territorial body of the Pension Fund of the Russian Federation at the location of the separate unit within 5 days from the date the organization submits the

following documents

:

– applications for deregistration of an organization at the location of a separate unit on the territory of the Russian Federation in the territorial body of the Pension Fund of Russia;

– copies of the decision (order, instruction) on termination of the activities of a separate division (liquidation, reorganization), decision (order, instruction) on the transition to centralized payment of the unified social tax and insurance contributions for compulsory pension insurance.

As we can see, we are talking here about terminating the activities of a separate unit, and not about changing its location.

Therefore, in this case, it is better for you to contact the territorial body of the Pension Fund of the Russian Federation with which your organization is registered for appropriate clarification.

If your organizations have ongoing contracts with counterparties, then if the branch address changes, you need to inform the counterparties about the change of address

.

You can conclude an additional agreement to the contract

, in which the section of the agreement “Addresses and details of the parties” is stated in a new edition.

Changing the branch address has no effect

on the branch's current account.

The score remains the same.

Reasons for changing your legal address

Grounds for changing the legal address of a subject:

- End of the lease term.

- Moving an organization to another city/district.

- The need to change the Federal Tax Service.

- The old legal address does not comply with the provisions of the law.

An application for a change of address is required to be submitted to the tax office. Only the general director or a person with a power of attorney can do this. The application must be sent no later than 3 days from the date of the relevant decision. The procedure involves paying a fee.

Grounds for refusal to change address

Change of address may be refused. As a rule, the grounds for refusal are as follows:

- Ignoring the deadline for submitting an application (later than 3 days after the decision is made).

- All necessary documents have not been collected.

- Typos and errors in the application.

- The location provided as the address does not exist.

- Legal address is a mass address.

ATTENTION! Sometimes the tax office refuses to change the address due to the presence of a large debt or because the organization is in bankruptcy. However, such refusals are not considered legitimate. They can be challenged in court.

Step-by-step instructions for changing your address

To change your legal address you need to do the following:

- Organization of a meeting of the founders of the company, during which a protocol is drawn up.

- Preparation of documents. You will need an application for registration of adjustments to the constituent documents, a decision to adjust the documents, an updated version of the Charter, and a receipt for payment of the fee. All papers must bear the signature of the general director.

- Submitting documents to the tax office. You need to contact the authority at the organization’s registered address.

- After 5 days, you need to contact the tax office again to receive papers confirming the change in legal address.

- Notification of a change of tax address at a new place of registration.

If errors are made when drawing up documents, the tax office will not provide paperwork confirming the change of address.

Sample decision on change of address

JSC "Phoenix"

Order No. 88

On changing the legal address of Phoenix CJSC

Due to the expiration of the lease at the address st. Malysheva 8 July 22, 2017

I ORDER:

1. Change the legal address of Phoenix CJSC to Chapaeva 50. 2. To the head of the office, A.A. Petrova. by July 30, 2017, organize work to change document forms and seals. 3. Head of the HR Department Rodeeva R.O. by July 30, 2017, add new address information to employment contracts with employees.

Director (signature) R.R. Sergeev

What is a separate division

Companies that have decided to expand their commercial interests may need to conduct activities through new divisions - branches or representative offices (according to Article 55 of the Civil Code of the Russian Federation), for example, in another region of our country. They will pursue the same goals and perform the same tasks as the parent organization. Also, separate divisions are assigned all the functions of the main company or part of them. This is the position of the Civil Code of the Russian Federation.

The position of tax legislation differs from civil law. The Tax Code of the Russian Federation distinguishes both branches and representative offices, and simply separate divisions. According to paragraph 1 of Art. 83 of the Tax Code of the Russian Federation, the company is obliged to register each new division at its location. The concept of a separate division can be found in paragraph 2 of Art. 11 of the Tax Code of the Russian Federation. This is a branch of the company, the actual location of which is different from the main legal address. A separate division can be formed in another region, city or district of an urban district, that is, in another municipal entity. One of the main conditions for recognizing a unit as separate is the presence of at least one stationary workplace in it. In this case, the place must be organized for a period of more than 1 month (Article 11 of the Tax Code of the Russian Federation).

As an example, we can cite such structures that have divisions located in different regions of the country and different districts of the same city, such as:

- retail trade networks;

- banking organizations.

Separate divisions can be different and created for various reasons. At the same time, registration under the Civil Code of the Russian Federation and the Tax Code of the Russian Federation is different. According to the Civil Code of the Russian Federation, only branches or representative offices are registered, and according to the Tax Code of the Russian Federation - any separate division (at the location of the property, at the place of installation of the cash register). For the tax inspectorate, a notification that, for example, a cash register or a real estate property is located on its territory is sufficient. This is necessary to control taxation. If your company decides to register a separate division under the Civil Code of the Russian Federation (as a branch or representative office), get ready for full-scale registration in accordance with all the rules. And here you will need detailed step-by-step instructions for registering a separate division in 2019.

To find out whether it is possible for a “simplified” to have a separate division, read the article “Opening a separate division under the simplified tax system.”

Changing a “separate” address

First, let's figure out what is considered a separate division and when it has tax registration.

Identification principles

As specialists from the main financial department indicated in letter No. 03-02-07/2-73 dated April 21, 2008, the Tax Code provides for two criteria, if present, a division is recognized as separate:

- the company carries out its activities through its division, territorially isolated from its location;

- creation of jobs at the place where this activity is carried out for a period of more than one month (clause 2 of article 11 of the Tax Code).

Thus, the financiers emphasized, the installation of at least one stationary workplace of a company outside its location is already recognized as the creation of a separate division, regardless of whether this fact is reflected in the constituent documents of the company or not.

Registration rules

Clauses 1 and 4 of Article 83 of the Tax Code oblige you to register for taxation at the location of a separate division of business entities. To do this, it is necessary to submit a corresponding application to the local inspectorate no later than one month from the date of creation of the “isolation”. A special form for such an application was approved by order of the Federal Tax Service dated December 1, 2006 No. SAE-3-09/ [email protected]

At the same time, if a company, for any of the reasons provided for by the Tax Code, is already registered with one of the inspectorates of the municipal district in the territory of which the division is opened, then there is no need to register such a “separate entity.” It is enough just to inform “your” tax authorities about its creation (clause 2 of article 23 of the Tax Code). However, this must also be done within a month and in a strictly established form, which was approved by order of the Federal Tax Service of Russia dated January 17, 2008 No. MM-3-09 / [email protected] Please note that the company is obliged to similarly notify controllers regarding each created unit, regardless of whether it is subject to registration or not.

A simplified procedure for tax accounting of organizations is also provided for cases when a company has several “separate entities” within the same municipal district, but in territories under the jurisdiction of different tax inspectorates. In this case, registration is carried out by auditors at the location of the unit that the norm itself chooses

So, within a month from the moment of creation of a separate division, the company must submit the following documents to the tax office:

- notification of the creation of a separate unit in form No. S-09-3, which is sent to the home inspectorate at the location of the parent organization;

- application for registration of a separate division in form No. 1-2-Accounting, sent to the auditors at the place of creation of the “separate division”.

In addition, the application must be accompanied by duly certified copies of the certificate of registration with the inspection of the parent organization and documents confirming the creation of a separate division.

Moving problems

One could say that the Tax Code quite clearly spells out the procedure for registering separate divisions, if not for one “but”. The Main Tax Law does not contain a rule providing for the possibility of changing the location of an “isolated” person, and, accordingly, no special rules for tax registration at a new address.

In essence, this means that, for example, when concluding a new lease agreement for premises to carry out activities through a division at an address under the jurisdiction of another tax authority, the company must carry out the procedure of closing one “separate unit” and opening a new similar structure. Moreover, most likely, the company will have to do the same even if the division changes its address within the territory of the same tax office.

Thus, it turns out that the organization in this situation is obliged, firstly, to send two messages in form No. S-09-3 to the inspectorate at the location of the head office about the closure of one division and the opening of a new one. Secondly, she needs to submit an application to the tax authorities at the location of the former “isolated entity” for deregistration using form No. 1-4-Accounting, approved by order of the Federal Tax Service of December 1, 2006 No. SAE-3-09 / [ email protected] And finally, at the location of the newly created structure, submit to the auditors the already mentioned application for registration in form No. 1-2-Accounting and the accompanying set of documents. We should also not forget that the closure of a separate branch is a legal basis for inspectors to conduct an on-site tax audit. In particular, paragraph 5 of Article 84 states that tax authorities must deregister such a structure within 10 days from the date of submission of the corresponding application by the taxpayer, but not earlier than the end of the on-site audit, if one is carried out.

Prospects

To be fair, it should be noted that this problem did not go unnoticed by the Ministry of Finance. Thus, in the mentioned letter dated April 21, 2008 No. 03-02-07/2-73, financiers considered the issue of establishing a procedure for tax authorities to make changes to the information they have about the unit in the event that the “isolated” changes its location within the area under its jurisdiction the same tax inspectors. As often happens in our country, the cause of all the troubles turned out to be gaps in the legislation. In their opus, specialists from the main financial department indicated that, according to Russian laws, the location of the organization and its branches and representative offices is determined through the corresponding addresses. The address is also one of the identification features of other separate divisions of business entities. At the same time, experts from the Ministry of Finance complained, neither the Tax Code nor the Civil Code defines what should be understood by a change in the location of a branch, representative office or other “separate entity.” The tax legislation does not establish the procedure for registering company divisions with the tax authorities in connection with a change in their location.

At the same time, we must give the Ministry of Finance officials their due: they do not intend to leave everything as it is. Another thing is that, in their opinion, the proposal to simplify the procedure for accounting for “wandering individuals” requires additional refinement. In particular, they believe that it is necessary to simplify “transfers” from the territory of one inspection to the territory of another. Financiers propose to make the rules for changing the location of branches and representative offices similar to recording information about changes in the location of the parent organization.

S. Kotova , expert at the Federal Agency for Financial Information

Package of documents for registration

So, the company decided to create a separate division. Before registering it, she will need to prepare a package of certain documents.

At this stage, the organization's actions are as follows:

- The decision to create a separate division is made by the enterprise management body - the board of directors, the supervisory board, the meeting of shareholders.

- Based on this decision of the governing body, presented in the form of a protocol, an order is issued to create a unit.

The order must reflect:

- name of the new division;

- the basis for its creation, for example, the minutes of the general meeting of shareholders (number and date);

- location of the unit;

- a manager who is appointed and removed from office by a decision of the management body of the parent enterprise, for example, by a decision of the supervisory board or a general meeting of shareholders;

- within what time the unit must be registered.

The document is signed by the head of the parent company.

- Based on the order, an internal local act is developed - the Regulations on a separate division (branch or representative office). It establishes:

- the degree of legal capacity and powers of the new unit;

- activities;

- functions;

- management structure;

- other aspects that relate to the activities and actions of the unit.

- Also, the order is the basis for amending the constituent documents if we are talking about a branch or representative office. They can be formatted as:

- a separate document that is attached to the current charter or constituent agreement, for example, amendment No. 1;

- new edition of the constituent document.

A sample compiled by ConsultantPlus experts will help you prepare the Regulations on a separate division. You can download it by getting free access to the system.

Once the necessary documentation has been collected, we move on to the next stage.

Registration of a separate division in 2019-2020: step-by-step instructions

A legal entity is obligated to report the creation of a separate division to the tax office within a month after the decision is made, for example, after the date of the minutes of the general meeting of shareholders. According to paragraph 3 of Art. 83 of the Tax Code of the Russian Federation, a new division of an enterprise must undergo the procedure of tax registration and inclusion in the Unified State Register of Legal Entities.

See also: “The Supreme Court again canceled the large fine for failure to register a unit.”

Registration of a separate division is carried out by the tax authorities. To do this, the enterprise must contact the tax office that will have jurisdiction over the territorial unit (municipal entity).

To register a branch or representative office, you must submit documents according to the following list to the tax authorities:

- a copy of the decision of the governing body to create a separate division;

- a copy of the approved regulations on the separate division;

- a copy of the constituent documentation and its amendments (as a separate document or as a new edition);

- a copy of the state registration certificate of the main enterprise;

- a copy of the orders on the appointment of the head and chief accountant of the new division;

- a copy of the payment order or bank statement confirming payment of the state registration fee, certified by the seal and signature of the head of the credit institution;

On our website you can use a payment order for payment of state duty “Payment order for payment of state duty - sample 2019-2020”.

- extract from the Unified State Register of Legal Entities for the parent company;

- application for registration of changes in forms P13001 (for changes in the charter) and P13002 (for changes in the Unified State Register of Legal Entities).

For other separate divisions, a special package of documents is not required. According to the order of the Federal Tax Service No. ММВ dated 06/09/2011 [email protected], it is enough to submit a message to the tax authority in form C-09-3-1.

All copies must be notarized. If a separate division will conduct its activities in rented premises, then it is necessary to have a copy of the lease agreement for the space. Documents can also be submitted electronically via appropriate communication channels in the form of scans. In this case, they will be certified with an electronic digital signature.

Registration is carried out by the tax authority within 5 days from the date of actual submission of the package of documents or receipt on the server through electronic document management. The corresponding notification serves as a document confirming the registration of the unit.

When registering, a separate unit is not assigned a TIN, but only a reason for registration code (RPC). In its documentation, the division will use the TIN of the parent company. However, it is not an independent legal entity.

Other separate divisions

Changing the address of a separate division that does not belong to the category of branches or representative offices is simplified. To register a change, it is necessary for the head of the organization to issue an appropriate order. After this, a tax notification is submitted about the change of address of the separate division, in form C-09-3-1. This notification is sent within three days (from the date of the decision) to the tax office at the place of registration of the legal entity.

In this case, it is also not necessary to notify the tax authorities at the location of the separate division.

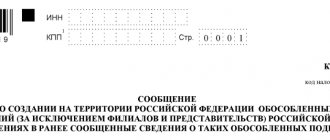

Application for registration of another separate division in form S-09-3-1

The application itself is a one-page form. The company should not have any difficulties filling it out.

The application shall indicate:

- TIN/KPP of the parent company;

- its full name;

- tax office code;

- OGRN of the parent enterprise;

- number of new units;

- Full name of the head of the company, his Taxpayer Identification Number;

- contact information (phone number, email address);

- round seal of the company.

Do you want to see a correctly completed application for opening an OP for the tax office? Then get trial access to K+ and move on to the sample prepared by specialists.

If the application is submitted not personally by the manager, but by a representative, then his data is filled out in the document. At the same time, his powers must be documented. Typically, a standard power of attorney form is used for these purposes.

The application is submitted in 2 copies. You can also provide a copy of the application as a second copy. This is necessary to mark on it the date of acceptance by the tax inspector.

Accounting in branches and representative offices

A separate division carries out activities in accordance with the goals and objectives of the parent company. Functions, types of activities, level of legal capacity and powers are determined by the parent organization and are enshrined in the regulations on the separate division. Including accounting, accounting is possible in two options.

- Option 1: the division does not have its own balance sheet.

In this case, the branch does not have its own accounting department and current account. All settlements with contractors, including payroll personnel, are carried out by the head office accounting department. In this case, the division has the right to issue, for example, shipping documents, but they will be accepted for accounting in the head accounting department.

- Option 2: the division is on an independent balance sheet.

This option involves creating an accounting service and maintaining records within the department. It has a current account with a credit institution and can carry out settlements with counterparties independently. Data from the financial statements of the division are taken into account in the general summary of the enterprise. A separate division carries out accounting according to the rules of the accounting policy of the parent company.

You will learn how to correctly draw up an accounting policy for your company from our material “How to draw up an organization’s accounting policy (2020)?”

How to change the registration data of a separate division or organization?

The address of a separate division/organization has changed and its registration data has changed accordingly. How can I enter information on the changed registration data (OKTMO, KPP) of a separate division/organization into ZUP 3?

According to registration data with the Federal Tax Service, history is saved, including for separate divisions/organizations.

Changes to the registration data should be made in the separate division card (Personnel - Divisions) for the Tax Registration details. authority via the link Edit :

In the form that opens, to enter data correctly, follow the link Select from known registrations :

If in the opened directory Registration with a tax authority, information about registration data in the new tax authority has already been entered for identification, then you can select them, otherwise you need to create a new element in which to enter information about: KPP, OKTMO of the tax authority (OKATO of the tax authority is no longer filled out), tax authority code and short name of the Federal Tax Service (full name will be generated automatically):

After selecting your registration data, it is important to pay attention to the month from which the registration data is valid:

This affects the correct accounting of personal income tax. Otherwise, when making changes to registration retroactively, you will have to re-post and refill the accrual and payment documents. Read more about this in the publication What needs to be done in ZUP 3 if information about registration with the tax authority was changed after the calculation and payment of wages?

When you try to record new registration information, a window will appear asking whether the error has been corrected or whether the registration information has changed. In this case, you should click the button Registration data with the tax authority has changed :

In the Registration form with the tax authority, using the link History of registration changes, you can check the history of information from the Federal Tax Service:

Changes to the registration data of an organization are made according to the same principle as for a separate division. This is only done in organization cards (Settings - Organizations/Organization Details)

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- How to fill out 6-NDFL and 2-NDFL if the registration details of the organization have changed? You do not have access to view. To gain access: Complete...

- Notification of the Federal Tax Service on the selection of the tax authority and the responsible person (organization, separate division of the organization Hello. In addition to the main division, 5 separate divisions have been created in the organization...

- Offsetting the advance payment issued to the supplier, if the payment is from the parent organization, and the primary documents are from a separate division. Good evening. What document can be used to offset the advance payment issued to the supplier...

- How to reflect an interest-free loan to an employee of a separate division in personal income tax reporting? Good afternoon This situation arose in our organization. Head organization…

Closing a separate division in 2019-2020: step-by-step instructions

The procedure for closing a branch or representative office differs from closing another separate division. According to sub. 3.1 clause 2 art. 23 of the Tax Code of the Russian Federation, an enterprise is obliged to notify the tax authority of the closure of a branch, representative office or other separate division within 3 days from the date of termination of activity.

The procedure for closing a branch and representative office is similar to the procedure for opening it. Such separate divisions are removed from tax registration with a full package of documents: a certified copy of the administrative document on the closure of the division (for example, minutes of a meeting of the board of directors), changes to the charter and the Unified State Register of Legal Entities, an application in form P13002.

To close another separate division, it is enough to submit an application to the tax authority in form C-09-3-2, which indicates:

- TIN and KPP of the parent organization;

- full name;

- tax authority code;

- OGRN of the parent organization;

- number of closing units;

- Full name of the head of the enterprise, his personal tax identification number;

- contact information (phone number, email address);

- company seal.

You can also find a sample of filling out an application for closing an OP in the K+ system, having received free access.

At the same time, applications for registration and deregistration of a unit are almost identical. The only difference is in the title of the document itself. The application is also drawn up in 2 copies. You can provide the original document and a copy of it, on which a tax inspector will mark acceptance.

If the closed enterprise was responsible for the centralized payment of income tax, then in addition to the above documents, notifications in Forms 1 and 2 should be sent to the Federal Tax Service.

See details.

The address of a separate division changes

The Ministry of Finance and the Federal Tax Service are confident that if a company division’s address has changed, even within the same inspection, it must first be closed and deregistered.

And then create a new additional office and register it at a new address (letter of the Ministry of Finance of Russia dated December 28, 2009 No. 03-02-07/1-575, Federal Tax Service of Russia dated August 21, 2009 No. 3-6-03/345).

There is no clear procedure for re-registration in the Tax Code for this case, so it is safer to follow the recommendations of officials. The algorithm of actions is as follows.

1. Deregister the unit at the old address

An application must be submitted to the inspectorate at the previous location of the unit using the updated form 1-4-Accounting (approved by order of the Federal Tax Service of Russia dated December 1, 2006 No. SAE-3-09 / [email protected] as amended by order of the Federal Tax Service of Russia dated February 15, 2010 No. MM- 7-6/ [email protected] ). A copy of the company’s decision to close the unit is attached to it.

For example, this could be an order from a manager. Moreover, there is no deadline for submitting such an application to the inspectorate, but it is better to submit the documents immediately after the manager’s order to liquidate the additional office is signed.

2. Register the unit at a new address

Within a month from the date of creation of the unit at a different address, an application is submitted to the new inspectorate in form 1-2-Accounting (approved by order of the Federal Tax Service of Russia dated December 1, 2006 No. SAE-3-09 / [email protected] as amended by the order of the Federal Tax Service of Russia dated February 15 .10 No. MM-7-6/ [email protected] ). A copy of the certificate of registration of the company at its location is attached to it.

And also a copy of an extract from the Unified State Register of Legal Entities with information about the branch (representative office), if its creation is reflected in the constituent documents, in other cases - a copy of the regulations on a separate division or the order on its creation.

BY THE WAY. If the new and old addresses of the unit are located on the territory of the same inspection, then the order does not change. Simply, documents on registration and deregistration of an additional office are submitted to one Federal Tax Service. This can be done at the same time.

3. Notify the inspectorate at the place of registration of the head office

Within a month from the date of closing the division at the old address and opening at the new one, this must be reported to the inspectorate at the location of the head office (Clause 2 of Article 23 of the Tax Code of the Russian Federation).

You will need to send a message to your tax office in form No. S-09-3 (approved by order of the Federal Tax Service of Russia dated April 21, 2009 No. MM-7-6 / [email protected] ). The same form is used to report the creation and closure of a unit.

The form simply contains the appropriate code (1 – when creating, 2 – when closing). That is, you need to submit two identical forms, but with different data.

Samples of the new application forms that will be required to register or deregister a division are available on the website in the section “Electronic Assistants”> “Your Tax Secretary”> “Creation and Liquidation of a Separate Division”.

The article was published in the newspaper “UNP” No. 16, 2010

Results

A separate division is not an independent legal entity. The decision to create a new division is made by the enterprise management body. After this, the company must contact the tax authority at the location of the unit and provide the necessary package of documents within a month after the decision is made (for a branch or representative office). To register another separate division under tax legislation, it is enough to notify the tax office in the form of an application.

After registration, the division receives its own checkpoint, and the TIN applies to the parent organization.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Representative offices and branches

To change the address of a representative office or branch, it is necessary to analyze the organization’s charter. If this document contains information about the address of such a separate division, then changes to the charter will be required. Let us recall that the current legislation does not oblige such information to be indicated in the charter of a legal entity, but practice shows that in many cases information about branches and their addresses is still available in this document. Therefore, changing the address of a separate division in such situations will require a procedure for amending the charter.

To do this, it is necessary to convene an extraordinary meeting of participants, at which a decision must be made to change the document. There are two options here:

- Exclusion from the charter of the clause on a separate division;

- Entering new information about the location.

The decision of the meeting is approved by the minutes, which, together with an application in form P13001 and with the new edition of the charter, are submitted to the tax office to register the changes.

In a situation where the organization’s charter does not contain information about a branch or representative office, the procedure for making changes is somewhat different. The head of the organization must make an appropriate decision, on the basis of which an application on form P14001 is filled out. The application must be received by the tax office at the place of registration of the organization within three working days from the date of the decision. Let us note that if the charter of an organization or the regulations on a branch provide for a different procedure for making decisions regarding its activities, including decisions on its name, location and other issues, then the procedure specified in these documents must be observed, for example, a general meeting of participants was held.

Please note that currently there is no need for a separate division to additionally notify the tax authorities at its location about the changes being made. Information about this is received by them through departmental exchange.