How non-profit organizations account for fixed assets

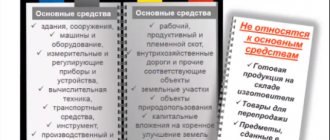

The conditions under which non-profit organizations accept fixed assets for accounting differ from the rules for commercial structures. Here are the criteria for a fixed asset for non-profit organizations:

- period of use of the object – more than 12 months;

- the organization does not plan to sell the property;

- the object is intended for the statutory, entrepreneurial activities of the organization or for its management needs.

Such conditions are written in paragraph 4 of PBU 6/01.

If an NPO has acquired or received free of charge (as a gift) an object that is intended for transfer to third parties, it is not included as a fixed asset. These assets are taken into account as part of materials.

Accounting entries for the receipt of fixed assets will vary depending on how they were received: for a fee or free of charge.

How non-profit organizations account for fixed assets

The conditions under which non-profit organizations accept fixed assets for accounting differ from the rules for commercial structures. Here are the criteria for a fixed asset for non-profit organizations:

- period of use of the object – more than 12 months;

- the organization does not plan to sell the property;

- the object is intended for the statutory, entrepreneurial activities of the organization or for its management needs.

Such conditions are written in paragraph 4 of PBU 6/01.

If an NPO has acquired or received free of charge (as a gift) an object that is intended for transfer to third parties, it is not included as a fixed asset. These assets are taken into account as part of materials.

Accounting entries for the receipt of fixed assets will vary depending on how they were received: for a fee or free of charge.

What postings should be used to reflect fixed assets for a fee?

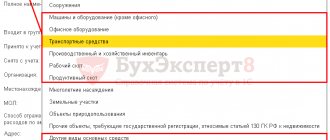

Purchased fixed assets are reflected in the accounting of non-profit organizations depending on the funds with which they were acquired and for what activity. There can be two sources: income from business activities or targeted income. Postings for each individual case are in the tables below.

- Fixed assets came from income from business activities subject to VAT

| Contents of operation | Debit | Credit | Sum | Primary document |

| Paid for a computer | 60 | 51 | 48 380 | payment order, bank statement |

| Received a computer | 08 | 60 | 41 000 | invoice |

| The amount of VAT paid to the supplier is reflected | 19-1 | 60 | 7380 | invoice |

| Accepted for VAT crediting on activities subject to VAT | 68 | 19-1 | 7380 | invoice, bank statement |

| The computer is accepted for accounting as an object of fixed assets | 01 | 08 | 41 000 | act of acceptance and transfer of fixed assets |

2. Fixed assets came from income from business activities, which are not subject to VAT

| Contents of operation | Debit | Credit | Sum | Primary document |

| Paid for a computer | 60 | 51 | 48 380 | payment order, bank statement |

| Received a computer | 08 | 60 | 41 000 | invoice |

| The amount of VAT paid to the supplier is reflected | 19-1 | 60 | 7380 | invoice |

| VAT is included in the price of the property, which will be used in income-generating activities exempt from VAT | 68 | 19-1 | 7380 | invoice, bank statement |

| The computer is accepted for accounting as an object of fixed assets | 01 | 08 | 41 000 | act of acceptance and transfer of fixed assets |

3. Fixed asset item purchased using targeted proceeds

| Contents of operation | Debit | Credit | Sum | Primary document |

| Paid for fixed asset | 60-2 | 51 | 41 300 | payment order, bank statement |

| Computers received | 08 | 60-1 | 41 300 | waybill, invoice |

| Advance paid to supplier credited | 60-1 | 60-2 | 41 300 | check |

| The computer is accepted for accounting as an object of fixed assets | 01 | 08 | 41 300 | act of acceptance and transfer of fixed assets |

| The source of financing for the purchased OS is reflected | 86-1, etc. | 83-1 | 41 300 | accounting certificate, estimate of income and expenses |

* A peculiarity of accounting for fixed assets that were received through targeted financing is that it is necessary to use account 83. The Russian Ministry of Finance recommends that the balances on it be reflected in the balance sheet in the line “Real estate and especially valuable movable property fund.”

Such recommendations are given by the Ministry of Finance of Russia in paragraph 15 of information PZ-1/2015, in letters dated February 19, 2004 No. 16-00-14/40, dated February 4, 2005 No. 03-06-01-04/83.

What postings are made when receiving fixed assets free of charge?

Fixed assets that come to non-profit organizations free of charge are taken into account at their current market value. The postings to capitalize such a fixed asset are in the table below.

| Contents of operation | Debit | Credit | Sum | Primary document |

| The obligation under the donation agreement, payment of the membership fee, etc. is reflected. | 76 | 86 | 45 000 | donation agreement, etc. |

| The market value of the object is reflected | 08 | 76 | 45 000 | Act |

| Costs for delivery, assembly, installation are reflected | 08 | 76 | 1500 | contracts, acts, accounts, etc. |

| Included in fixed assets | 01 | 08 | 46 500 | act of acceptance and transfer of fixed assets |

| The source of financing for the purchased OS is reflected | 86-1, etc. | 83-1 | 46 500 | accounting certificate, estimate of income and expenses |

Is it necessary to calculate depreciation in NPO accounting?

For fixed assets of non-profit organizations, depreciation is not calculated in accounting. And it doesn’t matter from what source the object was acquired. Instead of depreciation, NPOs charge depreciation of fixed assets, which is not recognized as an expense. This is stated in paragraph 3 of paragraph 17 of PBU 6/01, letters of the Ministry of Finance of Russia dated November 19, 2012 No. 07-02-06/275, dated September 30, 2010 No. 07-02-06/148.

Where in the balance sheet and its explanations do non-profit organizations reflect fixed assets?

In the Balance Sheet, the value of fixed assets of non-profit organizations is reflected in section 1 in the line “Fixed Assets”. This must be done at the full original cost. Do not reduce it by the amount of wear.

In the explanations to the Balance Sheet, the value of fixed assets of non-profit organizations is reflected in Section 2 “Fixed Assets”, Table 2.1 “Availability and Movement of Fixed Assets”. However, in this NPO table, the columns “Accumulated depreciation” and “Accrued depreciation” are renamed “Accumulated depreciation” and “Accrued depreciation”, respectively. That is, unlike the balance sheet, the table shows both the full original cost and accrued depreciation.

This is stated in Note 6 to Appendix 3 to Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010.

How to reflect the cost of fixed assets in a report on the intended use of funds

In the report, reflect the fixed assets that were acquired through targeted financing. This will include items purchased both in the current year and in the past. Reflect them at the contractual value in the line “Acquisition of fixed assets, inventory and other property.”

How to write off fixed assets

The Russian Ministry of Finance recommends writing off fixed assets that can no longer be used in the accounting of non-profit organizations as follows. Reduce the indicators for the groups of articles “Fixed assets” and “Fund of real estate and especially valuable movable property”. At the same time, reduce the amount of wear and tear.

| Contents of operation | Debit | Credit | Sum | Primary document |

| Fixed assets purchased using targeted proceeds or received free of charge have been written off | 83 | 01 | 45 000 | Accounting information |

| Depreciation written off | – | 010 | 45 000 | Accounting information |

This procedure is prescribed in paragraph 6 of the information of the Ministry of Finance of Russia PZ-1/2015.

What entries are made when selling fixed assets?

The accounting records for the sale of a fixed asset depend on the NPO taxation system. A set of wiring for the general and simplified system is in the tables below.

- Postings when selling fixed assets to non-profit organizations under the general taxation regime

| Contents of operation | Debit | Credit | Sum | Primary document |

| Listed per OS object | 60 | 51 | 60 000 | payment order, bank statement |

| Supplier's invoice accepted | 08 | 60 | 50 847,46 | invoice |

| The amount of VAT on the acquired fixed asset is reflected | 19 | 60 | 9152,54 | invoice |

| The amount of VAT is included in the price of the object | 08 | 19 | 9152,54 | accounting information |

| The object is included in fixed assets | 01 | 08 | 60 000 | act of acceptance and transfer of fixed assets |

| The source of financing for the acquired fixed asset is reflected | 86-2 | 83 | 60 000 | accounting certificate, estimate of income and expenses |

| Accrued depreciation during the operation of the OS object | 010 | 21 000 | accounting certificate-calculation | |

| The buyer's debt for the asset being sold is reflected | 76 | 91-1 | 64 900 | contract, invoice |

| The amount of VAT payable to the budget has been accrued [(64 900 – 60 000) × 18/118] | 91-3 | 68 | 748 | invoice, calculation |

| The original cost of a retiring fixed asset has been written off | 83 | 01 | 60 000 | act of acceptance and transfer of fixed assets |

| Received funds from the OS buyer | 51 | 76 | 64 900 | bank statement |

| The financial result from the sale of an asset has been identified (without taking into account other operations) [64 900 – 748] | 91-9 | 99 | 64 152 | accounting certificate-calculation |

2. Postings for the sale of fixed assets to non-profit organizations in a simplified manner

| Contents of operation | Debit | Credit | Sum | Primary document |

| Listed per OS object | 60 | 51 | 60 000 | payment order, bank statement |

| Supplier's invoice accepted | 08 | 60 | 50 847,46 | invoice |

| The amount of VAT on the acquired fixed asset is reflected | 19 | 60 | 9152,54 | invoice |

| The amount of VAT is included in the price of the object | 08 | 19 | 9152,54 | accounting information |

| The object is included in fixed assets | 01 | 08 | 60 000 | act of acceptance and transfer of fixed assets |

| The source of financing for the acquired fixed asset is reflected | 86-2 | 83 | 60 000 | accounting certificate, estimate of income and expenses |

| Accrued depreciation during the operation of the OS object | 010 | 21 000 | accounting certificate-calculation | |

| The buyer's debt for the asset being sold is reflected | 76 | 91-1 | 64 900 | contract, invoice |

| The original cost of a retiring fixed asset has been written off | 83 | 01 | 60 000 | act of acceptance and transfer of fixed assets |

| The amount of depreciation accrued during the operation of the asset has been written off | 010 | 21 000 | accounting certificate-calculation | |

| Received funds from the OS buyer | 51 | 76 | 64 900 | bank statement |

| The financial result from the sale of an asset has been identified (without taking into account other operations) | 91-9 | 99 | 64 900 | accounting certificate-calculation |

| Single tax charged for simplification (64 900 × 6%) | 99 | 68 | 3894 | accounting certificate-calculation |

BASIC

Is it possible to calculate depreciation in tax accounting?

Non-profit organizations that received fixed assets free of charge or purchased them using earmarked funds and use them in their statutory activities do not accrue depreciation on them. This is directly stated in subparagraph 2 of paragraph 2 of Article 256 of the Tax Code of the Russian Federation.

How to determine sales proceeds

When calculating income tax, determine the proceeds from the sale of a fixed asset of an NPO as its full sales price excluding VAT. It cannot be reduced for the cost of purchasing the property. Since targeted funds are not taken into account in income, then costs at their expense are not taken into account either. In addition, the organization had no intention of using such property for the purpose of generating income. And generating income is one of the conditions to write off as expenses for the acquisition of an object.

This conclusion follows from paragraph 1 of Article 252, paragraph 2 of Article 251, Article 250 of the Tax Code of the Russian Federation and letter of the Ministry of Finance of Russia dated February 5, 2010 No. 03-03-06/4/9.

How to calculate VAT on the sale of fixed assets

For non-commercial organizations, there are two options for calculating VAT on the sale of fixed assets.

First option: VAT must be charged on the full sales price (clause 1 of Article 154 of the Tax Code of the Russian Federation). Do this if VAT was not paid upon receipt of the fixed asset. For example, they received it for free or purchased it from an organization on a simplified basis.

Second option: charge VAT on the difference between the sale and residual value of the property. That is, according to the rules of paragraph 3 of Article 154 of the Tax Code of the Russian Federation. Using these rules, determine the tax base when the fixed asset was purchased with VAT, but the tax was not deducted. For example, the object was used for statutory activities or in business activities exempt from VAT. For full details on how to do this and examples, see How to calculate VAT on the sale of property accounted for with input VAT.

simplified tax system

Acquisition costs

Expenses for the acquisition of fixed assets received free of charge or at the expense of earmarked funds for statutory activities cannot be recognized as expenses under the simplified procedure. This conclusion follows from paragraph 4 of Article 346.16, paragraph 1 and subparagraph 2 of paragraph 2 of Article 256 of the Tax Code of the Russian Federation.

Income and expenses upon sale

When calculating the single tax, an NPO includes in its income the full sales value of the fixed asset. And even if you use a simplification with the “income minus expenses” object, do not take into account the initial cost of the fixed asset in expenses. Since targeted funds are not taken into account in income, then costs at their expense are not taken into account either. In addition, the organization had no intention of using such property for the purpose of generating income. And generating income is one of the conditions to write off as expenses for the acquisition of an object.

This conclusion follows from paragraphs 1 and 4 of Article 346.16, subparagraph 1 of paragraph 1.1 of Article 346.15, paragraph 1 of Article 252, Article 250, paragraph 2 of Article 251 of the Tax Code of the Russian Federation and letter of the Ministry of Finance of Russia dated February 5, 2010 No. 03-03-06/ 4/9.

What postings should be used to reflect fixed assets for a fee?

Purchased fixed assets are reflected in the accounting of non-profit organizations depending on the funds with which they were acquired and for what activity. There can be two sources: income from business activities or targeted income. Postings for each individual case are in the tables below.

Fixed assets came from income from business activities subject to VAT

| Contents of operation | Debit | Credit | Sum | Primary document |

| Paid for a computer | 60 | 51 | 48 380 | payment order, bank statement |

| Received a computer | 08 | 60 | 41 000 | invoice |

| The amount of VAT paid to the supplier is reflected | 19-1 | 60 | 7380 | invoice |

| Accepted for VAT crediting on activities subject to VAT | 68 | 19-1 | 7380 | invoice, bank statement |

| The computer is accepted for accounting as an object of fixed assets | 01 | 08 | 41 000 | act of acceptance and transfer of fixed assets |

Fixed assets came from income from business activities, which are not subject to VAT

| Contents of operation | Debit | Credit | Sum | Primary document |

| Paid for a computer | 60 | 51 | 48 380 | payment order, bank statement |

| Received a computer | 08 | 60 | 41 000 | invoice |

| The amount of VAT paid to the supplier is reflected | 19-1 | 60 | 7380 | invoice |

| VAT is included in the price of the property, which will be used in income-generating activities exempt from VAT | 68 | 19-1 | 7380 | invoice, bank statement |

| The computer is accepted for accounting as an object of fixed assets | 01 | 08 | 41 000 | act of acceptance and transfer of fixed assets |

Fixed assets purchased using targeted proceeds*

| Contents of operation | Debit | Credit | Sum | Primary document |

| Paid for fixed asset | 60-2 | 51 | 41 300 | payment order, bank statement |

| Computers received | 08 | 60-1 | 41 300 | waybill, invoice |

| Advance paid to supplier credited | 60-1 | 60-2 | 41 300 | check |

| The computer is accepted for accounting as an object of fixed assets | 01 | 08 | 41 300 | act of acceptance and transfer of fixed assets |

| The source of financing for the purchased OS is reflected | 86-1, etc. | 83-1 | 41 300 | accounting certificate, estimate of income and expenses |

* A peculiarity of accounting for fixed assets that were received through targeted financing is that it is necessary to use account 83. The Russian Ministry of Finance recommends that the balances on it be reflected in the balance sheet in the line “Real estate and especially valuable movable property fund.”

Such recommendations are given by the Ministry of Finance of Russia in paragraph 15 of information PZ-1/2015, in letters dated February 19, 2004 No. 16-00-14/40, dated February 4, 2005 No. 03-06-01-04/83.

Accounting for expenses in non-profit organizations. Separate accounting of statutory and entrepreneurial activities

Under non-profit organizations, in accordance with Art. 2 of the Federal Law of January 12, 1996 No. 7-FZ On Non-Profit Organizations (hereinafter referred to as Law No. 7-FZ) refers to organizations that do not have profit as the main goal of their activities and do not distribute the profits received among participants.

Non-profit organizations can be created in the form of public or religious organizations (associations), communities of indigenous peoples of the Russian Federation, Cossack societies, non-profit partnerships, institutions, autonomous non-profit organizations, social, charitable and other funds, associations and unions, as well as in other forms, provided for by federal laws.

The activities of such associations are regulated by the chart of accounts, certain accounting regulations, as well as the following regulatory documents:

- Law on Accounting No. 402-FZ;

- Civil Code (Civil Code of the Russian Federation);

- Law “On Non-Profit Organizations” No. 7-FZ of January 12, 1996;

- Law “On Public Associations” No. 82-FZ of May 19, 1995.

The exception is consumer cooperatives. Their activities are regulated by the Law of the Russian Federation of June 19, 1992 N 3085-1 “On consumer cooperation (consumer societies, their unions) in the Russian Federation” and other laws and legal acts.

Despite the fact that the goals of non-profit organizations are aimed at achieving socially beneficial benefits, they are not legally limited in their ability to carry out entrepreneurial activities. This is directly indicated in paragraph 2 of Art. 24 of Federal Law No. 7-FZ: A non-profit organization can carry out entrepreneurial and other income-generating activities only insofar as it serves the purposes for which it was created and corresponds to the specified goals, provided that such activities are specified in its constituent documents. Thus, Federal Law No. 7-FZ of January 12, 1996 “On Non-Profit Organizations” directly indicates that a non-profit organization can carry out one type of activity or several types of activities not prohibited by the legislation of the Russian Federation, which are provided for by its constituent documents (p. 1, article 24). The main activity of a non-profit organization should not make a profit; therefore, the main sources of material and financial resources for institutions of this organizational and legal form of ownership are funds from legal entities and individuals. Such funds, as a rule, are targeted.

Organizations of the non-profit sector of the economy have the right to conduct commercial (entrepreneurial) activities. At the same time, NPOs are granted the right to engage in entrepreneurial activities subject to the following conditions:

- business activities must correspond to the goals of creating an NPO;

- income from business activities should be directed only to achieving these goals.

According to paragraph 3 of Art. 26 of Law No. 7-FZ, NPOs do not have the right to distribute the profits received among their founders. Organizations are required to use it to finance their statutory activities.

Sources of formation of property in monetary and other forms of a targeted nature are: budget revenues; regular and one-time receipts from the founders (participants, members); voluntary property contributions and donations from legal entities and individuals (including foreign states); the work of activists and volunteers; other receipts not prohibited by law.

Thus, all sources of formation of property of non-profit organizations can be divided into targeted revenues (in any form) and income from business activities.

In accordance with paragraph 3 of Art. 50 of the Civil Code of the Russian Federation, legal entities that are non-profit organizations can be created in different organizational and legal forms and each of them has its own characteristics in keeping records of the organization’s expenses.

Let us consider in the article how expenses are accounted for in a non-profit organization as a whole.

Accounting for expenses in non-profit organizations

At first glance, the process of accounting for income and expenses in non-profit organizations is a simple process, but in fact it is a complex process that requires detailed study and improvement.

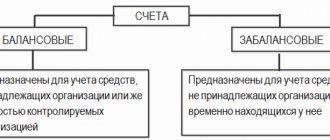

In the accounting system, account 86 “Targeted financing” is rarely used; the methodology for working with this account has not been properly developed, which makes it difficult to use for accounting in non-profit organizations. However, for accounting for targeted funds in accounting for NPO expenses, account 86 “Targeted financing” is the main one. Issues of obtaining and using targeted funds do not arise only in cases where the organization has one source of funding to complete a single project. However, an analysis of the practical activities of various non-profit organizations shows that this is extremely rare.

For proper accounting and taxation of received funds, the accountant should determine whether the activities of the NPO are statutory or whether they are considered entrepreneurial. It's not that simple.

The fact is that the legislation does not define the statutory activities of NPOs. Therefore, this concept can simply be understood as the activity included in the charter, for the sake of which a non-profit organization is created.

It is possible to determine which activities of an NPO are statutory based on the norms specified in the charter and budget of the NPO. We will not dwell on them in more detail in our article.

The Ministry of Finance of Russia combined all the features of accounting and preparation of financial statements of non-profit organizations in one document - Information No. PZ-1/2015 “On the features of the formation of accounting (financial) statements of non-profit organizations”, published on December 24, 2015.

Despite the fact that this document is advisory, it contains references to laws and PBUs and therefore can be reasonably used in the work of accountants. Let's consider the main features of cost accounting in non-profit organizations.

Using accounts 20 “Main production”

and 26 “General business expenses” in accounting for NPO expenses.

Accounting support

Zero 1500 rub. Activity 3500 rub. Activities + Salary 5000 rub.

• Personal accountant • Possibly remotely • 12 years of experience • 1000+ NGOs • All forms • Grants

Call your accountant right away

*The cost in Moscow and Moscow Region, St. Petersburg and Leningrad region is respectively: 2000, 5000, 7000 rubles

Order a consultation

Expenses for carrying out activities related to the statutory activities of the organization are reflected in the debit of accounts 20 “Main production” or 26 “General business expenses” in correspondence with accounts 70 “Calculations for wages”, 60 “Settlements with suppliers and contractors”, 76 “Calculations with other debtors and creditors”, etc.

The accounting policy indicates that account 20 directly reflects the costs of carrying out NPO activities, and account 26 reflects the costs of maintaining the management staff of the NPO (salaries, taxes, stationery, etc.).

And if a non-profit organization carries out several targeted programs, then it is necessary to distribute general administrative and economic costs between them. This can be done in one of the following ways:

- by writing off all administrative and economic expenses at the expense of those programs in which they are included in the estimate;

- by writing off expenses in proportion to the share of funds received for each program.

The chosen method for distributing general administrative and economic expenses must be reflected in the accounting policies of the organization.

At the end of each reporting period, expenses accumulated on accounts 20 or 26 are written off from targeted financing funds (account 86 “Targeted financing”).

Note! Some NPOs that do not conduct business or use a simplified taxation system reflect the expenditure of target funds bypassing account 20 - directly at the expense of target financing funds. They record this accounting option in their accounting policies. Let’s say right away that this is incorrect, since this accounting option does not comply with the Instructions for the use of the Chart of Accounts, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n.

Using account 86 “Targeted financing”

To account for targeted income and expenses, account 86 “Targeted financing” is used.

On the credit side, accounts 86 reflect entry and membership fees from founders and participants, voluntary contributions and donations from individuals and organizations, as well as all other targeted funds received to finance the statutory activities of the organization.

The following entries are used:

D-t of account 51 “Current account” (50 “Cash”, 52 “Currency account”) D-t of account 76 “Settlements with various debtors and creditors”;

Account number 76 Account number 86.

When receiving property that is not cash, the following is recorded in the accounting records of a non-profit organization:

D-t account 08 “Capital investments” (10 “Materials”, 41 “Goods”) D-t account 76 “Settlements with various debtors and creditors”;

Account number 76 Account number 86.

Analytical accounting for this account is carried out:

- by sources of their income (subaccount 86-1 “Targeted financing by type of income”);

- according to the purpose of targeted funds (subaccount 86-2 “Expenditure of targeted financing”, and analytical accounts to it).

For analytical accounting of target funding receipts (sources) in the working chart of accounts for account 86-1 “Targeted funding by type of revenue”, you can open the following analytical accounts:

- 86-1.1 “Entry fees”,

- 86-1.2 “Membership fees”,

- 86-1.3 “Share contributions”,

- 86-1.4 “Targeted contributions”,

- 86-1.5 “Voluntary contributions”,

- 86-1.6 “Income from business activities”,

- 86-1.7 “Other income”.

For analytical accounting of the use of NPO funds in the working chart of accounts, you can open the following analytical accounts for account 86-2 “Expenditure of targeted financing funds”:

- 86-2.1 “Expenses for targeted activities”,

- 86-2.2 “Costs for maintaining the management apparatus”,

- 86-2.3 “Expenses for the acquisition of fixed assets and materials”,

- 86-2.4 “Other expenses”.

Targeted funds received as sources of financing for various activities are reflected in the credit of account 86:

— receipt of targeted funds from participants, founders, sponsors is reflected:

Debit account 50 (51, 52, 55) Credit account 86;

— receipt of property targeted contributions in kind:

Debit accounts 07, 08, 10, 15, 41, etc., Credit account 86;

- direction to funds for targeted financing of the main statutory activity of profit from entrepreneurial activity (after accrual and payment of income tax):

Debit account 99, Credit account 86;

If targeted financing is carried out in parts, an accounting entry is drawn up:

Debit account 76, Credit account 86;

Targeted funds, as well as income from business activities received by NPOs, are intended for strictly defined purposes. Targeted funds are spent in accordance with the approved budget. A non-profit organization must have an independent balance sheet or budget (Clause 1, Article 3 of the Law “On Non-Profit Organizations”). The estimate of income and expenses is the main document on the basis of which an NPO operates. It reflects item by item all types of income and expenses of the organization for a certain period of activity of this institution. The estimate can be drawn up for any period (month, quarter, year (mostly))

There is no unified form of income and expense estimates. This is explained by the fact that NPOs may have specifics and therefore the estimate is developed by a specific NPO based on the assigned tasks or is developed by the founder of the organization. A separate estimate is drawn up for each target program. Each program provides a separate item for administrative expenses. At the end of the reporting period, a report on the execution of the estimate is drawn up.

The use of target income is reflected in the debit of account 86 in correspondence with the accounts:

- 20 “Main production” or 26 “General business expenses” - when directing funds for targeted financing for the maintenance of non-profit organizations;

- 83 “additional capital” - when using targeted financing received in the form of investment funds;

- 98 “Future income” - when directing budget funds to finance expenses, etc.

The following accounting entries are prepared:

— targeted funding is aimed at maintaining the organization:

Debit account 86, Credit account 20 (26);

It should be noted that accounts 20 and 26 are intended to summarize information on expenses for ordinary activities (in accordance with PBU 10/99). However, expenses from targeted financing are not expenses for ordinary activities and the provisions of PBU 10/99 do not apply to these expenses.

Thus, expenses directly related to the conduct of statutory activities can be reflected in two ways: on account 20 (sub-account “Expenses on statutory activities”) or 26 with subsequent attribution to account 86 and directly on account 86. The procedure for accounting for expenses on statutory activities is reflected in the accounting policies of non-profit organizations.

— targeted financing funds were returned:

Debit account 86, Credit account 50 (51,51,55);

— unused funds from targeted financing are transferred from the current account:

Account debit 60, account credit 51;

—equipment (fixed assets) purchased using targeted funding has been received:

Debit account 08, Credit account 60;

— targeted financing funds were used to purchase equipment:

Account debit 86, account credit 20;

— targeted financing funds were used for investment:

Account debit 86, account credit 83.

Since non-profit organizations maintain accrual accounting, they must reflect not only the funds received, but also accrue them on the planned date of receipt (according to the donation agreement, membership policy or other document). For example, if a non-profit partnership, based on the membership regulations, was supposed to receive membership fees on the 1st day of a month, then the accountant had to accrue them in the accounting records, regardless of whether the money was received or not.

That is, on the date of expected receipt of funds it was necessary to make the following entry:

Account number 76 Account number 86.

And only when you receive money:

Account number 51 Account number 76.

Sub-accounts are opened to account 86 based on the specifics of the organization’s core activities and the peculiarities of document flow.

Since the activities of a non-profit organization are based on an estimate, the methodology for accounting for target funds is reflected based on its structure: taking into account the items of income and expenses.

Moreover, analytics on types and sources of financing may not necessarily be carried out on account 86. It is enough to show it on account 76 “Settlements with various debtors and creditors.” It is also possible to duplicate some information on both accounts.

Similarly, in the case where analytics by types of programs and expense items is reflected on account 20, on account 86 it can not be maintained or duplicated.

The selected accounting options must be fixed in the accounting policies of the non-profit organization.

What postings are made when receiving fixed assets free of charge?

Fixed assets that come to non-profit organizations free of charge are taken into account at their current market value. The postings to capitalize such a fixed asset are in the table below.

| Contents of operation | Debit | Credit | Sum | Primary document |

| The obligation under the donation agreement, payment of the membership fee, etc. is reflected. | 76 | 86 | 45 000 | donation agreement, etc. |

| The market value of the object is reflected | 08 | 76 | 45 000 | Act |

| Costs for delivery, assembly, installation are reflected | 08 | 76 | 1500 | contracts, acts, accounts, etc. |

| Included in fixed assets | 01 | 08 | 46 500 | act of acceptance and transfer of fixed assets |

| The source of financing for the purchased OS is reflected | 86-1, etc. | 83-1 | 46 500 | accounting certificate, estimate of income and expenses |

Corporate income tax

In this case, the fixed asset was acquired at the expense of targeted revenues (donations), which for tax purposes are not taken into account as income (paragraph 1, paragraph 2, paragraph 1, paragraph 2, Article 251 of the Tax Code of the Russian Federation).

Let us remind you: the organization is obliged to keep separate records of income (expenses) received (incurred) within the framework of targeted revenues (clause 2 of Article 251 of the Tax Code of the Russian Federation).

An asset acquired at the expense of targeted proceeds and used to carry out non-commercial statutory activities is recognized for profit tax purposes as depreciable property that is not subject to depreciation (clause 2, clause 2, article 256 of the Tax Code of the Russian Federation).

Table of accounting entries

| Debit | Credit | Sum | Primary document | |

| The value of the property subject to accounting as an OS2 object is reflected | 08-4 | 60 | 120 000 | Seller's shipping documents |

| Payment has been made to the seller | 60 | 51 | 120 000 | Bank account statement |

| The property was accepted for accounting as part of fixed assets | 01 | 08-4 | 120 000 | Certificate of acceptance and transfer of fixed assets, Inventory card for accounting of fixed assets |

| The use of targeted financing and the emergence of a fund of real estate and especially valuable property are reflected | 86 | 83 | 120 000 | Accounting information |

1 Depreciation is not calculated for fixed assets of non-profit organizations. In relation to these objects, the off-balance sheet account reflects information on the amounts of depreciation accrued in a straight-line manner in relation to the procedure given in clause 19 of PBU 6/01 (clause 17 of PBU 6/01). Accrual of depreciation on an asset is not considered in this consultation.

2 For the purpose of rational accounting, the contractual value of an asset can be reflected on account 08 “Investments in non-current assets” in full, taking into account non-refundable VAT presented by the seller (i.e. without prior allocation of VAT on account 19 “Value added tax on acquired values"). We recommend enshrining this procedure in the accounting policy (clauses 4, 6 of the Accounting Regulations “Accounting Policy of the Organization” (PBU 1/2008), approved by Order of the Ministry of Finance of Russia dated October 6, 2008 N 106n).

Where in the balance sheet and its explanations do non-profit organizations reflect fixed assets?

In the Balance Sheet, the value of fixed assets of non-profit organizations is reflected in section 1 in the line “Fixed Assets”. This must be done at the full original cost. Do not reduce it by the amount of wear.

In the explanations to the Balance Sheet, the value of fixed assets of non-profit organizations is reflected in Section 2 “Fixed Assets”, Table 2.1 “Availability and Movement of Fixed Assets”. However, in this NPO table, the columns “Accumulated depreciation” and “Accrued depreciation” are renamed “Accumulated depreciation” and “Accrued depreciation”, respectively. That is, unlike the balance sheet, the table shows both the full original cost and accrued depreciation.

This is stated in Note 6 to Appendix 3 to Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010.

Formation of reserves in NPO accounting

When forming reserves in accounting, the accountant is guided by PBU 8/2010 (approved by Order of the Ministry of Finance of Russia dated December 13, 2010 N 167n). PBU 8/2010 also applies to non-profit organizations.

According to this document, an NPO must, for accounting purposes, create reserves for amounts for which it has obligations in accordance with applicable documents and legislation. Account 96 “Reserves for future expenses” is convenient for making reservations.

All types of reserves that the non-profit organization intends to create (to pay for vacations, bonuses, for warranty repairs, etc.) must be reflected in the estimate, in its individual articles. So account 96 “Reserves for future expenses” will automatically reflect all the specified reserves for which it is necessary to enter the corresponding subaccounts.

Let's consider the possible reserves of non-profit organizations that can be reflected in this account.

Let's start with the most understandable for an accountant - the reserve for vacation pay.

This reserve must be created taking into account the number of unused days of paid vacation earned by the employee and the planned vacation days reflected in the vacation schedule. The reserve amount is accounted for in a special sub-account opened to account 96 “Reserves for future expenses”. The entries will be like this:

D-t account 86 D-t account 96/Reserve for vacation pay - deductions to the reserve are reflected;

D-t of account 96/Reserve for payment of vacations D-t of account 70 - vacation payments are written off from the reserve.

Also, in accordance with PBU 8/2010, non-profit organizations need to create reserves to pay bonuses at the end of the year and for length of service (if such are specified in the salary regulations or other personnel documents), as well as to pay other expenses that may arise in the future based on the activities of NPOs.

How to write off fixed assets

The Russian Ministry of Finance recommends writing off fixed assets that can no longer be used in the accounting of non-profit organizations as follows. Reduce the indicators for the groups of articles “Fixed assets” and “Fund of real estate and especially valuable movable property”. At the same time, reduce the amount of wear and tear.

| Contents of operation | Debit | Credit | Sum | Primary document |

| Fixed assets purchased using targeted proceeds or received free of charge have been written off | 83 | 01 | 45 000 | Accounting information |

| Depreciation written off | – | 010 | 45 000 | Accounting information |

This procedure is prescribed in paragraph 6 of the information of the Ministry of Finance of Russia PZ-1/2015.

Accounting in NPOs for the acquisition of private equity property whose duration exceeds 12 months

How to reflect in the accounting of a non-profit organization (NPO) the acquisition of property, the useful life of which exceeds 12 months, at the expense of targeted income (donations)? The acquired property is intended for use in statutory non-commercial activities. The cost of the acquired property is 120,000 rubles. (in view of VAT).

The property of an NPO intended for use in activities aimed at achieving the goals of its creation for a period exceeding 12 months is taken into account as an item of fixed assets (FPE). This follows from clause 4 of the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n. An asset is accepted for accounting at its original cost, equal to the amount of actual costs for its acquisition, excluding VAT and other refundable taxes (except for cases provided for by the legislation of the Russian Federation) (clauses 7, 8 of PBU 6/01).

In this case, the actual costs of acquiring fixed assets are the amount payable to the seller in accordance with the contract, including non-refundable VAT (as discussed in the “Value Added Tax (VAT)” section) (paragraph 3, paragraph 8 of paragraph 8 of PBU 6/ 01, paragraph 1, paragraph 2, article 170 of the Tax Code of the Russian Federation).

When accounting for property as an asset, the non-profit organization shows the use of targeted financing for its acquisition (in this case, targeted revenues). This operation is reflected as a decrease in targeted funding for NPOs and an increase in additional capital in terms of the fund of real estate and especially valuable movable property. This follows from paragraphs 15, 16 of the Information of the Ministry of Finance of Russia “On the peculiarities of the formation of accounting (financial) statements of non-profit organizations (PZ-1/2015)”, Note 6 to the balance sheet, the form of which was approved by Order of the Ministry of Finance of Russia dated 07/02/2010 N 66n (Appendix No. 1), as well as Letters of the Ministry of Finance of Russia dated 02/04/2005 N 03-06-01-04/83, dated 07/31/2003 N 16-00-14/2431.

Accounting records for the transactions in question are made taking into account the above, as well as the rules established by the Instructions for the application of the Chart of Accounts for accounting of financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n, and are shown below in the table of entries.

What entries are made when selling fixed assets?

The accounting records for the sale of a fixed asset depend on the NPO taxation system. A set of wiring for the general and simplified system is in the tables below.

Postings when selling fixed assets to non-profit organizations under the general taxation regime

| Contents of operation | Debit | Credit | Sum | Primary document |

| Listed per OS object | 60 | 51 | 60 000 | payment order, bank statement |

| Supplier's invoice accepted | 08 | 60 | 50 847,46 | invoice |

| The amount of VAT on the acquired fixed asset is reflected | 19 | 60 | 9152,54 | invoice |

| The amount of VAT is included in the price of the object | 08 | 19 | 9152,54 | accounting information |

| The object is included in fixed assets | 01 | 08 | 60 000 | act of acceptance and transfer of fixed assets |

| The source of financing for the acquired fixed asset is reflected | 86-2 | 83 | 60 000 | accounting certificate, estimate of income and expenses |

| Accrued depreciation during the operation of the OS object | 010 | 21 000 | accounting certificate-calculation | |

| The buyer's debt for the asset being sold is reflected | 76 | 91-1 | 64 900 | contract, invoice |

| The amount of VAT payable to the budget has been accrued [(64 900 – 60 000) × 18/118] | 91-3 | 68 | 748 | invoice, calculation |

| The original cost of a retiring fixed asset has been written off | 83 | 01 | 60 000 | act of acceptance and transfer of fixed assets |

| Received funds from the OS buyer | 51 | 76 | 64 900 | bank statement |

| The financial result from the sale of an asset has been identified (without taking into account other operations) [64 900 – 748] | 91-9 | 99 | 64 152 | accounting certificate-calculation |

Postings for the sale of fixed assets to non-profit organizations in a simplified manner

| Contents of operation | Debit | Credit | Sum | Primary document |

| Listed per OS object | 60 | 51 | 60 000 | payment order, bank statement |

| Supplier's invoice accepted | 08 | 60 | 50 847,46 | invoice |

| The amount of VAT on the acquired fixed asset is reflected | 19 | 60 | 9152,54 | invoice |

| The amount of VAT is included in the price of the object | 08 | 19 | 9152,54 | accounting information |

| The object is included in fixed assets | 01 | 08 | 60 000 | act of acceptance and transfer of fixed assets |

| The source of financing for the acquired fixed asset is reflected | 86-2 | 83 | 60 000 | accounting certificate, estimate of income and expenses |

| Accrued depreciation during the operation of the OS object | 010 | 21 000 | accounting certificate-calculation | |

| The buyer's debt for the asset being sold is reflected | 76 | 91-1 | 64 900 | contract, invoice |

| The original cost of a retiring fixed asset has been written off | 83 | 01 | 60 000 | act of acceptance and transfer of fixed assets |

| The amount of depreciation accrued during the operation of the asset has been written off | 010 | 21 000 | accounting certificate-calculation | |

| Received funds from the OS buyer | 51 | 76 | 64 900 | bank statement |

| The financial result from the sale of an asset has been identified (without taking into account other operations) | 91-9 | 99 | 64 900 | accounting certificate-calculation |

| Single tax charged for simplification (64 900 × 6%) | 99 | 68 | 3894 | accounting certificate-calculation |

Accounting

Reflection of transactions for the acquisition of fixed assets in non-profit organizations is reflected in the same way as in commercial organizations. With the exception of one nuance - VAT is included in the price as a non-refundable tax. However, for commercial organizations that use the simplified tax system, the acquisition of OS is reflected in the same way.

Purchasing an OS

| Debit | Credit | |

| 60 | 51 | paid by OS |

| 08 | 60 | received by OS |

| 19−1 | 60 | the amount of VAT paid to the OS supplier |

| 08 | 19−1 | VAT is included in the cost of fixed assets as a non-refundable tax (PBU 6/01, clause 8) |

| 01 | 08 | OS accepted for accounting |

Since the OS is acquired using earmarked funds, it should be reflected in account 86. There are two options:

Option 1

| Debit | Credit | |

| 86 | 83 | This option is recommended by the Ministry of Finance (albeit in responses to private requests) |

Option 2

| Debit | Credit | |

| 86 | 86−9 | subaccount 9 “targeted proceeds used for the acquisition of fixed assets” |

The option you choose must be fixed in the accounting policy of the organization.

Wear

NPOs do not accrue depreciation on fixed assets; instead, depreciation is accrued monthly on off-balance sheet account 010. Even if a fixed asset was acquired using funds from business activities, depreciation is not accrued on it in accounting, because such conditions are specified in PBU 6/01 .

OS sales

In the case of the sale of fixed assets acquired using earmarked funds, there are four options for recording transactions related to the sale. Which one is correct is a subject of debate among NPO specialists.

- 1. Option for those who chose option 1 when purchasing the OS, i.e. made wiring Dt 86—Kt 83.

| Debit | Credit | |

| 76 | 91−1 | (1) buyer's debt for fixed assets |

| 91−3 | 68 | (2) VAT charged (by VAT payers) |

| 01−2 | 01−1 | (3) Assets to be disposed of |

| 91−2 | 01−2 | (4) write-off of the initial cost of fixed assets |

| 51 | 76 | (5) paid by OS by buyer |

| 91−9 | 99 | (6) financial result |

| 010 | (7) depreciation amount written off | |

| 86 | 83 | (8) red reversal, restoration of the source of financing for the acquired fixed asset |

- Option 2 is also for those who chose option 1 when purchasing the OS:

| Debit | Credit | |

| 76 | 91−1 | (1) buyer's debt for fixed assets |

| 91−3 | 68 | (2) VAT charged (by VAT payers) |

| 01−2 | 01−1 | (3) Assets to be disposed of |

| 83 | 01−2 | (4) write-off of the initial cost of fixed assets |

| 91−9 | 99 | (5) financial result |

| 010 | (6) depreciation amount written off |

- 3. Option for those who chose option 2 when purchasing the OS:

Postings from (1) to (7) are the same as option 1.

| Debit | Credit | |

| 86−9 | 86 | (8) restoration of the source of financing for the acquired fixed assets |

- 4. Option for those who chose option 2 when purchasing the OS:

Wiring (1)—(3), (5) and (6) are the same as in option 2.

| Debit | Credit | |

| 86−9 | 01−2 | (4) write-off of the initial cost of fixed assets |

BASIC

Is it possible to calculate depreciation in tax accounting?

Non-profit organizations that received fixed assets free of charge or purchased them using earmarked funds and use them in their statutory activities do not accrue depreciation on them. This is directly stated in subparagraph 2 of paragraph 2 of Article 256 of the Tax Code of the Russian Federation.

How to determine sales proceeds

When calculating income tax, determine the proceeds from the sale of a fixed asset of an NPO as its full sales price excluding VAT. It cannot be reduced for the cost of purchasing the property. Since targeted funds are not taken into account in income, then costs at their expense are not taken into account either. In addition, the organization had no intention of using such property for the purpose of generating income. And generating income is one of the conditions to write off as expenses for the acquisition of an object.

This conclusion follows from paragraph 1 of Article 252, paragraph 2 of Article 251, Article 250 of the Tax Code of the Russian Federation and letter of the Ministry of Finance of Russia dated February 5, 2010 No. 03-03-06/4/9.

How to calculate VAT on the sale of fixed assets

For non-commercial organizations, there are two options for calculating VAT on the sale of fixed assets.

First option : VAT must be charged on the full sales price (clause 1 of Article 154 of the Tax Code of the Russian Federation). Do this if VAT was not paid upon receipt of the fixed asset. For example, they received it for free or purchased it from an organization on a simplified basis.

Second option : charge VAT on the difference between the sale and residual value of the property. That is, according to the rules of paragraph 3 of Article 154 of the Tax Code of the Russian Federation. Using these rules, determine the tax base when the fixed asset was purchased with VAT, but the tax was not deducted. For example, the object was used for statutory activities or in business activities exempt from VAT. For full details on how to do this and examples, see How to calculate VAT on the sale of property accounted for with input VAT.

VAT

As was written above, when purchasing an operating system through targeted financing, a non-profit organization does not deduct VAT, and the VAT amount is included in the cost of the operating system. According to clause 3 of Article 154 of the Tax Code, when selling property that is subject to accounting at cost, taking into account the VAT paid upon acquisition, the tax base is determined as the difference between the price of the property being sold, including VAT, and the cost of the property being sold. The tax rate in this case is determined in accordance with clause 4 of Article 164 of the Tax Code (18/(100+18)x100)

simplified tax system

Acquisition costs

Expenses for the acquisition of fixed assets received free of charge or at the expense of earmarked funds for statutory activities cannot be recognized as expenses under the simplified procedure. This conclusion follows from paragraph 4 of Article 346.16, paragraph 1 and subparagraph 2 of paragraph 2 of Article 256 of the Tax Code of the Russian Federation.

Income and expenses upon sale

When calculating the single tax, an NPO includes in its income the full sales value of the fixed asset. And even if you use a simplification with the “income minus expenses” object, do not take into account the initial cost of the fixed asset in expenses. Since targeted funds are not taken into account in income, then costs at their expense are not taken into account either. In addition, the organization had no intention of using such property for the purpose of generating income. And generating income is one of the conditions to write off as expenses for the acquisition of an object.

This conclusion follows from paragraphs 1 and 4 of Article 346.16, subparagraph 1 of paragraph 1.1 of Article 346.15, paragraph 1 of Article 252, Article 250, paragraph 2 of Article 251 of the Tax Code of the Russian Federation and letter of the Ministry of Finance of Russia dated February 5, 2010 No. 03-03-06/ 4/9.

Moral or physical wear and tear

When writing off an item of fixed assets (FPE) acquired using targeted funding or received by an NPO as targeted revenue due to moral or physical wear and tear, its initial cost (depreciation on such fixed assets is not charged) is written off from additional capital, that is at the expense of those funds that served as a source of financing for its acquisition.

The chart of accounts for accounting of financial and economic activities of organizations and the Instructions for its application (approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n) for accounting for the disposal of fixed assets to account 01 “Fixed assets”, it is recommended to open a sub-account “Retirement of fixed assets”. The cost of the disposed object is transferred to the debit of this subaccount, and the amount of accumulated depreciation is transferred to the credit.

According to the author, when writing off objects for which depreciation was not accrued, there is no need to use an intermediate entry using the subaccount “Retirement of fixed assets”, therefore the initial cost of such fixed assets is written off from the credit of account 01 directly to the debit of account 83 “Additional capital” .

In addition, upon disposal of a fixed asset, a non-profit organization must also write off the amount of depreciation accrued during the operation of this property in off-balance sheet account 010 “Depreciation of fixed assets.”

Example 1. An asset with an initial cost of 15,000 rubles, received by a non-profit organization as targeted income, is written off due to obsolescence. The amount of depreciation accrued on the date of write-off of the object is 5,000 rubles.

Reflection of transactions in accounting:

Dt sch. 83 Set count. 01 - 15,000 rub. — the initial cost of the fixed asset is written off;

K-t sch. 010 - 5000 rub. - the amount of depreciation is written off.

Write-off of the cost of an asset acquired from profits from business activities and used for its implementation (depreciation is charged for such assets), due to moral or physical wear and tear, is reflected in accounting in the subaccount “Retirement of fixed assets” opened to account 01.

In this case, the original (replacement) cost of the fixed asset object is written off to the debit of the specified subaccount in correspondence with the corresponding subaccount of the fixed assets accounting account, and to the credit of the specified subaccount - the amount of accrued depreciation for the useful life of the organization of this object in correspondence with the debit of the depreciation accounting account.

Upon completion of the disposal procedure, the residual value of the fixed assets item is written off from the credit of the subaccount for accounting for the disposal of fixed assets to the debit of the profit and loss account as operating expenses.

Example 2. An item of fixed assets with an initial cost of 15,000 rubles, acquired from profits from business activities and used for its implementation, is written off due to obsolescence due to the ineffectiveness of its modernization. The amount of depreciation accrued during its operation is 5,000 rubles.

Non-profit organizations have opened the following accounting sub-accounts for account 01 “Fixed Assets”:

- 01-1 “Fixed assets in operation”;

- 01-2 “Disposal of fixed assets.”

Reflection of transactions in accounting:

Dt sch. 01-2 Set count. 01-1 — 15,000 rub. — the initial cost of the disposed fixed asset is written off;

Dt sch. 02 Set count. 01-2 — 5000 rub. — the amount of depreciation accrued during the operation of the asset is written off;

Dt sch. 91-2 Set of accounts. 01-2 — 10,000 rub. — the residual value of the disposed fixed asset is written off.

Based on the executed act for write-off of fixed assets, transferred to the accounting service of the organization, a note is made on the inventory card about the disposal of the fixed assets item. The corresponding entries on the disposal of an object are also made in a document opened at its location.

Inventory cards for retired fixed assets are stored for a period established by the head of the organization in accordance with the rules for organizing state archival affairs, but not less than five years.

If, upon disposal of fixed assets, the organization receives income in the form of material assets (parts, components and assemblies of the disposed object, suitable for repairing other fixed assets, as well as other materials obtained as a result of dismantling (disassembling) the object), then these material assets are credited to the accounting accounts property at the current market value on the date of write-off of the fixed asset in correspondence with account 91 “Other income and expenses”, subaccount 91-1 “Other income”, as operating income.

It should be borne in mind that income in the form of the cost of received materials or other property (according to paragraph 13 of Article 250 of the Tax Code of the Russian Federation) during dismantling or disassembly in the event of liquidation of fixed assets taken out of service for the purpose of calculating income tax is recognized as non-operating income of the taxpayer, and expenses for their liquidation, including the amount of depreciation not accrued in accordance with the established useful life - non-operating expenses (clause 8, clause 1, article 265 of the Tax Code of the Russian Federation).

Moreover, the specified norms of Chapter 25 of the Tax Code of the Russian Federation apply to liquidated fixed assets, both acquired at the expense of targeted financing or received as targeted revenues (with the exception of amounts of underaccrued depreciation, since such objects are not depreciated), and acquired at the expense of profits from business activities NPO.