Fairness in pricing is a somewhat ambiguous term. Correct assessment of a company's assets is very important for many aspects of its activities. It is important that the assessment is not only correct, but also meets the requirements for a particular asset, because they can be different. Each method of determining value has its own characteristics and scope of application, which does not always allow anyone interested in this information to draw an unambiguous conclusion. A fair assessment may be a way out of the situation.

How this type of asset valuation differs from others, what its characteristic features are and, in general, how to deal with fair value, we analyze in this article.

What are the problems in the practical application of fair value for the valuation of accounting objects? View answer

Fair value as an economic concept

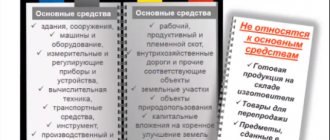

Asset valuation is needed in many business situations. It must reliably reflect the state of affairs at the current time, although the market situation is constantly changing. The results of the assessment should be easily interpreted in relation to the interests of different categories of persons. You can evaluate different fixed assets:

- individual objects;

- assets;

- obligations.

IMPORTANT! The determination of fair value has no connection with the mandatory valuation provided for by law and regulations in certain cases, such as, for example, privatization or non-cash contribution to the authorized capital. The state does not regulate fair assessment procedures.

Fair value is the amount that theoretically interested parties can pay for assets or liabilities (IFRS Standard 13).

Fair value characteristics:

- a specific object is assessed;

- categories of this object that are important for market participants are taken into account (for example, the place, time of the transaction, the condition of the asset, the credit risks of the debtor for the obligation);

- Fair valuation is affected by possible restrictions on the sale or purchase of the asset or its use.

Fair, liquidation and collateral value: how do these concepts relate ?

Purpose of using fair value

Reflection in reporting according to international standards (IFRS) of the actual current price of the company’s assets and liabilities is necessary for:

- activities in international markets;

- attracting foreign investors;

- lending from foreign banks;

- creation of joint ventures;

- acquisitions and mergers;

- increasing the cost of capital of the company.

Fair value measurement in accordance with International Financial Reporting Standards .

When does fair value apply?

Clause 1 Art. 11 of the Federal Law of the Russian Federation dated November 21, 1996 No. 129-FZ “On Accounting” as amended on March 28, 2002 approves the parameters for assessing assets for entering them on the balance sheet separately for each type. For assets acquired for compensation, you must apply:

- measurement at fair value if the asset was paid for in non-cash form;

- market valuation - for standard purchase and sale.

A more accurate translation from the IFRS Standard from English into Russian would be to use the word “measurement” instead of “assessment”, since we are initially talking about non-financial assets.

IMPORTANT! If the value of non-monetary assets transferred as payment for an asset cannot be estimated, a fair valuation will become difficult, then they will have to be valued at current market value.

Cases of determining the fair value of an asset

According to the requirements of Instruction No. 157n, adjusted in accordance with the Federal Financial Accounting Standards “Conceptual Framework”, the assessment (revaluation) of non-financial assets taking into account their fair value should be carried out in the following cases:

– receipt of objects of non-financial assets under agreements providing for the fulfillment of obligations (payment) in non-monetary funds (clause 24 of Instruction No. 157n) or as a result of non-exchange transactions (free of charge, including under agreements of gift or gratuitous use) (clause 25 of Instruction No. 157n) ; – impairment of objects (groups of objects) of non-financial assets in accordance with the requirements of the Federal Accounting Standards Service “Impairment of Assets” due to a decrease in the size of their current fair value below that reflected in the accounting records of the institution; – alienation of fixed assets, intangible assets, non-produced assets and inventories (except for finished products and goods) not in favor of public sector organizations (clause 28 of Instruction No. 157n).

Taking into account the fact that from 01/01/2018 in the accounting of state (municipal) institutions, the composition of non-financial assets began to reflect the rights of use arising under agreements of non-operating (financial) lease, operating lease and gratuitous use of fixed assets and non-produced assets, the fair value of such objects accounting must be determined similarly to other non-financial assets.

Fair or market value?

These concepts are largely similar; sometimes a fair valuation coincides with the market value (for example, for real estate, land plots, equipment). Market value is most often considered the most expected price that would be paid for it in the presence of free competition.

However, there are significant differences between these concepts. Let's compare fair and market values using different indicators in the table. In this case, other conditions will be considered equal by default:

- awareness of the seller and buyer of the asset;

- they make a transaction of their own free will, without coercion;

- Their market positions are approximately equal.

| № | Base | fair value | Market price |

| 1 | Legislative regulation | International Standards (IFRS) | State standards (RNBO) |

| 2 | Approaches to assessment | Depends on whether the object being assessed belongs to one of certain groups | It is necessary to apply three mandatory approaches (cost, income and comparative) or justify the refusal of any of them. |

| 3 | Form of payment for assets or liabilities | Non-monetary | Monetary or non-monetary, if the financial correspondence of the assets transferred as payment cannot be established |

| 4 | Additional factors | All factors expressing advantages or disadvantages for the parties to the transaction should be taken into account | All subjective factors are ignored, only the “bare” situation is taken into account |

| 5 | Comparison of concepts | More broadly: market value may coincide with fair value | Narrower: not every fair valuation is market value. |

Formation of the cost of the object

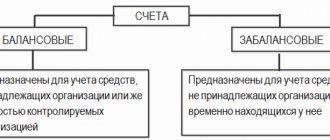

Changes in the valuation indicators of non-financial assets of state (municipal) institutions since 01/01/2018 can be shown in the following table:

| Conditions for obtaining NFA | Until 01/01/2018 | After 01/01/2018 | ||

| FSBU “Conceptual framework”, “Lease”, “Impairment of assets” | ||||

| Acquisition as a result of exchange transactions (purchase and sale, barter, etc.) | At the original (actual) cost, including all costs associated with delivering the NFA to the institution and bringing it to a state suitable for use for its intended purpose | |||

| Reflection in accounting - on the balance sheet accounts of non-fiscal assets (0 101 00 000, 0 102 00 000, 0 103 00 000, 0 105 00 000) | ||||

| Free receipt of property from public sector organizations (allocation of property, intradepartmental movement of property, centralized supply (purchase), etc.), as well as transfer of property to these organizations | At original cost, taking into account accrued depreciation | |||

| Reflection in accounting - on the balance sheet accounts of non-fiscal assets (0 101 00 000, 0 102 00 000, 0 103 00 000, 0 105 00 000) | ||||

| Free receipt from organizations of the non-state sector or internal reserves (donation, capitalization of previously unaccounted for property, etc.), as well as transfer of property to these organizations | At the current estimated (market) value, based on the cost of acquiring similar property under similar conditions | At fair value | ||

| Reflection in accounting - on the balance sheet accounts of non-fiscal assets (0 101 00 000, 0 102 00 000, 0 103 00 000, 0 105 00 000) | ||||

| Receiving a non-operating (financial) lease (leasing) | At the actual cost of the property specified in the leasing agreement | At the initial cost, including costs directly related to the conclusion of the leasing agreement, the total amount of lease payments for the entire period of its validity minus the total amount of interest accrued by the lessor (taking into account its discounting) | ||

| At fair value - if the cost of purchase on similar terms in the same region exceeds the amount of interest expenses (rent) for the entire period of use of the property (that is, the leasing agreement was actually concluded on preferential terms) | ||||

| Reflection in accounting - on off-balance sheet account 01 | Reflection in accounting - on the balance sheet account 0 111 00 000 (in terms of the use of fixed assets and non-produced assets) or on the off-balance sheet account 01 (in terms of the use of intangible assets) | |||

| Obtaining an operating lease | At the actual value of the property specified in the lease agreement | At the original cost, in the amount of interest expenses (rent) for the entire period of use of the property stipulated by the lease agreement (excluding costs associated with concluding a lease agreement and conditional lease payments to reimburse utility and other operating costs) | ||

| At a conditional price “one object – one ruble” - in cases where the actual cost of the property is not indicated in the lease agreement | At fair value - if the cost of purchase on similar terms in the same region exceeds the amount of interest expenses (rent) for the entire period of use of the property (that is, the leasing agreement was actually concluded on preferential terms) | |||

| Reflection in accounting - on off-balance sheet account 01 | Reflection in accounting - on balance sheet account 0 111 00 000 (in terms of the use of fixed assets and non-produced assets) or on off-balance sheet account 01 (in terms of the use of intangible assets and rights to limited use of other people's land plots (easements) *) | |||

| Receipt for free use | At the current assessed value, based on the cost of acquiring similar property under similar conditions | At fair value | ||

| Reflection in accounting - on off-balance sheet account 01 “Property received for use” | Reflection in accounting - on balance sheet account 0 111 00 000 (in terms of the use of fixed assets and non-produced assets) or on off-balance sheet account 01 (in terms of the use of intangible assets and rights to use land plots until their state registration is completed) | |||

| Periodic revaluation of fixed assets according to decisions of the Government of the Russian Federation, as well as bringing the book value of land plots assigned to the institution for permanent (perpetual) use to the current cadastral value | At the current revalued value, based on the revaluation indicators reported by the Government of the Russian Federation, taking into account the amount of accrued depreciation of fixed assets revalued at the time of revaluation, as well as based on the current cadastral value of land plots assigned to the institution for permanent (perpetual) use | |||

| Reflection in accounting - on the balance sheet accounts of non-fiscal assets (0 101 00 000, 0 102 00 000, 0 103 00 000) | ||||

| Periodic impairment of fixed assets, intangible and non-produced assets | – | The difference in excess of an asset's carrying amount over its fair value | ||

| – | Reflection in accounting - on the balance sheet account 0 114 00 000 “Impairment of assets” | |||

| Disposal of property for other reasons (loss, theft, etc.) | At the estimated cost of their replacement, based on market prices prevailing in the area on the day the damage was caused, but not lower than the value of the property according to accounting data, taking into account the depreciation of this property accrued at the time of loss | At fair value | ||

| Reflection in accounting - on the corresponding balance sheet or off-balance sheet accounts of this property | ||||

*By virtue of Art. 274 of the Civil Code of the Russian Federation, an easement can be established by agreement between an institution and the owner of a neighboring land plot to ensure passage and passage through the neighboring land plot, construction, reconstruction and (or) operation of linear objects that do not interfere with the use of the land plot in accordance with the permitted use, as well as other the needs of the owner of real estate, which cannot be provided without the establishment of an easement. The easement is subject to registration in the manner established for registration of rights to real estate. The cost of an easement is determined by the fee established by agreement between the parties who entered into it, or by the court, for the use of the easement, but within the limits of the cadastral value of the corresponding land plot (in this case, the fee for the use of the easement is included in the current costs of the institution as it is implemented).

Thus, with the entry into force of federal accounting standards for public sector organizations on January 1, 2018, the procedure for the initial assessment of non-financial assets has become more market-based in nature, and the list of cases of application of their subsequent assessment (impairment) has noticeably expanded.

Fair value calculation

The fair value standard divides the information on which it is based into three levels.

Level 1, market. The most reliable and obvious. A non-financial asset is valued at the same value in an active market at a given point in time (the moment of valuation).

Level 2, adjustment. When an asset or liability is not constant, but relates to a certain period, then its value can only be determined during this period by comparing it with current quotes. Therefore, the fair value will no longer be unconditional, but adjusted for time, place, condition of the asset and market characteristics.

Level 3, unobservable. Sometimes the data to determine the value of an asset or liability cannot be determined directly (they are unobservable); in this case, it is necessary to analyze the maximum available information about the asset.

A fair valuation of an asset will fall into one of these levels:

- the first level determines the undoubted assessment;

- the second and third require additional methods of evaluation and conditioning of choice;

- at the third level, it is necessary to provide information accompanying the assessment: changes in the reporting period, the amount of costs and profits on this asset for the assessed period, a description of the assessment process.

How to account for acquired claims measured at fair value?

Choosing an approach to measuring fair value

- Comparison with similar assets on the market according to defining indicators: during the period under evaluation, in the same volume, etc.

- The discounted cash flow method is to determine the ability for a stable profit from an asset in the forecast for the estimated period.

- Cost method - based on the analysis of the latest balance sheet values.

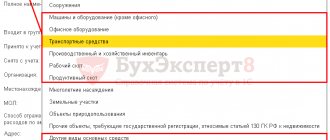

Fixed assets: changes in valuation and revaluation

In the information message dated November 3, 2020 No. IS-accounting-29, the Russian Ministry of Finance draws attention to changes in the rules for the valuation and revaluation of fixed assets introduced by FAS 6/2020.

What should be included in the initial cost?

As you know, a fixed asset item accepted for accounting is valued at its original cost. It is considered the total amount of capital investments related to this object made before the recognition of the fixed asset in accounting.

Unlike PBU 6/01, the new document does not contain an approximate list of expenses that form the initial cost. FSBU 6/2020

(clause 12) contains a reference norm for the amount of capital investments.

The concept of “capital investments” and their possible composition are given in paragraph 5 of FSBU 26/2020 “Capital investments” (Appendix 2 to Order No. 204n). According to this norm, capital investments include, in particular, costs for

:

- acquisition of property

intended for use directly as fixed assets or parts thereof, or for use in the process of acquisition, creation, improvement and (or) restoration of fixed assets; - construction, construction, production

of fixed assets; - improvement and (or) restoration of

fixed assets (for example, completion, retrofitting, modernization, reconstruction, replacement of parts, repairs, technical inspections, maintenance); - delivery

and bringing the object into a condition and location in which it is suitable for use for the intended purposes, including its installation, installation; - commissioning and testing

.

After recognition, the object is assessed in accounting at its original or revalued cost.

The selected method of subsequent valuation of fixed assets is applied to the entire group of objects.

Valuation at original cost

When assessing fixed assets at historical cost

such value and the amount of accumulated depreciation

are not subject to change

. The exception applies to the following cases:

- when the initial cost of a fixed asset takes into account the amount of the estimated liability for future dismantling, disposal of this object and restoration of the environment. A change in this value (excluding interest) increases or decreases the initial cost of the object (clause 23 of FSBU 6/2020);

- carrying out work related to the improvement and (or) restoration of fixed assets. The initial cost of the object increases by the amount of capital investments

at the time of their completion (clause 24 of FSBU 6/2020).

Valuation at revalued amount

When measured at a revalued amount, the value of the item is regularly revalued so that it is equal to or does not differ materially from its fair value.

. Fair value is determined in the manner prescribed by IFRS 13 “Fair Value Measurement” (put into effect on the territory of the Russian Federation by Order of the Ministry of Finance of Russia dated December 28, 2015 No. 217n).

As follows from IFRS 13 (clause 24), fair value is the price

that would be received upon the sale of an asset or paid upon the transfer of a liability in an orderly transaction in the principal (or most advantageous) market.

Such price is determined at the valuation date under current market conditions (ie the exit price), regardless of whether such price is directly observable or calculated using another valuation method. Example

At the reporting date, a company values a Granta van passenger car. The purchase price of the car is 760,000 rubles. Accrued depreciation – 260,000 rubles. The residual value at the time of valuation is RUB 500,000. During its operation, the car was involved in an accident, which may affect the price of the car if it is sold (depreciation - 100,000 rubles). According to marketing analysis, at the time of assessment, the cost of a similar car on the market is 800,000 rubles. Taking into account accrued depreciation and impairment, the fair value of the car will be RUB 440,000. (800,000 – 260,000 – 100,000).

Clause 15 of PBU 6/01 allows commercial organizations to revalue groups of similar fixed assets at current (replacement) cost no more than once a year (at the end of the reporting year). Having revalued groups of homogeneous objects, the organization must subsequently revaluate them regularly. This must be done so that the cost at which fixed assets are reflected in accounting and reporting does not differ significantly from the current (replacement) cost.

As we can see, FAS 6/2020 also authorizes the possibility of revaluing fixed assets. The standard establishes different provisions for the revaluation of fixed assets and investment property

.

The standard gives organizations the right to determine the frequency of revaluation of fixed assets for each group of revalued objects. The basis for this is exposure to changes in their fair value

. If a decision is made to revaluate fixed assets no more than once a year, it is carried out as of the end of the corresponding reporting year (clause 16 of FSBU 6/2020).

As under PBU 6/01, under the new FAS 6/2020, revaluation can be carried out by recalculating the original cost and accumulated depreciation so that the book value of the fixed asset after revaluation is equal to its fair value

.

At the same time, the standard allows for the recalculation of the residual value of an object (the difference between the original cost and the amount of depreciation accumulated on the date of revaluation) so that it becomes equal to the fair value of this fixed asset

.

To revaluate fixed assets included in one group, one method of revaluation must be used (clause 17).

The procedure established by FAS 6/2020 for reflecting the amount of revaluation is slightly different than in PBU 6/01. Revaluation amount

(clause 18):

- is reflected as part of the total financial result

of the period in which the revaluation of objects was carried out, separately without inclusion in the profit (loss) of this period. An exception is the part of the revaluation, which restores the amounts of markdown and (or) impairment of such fixed assets recognized in previous periods as an expense in profit (loss); - the excluded part of the revaluation recognized as income

as part of the profit (loss) of the period in which such revaluation was carried out.Markdown amount

fixed assets (clause 19):

- is recognized as an expense

in the profit (loss) of the period in which the revaluation of objects was carried out. An exception in this case is the part of the markdown, which reduces the amount of revaluation of such fixed assets, reflected in the aggregate financial result in previous periods without inclusion in the profit (loss) of the period in which the writedown of fixed assets was carried out;

the excluded part of the writedown is reflected in the aggregate financial result

of the period in which the writedown of fixed assets was carried out, separately without inclusion in the profit (loss) of this period.

reflected in the aggregate financial result without inclusion in profit (loss) form the indicator of accumulated revaluation

such objects.

Initially, the accumulated revaluation is reflected separately as part of capital

in the organization’s balance sheet.

Subsequently, the accumulated revaluation is written off to retained earnings.

.

The standard again gives the organization a choice. The accumulated revaluation can be taken into account

in retained earnings:

- at a time

when writing off a fixed asset item for which an additional valuation has been accumulated; - as depreciation accrues

on the fixed asset. In this case, the part of the accumulated revaluation to be written off represents the positive difference between the amount of depreciation for the period, calculated based on the original cost of the fixed asset item, taking into account the latest revaluation, and the amount of depreciation for the same period, calculated based on the original cost of the object without taking into account revaluations.

The method adopted by the organization of writing off the accumulated revaluation to retained earnings is applied to all fixed assets other than investment real estate.

Revaluation of investment properties

Having decided to value an investment property at a revalued value

, the organization will be required to apply this valuation method to all investment properties.

Investment property is revalued at each reporting date. The historical cost of an investment property (including previously revalued) is restated so that it becomes equal to its fair value.

An additional valuation or depreciation of an investment property is included in the financial result of the organization’s activities as income or expense

the period in which the revaluation of this object was carried out.

The consequences of changes in the method of valuing fixed assets are reflected prospectively

(without recalculation of data for previous periods).

It was noted a little earlier that if the initial cost of a fixed asset takes into account the amount of the estimated liability for future dismantling, disposal of this object and restoration of the environment, then a change in this value (without taking into account interest) increases or decreases the initial cost of the object. If this object is accounted for at a revalued value, then the accumulated revaluation of it (if any) is adjusted by the amount of the change in its initial value

.

The amount of such adjustment is included in the total financial result

without being included in profit (loss). If a decrease in the initial cost of a fixed asset leads to its book value becoming equal to zero, then a further decrease in the amount of the estimated liability is included in the financial result of the organization’s activities as income.

The standard proposes to reflect fixed assets in the balance sheet at book value, which is their original cost reduced by the amount of accumulated depreciation and impairment.

.

It is possible that the purpose of a property assessed at a revalued value may change in such a way that this property ceases or begins to be classified as investment property. In this case, the book value of such an object on the date of change in its purpose is considered to be its original cost.

(Clause 26 FSBU 6/2020).

Examples of fair value applications

Example 1. A woodworking company currently has an abundance of boards. She is in dire need of milling equipment and has agreed to exchange it for surplus raw materials. How to determine the amount that needs to be transferred as payment for the machine? To do this, you need to “add the price” of this asset. This would be his fair assessment. To evaluate, you need to take into account the cost of raw materials for this particular company. If the company has regular suppliers, then the fair value will be the sum of the costs of purchasing a batch of boards of similar size from these suppliers. In fact, this will be the quantity that the owner of the milling equipment will agree to accept in exchange.

Example 2. Company 1 has a stake in company 2, which is not currently operating. Previously, they were highly valued on the market. At what price can the company sell them now? A fair valuation does not depend on the previous, no longer current quotes (market valuation), but on other factors, in particular, whether firm 2 is going to resume its activity and how successful the forecasts are.

Example 3. A company is going to enter into a transaction with specialized property - part of the enterprise’s property complex. Such property is almost never sold separately on the market, so fair value will have to be determined differently from market value.