The company's balance sheet is rightfully considered one of the key documents in financial statements. All the necessary information is located on several pages, which contains detailed reporting on assets.

The most common asset of a company is considered to be accounts receivable. However, in the process of creating it, many accountants encounter certain problems.

Debt collection

At the end of the period established in the bilateral agreement, the receivables become overdue - only after this the creditor has the right to take any steps to collect them.

Measures to resolve the situation out of court include a constructive dialogue with the debtor company. In order not to aggravate the situation, it is not recommended to start communication from a position of strength. First of all, you need to find out why there was a delay in payment. After this, a reconciliation act is requested - this document is an official confirmation that the debtor recognizes all previously agreed obligations. If there are no disagreements at any of the listed stages, you can go to a meeting and agree on a deferment or the option of gradually paying off the debt.

What to do if the counterparty does not intend to repay the debt? In this case, you must go to court. This can be done 30 days from the date the debtor receives an official complaint about non-compliance with the deadlines for reimbursement of funds (sent by registered mail with notification). To start this procedure, you will need all documents on cooperation with the defaulter, collected at the inventory stage.

Before going to court, it is recommended to check the current status of the debtor and his solvency. In addition, you should take into account the statute of limitations, which is 3 years. In some cases, it is more expedient to write off a loss than, for example, to incur additional costs in an attempt to recover the debt from a liquidated enterprise.

Which account should accounts receivable not be reflected in?

Accounts receivable cannot be reflected in accounting accounts (for example):

- fixed assets and intangible assets - 01, 04;

- depreciation - 02, 05;

- inventory assets (inventory, goods, products) - 10, 15, 16, 41, 43, 45;

- cash - 50, 51, 52, 55;

- costs, income and expenses (for production, for sale, other income and expenses) - 20, 23, 25, 26, 44, 91.

In order not to make mistakes in using accounts to account for accounts receivable, it is necessary to correctly formulate a working chart of accounts and thoroughly have information about the purpose of each account used.

Find out more about the chart of accounts for 2021 - see the material.

What can you learn from the balance sheet about accounts payable?

Line 1520 “Accounts payable” is located in section V “Short-term liabilities” of the balance sheet. Large companies add lines to the balance sheet to decipher accounts payable by type. For example:

- line 1521 - debts to counterparties;

- line 1522 - debt on taxes and fees;

- line 1523 - underpaid insurance premiums;

- line 1524 - accrued but not paid wages, etc.

Separate details of the company's accounts payable are given outside the balance sheet lines, in explanations and transcripts to the balance sheet.

For detailed information on the composition and accounting nuances of accounts payable, see the material “How are accounts payable reflected in the accounts?”

Who uses accounts receivable and payable and when?

Accounts for settlements with debtors and creditors are an integral set of accounts for any company, since its functioning is impossible without:

- accrual and payment of wages and other payments to their employees (the appearance of debit and credit turnover on account 70);

- fulfillment of tax obligations (the emergence of a debit and credit balance on accounts 68 and 69);

- carrying out settlements with their counterparties (turnovers and balances on settlement accounts: 60,62,76);

It is impossible to organize full-fledged accounting without these accounts. Accounting for them must be maintained continuously in chronological order throughout the entire period of the company’s activities.

Which accounting accounts are used by budgetary organizations for settlements with debtors and creditors, see the material “Creating a chart of accounts for budgetary accounting - sample 2016”.

Typical errors identified during the audit

ERRORS ASSOCIATED WITH INCORRECT FORMATION OF ACCOUNTING INDICATORS

Reflection of advances related to the acquisition of fixed assets as part of accounts receivable in section 2 “Current assets” of the balance sheet

Very often, advances issued to suppliers and contractors related to the acquisition of fixed assets or construction are reflected by the organization as part of accounts receivable in the “Current assets” section of the balance sheet.

The current PBU standards do not contain direct guidance that would clearly distinguish between ordinary receivables associated with core activities and advances issued related to the acquisition of non-current assets.

According to current legislation1, if the maturity (repayment) period for assets and liabilities is no more than 12 months after the reporting date, then such assets and liabilities are presented as short-term. All others will be classified as long-term.

At the same time, according to the Ministry of Finance of the Russian Federation2, advances and preliminary payments associated with the acquisition of fixed assets, the repayment of the cost of which is carried out in periods exceeding 12 months, are reflected in the balance sheet in section 1 “Non-current assets”, regardless of the timing of repayment by counterparties of obligations under issued them in advance (advance payment).

This position of the Ministry of Finance of the Russian Federation is not new or revolutionary, but rather a well-forgotten old one. The instructions on the procedure for filling out annual accounting reporting forms, approved by Order of the Ministry of Finance of the Russian Federation dated November 12, 1996 No. 97 (valid until January 1, 2000), directly prescribed advances issued related to capital investments to be reflected as part of construction in progress.

Note that such a division of advances in the reporting seems logical, since the user of the reporting must understand that their liquidity is different, as is the essence itself. Unlike ordinary accounts receivable, when we wait for the receipt of money from customers, in a situation with advances issued, we count on the completion of construction work, the supply of equipment, that is, we acquire non-current assets. It should be noted that this procedure for the formation of balance sheet items complies with international financial reporting standards. Reflection of interest-free loans in financial investments

Often, the amounts of issued interest-free loans are reflected by the organization as part of financial investments, since PBU 19/023 mentions issued loans as an example of financial investments. However, it should be remembered that one of the main criteria for recognizing an asset as a financial investment is the ability to bring economic benefits (income) to the organization in the future in the form of interest, dividends or an increase in their value.

It is clear that an interest-free loan in this form does not bring income and, in fact, represents a receivable, therefore, must be reflected in the corresponding balance sheet item.

Violation of comparability of information for the previous and reporting periods

In a number of cases, an organization, when correcting an error in its financial statements caused by incorrect classification of assets or liabilities, forgets to correct comparable figures for the previous period. For example, in the previous reporting period, long-term financial investments were included in the line “Financial investments” in section 2 “Current assets” of the balance sheet. When drawing up the balance sheet for 2014, the error was taken into account, and such financial investments were transferred to section 1 “Non-current assets”. However, the current balance sheet indicators for last year remained in current assets. Errors of this kind lead to a violation of the comparability of balance sheet indicators across reporting periods.

Note that the transfer of balance sheet indicators does not require any entries in the accounting accounts. However, information about this fact must be disclosed in the explanations, since the balances for the last year period indicated in the current balance sheet will differ from the reporting data compiled for the previous year.

Detailed reflection of exchange rate differences in the composition of income and expenses in the financial results statement

It is traditionally customary to reflect exchange rate differences associated with the revaluation of assets and liabilities in full as part of other income and expenses of the financial results statement, referring to the legal norm4, according to which offsets between items of assets and liabilities, items of profit and loss are not allowed in the financial statements , except in cases where such offset is provided for by the rules established by regulations.

However, a collapsed reflection of the final result of foreign currency exchange rate fluctuations during the revaluation of assets and liabilities is not the result of offsetting reporting items. Thus, we simply do not show income and expenses received for interim periods, but reflect the result of currency exchange rate fluctuations obtained as of the reporting date.

By and large, a detailed reflection of income and expenses from the interim revaluation of assets and liabilities does not make economic sense. In addition, in conditions of currency exchange rate fluctuations, income and expenses will vary depending on how often the organization carries out revaluation: monthly, quarterly, or as the exchange rate changes (for example, when recalculating the value of banknotes in the organization's cash desk and funds in bank accounts).

Lack of necessary information in the notes to the financial statements

Almost all current PBUs contain instructions on the disclosure of information about facts to be reflected in the notes to the balance sheet and the income statement. However, in practice, often in practice, an organization’s textual explanations fit into one or two pages.

Let us note that very often the explanations to the balance sheet and financial statements do not indicate that the financial statements were prepared by the organization based on the accounting and reporting rules in force in the Russian Federation (except for cases where the organization made deviations from these rules when preparing the financial statements) 5.

Often there is also no information about the accounting methods adopted during the formation of accounting policies, which significantly influence the assessment and decision-making of interested users of financial statements6.

Organizations pay little attention to the disclosure of information about related parties7, events after the reporting date8, and contingent liabilities9.

We strongly recommend that you leaf through the PBU and check whether all the necessary information is reflected in your explanations.

ERRORS RELATED TO IMPACTS IN THE INTERNAL CONTROL SYSTEM

Reflection of doubtful and unrealistic debts in accounts receivable

The fact that reserves for doubtful debts should be created no longer causes resistance from anyone. It is clear that if the “Accounts Receivable” item of the balance sheet includes an amount of debt that is unlikely to be repaid, this leads to a distortion of the financial result and an overstatement of retained earnings.

However, at the same time, it happens that organizations do not carry out an inventory of payments before drawing up annual reports or carry it out formally, as a result of which debts that are doubtful or generally unrealistic for collection are listed as accounts receivable on the balance sheet (the statute of limitations has expired, the counterparty has long been liquidated, etc.). P.).

Reflection in the composition of inventories of materials that have not been used for a long time and have lost their original properties

This violation is also associated with a formal approach to inventory, as a result of which the cost of inventories is overstated in the organization’s accounting and reporting. Here we are not talking about those stocks that are actually not available, but they are listed in the accounting records because, for example, shipping documents got lost somewhere and did not reach the accounting department (this also happens). We are talking about materials that are in stock, but have not been used for years and are unlikely to be used in their quality.

PBU 5/0110 prescribes inventories that are obsolete, have completely or partially lost their original quality, or the current market value, the selling price of which has decreased, to be reflected in the balance sheet at the end of the reporting year minus a reserve for a decrease in the value of material assets. A reserve for reducing the value of material assets is formed at the expense of the organization’s financial results by the amount of the difference between the current market value and the actual cost of inventories, if the latter is higher than the current market value.

#FOOTNOTE# Failure to offset advances against completed shipments

There are situations when an organization does not timely reflect the offset of the previously received advance against payment for the reflected goods (work performed, services rendered), as a result of which both receivables and payables are recorded in the accounting records for the same buyer. In reporting, accordingly, such debts overstate the assets and liabilities of the organization.

Collapsed reflection of receivables and payables

The opposite error to the previous one is that the organization collapses debts from different counterparties and shows in the reporting only the difference between them: the balance of receivables or payables. This often happens when reflecting wage arrears, when there is a debt to some employees and a debt of other employees to the organization, when making payments to budgets for taxes, and with extra-budgetary funds for contributions.

A collapsed reflection of debts leads to an understatement of the organization’s assets and liabilities in the financial statements. Incorrect calculation of interest on loans and borrowings by period

If the agreement provides for the accrual of interest not for a calendar month (from the first to the last day), then interest is often accrued for the period specified in the agreement (for example, for a full month expiring on the 20th day, or on the expiration date of the use of funds).

According to PBU 15/200811, borrowing costs are reflected in accounting and reporting in the reporting period to which they relate. The reporting period for interim reporting is a month12, therefore, interest expenses should be reflected monthly.

Failure to reflect or incomplete reflection of interest on loans or credits received in the annual statements leads to a distortion of the financial result and retained earnings.

In conclusion, I would like to remind you of the basic accounting principles set out in PBU 1/2008, which help make decisions in difficult situations. For example, difficulties arose with the classification of an accounting object - where to classify it - directly as an expense or recognize an asset? Here it is appropriate to recall the principle of prudence: greater readiness to recognize expenses and liabilities in accounting than possible income and assets, avoiding the creation of hidden reserves. We should not forget about such a fundamental principle as the requirement of rationality: rational accounting, based on business conditions and the size of the organization.

How to deal with risks

1.Set it in the contract

- penalties (fines, penalties), the possibility of withholding the debtor’s property and other punitive measures in case of non-payment;

- special conditions for the transfer of ownership of the product: transfer only at the time of payment (so that in the event of bankruptcy of the counterparty, you can return your property that has not been paid for);

- rules for adjusting the terms of cooperation (prices/guarantee periods/deferred payment terms, etc.) in the event of changes in market conditions;

- the possibility of unilaterally terminating the contract in the event of failure by the other party to fulfill the terms of this contract;

2. Create a reserve fund for the amount of doubtful debts;

- Use a differentiated approach to pricing: make prepayment or payment upon receipt significantly more profitable for consumers than on credit.

- If possible, take deposits from counterparties.

How to improve quality and liquidity

In general, accounts receivable management should lead to achieving its optimal size and optimal liquidity, but a situation usually occurs when they strive to increase liquidity while maintaining volume.

You can act on several fronts:

- Prevent risks (detailed elaboration of contracts, terms of cooperation).

- Monitor mutual settlements, payments, and enforce late payments.

- Analyze the results.

- Adjust credit policy.

Results

To account for settlements with debtors and creditors, various accounts are used: account 60 or 62 - if the company’s counterparties owe it for goods supplied or have not worked out the advance payment, account 71 - if employees have not reported on accountable amounts or the company has not reimbursed their personal expenses spent on its needs funds, account 68 - if there are overpayments or tax debts, etc.

If receivables were acquired under an assignment agreement, they are reflected on account 58 if, according to the criteria, they correspond to the concept of a financial investment.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Acquiring debt: accounting nuances

When reflecting the acquisition in accounting, the buyer of debt must:

- check whether the acquired right to claim the debt meets the criteria for a financial investment;

- correctly form its initial amount.

To recognize a financial investment, the acquired receivables must be:

- potentially beneficial to its buyer - it can generate income;

- documented.

In addition, all financial risks (insolvency of the debtor, changes in the value of the debt, etc.) must be transferred to the buyer of the debt.

In order to reflect the purchased debt in accounting in a reliable estimate, it is necessary to correctly formulate its initial cost, calculated according to the formula (clauses 8–9 of PBU 19/02):

PSfv = FZ + KS + PS + PZ,

Where:

PSFv - the initial cost of the financial investment;

FZ - actual costs under the assignment agreement;

KS and PS - the cost of consulting, information and intermediary services related to the acquisition of receivables;

PP - other (other) costs associated with the acquisition of debt.

Find out the scheme for calculating the initial cost of various assets from the materials prepared by specialists on our website:

- “The initial cost of intangible assets is...”;

- “Accounting for fixed assets worth up to 100,000 rubles”.

Main differences from accounts payable

The concept of accounts payable is based on the same principles of commodity-money relations as accounts receivable. The main difference is that your company undertakes to return funds to counterparties. Another important detail is that only the creditor can make changes to the terms of the agreement between the parties (except for cases specifically specified in the contract or regulated by law).

If desired and possible, accounts payable can be repaid ahead of schedule. However, in this case the advantage of this approach is lost. For example, acting as a debtor, an organization can receive goods at the expense of third-party capital, sell it on terms favorable to itself, and pay off the creditor with the proceeds received.

The debtor may transfer its debt obligations to a third party only with the permission of the party in whose possession the receivables are located.

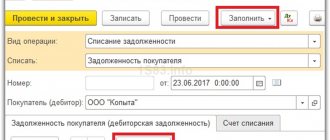

Write-off of accounts receivable

The procedure can only be started with the written consent of the management of the creditor company based on the results of the inventory. Write-off is carried out if the debt is recognized as bad due to one of the following reasons:

- The debtor company is excluded from the list of Unified State Register of Legal Entities.

- The individual entrepreneur who is the debtor is declared bankrupt or died.

- The court refused to satisfy the creditor's claims.

- The statute of limitations has been exceeded.

As a result, an act is drawn up indicating the reasons for writing off the debt at a loss and other information. However, the procedure itself does not imply the cancellation of receivables in the balance sheet. The relevant data must be reflected in the reports for 5 years, periodically monitoring (if necessary) changes in the financial condition of the debtor.

How debt is formed

There are many possible occurrences; here are the most common ones.

From counterparties:

- when a company pays an advance to a supplier or contractor;

- when the buyer (his role may be a branch or subsidiary) first receives a product or service and pays later;

- when a counterparty causes damage to the company and does not compensate for it immediately (for example, if a logistics company damages goods during transportation).

From government agencies:

- when overpaying tax;

- when deducting “input” VAT (when purchasing goods for the purpose of carrying out transactions subject to VAT, the taxpayer has the right to a deduction (Articles 171 and 172 of the Tax Code of the Russian Federation));

- for social payments that are reimbursed by the Social Insurance Fund (for example, when the amount of benefits paid to an employee exceeded insurance contributions or when the costs of preventive measures are covered (up to 20% of the contributions for the previous year can be spent on them)).

From employees and participants of the enterprise:

- when the financially responsible person is given funds for work needs;

- when an employer issues a loan to an employee;

- when a company member delays payment to the authorized capital.

How to calculate liquidity

The liquidity of a subsidiary can be assessed using its turnover ratio or using its turnover period.

1. The ratio is calculated as the ratio of revenue to “receivables” for a period of time:

Kob.dz = DR / DZsr,

Where:

- Kob.dz - turnover ratio D;

- DR - the company’s income from the sale of products or services over a period of time (usually a year, quarter or month);

- DZsr - average accounts receivable for the same period, i.e. amount of debt at the beginning and end of the period/2.

That is, the balance calculation will look like this:

Kob.dz = 2110 / (1230 at the beginning of the period 1230 at the end of the period) x 0.5

2. The turnover period is equal to the income at the end of the period, multiplied by the number of days of the billing period and divided by income:

Pob.dz = DZkp x P / DR,

Where:

- DZkp - debt at the end of the period;

- P is the period expressed in the number of days;

- DR is the company’s income from the sale of products or services for the same period.

That is, the balance calculation will look like this:

Pob.dz = 1230 at the end of the period x P / 2110

If a company sells a lot on prepayment and/or payment at the time of shipment of goods, then indicators should be calculated based on revenue received only from sales with deferred payment.

But even with such clarification, an assessment based only on accounting may not reflect the real situation: it does not show either a decrease in the solvency of suppliers or the expiration of the statute of limitations for debt collection. As a result, the loan agreement includes not only those debts that will probably be repaid, but also those that will most likely have to be written off. Therefore, the quality of receivables is usually assessed manually, then, based on this assessment, overdue, doubtful and bad debts are subtracted from the total amount, and only after that the turnover ratio and/or turnover period are calculated.