Home / Taxes / What is VAT and when does it increase to 20 percent? / VAT object

Back

Published: December 28, 2017

Reading time: 6 min

0

545

According to Russian legislation, today three VAT percentage rates are applied in the sale of goods and services - , 10% and 18%, each of which has its own regulated criteria for the distribution of validity.

- List of goods for which a VAT rate of 10% applies

- Procedure for confirming 10% VAT Where can I find the code for Russian and imported goods?

- For medical products

A rate of 10% is the most convenient when conducting operations with the sale of goods on the domestic market. In this regard, the Tax Code of the Russian Federation gives clear explanations: what goods are included in the group of distribution of the 10% VAT rate, how the right to use this rate is confirmed, what documents should be prepared.

Analyzed situation.

The trade organization submitted to the tax authority an updated VAT return, according to which the amount of tax to be reimbursed from the budget amounted to 7 million rubles. The tax authority conducted a desk audit of this declaration and revealed the following.

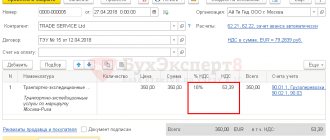

The trade organization imported imported food products into the territory of the Russian Federation, including cheese products. In declarations for goods for which the import of a cheese product is declared, the organization defines and indicates the HS code [1] 2106 90 980 9 (group 21 “Miscellaneous food products” - “Other”). Since the said HS code on the date of import of the goods was not named in the List of codes for types of food products in accordance with the Unified Commodity Nomenclature of Foreign Economic Activity of the Customs Union, subject to VAT at a tax rate of 10% when imported into the territory of the Russian Federation[2], these products were declared by the organization according to VAT rate 18%.

Note that tax legislation stipulates the right of a person who paid VAT upon import of goods to a tax deduction of the amount of this tax, but does not entail the obligation to calculate VAT when selling goods in the territory of the Russian Federation at the same tax rate that was applied by the customs authority when importing goods into the territory RF.

When selling the specified products in the Russian Federation, the organization applied a VAT rate of 10% (it confirmed this right with a declaration of goods and a certificate of conformity). That is, the reason why the organization announced a VAT refund of 7 million rubles from the budget was the difference in tax rates for the import of goods into the territory of the Russian Federation (18%) and the sale of these goods in the said territory (10%).

The tax inspectorate came to the conclusion that this enterprise did not confirm the legality of applying the reduced VAT rate; as a result, additional VAT was charged to it. Having disagreed with the decision of the tax authority, the company went to court. Next, we will tell you why the tax authorities (and subsequently the court) recognized the application of the 10% VAT rate as unlawful.

Tax norm.

VAT is assessed at a tax rate of 10% on the sale of food products listed in clause 2 of Art. 164 Tax Code of the Russian Federation. The last paragraph of paragraph 2 of Art. 164 of the Tax Code of the Russian Federation states: codes for the types of products listed in this paragraph, in accordance with the All-Russian Classifier of Products, as well as the Commodity Nomenclature of Foreign Economic Activity, are determined by the Government of the Russian Federation. In pursuance of this norm, the Decree of the Government of the Russian Federation of December 31, 2004 No. 908 approved:

- List of codes for types of food products in accordance with the All-Russian Classifier of Products, subject to VAT at a tax rate of 10% upon sale;

- List of codes for types of food products in accordance with the Unified Commodity Nomenclature for Foreign Economic Activity of the Customs Union, subject to VAT at a tax rate of 10% when imported into the territory of the Russian Federation.

If there is no code for the imported product in the list, a VAT rate of 18% is applied.

At the same time, taxpayers should take into account the position of the Plenum of the Supreme Arbitration Court, set out in paragraph 20 of Resolution No. 33 of May 30, 2014. According to the judges, for the application of the VAT rate of 10% both when importing goods into the territory of the Russian Federation and when selling them on this The territory is sufficient for the product to comply with the code determined by the Government of the Russian Federation with reference to at least one of two sources - OKP [3] or HS. In particular, the said resolution states that the application of a 10% rate in relation to a specific product cannot depend on whether the product was sold on the territory of the Russian Federation or whether it was imported into the territory of the Russian Federation, since the provision of clause 2 of Art. 164 of the Tax Code of the Russian Federation does not provide for the possibility of different taxation of transactions with the same product according to this criterion (the Ministry of Finance currently gives the same recommendations - see letters dated December 17, 2015 No. 03-07-07/74080, dated October 19, 2015 No. 03-07-08/59788).

Refusal to apply a preferential VAT rate: review of the main mistakes of importers

Transcript of the report by O. V. Evseeva at the “Customs Disputes” conference organized by MBS, March 29, 2021.

“The topic of my speech concerns disputes related to the application of a preferential VAT rate and the return of overpaid customs duties. Practice shows that the issue of refunding overpaid payments is one of the most pressing. We all understand that customs authorities strive to transfer as much money as possible to the budget. We also know how difficult it is sometimes to return overpaid customs duties. One of the reasons is the regulations governing the application of preferential VAT, which give rise to different interpretations.

To attract financing, including in the healthcare sector, the government has long used tax preferences. Currently, preferential taxation is provided for in Articles 149, 150, 164 of the Tax Code of the Russian Federation. In accordance with Articles 149 and 150 of the Tax Code of the Russian Federation, the import into the territory of Russia and the sale within the country of medical devices according to the list approved by Decree of the Government of the Russian Federation No. 1042 is not subject to taxation, subject to the provision of a registration certificate for a medical device issued in accordance with the law of the EAEU or the legislation of the Russian Federation. Federation. In accordance with the provisions of paragraph 2 and paragraph 5 of Art. 164 of the Tax Code of the Russian Federation establishes a 10% rate in relation to sold and imported goods, in particular, food products, goods for children, printed publications and medical goods. The same condition applies to medical products. This is the provision of a registration certificate for medicinal products (not for pharmaceutical substances, where the provision of a registration certificate is not required) and for a medical device.

Codes of types of products of the All-Russian Product Classifier and Commodity Nomenclature of Foreign Economic Activity are also determined by Government Resolution. There is a corresponding Government Resolution regarding a specific list. Since in our practice we often encounter disputes with customs authorities regarding the refund of overpaid VAT in relation to medical goods, in this speech I would like to focus on them. At the same time, the approach that I would like to discuss is also applied to the remaining lists of goods for which the VAT rate of 10% is applied.

In accordance with Decree of the Government of the Russian Federation No. 688, two lists have been approved. This is a list of codes in accordance with the all-Russian classifier of products, but from January 1, 2021, this is the all-Russian classifier of products by type of economic activity, for which a 10% rate is applied when selling within the country. The second list is a list of codes of medical goods in accordance with the Commodity Nomenclature of Foreign Economic Activity, for which a VAT rate of 10% is applied upon import.

Why were two lists approved? I could be wrong, but I believe that this is not due to the fact that different tax rates may be applied to the same product during import and sale. Tax legislation is based on the application of tax equality. In addition, the provisions of clauses 2 and 5 of Article 164 of the Tax Code of the Russian Federation apply a single tax rate to the same goods upon import and sale. In this regard, there is an internal conviction that various lists of goods have been approved due to the fact that in relation to goods produced and sold in Russia, the definition of a HS code is not required. As we know, the HS code is required only for import. For goods sold and manufactured in Russia, only the OKP code (now OKPD-2) is used. That is why, I believe, two different lists have been approved.

However, customs authorities refuse to apply a preferential VAT rate in a situation where the HS code is not included in the corresponding list of HS codes approved by Resolution No. 688, despite the fact that the OKP code is included in the corresponding list of OKP codes. The customs authorities justify this by the fact that the Government has the right to approve various lists, both in relation to imported goods and in relation to those being sold. Based on the logic of the customs authorities, it follows that, despite the fact that Article 164 of the Tax Code of the Russian Federation provides for a single tax rate, the Government has the right to decide when to apply which rate in relation to the same product (depending on whether the product is imported or sold within the country ). At the same time, Article 4 of the Tax Code of the Russian Federation does not allow changing or supplementing the legislation on taxes and fees when issuing regulations, including the Decree of the Government of the Russian Federation. On this basis, the Plenum of the Supreme Arbitration Court in Resolution No. 33 (clause 20) concluded that when exercising powers to determine codes for types of goods in accordance with OKP and TN FEA, the Government of the Russian Federation does not have the right to introduce additional grounds for restrictions on the application of the tax rate, which do not directly follow from the provisions of paragraph 2 of Article 164 of the Tax Code of the Russian Federation. In particular, the application of a tax rate of 10% in relation to a specific product cannot be made dependent on whether this product was sold on the territory of the Russian Federation, or the product was imported into the territory of the Russian Federation, since paragraph 2 of Article 164 of the Tax Code of the Russian Federation does not imply the possibility different taxation of transactions with the same product depending on the given criterion. Hence, the Plenum of the Supreme Arbitration Court concluded that in order to apply a reduced rate, it is sufficient that the imported or sold goods be included in one of the lists (either the OKP list or the list of Commodity Nomenclature for Foreign Economic Activity, approved by Government Resolution No. 688).

The legality of this position was confirmed by the Constitutional Court in Resolution No. 19-P, which stated that the establishment by the federal legislator in paragraph 22 of Art. 164 of the Tax Code of the Russian Federation, the reduced tax rate does not imply an arbitrary decision on the issue of its application in each specific case. In its ruling, the Constitutional Court confirmed the position of the Plenum of the Supreme Arbitration Court, set out in paragraph 20 of Resolution No. 33.

Based on these judicial acts, the courts satisfied the companies' demands and refunded overpaid customs duties. As a result, positive judicial practice has developed in various regions. This was the case until March 14, 2021. On March 14, the judicial panel for economic disputes of the Supreme Court, based on the results of consideration of the constitutional complaint of Sheremetyevo customs, issued a ruling that overturned judicial acts of three instances supporting the company’s demands. The company was refused to satisfy the stated requirements for amending the declaration of goods in terms of the application for a preferential VAT rate in relation to medical products with the HS code 9018.

The question concerned only products with the specified code. Why did I highlight this moment? Code 9018 was excluded from the list in accordance with the Commodity Nomenclature of Foreign Economic Activity, approved by Resolution No. 688, by Resolution No. 655. Subsequently, this code was included in Resolution No. 1042, which provides for exemption from VAT. The approach has changed for this code. Instead of the VAT rate of 10%, an exemption is subject. Thus, the Government has provided even more preferential tax treatment for this product. After changes were made to Resolution No. 688, negative judicial practice arose in the North-West and Central regions in disputes with customs authorities regarding the refund of overpaid VAT specifically in relation to code 9018, since the approach was changed. In refusing to satisfy the requirements, the courts proceeded from the fact that by Resolution No. 655 the code was excluded from Resolution No. 688. Regarding the companies’ argument regarding the application of the position set out in paragraph 20 of Resolution No. 33 of the Supreme Arbitration Court, the courts indicated that the regulations adopted by the competent authorities within of its powers, a new regulation of controversial legal relations was established. The resolution of the Plenum of the Supreme Arbitration Court was adopted before the relevant changes and therefore its direct application without taking into account the new legal regulation is impossible. As I already said, this position developed in relation to medical goods under code 9018. At first there were two cases (one case in each region). However, later the courts extended this position to goods classified according to other HS codes that were not mentioned in Resolution No. 655, which amended Resolution No. 688. As a result, for example, in the Central region, judicial practice began to take shape, which is based exclusively based on the fact that the Government has approved two lists, and if the imported goods are not included in the list of HS codes, despite the fact that the OKP code is present in the corresponding list, the VAT rate of 10% is not subject to application. Analyzing the judicial practice that has taken place in the judicial region, we can say, in my opinion, that the companies involved in these disputes missed the point that the issue of other codes was not considered in Resolution No. 655, and the conclusions that were drawn on the basis of these The two court cases that took place involved only one code.

What could be done? We analyzed the list of goods. There really was code 9018, and there were also other HS codes. If judicial practice has developed regarding code 9018, then it could be stated that this applies only to this code. For the remaining codes, the approach that was used initially could be applied. This was not done. No reasons were given to the court, and this practice followed all other codes.

Returning to the conclusions of the Supreme Court, set out in the Determination of March 14, 2021, it must be said that they will be extended to all goods in respect of which clause 2 of Article 164 of the Tax Code of the Russian Federation provides for taxation at a rate of 10% (not only in relation to medical goods) . Main conclusions. In cases where VAT is collected in connection with the import of goods into the territory of the Russian Federation and the tax is administered by customs authorities, the VAT tax rate provided for in paragraph 2 of Article 164, as a general rule, is applied if the imported goods meet the corresponding HS code, and not OKP code. Regarding the position of the Plenum of the Supreme Arbitration Court, the court indicated that the Plenum of the Supreme Arbitration Court stated the position in relation to issues that occurred in judicial practice at the time of its adoption, when the classification of goods OKP differed from the classification of the same goods in the Commodity Nomenclature of Foreign Economic Activity. There were separate contradictions in relation to the goods of the corresponding group of goods, which gave rise to arbitrariness in taxation and irremovable ambiguities in determining the conditions for applying the tax rate established by paragraph 2 of Art. 164 Tax Code of the Russian Federation.

And one more important conclusion. Accordingly, the explanations given in paragraph 20 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation No. 33 are not applicable if there are no such contradictions, and the established list of codes for the Commodity Nomenclature of Foreign Economic Activity subsequently began to cover a narrower list of goods in comparison with the list of codes for OKP, taking into account the changes made.

These findings in the definition raised a number of questions. For example, does the introduction by the Government of the Russian Federation of changes to the lists approved by Government Decree No. 688 mean that previously there were contradictions in relation to the relevant goods? Have these contradictions been corrected? Let me give you an example. The drug was classified according to the HS code 210690980 as a mixture of vitamins and minerals. This code has always been included in the List of HS codes approved by Government Decree No. 688. When importing, a VAT rate of 10% was applied. In July 2014, by Decision of the Board of the Eurasian Economic Commission No. 119, the classification of a vitamin-mineral complex with a certain chemical composition was changed to code 210690920. This is a code that was not in the list of HS codes approved by Government Resolution No. 688. The Government, by Resolution No. 50, amended the list HS codes, including this code only in January 2021 (we are looking at August 2014 and January 2018), thus confirming that a preferential VAT rate was and is being applied to this vitamin and mineral complex. We know well how Government Decrees are prepared. They undergo interdepartmental approvals and this is a fairly long period. We understand that the Government did not intend to change the approach to applying the VAT rate in relation to this product. If there had not been a Decision of the Eurasian Economic Commission, this product would still have been produced at a rate of 10%. After the code change, the vitamin-mineral complex remained a vitamin-mineral complex.

Can it be said that this circumstance indicates that the Government identified contradictions and eliminated them by amending the list by Resolution No. 50? In my opinion, there really were contradictions and they have been eliminated. Another issue is that Decree No. 50 does not make retrospective reference to the extension of these provisions in relation to this code as of the date after the classification changes were made. As a result, for 3.5 years the company simply imported at a rate of 18%. Following their logic that the preferential VAT rate does not apply if the HS code is not included in the HS list, despite the fact that the OKP code is included, the customs authorities will refuse to refund the overpaid VAT for this period. If this dispute cannot be resolved positively in court, the company will lose its money in 3.5 years. This example shows that when developing regulations, when there are specific issues, it is advisable to interact with government agencies. One head is good, but a head that “works on the ground and feels it with its hands” is better.

Are the conclusions of the Supreme Court, which are set out in the ruling, applicable to Resolution No. 1042, which provides for exemption from VAT payment? The fact is that this Resolution states that, for example, for the purposes of applying an exemption in relation to the list of medical products, one should be guided by the HS code, taking into account the reference to the corresponding OKP code. If we extend the conclusion of the Supreme Court that in cases where VAT is collected in connection with the import of goods into the territory of Russia and it is necessary to focus on the HS code, and not on the OKP code, then the company that was a party to the dispute in the case, to whom the ruling was issued, as well as other participants in foreign trade activities who received negative judicial decisions on similar disputes, have something to think about (subject to the three-year deadline for the return of overpaid customs duties).”

Dmitry, customs representative: “There is a letter from Roszdravnadzor. It's quite old, 2007 or 2008. It says that if the registration certificate contains the term “in composition,” then all components of the medical product must be provided to the customs authorities, and accessories can be presented in any quantity of the specified accessories. Question: Can the accessories themselves be provided in any quantity? If it is written in a single size, then provide no more than one piece?”

O. V. Evseeva: “It is necessary to provide no more than the quantity indicated in the registration certificate.”

Dmitry: “What if the number is plural and the quantity is not indicated?”

O. V. Evseeva: “Then it’s not limited.”

Dmitry: “And if it is written like this: laryngeal electrode, 10 pieces pack. Does that mean one package or maybe 100 packages?”

O. V. Evseeva: “10 pieces per package.”

Dmitry: “So I can supply 100 packages of 10 pieces together with a medical product? Or just one? It simply says: 10 pieces per pack.”

O. V. Evseeva: “That means there should be one package containing 10 pieces.”

S.P. Rogozhin: “I would like to make a comment regarding the determination of the judicial panel of the Supreme Court. Yesterday I read a report on “five years without YOU” (without the Supreme Arbitration Court). There are controversial conclusions, but I strongly agree with one of them. The fact is that (this follows from the provisions of the Arbitration Procedure Code and the Civil Procedure Code) in decisions and resolutions it is unacceptable to refer only to the Resolutions of the Presidium or Plenum of Higher Courts. Here I can say that not all definitions are included in the reviews. Let's start with the most important thing. We also have definitions that fall outside our general practice, however, they are not included in the reviews. This is the first signal that if the definition was not included in the review, it means that there was simply a specific dispute regarding certain ones.”

O. V. Evseeva: “I did not touch on this issue. However, we really hope that it will not hit, since in this case it will be a new circumstance.”

A. A. Kosov: “Here I would draw attention to the fact that when you were the SAC, the number of cases that were considered at the SAC level (customs disputes) was no more than 10. On average, 5-6. Now the situation has changed for the better. There are more such decisions, but still this is not the number that the Supreme Court considers in tax disputes. It turns out that definitions in which the problem is considered on its merits are piece goods. That's why they mean so much to us."

S.P. Rogozhin: “I do not question the legitimacy of the definition’s conclusions.

I’m just saying that the Plenum, when approving the review, may agree that this definition is system-forming, or it may not agree.” Presentation by O. V. Evseeva

What documents confirm the legality of applying the VAT rate of 10%?

So, when calculating VAT, a taxpayer applying a reduced rate is obliged to confirm the fact of the sale of goods subject to the requirements of tax legislation at a tax rate of 10%, and to be more precise, he must justify that the goods sold by him belong to the types of food products listed in the list of codes , subject to VAT at a rate of 10% (Resolution of the AS SZO dated June 10, 2015 in case No. A56-42376/2014). How to do it? The Tax Code does not answer the question, since Art. 164 of the Tax Code of the Russian Federation does not indicate specific documents necessary to certify the right to apply a reduced VAT rate.

To confirm product compliance with approved standards, a certification and declaration system is provided. Therefore, historically, it was possible to certify the legality of a taxpayer’s application of the 10% VAT tax rate by submitting a declaration (certificate) of compliance to the tax authority (resolution of the Federal Antimonopoly Service of the Moscow Region dated 02.22.2013 in case No. A40-12064/11-107-51, FAS VVO dated 01/11/2013 in case No. A79-7390/2011).

So, in particular, the declaration (certificate) of conformity, among other information, includes information about the object of conformity (certification), which makes it possible to identify this object, namely the OKP code according to OK 005-93 (Articles 24, 25 of the Federal Law of 27.12 .2002 No. 184-FZ “On technical regulation”).

List of goods for which a VAT rate of 10% applies

In order to support and develop small businesses in Russia, at the legislative level (clause 1 of Article 164 of the Tax Code of the Russian Federation), a fairly extensive list of categories of goods has been approved for which a partially reduced VAT interest rate of 10% can be applied.

This includes:

- Food products: products of animal origin (except deli meats), eggs, milk and dairy products, fish and seafood (except elite varieties), vegetables, bread and pasta, dietary and baby food.

- Children's goods: clothing and shoes (except sports shoes), diapers, children's furniture and accessories, school goods.

- Medical products: all medications and their elements that are used for laboratory research.

- Printed products: books, magazines, periodicals that belong to the field of science, education and culture.

- Pedigree livestock, including cattle and other breeding animals, including pigs and horses. This category also applies to the biological elements of animals associated with the reproduction of breeds.