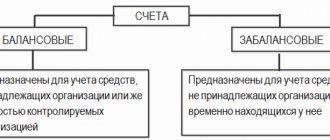

Organizations daily face situations where it is not possible to reflect property on balance sheet accounts. In accounting, off-balance sheet accounts are used to reflect transactions with valuables that are not objects of balance sheet accounting. It should be noted that information for off-balance sheet accounting, in the same way as for balance sheet accounting, is reflected in the reporting (certificate of off-balance sheet accounts f. 050730, f. 0503130 and f. 050830), and therefore it is necessary to maintain the correctness of the entered data so as not to distort reporting.

How off-balance sheet accounts work

Instruction 157n provides for thirty-one off-balance sheet accounts.

We remind you that the accounting entity has the right to use additional off-balance sheet accounts. To use additional accounts, they must be included in the working chart of accounts and approved when developing the Accounting Policy. The movement in off-balance sheet accounts is reflected as follows: the debit account takes into account the increase in the values of the account, and the credit account for the decrease, since all accounts are active. Recording on accounts, unlike balance sheet accounts, is simple; a corresponding account is not needed to generate postings.

The main business situations in which an institution, in accordance with current legislation, needs to make entries on off-balance sheet accounts.

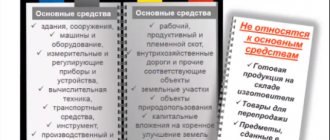

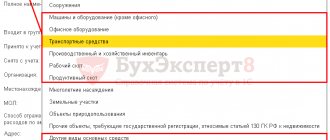

Fixed assets or materials?

The assignment of material assets to the corresponding group of non-financial assets (fixed assets or inventories) is within the competence of the educational institution, which independently makes a decision based on the methods of accounting (budget) accounting established in the accounting policy, the functional and economic orientation of the expenses incurred, taking into account the provisions instructions No. 157n, 162n, 174n, 183n, GHS “Fixed Assets” and GHS “Inventories”.

The main criterion in this case will be the useful life. If it exceeds 12 months, then office supplies are included in fixed assets; if not, they are included in inventories.