What is a reversal?

It is prohibited to delete entries in accounting documents. You also cannot cross out incorrect information. Reversal is used to correct errors. This is wiring with a minus sign. It allows you to correct incorrect data. As a result, two mutually exclusive entries appear in accounting, one of which has a minus. The wiring duplicates each other. Let's look at the main features of reversal:

- the entry is made for the period in which the error was made;

- the main sign of a reversal is the presence of a minus;

- without such a record, the final reporting will be incorrect;

- The adjusting entry is made for the amount for which the difference was established.

IMPORTANT! Reversal rules are extremely important. If they are ignored, turnover is likely to be overestimated, which is unprofitable for the enterprise.

In what cases is reversal used?

Adjustment entries are relevant under the following circumstances:

- correction of mistakes;

- write-off of the realized trade margin;

- the planned cost of inventories is brought into line with the actual price. This is relevant for those cases when the actual price is less than the accounting price. A similar situation may arise when uninvoiced supplies are recorded;

- the need for correction to reduce the amount of valuation allowances.

Reversal is a common tool in accounting practice.

Is it possible to make reversal entries in the sales ledger ?

What is a “red storno”?

“Red reversal” is a correction method that is relevant when the amounts indicated in the accounting are overstated. Applicable in the following ways:

- if this is a paper journal for accounting, then the reversed entry can be circled with a red pen;

- If a transaction is entered into a computer database, it must be highlighted in red.

At the end of the reporting year, it is necessary to make a calculation in which the amount of the reversed entry is subtracted from the total amount. The correction method is determined by the enterprise itself. The choice of instrument is not specified by accounting rules.

IMPORTANT! It must be borne in mind that the balance will be similar when using any of the types of reversals. The turnover in the accounting account differs.

Example of a “red reversal”

The company has created a reserve for doubtful debts. This operation is reflected by the entry:

- DT 91.02 “Other expenses”;

- CT 63 “Provisions for doubtful debts.” The amount is 1,200 thousand rubles.

Part of the created reserve is written off. It looks like this:

- DT 63 CT 62. Amount 95,000 rubles;

- DT 91 (subaccount 02) CT 63. Amount 15,000 rubles.

ATTENTION! All adjusting entries must be supported by an accounting statement.

AS for returnable containers

General information

Containers are another element of business activity for which returns are processed. By container is meant a type of material intended for packaging, transportation and storage of products (clause 160 of the Methodological Instructions of the Ministry of Finance No. 119n dated December 28, 2001).

The container can be disposable, the cost of which is usually included in the cost of the product. Or reusable, which can be reused. It is this kind of packaging that must be returned to the supplier, and its cost is not included in the price of the product, but is indicated on the delivery note as a separate line.

The procedure for handling returnable packaging must be reflected in the contract. The parties may use one of the following options:

- When paying for products for packaging, a deposit is required, which the supplier is obliged to transfer back to the buyer after returning the packaging.

- The buyer does not pay for the packaging, but returns it to the supplier within the period specified in the contract.

The deposit for the supplier acts as protection against the buyer’s dishonesty, since in the event of non-return of the container it compensates for lost funds. The situation is more complicated in the second case, where if the terms for returning the packaging are violated, the supplier will have to take a number of actions.

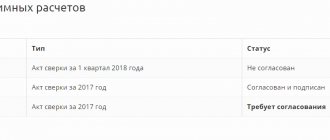

First, you need to check your container accounting data with these buyers by sending him a reconciliation report. The peculiarity of the container reconciliation act is that its data is presented not in monetary units, but in physical terms (pcs). The rest of the document is drawn up in a similar way. It indicates the details of the parties, the period, balances at its beginning and end, debit and credit turnover.

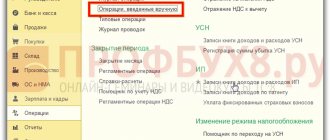

A typical configuration of accounting programs, as a rule, does not contain a container reconciliation report form (including . Therefore, it can either be compiled manually or use an external report. Such files do not make changes to the program configuration, which means they will not cause problems in the future with In 1C, for storing them, there is a reference book “Additional reports and processing” in the “Service” menu (the report must first be installed there).

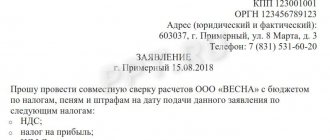

Along with the reconciliation report, the buyer is sent a letter demanding the return of the container. His writing method is similar to a letter for the return of an overpaid amount. Let's look at it with an example.

Letter writing example

Agrosnab LLC supplies Vympel LLC with agricultural products in wooden boxes, which are returnable packaging. Since the boxes were not returned on time, Agrosnab LLC sent the following letter to Vympel LLC:

To the Director of Vympel LLC

Surkov A.A.

From Agrosnab LLC,

TIN 3222267665, checkpoint 322957401, OGRN 2085987457887

Ref. No. 56 dated 08/23/2017

About returning packaging

08/05/2017 Agreement No. D-08/345 was concluded between Agrosnab LLC and Vympel LLC for the supply of agricultural products, according to which Agrosnab LLC undertakes to supply goods to Vympel LLC by 08/10/2017, and Vympel LLC undertakes to pay for the order and return the packaging (wooden boxes) within 10 days from the date of receipt of delivery. Agrosnab LLC fulfilled its obligations on 08/09/2017.

Invoice No. 89 dated 08/09/2017. and product acceptance and transfer certificate No. 90 dated 08/09/2017. are attached. Vympel LLC made payment for the received products on August 12, 2017, but the reusable packaging has not been returned to date. Please return it on the basis of the above agreement and the current legislation of the Russian Federation (Article 517 of the Civil Code of the Russian Federation).

Applications: ...

Director of Agrosnab LLC Polyakov E.V.

Additional recording correction method

Additional posting is relevant to increase the indicated amounts if they have been underestimated in accounting. The accountant needs to enter an entry with correspondence similar to the correspondence of the erroneous entry. The entry must not indicate the entire amount, but only the missing value.

Example

The cost of repair work in the report is indicated at 5,000, but in fact the amount is 6,000 rubles. The figure is underestimated by 1,000 rubles. Accounting corrections can be made as follows:

- DT 26 CT 60 “Settlements with suppliers.” The amount is 1000 rubles.

That is, the missing amount is recorded in the record.

Drawing up a reconciliation report for mutual settlements

The legislation does not establish uniform rules for drawing up and issuing a reconciliation report, however, there are basic principles that must be followed. Like any primary document, the reconciliation report must contain the following mandatory details:

- the name of the document, as well as the date of its preparation;

- the name of the originator’s organization and the name of the counterparty with whom the act is signed;

- indication of officials authorized to sign acts of verification of their surnames and initials, as well as signatures.

The reconciliation act itself is usually drawn up in the form of a register of documents, ordered by the date of their creation. Sometimes, instead of documents, the essence of the transaction is indicated (sale, purchase, payment, etc.).

In order for the reconciliation act to be up-to-date, it is better to draw it up from the beginning of cooperation or from the moment of signing the last reconciliation act. In addition to the originator, this document must be signed by the director of the enterprise.

The original reconciliation act, signed by the directors of the counterparty enterprises and certified by their wet seals, has legal force.

Why are “black” and “red” wiring not mutually exclusive?

Each correction method differs in its functional purpose. Entering a reversal instead of a reverse entry is a mistake. Let's look at an example. The accountant makes entries that do not correspond to the actual transaction. It looks like this:

- DT 26 CT 60. Amount 150,000 rubles.

You need to correct the entry using the following wiring:

- DT 60 CT 26. Amount 150,000 rubles.

Entering the entry DT 26 CT 60 would be a mistake.

IMPORTANT! An accounting error will lead to an artificial increase in turnover in both debit and credit. All this distorts accounting data. When checking or analyzing, you will have to spend time on auxiliary analytics.

Reversal rules

IMPORTANT! An example of a reversal when receiving a corrected invoice from a supplier from ConsultantPlus is available at the link

Proper reversal solves several problems at once. A correctly compiled report helps you quickly understand the trading operations carried out. It is also important to ensure the company's protection during tax audits. Let's look at the basic rules for making a reversal:

- If an incorrectly entered entry was identified in the current period before the delivery was made, then the corrections are indicated under the date of the day ending the quarter.

- The reversal can be made on the discovery date, but this is subject to certain conditions. In particular, this is relevant when identifying an error in the delivery period, which has already passed.

- Each of the adjusting entries must be confirmed by an accounting certificate. This document states the reason for making the corrections, as well as the amount of the new entry.

- All accounting entries must match the primary documentation. Entries are always supported by associated papers. If the information does not match, the company will have problems when passing tax audits.

Making a reversal is a relatively simple procedure. However, in practice, this wiring raises many questions.

IMPORTANT! Clause 3, Article 10 of the Federal Law “On Accounting” establishes the need for protection against unauthorized amendments. Execution of reversals must be justified. The accounting certificate for this entry must contain the signature of the accountant who made the reversal. The posting date and the accounting statement date must match.

How to reflect the implementation of the previous period

Let's look at an example.

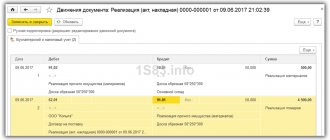

Let’s say that in March the Confetprom company discovered unrecorded sales of communication services for December 2015.

To reflect the forgotten implementation document in 1C 8.3, we create the Implementation (acts, invoices) on the date the error was found. In our case, March, not December:

In the invoice document we indicate the date of correction (March) and the same date is indicated in Issued (transferred to the counterparty):

To reflect VAT in the previous period, you must check the Manual adjustment box and correct it in the Sales VAT register:

- Recording an additional sheet – set to Yes;

- Adjusted period – set the date of the original document. In our case, December:

Erroneously forgotten document when creating the Sales Book from the Sales page:

We recommend watching our seminar, which discusses how to correct VAT amount errors that affect the tax calculation and how to correct “technical” errors that do not affect the tax calculation:

You can study in more depth the mechanism for adjusting past periods and correcting errors of the past period in 1C 8.3, as well as the necessary actions when an error is detected, at our master class “ Correcting errors and adjustments in accounting .”

Give your rating to this article: (

4 ratings, average: 5.00 out of 5)

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

What should I do if an error is discovered after accounting approval?

If the error is found for the next accounting year, there is no need to make corrections to the old accounts. The reversal is entered in the new accounting. For example, in February 2021, a mistake was made that was found only in 2021. Adjustments are made to the accounting records for 2021. This rule is due to the fact that no changes are ever made to the reporting of previous years.

Errors from previous years are considered gains or losses. Expenses or income must be reflected in account 92 “Non-operating income (expenses)”. It is also necessary to reflect them in the line “Profit (loss) of previous years.”

So. Accounting documents require strict reporting. They should not contain arbitrary information. All errors found must be corrected immediately. You can do this in two ways:

- reversal,

- making additional entries.

The first method will be relevant if the transaction amounts were inflated. To make an adjustment, it is not enough to simply make an entry, which must be confirmed by an accounting certificate.

Debt adjustment

Current as of: March 2, 2021

To be sure that there are no errors in the accounting of settlements with counterparties, and that the amount of receivables and payables corresponds to reality, an inventory is carried out. We told you in our consultations when to take an inventory of settlements with buyers and customers, as well as suppliers and contractors and how to formalize its results.

If errors are discovered as a result of the inventory of calculations, the organization will need to make the necessary adjustments to the debt. We will tell you in this article what kind of wiring to accompany these adjustments.