An erroneously entered document in 1C can be freely marked for deletion and deleted only if it is not included in the closed period. But what to do if the “erroneous” document turns out to be from a closed period, the month is closed and all reports have been submitted? After all, it is necessary to correct not only the document, but also the movements in the registers that are associated with this document. In 1C 8.3 Accounting 3.0, it is possible to create a reversal document for a previously entered business transaction.

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z, BASIC"

How to make a reversal in 1C 8.3

How to delete marked objects in 1C 8.3 Accounting and set up automatic deletion in 1C 8.3 through routine operations is discussed in another article.

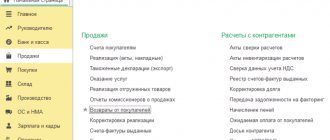

To achieve this goal in 1C Accounting 3.0 (8.3) there is a document Operation: Operations – Operations entered manually:

The purpose of the document is represented by a list of the following operations:

- Entering correspondence of accounts for accounting and tax accounting;

- Entering a document using a standard operation;

- Carrying out register adjustments;

- Reversing movements of another document.

To achieve the necessary goals, we are interested in the last possible point.

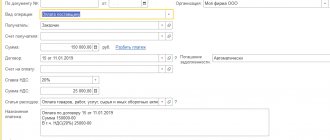

When we click on the Create button, you can see the types of the Operation document. From the drop-down submenu you must select the type of document reversal:

In the newly created document, you need to select an organization (if the 1C 8.3 information base keeps records of several organizations), and also select the “erroneous” document itself, having first selected its type:

Let's look at a small example of how to reverse an implementation in 1C 8.3 of the previous period.

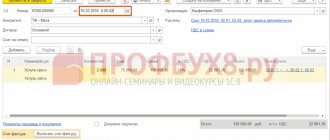

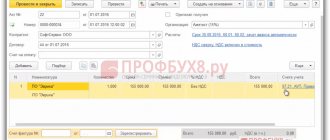

Let’s say that in June an organization sold goods in the amount of 17,700 rubles, including VAT of 2,700 rubles. The sales operation was formalized with the document Sales of goods (acts, invoices) dated June 23, 2016:

The document created the postings:

As well as movement according to the sales VAT register:

An invoice was generated for the document:

As soon as we issue an invoice, VAT on the sale of goods will be reflected in the Sales Book:

In July it turned out that the goods had not been shipped. There was a need to adjust the closed period and reverse the implementation in 1C 8.3.

As discussed earlier, we will use the reversal document mechanism in 1C 8.3. As soon as we select an organization, the “erroneous” implementation document will automatically appear:

- Text of the document details “Contents”;

- Postings with negative values:

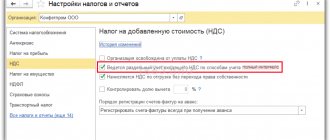

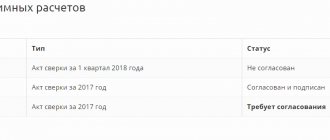

Also, a reversing entry in the VAT Sales register has been created. In order for it to be included in the additional sheet of the Sales Book, we set the values:

- Recording an additional sheet – “Yes”;

- The adjusted period is “06/23/2016”;

- Reversing entry additional. sheet - “Yes”:

How to register the movement in tax accounting and in the VAT accumulation registers for a reversed transaction, see our video lesson:

Having created canceling transactions and adjusted the register, we try to assemble the Sales Book, having previously configured its presentation in 1C 8.3:

Now you can see the result of the actions taken:

Reversal of sales from the previous period

There are several ways to reverse an erroneous amount. With retro discounts, the reversal occurs for the seller, but not for the buyer. Reverse postings distort account turnover.

Errors in accounting records can have tax consequences. To avoid this, it is important for the company to detect possible distortions in time and correct them. One of the adjustment methods is the “red reversal”. This method of making corrections is used if incorrect correspondence of accounts is given in the accounting. The point is that the erroneous wiring is first repeated in red ink (or in red in a computer program). When calculating the totals in the registers, the amounts written in red ink are subtracted from the total. Thus, the incorrect entry is canceled. After this, a new entry is made with the correct account correspondence or the correct amount.

Reflecting reverse postings instead of reversing the inflated amount entails doubling the turnover of the accounts

Often errors occur due to the accountant's carelessness or a glitch in the accounting program. For example, the organization received a certificate of completion of work in the amount of 30,000 rubles. And the accountant made an entry by mistake: Debit 44 Credit 60 - 33,000 rubles. In this case, you can reverse the difference between the correct and incorrect amount: Debit 44 Credit 60 - -3000 rub. Or cancel the entire erroneous amount and reflect the correct entry: Debit 44 Credit 60 - -33,000 rubles; Debit 44 Credit 60 - 30,000 rub. In both cases, there will be no accounting distortions. But if the accountant does not keep analytical records, it will be easier for him to remember the reason for the correction if the entire amount of transactions is reflected in the accounting, and not just the difference. In addition, to make corrections, you can use reverse entries - the amount previously recorded as the debit of the account is indicated as the credit of this account and vice versa: Debit 44 Credit 60 - 33,000 rubles. — the incorrect transaction amount is reflected; Debit 60 Credit 44 - 3000 rub. — the amount has been corrected. The final account balances will be correct, but the turnover will double. Therefore, we do not recommend using this correction procedure. Let us remind you that in any case, when making corrections, you must draw up an accounting certificate in which you indicate the error and justify its correction. The form of the certificate is not unified, but it makes sense to reflect all the mandatory details of the primary document, as well as the information necessary to determine the reasons for the correction: details of payment documents, contracts, settlements (Part 2 of Article 9 of Law No. 402-FZ).

It is impossible to correct errors of previous years through reversal if the reporting of last year has already been approved

If an accountant has identified an error that was made last year, then the possibility of using the “red reversal” method depends on whether the reporting for last year has been approved or not yet (clauses 5 - 14 of PBU 22/2010). Corrections are not made to the approved reporting, therefore it is impossible to reverse the data in accounting for the previous year (clause 10 of PBU 22/2010). The accountant will correct the erroneously inflated amount of the transaction on the date of discovery of the error with the recognition of profits or losses of previous years or in the accounts of other income or expenses (clauses 9 and 14 of PBU 22/2010).

Note. Errors from previous years cannot be corrected using reversal entries.

Example 1. Let's use the data from the example discussed above. November 25, 2013 Debit 44 Credit 60 - 33,000 rubles. — an error was made in the amount of expenses; August 15, 2014 Debit 60 Credit 91 - 3000 rubles. — other income is reflected in the amount of expenses incorrectly taken into account last year (the error is assessed by the company as insignificant); August 15, 2014 Debit 60 Credit 84 - 3000 rub. — retained earnings increased (the error is assessed by the company as significant).

Let us remind you that this procedure does not apply in tax accounting. An identified error from last year is corrected in the tax period in which it was made, regardless of the time it was discovered. If expenses were inflated, then an income tax arrears arose. Therefore, it is necessary to submit an updated declaration for this tax (clause 1 of Article 81 of the Tax Code of the Russian Federation). If VAT was also deducted in a larger amount on the inflated amount of expenses, then an updated VAT return will also have to be submitted.

Note. “Red reversal” does not always mean correcting errors.

Reference. Methods for correcting data in accounting documents Correction of accounting errors is regulated by Federal Law dated December 6, 2011 N 402-FZ “On Accounting” (hereinafter referred to as Law N 402-FZ) and the Accounting Regulations “Correcting Errors in Accounting and Reporting” (PBU 22/2010). In order to correct errors, accountants, in addition to the “red reversal” method, have several more methods: - proofreading method.

Used to correct errors in primary documents and accounting registers. The incorrect word or amount is crossed out with a thin line so that the original version can be read, and the correct value is carefully written on top. The correction is certified by the signature of the person responsible for maintaining the register, the date and seal of the organization are affixed (Part 7 of Art.

9 and part 8 of Art. 10 of Law N 402-FZ, section. 4 Regulations on documents and document flow in accounting, approved. Ministry of Finance of the USSR 07/29/1983 N 105, and Letter of the Ministry of Finance of Russia dated 03/31/2009 N 03-07-14/38). Thus, corrections to the accounting registers are made before the totals are calculated. This method is used for “manual” accounting, without the use of computer programs; - method of additional wiring. It is used when the transaction was not reflected in a timely manner or, with correct correspondence of accounts, the transaction amount turned out to be less than the real one. In this case, an additional accounting entry is made for the amount of the transaction or for the difference between the correct and reflected amounts. At the same time, an accounting certificate is drawn up, which explains the reasons for the correction. Thus, errors identified both in the current and in previous periods are corrected.

Providing retrospective discounts entails the reversal of revenue for the seller, the buyer does not change the cost of goods

Accountants have to reverse previously carried out transactions not only in case of mistakes, but also when providing discounts based on the results of shipments for the past period.

That is, after the seller ships the goods and records the revenue, and the buyer accepts these goods for accounting. At the end of the period, the seller provides a discount on already shipped inventory items (for example, for large volumes of purchases). According to the accounting rules, revenue is recognized based on all discounts and markups provided to customers (clauses 6 and 6.5 of PBU 9/99 “Organizational Income”, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 32n).

Example 2. The seller shipped the first batch of goods to the buyer in the amount of 11,800 rubles, including VAT - 1,800 rubles. Then, within a month, the second batch for 23,600 rubles, including VAT - 3,600 rubles. At the end of the month, the seller provided a 10% discount on shipped goods: RUB 11,800. + 23,600 rub. = 35,400 rub.; RUB 35,400 x 10% = 3540 rubles, including VAT - 540 rubles. The seller makes the following accounting entries: July 15, 2014 Debit 62 Credit 90 - 11,800 rubles. — revenue from sales is reflected; Debit 90 Credit 68 - 1800 rub. — VAT is charged on sales proceeds; July 25, 2014 Debit 62 Credit 90 - 23,600 rubles. — revenue from sales is reflected; Debit 90 Credit 68 - 3600 rub. — VAT is charged on sales proceeds. On August 4, the buyer was given a 10% discount on shipped goods (3540 rubles): Debit 62 Credit 90 - -3540 rubles.

— previously recorded revenue was reversed by the amount of the discount; Debit 90 Credit 68 - -540 rub. — VAT on revenue has been reduced after issuing an adjustment invoice. When receiving a retrospective discount, the buyer cannot adjust the cost of capitalized goods (clause 12 of PBU 5/01 “Accounting for inventories, approved by Order of the Ministry of Finance of Russia dated 06/09/2001 N 44n). Therefore, he will reflect the discount as other income, even if it was received in the same year that the goods were registered: July 15, 2014 Debit 41 Credit 60 - 10,000 rubles. — purchased goods are reflected; Debit 19 Credit 60 - 1800 rub. — VAT is reflected on the cost of goods; Debit 68 Credit 19 - 1800 rub. — subject to VAT deduction on the cost of goods; July 25, 2014 Debit 41 Credit 60 - 20,000 rubles. — purchased goods are reflected; Debit 19 Credit 60 - 3600 rub. — VAT is reflected on the cost of goods; Debit 68 Credit 19 - 3600 rub. — subject to deduction of VAT from the cost of goods. On August 4, the buyer was given a 10% discount on shipped goods (3540 rubles): Debit 60 Credit 91 - 3000 rubles. — other income is reflected in the amount of the discount received from the seller. After receiving a document from the seller about granting a discount or receiving an adjustment invoice, the buyer needs to restore VAT from the cost of goods, accepted for deduction: Debit 19 Credit 60 - 540 rubles. — VAT is reflected on the discount amount.

At the same time, the seller reflects the provision of discounts on goods shipped last year in accounting without using reversal entries, but posts them to account 91 “Other income and expenses” (Chart of accounts and Instructions for its use, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n).

Reversal entries are recorded when goods are returned in the same year as the sale.

Proceeds from the sale of goods are reflected in the seller’s accounting at the moment of transfer of ownership to the buyer (clause 12 of PBU 9/99). The buyer's right of ownership arises from the moment the goods are transferred to him by the seller - delivery of the goods to the buyer or the carrier (Articles 223 and 224 of the Civil Code of the Russian Federation). If the buyer returns part of the goods to the seller, this means that ownership has not transferred. Therefore, the seller has no reason to take into account the proceeds from the sale of these goods - he makes accounting adjustments.

Note. When the buyer returns goods or provides a retro discount, the seller reverses the proceeds.

In the event of a detected defect, the buyer draws up a report on the established discrepancy in quantity and quality upon acceptance of inventory items, which is the legal basis for filing a claim with the seller. And based on the claim made by the buyer, the seller’s records appear in red ink.

Example 3. On April 25, 2014, LLC “Company 1” shipped LLC “Company 2” freezers in the amount of 3 pieces at a price of 24,780 rubles. per piece (including VAT - 3,780 rubles). The cost of one camera is 17,000 rubles. On May 6, 2014, Company 2 LLC sends Company 1 LLC a claim that one of the supplied cameras was defective and returns it. On the same day, the seller transfers funds for the returned products. In accounting, the seller makes the following entries: April 25, 2014 Debit 62 Credit 90 - 74,340 rubles. — revenue for sold products is reflected; Debit 90 Credit 68 - 11,340 rub. — VAT is calculated based on the invoice; Debit 90 Credit 43 - 51,000 rub. — the cost of products sold is written off; May 6, 2014 Debit 62 Credit 90 - -24,780 rub. — previously recorded revenue is reversed; Debit 90 Credit 43 - -17,000 rub. — the previously written-off cost of sold defective products was adjusted; Debit 90 Credit 99 206 — -4000 rub. — previously reflected profit from the sale of defective products was adjusted; Debit 90 Credit 68 - -3780 rub. — VAT deduction on returned products is claimed; Debit 43, 28 Credit 43 - 17,000 rub. — acceptance of products returned by the buyer to the warehouse on the basis of an act; Debit 62 Credit 51 - 24,780 rub. — money was returned for defective products.

Note. When the “red reversal” method is still used, organizations prescribe in their accounting policies how they keep track of finished products - at the actual cost in account 43 “Finished products” or according to the standard cost, when, along with account 43, account 40 “Output of finished products” is used. Count 40 is used in small industries and with a small range of products. At the end of each month, the organization compares the balance of account 40 by debit and credit. The deviation shows the difference between the actual cost and the planned cost. The excess of the standard cost over the actual cost (savings) is reversed to the credit of account 40 and the debit of account 90 “Sales”. Overexpenditure - the excess of actual cost over standard cost - is written off from the credit of account 40 to the debit of account 90 “Sales” by an additional entry. In addition, “red reversal” entries are constantly found in the accounting of retail trade organizations that keep records at sales prices. Such organizations form the selling price of goods based on the price at which they purchased goods from suppliers and the trade margin. The amounts of trade margins (discounts, markups) on goods sold, released or written off due to natural loss, defects, damage, shortages are reversed by the seller to the credit of account 42 “Trade margin” in correspondence with the debit of account 90 “Sales”.

Read on e.rnk.ru.

The procedure for tax accounting of buyer discounts and other measures to increase sales. What is the position of departments and courts on the issue of accounting for the costs of displaying goods on the sales floor, sending advertising SMS messages, holding promotions and distributing product samples? Is the provision of goods in exchange for accumulated points considered a gratuitous transfer for income tax purposes? Read the answers to these questions, as well as about other complex aspects of taxation of discounts on the website e.rnk.ru in the articles “Nuances of accounting for costs of stimulating potential and existing customers” // RNA, 2014, No. 7 and “Retrospective discounts have become safer in compared with the payment of premiums and bonuses to customers” // RNA, 2012, No. 9.

If the goods are returned in the year following the sale, then the seller does not need to reverse the proceeds. In this case, as part of other expenses, it will reflect the loss of previous years identified in the current year (clause 11 of PBU 10/99 “Expenses of the organization,” approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n).

How to change an information register entry in 1C 8.3

As mentioned above, the Operation document is intended not only for adjusting documents, but also for adjusting registers.

Let's look at a small example. Let's say June 24, 2016. the fixed asset was taken into account. The initial information was filled in, in which an error was made - the useful life was incorrectly indicated as 68 months instead of 60:

The DtKt button shows the movement of the document, including in the information registers: Asset depreciation parameters (accounting), Asset depreciation parameters (tax accounting):

To adjust the information register, we use the already familiar document Operations – Operations entered manually. The difference is that we select the Operation type:

We indicate the organization and click on the “More” button:

We select the necessary information registers for adjustment:

We create adjusting entries for the fixed asset:

In order to verify the correctness of the information on a fixed asset after changes to the information register entry in 1C 8.3, we will generate a universal report, indicating the information register OS depreciation parameters (accounting) and OS depreciation parameters (tax accounting):

We recommend watching our free seminar “Error in using 1C 8.3, for which you can be fired,” which discusses in detail errors when correcting documents in 1C.

For more details on how you can reverse a document in 1C, see our video tutorial: