Home / Protection

Back

Published: 03.11.2019

0

15

- 1 Offsetting under the simplified tax system for income 1.1 Definitions

- 1.2 Legal grounds

Offsetting under the simplified tax system income

The notification should indicate the amount of claims to be counted, the numbers and dates of documents indicating the occurrence of mutual debt. The risk of adverse consequences associated with carrying out a unilateral offset and expressed in the other party’s rejection of the subject of the offset can be reduced through the preliminary preparation and signing by the parties of a settlement reconciliation act.

Preliminary preparation of reconciliation reports is also recommended when conducting bilateral and multilateral offsets. An offset carried out by agreement of two or more participants is formalized by an act of offset of mutual claims, signed by all participants in the offset. Attention

If mutual claims are different in size, only the claim that is smaller in size is fully repaid. The obligation for which a larger claim is presented is partially preserved.

Definitions: Offsetting under the simplified tax system for income is the repayment of counter homogeneous claims. In other words, organizations that use counteraction effectively cancel equivalent obligations under existing agreements.

Offsetting can be applied to supply agreements, contracts, etc. Homogeneous claims mean obligations that arose on the basis of different agreements, but with the same method of repayment.

In other words, if the parties have different valid agreements that require payment for goods or services in money, then such requirements are recognized as homogeneous.

For organizations participating in non-monetary transactions operating under the simplified tax system, the occurrence of income is confirmed by the fact of receipt of funds to the current account, and not by the signing of an act drawn up between the parties to the agreement, but the company reflects the expense in KUDiR after shipment and offset between the parties to the agreement.

For example, having received a signed certificate of completion of work, the executing company includes the amount in expenses (in 1C, how to reflect income on a certificate of completion of work, look for information in open sources of information). KUDiR is maintained in a single copy, even if the entrepreneur has several trading branches.

Records of transactions are reflected in KUDiR on the basis of information from the primary report papers, which are stored by the entrepreneur until the end of the period when it is no longer possible to carry out (for example, from 2008 to 2018) the transfer of losses from previous years.

This requirement is due to the fact that offset is a method of making payments between companies (decision of the Federal Antimonopoly Service of the North-West District dated May 21, 2007 in case No. A05-12882/2006-25).

{amp}gt; {amp}gt; {amp}gt; Tax-tax August 27, 2021 20874 Offsetting under the simplified tax system “income” often raises questions among accountants.

How to reflect offset in documents, what is the procedure for carrying it out, what to do when the amounts of mutual obligations are disproportionate? We will answer these questions in the article.

At the same time, organizations that apply a 15% tax rate take into account costs after they have been paid (Article 346.17 of the Tax Code of the Russian Federation). Consequently, if the claims were offset, then the date of payment is the day when the act of offset is signed.

The income of the enterprise is considered to be the repayment of accounts receivable, while expenses include the write-off of accounts payable.

How to draw up an act can be seen in the picture: act of offset Next, we will consider the main issues related to the implementation of offsets:

- Does offset apply to the income of the enterprise?

- What does contraction have to do with VAT?

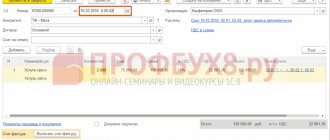

- How to display the repayment of counter homogeneous claims in 1C.

Is mutual offset income under the simplified tax system? The question that repayment of receivables is income was discussed above (see the subheading “Reflection in accounting ...”).

If the offset of mutual claims on these transactions occurs after December 31, 2008, the VAT amounts presented by suppliers (executors) can be deducted only after payment of the tax by a separate payment order.

If the buyer (customer) applied a VAT deduction earlier than the quarter in which the VAT amount was transferred to the supplier (performer) in cash, he must make an adjustment for these VAT amounts and submit an updated tax return for the corresponding quarter. This follows from paragraph 12 of Article 9 of the Law of November 26, 2008 No. 224-FZ.

Similar clarifications are contained in the letter of the Federal Tax Service of Russia dated March 23, 2009 No. ШС-22-3/215. An example of reflection in accounting and taxation of offset transactions.

The risk of adverse consequences associated with carrying out a unilateral offset and expressed in the other party’s rejection of the subject of the offset can be reduced through the preliminary preparation and signing by the parties of a settlement reconciliation act.

The obligation for which a larger claim is presented is partially preserved. By law, offset can only be applied to those obligations whose terms have already expired.

If such a period is not established by agreement, then it is determined on the basis of the requirement set by the counterparty (Article 410 of the Civil Code of the Russian Federation).

This procedure is provided for in paragraphs, Article 346.17 of the Tax Code of the Russian Federation. Therefore, if, as a result of offset, the buyer’s receivables are repaid, then, regardless of the chosen object of taxation, the seller organization applying the simplification must recognize income (Tax Code of the Russian Federation).

For purchasing organizations that pay a single tax on the difference between income and expenses, netting is the basis for recognizing expenses in the form of repaid accounts payable (p.

In case of partial offset of mutual claims, income (expenses) should be recognized: – on the date of offset (for the amount of debt subject to offset); – on the date of repayment of the balance of debt in another way (for example, in cash). An example of how to reflect offset of mutual claims in accounting and taxation.

The book of accounting for income and expenses (an example of offset, assignment and compensation, issued in KUDir, can be found in open sources) reflects the corresponding transactions based on the fact of income received and expenses incurred. For example, let’s say offset – for rent.

Using the simplified tax system, income minus expenses of an enterprise often formalizes such a transaction.

Offsetting (as reflected in KUDir, see below) is a common method of non-monetary settlements. Under the simplified tax system, an organization's income is recognized on the day funds are credited to the current account or deposited in the enterprise's cash register, or the acquisition of new property or services as repayment of the counterparty's debt.

Therefore, in tax accounting, the offset is considered payment under the agreement. Income and expenses under the simplified tax system are taken into account on the date of termination of the obligations of the participant in the transaction. Income and expenses when netting on the usn Info

at least two different agreements have been concluded between them, in one of which the organization is a debtor, and in the other - a creditor. Counterclaims must be homogeneous. What does “homogeneity” mean?

Obligations that are related to the execution of different contracts, but involve the same method of repayment, can be considered homogeneous.

Let’s assume that repayment is initially expected under two different contracts in cash, which means that the requirements are homogeneous.

Consequently, it is impossible to carry out offsets under such agreements. This conclusion is confirmed by judicial practice.

For example, in paragraph 7 of the Appendix to the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 29, 2001 N 65 it is said that the legislation

The risk of adverse consequences associated with carrying out a unilateral offset and expressed in the other party’s rejection of the subject of the offset can be reduced through the preliminary preparation and signing by the parties of a settlement reconciliation act. Attention

We invite you to read: How the tax office checks income minus expenses

If mutual claims are different in size, only the claim that is smaller in size is fully repaid.

The obligation for which a larger claim is presented is partially preserved. Definitions: Offsetting under the simplified tax system for income is the repayment of counter homogeneous claims.

Others

Taxpayers who are both a debtor and a credit to each other can use the following options for mutual settlement:

- Transfer money in accordance with the terms of the agreement.

- Conclude a contraction agreement.

Offsetting is often very convenient for counterparties, if you do not take into account the mistakes that participants in such transactions sometimes make.

One of these errors is the deadline that is set for the fulfillment of contractual obligations. By law, offset can only be applied to those obligations whose terms have already expired.

Definitions

Offsetting income under the simplified tax system is the repayment of counter homogeneous claims. In other words, organizations that use counteraction effectively cancel equivalent obligations under existing agreements.

Offsetting can be applied to supply agreements, contracts, etc. Homogeneous claims mean obligations that arose on the basis of different agreements, but with the same method of repayment.

In other words, if the parties have different valid agreements that require payment for goods or services in money, then such requirements are recognized as homogeneous.

If agreements provide for payment under one agreement in money, and in another agreement payment will occur in kind, then such obligations are not considered homogeneous.

Similar legal conclusions are set out in the letter of the Presidium of the Supreme Arbitration Court dated December 29, 2001 No. 65.

If we consider contravention in the context of the simplified tax system, then taxpayers must take into account the features of the simplified taxation system, in particular, when making accounting entries.

A feature of mutual offsets is the lack of movement of money through bank accounts. While repayment of accounts payable and receivable occurs in whole or in part.

Legal grounds

The main normative act that regulates the issue of mutual termination of obligations is the Civil Code. The procedure for recognizing income and expenses is approved by Tax legislation.

Settlement procedure

The basic conditions for mutual offset are contained in the Civil Code of the Russian Federation. These include:

- Presence of counterclaims. Offsetting is carried out in the presence of at least 2 agreements, so that both organizations are simultaneously a debtor and a creditor. It is impossible to offset if only one company has debt.

- Uniformity of requirements. This refers to a uniform method of repaying debt, for example, in cash, despite the fact that the organization actually pays by supplying goods or providing services.

- Validity and indisputability of requirements. Settlement is not possible in case of assignment of claims to third parties and disputes regarding the fulfillment of obligations.

- Legality of requirements. Art. 411 of the Civil Code of the Russian Federation contains an open list of grounds on which it is unacceptable to carry out offsets. There should also be no restrictions or prohibitions in concluded agreements.

- Written registration of mutual settlement. The Civil Code does not contain instructions on how to fill out the netting act; therefore, it is drawn up taking into account the requirements for primary accounting documentation. This means that it must necessarily reflect the following: the parties, the grounds for offset (numbers of contracts, work completion certificates, etc.), the amount of offset and the date of final write-off of mutual claims.

- The deadline for fulfilling obligations has arrived. Settlement is possible only for those contracts where the performance period has already arrived or is not defined. In case of different deadlines, the offset is carried out after the later one. Settlement cannot be carried out against future deliveries of goods or provision of services.

If these conditions are met, in order to carry out mutual offset, it is necessary to draw up a corresponding act (agreement) and provide the other party with a copy of it.

A sample settlement agreement can be found on our website.

A detailed algorithm of actions for unilateral and bilateral offset is described in detail in the Ready-made solution from ConsultantPlus, which you can view by getting free access.

According to clause 4 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 29, 2001 No. 65, a document notifying about the test must be received. The act (agreement) of offset must be signed by persons authorized to sign documents by power of attorney or order. If the document is signed by persons who do not have these powers, transactions on mutual offsets may be considered void.

The date of offset is considered to be the date of signing the act or the date specified in the document. It is this that is subsequently reflected in accounting and affects taxation. Situations not prescribed by law or contract are resolved in accordance with business customs.

Read about the nuances of preparing primary documents in the article “Primary document: requirements for the form and the consequences of violating it.”

Conditions under which offset is possible

The grounds for offset should not be controversial. The requirements of the parties are confirmed by reconciliation of calculations. If any inconsistency arises, the offset of claims is terminated until the obligations are fully agreed upon. To qualify, a number of conditions must be simultaneously met.

| Condition | Explanations |

| Presence of mutual demands | Each participant must be both a creditor and a debtor to the other party. If there is only one type of debt, no offset will be made. |

| Unconditionality of requirements | The contractual relationship should not involve third parties or other circumstances that violate the indisputability of the requirements |

| No prohibition on surgery | Agreements between the parties should not prohibit offsets |

| Uniformity of requirements | Homogeneity refers to the scheme of the transaction, for example, payment in cash |

| Compliance with test deadlines | Enterprises can make offsets after the maturity dates according to the agreements. There will be no offset against future deliveries. |

| Documenting | When carrying out an offset operation, a free form act is drawn up. The document must contain mandatory details that allow identification of the operation |

Should the operation of debt adjustment be included in kudir: netting?

In other words, the debtor repays financial obligations to the second party to the contract without the use of funds. Such calculations include:

- mutual settlement;

- cession;

- compensation

Within the framework of one obligation, it is allowed to combine methods of repaying debt under an agreement or supplement them with payments from a current account. For example, the debtor pays off part of the amount in cash, and the rest - under a mutual settlement agreement. Non-monetary settlements are made only after the subject of the transaction agreement has been fulfilled. It is impossible, for example, to set off the cost of a service that will be provided only next month. Organizations using the simplified system, as is known, keep tax records on the basis of the Book of Income and Expenses (KUDiR), making entries in this tax register on transactions made.

On the basis of what document does the accountant write off the debt when conducting unilateral mutual offset? When carrying out a unilateral mutual offset operation, a universal document is used - an accounting certificate. The document describes the basis for the offset, the forms used (application and others), confirmation of the fact of delivery of the notice to the partner, and the rationale for the date of repayment of the debt.

Question No. 5. How can a netting operation be carried out if one of the parties has expired the statute of limitations for the shipment? The law prohibits offsetting transactions that have expired. In this case, it is possible to restore the period of financial claims by transferring it from the moment of shipment to the date when the subject learned about the existing debt. Rate the quality of the article.

Types of debt for which mutual offset is not carried out

The Civil Code of the Russian Federation regulates legal relations arising on the basis of economic, property and civil and other contracts. A number of transactions have been established in respect of which mutual offset of claims is not carried out. Operations include:

- Transactions for which the statute of limitations has expired. For financial claims, there is a limitation period of 3 years.

- Obligations for lifelong maintenance of a person.

- Appointment of alimony as determined by the courts or by mutual agreement secured by a notary.

- Payments to compensate for damage caused to health.

Agreement on mutual settlements

represented by _________, acting on the basis of the charter, hereinafter referred to as “Party 1”, represented by _________, acting on the basis of the charter, hereinafter referred to as “Party 2”, and represented by __________, acting on the basis of the charter, hereinafter referred to as “Party 3” ", have concluded this Agreement on mutual settlements in the following order:

- Party 1 terminates the monetary obligations of Party 3 in the amount of ___________, which arose on the basis of the agreement ___________ in the amount of ___________.

- Party 2 terminates the monetary obligations of Party 1 in the amount of ___________, which arose on the basis of the agreement ___________ in the amount of ___________.

- Party 3 terminates the monetary obligations of Party 2 in the amount of ___________, which arose on the basis of the agreement ___________ in the amount of ___________.

- This Agreement is drawn up in three copies having equal legal force, one for each of the Parties.

- The Agreement comes into force from the moment of signing and is valid until the Parties fully fulfill their obligations.

- The Agreement can be terminated only by mutual consent of the Parties.

Unilateral refusal to fulfill obligations assumed under this Agreement is not permitted.

- Disputes arising during the execution of the Agreement are subject to consideration in arbitration court.

- Signatures of the parties.

Conducting mutual offsets between enterprises using the simplified tax system

Companies, if their accounting features, asset size, and headcount meet the requirements, often use the simplified tax system when conducting business. Features of the application of a special taxation regime:

- Possibility to choose the accounting scheme “income” or “income minus expenses”.

- Maintaining simplified document flow and accounting.

- Application of the cash method of accounting for income and expenses.

- Inclusion of expenses on a limited list.

When keeping records of an enterprise on the simplified tax system, it uses primary documents that are the basis for making an entry in KUDiR, which also includes data on mutual offsets. When carrying out the procedure, it is necessary to take into account the taxable object chosen by the enterprise.

Procedure for recognizing revenue and expenses during netting

When receivables are repaid, enterprises using a cash accounting system generate revenue. At the same time, for organizations with the object “income”, it is necessary to take into account the following features:

- The date of recognition of income is the day the act is signed or indicated in the document.

- Organizations that use “income” as the object of taxation recognize revenue in terms of offset.

- The balance of outstanding debt, if any, is recognized as income after repayment in cash or other form.

For enterprises using the “income minus expenses” scheme, the date of offset is simultaneously the day the income is received and the expense is incurred. The amounts are taken into account in equal amounts. When using the “income minus expenses” accounting scheme, the organization must take into account the condition of applying the simplified tax system, which concerns the right to reflect expenses in accounting only after the actual fulfillment of obligations to the second party - the sale of goods (works, services).

Offsetting in case of registration of legal entities: sample

When registering mutual settlements, it is worth taking into account the peculiarities of such transactions under the simplified tax system. The book of accounting for income and expenses (an example of offset, assignment and compensation, issued in KUDir, can be found in open sources) reflects the corresponding transactions based on the fact of income received and expenses incurred.

For example, let’s say offset – for rent. Using the simplified tax system, income minus expenses of an enterprise often formalizes such a transaction. Settlement (as reflected in KUDir, see below) {amp}amp;#8212; a common method of non-monetary settlements. Under the simplified tax system, an organization's income is recognized on the day funds are credited to the current account or deposited in the enterprise's cash register, or the acquisition of new property or services as repayment of the counterparty's debt.

Therefore, in tax accounting, the offset is considered payment under the agreement. Income and expenses under the simplified tax system are taken into account on the date of termination of the obligations of the participant in the transaction.

The offset can be unilateral, bilateral or multilateral.

Depending on its type, the documents used to formalize it differ. Unilateral set-off As has already been said, a statement from one party is sufficient for set-off.

But in order to avoid disputes with the counterparty, it is advisable to carry out a reconciliation before sending an application for offset. The act of reconciliation of mutual settlements will confirm the amounts of debts. This document will be especially important in the case when part of the contracts has already been paid (the remaining debt amounts will be recorded in the act). Before submitting an application for offset, you must make sure that the primary documents are available.

Results

Mutual obligations to each other in business are not uncommon. Mutual offset allows organizations to pay each other, while saving time and money on bank commissions. Accounting for offset transactions is the same for all tax regimes. For a company using simplified taxation system (STS) income, offset means the receipt of revenue, which must be taken into account for tax purposes.

Sources:

- Tax Code of the Russian Federation

- Civil Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Tax accounting during mutual offset

For posting, we enter the act of offset in 1C 8.3, for example, so that the completion of the transaction is reflected in the book of income and expenses. Managers of organizations should carefully consider the procedures for mutual settlements, because the Law provides for some restrictions on such transactions. A ban on concluding such a procedure is sometimes specified in the transaction agreement!

Assignment An assignment agreement is essentially an assignment of claims. When concluding such an agreement, one party transfers the rights of claim to a third party, for example, a factoring company, more often at a loss to itself, that is, the amount of income may be less than the amount of expenses for the transaction.

In other words, the debtor repays financial obligations to the second party to the contract without the use of funds. Such calculations include:

- mutual settlement;

- cession;

- compensation

Within the framework of one obligation, it is allowed to combine methods of repaying debt under an agreement or supplement them with payments from a current account. For example, the debtor pays off part of the amount in cash, and the rest - under a mutual settlement agreement. Non-monetary settlements are made only after the subject of the transaction agreement has been fulfilled.

On the basis of what document does the accountant write off the debt when conducting unilateral mutual offset? When carrying out a unilateral mutual offset operation, a universal document is used - an accounting certificate. The document describes the basis for the offset, the forms used (application and others), confirmation of the fact of delivery of the notice to the partner, and the rationale for the date of repayment of the debt.

We invite you to read: Compensation for moral damage in civil law: Articles 151 and 1100 of the Civil Code of the Russian Federation, judicial practice of recovery under the law on the protection of consumer rights

Question No. 5. How can a netting operation be carried out if one of the parties has expired the statute of limitations for the shipment? The law prohibits offsetting transactions that have expired. In this case, it is possible to restore the period of financial claims by transferring it from the moment of shipment to the date when the subject learned about the existing debt. Rate the quality of the article.

- Organizations must have counter-claims to each other, i.e. at least two different agreements are concluded between them, in one of which the organization is a debtor, and in the other - a creditor.

- Counterclaims must be homogeneous.

What does “homogeneity” mean? Obligations that are related to the execution of different contracts, but involve the same method of repayment, can be considered homogeneous. Let’s assume that repayment is initially expected under two different contracts in cash, which means that the requirements are homogeneous.

This conclusion is confirmed by judicial practice. For example, paragraph 7 of the Appendix to the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 29, 2001 N 65 states that the legislation does not insist that the requirement for offset arise from the same obligation or from obligations of the same type.

- Settlement is possible subject to the deadline for fulfilling the counterclaim or provided that this period is not specified in the contract.

- Testing is not possible in the following cases:

one of the parties to the offset has not reached the deadline for fulfilling its obligations (Article 410 of the Civil Code of the Russian Federation);

a bankruptcy case has been initiated against one of the parties to the offset (clause 14 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation No. 65);

the limitation period has expired for the obligations (even if at least one of the parties to the contract declares this);

obligations are associated with compensation for harm caused to life or health, with the collection of alimony, and lifelong maintenance of citizens.

- The offset of mutual claims, like any business transaction, must be documented (Clause 1, Article 9 of the Federal Law of November 21, 1996 N 129-FZ). Civil legislation does not impose any special requirements for registration of offsets. At the same time, in Art. 410 of the Civil Code of the Russian Federation states that in order to carry out offset, a statement from one of the parties is sufficient.

An organization can notify its counterparty in writing about the offset (Article 410 of the Civil Code of the Russian Federation). For this, it is sufficient to have mutual monetary debt. The document notifying about the offset in this case can be either an application, a letter, or a notification (notice). It is better to send an application for offset to the counterparty by registered mail with notification.

If, when a dispute arises, the organization does not prove that the counterparty received this statement, the offset of the counter-obligation may be declared invalid (clause 4 of Information Letter of the Supreme Arbitration Court of the Russian Federation No. 65, Resolution of the FAS Volga District dated January 28, 2008 in case No. A55-6395/2007, FAS Central District dated 08/30/2006 in case No. A23-3149/03G-10-121, Federal Antimonopoly Service of the West Siberian District dated 05/02/2006 N F04-1722/2006(21923-A81-10)).

Without consequences, a unilateral offset can be carried out only when there is absolute confidence in the amounts of mutual debt. Let’s say that if an act of reconciliation of mutual settlements is signed, then in this case the organization has every right to carry out a unilateral offset by sending a statement to the counterparty, even if such an offset is not included in the plans of the counterparty.

The organization can also set the date for the unilateral offset itself. To do this, you must indicate in the application a specific date from which the obligations of the parties are considered fulfilled; the offset is recognized as having taken place from this date. If the date is not indicated in the application, then the offset is considered to have taken place from the day the counterparty received the application.

It is possible to carry out both full and partial offset of mutual claims. Full set-off can be carried out if the counterclaims are identical in amount. Quite often, a different situation arises when the requirements are different and offset can be carried out for the amount of the smallest debt (partial offset).

Example. has a debt to pay for goods supplied under a sales contract in the amount of 100,000 rubles. “B” has a counter-debt to “A” to pay for work in the amount of 60,000 rubles. According to the statement, the parties decided to offset mutual claims on April 5, 2011.

After the offset, the obligation to remains in the amount of 40,000 rubles. Liability to the amount of 60,000 rubles. repaid in full.

In accounting, the offset of mutual claims is reflected in subaccounts opened for each counterparty to accounts 60 “Settlements with suppliers and contractors”, 62 “Settlements with buyers and customers”, 76 “Settlements with various debtors and creditors”.

D-t 60 (76), K-t 62 (76) - reflects the termination of the counter-obligation to pay for goods (work, services) by offsetting mutual claims.

In accordance with clause

Enterprises using the simplified tax system are required to keep accounting of business transactions. Entities are allowed to apply a minimum number of accounts per work plan. In accounting, standard entries required by law are made. When registering offsets, accounts 76, 60, 62 are used. The transaction is recorded by posting: Dt 60 (76) Kt 62 (76).

The enterprise Rassvet LLC maintains accounting using the simplified tax system with the object “income minus expenses”. Rassvet LLC shipped goods to Master LLC in the amount of 250,500 rubles. In the same month, Master LLC carried out repair work for Rassvet LLC in the amount of 30,500 rubles. The companies agreed to set off the amount of accounts payable that was the same for both organizations. The following entries are made in the accounting of Rassvet LLC:

- The following mutual claims were offset: Dt 60 Kt 62 in the amount of 30,500 rubles;

- Revenue from the sale of goods is reflected: Dt 62 Kt 90/1 in the amount of 30,500 rubles;

- The cost of shipped products is taken into account: Dt 90/2 Kt 41 in the amount of 30,500 rubles;

- The work paid for by the act was taken into account: Dt 20 Kt 60 in the amount of 30,500 rubles.

Enterprises using a simplified system maintain tax accounting by making an entry in the tax register - the Book of Income and Expenses. Based on the information reflected in the book, the tax base is determined and a single tax is calculated. When executing mutual netting transactions, there are several key points to consider.

| Condition for tax accounting | Description |

| Documentation of the operation | Entries in KUDiR are made on the basis of primary accounting documents |

| Moment of revenue determination | Income arises at the time of drawing up, signing the act or other date specified in the document accompanying the offset |

| The moment of determining expenses | The right to record expenses arises after shipment and mutual offset. |

USN: adjustment of tax accounting in “1C: Accounting 8”

We tell you how tax accounting data is adjusted in 1C:Accounting 8 when applying the simplified tax system.

Note:

* For information on how to correct errors of the current year and previous years when applying the general taxation system, read the articles:

General principles for adjusting tax accounting

The general principles for adjusting tax accounting and reporting are set out in Articles 54 and 81 of the Tax Code of the Russian Federation and do not depend on the taxation system used - general or simplified.

In accordance with paragraph 1 of Article 81 of the Tax Code of the Russian Federation, a taxpayer who has discovered in the declaration submitted to the tax authority that information is not reflected or is incompletely reflected, as well as errors:

- is obliged to make the necessary changes to the tax return and submit an updated tax return to the tax authority if errors (distortions) led to an understatement of the amount of tax payable;

- has the right to make the necessary changes to the tax return and submit an updated tax return to the tax authority if errors (distortions) do not lead to an understatement of the amount of tax payable.

Errors (distortions) that did not lead to an understatement of the amount of tax payable when applying the simplified tax system include failure to reflect or understate expenses, as well as overstatement of income.

And, of course, the taxpayer is interested in returning the overpayment of taxes resulting from these situations or offsetting them against future payments.

This can be done by filing an amended return or, in some cases, by making changes to tax accounting data in the current period.

In the general case, errors (distortions) relating to previous tax (reporting) periods and discovered in the current tax (reporting) period are corrected by recalculating the tax base and the amount of tax for the period in which these errors (distortions) were committed (clause 1 Article 54 of the Tax Code of the Russian Federation).

At the same time, the taxpayer has the right to recalculate the tax base and tax amount in the tax (reporting) period in which errors (distortions) were identified if:

- it is impossible to determine the period of commission of these errors (distortions);

- such errors (distortions) led to excessive payment of tax.

When commenting on the taxpayer’s right to correct errors (distortions) in the current period, regulatory authorities draw attention to the fact of the existence of a tax base in the current period.

If in the current reporting (tax) period an organization incurred a loss, then in this period recalculation of the tax base is impossible, since the tax base is recognized as zero (clause 8 of Art.

274 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated March 24, 2021 No. 03-03-06/1/17177).

As for the condition of excessive payment of tax in the previous period, then, according to the Russian Ministry of Finance, it is not met if in the specified period the organization incurred a loss or the tax base was equal to zero. Therefore, in such situations, corrections must be made during the period of the error (letter dated 05/07/2010 No. 03-02-07/1-225).

The explanations given relate to the adjustment of the tax base for income tax. Despite this, we believe that under the simplified tax system it is also impossible to “edit” tax accounting in the current period if an error in calculating the tax base was made in a “zero” or “unprofitable” declaration, or if a loss was incurred in the current period.

According to Article 346.24 of the Tax Code of the Russian Federation, tax accounting under the simplified tax system is the accounting of income and expenses in the book of income and expenses of organizations and individual entrepreneurs using the simplified taxation system (hereinafter referred to as KUDiR).

In “1C: Accounting 8”, the report Book of Income and Expenses of the simplified tax system (section Reports) is filled out automatically based on special accumulation registers.

Entries in accounting registers for the purposes of the simplified tax system are entered, as a rule, automatically when posting documents that register business transactions.

For manual registration of register entries, use the document Entry of the book of income and expenses (STS) (section Operations - STS).

The date of receipt of income is the day of receipt of funds, as well as the day of payment to the taxpayer in another way - the cash method (clause 1 of Article 346.17 of the Tax Code of the Russian Federation).

The procedure for recognizing expenses depends on the conditions set out in paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation, mandatory of which is their actual payment.

Thus, when correcting errors (distortions) made when reflecting (non-reflecting) business transactions in the accounting of an organization using the simplified tax system, tax accounting is adjusted in accordance with the provisions of Article 346.17 of the Tax Code of the Russian Federation, that is, taking into account the payment factor.

Adjustment of accounting and reporting

Correcting errors (distortions) made when reflecting (non-reflecting) business transactions usually entails simultaneous adjustments to both tax and accounting records. An exception is made by individual entrepreneurs (IP), who are not required to keep accounting records (Article 6 of the Federal Law of December 6, 2011 No. 402?FZ).

Source: https://buh.ru/articles/documents/60912/

Settlement under “simplified”

Other courts also note that to terminate an obligation by offsetting a similar counterclaim, a statement from one of the parties is sufficient. The law does not require the consent of the other party to the offset made. However, it is important that she receives the application for offset (reg. FAS PO dated January 28, 2007 No. A55-6395/2007).

FAS ZSO dated 02.05.2006 No. F04-1722/2006(21923-A81-10)). Bilateral or multilateral offset Bilateral offset can be formalized by an act, agreement or protocol for the offset of mutual claims.

We suggest you read: Sent a notification to the tax office about the transition to the usn by mail deadline

The name of the document (act, agreement or protocol) does not matter. The main thing is that such a document contains all the necessary details provided for by law (Article 9 of Law No. 129-FZ).

Accounting for netting transactions

Enterprises using the simplified tax system are required to keep accounting of business transactions. Entities are allowed to apply a minimum number of accounts per work plan. In accounting, standard entries required by law are made. When registering offsets, accounts 76, 60, 62 are used. The transaction is recorded by posting: Dt 60 (76) Kt 62 (76).

Example of netting

The enterprise Rassvet LLC maintains accounting using the simplified tax system with the object “income minus expenses”. Rassvet LLC shipped goods to Master LLC in the amount of 250,500 rubles. In the same month, Master LLC carried out repair work for Rassvet LLC in the amount of 30,500 rubles. The companies agreed to set off the amount of accounts payable that was the same for both organizations. The following entries are made in the accounting of Rassvet LLC:

- The following mutual claims were offset: Dt 60 Kt 62 in the amount of 30,500 rubles;

- Revenue from the sale of goods is reflected: Dt 62 Kt 90/1 in the amount of 30,500 rubles;

- The cost of shipped products is taken into account: Dt 90/2 Kt 41 in the amount of 30,500 rubles;

- The work paid for by the act was taken into account: Dt 20 Kt 60 in the amount of 30,500 rubles.

The balance not covered by the netting transaction will be recorded as the seller's accounts payable.

Procedure for conducting unilateral offset

To carry out unilateral offset, a statement from one party is sufficient. Before obtaining approval, it is necessary to clarify the obligations of the parties. Settlements are reconciled between enterprises, indicating the amounts of receivables and payables. The document must be signed by both parties to confirm the debt existing at the time of settlement. There are specific features of the operation that must be taken into account when completing the procedure.

| Condition for registration of credit | Description |

| Obligation to notify a party | One of the parties notifies the other in writing of the intention to set off. |

| Sending an application with confirmation of receipt | An application for mutual offset must be sent by registered mail with an inventory and notification or delivered in person with receipt of a registration mark in the incoming correspondence journal |

| Indication in the application of supporting facts of the existing debt | The document on offset must reflect the main points of the occurrence of debt on shipment with reference to contracts. The offset amount must be indicated |

| Availability of a date to determine the test day | The application must contain a date specified specifically or depending on the partners' receipt of the application |

The difference between bilateral and unilateral offsets is the need for mutual consent. Based on the reconciliation and agreement on offset, a bilateral act is drawn up, signed by the parties. An alternative option for registering a transaction is the conclusion of a contract or offset agreement. The title of the document in this case does not matter.

A less conflicting option is to conduct a bilateral offset of mutual claims, for which it is only necessary to draw up a bilateral offset document, which is usually an act of offset. However, this document can be called differently, for example, an agreement or protocol. The netting act is not a unified accounting document, therefore it can be drawn up in any form in compliance with the requirements for primary accounting documents (clauses 1, 2, article 9 of Law No. 129-FZ, Resolution of the Federal Antimonopoly Service of the North-Western District dated May 21, 2007 in case No. A05-12882/2006-25).

In the act of offset, it is necessary to clearly indicate all the circumstances of the offset: the amounts accepted for offset; details of documents confirming debts (contracts, invoices, acts of acceptance of work (services), invoices), as well as the debt repayment period established by the contract, so that there is no doubt about the validity of the offset. Failure to provide such information may result in disputes that may subject the organization to contractual sanctions.

There are examples of court decisions that confirm this position (for example, Determination of the Supreme Arbitration Court of the Russian Federation dated July 2, 2007 N 4790/07, Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated September 26, 2007 in case N A11-13478/2006-K1-11/612).

In addition, incorrect registration of offsets may result in tax penalties.

https://www.youtube.com/watch?v=SvPseON9heE

represented by _________, acting on the basis of the charter, hereinafter referred to as “Party 1”, represented by _________, acting on the basis of the charter, hereinafter referred to as “Party 2”, and represented by __________, acting on the basis of the charter, hereinafter referred to as “Party 3” ", have concluded this Agreement on mutual settlements in the following order:

- Party 1 terminates the monetary obligations of Party 3 in the amount of ___________, which arose on the basis of the agreement ___________ in the amount of ___________.

- Party 2 terminates the monetary obligations of Party 1 in the amount of ___________, which arose on the basis of the agreement ___________ in the amount of ___________.

- Party 3 terminates the monetary obligations of Party 2 in the amount of ___________, which arose on the basis of the agreement ___________ in the amount of ___________.

- This Agreement is drawn up in three copies having equal legal force, one for each of the Parties.

- The Agreement comes into force from the moment of signing and is valid until the Parties fully fulfill their obligations.

- The Agreement can be terminated only by mutual consent of the Parties.

Unilateral refusal to fulfill obligations assumed under this Agreement is not permitted.

- Disputes arising during the execution of the Agreement are subject to consideration in arbitration court.

- Signatures of the parties.

Bilateral netting agreement

A less conflicting option is to conduct a bilateral offset of mutual claims, for which it is only necessary to draw up a bilateral offset document, which is usually an act of offset. However, this document can be called differently, for example, an agreement or protocol. The netting act is not a unified accounting document, therefore it can be drawn up in any form in compliance with the requirements for primary accounting documents (clauses 1, 2, article 9 of Law No. 129-FZ, Resolution of the Federal Antimonopoly Service of the North-Western District dated May 21, 2007 in case No. A05-12882/2006-25).

In the act of offset, it is necessary to clearly indicate all the circumstances of the offset: the amounts accepted for offset; details of documents confirming debts (contracts, invoices, acts of acceptance of work (services), invoices), as well as the debt repayment period established by the contract, so that there is no doubt about the validity of the offset. Failure to provide such information may result in disputes that may subject the organization to contractual sanctions.

There are examples of court decisions that confirm this position (for example, Determination of the Supreme Arbitration Court of the Russian Federation dated July 2, 2007 N 4790/07, Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated September 26, 2007 in case N A11-13478/2006-K1-11/612).

In addition, incorrect registration of offsets may result in tax penalties.

Offsetting under a simplified taxation system

According to Art. 410 of the Civil Code of the Russian Federation, the obligation is terminated in whole or in part by offsetting a counterclaim of the same type, the due date of which has come or the due date of which is not specified or determined by the moment of demand. For offset, a statement from one party is sufficient.

Offsetting mutual claims is a common practice in any accounting department. However, not every accountant knows the answer to the question of how to correctly arrange offsets. However, it is the correctness of registration and accounting of this operation that determines whether the risk of claims from inspection authorities and partners against this organization is possible.

Determining the date of offset of mutual claims

Sometimes it is not easy to determine the date of set-off if the parties, for example, acted as follows:

- One of the parties first sent a statement of offset;

- Then the parties entered into an agreement on the stage-by-stage offset of mutual claims, in which they specified the terms and amounts of offset and indicated that each time the offset was carried out, a bilateral act would be signed;

- Subsequently, offsets were carried out repeatedly (with a frequency of approximately once a month) with the execution (signing) of an offset act.

In this case, what date is considered the offset date? The opinions of regulatory and judicial authorities are shown in Table 1

Thus, despite the fact that the offset transaction is considered completed at the time of filing an application by one of the parties, from the point of view of the Tax Code, the date of determination of income will be considered the date of signing the offset act. If there are several such acts, there will be several dates for determining income under the simplified tax system.

It is necessary to take into account that the date of offset may be separately agreed upon by the parties in the act of offset and may differ from the date of signing the act.

Category “Questions and Answers”

Question No. 1. Is it necessary to conduct reconciliations between all parties when conducting an offset involving several parties?

Reconciliations of settlements preceding the offset of claims are carried out only between parties with mutual obligations.

Question No. 2. Is it possible to refuse mutual offset after signing the documents?

The parties may change the decision to conduct bilateral mutual offset and abandon the operation. An additional agreement is drawn up for the act or other document accompanying the offset. When initiating offset unilaterally after delivery of documents to the other party, the procedure cannot be canceled.

Question No. 3. How is the day of offset determined when sending an application to a partner with whom there are mutual debts?

Receipt of correspondence by post is determined on the 6th day after sending. In the case of sending important documents for financial purposes, the day of receipt of correspondence is established by notification of delivery, which is returned to the sender with a postal note.

Question No. 4. On the basis of what document does the accountant write off the debt when conducting unilateral mutual offset?

When carrying out a unilateral mutual offset operation, a universal document is used - an accounting certificate. The document describes the basis for the offset, the forms used (application and others), confirmation of the fact of delivery of the notice to the partner, and the rationale for the date of repayment of the debt.

Question No. 5. How can a netting operation be carried out if one of the parties has expired the statute of limitations for the shipment?

The law prohibits offsetting transactions that have expired. In this case, it is possible to restore the period of financial claims by transferring it from the moment of shipment to the date when the subject learned about the existing debt.

Types and features of netting

- Unilateral netting

- Bilateral offset

When conducting a unilateral offset, a statement from one of the parties is sufficient. After receiving the application, the parties clarify mutual obligations, usually drawing up a reconciliation act for mutual settlements to confirm them.

When conducting a bilateral offset, the parties express mutual agreement on its conduct. It is also carried out on the basis of reconciliation of mutual settlements. The forms of expressing consent to set off may vary.

Usually only the deed of offset is signed. In complex cases, which are characterized by phased and partial offsets, an offset agreement or contract may be drawn up.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Multilateral offset

The right of organizations to carry out multilateral offset of obligations is provided for by the provisions of Art. 421 of the Civil Code of the Russian Federation, which states that the parties can enter into an agreement, both provided for and not provided for by law or other legal acts. At the same time, general provisions on the contract apply to agreements concluded by more than two parties, unless this contradicts the multilateral nature of such agreements (clause 4 of Article 420 of the Civil Code of the Russian Federation).

Typically, with multilateral offsets, an agreement is concluded on mutual settlements. Such an agreement is not a unified accounting document, so it can be drawn up in any form in compliance with the requirements for primary accounting documents (clauses 1, 2, article 9 of Law No. 129-FZ).

When conducting a multilateral offset, one basic rule should be taken into account: in case of unequal debts, the offset is carried out for the amount of the least of them.

Offsets and their reflection in accounting on the usn

For posting, we enter the act of offset in 1C 8.3, for example, so that the completion of the transaction is reflected in the book of income and expenses. Managers of organizations should carefully consider the procedures for mutual settlements, because the Law provides for some restrictions on such transactions. A ban on concluding such a procedure is sometimes specified in the transaction agreement! Tax authorities study mutual settlement agreements very carefully, because an incorrectly executed such agreement can be recognized by the tax inspectorate as an exchange agreement, which implies completely different tax and accounting records.

Assignment An assignment agreement is essentially an assignment of claims. When concluding such an agreement, one party transfers the rights of claim to a third party, for example, a factoring company, more often at a loss to itself, that is, the amount of income may be less than the amount of expenses for the transaction.

The most common cases of mutual settlements under the simplified tax system

- Offsetting counter obligations under an exchange agreement (goods, works, services). In this case, the company using the simplified tax system is, on the one hand, a seller, and on the other, a buyer. The moment of determining income under the simplified tax system in this case is the date of signing the transfer act under the exchange agreement/date of receipt of the property. This case is not a set-off and will not be considered further.

- Offsetting counter obligations when selling goods, works, services to your own supplier. This may be the lessor of the premises in which the simplified taxation system payer operates, or the performer of any work or services used by the company on the simplified taxation system. It could also be a supplier of any goods sold by the company on the simplified tax system. In this case, the moment of determining income under the simplified tax system is the date of offset signed by the parties. Read also the article: → “Features of mutual settlement between two organizations in 2021.”

Answers to common questions

Question No. 1. Should VAT be reflected in the netting act if the supplier with whom the netting is being carried out operates on a common taxation system?

Yes, the VAT amount must be reflected in the offset act. If offset is not made for the entire amount of the debt to the supplier, VAT must be calculated in proportion to the amount of the debt.

Question No. 2. Is it possible to draw up an act of mutual settlement in which there will be 4 participants?

Yes, multilateral reconciliation acts are allowed. In this case, it is advisable to confirm counter-debts between all participants by acts of reconciliation of mutual settlements (if any).

Question No. 3. Is it necessary to indicate the exact date of the test when conducting a test unilaterally?

The application for offset may indicate that the date of offset will be considered the date of receipt of the application by the counterparty.

And most importantly, there is no recognition of debt repayment in any other way. Does this mean that offset cannot be equated to payment? There are three points of view on this matter. The first is based on a literal reading of Art. 346.17 Tax Code of the Russian Federation. But it is unprofitable for the taxpayer, since only income can be taken into account, but expenses will disappear. After all, there is one basis for their accounting - actual payment. In this case, actual payment means only payment in cash. This concept cannot be interpreted more broadly. After all, where the legislator wanted to expand it, this is directly provided for. For example, for the cash method for income tax and VAT (clause 3 of Article 273, clause 2 of Article 167 of the Tax Code of the Russian Federation). Therefore, when carrying out offsets, an organization using the “simplified system” can only recognize income. Unpaid expenses cannot be taken into account. These are the features of “simplified”. Example.

Settlement in the usn

1, 2 tbsp. 346.17 of the Tax Code of the Russian Federation, the date of occurrence of income (expense) when applying the simplified taxation system is the date of actual payment for goods shipped (work performed, services rendered), including through termination of the counter-obligation. Therefore, if, as a result of offsetting mutual claims, receivables are repaid, then the seller organization applying the simplified taxation system must recognize income (clause 1 of article 346.15, clause 1 of article 346.17 of the Tax Code of the Russian Federation). The recognition of income does not depend on what object of taxation the organization applies - “income” or “income minus expenses”.

In practice, income received as a result of offsetting mutual claims is reflected in the Book of Income and Expenses on the date of repayment of the obligation (in any form). The basis for making entries in the Book of Income and Expenses is the act of offsetting mutual claims (either an agreement or an application).

For purchasing organizations that pay a single tax on the difference between income and expenses, offset is the basis for recognizing expenses in the form of repaid accounts payable (clause 1 of article 346.16, clauses 1, 2 of article 346.17 of the Tax Code of the Russian Federation). Accounts payable for certain types of expenses must be recognized taking into account the features characteristic of the items being written off, for example, when including the cost of goods purchased for further sale as expenses.

To summarize the above, it should be noted that a series of offsets for large amounts may attract the close attention of the tax authorities, mainly due to the fact that in the case of offset of mutual claims there is no real settlement for the goods (work, services) received. However, the courts support the taxpayer, so it is not advisable to completely refuse offsets.

D. Kornilov

Executive Director

LLC "Auditorskaya"