,

, “” . . 3 . 154 . , “” , . 2 . 170 .

-, , . 149 . , , (. 26 . 2 . 149 ).

-, , , , , . , , (08.09.2011 N 03-07-08/276).

-, , , . , , “”, . . “” (07/12/2010 N 03-11-06/3/102). – , (01/29/2010 N 03-11-06/3/12, – 11/06/2008 N 11-1514/2008-2-19/74).

-, , , . 2. 146. , , , , , “” (11/14/2011 N 03-07-11/311).

-, , (. 5 . 170), , , . . 5 . 2. 170, 1 2011. (07/19/2011 N 245-).

1. , , , . 180 000 ., . – 240 000 . – 100 000 . .

40,000. [180,000 – (240,000 – 100,000)]. , , , 6102 . (40,000. x 18: 118).

, , . . 5.1 . 154 , , , , 41 “”.

, , , – .

, , . , . 4 . 154, , , (. 16.05.2001 N 383).

, “” (07.12.2006 N 03-04-11/234, 11.11.2010 N -14988/10 11.11.2010 N 12-3142/2010).

, ( 01/26/2005 N 03-04-04/01 04/27/2002 N 04-03-11/17, – 06/08/2009 N 04-2975/2009(6522-03-42) 10/08/2008 N 36-528/ 2008).

: . 4 . 154, (05/08/2009 N 09-2751/09-2 – 01/16/2007 N 08-6441/06-2826).

VAT on the inter-price difference when purchasing a car

And in order to ensure that when the tax authorities process information from checks, there is no excessive VAT charge upon receipt of postpayment, the Federal Tax Service recommends indicating “VAT is not subject to.”

Accordingly, this is what should be on this check.

Situation 5. The buyer makes part of the payment before the car is transferred to him, and the rest - some time after receiving it.

For example, an advance payment of 470,000 rubles was made, and after receiving the car the balance of 130,000 rubles was paid.

A check for prepayment is issued in the same way as in situation 3.

In the technical check issued when transferring a car without payment, the product items and the VAT amount on the check will be indicated in the same way as in situation 2. The remaining data will be the same.

A check upon acceptance of the balance of payment in the amount of RUB 130,000.

is issued by analogy with a check for 80,000 rubles. from situation 4.

Situation 6.

Benefits for IT companies in 2021: who can get them and how

The changes to Chapter 11 of the Tax Code are aimed at resolving issues that have arisen among payers based on the practice of applying the provisions of this chapter. And also to simplify the administration of transfer pricing control.

As a result, the following changes have been made:

- The number of transactions subject to the control of tax authorities has been reduced. This applies to transactions concluded by organizations resident in Belarus with owners of international payment systems using bank payment cards VISA, MasterCard, American Express, registered in offshore zones

- The procedure for selecting sources of information containing information justifying the use of market prices has been simplified. In particular, the payer is given the right to independently select an information source, taking into account his chosen method for determining market prices, without adhering to the hierarchy that existed before January 1, 2021

- Informing tax authorities about analyzed transactions by entering information into an electronic invoice (ESFI) is carried out only by income tax payers. Until 2021, companies using the simplified tax system also submitted information to the ESChF.

- When identifying organizations that conduct comparable activities, it is possible

- The right has been granted , in the absence of information from the accounting and (or) financial statements of Belarusian organizations, to use information from organizations of the EAEU member states, and in their absence, from other foreign organizations, to determine market profitability indicators

- The right has been granted for one-time transactions for which it is impossible to establish the market value, using the methods provided for by the Tax Code of Belarus, to determine the market price based on the results of an independent assessment. In this case, a one-time transaction is understood as a transaction that differs from the main activity of the organization and is carried out once in the tax period

- The number of transactions for which documentation is not prepared confirming the economic justification of the applied price has been increased. Such transactions include transactions for the sale of goods (work, services), property rights, if the profit received from such sale is exempt from income tax, as well as if the transaction price (sum of transaction prices) with one counterparty in a calendar year is no more than 200,000 BYN. rub. and which cannot be grouped based on the homogeneity of transactions

- The procedure for determining the range of market prices and the range of market profitability indicators has been changed. From January 1, 2021, the specified ranges are determined based on quartiles (from the French quartile - “quarter”)

- From the point of view of strengthening control over the application of transfer pricing in transactions with related parties, it is envisaged to conclude an agreement between the Ministry of Finance and the Ministry of Taxation . In accordance with it, the Ministry of Finance will quarterly provide electronically to the Ministry of Taxes information on the owners of shares of joint-stock companies no later than 60 days following the end of the quarter.

Inspections by tax authorities regarding transfer pricing are not common. However, for companies with foreign capital, these rules are important. The reason is that in some cases they provide economic justifications for prices for foreign participants within a group of companies.

1. Certain items of food products, certain items of goods for children when they are sold on the territory of the Republic of Belarus and when imported into the territory of the Republic of Belarus are subject to VAT at a rate of 20% instead of the previously applied VAT rate of 10%.

2. When selling medicines and medical products (including prosthetic and orthopedic products) on the territory of Belarus and importing them into the territory of the Republic of Belarus, the VAT rate is set at 10%.

3. The exemption from VAT for the import and sale of medicines and medical products has been canceled (subclause 1.1 of article 118, subclause 1.5 of article 119 of the Tax Code-2021).

A transition period has been established until February 1, 2021, during which it is necessary to review prices in the retail network for the remaining food products, goods for children, medicines and medical products, taking into account the inclusion of VAT according to the new rules. At the same time, for goods sold in the period before prices are brought into compliance with the new rules, but no later than February 1, 2021, VAT will be calculated according to the norms of the Tax Code as amended in force in 2021.

Income from the provision of services in the field of education is one of the objects of taxation. Previously, there were no exceptions to this item. NC 2021 introduced an exception according to which conferences, forums, summits, symposia, and congresses are not recognized as services in the field of education if training is not carried out during them (clause 1.12.7, article 189 of NC-2021, clause 107, article 1 Law No. 72-Z).

Previously, in practice, this norm was a constant problem for payers, since the cost of conferences, forums, etc. VAT was added. Moreover, in many cases, the activities carried out by foreign partners cannot be clearly qualified, since they include a large number of activities, which may include training.

1. The right to apply the simplified tax system has been granted to organizations and individual entrepreneurs who provide for free use real estate that is not under their right of ownership (common property), economic management, or operational management.

2. Income received by individual entrepreneurs from commercial organizations in which they themselves or their close relatives are the founders, owners of these organizations, shall not be subject to income tax, but tax under a simplified taxation system at a rate of 16%.

Moreover, the circle of persons whose income will be taxed for the individual entrepreneurs who received it under a simplified taxation system at a rate of 16% has been expanded to include such persons as the founders and owners of non-profit organizations, as well as the heads of these organizations. The cost criteria of gross revenue for the application of the simplified tax system are indexed:

Click to enlarge image

There are two types of value added tax: internal , payable when selling goods, works and services on the territory of the Russian Federation and import , payable when importing goods into the territory of Russia.

Who is required to pay value added tax

The following are required to pay VAT:

- Organizations and individual entrepreneurs selling goods (works and services) on the territory of the Russian Federation;

- Organizations and individual entrepreneurs importing goods into the territory of the Russian Federation in the order of import;

- Exporters of goods in case of non-confirmation of the zero VAT rate.

Note: current legislation provides for exemption from the obligation to pay VAT for certain categories of taxpayers.

The following transactions are subject to value added tax:

- For the sale of goods (works and services), including free of charge, on the territory of the Russian Federation;

- Transfer of goods (works and services) on the territory of the Russian Federation for one’s own needs, the costs of which are not deductible when calculating corporate income tax;

- Import of goods into the territory of the Russian Federation;

- Carrying out construction and installation work for own consumption.

Basic rate – 18%

This rate applies to all transactions that are not subject to other preferential rates.

Preferential rates

0%

Individual entrepreneurs and organizations selling goods for export can apply a zero VAT rate. Also, a 0% rate is applied when providing services for international transportation and some other operations specified in clause 1 of Article 164 of the Tax Code of the Russian Federation.

10%

This rate applies to the sale of certain food and medical products, goods for children and printed publications. A specific list of goods, the sale of which is subject to VAT at a rate of 10%, is indicated in clause 2 of Art. 164 Tax Code of the Russian Federation.

Note: in cases provided for in paragraph 4 of Article 164, paragraphs. 3, 4, 5.1 art. 154, pp. 2-4 tbsp. 155 of the Tax Code of the Russian Federation, settlement rates of 10/110 and 18/118 are applied.

VAT payable to the budget is calculated in the following order:

- First, the amount of VAT calculated on the sale is calculated:

VAT(ex) = Tax base x Tax rate

The tax base

The tax base for VAT is the cost of goods, works and services, including excise taxes (excluding VAT), determined on one of the following dates (the one that occurs first):

- On the date of payment for goods (partial payment towards future deliveries);

- On the date of shipment of goods (performance of work or provision of services).

An example of calculating VAT calculated on sales

LLC "Steel" sold materials in the amount of 118,000 rubles. (including VAT 18% – 18,000 rub.)

The tax base is 100,000 rubles. (cost of materials excluding VAT)

Tax rate – 18%

Amount of VAT calculated for payment = 18,000 rubles.

100,000 x 18%

- We calculate the amount of VAT payable to the budget:

VAT(upl) = VAT(insp) – Input VAT – Recovered VAT

Input VAT

Input VAT or tax deduction is the amount of value added tax paid by the buyer when purchasing goods (works and services).

Let’s say LLC “Steel” sold goods for the amount of 354,000 rubles. (including VAT - 54,000 rubles) and bought materials in the amount of 236,000 rubles. (including VAT – 36,000 rubles).

VAT received from the sale of goods – 54,000 rubles. is VAT on sales.

VAT paid on the purchase of materials – RUB 36,000. is input VAT or, as it is also called, a tax deduction.

A tax deduction reduces the amount of VAT on sales and, if the deduction is greater than the amount of VAT on sales, the difference is subject to reimbursement.

Recovered VAT

In some cases, when calculating VAT payable, it is necessary to take into account the amount of the recovered tax.

Amounts of value added tax previously legally accepted for deduction are subject to restoration if the purchased goods (works and services) are no longer used for operations subject to VAT.

This often happens when a taxpayer switches from a general regime to a special one, when VAT has already been previously accepted for deduction, but part of the goods has not yet been sold. VAT accruing on part of the unsold goods must be restored.

VAT is calculated and paid to the budget quarterly. The tax for the past month is paid in stages, not in a single amount (although this is also possible), but in three installments over the next three months. The payment deadline is no later than the 25th of each month.

Let’s say VAT payable for the 1st quarter amounted to 120,000 rubles. It must be paid either in full or at least 1/3 every month (40,000 rubles every month):

- Until April 25 – 40,000 rubles. (1/3 of 120,000 rub.);

- Until May 25 – 40,000 rubles;

- Until June 25 – 40,000 rubles.

Note: that is, in fact, VAT is paid every month.

Federal Law No. 265-FZ of July 31, 2020 amended the Tax Code (Tax Code of the Russian Federation) regarding the grounds for exemption from VAT on the sale of rights to computer programs and databases . Amendments to the Tax Code of the Russian Federation on the “tax maneuver in the IT industry” come into force on January 1, 2021 .

From the new year, without VAT, rights will only be sold to software of Russian copyright holders, which is included in the so-called Register of Domestic Software.

As a result of changes in tax legislation, the import of foreign software, regardless of the type of agreement, will be subject to Russian VAT .

In all cases of alienation of an exclusive right, as well as granting the right to use foreign software in a non-automated way (import on tangible media, network transfer with human participation), Article 174.2 of the Tax Code of the Russian Federation on services in electronic form does not apply .

From 2021, the import of rights to foreign software on the basis of an alienation agreement or a license agreement is not a basis for exemption from VAT in accordance with the new edition of clause 26, clause 2, article 149 of the Tax Code of the Russian Federation. Consequently, in b2b relationships, the obligation to pay VAT rests with the Russian buyer as a tax agent (Article 161 of the Tax Code of the Russian Federation).

If in the described case the buyer is an individual (b2c relationship), VAT is not paid, because a citizen without individual entrepreneur status is not recognized as a tax agent. When purchasing a software license from a foreign citizen (regardless of status), VAT also does not arise.

If a foreign organization grants rights to use software (including computer games), automatically using information technology via the Internet, including by providing remote access to them, including updates to them and additional functionality, such foreign organization is obliged pay VAT yourself (clause 3 of Article 174.2 of the Tax Code of the Russian Federation). To pay VAT, a foreign organization must register for tax purposes in Russia remotely (Clause 4.6, Article 83 of the Tax Code of the Russian Federation).

The sale of rights to software by individuals, or organizations and individual entrepreneurs that do not apply VAT (USN, Skolkovo resident, etc.) is exempt from VAT.

The exercise of rights to software without VAT by organizations and individual entrepreneurs on OSNO is subject to the inclusion of such software in the unified register of Russian programs for electronic computers and databases ( Register of Domestic Software ).

However, registering software in this Register has a number of difficulties and limitations. For example, the private copyright holder of registered software can only be a citizen of the Russian Federation or a Russian organization, with a share of participation of Russian citizens, commercial organizations and NPOs without predominant foreign participation, more than 50%, as well as a Russian NPO without predominant foreign participation.

Thus, when importing foreign software and services based on such software, VAT benefits based on paragraph 26, paragraph 2, Article 149 of the Tax Code of the Russian Federation will not be provided regardless of the type of contract.

Russian software copyright holders also experience difficulties with including their software products in the Register, since there are a number of restrictions on the use of foreign software components in domestic software. In addition, there are a number of problems with compliance with the requirements of the Decree of the Government of the Russian Federation of November 16, 2015 N 1236 regarding the composition of the technical documentation provided in the package for software registration in the Register.

Detailed information on the registration procedure in the Register of Domestic Software can be found here.

Accounting procedure

First, let's look at the basic processes when buying a car.

The car is accounted for as a fixed asset. After purchasing a car, a state duty is paid to the traffic police either before putting the car into operation or after. This determines where the state duty will be included:

- in the cost of the car to account for fixed assets, if the duty is paid before putting it into operation;

- to the organization's expenses if the duty is paid after commissioning.

Depreciation is then calculated monthly for the vehicle.

For car ownership, transport tax is calculated annually and a declaration is generated.

Next, consider an example: an organization buys a Renault Logan car for 500,000 rubles, with a power of 97 horsepower. The state duty is included in the cost of the car.

How much does a report cost?

Our report helps to understand the reasons for discrepancies between VAT and Profit in regulated reports and will answer the question of whether there is a problem.

The cost of development for BP 3.0 is 6,000 rubles.

The cost of development for ERP and KA 2 is 10,000 rubles.

One year of free support (if the configuration is updated or the form changes, we will fix everything)

A year of additional support costs RUB 3,000.

Other information: The report was tested on versions: 1C: Enterprise Accounting 3.0.53 and higher

If necessary, we can provide paid consultations on identifying the differences between income tax and VAT.

If it is necessary to take into account individual nuances and modifications to work in changed configurations, the work is paid by the hour.

Do I need to pay tax when selling a car in 2021?

Any sale transaction, be it movable or immovable property, is subject to personal income tax in Russia. Part of an individual’s profit is required to contribute to the state’s income. We found a buyer, successfully completed the transaction - now you need to pay tax on the sale of the car (with the exception of a few cases, which we will discuss below).

The tax rate is standard – 13%. If you pay it in full, it turns out to be a rather impressive amount. But there are several life hacks that help reduce and even completely eliminate the payment.

Concept of a report comparing VAT and Income Tax indicators

- During the analysis, we compare data from regulated reports. Moreover, the report includes the latest adjustment declarations

- Program credentials are used to calculate allowed differences

- Indicators are calculated in full rubles

- “Allowed differences” are divided into two groups:

- Carryover differences (differences in the moment of income recognition)

- Constant differences

is zero.

What should you do now?

The first step is to understand what inaccuracies were reflected in the request sent by the tax inspector. All inaccuracies are grouped by codes:

- Code “1” - the declaration for the previous period was not submitted, the information on the invoice is incorrect. The declaration indicates a transaction that is not reported by the counterparties.

- Code “2” - discrepancy between the data in the accounting journal (book of purchases and sales).

- Code “3” - the declaration did not indicate Code “2” - discrepancies in data between the purchase and sales books.

- Code “3” - the declaration contained incorrect information about the actions of intermediaries.

- Code "4" - other cases. The column that raised questions from the Federal Tax Service is also indicated here.

After the analysis has been completed, we begin to compile an explanation.

Why compare income based on profit and VAT?

The answer is very simple - the tax office does this, which means we, accountants, need to do this too =)

Tax officials compare VAT and profit returns to find income that the company forgot to charge with VAT.

In the simplest case (if we are analyzing the 1st quarter of the reporting period and we have no accounting difficulties), to reconcile we just need to carefully look at both declarations and check lines 010 + 020 (Sheet 02) in Profit and line 010 (Section 3) in VAT returns.

And this is quite easy to do.

Difficulties begin if we need to compare indicators over 9 months or over a year. Profit is easy to calculate - it is indicated in the declarations on an accrual basis. But with VAT there is already a problem - reporting is quarterly, which means we need to take all declarations from the beginning of the year and summarize their indicators.

Now let’s add some more truths of life:

- refunds to suppliers (increase the VAT base, but no profit)

- customer returns (reduce income in profit, but not in VAT)

- VAT-free income

- different periods of income recognition for export sales

All this leads to the need to understand the discrepancies between VAT and profit

- becomes a very difficult task, requiring a deep dive into accounting, drawing up additional tables and additional checks.

Specialists have a lot of experience in finding VAT and profit differences using Excel tables and “working weekends,” but we are tired of searching everything by hand. We used all our knowledge and experience and developed a special report that allows you to automatically check the convergence of the VAT and Profit base

and take into account common discrepancies. And we are ready to share our findings.

Important: in addition to the adequate reasons for the differences between VAT and Profit, we often find accounting errors that distort the tax base. Our report removes all “resolved” discrepancies and allows you to focus on the actual errors.

Existing VAT rates

In addition to the settlement rates applied in a special regime (clause 4 of Article 164 of the Tax Code of the Russian Federation), there are basic VAT rates. These include: 1. The VAT rate is 0%, the application of which is given in paragraph 1 of Art. 164 Tax Code of the Russian Federation.

See also the material “What is the procedure for refunding VAT at a rate of 0% (receiving confirmation)?” .

2. VAT at a rate of 10% is calculated on the basis of the conditions given in paragraph 2 of Art. 164 Tax Code of the Russian Federation.

See also the materials “What is included in the list of goods subject to VAT at a rate of 10%”.

3. The VAT rate of 20% is applied on the basis of clause 3 of Art. 164 Tax Code of the Russian Federation.

ConsultantPlus experts spoke about the nuances of applying VAT rates:

Learn the material by getting trial access to the system for free.

How to pay VAT in 2021: procedure and deadlines

VAT is a tax that requires quarterly declaration and payment. It is calculated based on the results of each quarter: the difference in the tax base and deductions is multiplied by the tax rate. Thus, the budget receives these tax payments four times a year.

IMPORTANT INFORMATION! If legal deductions exceed the revenue portion of the VAT, then the budget will compensate for the missing share: the amount will be counted toward future payments or to pay off any arrears. In the absence of arrears, the law allows the amount of compensation to be transferred to the bank account of the entrepreneur.

The tax base is considered to be the main characteristic of the goods or services being sold - their value on the day of shipment of the goods or transfer of the service or the day of their payment (the date of the event that occurred earlier).

There are some nuances regarding VAT tax rates:

- same rate – same base;

- if transactions are subject to VAT at different rates, then their base is also calculated separately;

- the cost is always calculated in national currency, revenue from imports is converted into rubles at the current exchange rate.

- From January 1, preferential rates for the sale of goods and services provided for by the Tax Code come into effect. For some products it is recognized as zero.

- The conditions for confirming the right to a preferential VAT tariff have been simplified.

- Double taxation exceptions for those using the simplified taxation system and unified agricultural tax when issuing invoices.

- Elimination of paper media: starting from this year, VAT returns can only be submitted electronically.

- New budget classification codes for VAT transactions.

NOTE! Tax rates and the method of calculating VAT have not changed.

To transfer VAT, you need to indicate the current BCC on your payment slip:

1. If work, service or goods are sold on the territory of Russia, VAT is paid according to KBK 182 1 0300 110.

- penalties for this tax need KBK 182 1 03 01000 01 2100 110;

- fines for arrears - KBK 182 1 03 01000 01 3000 110;

- interest on VAT must be transferred according to KBK 182 1 0300 110.

2. Are you importing from any country that is part of the customs union? BCC for paying VAT to the tax office on such transactions is 182 1 0400 110.

3. If VAT deductions for imports are related to the customs budget, the BCC will be different: 153 1 0400 110.

— 1. The new edition of the Tax Code (hereinafter referred to as the Tax Code) has been supplemented with a new criterion for recognizing expenses as economically unjustified - the property has not been leased (financial lease (leasing)) and continues to be used by the lessor (clause 4.1 of Article 169).

An example of such a situation in practice is a lease agreement concluded between organizations and/or individual entrepreneurs, under which the agreement and all relations between the entities exist only on paper, in fact, the property is not transferred for use. These types of transactions are often made between related companies to increase the amount of income tax expense.

2. Tax Code 2021 is supplemented by a norm (clause 2.9, Article 170), according to which labor costs are included in income tax expenses . These include:

- Any accruals to individuals working in organizations under employment contracts, in cash and (or) in kind

- Remunerations based on the results of work for the year and payments that are in the nature of remunerations based on the results of work for the year

- Bonuses, additional payments, allowances related to working hours or working conditions, provided for by law and (or) employment contract, agreement, collective agreement, on the basis of legislation.

Previously, such expenses were taken into account by payers as part of normalized costs, that is, they were included in normalized expenses in the amount of no more than 1% of revenue from the sale of goods (works, services), property rights and amounts of income. The new rule allows all labor costs, including annual bonuses, bonuses, etc., to be included in labor costs for income tax purposes.

1. An addition has been made according to which individuals who receive income in the form of dividends, subject to income tax at a rate of 6%, have the right to receive tax deductions established by Articles 209−211 of the Tax Code (clause 3 of Article 199 of the Tax Code).

2. Tax Code-2021 is supplemented by a norm (clause 5 of Article 216), according to which, if the controlling body establishes the fact of unlawful non-withholding and non-transfer of income tax to the budget by a tax agent, the payment of income tax is carried out by him at his own expense .

Such tax is not subject to further withholding from an individual in the manner established by clause 5 of Art. 216 Tax Code (Part 1, Clause 5, Article 216).

Unlawful non-withholding - wages have been calculated, but the tax on the amount of income has not been withheld and not transferred to the budget.

Unlawful non-transfer - tax is calculated from accrued wages, but according to the deadline for payment of wages, it is not transferred to the budget.

Such facts can be established both during a tax audit based on accounting data and on the basis of evidence collected by law enforcement agencies. In most cases, information reaches regulatory authorities from the employees themselves, including anonymously.

The above rule is aimed primarily at preventing the payment of wages in envelopes and is a kind of measure of influence on unscrupulous payers who do not pay income tax.

In addition, a common practice, especially for insolvent enterprises, is non-payment of income tax (when documents for payment of wages are submitted to the bank, income tax is not paid in full, but purely nominally).

Buying a car

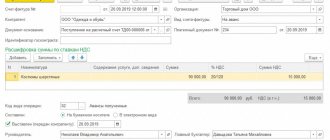

To reflect the purchase of a car, we will create a document “Receipts (acts, invoices)”, type of operation “Equipment”.

On the “Equipment” tab we will indicate the Renault Logan car and its cost of 500,000 rubles.

We will also register an invoice.

Let's look at the document postings.

The cost of the car is collected on the account on 08.04.1.

Video review of the development

In this video, we tell you why you need to compare VAT and profit, and show how the report “Analysis of discrepancies in VAT and Income Tax revenue in declarations” will help you find all the discrepancies.

We talk about this in even more detail at a large seminar.

Seminar timing:

- 01:38 why compare VAT and profit - 03:32 when differences arise - 05:01 how to find permitted differences - 05:32 analysis of real discrepancies - 33:50 why reconciliation is useful

VAT on the inter-price difference when buying a car, what is it?

Federal Law “On Accounting”).

Accounting for the cost of a purchased car

The acquired asset intended for resale is a commodity - part of the inventory. Their accounting is carried out in accordance with PBU 5/01. Note that inventories are received at actual cost (clause 5 of PBU 5/01). And for a used car, it is recognized in the amount paid to the seller in accordance with the agreement.

The car dealership records the cost of the purchased car in the debit of account 41 “Goods”.

After purchasing a used car, a car dealership usually carries out pre-sale preparation. That is, in this case, costs arise to bring the asset to a state in which it is suitable for use. The corresponding amounts in accounting are also included in the actual cost of goods (clause

Examples of using the report

Video review of the development

Let's consider the work of the report using the example of one year of the organization's work

1st quarter

In the 1st quarter we see the following situation:

- adjustment declarations are used for analysis (k/1)

- in this quarter, the VAT rate of 0% was confirmed for the amount of 10,878,485 rubles (for income tax purposes, these sales were taken into account in previous quarters)

- For sales in the amount of 3,730,529 rubles, the 0% rate has not yet been confirmed

Result: there are no erroneous differences, all differences are “allowed”

2nd quarter

This quarter we see a similar situation with differences, but the indicators are already considered both quarterly and cumulatively - to facilitate reconciliation. Please note that indicators that are obtained by calculation are highlighted in gray (you will not find these figures in the declarations).

3rd quarter

In the 3rd quarter we see a difference of 33,700 rubles. If you analyze all the data, you can find the reason for the difference - the presence of non-operating income not subject to VAT.

Setting up other income not subject to VAT

There is a special setting in the VAT and Profit reconciliation report that allows you to specify a list of non-operating expenses that should not be subject to VAT and that must be included in the “allowed” differences.

If an item of other income is added to this list, then the detail “Not subject to VAT” is filled in (it can also be set in the directory itself).

This allows you to build SALT for the 91st account, grouped by VAT taxability. By default, this list is filled with unambiguously “allowed” differences. The user can independently supplement the list. In this case, we will add the article “Insurance compensation (MTPL)” to the exceptions.

As a result, we will receive a report in which there are no unresolved differences

4th quarter

In the 4th quarter we see that a whole range of “allowed” differences have been taken into account:

- unconfirmed export 0%

- returns of goods to the supplier

- returns of goods from customers

- non-operating income not subject to VAT

And still we get an unresolved difference. In this case, it means the presence of an accounting error in the VAT or Profit return. Additional data analysis (outside the scope of this report) is required to identify the error. But our primary recommendation is to update the closing of months, the formation of a sales book and refill tax returns.

VAT on assignment agreements

Despite the prescribed procedure for determining the tax base for various types of transfer of property rights, in practice many accountants and tax specialists encounter difficulties when assessing VAT on the assignment of a monetary claim.

In this article, we drew attention to a number of nuances on this topic, which are mentioned in the legislation only indirectly or not at all.

Currently, contracts for the assignment of the right of claim (assignment) are becoming increasingly relevant, under which an organization, without waiting for the receipt of funds from the buyer (or borrower), has the opportunity to receive a large part of the debt by selling the right of claim to another company.

However, the procedure for assessing VAT on assignment agreements is not regulated in sufficient detail by law.

Updates

We provide new development versions free of charge within a year after purchase.

One year of additional support - 3,000 rubles. Attention, we do not guarantee the functionality of the development for which the additional support period has not been paid for.

The current version of the development can be obtained by writing to us by email. Managers will check whether you have access to support, send a new version or send an invoice.

Version 1.2

- interface fixes

Version 1.3

- the report has been prepared for use in cloud versions

- Fixed errors in report generation for users with limited rights

Version 1.4

- New indicators have been added to the allowed differences: Unconfirmed sales 0% (in case of additional VAT charges)

- Sales according to 90.01.1 without VAT

- Implementation according to 90.02.2 UTII and Patent

- the year-end closing mechanism was taken into account when analyzing accounts 90 and 91

- fixed determination of differences in returns to suppliers and from customers

Version 1.5

- Adjustments to sales taken into account (downward)

- Adjustments to sales downwards from sales from previous years have been taken into account

Version 1.6

- Added control for discrepancies in revenue and other income according to accounting data (90.01 and 91.01) and according to the profit declaration data

Version 1.7

- The 2021 analysis shows a VAT rate of 20%

- Corrected the indicator “Confirmed export sales” (Section 4 line 020) in the 2021 reports

- The difference of 1 ruble between SALT and the Profit Declaration is not controlled

Version 1.8

- We added revenue data for other operations (Appendix No. 3 to Sheet 02) to the analysis of the convergence of accounting and reporting data - this is usually the sale of fixed assets or intangible assets

- Added the ability to open regulated reports via hyperlink (in one click you can open everything you need for reconciliation)

- Added a description of the “Difference” column - the main reasons and necessary actions

Version 1.9

- This release adds checking for discrepancies in gratuitous transfer transactions

Version 1.10

- Added a new indicator “Shipment without transfer of ownership”

- Identified errors have been corrected

Version 1.11

- Added a new indicator “Sales of shipped goods” (actual transfer of ownership)

- We have finalized indicator 040 of section 4 of the VAT return. Now all the lines of this column are summed up

Version 1.12

We decided to make development even more convenient and transferred the functionality to the Extension. This will allow:

- more convenient to open development

- It’s more convenient to set up other income and expense items

- improve checking the compatibility of development with future versions of 1C:Accounting

But we haven’t forgotten about the development of functionality:

- We show differences only if there is something to show

- simplified setting up the item of other income from expenses (the “Not subject to VAT” flag)

- added a certificate for the indicator “Sales at a rate of 0%” (to open you need to click the “?” sign)

Version 1.13

- The extension is adapted to version 1C: Accounting 3.0.75

Version 1.14

The extension has been adapted to the new form of the regulated Profit report from the 4th quarter of 2021 (1C: Accounting 3.0.75)

Version 1.15

- added analysis of returns to the supplier (if it is made on the basis of an adjustment invoice)

- identified errors have been fixed

Version 1.16

- the long-awaited decoding of discrepancy indicators

- other income “Return of goods sold in the previous tax period” has been added to the default exceptions

Version 1.17

- Fixed minor inconvenience of adding other income

- Improved determination of the required declaration in the presence of separate divisions

Version 1.19

In this version, we have updated the declaration forms, corrected several important details and made working with the report even more convenient:

1. The report has been updated for the Profit and VAT declaration forms from the 4th quarter of 2021, the diagnosis of filling errors has been improved due to the update of reporting forms 2. The verification of amounts in the Profit declaration and in accounting data for complex transactions has been corrected 3. The line “ has been highlighted in the analysis Proceeds from the sale of other property" 4. Simplified the work with setting the flag "Not subject to VAT" for other income. After setting the flag, you no longer need to re-open the discrepancy analysis; the new settings will be accepted automatically. 5. Added the ability to quickly open OSV for 91.01 from the report settings form

Version 1.20

- The analysis takes into account additional VAT sheets

- Fixed bug with finally unconfirmed VAT

- Minor bugs fixed

Version 1.0

- the extension contains the main functionality from BP 3.0

- While some checks have not been implemented, we will add according to user requests

Version 2.1

Fixed checks for:

- sales adjustments (downward)

- returns of goods