Why is this necessary?

According to Russian legislation, all taxpayers are required to pay fiscal fees to the state budget on time and in full. Otherwise, the company or individual entrepreneur will be punished with rubles: fines and penalties. And especially large tax crimes face criminal liability.

To avoid problems, tax authorities strongly recommend systematically monitoring the current state of mutual settlements with the budget. Officials remind that even a minor error in a payment order can lead to disastrous consequences.

For example, the budget classification code in the payment slip is incorrectly indicated, and the funds will not reach their intended destination. Consequently, the tax will not be considered paid, and inspectors will apply penalties. Let us remind you that the punishment for late payment of obligations is not only fines. Representatives of the Federal Tax Service have the right:

- independently write off money from the taxpayer’s current account;

- freeze the company's current accounts;

- suspend the activities of an organization or entrepreneur;

- initiate legal proceedings.

Systematic control of mutual settlements will help avoid such consequences. Carrying out a check is quite simple: just submit an application for reconciliation with the tax office at the nearest territorial branch of the Federal Tax Service. But there are other ways.

About the importance of reconciliation

It is important for both large companies and micro-businesses to ensure that all taxes and other necessary payments are made on time. Neglect of this may result in liability, including criminal liability. True, such a harsh measure can be applied to very significant amounts of debt. But even with other debts, sanctions are threatened - fines and penalties for late payment.

Note! A very common error in the KBK. If you enter the wrong code, the payment will not arrive or will be credited to another budget account. In this case, the subject will have a debt, which will accrue penalties over time.

What happens if a taxpayer has a tax debt? The consequences can be very sad:

- writing off the debt amount from the current account of a company or entrepreneur;

- blocking of existing current accounts, inability to open new ones;

- suspension of activities;

- the tax authority's appeal to the court.

Timely reconciliation with the Federal Tax Service will help avoid this.

Attention! In some cases, if it is impossible to pay taxes on time, the taxpayer may receive a deferment.

The rules for reconciliation with the Federal Tax Service have changed

The Federal Tax Service of Russia sent a letter dated 03/09/2021 No. AB-4-19/2990 to the territorial tax authorities, which updated the temporary procedure for joint reconciliation of calculations for taxes, fees, insurance premiums, penalties, and fines. The reconciliation procedure sent by letter dated April 16, 2020 No. AB-4-19/ [email protected] has become invalid.

According to the new rules, the largest taxpayers are no longer required to conduct quarterly reconciliations with the Federal Tax Service on their calculations. As before, the tax office must carry out a reconciliation at the taxpayer’s request. The new deadline is 5 days from the date of receipt of the application. It has been established that reconciliation of calculations is carried out by the tax authority without fail in the following cases:

- at the initiative of the taxpayer when submitting an application for a statement of reconciliation of calculations;

- in other cases established by legislation on taxes and fees.

The maximum period for reconciliation of calculations has not changed - it is 3 years.

Additionally, the letter contains the following forms:

- notifications of refusal to accept an application for reconciliation of settlements with the budget;

- notifications of refusal to reconcile settlements with the budget.

The rules were updated and the article became irrelevant. But we'll fix that soon.

If you need up-to-date instructions and documents right now, go to ConsultantPlus. Using our link, get free access for 2 days and find everything you need.

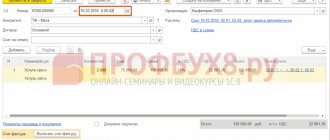

OPTION 1: KND 1160070 – via “Kontur.Extern”

Step one:

- Log in to the Kontur Extern website.

If you do not have Kontur Extern, then use the free “Test Drive” version: 3 months.

- On the main screen of Contour Extern, go to the “FTS” tab, then click on the “Request reconciliation” button.

Step Two:

- On the “Request Reconciliation” tab, select the required document.

Step Three:

- On the request screen for the provision of information services, fill in all the required fields: (Type of request according to the Federal Tax Service, Inspectorate Code, Requested tax according to KBK and OKTMO.)

- In the “Response format” field, enter: “XML”.

- Next we move on to sending.

Step Four:

- Wait for the results of document processing by the tax authority (usually this operation takes a few minutes, but delays may occur.)

- Go to the “Documents”, “ION Requests” section and download the finished act.

How to reconcile with the tax office

There are three ways to request information from the Federal Tax Service for reconciliation:

- By contacting in person or through a trusted representative. To do this, you will have to visit the nearest territorial branch of the Federal Tax Service. But a verbal request is not enough. It is necessary to prepare a special application for a reconciliation report with the tax office (a sample is presented below) and submit it to the inspector.

IMPORTANT!

If the application is submitted by an authorized representative of the taxpayer, then a copy of the power of attorney on the basis of which the authorized representative is acting will have to be attached to the application form. The original power of attorney will also need to be provided to the Federal Tax Service inspector.

- Send a request through the taxpayer’s personal account in the unified service of the Tax Service. But this procedure is available only to registered users. To register for the online service, you will need to contact the Federal Tax Service. It is also possible to register on the inspection website using an account on the State Services portal.

- Send a request for a reconciliation report with the tax office (download a sample form below) electronically via secure communication channels. In this case, the response from the Federal Tax Service will come in electronic form via TKS.

Now we will determine which forms of request for reconciliation with the tax office (sample) need to be prepared.

When the reconciliation is considered complete

If no disagreements arise during the reconciliation between you and the Federal Tax Service, the period for its completion will be 10 working days from the date of registration of the application.

Otherwise, the period for conducting, generating and issuing a settlement reconciliation report will extend to 15 working days. But not more.

There is always something to discuss. Let's solve problems together. Join the VK Bukhgalteriya.ru group

Reconciliation of calculations will end if:

- Section 1 of the act will be signed without disagreement;

- within 10 working days from the date of registration of the application, you do not return section 1 of the act to the inspection;

- Section 2 of the act will be signed;

- within 15 working days from the date of registration of the application, you will not return section 2 of the act to the inspection.

You will receive a response to the reconciliation report with disagreements returned to the inspectorate within 30 calendar days from the date of its registration with the Federal Tax Service.

During the quarantine period, each organization or entrepreneur can send to the Federal Tax Service an application for reconciliation of payments in electronic form using the TKS, as well as through the electronic services “Taxpayer Personal Account.

You will receive a reconciliation report generated and signed by UKEP from the tax office also via the Internet. If you are not an EDF participant, the reconciliation report will be sent to you by mail.

Read in the berator “Practical Encyclopedia of an Accountant”

How to draw up a statement of reconciliation of payments between organizations

Stay up to date with the latest changes in accounting and taxation! Subscribe to Our news in Yandex Zen!

Subscribe

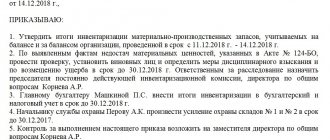

Application in person

Officials did not approve a unified application form. Therefore, you have the right to contact the Federal Tax Service in any form. Please provide required details:

- Full name of the organization or full name. individual entrepreneur.

- INN, KPP, OGRN, addresses and contact numbers.

- List of taxes, contributions, fees that require reconciliation.

- The time period (year, quarter, month, any other period) for which the audit is carried out.

- Method of obtaining a reconciliation report with the tax office (sample below): by mail or in person.

- FULL NAME. and the position of the employee responsible for reconciling the calculations.

Please note that if the taxpayer prefers to receive the reconciliation report by mail, then it is necessary to indicate the address for sending. Otherwise, the Federal Tax Service will send a letter to the legal address of the company.

Example for reconciliation with the tax office, application (sample)

The application will be reviewed and a paper document will be sent to the applicant within 5 days. And in two copies.

Subtleties that you need to pay attention to when drawing up the act

Both the text of the act and its execution are completely left to the representatives of enterprises and organizations. In other words, the act can be printed on a computer or written by hand, done on the company’s letterhead or on an ordinary A4 sheet.

It is important that the act be certified by the signatures of representatives of both parties (in this case, the signatures must be original - the use of facsimile autographs is unacceptable).

If the company’s regulations stipulate the requirement to use stamps (stamps or seals) to certify documentation, then the act form must be endorsed with them.

The act is drawn up in two copies , but if necessary, certified copies can be made. Information about the act must be entered into the documentation journal.

Electronic appeal

If the taxpayer decides to obtain information via the Internet, he will have to fill out a special form. The unified form was approved by Order of the Federal Tax Service of Russia No. ММВ-7-6/ [email protected] dated June 13, 2013, KND 116101.

Form

The request indicates similar information: the name and registration codes of the taxpayer, his address. This information is entered into the unified form automatically.

IMPORTANT!

An act received electronically cannot be returned to the Federal Tax Service with references to disagreements. If the company does not agree with the data specified in the control document, it will have to contact the inspectorate again.

Contents of the settlement reconciliation report

The reconciliation report consists of three parts: a title page and two information sections.

The title page should contain the following information:

- about the enterprise;

- about the tax inspectorate;

- about taxes specified in the act.

Sections are filled out for each tax on a separate page. The first section should contain the total amounts not only for taxes, but also for associated penalties, fines and interest as of the date the reconciliation report was created.

The second section provides a breakdown of calculations for the selected period.

At the request of the payer, the inspector prepares and sends to the company an act consisting only of a title page and one (first) section, the form of which provides a specially designated place for noting the identification of inconsistencies and proposals for their elimination.

The inspection transmits the document to the enterprise in two copies in the manner specified in the application.

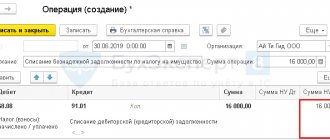

We carry out reconciliation

So, we have determined how to obtain a tax reconciliation report. The document has a unified form KND 1160070. The form is approved by Order of the Federal Tax Service of Russia No. ММВ-7-17 / [email protected] dated 12/16/2016. The structure of the form is a title page and two sections.

The title page contains the taxpayer's registration information. The types of fiscal payments and the period for which the verification document was generated are also specified. Sections No. 1 and No. 2 are filled out separately for each type of tax, fee or contribution.

Check the information with accounting and tax records. After the reconciliation, the taxpayer is obliged to report the results to the Federal Tax Service. If there are no disagreements, then an o is made in the act, and one copy is returned to the inspection.

Tax reconciliation with the tax office, sample completed report

Question

How to properly reflect personal income tax accounting in order to get along with the Federal Tax Service? According to the Turnover balance sheet account 68.01, posting D70 K68.01 is formed monthly on the last day of the month, a document reflecting wages in regulated accounting. The amount is reflected as calculated personal income tax. For example, 10,000 rubles. 03/31/2017 Payment is reflected on the basis of a payment order and a posting is made D68.01 K70 for example 2,000 rubles. 03/20/2017 (payment of personal income tax on vacation pay) Payment of personal income tax on salary 04/10/2017 - 8,000 rubles. In 6-NDFL in the report for the 1st quarter. 2021 section 2 reflected block: 03/20/17 03/20/17 03/31/17 in 6-NDFL in the report for the half year 17 section 2 reflected block 03/31/17 04/10/17 04/11/17. The Federal Tax Service reflects the tax accrued on the basis of the submitted 6-NDFL report. That is, when I request a reconciliation report from the Federal Tax Service as of March 31, 2017, I see that a tax of 2,000 rubles has been charged. And according to SALT account 68.01, as of March 31, 2017, I have accrued personal income tax of 10,000 rubles. Or if the reconciliation report with the Federal Tax Service as of 05/02/2017, I have a tax accrued for March (03/31/2017) for March (03/31/2017) - 10,000 rubles and a tax for April is accrued 10,000 rubles (04/30/2017) and the personal income tax reconciliation report for April will not yet be reflected because as of May 2, 2017, the 6-NDFL report has not been submitted. And as a result, the debt (final balance as of the date) also does not agree between the SALT and the act. How to sign a reconciliation report with the Federal Tax Service, with discrepancies.

If there is disagreement

If there are disagreements, then you need to act like this:

- In column 4 of the first section, against the information with which you do not agree, indicate the amounts according to the accounting records of the enterprise (entrepreneur).

- On the last page of the first section, put o.

- Submit this copy to the Federal Inspectorate.

Based on the act of disagreement, inspectors initiate a check of the specified data using information systems. Then the payer will be asked to provide the Federal Tax Service with documents confirming your accounting data. For example, copies of payment orders for payment of contributions.

If a mistake was made by the inspector, it will be corrected. The Federal Tax Service will send a special notification. If disagreements arose due to your error, for example, an incorrect KBK in the payment slip or an incorrect calculation in the declaration, then the inspector will send a letter indicating the mistake made by the taxpayer.

The company is obliged to correct its own mistakes. For example, submit an adjustment declaration, pay an additional fee, or write an application to offset the overpayment amounts. After the disagreements are resolved, the inspector and the taxpayer sign the act (“Agreed, no disagreements”).

Statement

KND 116101

Checking compliance of forms 6-NDFL and 2-NDFL

Since 2-NDFL is submitted at the end of the year, the algorithms for identifying violations discussed below are used for the annual 6-NDFL.

Checking the annual amount of accrued income:

- Select the tax rate.

- From 6-NDFL we take the value in line 020.

- In 2-NDFL (with sign 1), we summarize the values of the lines “Total amount of income” for all individuals.

- In the income tax return (hereinafter referred to as NP), we summarize lines 020 of Appendix 2 for all individuals.

- Equality must be observed: clause 2 = clause 3 + clause 4.

Checking the annual amount of accrued dividends:

- From 6-NDFL we take the value in line 025.

- In 2-NDFL (with sign 1), we summarize the values by income code 1010 for all individuals.

- In the NP declaration, we summarize the values by income code 1010 in Appendix 2 for all individuals.

- Equality must be observed: item 1 = item 2 + item 3.

Checking the annual amount of calculated tax:

- Select the tax rate.

- From 6-NDFL we take the value in line 040.

- In 2-NDFL (with sign 1), we sum up the values of the line “Tax amount calculated” for all individuals.

- In the NP declaration, we summarize lines 030 in Appendix 2 for all individuals.

- Equality must be observed: clause 2 = clause 3 + clause 4.

Checking the annual amount of unwithheld tax:

- Select the tax rate.

- From 6-NDFL we take the value in line 080.

- In 2-NDFL (with attribute 1), we sum up the values of the line “Amount of tax not withheld by the tax agent” for all individuals.

- In the NP declaration, we summarize lines 034 in Appendix 2 for all individuals.

- Equality must be observed: clause 2 = clause 3 + clause 4.

Checking the total number of individuals who received income:

- From 6-NDFL we take the value in line 060.

- We count the number of 2-NDFL certificates with attribute 1.

- We count the number of attachments 2 to the NP declaration.

- Equality must be observed: item 1 = item 2 + item 3.

Read about what discrepancies are normal for 6-NDFL and 2-NDFL in this material.

Read more about control ratios for checking 6-NDFL.

Options for applying for reconciliation

Carrying out the reconciliation, the taxpayer's calculation of taxes is carried out in accordance with paragraph 3 of the Regulations from the order of the Federal Tax Service of Russia dated September 9, 2005 No. SAE-3-01/444 @.

You can contact the Federal Tax Service regarding the issue of reconciliation in different ways:

Let us immediately note that no special form has been approved for an application for reconciliation. You can compose an appeal in any form, without fail indicating all the important parameters:

Note! If you select the option of receiving the reconciliation report by mail, you must provide a mailing address. Otherwise, the documents will be sent to legal.

The tax authority must review the application within 5 days and send a reconciliation report to the taxpayer in 2 copies.

Sample application for reconciliation with the budget

When applying via TKS, the application will be generated automatically. The user will only need to select taxes and reconciliation periods. However, the option of receiving the act is not subject to choice - it will come in electronic form (letter of the Federal Tax Service dated October 30, 2015 No. SD-3-3 / [email protected] ).

Note! The electronic reconciliation report cannot be returned to the tax office if there is a disagreement. If they are found, you will have to contact the Federal Tax Service again.