How to fill? | Query ION | VLSI Electronic reporting and document flow

To obtain the requested documents, the applicant sends a request to the tax authority.

Type of document Purpose of receipt

| Certificate on the status of settlements for taxes, fees, penalties, fines, interest | Provides information on taxes, fees and tax sanctions for a specific date | 1. Monitoring the correctness of tax payments 2. Identification of arrears or overpayments on payments 3. Obtaining a loan, license or participation in a transaction |

| Certificate of fulfillment by the taxpayer (payer of fees, tax agent) of the obligation to pay taxes, fees, penalties, fines, interest | The payer's debt to the budget for taxes, fees and penalties is reflected. | 1. Confirmation of absence of debt to the budget 2. Obtaining a loan, license or participation in a transaction |

| Extracting transactions for settlements with the budget | Contains a list of all transactions of the payer with the budget for the requested period | 1. Checking the compliance of the payer’s accounting data with the data of the tax authority 2. Monitoring the payment of taxes, fees and sanctions |

| List of accounting and tax reporting | Displays a list of forms of tax and accounting documents that were submitted by the payer for the requested period | 1. Acceptance of affairs from predecessor 2. Current self-control3. Control by the lender over the tax discipline of the borrower |

| Act of joint reconciliation of calculations for taxes, fees, penalties, fines, interest | Contains complete information on the formation of debt (overpayment) for taxes, fees and penalties | 1. Control of settlements with the budget before preparing annual reports 2. Prevention of penalties and overpayments 3. Obtaining a loan, license or participation in a transaction4. Reconciliation of calculations upon deregistration with the tax authority |

Certificate on the status of settlements for taxes, fees, penalties, fines, interest

The certificate contains data from the tax authority on the amount of overpayment (debt) of the payer for taxes, insurance premiums, penalties and fines on a specific date.

A taxpayer needs a certificate about the status of payments for taxes and fees to monitor the correctness of tax payment. Such a certificate indicates all types of taxes and the status of them, for example, if there are amounts to be collected or if there is an overpayment.

A certificate of the status of settlements is provided to the payer within 5 days from the date the tax authority receives the relevant request.

Certificate of fulfillment by the taxpayer (payer of fees, tax agent) of the obligation to pay taxes, fees, penalties, fines, interest

Contains information about the presence or absence of debt on taxes, fees, penalties, fines, and interest.

This certificate reflects all the payer’s debt to the budget, except for amounts for which:

- deferment (installment plan) or tax credit is provided;

- restructuring is in effect in accordance with the law;

- there is a court decision that has entered into legal force recognizing the obligation to pay these amounts as fulfilled.

If there are arrears for other obligatory payments to the budget, a note is made in the issued certificate that the applicant has an unfulfilled obligation to pay taxes (fees, insurance premiums, penalties and tax sanctions).

The tax authority is obliged to issue a certificate of fulfillment of the obligation to pay tax payments within 10 days from the date of receipt of the request from the subject.

Extracting transactions for settlements with the budget

Contains information about settlements with the budget in the form of a list of all transactions of the payer for the requested period. A separate statement is prepared for each type of tax.

The statement reflects:

- accrued taxes (information is taken from the declarations submitted by the payer);

- paid taxes, fines, penalties;

- amounts accrued based on the results of tax audits;

- settlement balance at the beginning of the period.

The statement of transactions first of all indicates as of what date it was generated and for what period. Next, it reflects information about the taxpayer (TIN, KPP, address, etc.), the tax authority, as well as the BCC and the name of the tax for which the extract was generated.

List of accounting and tax reporting

Contains a list of all tax returns and financial statements that were submitted by the payer for the requested period.

Act of joint reconciliation of calculations for taxes, fees, penalties, fines, interest

Contains complete information on the formation of debt (overpayment) for taxes, fees, penalties, fines, and interest.

Reconciliation of calculations is carried out by the tax authority without fail in the following cases:

- at the initiative of the taxpayer;

- quarterly with the largest taxpayers;

- when deregistering a taxpayer in case of transfer from one tax office to another;

- when deregistering a taxpayer in the event of its liquidation (reorganization).

The form of the act consists of a title page and two sections. The first section is intended for a brief reconciliation, and the second for a more detailed one.

Section 1 of the act is filled out by a representative of the tax authority according to the applicant’s personal account data. It reflects only the balance of calculations for taxes and penalties at the end of the reconciled period.

If there are no discrepancies with the applicant’s data, the period for reconciliation and execution of the report should not exceed 10 working days. If the indicators diverge, the reconciliation period should not exceed 15 working days. In this case, Section 2 of the act is completed.

Source: https://SBIS.ru/formats/docFormatCard/101166/help

What kind of certificate is this and why is it needed?

With the help of this certificate, you will be able to quickly clarify whether there are any overpayments or debts in the area of budget payments. It is used to constantly monitor the situation so as not to receive fines or penalties, and also, if there is an overpayment, to reduce expenses in the next month. Considering the fact that the KND 1160080 form is currently relevant, there is a misunderstanding about what kind of KND 1166112 certificate is and what to use it for? This document is an obsolete form and is not used now, but out of old habit the paper is called that way.

Status of settlements for penalties with a minus sign

It is very important that consumers submit meter readings on time - from the 23rd to the 26th of each month.

If in a request sent via telecommunication channels (hereinafter referred to as a request via TKS), an organization specifies the tax authority code, but does not indicate the reason for registration code (hereinafter referred to as the KPP) of the organization, a certificate of the status of settlements is generated taking into account all separate divisions of this organization registered with the specified tax authority.

A certificate of the status of settlements, submitted to an organization (individual entrepreneur) on paper, is signed by the head (deputy head) of the inspectorate of the Federal Tax Service of Russia and certified by the seal of the inspection of the Federal Tax Service of Russia with a reproduction of the State Emblem of the Russian Federation.

A balance with a minus is an overpayment or debt

If there are arrears for other obligatory payments to the budget, a note is made in the issued certificate that the applicant has an unfulfilled obligation to pay taxes (fees, insurance premiums, penalties and tax sanctions).

How can I get a certificate in the KND form confirming the fact that I have not received a public tax deduction. The document is a certificate from the Federal Tax Service about the absence of debt, the deadline is 1 day. You can also write a special application so that your documents are sent to another address located in the unified municipal register of taxpayers (clause

But only the statement contains a breakdown of all payments and charges. § Write the taxes of interest to the KBK in your request.

Can take the following values: “C” is a complex logical model element (contains nested elements), “P” is a simple logical model element implemented as an XML file element, “A” is a simple logical model element implemented as an XML element attribute file.

The certificate contains data from the tax authority on the amount of overpayment (debt) of the payer for taxes, insurance premiums, penalties and fines on a specific date.

A certificate of the status of payments of individuals is generated as of the date specified in paragraph 2 of this Procedure.

Those citizens who carefully study the payment they receive for electricity often wonder what the balance in the receipt is. This column is not always clear to the average person. This article will help clarify all the unclear points about paying for electricity using this type of document.

In March 2021, a budgetary healthcare institution, due to insufficient funds under KVFO 4 to pay salaries to employees, borrowed in the amount of 560,000 rubles. with KVFO 2. In April 2021, upon receipt of funding, the funds were returned.

In the certificate on the status of tax payments with a minus - what does it mean?

Contains complete information on the formation of debt (overpayment) for taxes, fees, penalties, fines, and interest.

When calculating the value of this indicator, the values reflected in column number five in the received receipt are taken into account.

The ending balance can be either positive or negative. If the balance is negative, it means you overpaid, overpaid your utility provider, and they will take this overpayment into account in next month's calculations.

In certain cases, the Federal Tax Service may personally initiate an unscheduled reconciliation of calculations. As practice shows, this happens in the event of excessive payment of taxes to the budget. This situation is regulated by Article 78 of the Tax Code of the Russian Federation. Moreover, if the payer independently requests the procedure, then, according to Article 32 of the Tax Code of the Russian Federation, the tax service is forced to carry it out.

How to get back overpaid taxes

Generalized data on the status of settlements for the institution's receivables and payables as of the reporting date are reflected in the information on the institution's receivables and payables (form 0503769) (hereinafter referred to as information (form 0503769)). The frequency of submission of this information is as of July 1, October 1, January 1 of the year following the reporting year (clause 69 of Instruction No. 33n).

If you see incomprehensible debts or overpayments in the certificate, you will need an extract of transactions with the budget to find out the reason for their occurrence.

The first value is the debt to the company; it can be either current or come from the previous period.

Unlike a certificate, an extract does not show the situation on a specific date, but the history of your relationship with the tax office for the period. For example, from the beginning of the year to today.

The word balance, which you often see on your receipt, represents the difference between two values.

In addition, the request can be sent to tax authorities electronically (Appendix No. 9 to the Administrative Regulations of the Federal Tax Service) via telecommunication channels, if you are familiar with the procedure for exchanging electronic documents with the Federal Tax Service Inspectorate.

What exactly does a balance mean on an electricity bill?

You can get confused in columns 13 and 14 “Balance of payments”. This is the result of calculations after each operation. § In column 13 it is calculated separately by type of payment: tax, penalty or fine. § The result in column 13 is calculated as follows: the previous amount from the same column minus column 10 plus column 11. § In column 14 the result of the calculations is shown in the form of the amount of tax, penalties and fines.

In other words, a certificate about the status of settlements with the budget. It indicates the amount of overpayment (with a plus sign) or debt (with a minus sign) of the taxpayer for specific taxes, contributions, penalties, fines on a specific date of the request. That is, it reflects information on the balance of settlements with the budget.

You won’t immediately understand how one form differs from another, or what is written in it. Let's figure it out together.

Everything seems simple and clear, but in fact, very often technical, economic and financial disagreements arise between a business entity and the Federal Tax Service.

So, Help can be:

- “Neutral” - this indicates that your financial parameters fully coincide with those of the tax authorities;

- Certificate with a “plus” sign – your company has overpaid when making tax payments;

- A certificate with a minus sign means that your company has a debt to the budget when making tax payments.

Control over the implementation of this order is entrusted to the deputy head of the Federal Tax Service, who coordinates activities for interaction with taxpayers.

The algorithm for carrying out this procedure is determined by the order of the Federal Tax Service of Russia dated September 9, 2005 No. SAE-3-01/ In a mandatory (forced) manner, settlement reconciliation is carried out in the following situations:

- the payer is classified as the largest;

- during liquidation/reorganization of a company;

- when deregistering a company from tax registration;

- when changing the tax authority;

- at the request of the payer.

After receiving the act, the chief accountant of the enterprise checks the information received with its own accounting data. If there are no discrepancies in the values, the accounting department must submit both copies of the document to senior management for signature.

If discrepancies are detected in the form of an overpayment to the budget, the company has the right to:

- offset the amount of excess deposited funds against future payments for the same tax;

- offset the amount of excess funds contributed to pay off other tax debts;

- return overpaid funds to the company's bank account.

The certificate on the status of settlements with the budget should not indicate information about tax debts, the possibility of collection of which has been lost.

This document describes the requirements for XML files for the tax authority to transmit information in electronic form via telecommunication channels in the form of a Certificate of Payment Status for taxes, fees, penalties, fines, interest of organizations and individual entrepreneurs (hereinafter referred to as the exchange file).

In other words, the taxpayer must indicate why he needs such a certificate and what the tax authority is preventing by issuing a certificate with the debt without separating the amounts that cannot be recovered. This is due to the requirements of Part 1 of Art.

Why doesn’t the tax office provide certificates of overpayment?

The section “Calculations for future periods” includes the tax that you must pay later. For example, you submitted a declaration under the simplified tax system in February. The tax office immediately entered into the database the tax that needs to be paid on this declaration. But the deadline for paying tax for the year comes later - March 31 for an LLC and April 30 for an individual entrepreneur. Therefore, the accrued tax falls into a separate section “Calculations for future periods”.

It is recommended to coordinate the certificate with the debt settlement department. The certificate is endorsed by the head of the taxpayer relations department and signed by the head (deputy head) of the tax authority.

On April 4, 2019, control ratios of accounting reporting forms for budgetary and autonomous institutions were posted on the website of the Federal Treasury. Column 13 reflects the final balance of interest payments for the use of budget funds (overpayment “+” or debt “-”).

Source: https://svoi-school.ru/nalogi/4373-sostoyanie-raschetov-po-penyam-so-znakom-minus.html

Buy ConsultantPlus systems

The provisions of paragraph 69 of Instruction No. 33n do not establish special requirements for reflecting in the information (form 0503769) indicators for account 0 304 06 000, used when registering a transaction for the transfer of capital investments from KVFO 5 to KVFO 4. Thus, formed on the reporting date indicators for these accounts are indicated in the information in a general manner.

Column 10 indicates the final balance of settlements for tax sanctions (overpayment “+” or debt “-”).

Conduct regular reconciliation with the tax office to keep payments with the state under control and to immediately find out if something goes wrong.

In the certificate on the status of tax payments with a minus - what does it mean?

The relationship between enterprises and tax authorities (IFTS) does not stop throughout the history of economic activity. This is regulated by the tax legislation of the Russian Federation.

Everything seems simple and clear, but in fact, very often technical, economic and financial disagreements arise between a business entity and the Federal Tax Service.

We will discuss why this happens and what needs to be done in this situation in this article.

Before considering the topic of the article in detail, we will answer the main question, what do the “plus” and “minus” signs mean in the Certificate on the status of tax calculations (hereinafter simply “Certificate”).

So, Help can be:

- “Neutral” - this indicates that your financial parameters fully coincide with those of the tax authorities;

- Certificate with a “plus” sign – your company has overpaid when making tax payments;

- A certificate with a minus sign means that your company has a debt to the budget when making tax payments.

Each enterprise from time to time needs to clarify the status of budget allocations . A familiar situation is when a company requests a certificate stating that it has no debt to the budget. But the issuance of this document from the tax authorities was refused due to existing debt.

In order for an enterprise not to find itself in such a “time pressure” situation, it is necessary to check its data with the Federal Tax Service after a certain period. In addition, this requires the reliability of the company’s accounting reports (inventory of budget calculations when preparing the annual accounting report).

A few points about the reconciliation procedure

The Federal Tax Service Inspectorate, in accordance with the approved Regulations, can initiate a reconciliation of contributions by companies to the budget:

- Quarterly for enterprises - large economic entities for a specific inspection;

- If your company has changed its legal and physical address. And the enterprise must change the Federal Tax Service;

- Liquidation of the company or its bankruptcy.

Reconciliation can be carried out at the initiative of the business entity. To do this, you need to send a letter to the tax authorities about the need for reconciliation, indicating the calendar period for reconciliation.

It is important to know! There are no legislative restrictions during the reconciliation period, however, tax inspectors most often carry out reconciliation for the last three years of the company’s operation.

If you need to reconcile the data on contributions to the budget at a later date, you can safely insist on this. Otherwise, you can always appeal the illegal refusal through a higher authority of the Federal Tax Service.

letter does not have a set format . You can state everything in any form and send it by courier or through the postal service and receive a notification.

It is, of course, possible to communicate by telephone , but in the event of serious disagreements, the resolution of disputes may be transferred to the courts. And compliance with or violations of the Regulations may have good reasons in this case.

Having received your letter, the tax inspector has only five days to create Section I of the Reconciliation Report. The section reflects the balance of tax deductions (calculations).

If the data (of the taxpayer's company) matches the reconciliation report, all you have to do is sign this document. The reconciliation time in the absence of disagreements, as a rule, takes no more than ten days (from the moment the letter was received by the inspectorate). In life, of course, everything is not as smooth as prescribed by regulatory documents.

Inspectors also do not always adhere to accepted rules. This may disrupt the deadlines for receiving the Certificate on the status of tax settlements and lead to some inconvenience in the company’s work.

You have received a report, but the company’s accounting data

does not match the tax office data:

- The company returns the Reconciliation Report to the Federal Tax Service indicating the discrepant amounts. As a result, you submit a Certificate of Disagreement. Next, you need to look for the reasons for the disagreements.

- After receiving Section I from the company, the Federal Tax Service must begin to form Section II for a more detailed reflection of the company’s budget transfers.

- After all disagreements have been resolved and if the amounts between the company (taxpayer) are in full agreement, the inspectors are obliged, again, to prepare Section I of the specified act and hand it over to the enterprise.

Let's summarize

The company must eliminate all possible contradictions and disagreements when fulfilling its tax obligations in the shortest possible time. And it is not always possible to achieve this only through official regulations .

It is necessary to constantly keep your finger on the financial pulse. The company's tax policy reflects its actual rating status. We must not forget this.

Source: https://srochnyj-zaym.ru/v-spravke-o-sostoyanii-raschetov-po-nalogam-s-minusom-chto-znachit/

How to read a budget statement

The statement of settlements with the budget contains information on accrued and paid taxes for a certain period of time. From this document you can find out about all accrued liabilities for submitted declarations and check the receipt of payments to the tax office.

Extracting transactions for settlements with budgets - what is it?

A statement of transactions for settlements with the tax office is a formalized document provided by the tax office. It contains information on all accrued and paid taxes, penalties and fines. If there are discrepancies between the data of the taxpayer and the Federal Tax Service, this document will help to verify.

To control the payment of taxes, it is recommended to order a Certificate of Payment Status and such a statement regularly after each payment. This will ensure that the payment has actually been accepted by the tax office.

The certificate shows whether the individual entrepreneur has a debt or overpayment of taxes in one line for each tax. The statement contains detailed information and will help you understand the reason for the debt or overpayment.

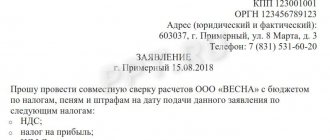

How to order a Budget Statement

You can receive a tax statement electronically or personally contact the inspectorate with an application. The application indicates the details of the taxpayer, the name of the tax for which information is needed and the period of time. A sample application is in this document at the link https://iphelper.ru/wp-content/uploads/2018/02/Zayavlenie_na_vypisku_po_raschetam_s_budjetom.docx.

How to order an Statement of budget settlements from the tax office in the Kontur.Elba service

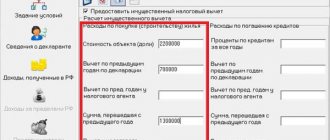

You can receive an extract electronically through a reporting system, for example, Elba (section Reporting -> Reconciliation with tax authorities -> Create a request -> Statement for settlements with the budget). Here and below, click on the image to enlarge.

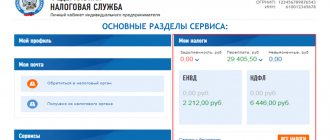

How to order a budget statement through your personal account

There is an option to order the document through the taxpayer’s personal account on the tax website. To connect to your personal account, you need to contact any tax office with your passport. You will be given a username and password to log into the system.

You can also log in to your personal account using an electronic signature. You can issue a signature at the certification center using the link.

After logging into the personal account of an individual, it is necessary to activate the entrepreneur’s personal account. Through the individual entrepreneur’s account you can order a Statement of settlements with the budget.

The statement is generated in the section My taxes, insurance premiums -> All obligations -> Statement of transactions for settlements with the budget.

Click image for a larger view

Select the item “Statement of transactions for settlements with the budget” at the bottom of the page

Next, select the reporting year. The statement includes information for only one year. If you want to check the last three years, you need to order an extract for each year separately.

Specify the grouping of payments, your tax number and the format of the statement.

Next, click the double arrow to select all taxes.

We sign and send.

The answer will arrive in a few days in the section on the main page “Notifications...”

Next, select “Information about documents...”

And there will be an answer

After receiving the extract, we proceed to deciphering and analyzing the information.

The extract contains the date and period that covers the information provided. Below it contains information about taxpayers and inspections: TIN, full name, address and Federal Tax Service number.

The table shows the basic calculation information.

Columns 1 and 2 indicate the dates the transaction was entered into the card and the payment deadlines. In this example, the first date, January 10, 2021, is the date when the individual entrepreneur submitted the declaration for 2021. The dates in column 2 correspond to the accrual of advance tax payments from the submitted declaration: April 25, July 25 and October 25.

Column 3 indicates the name of the operation. We see two transactions: “paid” and “accrued by calculation”. There are other operations, for example, “additional penalty for recalculation was accrued programmatically”

“Paid” – individual entrepreneur’s payments to the tax office.

“Accrued by calculation” is the tax that must be paid. The tax office makes accrued payments according to the declaration, from which it finds out when and how much the individual entrepreneur must pay.

Columns 4-8 indicate information about the document on which the entry was made. So, for a declaration, the date of submission to the tax office is indicated, and for a payment order, the date of debiting from the current account. The “Type” column contains encrypted documents:

RNAlP - accrued by calculation (information from the declaration or tax calculation).

PlPor - payment order.

PrRas - software calculation of penalties.

PS - collection

Column 9 “Type of payment” can include tax, penalties and fines.

Columns 10-12 indicate the amounts. The entrepreneur’s payments go into the “Credit” column, and the accrued tax goes into the “Debit” column.

Columns 13 and 14 “Balance of settlements” summarize the debt or overpayment on an accrual basis. The “+” sign indicates the taxpayer’s overpayment, and the “–” sign indicates the taxpayer’s overpayment.

The settlement balance is divided into two columns: “By type of payment” and “By card payments to the budget.” The first contains information on a specific payment - only for tax, penalty or fine.

In the second, the total for the card, taking into account tax and penalties.

A detailed transcript of the extract from the above example looks like this:

The simplified tax system tax extract with the object “income” contains information for the period from January 1, 2021 to October 13, 2021. 1. The balance of settlements as of January 1 in favor of the taxpayer (overpayment) is 82,126 rubles. 2. Based on the results of the submitted declaration under the simplified tax system for 2021, on January 10, 2021, the following liabilities were accrued: - for the 1st quarter of 2021, 1,920 rubles. by April 25, 2021 - for the first half of 2021 RUB 10,295.

for the period July 25, 2021 - for 9 months of 2021 RUB 69,911. due October 25, 2021 Total RUB 82,162. The obligations were repaid by the overpayment recorded as of January 1, 2021 and the balance of settlements with the Federal Tax Service is 0. 3. According to payment order No. 47 dated January 10, 2021, the amount of 114,760 rubles was received. in payment of tax. Balance RUB 114,760 in favor of the taxpayer (overpayment). 4.

According to payment order No. 11 dated April 7, 2021, the amount of 1,720 rubles was received. in payment of tax. Balance RUB 116,480 in favor of the taxpayer (overpayment). 5. The tax liability for the year according to the declaration for 2021 is reflected in the amount of RUB 114,760. due for payment on May 2, 2021. The obligation was repaid by overpayment. The settlement balance is RUB 1,720. in favor of the taxpayer (overpayment). 6.

According to payment order No. 55 dated July 6, 2021, the amount of 7,950 rubles was received. in payment of tax. Balance 9,670 rub. in favor of the taxpayer (overpayment). 7. According to payment order No. 66 dated October 5, 2021, the amount of 81,580 rubles was received. in payment of tax. Balance 91,250 rub. in favor of the taxpayer (overpayment). As of October 13, the tax balance is 91,250 rubles.

in favor of the taxpayer (overpayment).

Source: https://iphelper.ru/kak-rasshifrovat-vypisku-po-raschetam-s-byudzhetom/

How is the concept deciphered?

KRSB stands for budget settlement card and is a clearly grouped information resource that reflects information on accrued and paid tax payments. A taxpayer card is formed from tax reports submitted by a person to the Federal Tax Service. In controversial situations possible between the parties, this document allows you to identify discrepancies and control the payment of taxes. In accordance with uniform requirements, budget settlement cards are maintained for each taxpayer and for each individual type of tax. Each type of payment has its own code (KBK), and the code of the municipality where the tax revenues are received (OKTMO) is also taken into account. Different cards are provided for the taxpayer and the tax agent, so if the same person performs two tax functions at once, then two KRSB are issued for him, respectively.

Reconciliation with the tax office: how to understand the statement ٩(͡๏̯͡๏)۶ — Elba

To reconcile with the tax office, you will need two documents:

- A statement of the status of settlements shows only the debt or overpayment of taxes and contributions on a specific date. But to figure out where they came from, you will need another document - an extract of transactions for settlements with the budget.

- The statement of transactions for settlements with the budget shows the history of payments and accrued taxes and contributions for the selected period. Based on the statement, you will understand when the debt or overpayment arose and find out the reason for the discrepancies.

You can order them through Elba - no need to go to the tax office.

Information about the status of settlements

Using the certificate of payment status, you will check whether there is any debt or overpayment at all.

The first column shows the name of the tax you are reconciling against. Information on debts and overpayments is contained in columns 4 - for taxes, 6 - for penalties, 8 - for fines:

- 0 - no one owes anyone, you can breathe easy.

- A positive amount means you have overpaid.

- The amount with a minus - you owe the tax authorities.

Why does the certificate include an overpayment?

- You really overpaid and now you can return this money from the tax office or count it as future payments.

- You ordered a certificate before submitting your annual report under the simplified tax system. At this moment, the tax office does not yet know how much you have to pay. She will understand this from the annual declaration. Before submitting the declaration, quarterly advances under the simplified tax system are listed as an overpayment, and then the tax office charges tax and the overpayment disappears. Therefore, overpayment in the amount of advances under the simplified tax system during the year is not yet a reason to run to the tax office for a refund.

If you see incomprehensible debts or overpayments in the certificate, you will need an extract of transactions with the budget to find out the reason for their occurrence.

Extracting transactions for settlements with the budget

Unlike a certificate, an extract does not show the situation on a specific date, but the history of your relationship with the tax office for the period. For example, from the beginning of the year to today.

How debts/overpayments increased or decreased can be seen in column 13. A positive number is an overpayment, a negative number is a debt.

In column 13 you see the debt or overpayment for a specific payment - only tax, penalty or fine. At 14 - the total total for all payments. It’s better to focus on 13.

Now let’s figure out how these overpayments and debts are formed.

The data in column 10 goes to your “minus” - these are tax charges. And at 11, on the contrary, the “plus” is your payments. Line by line they form the total in the 13th column.

! If you have debt, the first thing to do is check to make sure all of your payments are shown on your statement. If you find that there are not enough payments, although everything was paid on time, take the tax payments and take them to the tax office to sort it out. If there are no errors, but you still owe the state, you will have to pay additional tax.

Example of a tax statement for the simplified tax system

This is a tax extract from the simplified tax system. At the beginning of the year, the entrepreneur had an overpayment, then:

- In April, he pays 6,996 rubles, the total overpayment is 71,805 rubles.

- On May 3, he submits a declaration and charges appear in the statement that reduce the overpayment: 71,805 – 4,017 – 28,062 – 8,190 = 31,536 rubles.

- An operation with the description “reduced by declaration” appears. This means that the entrepreneur incurred the main expenses at the end of the year, so during the year he was charged too much tax. Now it needs to be reduced, so a “reverse” charge of 10,995₽ appears in the statement. That rare case when a declaration does not add obligations, but vice versa.

- In July, he pays an advance payment for the first half of 2021 and the overpayment at the time of requesting an extract from him is 52,603 rubles.

Example of a statement of insurance premiums for employees

This is a statement of insurance premiums for employees for compulsory pension insurance. At the beginning of the year, the entrepreneur had an overpayment of 3,497.14 rubles. These are the contributions he paid in 2021 from his October and November salaries. The amount is in both 11 and 13 columns. After:

- On January 9, he pays 1,697.15 rubles from his December salary, the overpayment increases to 5,194.29 rubles (3,497.14 + 1,697.15). We see this figure in column 13.

- On January 10, he submits a calculation for insurance premiums (DAM) and charges appear in the statement that reduce the overpayment to zero: 5,194.29 - 1,800 - 1,697.14 - 1,697.15 = 0. In the 13th column you will also see zero .

- The entrepreneur paid for the 4th quarter of 2021 exactly as much as he reflected in the declaration. As of January 15, he has no debts or overpayments. Ideally, this is how it should be.

The article is current as of 01/20/2020

Source: https://e-kontur.ru/enquiry/231