The authorized capital has been formed and declared - what posting is necessary?

Commercial legal entities (PJSC, JSC, LLC, business partnerships, state unitary enterprises, municipal unitary enterprises) are created with the mandatory formation of an authorized capital (MC).

The size of the management company, the share of participation in it of each of the founders, payment terms, form of contributions and assessment of non-monetary contributions are stipulated in the constituent agreement. The authorized capital is the starting amount of funds with which a legal entity begins its activities. After completion of all activities for making contributions to the authorized capital, postings begin with the corresponding entry made on the date of its registration. It should reflect the accrual of the full amount of the capital provided for by the charter, in correspondence with the debt of the founders on contributions to it: Dt 75 - Kt 80.

Analytics on account 80 (accounting capital account) is organized according to:

- founders (participants);

- stages of formation (in PJSC, JSC and business partnerships);

- types of shares (in PJSC and JSC).

Account 75 is the account for settlements with the founders. The debit balance of its subaccount, reserved for settlements of contributions to the capital account, will show the amount of the unpaid capital account.

For information on how the capital account will be reflected in accounting, read the article “Procedure for drawing up a balance sheet (example)” .

ConsultantPlus experts explained in detail how the authorized capital is paid. If you have an LLC, this Ready Solution will help you. If AO, this material is for you. If you do not have access to the K+ legal reference system, get a trial demo access for a while. It's free.

Increasing the authorized capital of a joint-stock company due to additional contributions from participants (shareholders)

1. An operation to increase the authorized capital by issuing additional shares.

- Accounting

To summarize information about the state and movement of the authorized capital of a joint-stock company, the Chart of Accounts and the Instructions for its application are intended to account 80 “Authorized capital”.

Entries on it are made in cases of formation of the authorized capital and its increase and decrease only after making appropriate changes to the constituent documents of the organization and their state registration. Sub-accounts and analytical accounts are opened for account 80 in order to ensure recording of information on the founders of the company, types of shares and stages of formation of the authorized capital.

To account for settlements with founders, account 75 “Settlements with founders” is provided. Analytical accounting for it is carried out for each founder, except for accounting for settlements with shareholders - owners of bearer shares.

- Income tax

Income of shareholders - legal entities in the form of the value of additionally received shares, distributed among shareholders by decision of the general meeting in proportion to the number of shares owned by them, or the difference between the par value of new shares received in exchange for the initial shares of the shareholder when distributing shares among shareholders in the event of an increase in the authorized capital of the JSC ( without changing the shareholder's share of participation in this joint-stock company), are not taken into account when determining the tax base for income tax (clause 15, clause 1, article 251 of the Tax Code of the Russian Federation). Example 1

The authorized capital of a joint-stock company is RUB 3,500,000. and consists of 100 ordinary shares with a par value of RUB 3,500. each. To attract additional funds, the board of directors decided to increase the authorized capital by 500,000 rubles.

The following entries will be made in the company's accounting records:

Debit 75, subaccount 1 “Calculations for contributions to the authorized capital”, Credit 80, subaccount 1 “Declared capital” - 500,000 rubles. — the debt of the founders for contributions to the authorized capital after state registration of changes in the constituent documents is reflected;

Debit 80, subaccount 1 “Declared capital”, Credit 80, subaccount 2 “Subscribed capital” - 500,000 rubles. — the results of subscription to shares are reflected;

Debit 51 “Current account”, Credit 75, subaccount 1 “Calculations for contributions to the authorized capital” - 500,000 rubles. — funds were received into the current account in payment for additionally placed shares;

Debit 80, subaccount 2 “Subscribed capital”, Credit 80, subaccount 3 “Paid-up capital” - 500,000 rubles. — reflects the amount of paid-in capital.

2. Operations to increase the authorized capital of an LLC through additional contributions in cash and fixed assets.

- Accounting

An increase in the authorized capital of the company is reflected in the organization’s accounting by the debit of account 75 “Settlements with founders”, subaccount 1 “Settlements for contributions to the authorized (share) capital” and the credit of account 80. Receipt of cash and material assets as payment for a contribution to the capital company is shown by the debit of accounts for accounting for cash and material assets and the credit of account 75, subaccount 1.

Cash and fixed assets received as a contribution to the authorized capital are not recognized as income for accounting purposes (clause 2 of the Accounting Regulations “Income of the Organization” ( PBU 9/99), approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 32n).

Fixed assets are accepted for accounting at their original cost (clause 7 of the Accounting Regulations “Accounting for Fixed Assets” (PBU 6/01), approved by Order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n).

The initial cost of fixed assets contributed to the contribution to the authorized (share) capital is recognized as their monetary value, agreed upon by the founders (participants) of the organization (clause 9 of PBU 6/01).

The amount of VAT recovered by the participant upon transfer of fixed assets and indicated in the documents documenting the transfer of the contribution to the authorized capital is applied to the increase in additional capital (letter of the Ministry of Finance of Russia dated December 19, 2006 No. 07-05-06/302, Federal Tax Service of Russia for the city Moscow dated July 4, 2007, No. 19–11/063175).

- Value added tax

The transfer of property as a contribution to the authorized capital is not recognized as a sale and is not subject to VAT (clause 4, clause 3, article 39, clause 1, clause 2, article 146 of the Tax Code of the Russian Federation).

When transferring a fixed asset as a contribution to the management company, a company participant is obliged to restore the amount of VAT previously accepted by him for deduction on this fixed asset, in proportion to its residual (book) value without taking into account revaluation (clause 1, clause 3, article 170 of the Tax Code of the Russian Federation ). The specified amount of VAT is subject to tax deduction from the organization accepting the contribution to the authorized capital, provided that this fixed asset is registered and used for carrying out operations recognized as objects of VAT taxation (paragraph 3, paragraph 1, paragraph 3, Article 170, p. 11 Article 171, paragraph 8 Article 172 of the Tax Code of the Russian Federation).

An invoice for the deduction is not required, and the documents used to document the transfer of property are registered in the purchase book (clause 14 of the Rules for maintaining the purchase book used in calculations of value added tax, approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137) .

- Corporate income tax

Cash and fixed assets received as a contribution to the management company, as well as the amount of VAT transferred by the participant and subject to deduction from the receiving organization, are not recognized as its income (clauses 3, 3.1, clause 1, Article 251 of the Tax Code of the Russian Federation).

A fixed asset received as a contribution to the authorized capital is depreciable property and is taken into account at its residual value, which is determined according to the tax accounting data of the transferring party on the date of transfer of ownership of this fixed asset (clause 1 of article 256, clause 1 Article 277 of the Tax Code of the Russian Federation).

Example 2

The authorized capital of an LLC increases by 1,000,000 rubles. due to additional contributions from participants. As a contribution to the management company, the first participant (legal entity) transfers a fixed asset, the monetary value of which, agreed upon by the participants and confirmed by an independent appraiser, is 500,000 rubles, the second participant (individual) contributes funds in the amount of 500,000 rubles. The share of each participant is 50% of the authorized capital. The nominal value of each participant's share increases by the amount of his additional contribution (500,000 rubles). According to accounting and tax accounting data, the residual value of the fixed asset of the transferring party is 500,000 rubles. The amount of VAT recovered by the participant upon transfer of fixed assets is RUB 90,000. This amount is not recognized as a contribution to the authorized capital of the LLC. The organization uses the accrual method for profit tax purposes.

In the accounting of the organization, the increase in the authorized capital due to additional contributions of participants (contributed in cash and transfer of fixed assets) must be reflected as follows (Table 1).

| Table 1. Accounting for an increase in authorized capital in an LLC due to additional contributions from participants | ||||

| Debit | Credit | Amount, rub. | Primary document | Contents of operations |

| 08 | 75–1 | 500 000 | Decision of the general meeting of company participants, act of acceptance and transfer of fixed assets | Fixed asset received from the first participant as a contribution to the management company |

| 19–1 | 83 | 90 000 | Certificate of acceptance and transfer of fixed assets | The amount of VAT recovered by the participant upon transfer of fixed assets is reflected |

| 50 | 75–1 | 500 000 | Decision of the general meeting of company participants, cash receipt order | Received funds from the second participant as a contribution to the management company |

| 01 | 08 | 500 000 | Certificate of acceptance and transfer of fixed assets | Fixed asset accepted for accounting |

| 68-VAT | 19–1 | 90 000 | Certificate of acceptance and transfer of fixed assets | The amount of VAT recovered by the participant upon transfer of fixed assets is accepted for deduction |

| 75–1 | 80 | 1 000 000 | Documents confirming state registration of changes in constituent documents | The authorized capital has been increased (RUB 500,000 x 2) |

- Increasing the authorized capital at the expense of the organization’s property

It is possible to increase the authorized capital at the expense of the specified source only on the condition that the amount by which the capital is increased at the expense of the company’s property should not exceed the difference between the value of net assets and the amount of the authorized and reserve capital (fund) of the company (paragraph 2, clause 5, art. 28 of Law No. 208-FZ, paragraph 2 of Article 18 of Law No. 14-FZ).

- Increasing the authorized capital due to:

Additional capital funds are reflected by the entry: Debit 83 “Additional capital”, Credit 80 “Authorized capital”; retained earnings - Debit 84 “Retained earnings (uncovered loss)”, Credit 80 “Authorized capital”.

- Corporate income tax

Based on clause 15 of Art. 251 of the Tax Code of the Russian Federation, for a shareholder who is a legal entity, income not taken into account when determining the tax base for income tax includes the cost of additionally received shares distributed among shareholders with an increase in the authorized capital (or, accordingly, an increase in the par value of shares owned by the organization). In this case, it does not matter from what source the authorized capital was increased: from additional capital or retained earnings, etc. Example 3

The general meeting of LLC participants decided to increase the authorized capital by 500,000 rubles.

by increasing the nominal share of participants using part of the retained earnings of the previous year. Registration of changes in the charter was made on October 25, 2016. On this date, the following entry must be made in the LLC’s accounting: Debit 84, Credit 80 - 500,000 rubles. (CC increased). Example 4

At the meeting of shareholders on November 25, 2016, a decision was made to increase the authorized capital of the joint-stock company in the amount of 6,000,000 rubles. by increasing the nominal value of shares using additional capital. At the time of the decision, the share premium was RUB 7,800,000. Registration of changes in the charter was made on December 5, 2016. On this date, the following entry must be made in the organization’s accounting records: Debit 83, Credit 80 - 6,000,000 rubles. (CC increased).

Contribution to the capital of another organization from its founder

A commercial legal entity can be created by both individuals and organizations. At the same time, foreigners may be present among both.

By participating in the creation of a legal entity, the founder assumes obligations to pay for the contribution to its management company, in return acquiring the right to part or all (depending on the share of participation) of the property of this legal entity and to receive income from participation in its activities. There is a peculiarity here: when posting, the authorized capital must be reflected both for the founder and for the company receiving the contribution.

On the date of registration of the newly created organization, the founder - a legal entity registered in the Russian Federation, in its accounting shows the debt for the amount of the contribution to the capital specified in the founding agreement, which for it is a financial investment: Dt 58 - Kt 76. Credit balance on the subaccount of account 76, allocated for calculations of contributions to the management company, will show the amount of the management company unpaid by the founder.

The legislation allows payments to the management company both in money and in property or property rights. On the date of making the contribution (the full amount or part thereof), both the founder and the legal entity established by him are repaid the corresponding part of the existing debt.

Accounting for authorized capital and settlements with founders (account 80 and 75)

But that is not all. The formation of authorized capital is a business transaction, and for each operation we must carry out accounting entries using the double entry principle. Details on how to make postings are written here. In short, from the Chart of Accounts you need to select two accounts involved in the business transaction associated with the formation of the authorized capital, and make a simultaneous entry for the debit of one and the credit of the other. Now you have gone through the procedure of registering an LLC, you have in your hands documents confirming the registration of your company. What to do next? In addition to the fact that you will begin to actively engage in entrepreneurial activity, you also need to keep accounting records for the enterprise, and subsequently calculate and pay taxes, fill out and submit reports. Taxes and reporting are still a long way off; first you just need to properly organize accounting at your enterprise. It doesn’t matter who will organize this, you or a hired accountant, the main thing is that the records are kept correctly and without errors.

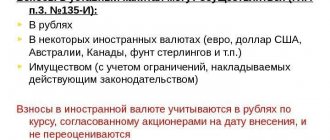

Authorized capital – depositing funds into the current account and cash register

The easiest way to make a deposit is to pay it in money: to a current account or to a cash desk. For foreign participants, payment to a foreign currency account is acceptable.

Postings for contributions to the authorized capital in cash will be as follows:

- at the payee: Dt 50 (51, 52) – Kt 75;

- for the Russian founder: Dt 76 – Kt 50 (51).

Find out how to determine the amount of authorized capital in ConsultantPlus. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Authorized capital of a limited liability company

Based on Art.

14 of the Federal Law of February 8, 1998 No. 14-FZ “On Limited Liability Companies” (hereinafter referred to as Law No. 14-FZ), the authorized capital of an LLC is made up of the nominal value of the shares of its participants. The size of the company's authorized capital must be at least 10,000 rubles. The size of the authorized capital and the nominal value of the shares of LLC participants are determined in rubles. Each founder of the company must pay in full his share in the authorized capital within the period determined by the agreement on the establishment of the company, or in the case of the establishment of the company by one person, by the decision on the establishment of the company. The period for such payment should not exceed four months from the date of state registration of the company. In this case, the share of each LLC founder can be paid at a price not lower than its nominal value (Article 16 of Law No. 14-FZ).

It is not permitted to release the founder of a company from the obligation to pay for a share in its authorized capital.

In case of incomplete payment of the share in the authorized capital within the period determined in accordance with clause 1 of Art. 16 of Law No. 14-FZ, the unpaid part of the share passes to the company. This part of the LLC’s share must be sold in the manner and within the time limits established by Art. 24 of Law No. 14-FZ.

An increase in the authorized capital of a company can be achieved at the expense of the company’s property, and (or) at the expense of additional contributions of the company’s participants, and (or) if this is not prohibited by its charter, at the expense of contributions from third parties accepted into the company (Article 17 of Law No. 14 -FZ).

The fact of the decision of the general meeting of participants to increase the authorized capital and the composition of the company’s participants present when making this decision must be confirmed by notarization (clause 3 of Article 17 of Law No. 14-FZ).

Contribution of property

Any type of property and rights to it can be transferred to the deposit: fixed assets, intangible assets, inventories, securities, debt on borrowed funds. The parties transfer the property contributed to the management company at the value agreed upon by them in the constituent agreement. At this value, the contribution is taken into account in accounting. For a contribution to the authorized capital formed in this way, entries are made to the recipient at the cost reflected by the founder. The founder, when forming the amount of the contribution made to the management company, adjusts the actual value of the property to the value agreed upon at the expense of other income and expenses (account 91). Regardless of the cost, records of property received by a legal entity are kept as part of the same type to which it belonged to the founder.

If the transferred property was subject to VAT upon acquisition, and it was presented to the budget, then the founder shall restore the tax either in full or in proportion to its residual value (for depreciable property). Recovered VAT is included in the deposit amount and is indicated in the transfer documents. The transferring party pays it to the budget, and the receiving party can take it as deductions.

The contribution to the authorized capital formed by the property is accompanied by the following transactions:

- For the receiving party:

Dt 07 (08, 10, 11, 21, 41, 58, 66, 67) – Kt 75 - property received;

Dt 19 - Kt 75 - accepted for VAT accounting on it.

- From the founder:

Dt 02 (05) – Kt 01 (04) - the residual value of the disposed depreciable property is formed;

Dt 76 – Kt 01 (04, 10, 11, 21, 41, 58) - property transferred;

Dt 76 - Kt 68 - VAT on transferred property has been restored;

Dt 76 - Kt 91 (or Dt 91 - Kt 76) - the value of the transferred property has been brought to the agreed value.

If you have access to ConsultantPlus, check whether you have correctly reflected the contribution to the management company with property. If you don't have access, get a free trial of online legal access.

Increasing the authorized capital through contributions to the authorized capital of the property of third parties

The authorized capital of an LLC can be increased at the expense of contributions from third parties accepted into the company (Clause 2, Article 17 of Law No. 14-FZ).

The procedure for such an increase is established in Art. 19 of Law No. 14-FZ.

The general meeting of LLC participants may decide to increase the capital capital on the basis of an application from a third party to accept him into the company and make a contribution (paragraph 1, paragraph 2, article 19 of Law No. 14-FZ). Simultaneously with this decision, decisions must be made on accepting the specified person into the company, making changes to the LLC charter in connection with an increase in the authorized capital, determining the nominal value and size of the third party’s share, as well as changing the size of the shares of the company’s participants. At the same time, the nominal value of the share that is acquired by each third person admitted to the company should not be greater than the value of his contribution (paragraph 3, paragraph 2, article 19 of Law No. 14-FZ).

The contribution must be made by a third party within 6 months from the date of adoption of these decisions (paragraph 5, paragraph 2, article 19 of Law No. 14-FZ).

Shares in the authorized capital of an LLC can be paid for, among other things, in cash (Clause 1, Article 15 of Law No. 14-FZ).

If the nominal value of a company participant’s share in its authorized capital, paid in kind, is more than 20,000 rubles, an independent appraiser must be involved in order to determine the value of this property. The nominal value of the share paid for with such non-monetary funds cannot exceed the amount of the valuation of the specified property, determined by an independent appraiser (paragraph 2, paragraph 2, article 15 of Law No. 14-FZ).

According to paragraphs 1, 2, paragraph 4 of Art. 12, art. 13 of Law No. 14-FZ, changes to the charter of an LLC are made by decision of the general meeting of company participants and are subject to state registration, which is carried out on the basis of a corresponding application from the company in the manner prescribed by Art. 17, 18, 19 of the Federal Law of August 8, 2001 No. 129-FZ “On state registration of legal entities and individual entrepreneurs.”

The specified application and other documents for state registration of changes in connection with the increase in the authorized capital of the company, the admission of a third party to the LLC, the determination of the nominal value and size of the share of this person and the change in the size of the shares of the LLC participants, as well as documents confirming the full contribution of the third party , must be submitted to the Federal Tax Service of Russia within a month from the date of making the contribution by a third party on the basis of his application (clause 2.1 of article 19 of Law No. 14-FZ, clause 1 of the Regulations on the Federal Tax Service, approved by Decree of the Government of the Russian Federation dated September 30, 2004 No. 506).

- Accounting

An increase in the company’s capital due to the contribution of a third party is reflected in the accounting records by debiting account 75, subaccount 1 “Calculations for contributions to the authorized (share) capital”, and by crediting account 80. Receipt of cash and material assets as payment for contributions to the authorized capital of the organization is shown in the debit of accounts for accounting for cash and material assets and the credit of account 75, subaccount 1. If the deposit amount exceeds the nominal value of the share, then the difference is reflected in the debit of account 75, subaccount 1, and the credit of account 83 “Additional capital”.

- Value added tax

The transfer of property as a contribution to the authorized capital is not recognized as a sale and is not subject to VAT (clause 4, clause 3, article 39, clause 1, clause 2, article 146 of the Tax Code of the Russian Federation).

When transferring a fixed asset as a contribution to the authorized capital, a company participant is obliged to restore the amount of VAT previously accepted by him for deduction on this fixed asset in proportion to its residual (book) value without taking into account revaluation (clause 1, clause 3, Article 170 of the Tax Code RF).

The amount of VAT restored for payment to the budget is indicated in the documents that formalize the transfer of fixed assets. This amount of VAT is subject to tax deduction from the organization accepting the contribution to the authorized capital, provided that this fixed asset is registered and used for carrying out operations recognized as objects of VAT taxation (paragraph 3, paragraph 1, paragraph 3, Article 170, p. 11 Article 171, paragraph 8 Article 172 of the Tax Code of the Russian Federation).

An invoice for the deduction is not required, and the documents used to document the transfer of property are registered in the purchase book (clause 14 of the Rules for maintaining the purchase book used in calculations of value added tax, approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137) .

- Corporate income tax

The amount of the contribution to the authorized capital of the company, regardless of the payment method, is not included in income for the purposes of calculating the tax base (clause 3, clause 1, Article 251 of the Tax Code of the Russian Federation). Example 5

Based on the decision of the general meeting of founders, the LLC increases its authorized capital through the contribution of a third party in the amount of 150,000 rubles. As payment for the deposit, a third party transferred funds to the organization’s current account. In accounting, the operation to increase the authorized capital at the expense of the specified source must be reflected as follows (Table 2).

| Table 2. Accounting for an increase in authorized capital in an LLC due to the contribution of a third party | ||||

| Debit | Credit | Amount, rub. | Primary document | Contents of operations |

| 51 | 75–1 | 150 000 | Resolution of the general meeting of company participants, bank statement on the current account | Received funds from a third party to pay for a deposit in the management company |

| 75–1 | 80 | 150 000 | Registered changes made to the constituent document | The authorized capital was increased due to the contribution of a third party |

Example 6

(the contribution of a third party to the authorized capital exceeds the nominal value of the share). The participants of the company are two legal entities, each of which owns a 50% share of the authorized capital. The authorized capital before the increase is 300,000 rubles. The nominal value of the share acquired by a third party, agreed upon by the participants, is 200,000 rubles. According to the accounting and tax records of the transferring party, the residual value of the fixed asset is 250,000 rubles. The cost of the fixed asset contributed to pay for the share by a third party, according to an independent appraiser, is 250,000 rubles. The LLC charter does not prohibit the admission of third parties into the company. The amount of VAT recovered by the participant upon transfer of fixed assets is equal to 45,000 rubles. This amount is not recognized as a contribution to the authorized capital of the LLC.

Based on an application from a third party (legal) to accept him into the company and make a contribution, if a fixed asset is made as a contribution, the increase in the authorized capital must be reflected in the LLC’s accounting as follows (Table 3).

| Table 3. Accounting for an increase in authorized capital in an LLC if the contribution is made by a third party as OS and exceeds the nominal value of the share | ||||

| Debit | Credit | Amount, rub. | Primary document | Contents of operations |

| On the date of receipt of the fixed asset | ||||

| 08 | 75–1 | 250 000 | Decision of the general meeting of company participants, act of acceptance and transfer of fixed assets | Fixed asset was received as a contribution to equity capital from a third party |

| 19 | 83 | 45 000 | Certificate of acceptance and transfer of fixed assets | The restored amount of VAT not included in the management company is reflected when transferring the fixed asset to the management company |

| 01 | 08 | 250 000 | Certificate of acceptance and transfer of fixed assets | Fixed asset accepted for accounting |

| 19 | 68-VAT | 45 000 | Certificate of acceptance and transfer of fixed assets | The restored amount of VAT upon transfer of fixed assets to the management company is accepted for deduction |

| As of the date of registration of changes in the LLC charter | ||||

| 75–1 | 80 | 200 000 | Certificate of state registration of changes in constituent documents | Authorized capital increased |

| 75–1 | 83 | 50 000 | Accounting certificate-calculation | The amount of excess of the value of the deposit over the nominal value of the share (250,000 rubles - 200,000 rubles) was allocated to additional capital. |

Example 7

(the monetary contribution of a third party to the authorized capital exceeds the nominal value of the share). The LLC charter does not prohibit the admission of third parties into the company. The authorized capital of the company before the increase is 100,000 rubles. The contribution of a third party is equal to 250,000 rubles, the nominal value of the share of this participant is 150,000 rubles.

In the accounting of LLCs, the increase in the authorized capital must be reflected as follows (Table 4).

| Table 4. Accounting for an increase in authorized capital in an LLC if the monetary contribution of a third party exceeds the nominal value of the share | ||||

| Debit | Credit | Amount, rub. | Primary Document | Contents of operations |

| 51 | 75–1 | 250 000 | Resolution of the general meeting of company participants, bank statement on the current account | Received funds from a third party |

| 75–1 | 80 | 150 000 | Certificate of state registration of changes in | |

| 75–1 | 83 | 100 000 | Accounting certificate-calculation | Reflected as additional capital is the amount of excess of the contribution received over the nominal value of the third party’s share in the authorized capital (250,000 rubles - 150,000 rubles) |

Increase in capital: contribution in cash or property

The legislation allows for an increase in the capital capital by decision of its founders (participants) if the following conditions are met:

- the PJSC or JSC has registered an additional issue or conversion of shares in the SBRFR and the Federal Tax Service;

- not only the initial charter capital is fully paid, but also the part by which the increase occurs.

Sources of increase in capital can be:

- retained earnings of a legal entity or its additional capital - in this case, additional payments from the founders (participants) will not be required;

- funds of participants: one, if it is accepted additionally, single or several, if they increase the share of their participation, or all, if the increase in share occurs due to a proportional increase in existing shares or par value of shares.

The procedure for accounting for the accrual and payment of additional contributions to the capital company when it increases is absolutely the same as that used when creating a legal entity. The founders (participants) determine the amounts, form and terms of payment in their decision. Entries for the accrual of obligations are made on the date of the decision to increase the capital and on the date of registration of changes in the charter, and entries for payment - on the actual date of transfer of funds or transfer of property (property rights).

Read about the nuances of taxation of contributions to a management company in the material “ List of income not taken into account when establishing the size of the profit base in accordance with Art. 251 Tax Code of the Russian Federation " .

Authorized capital of a joint stock company

According to Art.

99 of the Civil Code of the Russian Federation, the authorized capital of a joint-stock company (JSC) is made up of the par value of the company's shares acquired by shareholders. It is not permitted to release a shareholder from the obligation to pay for the company's shares. In accordance with Art. 34 of the Federal Law of December 26, 1995 No. 208-FZ “On Joint-Stock Companies” (hereinafter referred to as Law No. 208-FZ), payment for shares distributed among the founders of the company upon its establishment, additional shares placed by subscription, can be made in money, valuable papers, other things or property rights or other rights that have a monetary value. The form of payment for shares is determined by the agreement on the creation of the company, additional shares - by the decision on their placement.

It is not possible to carry out an open subscription for the company's shares until the authorized capital is paid in full.

When establishing a JSC, all its shares must be distributed among the founders.

The increase in the authorized capital of a joint-stock company is regulated by the provisions of Art. 100 of the Civil Code of the Russian Federation and Law No. 208-FZ.

A JSC has the right to increase its authorized capital by increasing the par value of shares or issuing additional shares. An increase in the capital of a joint-stock company is allowed after full payment (Article 100 of the Civil Code of the Russian Federation, Article 28 of Law No. 208-FZ).

An increase in the authorized capital by placing additional shares can be carried out at the expense of the company's property. An increase in the authorized capital by increasing the par value of shares is carried out only at the expense of the company’s property (clauses 1 and 5 of Article 28 of Law No. 208-FZ).

Amendments and additions to the company's charter, including changes related to an increase in the authorized capital, are carried out based on the results of the placement of shares on the basis of a decision of the general meeting of shareholders to increase the authorized capital of the company or a decision of the board of directors (supervisory board) of the company, if in accordance with the charter of the company, the latter has the right to make such a decision (clause 2 of article 12 of Law No. 208-FZ).

Changes and additions made to the company's charter are subject to state registration in the manner prescribed by Art. 13 of Law No. 208-FZ.

Authorized capital: purpose, postings, features of reflection in accounting

To carry out the subsequent activities of the enterprise, its founders form start-up capital in the form of their contributions. These may include inventories, securities, non-current assets, money and others. The size of the dividends received depends on the size of their deposits. In addition, the formed capital acts as a kind of guarantor for the credit obligations of the enterprise. Its size can either increase or decrease according to the decision of its founders:

- Limited liability companies (LLC) – RUB 10,000.00.

- Closed joint stock companies – 100 times the minimum wage for the corresponding year. This indicator is constantly indexed (prescribed in the budget of the corresponding year).

- Open joint stock companies – 1000 minimum wages.

- Municipal enterprises – 1000 minimum wages.

- State enterprises – 1000 minimum wages.

22 Dec 2021 marketur 592

Share this post

- Related Posts

- The contract for the maintenance of gas equipment in an apartment building for what period is it concluded?

- Is the income tax benefit for children carried over to the next year?

- Deadlines for payment of UTII tax in 2021

- Is it possible to drive a non-customs cleared car in Russia?