Every company carries out tax reconciliations from time to time. On the one hand, this procedure is familiar to accountants. On the other hand, reconciliation must be carried out carefully and step by step so as not to return to it again and again. Considering that tax authorities are constantly making changes to the reconciliation procedure, it is difficult for an accountant to predict its result and timing in advance. And this can be difficult to explain to the director if he himself has never personally communicated with the Federal Tax Service.

The algorithm from the berator is the best cheat sheet that will help you complete the reconciliation while spending a minimum of time on it.

Berator Practical encyclopedia of accountant

Algorithm. Reconciliation of settlements with the tax office

We learn to draw up a statement of reconciliation of calculations (1C: Accounting 8.3, edition 3.0)

Lessons on 1C Accounting 8 >> Trade

2016-12-08T13:37:38+00:00

| Is the article outdated and in need of revision? |

In this lesson we will learn how to correctly draw up a statement of reconciliation of mutual settlements with a counterparty for 1C: Accounting 8.3 (edition 3.0).

Situation. We have long-term cooperation with our counterparty Prodmarket LLC. The food market supplies us with some goods, and we provide it with some services.

Once a quarter, we draw up reconciliation acts for mutual settlements in order to avoid accounting errors, as well as to legally fix the debt to each other, because the act certified by both parties can be used in court.

On October 10, we decided to draw up a reconciliation report for the 3rd quarter. Thus, we initiated the preparation of an act of reconciliation of mutual settlements with the counterparty.

According to our data (analysis of accounts 60, 62, 66, 67, 76), at the beginning of the 3rd quarter we had no debt to each other.

Then:

- On September 2, we received goods from the food market in the amount of 4,000 rubles.

- On September 3, we paid 4,000 rubles from the cash register to the food market for goods.

- On September 24, we provided services to the food market in the amount of 2,500 rubles.

Thus, according to our data,

at the end of the 3rd quarter, the food market owes us 2,500 rubles .

How to apply for reconciliation

To perform a reconciliation, you must submit an application either in paper or electronic form.

You can submit an application:

- to the Federal Tax Service Inspectorate in person - if the application is not submitted by the director himself, a power of attorney is required;

- through the MFC - if the application is not submitted by the director himself, a power of attorney is required;

- send by mail - preferably by registered mail with a list of the contents;

- send via TKS - you will need an enhanced qualified electronic signature;

- through the taxpayer’s personal account on the tax website - a sufficiently enhanced non-qualified electronic signature.

We draw up our own version of the act

We go to the “Purchases” section, “Calculation Reconciliation Acts” item:

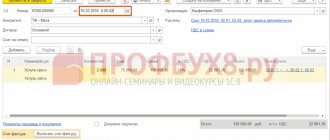

We create a new document “Act of reconciliation of settlements with the counterparty”. We fill in the counterparty of the food market and indicate the period for which the reconciliation report is drawn up (3rd quarter):

If you needed to make a reconciliation for a specific agreement, you would need to indicate it in the “Agreement” field. But we carry out a general reconciliation of all contracts, so we leave the contract field empty.

Go to the “Additional” tab and indicate representatives of our organization and representatives of the food market.

Since we are reconciling all contracts, it will be convenient if in printed form the lines are divided according to contracts. To do this, check the “Split by contracts” checkbox:

We go to the “Accounts” tab and mark here the accounting accounts that need to be analyzed to reconcile our settlements with the counterparty. The most typical accounts are presented here (60, 62, 66...), but it is possible to add new ones (the “Add” button):

Finally, go to the “According to organization data” tab and click the “Fill in according to accounting data” button:

The tabular part is filled with primary documents and settlement amounts:

We post the document and print the reconciliation report:

It shows that we have zero debt to each other at the beginning of the period, and at the end of the period the food market owes us 2,500 rubles.

Please note that this form contains only our data for now. We have yet to find out the details of the counterparty (food market).

How is information about payers generated?

Different regions of the country have their own rules for providing services to the population in the context of the isolation of service providers from each other. This division occurs according to the direction of provision of housing and communal services. Enterprises have their own current accounts and separate balance sheets.

Each resident has a separate personal account, which is opened in all housing and communal services organizations and has a unique set of numbers for their locality. The personal account is filled with information about the consumer. Such data includes:

- Full name of the tenant.

- The address to which the personal account is assigned.

- The total and living area of the home.

- Number of persons registered in the apartment.

- Tariffing of services.

- Monthly accruals and payment dynamics.

- Availability of preferential rights.

Based on the order of local authorities, each locality has a unified calculation base, which is compiled on the basis of data transmitted by each municipal office. The database is synchronized with service providers, and if changes are made to the enterprise’s accounting department, this action will be reflected in the unified database. At the same time, only employees directly of the organization that provides housing and communal services are authorized to make adjustments to personal accounts.

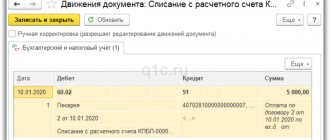

We are correcting our accounting error.

Having learned about these discrepancies, we looked up the primary documents and found out that the operator missed one item when filling in the invoice. We corrected this error, went back to the created act and again clicked the “Fill in according to accounting data” button:

Since we are sure that this act will be final, we go to the “According to the counterparty data” tab and click the “Fill in according to the organization’s data” button:

The tabular part from the first tab is completely copied into this one, only the amounts in Debit and Credit are inverted (swapped):

Methods for reconciling utility payments

For the convenience of residents in checking their balance status and obtaining information on their personal account, a unified database has been installed in many government agencies. Therefore, you can check the debt or the presence of overpayment in the following available ways:

- when visiting the accounting department of a municipal institution. It should be understood that each organization will be able to perform reconciliation only for its own service. That is, the rent is verified by the housing office, and electricity charges are checked by the power engineers. A nuance in this matter may be the presence of powers in the management company to work with individual utility bills; the availability of such rights can be found directly in the management company;

- through the official websites of utilities online. Such a service exists in many organizations. As a rule, this function works in the “Personal Account” section. Each consumer can register on the site and then keep track of their payments and the correctness of charges;

- Many leading banks in the country are also equipped with online payment verification services. If such a function is available on the official website of the financial institution, the citizen can only register in a special section of the portal - Internet banking, and carry out the necessary operations without visiting utility offices;

- Many settlements are equipped with MFCs. Usually these MFCs are located in the building of the executive committees of the Moscow Region. This is aimed at providing maximum convenience to citizens. The centers are provided with information about the status of personal accounts of all organizations providing housing and communal services. The convenience of reconciliation at the MFC is the absence of queues and speed of service;

- It is also possible to carry out reconciliation at post offices endowed with such functions. The inconvenience of choosing this method is the constant presence of queues, which does not make it possible to obtain the information of interest in full.

What to do if inconsistencies are identified in housing and communal services receipts

The need to perform a comparison on a personal account arises if payment receipts are lost or a discrepancy is found in settlements with service providers. Having received a receipt with incorrect data, you need to check it in any available way. If, after working on data comparison, your confidence in the untruthfulness of the information written on the receipt has only increased, you should perform the following steps:

- Make a written statement addressed to the head of the housing and communal services office who made an error in the receipt. In your appeal you should clarify your disagreements.

- Request the issuance of a reconciliation report for the period allowed for consideration in court. That is, over the past three years.

- If you do not receive a written response and a reconciliation report within thirty days, you should contact the supervisory authorities with a statement of violation of civil rights.

- If an act has been issued and, based on the information specified in it, there is a fact of inflated tariffs or unlawful additional charges, these violations can only be appealed in court.

The need to obtain a reconciliation report lies in the fact that the issued document is confirmation for the court of charges made by public utilities. And if they are truly unlawful, then the court will oblige them to be excluded from the personal account.

Also, if such a disputed amount arises, it will be problematic for utility companies to collect it through the court as a debt, since it is disputed and actions with it are frozen until the correctness of its occurrence is determined. But only if there is correspondence with the utility office.

Since methods of dealing with debtors have recently become more stringent, various methods have been introduced to obtain information about the state of one’s balance on utility bills. Therefore, in case of disagreement with the data specified in the receipt, you can always make an official comparison of the information without postponing this event for a long time.

Approval of the reconciliation report

In connection with the approved Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n (as amended on March 29, 2017), to ensure the reliability of accounting data and financial statements, organizations are required to conduct an inventory of property and liabilities.

We have prepared a WEB form that will help you carry out a reconciliation with Evotor OFD LLC (OFD Platform). You can go to the form from the main menu of your personal account lk.platformaofd.ru by selecting the “Personal Account” -> “Reconciliation Report” section. This section is also available via the direct link lk.platformaofd.ru/web/auth/billing/revise.

Rice. 1 – List of acts for periods

After going to the page, acts for individual periods are available to you (Fig. 1). Statuses determine the current state of the reconciliation report. To view the contents and open the WEB form of the act (Fig. 2), you need to click on it.

Statuses:

- Requires approval - you need to check the lines of the act and sign it;

- Agreed and signed – the act has been agreed upon and signed by the EPC;

- Not agreed upon - changes have been made to the act, it is being reviewed by the OFD Platform manager.

Rice. 2 – Example of a WEB form of an act.

If you agree with the act, then you must:

- Indicate the full name of the performer, who can confirm the correctness of the act data if necessary.

- Indicate the performer’s email or phone number so that our managers can contact the performer if necessary.

- Click on the “Sign the CEP” button and use the CEP to sign the PDF version of the “Reconciliation Report” file.

This completes the process of approving the reconciliation report. The document can be viewed and downloaded in the “Documents” section at lk.platformaofd.ru/web/auth/documents. If you do not have a Qualified Electronic Signature Certificate (CES), you can purchase one by following the link.

Change of information in the reconciliation report:

- To edit a line, you need to uncheck the corresponding line and be sure to indicate the reason in the pop-up window, attach the file and specify a comment if necessary. For more details, see table No. 1 and fig. 2.3.

- To add a line, you need to click on the “+” button located at the very end of the act form and fill in the required fields in the pop-up window. For more details, see table No. 1 and fig. 4.

After finishing editing, you need to send the act by clicking on the “Send” button, having previously specified:

- Full name of the contractor who directly conducts the reconciliation and will be able to answer our manager’s questions if necessary.

- Indicate the artist’s email or phone number so that our manager can contact the artist.

During the review of the act you edited, our manager may contact you according to the data specified on the form in the appropriate fields (Contractor). Please provide correct information so that the approval process goes as quickly as possible.

The final version of the reconciliation report, confirmed by our manager, will again be presented in the form of a WEB form in your personal account, which will need to be signed with the EPC by clicking on the appropriate button.

Rice. 3 – Example of a submitted reconciliation report form.

The list of reasons for disagreements with the reconciliation report is presented below in table No. 1.

Table No. 1

| № | Cause | A comment |

| 1 | The document amount does not match | • Attach a scan of your document in jpg, pdf, doc, docx format (Fig. 3). |

| • The comment should briefly describe the circumstances. | ||

| 2 | My payment is missing | This field is added through a separate interface button “+” (Fig. 4). |

| • Attach a scan of the payment order or receipt in jpg, pdf, doc, docx format. | ||

| 3 | The document number or date does not match | • Attach a scan of your document in jpg, pdf, doc, docx format (Fig. 3). |

| • In the comment you must indicate what exactly does not match: Date, Number, Date and number. Also briefly describe the circumstances (for example, the document was received by Russian Post, received from the manager, downloaded in your personal account) | ||

| 4 | Correction document missing | This field is added through a separate interface button “+” (Fig. 4). |

| • Attach a scan of the application for adjustment in jpg, pdf, doc, docx format. | ||

| • In the comment, be sure to indicate the fact of contacting technical support. support (case number, date of call). | ||

| 5 | Invalid contract number | • Attach a scan of your contract in jpg, pdf, doc, docx format (Fig. 3). |

| • In the commentary, indicate the contract number, date and briefly describe the circumstances. | ||

| 6 | Not my entry | See fig. 3. |

| 7 | Another reason | If none of your options suits you, then you must indicate the circumstances of your case in the comment (Fig. 3). |

Rice. 4 – Select the reason for the disagreement with the line.

Rice. 5 – Adding an act line.