General rule

For example, an accountant made a mistake when calculating the income tax base in December 2021.

The same error led to an understatement of income taxes and distorted accounting data. The bug was discovered in December 2021. The accountant must reflect the corrections as follows:

- in accounting – in reporting for 2021;

- in tax accounting - in the income tax return for 2019.

If it is impossible to determine the period when the error was made or the tax base was underestimated and the tax was underpaid, the error is corrected in the period when it was discovered (clause 1 of Article 54 of the Tax Code of the Russian Federation).

Adjustment of sales for the reporting year

In "1C: Accounting 8" edition 3.0, there are mechanisms for automatically adjusting tax and accounting data (in a simplified manner) through special documents. Let's consider how the program can reflect the adjustment of the reporting year's implementation when applying the simplified tax system.

Example 1

| Romashka LLC applies the simplified tax system with the object of taxation “income reduced by the amount of expenses.” In December 2021, funds in the amount of RUB 25,000.00 were transferred to the current account of Romashka LLC. as an advance payment from a wholesale buyer. In the same month, 50 units of goods were sold to this buyer for the amount of RUB 25,000.00. The specified goods have been fully paid to the supplier. In February 2021, a wholesale buyer discovered a hidden defect in 10 units of the product. By agreement with Romashka LLC, the buyer, instead of returning the low-quality product, disposed of it, and Romashka LLC transferred the corrected primary document to the buyer. Adjustments in the accounting of Romashka LLC were made before the submission of a tax return under the simplified tax system for 2021 and before the signing of the financial statements for 2021. |

The receipt of funds from a wholesale buyer is registered in the program with the document Receipt to the current account (section Bank and cash desk - Bank statements) with the transaction type Payment from the buyer. An organization using the simplified tax system must explicitly indicate in the Advance field in the tax accounting system the procedure for accounting for advances for tax accounting purposes. According to the conditions of Example 1, in this field you must indicate the value: Income of the simplified tax system, selecting it from the list proposed by the program.

When posting a document, an accounting entry is generated:

Debit 51 Credit 62.02 - for the amount of the prepayment (RUB 25,000.00).

Amount 25,000.00 rub. is recorded in the register Book of Income and Expenses (Section I) as income of the simplified tax system.

Sales of goods in wholesale trade are reflected in the standard document Sales (act, invoice) with the transaction type Goods (invoice).

When posting a document, accounting entries are generated:

Debit 90.02.1 Credit 41.01 - for the cost of goods (RUB 12,500.00); Debit 62.02 Credit 62.01 - for the offset amount of the prepayment (RUB 25,000.00); Debit 62.01 Credit 90.01.1 - for the amount of proceeds from the sale of goods (RUB 25,000.00).

For the purposes of the tax paid in connection with the application of the simplified tax system, entries are made in the accumulation registers, the Book of Income and Expenses (Section I), Explanation of KUDiR and Expenses under the simplified tax system.

Since the goods sold were paid to the supplier, the amount is RUB 12,500.00. recorded in the register Book of Income and Expenses (Section I) as expenses of the simplified tax system.

The amounts of income and expenses from the result of this transaction, reflected in the register Book of Income and Expenses (Section I), automatically fall into Section I of the KUDiR for 2021:

- in the column “Income taken into account when calculating the tax base” - the amount of payment for goods sold (RUB 25,000.00);

- in the column “Expenses taken into account when calculating the tax base” - the cost of goods sold, paid to the supplier (RUB 12,500.00).

Let's say that in February 2021, the accounting service of Romashka LLC received information that the buyer discovered a defect in the goods accepted for registration and disposed of it by agreement with the seller.

In this case, the program must reflect changes in accounting and tax accounting and generate the corresponding primary document*.

Note:

* 1C experts talked about the procedure for correcting and adjusting primary accounting documents using the program, as well as how to reflect the changes made in the accounting of the seller and buyer, in the article Correcting and adjusting primary accounting documents in 1C: Accounting 8 (rev. 3.0).

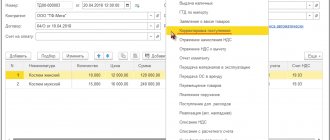

To adjust accounting and tax accounting data, as well as to generate corrected primary documents transferred to the buyer, in “1C: Accounting 8” the document Sales Adjustment (Sales section) is intended. It is most convenient to generate a document based on the document Sales (deed, invoice) (Enter based on button). On the Main tab, in the Operation type field, the following operations are available:

- Adjustment by agreement of the parties - registers a change in the cost of previously sold goods, works and services agreed between the seller and the buyer, that is, an independent event that relates to the current period. If the supplier is a VAT payer, then in this case he must issue an adjustment invoice to the buyer;

- Correction in primary documents - used to reflect the correction of errors made by the supplier when preparing documents. Correction in primary documents is not an independent event and refers to the same period as the document being corrected. The VAT payer supplier, correcting the primary documents, issues a corrected invoice to the buyer.

The correct qualification of these transactions is extremely important for VAT accounting purposes. The selected type of transaction in the Sales Adjustment document does not affect accounting entries and entries in tax accounting registers for the purposes of the simplified tax system.

According to the conditions of Example 1, at the time of sale of the goods, Romashka LLC had no information about the presence of hidden defects in it.

Therefore, in the document Adjustment of sales, you should select the transaction type Adjustment by agreement of the parties, which reliably reflects the essence of the business transaction (Fig. 1).

Rice. 1. Implementation adjustments

In the Reflect adjustment field, you must leave the default value in all accounting sections, then after posting the document, movements in the accounting and tax accounting registers will be generated.

The tabular part of the Products tab is filled in automatically based on the selected Sales document (act, invoice). Each line of the source document corresponds to two lines in the adjustment document:

- before change;

- after the change.

The quantity and amounts from the source document are transferred to the line before the change, and this line is not edited. In the line after the change, you need to indicate the corrected quantitative indicators, and the new total indicators will be recalculated automatically.

The form of the document Adjustment of sales on the Calculations tab is modified depending on the period of making changes to the basis document.

If the Implementation Adjustments document adjusts the implementation:

- current year - additional parameters for reflecting income and expenses from the adjustment are not required, since all adjustments will be made in the current year.

- last year - on the Calculations tab in the Reflection of income and expenses group, an additional parameter appears: Last year’s accounting is closed for adjustment (the reporting has been signed).

According to the conditions of Example 1, corrections to the accounting data are made in 2017, but before the signing of the financial statements for 2021, therefore the flag Last year’s accounting is closed for adjustments (the statements are signed) does not need to be set.

Despite the fact that the document Adjustment of Sales is dated February 2021, after the document is processed, part of the transactions is formed with the date December 31, 2016, namely:

REVERSE Debit 90.02.1 Credit 41.K - for the cost of defective goods (-2,500.00 rub.); REVERSE Debit 76.K Credit 90.01.1 - for the amount of proceeds from the sale of goods (-5,000.00 rub.); Debit 99.01.1 Credit 90.09 - for the amount of adjustment to the financial result (RUB 2,500.00).

Accounting data adjusted in this way will automatically be included in the financial statements for 2021.

As of the date of the Sales Adjustment document (02/27/2017), the following accounting entries are generated:

REVERSE Debit 41.K Credit 41.01 - for the amount of adjustment of goods (-2,500.00 rub.); REVERSE Debit 62.01 Credit 76.K - for the amount of adjustment of settlements with the buyer (-5,000.00 rub.); Debit 62.01 Credit 62.02 - for the allocation of an advance received from the buyer (RUB 5,000.00).

Account 76.K “Adjustment of settlements of the previous period” is used to record the result of adjustments to settlements with counterparties, which were made after the end of the reporting period. Debt for settlements with counterparties is recorded on the account from the date of the transaction that is subject to adjustment to the date of the correcting transaction.

Account 41.K “Adjustment of goods of the previous period” is used to record the result of adjustment of inventory balances, which was performed after the end of the reporting period. Adjustment of inventory balances and (or) their value is taken into account on the account from the date of the transaction that is subject to adjustment to the date of the adjusting transaction. It is easy to see that the amounts in accounts 76.K and 41.K are in transit, then what are they for? Thanks to special accounts 76.K and 41.K, information on settlements with counterparties and product balances falls into the required section of the reporting, but this information cannot be used until the adjustment is reflected. When this moment comes, settlements with counterparties and goods balances are transferred to “regular” settlement or goods accounts.

For example, goods credited to account 41.K as a result of last year’s adjustment are reflected on line 1210 “Inventories” of the balance sheet, but cannot be used in transactions until the adjustment is reflected in the current year.

For the purposes of the tax paid in connection with the application of the simplified tax system, corrective entries are also entered into the accumulation registers, the Book of Income and Expenses (section I), Explanation of KUDiR and Expenses under the simplified tax system.

In the register Book of Income and Expenses (Section I), the simplified tax system expense is reversed in the amount of 2,500.00 rubles, and in Section I of the report Book of Income and Expenses of the simplified tax system for 2021, the entry about the decrease in expense is automatically reflected in the last line (Fig. 2).

Rice. 2. Book of income and expenses for the fourth quarter of 2021

The Sales Adjustment document does not affect the recognition of income in any way, since the simplified tax system uses the cash method, and income is recognized at the time of receipt of funds from the buyer.

To generate a separate primary document recording the new cost of goods sold, you can use one of the printed forms that the program offers as part of commands called by the Print button:

- Value change agreement;

- Universal adjustment document (UCD) with status 2.

The printed form of the agreement (UCD) indicates the number and date of the adjustment, as well as the number and date of the initial certificate of service provision (UPD).

When you select the operation type Correction in primary documents, printed forms of primary documents are available in the Implementation Adjustment document:

- Consignment note (TORG-12) with amendments made;

- Universal adjustment document (UCD) with status 2.

When automatically filling out a tax return under the simplified tax system for 2016, the adjustment made will be reflected in the indicators in Section 2.2.

Ten units of goods capitalized as a result of adjustment and actually disposed of by the buyer must be written off. Depending on the conditions of a particular business transaction, defective goods are written off either as other expenses, or as settlements for claims presented to the supplier, or as settlements with personnel for compensation for material damage.

In the current period - profit

If an error resulted in an excessive payment of tax, it can be included in the tax base of the current reporting (tax) period. This is also provided for in paragraph 1 of Article 54 of the Tax Code of the Russian Federation.

The determining condition for correcting an error of the previous period in the current period is the excessive payment of tax.

But only if a profit was made in the current period. If, based on the results of the current reporting (tax) period, the company suffered a loss, that is, the tax base is zero, it is impossible to recalculate such a zero base. This means that you need to recalculate the tax base for the period in which the error occurred.

In the period of error – profit payable

So, to correct a past error in the current period, it is necessary that the result of the error is not simply an overstatement of the tax base due to the fact that some expense was not included in it. We are not talking about a zero base. There must be an excess payment of tax. This is what is written in the Tax Code.

If there is no tax payable in the return for the period in which the error was made, there cannot be an overpayment of tax.

This means that in this case, too, you will have to make corrections to the declaration for the period when the error was made.

The right to correct misstatements in the current period arises only if tax profit was received within the period when they were committed.

Adjustment of expenses for the reporting year

Let's look at how in the 1C: Accounting 8 version 3.0 program you can correct a technical error made when registering a current year receipt document if the taxpayer uses a simplified taxation system with the object “Income minus expenses”.

Example 3

| In October 2021, Romashka LLC entered into a lease agreement for office space with the landlord. In the same month, Romashka LLC paid 200,000.00 rubles to the landlord. (including VAT 18%), of which RUB 100,000.00 is the rent for the fourth quarter, and 100,000.00 rubles. — security payment in the amount of RUB 100,000.00. In December 2021, the accounting records of Romashka LLC erroneously included the costs of renting office space in the amount of RUB 200,000.00. In February 2021, the error was discovered and corrected. Adjustments in the accounting of Romashka LLC were made before the submission of a tax return under the simplified tax system for 2021 and before the signing of the financial statements for 2021. |

The costs of renting office space are reflected in the program using the document Receipt (act, invoice) with the transaction type Services (act). As a result of the document, accounting entries were generated:

Debit 60.01 Credit 60.02 - for the amount of the offset prepayment for the rental of premises (RUB 200,000); Debit 26 Credit 60.01 - for the cost of renting the premises (200,000 rubles).

The amount of 200,000.00 is reflected in the register Book of Income and Expenses (Section I) as an expense of the simplified tax system.

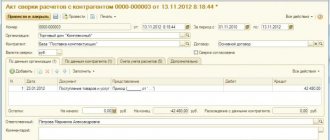

To reflect accounting errors made by the user when registering primary documents received from the supplier, we will use the Receipt Adjustment document, which we will create based on the Receipt document (act, invoice).

The form of the document Adjustment of receipts on the Main tab is modified depending on the selected type of operation, as well as on the period of making changes to the basis document.

According to paragraph 6 of PBU 22/2010, an error in the reporting year identified after the end of this year, but before the date of signing the financial statements for this year, should be corrected by entries in the corresponding accounting accounts for December of the reporting year. Therefore, in our case, the Receipt Adjustment document should be dated December 2021 (from field).

On the Main tab, in the Operation type field, the following operations are available:

- Correction in primary documents;

- Adjustment by agreement of the parties;

- Correcting your own mistake. This operation is intended to correct data entry errors made by the user when registering primary documents and (or) a received invoice, and allows you to correct erroneously entered invoice details, including totals. The correction refers to the same period as the incorrectly entered document itself.

Since, according to the conditions of Example 3, a technical error was made in the organization’s accounting, it is necessary to select the type of operation Correction of own error (Fig. 3).

Rice. 3. Adjustment of receipts

The tabular part on the Services tab is filled in automatically based on the document specified in the Basis field. In the line after the change you need to indicate the corrected totals.

After posting the Receipt Adjustment document, the following accounting entries will be generated:

Debit 60.02 Credit 60.01 - for the resulting advance amount to the supplier (RUB 100,000.00), paid as a security payment; REVERSE Debit 26 Credit 60.01 - for erroneously inflating the cost of renting the premises (-RUB 100,000.00).

For the purposes of the tax paid in connection with the application of the simplified tax system, corrective entries are entered into the accumulation registers, the Book of Income and Expenses (Section I) and the Explanation of KUDiR.

In the register Book of Income and Expenses (Section I), the expense of the simplified tax system is reversed in the amount of 100,000.00 rubles, and in Section I of the Book of Income and Expenses of the simplified tax system for 2021, the entry about the decrease in expense is automatically reflected in chronological order by the date of the document Adjustment of receipts , that is, December 31, 2016.