Who pays property tax

The obligation to pay property tax in accordance with Article 400–401 of the Tax Code of the Russian Federation is assigned to citizens who own:

- residential real estate;

- garages, parking spaces;

- unfinished construction projects;

- other real estate.

CCTV cameras https://www.minimaks.ru/catalog/videokamery/videokamera-antivandalnaya/

Common property owned by homeowners in apartment buildings is not subject to taxation.

For certain categories of citizens, the legislation has introduced benefits that provide for the exemption of the taxpayer from payments relating to one object in each of the following categories:

- apartments (rooms);

- garages (car spaces);

- individual residential buildings;

- outbuildings with an area of less than 50 m2;

- premises used by citizens exclusively for creative activities (workshops, studios, galleries).

In particular, the following are entitled to benefits:

- pensioners;

- disabled people;

- various categories of military personnel, persons equivalent to them, and members of their families.

Article 407 of the Tax Code of the Russian Federation also provides for restrictions related to the use of benefits: real estate cannot be used for commercial purposes, and its cadastral value should not exceed 300 million rubles.

Article 401. Object of taxation

1. The following property located within a municipal formation (federal city of Moscow, St. Petersburg or Sevastopol) is recognized as the object of taxation:

- House;

- apartment, room;

- garage, parking place;

- single real estate complex;

- unfinished construction project;

- other building, structure, structure, premises.

2. For the purposes of this chapter, houses and residential buildings located on land plots provided for personal subsidiary plots, dacha farming, vegetable gardening, horticulture, and individual housing construction are classified as residential buildings.

3. Property included in the common property of an apartment building is not recognized as an object of taxation.

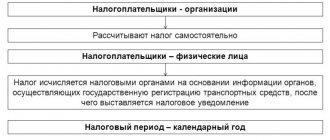

How is personal property tax calculated?

In relation to the property tax of citizens, a transition period has been established, which involves a gradual transition to the calculation of the specified fee based on the cadastral value.

The decision on such a transition is made at the regional level.

The tax for 2015 will be calculated in a new way in 28 constituent entities of the Russian Federation; in the next reporting period there will be 49 such regions.

Due to the great public interest in the new rules for calculating property tax, the Federal Tax Service (FTS) has introduced a service that allows for a preliminary calculation of the payment amount. All you need to know is the cadastral number assigned to the building or premises.

All organizations pay income tax unless they have switched to an individual payment system. Income tax: rate, calculation and filling out the declaration, read carefully.

Read more about how to calculate the single tax on imputed income here.

The state budget is replenished through various taxes and fees. Here https://businessmonster.ru/buhuchet/nalogooblozhenie/vidyi-nalogov.html we will look at what payments and deductions are due for legal entities and individuals.

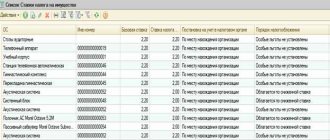

Article 406. Tax rates

COMMENT For details on the property tax rate in your region, see the link.

1. Tax rates are established by regulatory legal acts of representative bodies of municipalities (laws of federal cities of Moscow, St. Petersburg and Sevastopol) depending on the applied procedure for determining the tax base, taking into account the provisions of paragraph 5 of this article.

2. In the case of determining the tax base based on the cadastral value of the taxable object, tax rates are established in amounts not exceeding:

1) 0.1 percent in relation to:

- residential buildings, parts of residential buildings, apartments, parts of apartments, rooms;

- objects of unfinished construction if the designed purpose of such objects is a residential building;

- single real estate complexes, which include at least one residential building;

- garages and parking spaces, including those located in taxable objects specified in subparagraph 2 of this paragraph;

- economic buildings or structures, the area of each of which does not exceed 50 square meters and which are located on land plots provided for personal subsidiary farming, dacha farming, vegetable gardening, horticulture or individual housing construction;

2) 2 percent in relation to taxable objects included in the list determined in accordance with paragraph 7 of Article 378.2 of this Code, in relation to taxable objects provided for in paragraph two of paragraph 10 of Article 378.2 of this Code, as well as in relation to taxable objects, the cadastral value of each of which exceeds 300 million rubles;

3) 0.5 percent in relation to other taxable items.

3. Tax rates specified in subparagraph 1 of paragraph 2 of this article may be reduced to zero or increased, but not more than three times, by regulatory legal acts of representative bodies of municipalities (laws of the federal cities of Moscow, St. Petersburg and Sevastopol).

4. In the case of determining the tax base based on the inventory value, tax rates are established on the basis of the total inventory value of taxable objects owned by the taxpayer (taking into account the taxpayer’s share in the right of common ownership of each of such objects), multiplied by a deflator coefficient, located in within one municipality (federal city of Moscow, St. Petersburg or Sevastopol), within the following limits:

Tax rates

| The total inventory value of taxable objects, multiplied by a deflator coefficient (taking into account the taxpayer’s share in the right of common ownership of each of such objects) | Tax rate |

| Up to 300,000 rubles inclusive | Up to 0.1 percent inclusive |

| Over 300,000 to 500,000 rubles inclusive | Over 0.1 to 0.3 percent inclusive |

| Over 500,000 rubles | Over 0.3 to 2.0 percent inclusive |

5. It is allowed to establish differentiated tax rates depending on:

- cadastral value of the taxable object (the total inventory value of the taxable objects, multiplied by the deflator coefficient (taking into account the taxpayer’s share in the common ownership of each of such objects);

- type of taxable object;

- location of the taxable object;

- types of territorial zones within the boundaries of which the taxable object is located.

6. If tax rates are not determined by regulatory legal acts of representative bodies of municipalities (laws of the federal cities of Moscow, St. Petersburg and Sevastopol), taxation is carried out:

- in the case of determining the tax base based on the cadastral value of the taxable object - at the tax rates specified in paragraph 2 of this article;

- in the case of determining the tax base based on the inventory value of the taxable object - at a tax rate of 0.1 percent in relation to objects with a total inventory value multiplied by a deflator coefficient (taking into account the taxpayer’s share in the right of common ownership of each of such objects), up to 500 000 rubles inclusive and at a tax rate of 0.3 percent in relation to other objects.

Tax on cadastral value

Property tax is calculated on the basis of cadastral property in the entities that have adopted the relevant regulatory legal act. Information about the cost is contained in the state real estate cadastre.

The cadastral value is also approved by an act of the municipality or subject according to data obtained during the mass state cadastral valuation, which is carried out in each subject at least once every five years.

The basis for calculating tax taking into account various categories of real estate is the cadastral value of a specific property minus the cadastral value:

- 20 m2 (apartments);

- 10 m2 (rooms);

- 50 m2 (individual houses).

All types of housing, garages and other related buildings are taxed at a rate of 0.1%.

For owners of luxury real estate (valued at an amount exceeding 300 million rubles), buildings included in a special list (shopping, office complexes) the rate is increased to 2%. Owners of other types of property must pay 0.5%.

By regional legislation, these tariffs can be increased by no more than 3 times, or reduced to zero.

If real estate was acquired or the rights to it were lost during the tax period, then a coefficient is applied to the calculated tax amount, calculated as the ratio of the number of full months of ownership of real estate to 12 (the number of months in a year).

Article 402. Tax base

1. The tax base in relation to taxable objects is determined based on their cadastral value, except for the cases provided for in paragraph 2 of this article.23

The specified procedure for determining the tax base can be established by regulatory legal acts of representative bodies of municipalities (laws of the federal cities of Moscow, St. Petersburg and Sevastopol) after approval by a constituent entity of the Russian Federation in the prescribed manner of the results of determining the cadastral value of real estate objects.820

The legislative (representative) body of state power of a constituent entity of the Russian Federation (with the exception of the federal cities of Moscow, St. Petersburg and Sevastopol) establishes, before January 1, 2021, a single date for the commencement of application in the territory of this constituent entity of the Russian Federation of the procedure for determining the tax base based on the cadastral value objects of taxation taking into account the provisions of Article 5 of this Code.

2. The tax base in relation to taxable objects, with the exception of the objects specified in paragraph 3 of this article, is determined based on their inventory value in the event that the subject of the Russian Federation does not make the decision provided for in paragraph three of paragraph 1 of this article.

3. The tax base in relation to taxable objects included in the list determined in accordance with paragraph 7 of Article 378.2 of this Code, as well as taxable objects provided for in paragraph two of paragraph 10 of Article 378.2 of this Code, is determined based on the cadastral value of these taxable objects.

From inventory value

Until 2021, regions have the right to calculate tax based on information about inventory value.

This cost was determined by the technical inventory authorities (BTI) based on information about the technical inventory of real estate and, until March 1, 2013, was sent by them to the relevant tax inspectorates.

The tax base is calculated by multiplying the inventory value by a special deflator coefficient. The size of this indicator is established annually by the Ministry of Economic Development of the Russian Federation. When determining the amount of payment for the previous year, a coefficient of 1.147 is used. Tax rates are established by the constituent entities of the Russian Federation depending on the cost characteristics of the object of taxation.

Article 409. Procedure and terms for payment of tax

1. The tax must be paid by taxpayers no later than December 1 of the year following the expired tax period.

2. The tax is paid at the location of the object of taxation on the basis of a tax notice sent to the taxpayer by the tax authority.

3. Sending a tax notice is allowed no more than three tax periods preceding the calendar year of its sending.

4. The taxpayer pays tax for no more than three tax periods preceding the calendar year of sending the tax notice.

5. Refund (credit) of the amount of overpaid (collected) tax in connection with the recalculation of the tax amount is carried out for the period of such recalculation in the manner established by Articles 78 and 79 of this Code.

Tax according to the new rules in the first 4 years: calculation example

During the initial four-year period of application of the new procedure for calculating tax payments, a special method of calculating the amount payable to the budget is in effect. The payment amount is determined by the formula:

N = (N1 – N2) x k + N2,

- where N is the amount of tax to be paid;

- N1 – tax calculated by multiplying the tax base calculated from the cadastral value by the interest rate;

- N2 – the amount of payment paid for the previous tax period (calculated from the inventory value);

- k – coefficient (0.2 – in the first of four years of application of the special regime; 0.4 – in the second; 0.6 – in the third and 0.8 – in the fourth).

If N1 is less than N2, then this formula does not apply. In this case, as well as after four years, the tax amount is calculated as N1.

Calculation algorithm:

| Basic information about the apartment | Computations |

| Cadastral value, rub. | 3 658 800 |

| Tax rate, % | 0,2 |

| Area, m2 | 30 |

| Tax for 2014, calculated on the basis of inventory value, rub. | 401 |

| Deduction, rub. | 2,439,200 (3,658,800 / 30 x 20) |

| Tax base, rub. | 1 219 600 (3 658 800 – 2 439 200) |

| Amount of tax calculated from the cadastral value, rub. | 2439 (1,219,600 x 0.2%) |

| Tax payable for 2015, rub. | 809 ((2439 – 401) x 0.2 + 401) |

Article 408. Procedure for calculating the amount of tax

1. The amount of tax is calculated by the tax authorities at the end of the tax period separately for each object of taxation as a percentage of the tax base corresponding to the tax rate, taking into account the specifics established by this article.

2. The amount of tax is calculated on the basis of information submitted to the tax authorities in accordance with Article 85 of this Code.

In relation to taxable objects, the rights to which arose before the entry into force of the Federal Law of July 21, 1997 No. 122-FZ “On State Registration of Rights to Real Estate and Transactions with It”, the tax is calculated on the basis of data on the right holders, which are presented in in accordance with the established procedure to the tax authorities before March 1, 2013 (with the exception of objects located in the territories of the Republic of Crimea and the federal city of Sevastopol).

3. If the object of taxation is in common shared ownership, the tax is calculated in accordance with paragraph 1 of this article, taking into account the provisions of paragraph 8 of this article for each of the participants in shared ownership in proportion to his share in the ownership of such object of taxation.

If the object of taxation is in common joint ownership, the tax is calculated in accordance with paragraph 1 of this article, taking into account the provisions of paragraph 8 of this article for each of the participants in joint ownership in equal shares.

4. If during the tax period the taxpayer’s share in the right of common ownership of a taxable object changes, the amount of tax is calculated taking into account the coefficient determined in accordance with paragraph 5 of this article.

5. If a taxpayer acquires (terminates) the right of ownership of property during a tax period, the amount of tax in respect of this property is calculated taking into account a coefficient defined as the ratio of the number of full months during which this property was in the taxpayer’s ownership to the number of calendar months months in the tax period.

If the emergence of the right of ownership of the property occurred before the 15th day of the corresponding month, inclusive, or the termination of the right of ownership of the property occurred after the 15th day of the corresponding month, the month of the emergence (termination) of the specified right is taken as the full month.

If the emergence of the right of ownership of property occurred after the 15th day of the corresponding month or the termination of the specified right occurred before the 15th day of the corresponding month inclusive, the month of emergence (termination) of the specified right is not taken into account when determining the coefficient specified in this paragraph.11 Who must pay the tax on the property of individuals.

6. If a taxpayer acquires (terminates) the right to a tax benefit during a tax period, the tax amount is calculated taking into account a coefficient defined as the ratio of the number of full months during which there is no tax benefit to the number of calendar months in the tax period. In this case, the month in which the right to a tax benefit arises, as well as the month in which this right is terminated, is taken to be a full month.

In the case of an application for a tax benefit, the tax amount is recalculated for no more than three tax periods preceding the calendar year of application, but not earlier than the date the taxpayer becomes entitled to a tax benefit.

7. In relation to property inherited by an individual, the tax is calculated from the date of opening of the inheritance.11 How to transfer property tax for individuals to the budget

8. The amount of tax for the first three tax periods from the beginning of application of the procedure for determining the tax base based on the cadastral value of the taxable object is calculated taking into account the provisions of paragraph 9 of this article using the following formula:

H = (H1 - H2) x K + H2.7

- where N is the amount of tax to be paid. In the event of termination of the taxpayer's right of ownership of the specified taxable object during the tax period, the emergence (termination) of the right to a tax benefit, or a change in the share in the right of common ownership of the taxable object, the calculation of the tax amount (N) is carried out taking into account the provisions of paragraphs 4-6 of this article ;

- N1 - the amount of tax calculated in the manner prescribed by paragraph 1 of this article, based on the tax base determined in accordance with Article 403 of this Code, without taking into account the provisions of paragraphs 4-6 of this article;

- N2 - the amount of tax calculated on the basis of the corresponding inventory value of the object of taxation (without taking into account the provisions of paragraphs 4-6 of this article) for the last tax period for determining the tax base in accordance with Article 404 of this Code, or the amount of property tax for individuals calculated for 2014 year in accordance with the Law of the Russian Federation of December 9, 1991 No. 2003-I “On taxes on property of individuals” and attributable to the specified object of taxation, in the case of applying the tax calculation procedure in accordance with Article 403 of this Code starting from January 1, 2015 ;

- K - coefficient equal to:

- 0.2 - in relation to the first tax period in which the tax base is determined in the relevant municipality (federal city of Moscow, St. Petersburg or Sevastopol) in accordance with Article 403 of this Code;

— 0.4 — in relation to the second tax period, in which the tax base is determined in the relevant municipality (federal city of Moscow, St. Petersburg or Sevastopol) in accordance with Article 403 of this Code;

- 0.6 - in relation to the third tax period, in which the tax base is determined in the corresponding municipality (federal city of Moscow, St. Petersburg or Sevastopol) in accordance with Article 403 of this Code;

The paragraph has lost force - Federal Law of August 3, 2021 No. 334-FZ - see the previous edition.

Starting from the fourth tax period, in which the tax base is determined in the relevant municipality (federal city of Moscow, St. Petersburg or Sevastopol) in accordance with Article 403 of this Code, the tax amount is calculated in accordance with this article without taking into account the provisions of this paragraph.

The formula provided for by this paragraph is not applied when calculating tax in relation to taxable objects specified in paragraph 3 of Article 402 of this Code, with the exception of garages and parking spaces located in such taxable objects.

8.1. If the amount of tax calculated in accordance with this article based on the cadastral value of the taxable object (without taking into account the provisions of paragraphs 4-6 of this article) exceeds the amount of tax calculated on the basis of the cadastral value in relation to this taxable object (without taking into account the provisions of paragraphs 4-6 of this article) for the previous tax period, taking into account the coefficient of 1.1, the amount of tax is payable in an amount equal to the amount of tax calculated in accordance with this article based on the cadastral value of this object of taxation (without taking into account the provisions of paragraphs 4-6 of this article article) for the previous tax period, taking into account the coefficient of 1.1, as well as taking into account the provisions of paragraphs 4-6 of this article, applied to the tax period for which the amount of tax is calculated.

The provisions of this paragraph are applied when calculating tax starting from the third tax period, in which the tax base is determined in the relevant municipality (federal city of Moscow, St. Petersburg or Sevastopol) in accordance with Article 403 of this Code.

The provisions of this paragraph do not apply when calculating tax in relation to taxable objects specified in paragraph 3 of Article 402 of this Code, with the exception of garages and parking spaces located in such taxable objects.

9. If the value of the amount of tax N2 calculated in accordance with paragraph 8 of this article in relation to the object of taxation exceeds the corresponding value of the amount of tax N1, the amount of tax payable by the taxpayer is calculated without taking into account the provisions of paragraph 8 of this article.

Tax notice

All information necessary for a taxpayer on the calculation and payment of taxes is contained in a single tax notice, which is generated and sent to citizens by tax authorities no less than 30 days before the payment date.

The tax notice form also includes a section on property tax, containing the information necessary to calculate the payment and pay:

- amount of payment;

- billing period;

- calculation base;

- applied coefficients and benefits.

Article 399. General provisions

1. The property tax for individuals (hereinafter referred to as the tax in this chapter) is established by this Code and the regulatory legal acts of the representative bodies of municipal formations, is put into effect and ceases to be in effect in accordance with this Code and the regulatory legal acts of the representative bodies of municipal formations and is obligatory for payment in the territories of these municipalities.

In the federal cities of Moscow, St. Petersburg and Sevastopol, the tax is established by this Code and the laws of the specified constituent entities of the Russian Federation, is put into effect and ceases to be in effect in accordance with this Code and the laws of the specified constituent entities of the Russian Federation and is obligatory for payment in the territories of these constituent entities of the Russian Federation.

2. When establishing a tax, the representative bodies of municipalities (legislative (representative) bodies of state power of the federal cities of Moscow, St. Petersburg and Sevastopol) determine tax rates within the limits established by this chapter, and the specifics of determining the tax base in accordance with this chapter.

When establishing a tax, regulatory legal acts of representative bodies of municipalities (laws of federal cities of Moscow, St. Petersburg and Sevastopol) may also establish tax benefits not provided for by this chapter, the grounds and procedure for their application by taxpayers.

How to find out your debt

It is also possible to obtain information about the status of property tax payments if the owner has not received notification. To do this, you can use the following electronic services:

- “Taxpayer’s personal account” on the Federal Tax Service portal;

- “Find out your debt” on the government services website.

Information about debt is provided to citizens upon personal contact with the tax office.

In some cases, entrepreneurs have the right to switch to a simplified tax payment system. Is there a simplified taxation system for LLCs? Read on.

You will find useful tips on how to open an insurance company on this page.

Article 407. Tax benefits

COMMENT For details on who is entitled to receive tax benefits and how to apply for them, see the link.

1. Taking into account the provisions of this article, the following categories of taxpayers have the right to a tax benefit:

1) Heroes of the Soviet Union and Heroes of the Russian Federation, as well as persons awarded the Order of Glory of three degrees;

2) disabled people of disability groups I and II;

3) disabled since childhood, disabled children;

4) participants in the Civil War, the Great Patriotic War, and other military operations to defend the USSR from among military personnel who served in military units, headquarters and institutions that were part of the active army, and former partisans, as well as combat veterans;

5) civilian personnel of the Soviet Army, Navy, internal affairs and state security bodies who held regular positions in military units, headquarters and institutions that were part of the active army during the Great Patriotic War, or persons who were in military service during this period cities, participation in the defense of which is counted towards these persons' length of service for the purpose of granting a pension on preferential terms established for military personnel of active army units;

6) persons entitled to receive social support in accordance with the Law of the Russian Federation of May 15, 1991 No. 1244-I “On the social protection of citizens exposed to radiation due to the disaster at the Chernobyl nuclear power plant”, in accordance with the Federal Law of November 26, 1998 year No. 175-FZ “On the social protection of citizens of the Russian Federation exposed to radiation as a result of the accident in 1957 at the Mayak production association and the discharge of radioactive waste into the Techa River” and Federal Law of January 10, 2002 No. 2-FZ “On social guarantees to citizens exposed to radiation as a result of nuclear tests at the Semipalatinsk test site";

7) military personnel, as well as citizens discharged from military service upon reaching the age limit for military service, health conditions or in connection with organizational and staffing events, having a total duration of military service of 20 years or more; 2 Federal benefits for property tax for individuals ;

persons who were directly involved as part of special risk units in testing nuclear and thermonuclear weapons, eliminating accidents of nuclear installations at weapons and military facilities;

persons who were directly involved as part of special risk units in testing nuclear and thermonuclear weapons, eliminating accidents of nuclear installations at weapons and military facilities;

9) family members of military personnel who have lost their breadwinner, recognized as such in accordance with Federal Law No. 76-FZ of May 27, 1998 “On the status of military personnel”;

10) pensioners receiving pensions assigned in the manner established by pension legislation, as well as persons who have reached the ages of 60 and 55 years (men and women, respectively), who, in accordance with the legislation of the Russian Federation, are paid a monthly lifelong allowance;

11) citizens discharged from military service or called up for military training who performed international duty in Afghanistan and other countries where hostilities took place;

12) individuals who received or suffered radiation sickness or became disabled as a result of tests, exercises and other work related to any types of nuclear installations, including nuclear weapons and space technology;17

13) parents and spouses of military personnel and government employees who died in the line of duty;

14) individuals carrying out professional creative activities - in relation to specially equipped premises, structures used by them exclusively as creative workshops, ateliers, studios, as well as residential buildings, apartments, rooms used to organize non-state museums and galleries open to the public , libraries - for the period of such use;

15) individuals - in relation to economic buildings or structures, the area of each of which does not exceed 50 square meters and which are located on land plots provided for personal subsidiary farming, dacha farming, vegetable gardening, horticulture or individual housing construction.

2. A tax benefit is provided in the amount of tax payable by the taxpayer in relation to an object of taxation that is owned by the taxpayer and is not used by the taxpayer in business activities.

3. When determining the amount of tax payable by a taxpayer, a tax benefit is provided in respect of one taxable item of each type at the taxpayer’s choice, regardless of the number of grounds for applying tax benefits.

4. Tax benefits are provided in relation to the following types of taxable items:

- apartment, part of an apartment or room;

- residential building or part of a residential building;

- premises or structures specified in subparagraph 14 of paragraph 1 of this article;

- economic building or structure specified in subparagraph 15 of paragraph 1 of this article;

- garage or parking space.

5. Tax benefits are not provided in respect of taxable objects specified in subparagraph 2 of paragraph 2 of Article 406 of this Code, with the exception of garages and parking spaces located in such taxable objects.

6. Individuals entitled to tax benefits established by the legislation on taxes and fees submit an application for a tax benefit to the tax authority of their choice, and also have the right to submit documents confirming the taxpayer’s right to a tax benefit.

Confirmation of a taxpayer's right to a tax benefit is carried out in a manner similar to the procedure provided for in paragraph 3 of Article 361.1 of this Code.

The form of an application for a tax benefit and the procedure for filling it out, the format for submitting such an application in electronic form are approved by the federal executive body authorized for control and supervision in the field of taxes and fees.

7. A notification about the selected objects of taxation in respect of which a tax benefit is granted is submitted by the taxpayer to the tax authority of his choice before November 1 of the year, which is the tax period from which the tax benefit is applied to the specified objects.

A taxpayer who has submitted a notification to the tax authority about the selected taxable object does not have the right, after November 1 of the year that is the tax period, to submit an updated notification with a change in the taxable object in respect of which a tax benefit is granted in the specified tax period.

If a taxpayer entitled to a tax benefit fails to provide notice of the selected taxable item, the tax benefit is granted in respect of one taxable item of each type with the maximum calculated tax amount.

The form of the notification is approved by the federal executive body authorized for control and supervision in the field of taxes and fees.

How is the tax base determined based on the cadastral value?

The tax base is calculated for each object. The tax base is the cadastral value of the property as of January 1. If the object is formed in the middle of the year, then the cadastral value is taken as of the date the object is registered for cadastral registration. The cadastral value can be found in the documents for the object, in the offices of Rosreestr and the cadastral chamber, in Multifunctional Centers (MFC) or on the official website of Rosreestr. This information is provided free of charge.

When calculating the tax amount, the cadastral value is reduced by the amount of the tax deduction. Chapter 32 of the Tax Code of the Russian Federation provides the following deduction values: for an apartment - the cadastral value of 20 square meters, for a room - the cadastral value of 10 square meters, for a house - the cadastral value of 50 square meters, for a single real estate complex - 1,000 000 rub. We illustrate the calculation of the base with an example.

Example

The cadastral value of an apartment is 4,500,000 rubles, and the cadastral value of one square meter is 90,000 rubles. Then the amount of the tax deduction will be equal to 1,800,000 rubles (20 x 90,000 rubles), and the size of the tax base will be 2,700,000 rubles (4,500,000 - 1,800,000).

Municipalities have the right to increase deductions without any restrictions. If, as a result, the amount of the deduction is greater than the cadastral value of the property, the tax base will become zero. A negative base value is not allowed.