Transport tax is a regional duty paid by individual entrepreneurs, companies and individuals who own vehicles of various types: water, air, automobile, motorcycles and other movable vehicles. Last year, when paying the fee in the payment receipt, citizens used the 2021 transport tax for individuals to indicate the type of payment, KBK; in 2019, new ones are used. Budget classification codes for individuals and individual entrepreneurs are the same, but for companies they use different numbers that determine the type of collection.

KBK for individuals

All people who own vehicles must pay tax. Unlike companies that calculate it themselves, citizens are sent a notification from the tax service. If there was no notification, the individual should inform the tax authorities himself that he has a vehicle that needs to be taxed.

According to the law, citizens who own a car must make timely tax payments before the first of December of the coming year.

| Tax for individuals | KBK |

| KBK transport tax for 2021 and 2021: | 182 1 0600 110 |

Answers to common questions

Question: Does the specified increasing factor apply to transport tax on expensive passenger cars owned by a legal entity?

Answer: Yes, even if the owner of an expensive car is a legal entity, this does not cancel the obligation to apply the increasing coefficient. The only difference will be that legal entities will have to independently determine the value of this coefficient and make calculations. Individuals will simply receive a corresponding notification.

Question: Our organization is on the simplified tax system, are we exempt from paying transport tax?

Answer: If a company owns a vehicle, then regardless of what taxation regime it is in (OSN or special regimes), this does not cancel the obligation to independently calculate and pay transport tax.

KBK for legal entities

Commercial companies must pay tax on all vehicles they own. They must do the calculations themselves. Payment is transferred once a quarter or for the whole year at once. The report must be submitted to the fiscal authorities before 01.02. of the year following the reporting year

KBK transport tax in 2021 for legal entities and organizations is as follows:

| Tax for legal entities | KBK |

| KBK | 182 1 0600 110 |

KBK penalties for transport tax

If you fail to pay your transport tax on time, you will have to pay a late fee. What penalties are assigned to individuals and legal entities?

- For individuals, KBC penalties: 182 1 0600 110.

- For legal entities of KBK penalties: 182 1 0600 110.

A special calculator will help you calculate the penalty.

The payment form, which is intended for paying tax on a vehicle, contains special details. According to the law, a taxpayer can avoid penalties only in 2 cases:

- If there is a court decision to temporarily suspend transactions on accounts;

- If the inspection seized the property.

You can calculate late fees using a certain formula:

- amount of tax debt * number of overdue days * 1/300 of the Central Bank of Russia refinancing rate.

The latest figure in 2021 was 9%. It is easier to calculate using a calculator created for this purpose.

The payer can pay penalties for transport tax himself. But if this does not happen, then the tax authorities carry out forced collection from the payer.

From 10/01/2017, from 31 days of delay, organizations began to be charged 1/150 of the refinancing rate.

Penalties for non-payment of transport tax are not the only punishment. Also, an irresponsible taxpayer will be assessed a fine for failure to comply with the law. The amount of the fine will depend on the type of violation by the taxpayer. If the established amount was not paid out of malicious intent, then the taxpayer will have to pay 40% of the existing debt. If the payment was not made due to negligence, you will have to pay only 20%.

Penalties and fines for individuals

For all individuals, vehicle tax comes along with the notification. The document can be transmitted in paper form or electronically.

If the vehicle owner has not received a notice to pay it in less than a month, then you should receive it yourself. For overdue debt, a fine will be charged immediately. And the more time has passed since the date on which payment was required, the greater the fine will be.

The tax limitation period is 36 months. So during this time period the tax service will not present any demands to the individual, then you can forget about the unpaid payment.

| Penalty | Interest | Fines | |

| KBK | 182 1 06 04012 02 2100 110 | 182 1 06 04012 02 2200 110 | 182 1 06 04012 02 3000 110 |

What to do if the code is incorrect

When paying tax, it is very important to indicate the correct BCC. If the code is specified incorrectly, then two scenarios are possible:

- the funds will still go to the state budget;

- payment will not go to the state budget.

How to calculate transport tax, details in this video:

The first situation is possible when an error was made in the KBK, but the number entered by the payer still corresponds to the code that is relevant for another payment to the state budget.

If the code entered by the payer is not relevant for any payment, then the funds will not go to the state budget at all.

In the first situation, the tax service will most likely oblige you to pay a fine for inattention. However, if the payer does not want to pay the fine, then it is possible to challenge it in court, appealing to the actual receipt of funds into the budget.

Is it possible to find out a fine by car number, how to do this is described here.

However, paying a fine will be much easier than dealing with government officials in court.

If the funds do not reach the state budget at all, then the only way out of the situation will be to pay the tax again. Here it is very important to detect the error in time, since if funds are not received into the budget on time, the payer may also be punished with a fine, which will be impossible to challenge.

Budget classification codes must be indicated in the payment details when paying any contributions to the budget of the Russian Federation.

At the same time, before making a payment, it is very important to check the relevance of the BCC, since they can be changed at any time.

Penalties and fines for legal entities

The 2021 and 2021 transport tax for vehicles owned by legal entities has certain specifics. For organizations, advance payments of such payment are provided. So penalties for transport tax of legal entities will be calculated on advances.

The terms for accrual of advances are determined by the law of the Russian Federation. There are no rules that are the same for everyone. Every region has its own.

There are some exceptions whereby organizations located in specific regions are exempt from making payments. The tax service portal has a service where you can view:

- Vehicle tax payment dates for legal entities;

- Tax benefits.

For delaying the payment of the advance, the organization will have to pay penalties. But inspectors will be able to determine the arrears only with the help of a declaration. Only when it is submitted to legal entities can you see the base, as well as all the calculations that arise from it. It will be possible to calculate penalties for legal entities in the same way as for ordinary citizens. And a special calculator will help you do this.

There are no penalties for advance payments. However, in case of non-payment of tax for the year, fines are imposed in full.

The deadline for paying the advance may vary. It depends on the specific region. All payment deadlines for transport taxes are tied to the reporting period. Those. The advance payment must be made at the end of any quarter.

| Penalty | Interest | Fines | |

| KBK | 182 1 06 04011 02 2100 110 | 182 1 06 04011 02 2200 110 | 182 1 06 04011 02 3000 110 |

So, for example, in Dagestan, an advance payment must be made no later than the final day of the month, which immediately follows the previous quarter.

Before calculating the advance payment, you should take into account additional indicators that may affect the final amount:

- How much time has passed since the car's release date;

- How many months have you owned the car?

- Share in the right to transport;

- Ownership coefficient;

- Increasing factor;

- Tax benefits;

- Tax deduction for payments using the Platon system.

In order to make a payment, you will need to fill out a payment order. A special calculator will help you accurately calculate the tax amount.

You must pay for each vehicle that is registered to a commercial company.

What are the BCCs in 2021: a single table (subject to changes)

- Phys. persons in whose name the vehicle is registered.

- Legal persons who have vehicles on their balance sheet.

- Individuals and legal entities for whom a power of attorney was issued for a vehicle or vehicle leasing.

The CBC for citizens and organizations is different. Therefore, you should be especially careful when filling out a payment order.

The main recipient of funds paid as transport tax is the Federal Tax Service. In this regard, the first digits of the BCC are 182. It can then be deciphered as follows:

- 1 - indicates the tax nature of the income.

- 06 - indicates an object that is subject to tax, in this case property.

- 04011 - informs the purpose of the contribution, namely for the vehicle.

- The next 4 digits indicate what type of debt is being paid for - tax, penalty, fine or interest.

- the last three digits - 110 - indicate tax income in accordance with the Tax Code of the Russian Federation.

Please note that when filling out a payment document, the recipient must indicate the Federal Treasury (Federal Treasury). However, further in brackets it is necessary to enter information about the administrator, namely the Federal Tax Service of the Russian Federation.

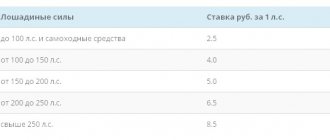

According to Article 361 of the Tax Code of the Russian Federation, each region of the Russian Federation has the right to independently set the size of rates. The article defines the basic rates, which can be reduced at the initiative of the subject by no more than ten times from the basic value. The place where tax obligations are paid does not matter. The twelfth and thirteenth digits of the BCC - 02 - carry information that the payment is made to the regional budget.

The Ministry of Finance, in its letter dated August 17, 2015, indicated that payment of the tax must be made by the person to whom the vehicle was directly registered. Accordingly, if the car is registered by the lessor, it will be he who will pay the tax. If the lessee, with the permission of the owner of the vehicle, has registered the vehicle in his name, then the obligation to pay the tax passes to him. Based on this, the budget classification code is determined when paying transport tax, which is different for legal entities and individuals. If the car is registered to a person, and an organization uses it, then when paying you must indicate the code appropriate for individuals.

- Pension contributions. Decoding codes for the budget classification of pension contributions for 2021.

- Contributions to compulsory social insurance. Decoding codes for the budget classification of contributions to compulsory social insurance for 2021.

- Contributions for compulsory health insurance. Decoding codes for the budget classification of contributions for compulsory health insurance for 2021.

- Personal income tax (NDFL). Deciphering the budget classification codes for personal income taxes (NDFL) 2021.

- Value added tax (VAT). Decoding the budget classification codes for value added tax (VAT) 2021.

- Income tax. Decoding the 2021 income tax budget classification codes.

- Excise taxes. Decoding the codes for the budget classification of excise taxes for 2021.

- Organizational property tax. Decoding the codes of the budget classification of property tax for organizations 2021.

- Land tax. Deciphering the codes for the budget classification of land tax for 2021.

- Single tax with simplification. Decoding the codes of the budget classification of the single tax during simplification for 2021.

- Unified tax on imputed income (UTII). Decoding codes for the budget classification of the single tax on imputed income (UTII) 2021.

- Unified Agricultural Tax (USAT). Decoding the codes of the budget classification of the Unified Agricultural Tax (USAT) 2021.

- Mineral extraction tax (MET). Deciphering the budget classification codes for mineral extraction taxes (MET) 2021.

- Fee for the use of aquatic biological resources. Decoding the budget classification codes of the fee for the use of aquatic biological resources for 2021.

- Fee for the use of fauna objects. Deciphering the codes of the budget fee for the use of wildlife objects in 2021.

- Water tax. Decoding the codes of the budget classification of water tax for 2021.

- Payments for the use of subsoil. Decoding codes for the budget classification of payments for the use of subsoil for 2021.

- Payments for the use of natural resources. Decoding codes for the budget classification of payments for the use of natural resources for 2021.

- Gambling tax. Deciphering the budget classification codes for the gambling tax for 2021.

- Government duty. Decoding the codes of the budget classification of state duty for 2021.

- Income from the provision of paid services and compensation for state costs. Decoding codes for the budget classification of income from the provision of paid services and compensation for state expenses in 2021.

- Fines, sanctions, payments for damages. Decoding codes for the budget classification of fines, sanctions, payments for damages in 2021.

- Trade fee. Decoding the codes of the budget classification of trade tax for 2021.

- News. All news on changes in (KBK) budget classification codes for past and current years.