Vehicles may also be subject to additional tax concessions. This program applies to almost all pensioners. In order to receive the necessary type of such government subsidies, you must comply with all legally established rules and forms.

Not all vehicles are eligible for this preferential tax. Therefore, before submitting an application to the tax authorities to recognize a vehicle as suitable for receiving government subsidies in the form of a reduced tax rate, you must also familiarize yourself with the rules.

They indicate what types of equipment pensioners can receive a tax break for and what needs to be done to properly process such a subsidy.

Who gets the benefit?

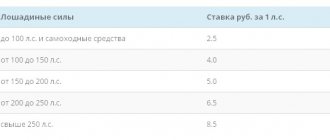

Pensioners and large families with three or more children under the age of eighteen who own passenger cars with an engine power of up to 150 horsepower. Tax breaks also apply to motorcycles and scooters with engine power up to 36 horsepower.

Tax is paid at a rate of 1 ruble per horsepower only in respect of one vehicle at the taxpayer’s choice.

Also not subject to taxation are cars specially equipped for disabled people, and cars with an engine power of up to 100 horsepower purchased by disabled people through social security authorities.

Since this tax is regional, all the details, from its scale to the moment of deduction to the treasury, are decided by local authorities. The federal level of laws determines only the deadline by which payment of transport tax must be made by pensioners and other persons.

Who is a beneficiary in Moscow?

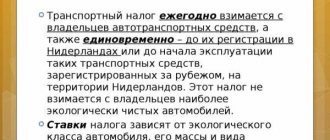

The peculiarity of the transport tax is that it is a regional tax. This means that tax rates and benefits are not established at the federal level. The establishment of rates and benefits for this tax is completely transferred to the jurisdiction of the constituent entities of the Russian Federation, which, by their laws, can provide for regional benefits in relation to both certain categories of citizens and certain categories of vehicles.

In Moscow, the Moscow City Law “On Transport Tax” has approved a list of persons who are completely exempt from paying transport tax in relation to separately specified vehicles. The following are exempt from paying transport tax:

- Heroes of the Soviet Union, Heroes of Russia, citizens awarded the Order of Glory of three degrees;

- veterans and disabled people of the Great Patriotic War;

- veterans and disabled combat veterans;

- disabled people of groups I and II;

- former minor prisoners of concentration camps, ghettos, and other places of forced detention created by the Nazis and their allies during the Second World War;

- one of the parents (adoptive parents), guardian, trustee of a disabled child;

- citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant, the accident at the Mayak production association and the discharge of radioactive waste into the Techa River, nuclear tests at the Semipalatinsk test site and have the right to receive appropriate social support;

- citizens who, as part of special risk units, took direct part in testing nuclear and thermonuclear weapons, eliminating accidents at nuclear installations at weapons and military facilities;

- citizens who received or suffered radiation sickness or became disabled as a result of tests, exercises and other work related to any types of nuclear installations, including nuclear weapons and space technology;

- one of the guardians of a disabled person since childhood who has been declared incompetent by the court;

- one of the parents (adoptive parents) in a large family;

- persons who own passenger cars with an engine power of up to 70 horsepower (up to 51.49 kW), inclusive.

All citizens of the specified categories listed above can enjoy transport tax benefits only in relation to one vehicle registered in their name.

Please note that the listed persons residing in Moscow have the right not to pay transport tax on only one vehicle registered to them with an engine power of up to 200 hp. With. (up to 147.1 kW). But there is an exception for large families: the restriction on car engine power does not apply to parents (adoptive parents) in a large family.

Moreover, if there are two disabled children in a family or a disabled child in a large family, then both parents are exempt from paying transport tax in relation to the car registered to each of them.

The benefits established by the Moscow city law on transport tax do not apply to water, air vehicles, snowmobiles and motor sleighs.

When a Muscovite becomes entitled to a transport tax benefit during a calendar year, the tax amount is calculated taking into account a coefficient defined as the ratio of the number of complete months preceding the month in which the right to the benefit arises to the number of calendar months in the calendar year. In this case, the coefficient is calculated to three decimal places.

How has the size of the benefit changed over the past 3 years?

The project for preferential subsidies for vehicles for disabled pensioners and large families is constantly developing. Therefore, legislation needs to be amended to expand the list of vehicles. Over the past 3 years, such programs have had the opportunity to develop not only at the federal, but also at the regional level.

To find out complete information about these benefits, it is not necessary to independently study regional legislation, which is not always easy to find and analyze. It is enough to contact the tax office at your place of residence.

It will explain what car tax breaks for retirees are available in your region and which one is best for you. The amount of tax benefits varies, usually depending on the characteristics of the vehicle and the number of vehicles. What is the size of the transport tax benefit in 2018?

Tax rates established by the Tax Code of the Russian Federation can be reduced or increased by the laws of the constituent entities of the Russian Federation, but not more than five times.

It is allowed for the laws of the constituent entities of the Russian Federation to establish differentiated tax rates in relation to each category of vehicles, as well as taking into account the useful life of the vehicles.

The car tax was introduced in the Russian Federation in 2003. From now on, the owner of the vehicle, who does not have benefits, pays a certain amount for the reporting period - a calendar year - to the budget. By law, the tax is included in regional fees, so local authorities independently decide which categories of Russians and under what conditions will receive transport tax benefits.

It turns out that pensioners do not pay transport tax if local legislation provides for this, and they have demonstrated their right to receive this benefit. In some subjects of the Russian Federation, the law provides for several options for benefits; the right to choose which one to use is given to the pensioner himself. Transport tax benefits for pensioners depend on the technical characteristics of transport and the quantity of transport owned by a person.

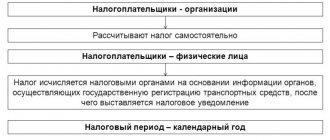

Rules and deadlines for paying taxes for individuals

Citizens do not make advance payments; the tax is paid in full at the end of the reporting year. There is no need to calculate the amount yourself either. It is enough just to wait for the notification sent by the Federal Tax Service, which will arrive at the taxpayer’s residence address.

This document details information on each tax object and displays the total amount payable. It contains the details to which funds must be transferred before December 1st.

If for some reason the payer has not received a tax notice, you must use your personal account on the Federal Tax Service website, where information on charges is also displayed.

Deadline for payment of transport tax for individuals in 2021:

- for 2021 - no later than December 1, 2021

- for 2021 - no later than December 1, 2022

Please take into account: in accordance with paragraph 7 of Art. 6.1. Tax Code of the Russian Federation, if the last day of the period falls on a weekend, then the day of expiration of the period is considered to be the next working day following it.

How to get transport tax benefits in 2021

In order to receive the necessary subsidiary contributions and tax reductions, disabled pensioners or large families must obtain the appropriate certificate from the social services at their place of registration. He confirms their status.

Next, you need to write an application at the tax office at the place of registration of the person. After reviewing the application, the tax authority will notify the person and the rate reduction will take effect.

This benefit is provided in respect of one vehicle at the choice of the taxpayer on the basis of a written application and upon presentation to the tax authority at the location of the vehicle of documents confirming its inclusion in the category of taxpayers provided for in the specified paragraph, in accordance with the law.

Individuals who have the right to benefits are required to independently declare them to the tax authority at the place of registration of taxable objects. To do this, it is necessary to provide a written application in any form and copies of documents that confirm the right to benefits. If you do not apply for a benefit on time, the tax will be recalculated no more than three years in advance.

For what type of transport do you need to pay transport tax?

Transport tax in the Russian Federation is regulated by Chapter 28 of the Tax Code of the Russian Federation. In accordance with Art. 358 of the Tax Code of the Russian Federation, owners of the following vehicles are required to pay transport tax:

- automobile;

- motorbike;

- scooter;

- bus;

- self-propelled machines and mechanisms on pneumatic and caterpillar tracks;

- airplane;

- helicopter;

- motor ship;

- yacht;

- sailing ships;

- boat;

- snowmobile;

- motor sleigh;

- powerboat;

- jet ski;

- non-self-propelled (towed) vessels;

- other water and air vehicles registered in accordance with the established procedure in accordance with the legislation of the Russian Federation.

It is vehicles that are subject to taxation .

Individuals who have at least one of the listed vehicles registered are required to pay transport tax. If a vehicle is transferred for full use to another person, the owner must notify the tax authorities about this in order to avoid charging transport tax on a vehicle that he does not actually use .

Last news

Issues about expanding the list of acceptable vehicles are being considered at the government level. Many of the established rules are already practically outdated and in fact it is necessary to finalize the budget legislation in the field of tax breaks on movable property of pensioners.

For these purposes, an expert group has been created, whose main goal is to study the current car market and determine for which types of equipment it is better to provide tax benefits for pensioners.

Want to know how to earn over 450% per annum in the stock market?

Get a free course on investing in high-yield instruments that brought in more than $1 million in 2021.

I, Andrey Abrechko, an investment expert with 12 years of experience and the founder of the Academy of High Profit Investments, invite you to take part in my free course, where you will learn:

— which instruments are the most profitable in 2021;

— what are IPOs and SPACs and how to start making money on them from 100% per annum;

I will analyze my real case, where I will show with a clear example how I managed to make more than 450% per annum for 2020.

The course consists of 5 small lessons that will be sent to you via Telegram and you can watch them at any convenient time.

Follow the link and start free training