Payment of property tax for individuals from 2021 is carried out based on the cadastral, and not on the inventory value of real estate. The cadastral value is closer to the market value, which means the tax will be rather large. That’s why it’s so important to know your rights and calculate your tax correctly!

How to calculate property tax for individuals

From January 1, 2021, only the cadastral value is taken into account when calculating tax.

Note that the cadastral value may differ from the market value upward, since it is not an absolutely accurate indicator. Since it consists of an average assessment of the object for the cadastral region, taking into account the date of commissioning and some features of the structure. The legislation establishes that once every five years the cadastral value must be clarified and recalculated based on data from independent appraisers.

How to reduce the cadastral value of real estate?

To calculate tax for 2021, you need to know:

1. Cadastral value.

2. Tax rate.

The levy rate on the property of individuals in 2021 will be 0.1%, calculated from the value according to the cadastre. All residential premises, as well as utility buildings larger than 50 square meters, will be subject to taxation. meters, if located on a plot of land for construction purposes, subsidiary farming, etc.

In some cities, the tax rate may vary depending on the building, be it a garage, an apartment or a residential building, we recommend checking the exact information in the service “Reference information on rates and benefits for property taxes.”

Follow the instructions:

- O;

- you need to select a tax period;

- select “Russian Subject”;

- specify “Municipal entity”;

- click the Find button;

- Next, a table will be generated, in it, click on the “More details” link and all information on tax rates in this region will open.

3. A tax deduction is provided for property tax payers, according to paragraphs. 3 - 6 tbsp. 403 Tax Code of the Russian Federation. An area standard is established that reduces the tax base of real estate for:

- rooms (part of an apartment) of 10 sq. meters;

- apartments (part of a house) of 20 sq. meters;

- residential building of 50 sq. meters.

- for a large family with 3 or more minor children, 5 sq.m. is added to the above standard. for apartments and rooms, 7 sq.m. for houses.

- a single real estate complex (includes one residential building) - 1 million rubles from the cadastral value (the definition of the Unified Tax Code is given in Article 133.1 of the Civil Code).

The deduction is applied automatically when calculating tax and does not require a declaration. The final difference will be used to calculate the property tax for individuals. Thus, if the calculation turns out to be zero, then there will be nothing to pay and there is no need to pay tax.

4. To somehow reduce the burden, benefits are provided for those in need.

Formula for calculating property taxes in 2021

H = (KC – B) × D× HC, where

- KC is the price of the object according to the cadastre;

- B - property deduction;

- D - share (provided that the property is divided into shares and it is necessary to find out the calculation of its part);

- CD - coefficient deflator;

- NS - tax rate.

Calculation example

Let's consider an ordinary two-room apartment in Tyumen with an area of 62 square meters, with a cadastral value of 2.26 million rubles. without divided shares.

First let's find H1:

We calculate the cost of one square meter by dividing the cadastral value by the area.

2260000 / 62 = 36,451 rub. for 1 sq. meter

Then we calculate the area of the apartment that is subject to taxation taking into account the tax deduction:

62 – 20 = 42 sq. m.

It remains to multiply them by the cadastral value of a meter of area:

42 × 36,451 = 1,530,942 rubles.

Applying a rate of 0.1%, we find the amount of property tax.

1,530,942 × 0.1% = 1,531 rubles.

Let's calculate an example for a large family with 3 children. Taking into account the benefits, an additional 15 square meters will be added to the standard area. meters.

62 - (20 + 15) = 27 sq. m.

(27 × 36451) × 0.1% = 984 rubles.

The savings will be: 1,531 - 984 = 541 rubles per year.

Let's add to this other objects that the family may own (land under the dacha, garage, car), and in the end the amount will accumulate to pay all taxes at once.

At the same time, the Moscow and Leningrad regions were left to independently determine the rates of property tax for individuals.

Among the problems of the new reform, analysts cite the insufficient number of accredited appraisers and their competence, which is increasingly being paid attention to in training and issuing certificates. You can already notice that an apartment in a new building may turn out to be cheaper at cadastral value than in a Khrushchev-era building.

Garage tax for individuals in 2021

Any real estate of citizens, including non-residential property, which includes a garage, is subject to taxation. This norm is enshrined in the Tax Code.

The tax itself is local and its rates are determined by the Tax Code of the Russian Federation and regulations of the territorial authorities. The base rate for a garage is 0.1% of its cadastral value. Local authorities can set their own value, but the Tax Code limits the upper tax limit. To calculate it, the total value of all property is used:

- 300 - 500 thousand rubles, the maximum values will be limited - 0.3%,

- over 500 thousand rubles – up to 2%.

Please note that garages are included in the calculation along with other real estate objects.

The tax is calculated once a year for the period from the moment the right arises. For example , citizen I. bought a garage on March 5, 2021. The 2021 tax on this property will be calculated based on 10 months of ownership.

The owner of a garage can also be the owner of the land underneath it. Then you have to pay land tax for it.

The deadline for paying tax for a garage that a citizen owned during the year is December 2 of the following year. Today, personal property tax for 2021 must be paid by December 2, 2021.

For reference: Pensioners are exempt from property tax on all residential and non-residential properties. But, if a pensioner owns several garages, then only one of them is exempt from paying tax at his discretion. You will have to pay for the land under the garage in any case.

Tax payment deadlines

In 2021, the deadline is the same for everyone - no later than December 1, 2017. If the deadlines are ignored, a penalty will be charged for each day of delay. The amount of the penalty is one three-hundredth of the refinancing rate of the central bank.

Moreover, the tax office has the right to notify his employer of problems with the taxpayer. In this case, the arrears will be collected from wages. And the violator will also receive the status of a travel ban. That is, it will be impossible to leave the Russian Federation.

In addition, there is no fine for individuals.

Who can avoid paying property taxes?

Below we will look at examples of when you can avoid paying property taxes.

Property tax benefits for individuals

The Tax Code in Articles 399 and 407 determines the beneficiaries for paying property tax: federal by categories and types of property, as well as regional.

Federal categories that are completely exempt from payment include:

- disabled people of groups 1 and 2, as well as disabled people from childhood and children;

- recipients of old-age pensions;

- WWII veterans;

- persons holding the title of Hero of the Soviet Union and the Russian Federation;

- holders of the Order of Glory of three degrees;

- liquidators of emergencies that occurred at radioactive sites: the Chernobyl nuclear power plant, Mayak PA, tests at the test site in Semipalatinsk;

- other categories of military personnel, as well as their families.

Article 407 of the Tax Code of the Russian Federation determines that individuals do not pay tax for buildings of less than 50 square meters on lands for individual housing construction, vegetable gardening, horticulture and summer cottages.

Regional authorities can determine local benefits through their legislative acts. For example, in Moscow, under certain conditions, you can obtain an exemption from tax on a garage or parking space (this concept has been introduced in 2021).

There are also conditions for receiving benefits:

- the object must be owned and not used for business activities;

- if the cadastral value of a real estate property is above 300 million rubles, the owner cannot count on a benefit.

Benefits for pensioners

Real estate tax for pensioners from 2021, who have been assigned a pension according to the legislation of the Russian Federation, are exempt from paying tax on only one unit of each type of property. A pensioner can choose a preferential facility himself. The rest are taxed at the established rate. In other words, only one apartment and car owned by a pensioner is exempt from property tax.

If a pensioner, for example, has several apartments, and he has not submitted to the Federal Tax Service an application for choosing an object for which he wants to receive tax exemption, then the one with the maximum tax amount is accepted for the benefit.

You can get acquainted with all the benefits for pensioners on the Federal Tax Service website; detailed instructions were given above.

For large families

At the federal level, starting from 2021, a benefit has been introduced that increases the amount of property deduction for families with 3 or more children. 5 sq.m. is added for each person. m. for apartments and rooms, 7 sq. m. for private and gardening houses.

Also, local authorities at their level can help reduce the amount of property taxes. Few of the territories decide to apply such measures; so far, only Nizhny Novgorod, Krasnodar and Novosibirsk, by decision of local Dumas, have exempted families with three or more children from property taxes.

For invalids

The Tax Code has determined that disabled people since childhood, WWII, and groups 1 and 2 are completely exempt from property tax. This is a federal norm and local regulations do not play a role here.

The only exception will be property received by a disabled person through inheritance.

To find out the exact list of beneficiaries and objects for which benefits can be obtained, you should contact the Federal Tax Service at the location of the property. Submit an application for exemption from tax calculation, and indicate in the application information about the property for which you are applying for a benefit. The right to it can be confirmed by relevant documents.

You can take advantage of the property tax benefit only from the month in which the right to it accrued. For the previous period, the tax will be calculated and should be included in the budget. If the application was received significantly later than the right to apply, and the citizen continued to pay the tax, then the overpayment will be returned to him, but only for no more than the three previous years .

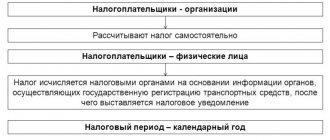

Tax notice

As was already stated at the beginning of the article, there is no need for an individual to make calculations personally. The tax service does this for him, after which the property owner is sent a notice of how much tax he must pay and by what deadline he is allowed to meet.

In 2021, citizens of our country will receive notifications between April and November. But it must arrive at least 30 days before the payment date.

Important! You cannot assume that if you have not received a notice, then you do not have to pay tax. And since 2015, a law has been in force that obliges those who have not received a notification to personally contact the tax office to report that they are in possession of property or a vehicle.

Note: You must report by December 31 of the following year. Moreover, documents should also be provided. This must be a copy of the document that denotes ownership.

Example:

If you purchased an apartment in 2021, but never received a notification, then you must go to the tax office by December 31, 2021 to correct this deficiency. In this case, the calculation will be carried out for the year in which you submitted the information, but only if the tax office did not have data about your property.

If this regulation is violated, paragraph 3 of Article 129.1 will be applied to the violator. The fine in such a combination of circumstances will be 20 percent of the outstanding tax amount.

Important! Notifications will be sent to the taxpayer’s personal account for the Federal Law. If it is more convenient for you to use paper versions sent by mail, you need to personally notify the department about this. But this only applies to those who have access to their personal account. For all others, paper notices will continue to be sent.