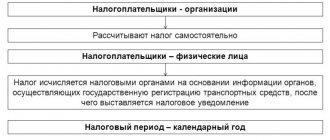

Who pays

Land tax for individuals is a type of local taxation, the funds of which are transferred to the municipal budget.

Land tax for legal entities is paid throughout the entire activity of the enterprise, from the moment of formation to closure. Payments are provided for at the legislative level and apply to the entire period of business activity when an individual entrepreneur or organization receives commercial benefits.

Tax payments for the right to own a land plot apply to the following categories of citizens:

- persons who own land based on property rights;

- heirs with the right of lifelong ownership;

- citizens who own land on the basis of perpetual use.

It should be clarified that individuals who have received a land plot for free, fixed-term use or who are tenants are exempt from paying land tax.

Important! The deadlines for payment of land tax are established at the legislative level, so the required transfers must reach the municipal budget no later than December 1.

Changes in 2021

The key change that has occurred with land tax is the calculation procedure.

In particular, previously the book value of the plot was taken as a basis, now it is the cadastral value. You can get acquainted with the basic amount for taxation on the Rosreestr website.

These calculation rules came into force in January 2021. It should be noted that the changes affected only 29 constituent entities of the Russian Federation. This is a kind of test of the pen, after successful completion of which the optimal calculation formula will be derived.

The new principle of collecting land tax is not yet ideal, so further improvements and changes will be made. One thing is certain, it is planned to increase the rate annually for 5 years .

Thus, the final amount will be set in 2021.

Who has the right to apply the Unified Agricultural Tax?

In accordance with clause 2.1 of Art. 346.2 of the Tax Code of the Russian Federation, the unified agricultural tax in 2021 can be applied by producers of agricultural products, which include:

- legal entities and individual entrepreneurs who are comprehensively engaged in the production of agricultural products, primary and subsequent processing and sales (if the entity is engaged only in the processing of agricultural products, it will not be able to switch to the Unified Agricultural Tax), the share of income from the sale of agricultural products in the total income of which is at least 70% (during the year, preceding the transition);

- economic entities providing auxiliary agricultural services, the share of income from which is at least 70% (such services include preparing fields, sowing seeds, cultivating land, as well as grazing animals, examining and caring for them, etc.);

- agricultural cooperatives subject to the same 70 percent limit;

- fishery entities (provided that the number of hired workers does not exceed 300).

The full list of products related to agricultural products is approved by Decree of the Government of the Russian Federation dated July 25, 2006 No. 458.

Organizations and entrepreneurs who:

- produce excisable products;

- organize gambling;

- belong to budgetary, state or autonomous institutions.

Calculation example for 2017

Land tax is calculated using the following formula: N=K*D*S*Kf.

The definitions look like this:

- N - land tax;

- K is the cadastral value of the site, taken from the official resource of Rosreestr;

- D - size of shared ownership;

- The rate is individual for each region, you can find out on the Federal Tax Service website: nalog.ru;

- Kf - ownership coefficient applied in cases where the site is owned for less than a calendar year.

Example

Ivanov I. I is the owner of a land plot, the cadastral value of which is 2,400,385 rubles.

The land is located in the Moscow region, so the tax rate is 0.3%.

Substituting the values into the formula, we get the following:

2 400 385*0.3/100.

As a result, the amount of land tax will be 7,201 rubles.

If the plot is owned for less than a year, the ownership coefficient is taken into account.

Taking into account the previous example, we substitute the variable: Ivanov I. And owns the land for 3 months, this is a coefficient of 0.25 from the calendar year.

Substituting this number into the formula, we get the final amount of 1,801 rubles.

Payment Methods

Citizens can pay for ZN in any way convenient for them:

- at any branch of a credit institution;

- via online banking;

- in the taxpayer’s personal account on the tax office website;

- from January 1, 2021 in the MFC “My Documents” (subject to availability).

The tax can be paid for third parties.

On the website of the Federal Tax Service it is possible to pay taxes.

To do this, use the Electronic Service.

In the payment type menu, select “Land tax”, indicate the payment type - “Tax”, the payment amount according to the NU and click “Next”.

Payment methods - To separate rubles and kopecks in total, use only a dot to enter.

In the payment recipient details, enter the address of the location of your land plot.

The Federal Tax Service Code and Municipality will be filled in automatically after entering the full address of the location of the land property.

Tax details are filled in automatically

To enter an address, enter the address menu and select a subject of the Russian Federation. The index will be entered automatically after entering the full address.

In the “Russian Federation Address” section, start typing the first letters of the district or village and you will be presented with address options to choose from. Click on the required one.

Next, indicate the house (possession, household, letter), building (building, structure, structure), apartment (room, premises, office).

Finally, save by clicking “OK.”

Filling in the address of the object for payment

In the next step, enter your last name, first name, and middle name. Be sure to indicate the TIN; if the address of your place of residence is the same, check the box. If the address is different, you don’t have to fill it in. And then the “Next” button.

Details of an individual for payment - Be sure to indicate the TIN

After entering all the necessary data, you will see a “Pay” button. Click on it and go to select a payment method.

Check the convenient payment method. When choosing a bank card, click on the “Payment for State Services.RF” logo to proceed to payment.

If you want to pay through the website of a credit institution, select from the logos below or enter the name of the bank in the input line.

Payment - choice of bank

You can print a receipt and pay at any credit institution.

By clicking “Generate payment document”, a receipt will be generated and can be printed or saved.

By clicking “Generate payment document”, a receipt will be generated and can be printed or saved

Another service “Payment of taxes for third parties” has become available on the website of the Federal Tax Service of Russia. Using it, you can quickly generate a receipt for payment for third parties and pay.

Tax rates

The tax rate is determined by territorial authorities or federal cities. However, the size is strictly regulated by Article 394 of the Tax Code of the Russian Federation.

Using Moscow and the region as an example, it will look like this.

| Purpose of the site | Rate in 2021 |

| Personal subsidiary and country farms, gardening partnerships, plots allocated for development. | 0.025% |

| Areas designated for vehicle storage: garages, multi-story parking lots. | 0.1% |

| Plots allocated for the construction of housing and related infrastructure. | 0.1% |

| Agricultural land. | 0.3% |

| Territories allocated for the construction of sports facilities. | 0.3% |

| Other purpose. | 1.5% |

The percentage is taken from the calculation of the cadastral value of the land plot.

Privileges

Any taxation scheme implies preferential conditions for certain categories of citizens and organizations.

The right to use exemptions is regulated by Article 395 of the Tax Code of the Russian Federation. This applies to the following institutions:

- Organizations related to the Federal Penitentiary Service of the Russian Federation.

- Enterprises that own areas where public highways are located.

- Organizations with a religious orientation.

- Centers for the disabled, where the number of people with disabilities prevails (at least 80% of the total number of participants).

If we talk about individuals, a reduction in the tax rate is provided for the following categories of citizens:

- persons with confirmed disabilities of groups 1 and 2;

- disabled children;

- participants in hostilities and local conflicts;

- WWII veterans;

- victims of man-made disasters;

In addition, municipal authorities have the right to independently determine the categories of citizens and organizations for which taxation will be carried out according to a preferential schedule.

Download for viewing and printing:

Tax Code of the Russian Federation (part two) dated 08/05/2000 N 117-FZ (as amended on 04/03/2017) (with amendments and additions, entered into force on 05/04/2017)

Payment deadlines

Territorial authorities can not only establish preferential categories of citizens, but also deadlines for payment of land tax.

It was already mentioned above that individuals are required to make required tax deductions no later than December 1, 2017-2018.

A different payment procedure is provided for legal entities and organizations. Here, the maximum permissible deadlines are set on February 1, however, the organization does not have the right to pay tax until the end of the reporting period.

Enterprises making advance payments of taxes are calculated according to the established schedule. The amount for the last reporting quarter must be paid no later than February 1 of the coming year.

Violation of the transfer schedule implies the imposition of penalties. This is 20 and 40% of the payment if the delay is independent and intentional, respectively.

Important! In addition to the established fine, the organization is subject to a penalty in the amount of 1:300 of the refinancing rate of the Central Bank of the Russian Federation for each overdue day.

Debt

Responsibility for paying taxes rests with citizens who own land.

And if you do not pay the tax on time, then you will develop a debt and will be subject to fines and penalties.

The absence of a payment receipt for any reason does not exempt you from paying and accruing penalties.

You can find out the debt under ZN in the following ways:

- visit the tax office at the place of registration of the land property and the inspector will tell you the exact amount. The tax inspector will print out a receipt for you to pay.

- in your Personal Taxpayer Account. It will indicate the amount of tax, penalties and fines. Payment can be made immediately in your Personal Account.

- Any branch of the MFC will provide you with information about the debt.

- receive in your personal account of State Services.

To use the State Services on the website, you need to log into your Personal Account or register.

In the category, and then “Tax debt”.

Click on “Fill out an application”.

Find out the debt on public services

Fill in your last name, first name, middle name and TIN. Then click "Find Debt".

You can also enter your receipt number if you have one.

Find out the debt by TIN

Or you can enter your receipt number if you have one. Enter the UIN indicated on the form.

Find out the debt by receipt number

If a debt is identified, the window will indicate the amount of debt for taxes, penalties and fines. And you can immediately proceed to pay off the debt.

If there is no debt, the following window will appear:

If there is no debt