One-time payment to a new employee

The organization, in accordance with the employment contract concluded with the new employee, undertakes to make a one-time payment to this employee after signing the employment contract.

Can an organization take such a payment into account as part of labor costs when calculating income tax on the basis of clause 25 of Art. 255 of the Tax Code of the Russian Federation? According to Art. 255 of the Tax Code of the Russian Federation, the taxpayer’s expenses for wages include any accruals to employees in cash and (or) in kind, incentive accruals and allowances, compensation accruals related to working hours or working conditions, bonuses and one-time incentive accruals, expenses associated with the maintenance of these employees, provided for by the norms of the legislation of the Russian Federation, labor agreements (contracts) and/or collective agreements.

According to the norms of paragraph 25 of Art. 255 of the Tax Code of the Russian Federation, the taxpayer’s expenses for remuneration may include other types of expenses incurred in favor of the employee and provided for by labor and/or collective agreements. Thus, a one-time payment to an employee made after he signs an employment contract can be taken into account as part of labor costs.

Purpose of the method of reflecting wages in accounting

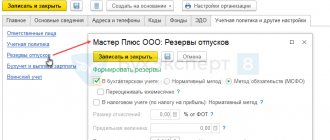

The method of recording in accounting can be specified for a separate document, accrual, or employee. However, it is necessary to take into account the priority in reflecting salaries. For example, when the reflection method in the “Organization” directory is specified differently from the reflection method in the “Employee” directory, the program will “transfer” to “1C: Accounting 8” the reflection method specified for the employee, since the priority of this method of reflecting salaries is higher.

Let's consider the purpose of the reflection method in order of increasing priority:

- For an organization (section “Salary accounting”

via the link

“Accounting and payment of salaries”

on the

“Accounting policies and other settings”

in the

“Organizations”

(section

“Settings”

-

“Organizations”

). - For a division (section “Settings”

-

“Divisions”

). - For the territory (section “Settings”

-

“Territories”

). - For an employee (section "Personnel"

—

"Employees"

, chapter

"Payroll Accounting"

, link

"Payments"

, cost accounting in the employee card). - For the accrual type (section “Settings”

-

“Accruals”

, section

“Accounting”

, tab

“Taxes, contributions, accounting”

of the accrual type form). - For the planned accrual of an employee in the documents “Assignment of planned accrual”

,

“Combination of positions”

. - In some settlement documents, such as "Prize"

,

"Contract (work,

,

“Accrual of other income”

. - By employee and accrual. The setup is carried out by the document “Employee Accruals Accounting”

in the

“Salary”

-

“Employee Accruals Accounting”

.

Additional payment before salary when paying vacation pay

When paying vacation pay, sometimes the employer (organization) pays extra up to the salary. The employment contract then stipulates that when paying vacation pay, if the income received during the month is less than the amount of the monthly salary, the organization guarantees the employee an additional payment up to the amount of the monthly salary. How to account for these funds?

The taxpayer has the right to take into account the amount of such additional payment as part of expenses that reduce taxable profit, in accordance with the provisions of paragraph 25 of Art. 255 of the Tax Code of the Russian Federation, that is, as other types of expenses incurred in favor of the employee, provided for by the labor and/or collective agreement.

Attention should be paid to the fact that the employer’s attribution of the amounts of the above additional payments to expenses when calculating income tax is possible only when such additional payments are provided for by labor and/or collective agreements in accordance with Art. 255 of the Tax Code of the Russian Federation and meet the requirements of Art. 252 of the Tax Code of the Russian Federation.

Travel expenses for a future candidate of sciences

The organization pays the employee’s expenses on study leave to and from the place of study. At the same time, the employee received higher postgraduate education (academic degree of Candidate of Sciences) at a higher educational institution that has state accreditation. How can you account for these costs?

Within the meaning of paragraph 13 of Art. 255 of the Tax Code of the Russian Federation to labor costs for the purpose of applying Ch. 25 of the Tax Code of the Russian Federation includes expenses for remuneration, maintained in accordance with the legislation of the Russian Federation for the duration of study leaves granted to the taxpayer’s employees, as well as expenses for travel to the place of study and back.

As stated in paragraph 7 of Art. 19 of the Federal Law of August 22, 1996 No. 125-FZ “On Higher and Postgraduate Professional Education”, postgraduate students studying in postgraduate courses via correspondence courses are granted the right to annual additional leave at the place of work for a duration of 30 calendar days with the preservation of the average salary. To the annual additional leave of a graduate student, the time spent traveling from the place of work to the location of the graduate school and back is added, while maintaining the average salary. The specified travel is paid by the employing organization.

It turns out that the taxpayer’s expenses associated with providing a graduate student with additional leave while maintaining the average salary, as well as the costs of paying for the graduate student’s travel to and from the place of study can be taken into account for profit tax purposes.

Incentive payments

The employment contract concluded between the organization (employer) and the employee stipulates the employer’s obligation, in addition to wages, to make other incentive payments and compensations established by the provisions approved by the employer. Thus, the regulations on the procedure for remuneration and material incentives for employees provide for the following payments:

- financial assistance for the annual basic paid leave - once a year;

- in connection with employee anniversaries;

- for conferring honorary titles, awarding certificates of honor, declaring gratitude, etc.;

- on holidays: February 23, March 8, professional holidays;

- for awarding prizes at shows, competitions, sports days, etc. (rewarding employees for success in sports is also provided for by the regulations on the organization of mass sports work).

In addition, the regulations on social security for employees provide for the following payments:

- additional payment to employees in excess of the maximum amount of temporary disability benefits established by the legislation of the Russian Federation;

- a one-time benefit to employees retiring for the first time for an old-age pension or a disability pension;

- monthly allowance for child care up to three years of age in the amount of 500 rubles.

Are these payments taken into account under the above provisions in order to reduce the taxable base for income tax, taking into account the requirements of paragraph 25 of Art. 255 of the Tax Code of the Russian Federation?

Clause 2 of Art. 255 of the Tax Code of the Russian Federation provides that labor costs for profit tax purposes include, in particular, accruals of an incentive nature, including bonuses for production results, bonuses to tariff rates and salaries for professional excellence, high achievements in work and other similar indicators .

Incentive payments (additional payments and bonuses of an incentive nature, bonuses and other incentive payments) are elements of the remuneration system in the organization.

According to Art. 191 of the Labor Code of the Russian Federation, the employer encourages employees who conscientiously perform their job duties (declares gratitude, gives a bonus, awards a valuable gift, a certificate of honor, nominates them for the title of the best in the profession).

Other types of employee incentives for work are determined by a collective agreement or internal labor regulations, as well as charters and discipline regulations. For special labor services to society and the state, employees can be nominated for state awards.

It should be noted that expenses in the form of payments in connection with employee anniversaries, rewarding employees for success in sports, as well as payments for holidays do not comply with the requirements of Art. 252 of the Tax Code of the Russian Federation, since these payments are not related to the production results of employees.

A similar procedure should be followed when considering the issue of accounting for profit tax purposes for a lump sum benefit paid upon dismissal of employees due to retirement, and other similar additional payments. If these types of labor costs are not related to the production results of employees and do not meet the criteria of Art. 252 of the Tax Code of the Russian Federation, then, regardless of their name, they cannot be taken into account as expenses for profit tax purposes.

Analytical accounting and its features

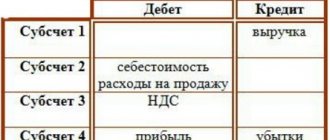

Analytical methods are carried out on the 70th account. Their feature is separate account maintenance for each employee. This method allows you to detail each of the operations. Its function is the ability to obtain information about payments for each employee. For example, an accountant can at any time obtain information about the date and amount of contributions to a specific employee. For example, issuing sick leave and bonuses.

Analytical accounting accounts

For analytical accounting, account 70 “Settlements with personnel” is used. Usually various sub-accounts are opened for it. They are required for detailing. The following subaccounts can be distinguished:

- 70-1 “Settlements with full-time employees of the enterprise.”

- 70-2 “Payments to employees working part-time.”

- 70-3 “Payments to employees collaborating with the enterprise on the basis of civil contracts.

The following items are displayed for the account credit:

- Salaries (correspondence – invoices for production costs).

- Payment of vacation pay and remunerations from the formed reserve (account 96 “Reserves for future expenses”).

- Calculation of social insurance benefits, pensions and other expenses of this type (correspondence - account 69 “Social security payments”).

- Payments to auctioneers (correspondence - “Profits that were not distributed”).

The debit of account 70 displays the following amounts:

- Salaries.

- Prizes and benefits.

- Pension contributions.

- Tax charges.

- Payments made on the basis of executive documents.

- Holds.

IMPORTANT! Payments may not be made on time due to the fault of the recipient. For example, an employee did not show up to the company to receive vacation pay. These unfulfilled payments are recorded on the debit of account 70 “Settlements with employees” and on the credit of account 76 “Settlements with creditors”. In the latter case, a sub-account “Calculations based on deposited values” is opened.

When maintaining individual accounts of employees, personal accounts of employees are used (according to the established form No. T-54). A personal account must be opened for each employee upon hiring. It opens annually. The shelf life of such accounts is 75 years. The following information is entered into personal accounts:

- Salary.

- Other employee income.

- Completed holds.

Personal accounts are formed on the basis of working time sheets, orders for piecework, and orders for bonuses.

Analytical accounting registers

To fully maintain analytical accounting, it is necessary to create registers. They allow you to collect information about all accruals and payments made, confirmed by primary documentation. Let's look at the types of salary registers:

- Personal account.

- A payroll sheet created to calculate the amount of wages.

- Card and detailed statement for account 70.

- Card drawn up in the form of personal income tax-1. Its formation is not necessary: it is created at the request of the accountant.

- Tax accounting register. The law does not determine its form. The company can develop it according to its policy.

Registers are created in paper and electronic form. The first must be supplemented with the official stamp of the enterprise, as well as the signatures of responsible persons. The electronic form is provided with an electronic signature.