General rules for issuing vacation pay

Vacation pay represents financial support during vacation. Rely on employees who have worked for the company for at least six months. If an employee does not exercise his right to leave and resigns, he is entitled to compensation. The amount of vacation pay depends on the following factors:

- Duration of vacation.

- Average employee salary.

- The period for which the calculation is performed.

The amount of the employee's salary is used to calculate the tax. This amount includes bonuses and various compensations issued for the year preceding the vacation.

IMPORTANT! Both budgetary structures and commercial enterprises and individual entrepreneurs are required to provide annual paid leave to their employees. The amount of vacation pay is calculated based on the official salary.

Payment procedure

Income tax is charged only on the amount due to the employee. This matters when the employee has partially used vacation days. If two or more employees in an organization take vacation at once, the tax is transferred as a total amount.

As already mentioned, management now has the right to transfer money to the budget until the end of the month in which the employee has a vacation. The period for paying vacation pay this year according to the Labor Code of the Russian Federation is 3 days.

Personal income tax is withheld only from the amount that is currently due to the employee

Basic rules for calculating personal income tax

The object of taxation is the totality of all vacation payments. According to the provisions of Letter No. 8-306 of the Ministry of Finance, these funds cannot be considered as a component of salary. For this reason, personal income tax on vacation pay is calculated separately from payroll tax.

When to make tax payments?

Vacation pay is issued to the employee three days before his vacation. At the same time, income tax is withheld on the basis of Article 226 of the Tax Code of the Russian Federation. The timing of tax transfer to the treasury depends on how vacation pay is calculated:

- Cash - on the day the funds are issued or the next day . For example, if the money was issued on Friday, the tax is paid on the same day or Monday.

- When withdrawing cash from an organization's account - on the same day . Payment of personal income tax must be carried out on the date of withdrawal of vacation funds from the organization’s account, regardless of when the money will be transferred to the employee.

- Transfer to a bank card or account from a company card or account - on the day of accrual.

IMPORTANT! Some accountants transfer tax before the deadline for issuing vacation pay, when they are recorded in the payroll. This order is considered erroneous.

In 2021, an amendment was made regarding the tax calculation procedure. In particular, now the transfer can be made until the end of the month in which vacation pay was paid.

Let's look at an example

The employee goes on vacation on September 16, 2021. The funds are issued to him in 3 days, that is, on September 13. Personal income tax is transferred to the treasury on the day the money is actually issued. If the responsible persons did not have time to make all the necessary accruals, they can be made until September 30, 2021. The amendment has significantly simplified the work of tax agents. Now you can avoid making payments to employees, maintain accounting and tax records, and transfer personal income tax to the treasury on the same day.

When is tax paid on compensation for unused vacation?

An employee must be granted leave after 6 months of work at the enterprise. If he quits without using his right to leave, compensation is due. It is also considered employee income and therefore subject to tax.

Compensation is issued on the day of dismissal. At the same time, tax is calculated. Funds are transferred to the country's budget on the last day of the month. The compensation paid must be indicated in the 2-NDFL certificate.

Income tax

Income tax is a type of direct tax. It is collected from all individuals who have income. The Tax Code reflects some types of profit from which tax is not withheld. For example, they are not subject to benefits issued from the state budget.

The tax rate is 13%. In some cases it is equal to 9, 15, 30 and 35%. The rate depends on the type and status of profit that is due to working persons.

The tax base is based on income in full. It is worth considering that individuals have the right to count on a tax deduction.

Income tax is 13%

Income tax for employees with their salary is calculated by management, who is the tax agent and who is responsible for the correct execution of all transactions.

Personal Income Tax is an abbreviation for “personal income tax.” The tax is removed from all employed persons. It is collected from citizens of the Russian Federation, foreigners working in Russia and stateless people. This is the same as income tax

Important ! As a rule, taxpayers are not concerned about the deadlines for paying taxes. But if they have income that was not received for working in an organization, for example, for the sale of an apartment or car, then they need to transfer the information by filling out a declaration.

The reporting period for tax payments is 365 days

The tax reporting period is 365 calendar days. The declaration can be completed on paper or electronically. The deadline for its submission is April 30 of the following reporting year.

Features of personal income tax calculation

The object of taxation is the amount of vacation pay. This amount of money cannot be considered as part of the salary. In this regard, the tax on vacation pay is determined independently of the tax on wages.

How to calculate personal income tax?

The most convenient way: use an online personal income tax calculator.

First, the following amounts are deducted from the amount of vacation pay issued:

- Social Security contributions.

- Pension and medical contributions.

- Insurance premiums for occupational injuries and illnesses.

Only after this the tax is deducted. Its rate is 13%.

Calculation of tax on additional vacation days

An employee may request additional paid vacation days. They are also taxed. For each day of vacation, the employee's average salary for the shift is calculated. For example, it is 300 rubles. In this case, for 3 days of additional vacation, vacation pay will be 900 rubles. To calculate the tax, you need to multiply this amount by the rate of 13%. Personal income tax will be 117 rubles.

Calculation example

Ivan Sidorov goes on vacation from June 20 to July 3, 2021. First you need to calculate the amount of his vacation pay. They are determined depending on the size of the salary. Ivan Sidorov receives 47 thousand a month. The average salary per shift is 1,600 rubles. In June, the employee worked 10 shifts. His actual salary for the month was 23,500 rubles. The accountant makes the following calculations:

- 47 thousand rubles * 5 months (time worked in 2021) + 1,600 rubles * 14 (number of vacation days) = 257,400 rubles.

- 1,600 *14 days – 1,400 (standard deduction). The result is multiplied by 13%. Income tax is 2,730 rubles.

The procedure for calculating tax on compensation for unused vacation is similar.

Definition of payment

In tax and accounting reporting, tax must be displayed taking into account the following rules:

- the tax is entered as labor costs;

- if there is an insurance premium, they are classified as other expenses for core activities;

- expenses relate to the month in which they were incurred.

The tax is defined in the financial statements as labor costs

Holiday pay accounting

When withholding income tax, the following entries are used:

- DT 68 “Calculations for tax collections.”

- DT 70 “Wages and salaries”.

Accounts numbered 68, 51 can be used for the loan.

Examples

Employee Vasiliev will go on vacation for 28 days from July 2, 2021. His salary was 38,629 rubles. Funds are transferred to the company's reserve account. No deductions are made from vacation pay. Their size will be 5,022 rubles. In this situation, the following wiring is used:

- DT 70 CT 68. Explanation: tax withholding. Amount: 5,022 rubles.

- DT 68 CT 51. Explanation: tax transfer. Amount: 5,022 rubles.

Employee Vasiliev goes on vacation. His salary is 30 thousand rubles. An employee has the right to a tax deduction in the amount of 1,900 rubles. As a result, the amount of vacation pay will be 3,653 rubles. The following wiring is used:

- DT 70 CT 68. Explanation: personal income tax withholding. Amount: 3,653 rubles.

- DT 68 CT 51. Explanation: transfer of the amount to the treasury. Amount: 3,653 rubles.

The information specified in the accounting must be confirmed by primary documentation.

The legislative framework

The main regulatory act that controls the procedure for calculating vacation pay is the Labor Code of Russia. All issues regarding taxation are clarified in the Tax Code of the Russian Federation.

These main legal acts make it possible to count on receiving payments due to the employee and taxing them.

The Labor and Tax Codes provide information regarding vacation pay and tax withholding

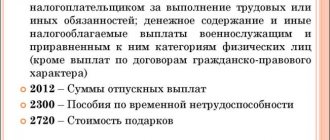

Fixation of vacation pay in 2-NDFL

Vacation pay is subject to taxation. Therefore, they must appear in the 2-NDFL certificate as the employee’s income. Displayed in the month in which the funds were actually issued to the employee. For them you need to provide a separate line with code 2012.

Fixing compensation for unused vacation in 2-NDFL

When displaying compensation on a tax certificate, you must use the code. There is no special number for the payments in question. The following codes are allowed:

- 4800 (payment of compensation upon dismissal).

- 2000 (income related to wages).

- 2012 (vacation pay).

IMPORTANT! According to the explanations of the Federal Tax Service, code 2012 should be used. However, the use of other numbers will not be considered a serious error.

Correct reflection of vacation pay in accounting and tax documentation allows you to avoid problems during audits.

Object of taxation

The income that an individual has is subject to taxation. Vacation pay is issued to the employee before his vacation begins. They are the ones who are subject to personal income tax.

The formula for calculating vacation pay is as follows: duration of vacation (in days) * average daily earnings of the employee.

After which the resulting figure is * 13%.

The final number will reflect the amount of tax.

Vacation pay must be issued by the employer before the employee goes on vacation.

In this case, no action is required from the employee. All work falls on the management. He is responsible for the correctness of calculations and timely transfer of money to the treasury.

Income tax calculation

From the vacation pay received, you need to subtract:

- contributions to social and pension funds;

- medical deductions;

- contributions to the insurance fund in case of work injury or illness.

After all these deductions, the tax is calculated. The rate is 13%.

Contributions to the Pension Fund, compulsory medical insurance, etc. are also deducted from income.

Who pays maternity benefits and is it possible to collect income tax for individual entrepreneurs?

Responsibility for maternity payments lies entirely with the Social Insurance Fund of Russia, which allocates funds from insurance premiums for social insurance for incapacity and maternity. All employers are required to pay these contributions, regardless of whether they are individual entrepreneurs or legal entities. For the last two years, contributions are made not specifically to the fund, but to the Federal Tax Service. But the Social Insurance Fund is still responsible for the procedure for paying maternity benefits and makes decisions on reimbursement to their superiors.

Important ! In this case, the female employer may lose maternity benefits. She can count on them only if she has signed an agreement with the Social Insurance Fund on voluntary insurance and made a contribution 12 months before going on maternity leave.

The Social Insurance Fund is responsible for the procedure for paying maternity benefits.

For example, having entered into a contractual relationship with the Fund in 2021, a woman needs to pay contributions for all 12 months by December 31, 2018. Then the right to social insurance will be valid from January 1, 2020. If a girl works several jobs at once, she is entitled to maternity leave from all jobs. The boss at a non-main job must pay the B&R allowance in the same way as at the main job.

Income tax on maternity leave

Paragraph 1 of Article 217 of the Tax Code of the Russian Federation fully discloses the topic regarding the taxation of maternity leave. According to this article, the tax does not affect payments under the BiR. Payments under the BiR differ from standard sick leave, from which tax is supposed to be collected.

Girls who are not employed cannot take maternity leave. The only exceptions are those women who were forced to quit due to the closure of the enterprise. Like women who are on regular maternity leave, they are accrued all benefits without reduction by the amount of personal income tax.

Excerpt from Article 217 of the Tax Code of the Russian Federation

Also, women in this position are entitled to additional payments.

- One-time benefit. It is available to those who register with the antenatal clinic before 3 months of pregnancy. Its standard size is determined by law and is equal to 330 rubles. Indexation carried out on February 1, 2021 increased the benefit amount to 650 rubles.

- One-time payments for the birth of a baby. Their standard size is determined at the legislative level and is equal to 8 thousand rubles. Indexation also made it possible to increase the amount of payments by more than 2 times, and now they are equal to 17,500 rubles.

Important ! The amount of these benefits is also tax-free.

Various payments for a child are not subject to personal income tax

There are no changes regarding the calculation and taxation of maternity taxes this year. This means that no tax is charged on such payments. But the standard changes affected the amount, which depends on the minimum wage and the employee’s salary, which in turn is subject to income tax.

Taking into account these amounts from the beginning of 2021 for the amount of maternity benefits:

- the minimum amount as a result of the next increase in the minimum wage is 52 thousand rubles in the case of a normal birth;

- the minimum amount for childbirth with complications is 58 thousand rubles;

- the minimum amount for the birth of 2 or more children is 72 thousand rubles;

- the maximum size for normal childbirth is 301 thousand rubles;

- the maximum amount for childbirth with complications is 335 thousand rubles;

- the maximum amount for the birth of 2 or more children is 417 thousand rubles.

The amount of maternity leave depends on the employee’s salary

Answers to frequently asked questions

Is personal income tax collected on vacation pay?

As stated in the legislation, all income that an individual has from an employer is subject to income tax. Vacation pay is also included in this number.

I was given vacation pay, from which personal income tax was taken away. But later I was recalled from vacation. As a result, vacation pay was deducted from subsequent salaries. Where does the tax go in such a situation?

It must be returned based on the written statement drawn up by the employee.

If the tax was deducted but the vacation was not used, it will be returned upon application to the employee

Does accounting have the right to calculate vacation pay and wages together and deduct personal income tax from the total amount?

According to the Labor Code of the Russian Federation as amended on December 20, 2001, Article 136, wages are paid no less frequently than every 15 days. A more precise date for calculating an employee’s salary is determined by the norms of the internal work code, a collective agreement or a work contract no later than 15 days from the end of the period for which it is due.

Vacation pay is accrued no later than 3 days before the start. If the dates coincide, salaries and vacation pay are issued together. Personal income tax is charged on both wages and vacation payments.

Salaries and vacation pay can be issued together; accordingly, tax is deducted from both payments

What is the amount of personal income tax??

Income tax is required to be withheld from vacation pay. This is provided for in paragraph 1 of Article 210 of the Tax Code. Tax collection occurs on the day vacation pay is calculated, i.e. the employee is paid funds from which income taxes have already been deducted.

The amount of tax depends on the employee's salary. It makes up 13% of income.

My husband is employed at PCH. When he took a vacation, personal income tax was withheld from his vacation pay. When the vacation ended and he returned to official duties, he was paid his salary without bonuses or other allowances. This is right? Since I was told that at some enterprises, after a vacation, additional accruals are paid in addition to the salary.

The employer must collect personal income tax from all salaries and transfer it to the state budget. The accrual of bonuses is reflected in the employment agreement and other local acts of the Labor Code. According to Art. 135, an employee’s salary is determined on the basis of an employment agreement, taking into account the remuneration system established by management.

Such a system exists along with the amount of tariff rates, official salary, bonuses and other accruals, including work with difficult or unhealthy conditions. All allowances, bonuses, compensation payments are agreed upon and reflected in the collective agreement, local regulations, taking into account the Labor Code of Russia and other acts that refer to labor standards.

Bonuses and other additional payments are specified in the employment contract

If management does not withhold tax on income and does not pay vacation pay at the same time, it argues that the tax rate is not deducted. Are there legal grounds for this?

The bosses have no right to refuse to pay vacation pay. All employees who have worked for at least six months have a legal entitlement to leave. This right is approved in Article 37 of the Russian Constitution, which additionally emphasizes that all officially employed citizens have such a right. According to Article 142 of the Labor Code, in Russia, management and responsible persons who are appointed by management, who delayed the payment of wages to employees or committed other violations of the employment contract, are required to bear responsibility, taking into account current legislation and regulations.

The employer has no right not to pay vacation pay

How does the income tax withholding process work? My situation is as follows: I worked for 2 weeks, part of my salary arrived, after which I went on a 2 -week vacation, of which only 10 days were paid as vacation pay. A 13% tax was withheld from the amount of vacation pay. I received my vacation pay 7 days before payday. I received vacation pay and salary in one total amount. Is this legal?

No, this is not considered legal. Personal income tax is taken into account only once and cannot be withdrawn again. In this case, it is appropriate to file a complaint with the labor inspectorate.

The individual entrepreneur did not withhold personal income tax from his salary; when it was time for vacation, they refused to give it to me, arguing that taxes had been paid for me for 12 months. Can an individual entrepreneur refuse leave?

In this case, you should contact your local prosecutor. According to Article 45 of the Civil Legal Code, the prosecutor must protect the rights of citizens in court if the rights and interests of citizens have not been respected.

A citizen can contact the prosecutor's office if his rights, enshrined in the Labor Code of the Russian Federation and the Constitution, are not fulfilled

So, since vacation pay is considered income of an individual, income tax (NDFL) is deducted from it. It is 13% of income.