Whatever one may say, there is no escape from taxes. Everyone must pay them and, most importantly, on time. Moreover, if individuals in most cases shift this responsibility to the employer, then legal entities need to independently monitor the correctness and timeliness of making a payment to the budget.

The period of filling out a declaration and paying taxes is a rather stressful moment in an organization, especially in accounting: you need to carefully calculate everything, take into account all income and expenses, correctly determine the tax base, and on its basis - VAT, which the company will pay when submitting documents to the tax office inspection. Things don't always go smoothly.

For various reasons, situations often occur when companies untimely or do not fully fulfill their obligations to the budget. The result is late payment. In order not to fall into the category of unscrupulous taxpayers and not to be subject to “punitive measures” from tax authorities, you need to promptly correct the discovered error by paying the missing part of the tax and VAT penalties that arose as a result of late payment. You will learn how to do this correctly from this article.

For what period are tax penalties calculated?

If an organization or individual entrepreneur does not pay the tax within the period established by law, then starting from the next day after the end of this period, penalties are accrued on the amount of the arrears in accordance with clause 3 of Art.

75 of the Tax Code of the Russian Federation. Read about the rules that govern tax payment deadlines in the material “What you need to know about tax payment deadlines .

The period for calculating the amount of penalties ends on the day the arrears are transferred to the budget. Thus, the next day after the debt is repaid, the accrual of penalties stops.

What are penalties and how are they calculated?

Since 2021, insurance premiums have been divided in relation to the legislative norms establishing the rules for working with them:

- the bulk of contributions (for compulsory health insurance, compulsory medical insurance, compulsory health insurance for disability and maternity) began to be subject to the Tax Code of the Russian Federation and the requirements that apply to tax payments;

- contributions for injuries remained under the provisions of the Law “On Compulsory Social Insurance...” dated July 24, 1998 No. 125-FZ.

However, the requirements for their payment have remained unchanged: insurance premiums must be paid by the payer on time and in full. If due to any circumstances they are not paid or not paid in full, not only the arrears are collected from the payer, but also a sanction for late payment, which is called a penalty.

The basis for payment of penalties (if they are not paid voluntarily) are the requirements presented to the payer by the body supervising the relevant contributions (IFTS or Social Insurance Fund). Thus, penalties are the estimated amount that must be paid by a payer who has violated the deadline for paying contributions. They are calculated as a percentage for each day of delay, starting from the day following the payment deadline, which is established by law.

You can calculate penalties using our calculator .

Read about the specifics of calculating penalties in the material “How to correctly calculate tax penalties (nuances).”

You will always find the KBC for contributions and taxes in ConsultantPlus. Get a free trial and jump into the content.

What formula can you use to calculate tax penalties?

In order for an organization to calculate penalties for late transfers of payments to the budget, you must use the following formula:

When calculating penalties for individual entrepreneurs and individuals for the entire period of delay, only the first part of the formula is applied - without increasing the rate after the 30th day. Doubling the rate is provided only for organizations.

When calculating penalties for payment, the accountant in this formula must use the actual values of the refinancing rate that were in effect during the period of late payment of taxes (clause 4 of Article 75 of the Tax Code of the Russian Federation). That is, if the refinancing rate changes during this period, you need to calculate penalties separately for the periods of validity of each refinancing rate, and then add up the resulting amounts.

If tax authorities decide to round up the interest rate for accrual of penalties, for example, to whole values, which will lead to an increase in payment, then such actions of inspectors can be appealed either to a higher tax authority or in court (Article 137, paragraph 1 of Article 138 of the Tax Code of the Russian Federation) . Moreover, the courts often take the side of taxpayers, as, for example, in the resolution of the Federal Antimonopoly Service of the North-Western District dated November 9, 2005 No. A42-5178/04-29 or the resolution of the 14th Arbitration Court of Appeal dated January 21, 2011 No. A05-9658/2010. This is due to the fact that the text of Art. 75 of the Tax Code of the Russian Federation does not provide for rounding of interest rates.

To calculate penalties, we recommend that you use our service Penalty Calculator .

What objects are subject to taxation?

In accordance with Article 401 of the Tax Code of the Russian Federation, the objects of taxation are those objects that are located within the municipality. Such objects include:

- Residential buildings, these include houses and residential buildings that are located on land plots intended for personal farming, country farming, vegetable gardening, gardening, etc.;

- Apartments, rooms;

- garage, parking space;

- single real estate complex;

- unfinished construction project;

- other building, structure, structure, premises.

The property that is located, which is part of the common multi-apartment property, is not subject to taxation.

An example of calculating tax penalties

Let's look at how tax penalties are calculated using a specific example.

Individual entrepreneur Yu. V. Serebryakov, who uses the simplified tax system, had to pay an advance payment for the 2nd quarter in the amount of 48,000 rubles. no later than July 25. Individual entrepreneur Serebryakov transferred the tax to the budget only on August 2. That is, the entrepreneur was overdue for the advance payment by 8 days (from July 26 to August 2 inclusive), and penalties must be charged for this entire period of 8 days.

Let's assume that in a given period of time the refinancing rate was set at 7.5%.

Let's calculate the amount of penalties payable:

Penalties = 48,000 × 8 × 1/300 × 7.5% = 96 rubles.

So, penalties in the amount of 96 rubles are subject to transfer to the budget.

Transfer of penalties to the budget and postings to reflect them in accounting

Once the amount of the sanction is determined, it is necessary to make appropriate adjustments to the accounting and tax reporting.

In order to reflect the accrual of penalties in accounting, the following type of posting is used: “99-68”. That is, the operation is reflected as a debit to account 99 (Profits and losses) and a credit to account 68 (Calculations for taxes and duties); for VAT it is better to open a separate subaccount here. In addition to this posting, another one is used to transfer the accrued amount to the budget: “68-51”. This reflects the transfer of tax sanctions on the debit of the 68th account and the credit of the 51st (Current accounts).

In tax accounting, penalties, fines and other sanctions are not reflected in calculations. Thus, their value is not taken into account when determining the tax base (clause 2 of Article 270 of the Tax Code of the Russian Federation).

As for the transfer of penalties to the budget as a separate payment, the same BCC, current for 2014, is used as for paying value added tax. The only difference is that the 14th digit in it will be changed to “2”. If an additional fine is established, then for its transfer the figure in the KBK changes to “3”. Currently, the following code for VAT penalties is in effect - 182 1 03 01000 01 2000 110 (according to the budget classification code directory approved for 2014).

How to write correctly: penalty or penalty, pays penalty, payment of penalty or payment of penalty

If there is any doubt when drawing up a payment document, which is correct - a penalty or a penalty, then it is better to consult a dictionary. Thus, in Ozhegov’s dictionary the word “penalty” is used to denote a fine for failure to fulfill any established obligations.

On the other hand, if there are several reasons for accruing a penalty, or if this penalty is accrued for a certain number of days, then it is customary to use the plural word - penalty. In addition, the word “peni” is considered obsolete today; instead, the plural word “peni” is widely used, this is a modern priority.

Therefore, when figuring out how to write correctly - penalty or penalties, amount of penalties or amount of penalties, pays a penalty or penalties, payment of penalties or penalties, calculation of penalties or penalties - it is advisable to opt for using the word “penalty” in the plural.

What is personal property tax?

Personal property tax is a direct tax that is imposed on the property of individuals. The bearer of tax obligations are individuals who own any property.

Important!!! Everyone must pay property tax, regardless of age category. For owners who have not yet turned 18 years of age, their legal representatives, namely parents, guardians, etc., must pay tax.

Results

Calculation of penalties for taxes is done according to the formula given in Art.

75 of the Tax Code of the Russian Federation. It involves the amount of tax not paid on time, the number of days of delay and the rate, determined as a share of the refinancing rate in force during the period of delay. This share in the general case is 1/300. But for legal entities that allow a delay of more than 30 calendar days, another value of this share is used - 1/150. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

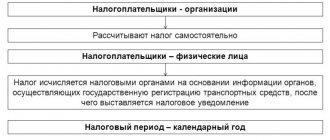

Who should pay property tax

Property tax must be paid by the following persons:

- Legal entities are organizations that own, under the right of trust management, dispose of property that is subject to taxation;

- Individuals are citizens who own property by right of ownership and it is subject to taxation;

- Individual entrepreneur - pay only for the property that is used to carry out business activities. The tax is paid at the rate that is intended for legal entities.

Payment deadlines

Deadlines for paying taxes and insurance fees, filing tax returns and reports.

The day indicated in the Tax Code is the last day for tax payment. The wording “before” or the adverb “no later” is not important (letter of the Ministry of Finance dated April 30, 2019 No. 03-02-08/32422) and (Supreme Court ruling dated October 16, 2018 No. 304-KG18-7786).

TaxTax payments under the simplified tax system (once a quarter): Q1. - until April 25Q2 - until July 25th quarter - until October 25th quarter — until April 30 (for individual entrepreneurs) until March 31 (for organizations) UTII tax payments (once a quarter): I quarter. - until April 25Q2 - until July 25th quarter - until October 25th quarter - until January 25 Personal income tax payments (13%) (once a year): until April 30 Payments Income tax (once a quarter): Q1. - until April 28Q2 — until July 28th quarter - until October 28th quarter - until January 28 VAT payments (once a quarter): I quarter. - until April 202nd quarter - until July 20th quarter — until October 20 IV quarter - until January 20 Since 2015, VAT returns must be submitted by the 25th. But the payment deadline is still until the 20th. Personal income tax 13% for employees (until the 15th of the next month) | Pension FundFixed payment to the Pension Fund of Individual Entrepreneurs (paid once a year, until December 31) in 2021 and 2021 - 40,874 rubles. (for income up to 300 rubles per year and + 1% of income from amounts over 300 rubles), Contributions to the Pension Fund for compulsory pension insurance (paid monthly no later than the 15th day of the next calendar month) For employees: 26% (or The pension penalty also needs to be broken down into a penalty for the insurance and savings part, FFOMS, TFOMS See: Salary and Pension Fund contribution calculator (free) In this case, you can try to reduce the fine and sue. For example, the company reduced the fine by 2 times, citing the fact that the report was overdue by a small number of days (see resolution of the Moscow District Arbitration Court dated April 1, 2016 No. A41-30902/2015). The Pension Fund itself cannot reduce fines, only through the courts. | FSSPayment to the Social Insurance Fund: Q1. — until April 15, 2nd quarter. — until July 15, 3rd quarter. — until October 15, quarter IV. - until January 15 Completed sample 4-FSS 2015. See: Salary and Social Insurance Contributions Calculator (free) |

When are fines illegal?

Unlike disputes with the tax inspectorate, company funds are dealt with in court much less frequently. However, there are controversial situations. The most common cases when the fund imposes a fine and the court cancels it are given below.

- Fines for the branch

The FSS can come with an inspection to a branch of a company that pays its own contributions, but officials have the right to demand payment of arrears, penalties and fines only from the company itself. If the decision was issued in the name of the branch, then such fines are illegal - this was confirmed by the judges (see Determination of the Supreme Arbitration Court of the Russian Federation dated September 4, 2013 No. VAS-7713/13). The same applies to pension contributions (see Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 25, 2011 No. 12902/10). The argument is this: if the insured is the organization, then only it can be held liable.

- Late payment

A company can be fined for late payment only if it has underestimated the base for insurance premiums. That is, when the company did not reflect their amounts in the reporting. If we are talking only about late payment of assessed contributions, then a fine cannot be applied. The judges came to this conclusion when the Pension Fund of the Russian Federation fined a company that did not pay insurance premiums on time (determination of the Supreme Arbitration Court of the Russian Federation dated February 13, 2014 No. VAS-808/14). It turns out that if contributions are paid late, but are calculated correctly, then fund employees do not have the right to present a fine for non-payment of contributions under Article 47 of Law 212-FZ. Late payment of correctly calculated insurance premiums entails only penalties on contributions to the Pension Fund (penalties on contributions to the Social Insurance Fund). Payment of a fine to the Pension Fund or Social Insurance Fund in this situation is not provided.

- Understatement of advances

The Fund does not have the right to fine a company for understating contributions based on the results of an interim period - a quarter, half a year, nine months. The company calculates contributions on an accrual basis. Until the year ends, controllers do not have the right to declare an understatement of the base (Part 1, Article 47 of Law No. 212-FZ). This means that if all contributions are accrued in the annual reporting, then there are no grounds for a fine (Determination of the RF Armed Forces dated March 13, 2015 No. 310-KG15-1761).

| Good reasons that reduce the fine When calculating the amount of the fine, funds are required to identify mitigating circumstances. And if they really exist, then reduce the fine by an amount at your discretion, but not less than 1000 rubles. (Part 1 of Article 46 of Law No. 212-FZ). The list of mitigating circumstances is open, so the company has the right to cite any objective reasons that prevented it from submitting reports on time. Such circumstances include the accountant’s illness, as well as other work and personal troubles (for example, family problems, personnel changes, unforeseen business trips, etc.). |

Errors in accounting

Since 2014, personalized accounting data for employees, the so-called individual information, is submitted as part of the RSV-1 (section 6 of the calculation). So, if suddenly an error creeps in, the company will be fined. The pension fund fine for over-accounting is 5% of the amount accrued for payment to the Pension Fund for the last three months of the reporting period for which the information about the insured persons was not submitted within the established time frame or incomplete and (or) unreliable information was provided. However, fund employees can collect this fine only in court (Article 17 of the Federal Law of April 1, 1996 No. 27-FZ, letter of the Ministry of Labor of Russia dated April 8, 2014 No. 17-3 / B-142).

Late payment for injuries

If you are late with 4-FSS, there will also be a fine for late submission of the calculation of contributions for injuries - since it is included in this reporting (Part 1, Article 19 of the Federal Law of July 24, 1998 No. 125-FZ). The fine is 5% of the amount payable or additional payment based on late payment for each full or partial month of delay. But no more than 30% and no less than 100 rubles. If you delay submitting the payment for more than six months, the fine for the organization will be 30% of the amount of contributions due. Plus 10% for each full or incomplete month, starting from the 181st calendar day. Minimum – 1000 rub.

Fine for failure to provide documents to the Social Insurance Fund

Companies that, for one reason or another, pay contributions at reduced rates (for example, for temporarily staying foreigners) may receive a request from the Social Insurance Fund to provide documents confirming their right to the benefit.

The fund's written request must be responded to no later than 10 business days after receipt of the request. For failure to submit documents related to the calculation and payment of contributions, or for being late in submitting them, there will be a fine of 200 rubles. for each document (Article 48 of Law No. 212-FZ). And the manager can be fined from 300 to 500 rubles. (Part 3 of Article 15.33 of the Code of Administrative Offenses of the Russian Federation). When a company applies to the fund for reimbursement of benefits, the Social Insurance Fund requests documents related to their calculation and payment. If documents are not submitted or submitted late, i.e. later than 10 working days after receiving the request, the company will be fined in the amount of 200 rubles. for each document not submitted (Article 48 of Law No. 212-FZ). And the manager receives a fine from 300 to 500 rubles. (Part 4 of Article 15.33 of the Administrative Code).

The tax base

For individuals, the tax base is the inventory value of the property itself.

If an individual owns several objects, then to calculate the tax it is necessary to add up the inventory value of all objects, and this total value will serve as the tax base in this case.

The inventory value of the property is indicated in the BTI documents. The Tax Service sends out a notice to all individuals with an already specified amount that must be paid to the budget.

Responsibility

Non-payment

Criminal

Such liability occurs when a certain amount of non-payment accumulates.

IP

| Violation | — Amount of underpaid taxes — Amount of income (evasion) | Possible penalties |

| Evasion of taxes (fees) on a large scale (Article 198, paragraph 1 of the Criminal Code) | – from 0.9 million rubles. for three years, and the amount of arrears exceeds 10 percent of the tax payable; – from 2.7 million rubles. | – fine from 100 thousand to 300 thousand rubles. or in the amount of the culprit’s salary for 1-2 years; – forced labor for up to 2 years); –arrest for up to 6 months; – imprisonment for up to 1 year If the individual entrepreneur fully pays the amounts of arrears (taxes) and penalties, as well as the amount of the fine, then he is exempt from criminal prosecution (but only if this is his first such charge) (Article 198, paragraph 3 of the Criminal Code) |

| Evasion of taxes (fees) on an especially large scale (Article 198, paragraph 2. (b) of the Criminal Code) | – from 4.5 million rubles. for three years, and the amount of arrears exceeds 20 percent of the tax payable; – from 30.5 million rubles. | – fine from 200 thousand to 500 thousand rubles. or in the amount of the culprit’s salary for 1.5-3 years; – forced labor for up to 3 years; – imprisonment for up to 3 years |

Legal entities

| Violation | — Amount of underpaid taxes — Amount of income (evasion) | Possible penalties |

| Evasion of taxes (fees) on a large scale (Article 199.1 of the Criminal Code) | – from 5 million rubles. for three years, and the amount of arrears exceeds 25 percent of the tax payable; – from 15 million rubles. | – fine from 100 thousand to 300 thousand rubles. or in the amount of the culprit’s salary for 1-2 years; – forced labor for up to 2 years with deprivation of the right to hold certain positions for up to 3 years (or without it); –arrest for up to 6 months; – imprisonment for up to 2 years with deprivation of the right to hold certain positions for up to 3 years (or without it) If the director fully pays the amounts of arrears (taxes) and penalties, as well as the amount of the fine, then he is exempt from criminal prosecution (but only if this is his first such charge) (Article 199 clause 2 of the Criminal Code) |

| Tax evasion (fees) committed by a group of persons by prior conspiracy (Article 199.2 (a) of the Criminal Code) | – from 5 million rubles. for three years, and the amount of arrears exceeds 25 percent of the tax payable; – from 15 million rubles. | – fine from 200 thousand to 500 thousand rubles. or in the amount of the culprit’s salary for 1-3 years; – forced labor for up to 5 years with deprivation of the right to hold certain positions for up to 3 years (or without it); – imprisonment for up to 6 years with deprivation of the right to hold certain positions for up to 3 years (or without it) |

| Evasion of taxes (fees) on an especially large scale (Article 199.2 (b) of the Criminal Code) | – from 15 million rubles. for three years, and the amount of arrears exceeds 50 percent of the tax payable; – from 45 million rubles. |

Tax

Article 122 of the Tax Code of the Russian Federation - Non-payment or incomplete payment of tax amounts (fees)

1. Non-payment or incomplete payment of tax (fee) amounts as a result of understatement of the tax base, other incorrect calculation of tax (fee) or other unlawful actions (inaction) entails a fine in the amount of 20 percent of the unpaid amount of tax (fee).

Penalty

There are fines for declaration and other violations. For late payments (if the reports have been submitted) - only penalties (exception: when the tax was specifically hidden).

If taxes or payments to the Pension Fund are not paid on time, a penalty of 1/300 multiplied by the refinancing rate per day is provided.

Personal income tax

Unlawful non-withholding and (or) non-transfer (incomplete withholding and (or) transfer) within the period established by this Code of tax amounts (personal income tax for an employee or for rent from an individual, etc.) subject to withholding and transfer by the tax agent, entails the collection of a fine of in the amount of 20 percent of the amount subject to withholding and (or) transfer (Article 123 of the Tax Code).

Not filing reports

ERSV

Penalty for reporting Unified calculation of insurance premiums (ERSV)

“1)

if less than 180 days have passed,

5 percent of the unpaid amount of tax subject to payment (surcharge) on the basis of this declaration, for each full or partial month from the day established for its submission, but not more than 30 percent of the specified amount and not less than 1,000 rubles."

2) if more than 180 days have passed

30% of the amount + 10% for each month (07/27/2010 No. 229-FZ). Those. If you paid the simplified tax system, but did not submit the declaration, then the fine is 1000 rubles. Fines and penalties are not displayed in the declaration.

The amount of the fine for late submission of the ERSV must be calculated and distributed separately for each type of compulsory insurance in accordance with the tariff (letter of the Federal Tax Service of Russia dated May 5, 2021 No. PA-4-11/8641). For example, a fine of 1000 rubles and insurance premiums of 30% (1000 rubles) - 22 percent are attributed to compulsory pension insurance (733.33 rubles), 5.1 percent - to compulsory medical insurance (170 rubles) and 2.9% - to compulsory social insurance in case of temporary disability and in connection with maternity (96.67 rubles).

4-FSS

Penalty for reporting to the Social Insurance Fund

5% of the amount of insurance premiums accrued for payment for the last three months of the reporting (calculation) period, for each full or partial month from the date established for its submission, but not more than 30 percent of the specified amount and not less than 1,000 rubles.

Tax returns

Fine for late submission of the Declaration to the tax office

: “1)

if less than 180 days have passed,

5 percent of the unpaid amount of tax subject to payment (surcharge) on the basis of this declaration, for each full or partial month from the day established for its submission, but not more than 30 percent of the specified amount and not less than 1 000 rubles."

2) if more than 180 days have passed

30% of the amount + 10% for each month (07/27/2010 No. 229-FZ). Those. If you paid the simplified tax system, but did not submit the declaration, then the fine is 1000 rubles. Fines and penalties are not displayed in the declaration.

The fine for not submitting a declaration on time is calculated from the amount of tax not paid on time. The Ministry of Finance believes that if the tax is paid, then no fine is charged for late reporting, however, the tax authorities and the FAS believe that then a minimum fine should be charged - 1000 rubles. (Article 119 of the Tax Code)

Also for officials: Fine for late submission of the Declaration to the tax office

: “Violation of the deadlines established by the legislation on taxes and fees for submitting a tax return to the tax authority at the place of registration - entails a warning or the imposition of an administrative fine on officials in the amount of three hundred to five hundred rubles.” (Article 15.5 of the Code of Administrative Offenses). Note that individual entrepreneurs also bear administrative responsibility as officials.

After 10 days of delay, the tax office has the right to block the current account (Clause 3, Article 76 of the Tax Code of the Russian Federation).

Other

Penalty for the average list to the tax office not on time: 200 rubles (it refers to statistical data).

The fine for 2-personal income tax not being submitted on time is 200 rubles for each certificate (TC article 126 clause 1). Starting in 2021, a new fine of 500 rubles will be introduced for each document for tax agents who provide false data. However, if an error was discovered and corrected (an amendment was submitted) before the decision on the fine, then the Federal Tax Service does not have the right to apply this fine. The fine for failure to submit (late) form 6-NDFL is 1000 rubles for each month. 10 days after the delay, the Federal Tax Service has the right to block the current account by suspending operations on it. Since 2016, a new fine of 500 rubles has been introduced for each document (2-NDFL and 6-NDFL) for tax agents who provide false data. However, if an error was discovered and corrected (an amendment was submitted) before the decision on the fine, then the Federal Tax Service does not have the right to apply this fine.

Statute of limitations

According to Article 113 of the Tax Code of the Russian Federation, the statute of limitations for fines before the tax office is three years from the date of its violation, or from the date of the end of the tax period. Also, the tax office cannot require reporting for audit for a period of more than three years from the end of the tax period. Those. in 2021 these years are 2021, 2021, 2021, 2015.

The Tax Code does not apply to the Pension Fund and Social Insurance Fund and there are no statutes of limitations for these funds (their contributions). For such contributions, the requirement for payment is made “no later than three months from the date of discovery of the arrears” (Article 70 of the Tax Code of the Russian Federation). They can ask for a debt for any period.

The organization will face a fine if it does not submit an explanation or clarification within 5 days if:

- found discrepancies between the reporting and other data that the Federal Tax Service has or other errors or contradictory data in the reporting;

- the organization has reduced the tax (fee) as specified;

- they are asked to justify the loss in the declaration (clause 3 of article 88 of the Tax Code of the Russian Federation).

Fine 5,000 for the first violation and 20,000 for subsequent violations within a calendar year (clause 1 and clause 2 of Article 129.1 of the Tax Code of the Russian Federation).

If an individual has not received a notification from the Federal Tax Service

Sometimes there are cases when, due to a large number of taxpayers and poor logistics, the Federal Tax Service is not able to send notifications to everyone on time. Then an individual needs to contact the tax office and clarify how much tax he needs to pay. But there is another option, go to the official website of the Federal Tax Service in your personal account, where you can register an account through the State Services resource and there, in your personal account, the amount of tax that needs to be paid will be reflected. There is also the opportunity to immediately pay the existing tax using a bank card.

Each taxpayer must notify the Federal Tax Service about an object that is subject to taxation. The message is sent to the tax office by December 31 of the year following the reporting year. But there are exceptions, for example, you do not need to report to the Federal Tax Service if a tax benefit was applied or if the notification was received earlier.

Accrued fines

In addition to penalties, the tax office may also impose a fine, which is a monetary amount of 20% of the total tax debt. By the way, if tax authorities prove intent to evade, then the fine for non-payment of property tax for individuals will increase to 40%, and they can declare a violation and collect the money within three years from the end of the reporting period. For example, if there is debt for 2021, the Federal Tax Service may impose sanctions during 2021-2021, after which the statute of limitations will expire.

You definitely need to be prepared for the fact that the tax officer may provide a number of papers that will be evidence of an offense committed by an individual. For example, documents confirming the legal calculation of the amount of tax, as well as confirming the sending of a notification to the payer, will be useful. It is also important that the debtor should have received the message, and if this did not happen, the decision can be challenged in court.