In what cases is a salary change made?

Information about an employee’s salary is one of the important components of the employment agreement.

It should not have double interpretation. In this case, the employee can receive his remuneration for the time actually worked or for the number of units of output. If an employee is paid a salary, this means that if he works a set amount of time every month, he will receive the same amount.

The administration may increase salaries. This occurs when individual legislative acts come into force, or on the initiative of the administration itself, subject to the availability of financial opportunities.

The most common situation for salary changes is when it is set at the minimum wage. As soon as a decision is made at the legislative level to increase this indicator, the administration is also obliged to revise the employee’s earnings upward.

Otherwise, the company will be held liable for failure to comply with the requirements of the law. It is not allowed if, with a typical working day, the employee’s payment will be less than the minimum wage.

In addition, the Constitutional Court is obliged by business entities to index the employee’s earnings annually. The inflation rate, consumer price growth rate, etc. can be used as a coefficient.

Attention: therefore, the salary must be increased by at least the established factor. Commercial organizations can choose the coefficient for themselves; budgetary institutions use the approved inflation rate.

Business entities can voluntarily, if they have the financial capacity, index the earnings of their employees.

The procedure for indexing in various organizations

The specifics of measures to increase wages are enshrined in Article 134 of the Labor Code.

In non-profit organizations, such events are carried out in accordance with the procedure established by laws and internal documentation. As practice shows, payments in budgetary institutions increase after the government issues a special order.

In commercial enterprises, this procedure is prescribed in local documents, taking into account the influence of various circumstances. Many enterprises indicate in the collective agreement that indexation is carried out based on the financial capabilities of the company. Indexing is based on a change in salary or rate by a certain percentage.

In government institutions, the entire wage fund is being increased. Many commercial enterprises introduce additional incentive coefficients.

The reasons for indexing are:

- price level by country and region;

- inflation indicators;

- change in the cost of living;

- regional coefficient to wages.

The regional coefficient is an increase to the basic salary for employees working in harsh climatic conditions. The additional payment applies to those whose employment agreement reflects the conditions for using this method of calculating wages.

The timing of events is reflected in local regulations or the collective agreement of the enterprise. Wages can be indexed monthly, quarterly, semi-annually or annually.

IMPORTANT! Information in local regulations must be communicated to all employees to avoid misunderstandings. Employees must understand the difference between indexing and regular salary increases.

The legislation does not stipulate the frequency of increases in employee salaries, but official inflation data imply a mandatory increase in the level of remuneration.

How to commit a change

If a decision is made to change an employee’s salary, it must be recorded in several documents at once:

- An order to change the salary is the main document for the enterprise, which states which employee and what salary should be set. Here it is determined from what date this change begins to take effect. The order may also contain instructions to change other documents.

- Staffing table - the document indicates the name and number of employee positions, as well as the salaries associated with them. In the event that an employee’s salary changes, the salary must also be changed in the staffing table. This step can be carried out by ordering changes, or by developing and introducing a new staffing table (if a large number of salaries are changing).

- Employment agreement with an employee - the Labor Code determines that the amount of an employee’s salary is necessarily fixed in the employment agreement with him. If the salary changes, then it is best to draw up an additional agreement to the employment contract on the salary change. Thanks to this document, the old provision of the contract changes to a new one.

Grounds for issuing an order

The reasons why an order to change the salary may be issued can be divided into two groups - at the initiative of the employer or by force of law.

The law states that wages must be expressed as a fixed amount, which the employee will receive if he works in full for the month. Its size in this case should also not be less than the minimum wage.

Therefore, if the law establishes a new minimum wage, the employer is obliged to adjust existing salaries to its level - they should not be less than the minimum amount.

In addition, the law or internal regulations may establish the need for annual salary indexation. It must be carried out on the value of inflation for the previous year or the increase in consumer prices. Then it is necessary to indicate Art. 134 of the Labor Code, as well as the clause of the Regulations on payment, or a separate Regulation on indexation.

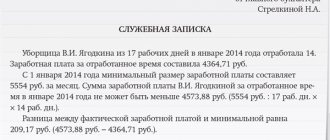

Attention: if the administration wants to encourage an employee, it can do this by increasing the salary. The step for this should be a memo from the immediate supervisor. The manager must consider it and put down his resolution.

If the decision to increase the salary is positive, then when drawing up the order, this memo will be used as a basis.

Who received a minimum wage increase from October 1

Lucky Muscovites. This year, the minimum wage in Moscow changed twice: from July 1 and from October 1 (PP No. 1177-PP dated September 10, 2019):

- from July 1st they raised it by 570 rubles. up to RUB 19,351;

- from October 1, the amount was increased by another 844 rubles. up to 20,195 rub..

The minimum wage in Moscow from October 1, 2021 is 20,195 rubles (approved by Moscow Government Decree No. 1177-PP dated September 10, 2019). In the Moscow region, the figure has not changed - 14,200 rubles (agreement on the minimum wage in the Moscow Region No. 41 of 03/01/2018).

The amount is adjusted depending on the cost of living, which legislators have the right to change quarterly. It is possible that it will soon be counted in the regions.

IMPORTANT!

In 2021, the total amount of money earned by an employee from a particular employer cannot be less than 11,280 rubles.

When is a salary increase order prepared?

The Labor Code of the Russian Federation provides all workers with a guarantee in the form of wages at a level not lower than the minimum wage, without taking into account regional allowances and coefficients. This means that employers must monitor the innovations that the authorities approve in this area and raise salaries for their employees if the amounts currently paid are below federal standards.

According to current legislation, the minimum wage is established annually from January 1. It is permissible to increase it or maintain it at the same level, depending on the level of the living wage for the working-age population approved by officials for the 2nd quarter of the previous year. Therefore, an order to increase salaries due to the minimum wage will be needed at least once a year.

The last time the requirement to increase the minimum wage came into force was on 01/01/2020, and from this date, persons who entered into full-time employment contracts and worked a full month must receive at least 12,130 rubles. This is a federal figure, and in some regions it is higher. But it does not include income taxes and labor allowances in certain localities. This means that a person will receive either less (minus personal income tax) or more (plus regional allowances). If your company’s salaries are below 12,130 rubles or the regional indicator, they need to be recalculated, be sure to increase them.

Another case when you will need an order to increase the salary in connection with a change in the minimum wage is the annual indexation provided for in Art. 134 Labor Code of the Russian Federation.

Let us remind you that for refusal to increase wages taking into account the new minimum wage, fines of up to 50,000 rubles are provided. The fine will increase if employees complain about the delay or incomplete payment of amounts due to them - up to 100,000 rubles, in accordance with Art. 5.27 Code of Administrative Offenses of the Russian Federation.

What to do due to an increase in the minimum wage

Employers whose employees receive wages less than the minimum wage must increase it to the new established values. To do this, you will have to issue a sample order to increase wages and adjust the staffing table.

You need to understand that the salary may remain the same, since it is not the salary itself that is less than the minimum wage, but the total amount of the salary received by the employee, which includes:

- compensation payments, including allowances and additional payments;

- incentive payments (bonuses);

- reward for work.

Reasons for increasing wages

According to labor law, the employer can independently determine the employees who deserve an increase in remuneration. Usually these are those who exceeded production standards and achieved good sales figures. Increases can occur at different intervals and in different amounts depending on the company's profit.

The salary increase must be justified:

- Internal regulatory documents: regulations on remuneration, industry agreement, collective agreement that define the regulations and timing of changes.

- Minimum wage: if income does not meet the minimum wage standards, then changes are made to the employment contract.

- Review of payment due to rising prices in accordance with the provisions of Article 134 of the Labor Code of the Russian Federation. The issue is within the competence of territorial self-government bodies, government agencies and departments. If organizations are financed from the budget, then they must be guided by the relevant legislation on the procedure for increasing wages.

- An agreement between an individual and an employer. The amount of remuneration for work is determined by the labor market, and if the worker has improved his qualifications and his value in the market has increased, then the remuneration should be increased.

Labor legislation does not provide clear guidance on when and by what amount remuneration should be increased, so a salary increase can be justified on various grounds.

How to increase your salary due to an increase in the minimum wage

If the employee’s salary consists only of salary or tariff rate, the employer must correctly draw up documents to increase the established payments to the minimum wage. To do this, use a sample order to increase salaries for all employees or only those whose salaries do not reach the established minimum.

If the employer includes in the employee’s remuneration, in addition to the salary, other allowances or additional payments, either their amount or the salary (tariff rate) should be increased so that the total amount is at least 11,163 rubles.

To do this, an order should be issued to increase wages in connection with the increase in the minimum wage, which changes the staffing table. Here are instructions on how to do this:

- Issue an order to increase wages.

- Based on this order, make changes to the staffing table (established form T-3).

- Make changes to employment contracts regarding remuneration for labor.

Requirements of the law on wage indexation

Based on Article 134 of the Labor Code of the Russian Federation, the employer is obliged to carry out indexing in connection with a jump in the price index. But the legislation does not define the regulations for the implementation of this guarantee, in particular, the frequency and exact amount. The Supreme Court of the Russian Federation determined that remuneration for work may not be increased if it needs to be increased by other means. Alternative methods include paying bonuses, introducing additional coefficients, and salary supplements. Article 130 of the Labor Code of the Russian Federation regulates the main state guarantees regarding the remuneration of workers. These also include measures to increase income. The procedure must be reflected in internal regulations, which are the basis for organizing indexation.

When indexing, the salary increases; the amount of the increase must be fixed. The purpose of indexing is to increase wages in order to ensure the purchasing power of employees at a decent level against the backdrop of continuous inflationary processes.

How to write an order for a salary increase

Many employers ask the question of how to draw up an order to increase wages or salaries. Keep the following in mind:

- There is no established template for an order to increase wages for employees.

- Registration takes place in accordance with the general requirements defined for this type of document.

An order to increase salary is issued on the institution’s letterhead. It indicates the date and place where it was compiled. The document is assigned a serial number. The text consists of a preamble and a main part. The preamble contains the basis for issuing a local act, if necessary, with reference to regulatory documents. The main part reveals the essence of the content.

The salary order is signed by the head of the institution. The order must be familiarized to all persons mentioned in it and those to whom it applies.

How to properly pay up to the minimum wage based on an order?

The order must be in writing; a verbal order is not enough. When developing a document, you can use either the company’s letterhead or any other sheet of any format (preferably the generally accepted format - A4).

The form of the document that must be used has not been developed; therefore, when drawing up a sample order for additional payment to the minimum wage, one should be guided by generally accepted standards and business customs. It is advisable to refer to Art. 9 Federal Law “On Accounting” dated December 6, 2011 No. 402, which reflects information on how primary accounting documents are compiled. This information can also be used when drawing up the order we are considering.

It reflects information about:

- Name of the organization, OGRN, INN, location address.

- The name of the document (Order for additional payment up to the minimum wage) and the date when it was drawn up.

- The reasons for which the additional payment is made (you can provide a link to the legal acts that set the minimum wage (Federal Law No. 421 of December 28, 2017). In addition, you can indicate the wording according to which the additional payment is made due to the discrepancy between the salary level and the minimum wage level.

- FULL NAME. and the position of the person to whom the additional payment is made (or a list of employees if the order is drawn up in relation to several persons).

- Instructing the contractor (for example, accounting) about the need to execute the order.

- Compiler's signature.

- Company seal (if any).

It is important to remember the need to familiarize both the employee to whom the additional payment is being made and the performers, for example an accounting employee, with the order.

Have a question? We'll answer by phone! The call is free!

Moscow: +7 (499) 938-49-02

St. Petersburg: +7 (812) 467-39-58

Free call within Russia, ext. 453

Is it possible not to raise wages?

The employer needs to understand that the increase in wages applies to those employees who work under an employment contract. Persons involved in cooperation under civil contracts (contracts, services) will not be able to count on an increase. In relation to such citizens, the employer is not obliged to fulfill the legal condition.

In other cases, the employer is obliged to increase pay, including:

- when working on a part-time basis;

- when working part-time (if, for example, a part-time worker performs half the normal working hours, the employer is obliged to pay him half the minimum wage).

If the salary of the organization’s employees is below the minimum wage, the employer will be fined. Fine amount:

- for a legal entity will be from 30,000 to 50,000 rubles, for a repeated violation - up to 70,000 rubles;

- the director will be given a warning or a fine in the amount of 1,000 to 5,000 rubles, if detected again - from 10,000 to 20,000 rubles. Additionally, disqualification is provided for a period of one to three years.

Indexation coefficient

The minimum level of increase, as a rule, is equal to the level of the price increase indicator and assumes an increase in the income of workers once a year.

For example, an increase is carried out at the end of the quarter. The inflation rate in April was 0.33%, in May - 0.37%, in June - 0.61%. If an employee’s salary is 35,000 rubles, then for April it will be 100.33% of this amount. In May, respectively, 35,115.5 x 1.0037 = 35,245.43 rubles.

Thus, the salary will rise by 460 rubles. This is an example of retrospective indexing. When calculating the expected indexation, the price growth index published by Rosstat is used. Employee salaries increase by the percentage of inflation.

Executing an order to increase wages in 2021: rules

An increase in employees' salaries or wages in any other part must be carried out in accordance with the requirements of the current Russian labor legislation in accordance with certain rules. At the same time, it is necessary to take into account many subtleties and nuances that accompany changes in employee income - ignoring some issues may lead to the need to incur additional costs, or even to bringing the employer and its officials to administrative liability.

Accordingly, persons who issue orders at an enterprise to increase wages for employees must know all these key features if it is necessary to increase wages for workers. The basic features of how to formalize a salary increase for an employee and correctly draw up an order to increase wages include the following principles:

Every employer must index wages. At the same time, the salary increase within the framework of indexation must be reflected in the corresponding order.- An order to increase an employee’s salary must be issued in accordance with the company’s local regulations, including the regulations on wages or other similar documents, if they are recorded as local regulations.

- The employee has the right to familiarize himself with the order to increase wages, and the employer is obliged to ensure such familiarization.

- If the salary is increased voluntarily by the employer, it is not considered indexation unless there is such justification.

- Individual salary increases should not be discriminated against - employees in similar positions should also be able to receive a similar salary increase if they perform their duties in the same way as the employee receiving the salary increase.

- An order for a salary increase must be registered in the order book at the enterprise, have a serial number and generally meet the requirements for maintaining official company documentation.

These are just the basic principles by which an order to increase a worker’s salary is issued. It should be noted that each enterprise may have its own regulations, which means special nuances for increasing employee salaries.

Mandatory details in the order

Since there is no unified form for such administrative documents, the employer can develop his own order to increase wages according to the model that will be proposed below. The document must be developed taking into account the norms and rules of office work adopted by the enterprise.

According to the practice established in most enterprises, such an order has the following details:

- publication date;

- registration number;

- basis for increasing earnings;

- a list of persons who will be directly affected by this order;

- list of instructions;

- the person responsible for executing the order;

- date of entry into force of the order;

- signature and position of the person who issued the order;

- notes on familiarization with the document.

Sample order to increase salary

To better understand how exactly the documentation related to a salary increase should look, it would be a good idea to familiarize yourself with samples of such documents. This will help you immediately select the appropriate wording and justification for the salary increase and eliminate the need to independently develop the entire text of the document.

Minimum wage: general provisions

The minimum wage is the minimum amount of money paid to an employee at the end of the month if that month is worked in full. The minimum payment is constantly changing (increasing). Subjects of the Russian Federation have the right to set their own minimum size, provided that it exceeds the size fixed at the federal level.

Employees' wages consist of several components, in accordance with the requirements of Art. 129 Labor Code of the Russian Federation.

Firstly, this is the salary, i.e. a minimum fixed amount that is payable in proportion to the period worked.

Secondly, these are various bonus payments, compensations and allowances, the amount of which is fixed in the local acts of the organization (for example, Regulations on remuneration), employment contracts with employees. The total amount of payments for the month worked should not be less than the minimum wage (Article 133 of the Labor Code of the Russian Federation). If an employee receives less, the employer is obliged to pay up to the minimum wage.

For example, an employee receives a bare salary of 6,000 rubles, which is less than the minimum wage. However, he receives a monthly bonus of 8,000 rubles. The total monthly salary, including bonus, is more than the minimum amount established by law, so no additional payment is required.

The question often arises: is it necessary to pay extra up to the minimum wage if an employee, in addition to a salary that does not reach the minimum wage, receives bonuses for working in the Far North? The answer to this is given in the Review of Judicial Practice of the RF Armed Forces dated February 26, 2014. Since northern bonuses are not taken into account as part of the salary, the additional payment to the minimum wage must be made before the northern bonus is accrued.

For example, the minimum wage is 9,489 rubles. The employee works in the Udmurt Republic, where the surcharge rate is set at 15%, and at the end of the month he received 9,000 rubles. The employer, despite the fact that the total amount of payments to the employee, taking into account the 15% bonus, will be more than the minimum wage, must initially pay the employee up to the minimum wage (489 rubles), i.e. issue an appropriate order, and only then charge 15% on the resulting amount.

Is it possible to do without raising wages?

Many employers are interested in whether the indexation of employee salaries and their annual increase is a mandatory event. From the point of view of the current labor legislation, as well as direct explanations from the Ministry of Labor and judicial practice, every employer is indeed obliged to index the salaries of its employees annually. At the same time, the law does not provide for a clear procedure for indexation, as well as indicators according to which indexation should be carried out.

However, it is impossible to do without raising wages in any case. Most often, employers increase the salaries of all employees at the same time, especially in large enterprises. The consumer price index recorded by Rosstat is used as a criterion for indexation.

You can read more about what wage indexation is in a separate article.

As mentioned earlier, a mandatory salary increase as part of indexation must be reflected in the salary increase order. Thus, its text must clearly indicate that the increase in salary or tariff rate is carried out for indexation purposes.

How to justify a voluntary increase?

If an employer decides on his own initiative to increase an employee’s salary, he is also advised to ensure that there is a suitable justification for such actions.

Such a justification can serve either as the actual wage regulations in force at the enterprise, or directly as an internal memorandum about a salary increase. An order to increase salary must refer to any reasons for such actions. In this case, a memo about the need to increase an employee’s salary can be drawn up either by the employee himself or by his colleague or manager. The form of the memo in this case can be either free or enshrined in the local regulations of the enterprise.

Justification for a mandatory salary increase - sample order

Document the salary increase in administrative documentation. Let's look at how to do this using an example.

From January 1, 2021, the minimum wage is 12,130 rubles. If we have employees whose wages are below the minimum wage, then we are obliged to increase it.

You can do this in two ways:

- establishing a new monthly salary;

- establishing an additional payment up to the minimum wage.

To set a new salary amount, issue an order to increase it. The order is drawn up in any form indicating the reasons for the salary increase and new payment amounts.

You can download the order to increase the salary to the minimum wage using the link below.

Based on the order, make changes to the staffing table, and also conclude additional agreements to employment contracts with employees, since the condition on remuneration is an essential point of the employment contract (Part 2 of Article 57 of the Labor Code of the Russian Federation).

However, it is not at all necessary to increase the salary each time in connection with an increase in the minimum wage. You can include in the wage regulations a condition for additional payment up to the minimum wage, specifying the conditions for its appointment and the procedure for calculation.

IMPORTANT! By choosing this method, you will have to ensure that the total amount of payments to the employee is not lower than the minimum wage every month.

Annual salary increase at the enterprise for all employees

If pay for work is changed for all subordinates, it increases by the same percentage, then this is possible, most often due to indexing. These terms and limits are not established by law, but usually wages thus change once a year.

The company chooses the date of salary changes at its discretion. This can be either the beginning or the end of the working year.

If all subordinates’ pay increases annually not due to indexation, and there are specific regulations in internal documents, then certain changes should be recorded in important papers.

They may be Regulations on payments for work , or on bonuses, etc. Adjustments are made taking into account the way in which these documents were adopted. It must be remembered that any changes must be introduced to subordinates against signature.

If an enterprise plans to index, then all it needs is a document confirming its implementation. If the salary increases for other reasons, then the need for orders will depend on the document flow adopted in the organization. As a rule, an additional agreement and presented to the employee for signature.

Download a sample additional agreement on salary increase here for free.

If there are a lot of workers in an organization, then it becomes expensive to draw up separate orders. But, if you enter all the data into one document, then workers can find out each other’s salaries, and this is not advisable.

Who draws up the order

The order can be written by any employee of the enterprise whose job responsibilities include this function:

- legal adviser,

- secretary,

- personnel officer, etc.

Only one thing is important: this specialist must have the skills to draw up administrative documentation and knowledge of the Labor and Civil Legislation of the Russian Federation.

In addition, after drawing up the order must be submitted to the director of the organization for approval - without his signature it will not acquire legal force.

Opportunities to increase or reduce salary

The wages of employees of a budgetary enterprise are prescribed in the provisions of the labor or collective agreement.

A salary reduction is possible only if the terms of the employment contract are revised during negotiations between the employee and the director of the organization (Article 72 of the Labor Code of the Russian Federation).

You can increase the permanent part of your salary for the following reasons:

- the desire to bring wages in line with certain economic indicators;

- incentives for one or more employees;

- introducing an additional measure of staff motivation.

The director of the enterprise can change the remuneration of employees for work upward as many times as he likes, even every month; there are no restrictions for this action. In most situations, the company's management takes as a basis the rules prescribed in local documentation, which stipulate the reasons and dates for the increase.

In any case, an order must be issued. For salary increases and decreases, they are slightly different. When cutting a fixed portion of your salary, there are many more steps required.

It is important to remember that when drawing up a sample order to change the salary, changes must also be made to the staffing table. It is enough to include such a clause in the first document.

The procedures for salary increases and wage indexation should not be confused. The main difference is that a company director can increase the salary of one employee or a group of people by different amounts and at any time (without allowing discrimination in wages). Indexation applies to all personnel of the organization, and after it the salary increases by the same percentage for all employees.

Ways to increase your salary

The component of wages is prescribed in Article 129 of the Labor Code of the Russian Federation. According to the law, you can increase your salary if you increase the tariff rate, official salary , as well as the basic and basic salary rate.

In addition, it may become necessary to increase or establish compensation payments (for work in difficult conditions, in contaminated areas, etc.).

The manager can increase the amount of incentive payments that were established earlier (bonus portion, incentive allowances, etc.).

The first option for increasing wages is the most labor-intensive. But even in this case, there are options that are influenced by the fact whether the salaries of all workers will increase, or only some (one department or a pair of employees).

Salary reduction

Staff are notified two months in advance of the upcoming reduction in the fixed part of their salary.

The responsible employee draws up the following documents:

- notification;

- additional agreement;

- order.

A notice is sent to all employees whose earnings will be reduced. After a 2-month period, the employer has the right to draw up an additional agreement to the employment contract. After the employee signs it, the director of the organization must draw up an order indicating the planned changes and their reasons, as well as a list of employees.

There is no unified notification form established by law, therefore it is allowed to draw up a document in any form. However, you must specify:

- name of the enterprise;

- exact legal address of the organization;

- total number of personnel;

- details of company managers;

- information about the upcoming salary reduction;

- full initials of the employee or group of people affected by the changes;

- reasons for salary reduction;

- possible consequences for the organization if wages are not reduced;

- director's signature and seal.

The notice is given to each employee personally.

IMPORTANT!

The employer must be notified of the salary reduction against signature within a two-month period before the action is implemented. If the employer is an individual, the period is reduced to 2 weeks, and if a religious organization - to one week (Article 344, Labor Code of the Russian Federation).

If the employee refuses to accept the new conditions, the director of the enterprise is obliged to offer him other options in writing, for example:

- Transfer to a lower position.

- Another vacancy corresponding to the employee’s qualifications.

- A position with a lower salary that is acceptable for the employee's health condition.

The director of the company also provides alternative jobs to the employee upon signature. If an agreement is reached, an addition to the employment contract and an order to change the salary are drawn up.