The letter regarding the change of general director is for informational purposes only. This document confronts the organization's counterparties with a fait accompli.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

When the head of an institution changes, this must be recorded in the Unified State Register of Legal Entities. No later than three days from the date of appointment of a new person, the organization is obliged to submit the appropriate paper to the tax office at the place of registration of the company. And then you can send letters of relevant content to other organizations. The same should be done if the general director’s last name simply changed for some reason.

Important: notification of a change of general director has a unified form, but an information message in the form of a letter does not. The one who draws up the paper has the right to add data and give comments (naturally, observing the norms of business correspondence).

Components of a letter

The document has a free form. However, it is built according to a generally accepted algorithm. So, at the very top of the sheet are usually located:

- Company details. There is simply some free space left on the form for them. Ideally, all documents of this scale and focus are printed on the letterhead of a specific organization, which initially contains its name, address, telephone number and other contact information.

- Letter number. It is necessary for correct registration of outgoing correspondence.

- Date the document was signed. Without a signature, it has no legal force.

- Destination. If this is a legal entity, then the organization is indicated first, then the position and name of the specific employee of this organization to whom the message is intended.

In addition to the introductory part, which is the same for a large number of documents, the letter about the change of director has a main part. It may begin with the phrases: “By this letter we notify you...” or “By this letter we inform you...”, or simply “We inform you that from today Ivan Ivanovich Ivanov has been appointed general director.”

There is no standardized form for a sample letter. However, you should concisely and reasonably inform the addressee of the essence of the paper - information about the change of director. In this case, it is necessary to indicate as an attachment the paper that was the basis for such a change.

So, the mandatory points for the main part are:

- Full name of the new general director.

- The date on which he began to perform his duties.

- What document is the basis for this? It may be the minutes of the general meeting of shareholders (owners) of the company or the decision of the sole founder.

Who signs?

When drawing up a document, many people wonder who should certify the letter: the old or new general director of the organization. The answer here is clear: new. After all, the document on his appointment has already entered into force. And even if the tax authorities are still in the dark about the change of director, only the new boss now has the right to sign and certify the documentation with his visa.

In practice, a situation often occurs when two people are in power in a company at once.

In order to avoid such moments and possible related troubles, it is necessary to immediately indicate in the minutes of the meeting of owners on this issue specific dates for the dismissal of the previous employee and the appointment of a new one.

Applications

Since the new boss is signing, the letter needs evidence of the information provided, otherwise it would open up wide opportunities for scammers. Proxies could take advantage of the resulting confusion when reporting this type of information. Therefore, the following must be attached to each letter about a change of general director:

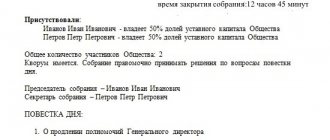

- A copy of the minutes of the general meeting at which the decision on his appointment was made. In practice, for convenience, it also prescribes the dismissal of the old one.

- A copy of the power of attorney for signing the documentation.

- A copy of the order on the appointment of the general director. The meaning of the power of attorney may be included in it.

Only the first paper will be required, but by attaching copies of the others, you can make your appeal more reasoned. Each organization in this case acts in accordance with its Charter.

The final part of the letter is the signature of the new general director and, if possible, the seal of the organization. In this way, counterparties and other persons to whom the letter will be addressed will learn how the new manager signs.

How changes are registered in the Unified State Register of Legal Entities when there is a change of director

In order to make changes to the Unified State Register of Legal Entities when changing the director, you must submit an application in form P14001 to the territorial department of the tax service at the location of the organization. The application form is unified, it is approved by Order of the Federal Tax Service of Russia dated January 25, 2012 No. ММВ-7-6/ [email protected] You can download it from the link.

Have a question? We'll answer by phone! The call is free!

Moscow: +7 (499) 938-49-02

St. Petersburg: +7 (812) 467-39-58

Free call within Russia, ext. 453

You do not need to fill out all the sheets of the application; it is lengthy. It is enough to fill out sheets K and R (data about the director and organization). In addition, the title page is filled out. The filling out procedure is described in detail in Appendix No. 20 to the above Order of the Federal Tax Service of Russia (Section VII).

The application must be signed by the new manager. He has the right to do this after the minutes of the general meeting on the appointment have been adopted, or the decision of the sole participant on this. It is important to note that the right to sign an application arises before registration of changes in the Unified State Register of Legal Entities, which is logical and is confirmed by judicial practice, for example, decision of the Supreme Arbitration Court of the Russian Federation dated May 29, 2006 No. 2817/06.

In addition to the application, the new director must submit to the Federal Tax Service a certified copy of the decision on his appointment. The old director does not need to do this.

After submitting the application, the Federal Tax Service makes a decision to register changes in the Unified State Register of Legal Entities within 5 days.

After changes are made, the organization should not notify the FSS and the Pension Fund of the Russian Federation about this, since such a responsibility is assigned to the tax authorities.

***

Thus, registering a change of director of an organization is a fairly simple procedure. It is enough to fill out an application in form P14001, using the instructions contained in the Order of the Federal Tax Service No. ММВ-7-6 / [email protected] (Section VII of Appendix 20) and submit it to the Federal Tax Service. Applications can be found at this link.

Is it necessary to notify partners?

By law, the company is obliged to notify only the tax service and the bank about the change of director. However, according to the rules of business communication, counterparties must also be aware of the current state of affairs. This is especially true in cases in which the previous CEO was fired from the organization due to loss of trust. His actions could also be related to business partners.

In addition, there is one more reason to notify business partners: additional agreements should be concluded with them to all contracts in which the full name of the old specialist appears (in order for them to have legal force).

Thus, mass mailing of letters about a change of general director is a mandatory item in the algorithm of any self-respecting company. If you don’t want to waste precious time signing multiple copies, you can use a facsimile of the new boss’s signature.

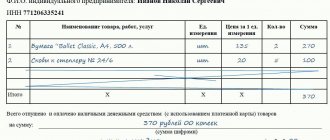

An approximate application for making changes to the card with sample signatures and seal imprints in the fields “Location (place of residence)” and “tel.

N ".

B From ___________________ (position name) (organization name) (full name)

In connection with the change in the address of the actual location, we ask you to make changes to the card with sample signatures and the seal of _______ (name of organization) for account number _______ in the fields “Location (place of residence)” and “tel. N":__________________________________________________________________________. (indicate the new address of location (place of residence) and telephone number)

Position Signature, Seal Last name, initials

An example cover letter for documents for making changes to the card with sample signatures and a seal impression.

On the organization's letterhead

B From ___________________ (job title)

Please accept documents to make changes to the card with sample signatures and seal imprint _____________________________ associated with (name of organization) _____________________________________ (indicate changes) on account number____. Documents confirming the changes are attached.

Appendix: 1. Name of the document, form (original, copy), number of sheets; 2. ...

Position Signature, Seal Last name, initials

Information about the current manager is not reflected in the statutory documents, but is published in the Unified State Register of Legal Entities, and when concluding transactions, counterparties can check the authority of a particular person.

Who and how long will hold the position of head of a legal entity is determined solely by the decision of the company’s founders or the employee himself.

Company representatives must send notifications about the change of general director to government agencies and contractors as soon as possible, regardless of the reason for the dismissal of the employee and the article of the Labor Code.

So, it is necessary to notify the following authorities when changing the general director.

Deadline for the appointment of a new CEO

16.03.2020

The founders of the organization need to remember that when changing the head of the company, it is not enough to simply sign the decision and order of appointment to the position.

The organization must make appropriate changes to the Unified State Register of Legal Entities. Information about the person acting as general director is not reflected in the constituent documents of the legal entity, but is contained in the Unified State Register of Legal Entities. Only from the date of making the corresponding entry in the unified state register of legal entities, information about the new general director will be reflected in the extract from the Unified State Register of Legal Entities and will become available to counterparties.

Article 5 of the Federal Law of August 8, 2001 No. 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs” contains provisions obliging the organization to notify the Federal Tax Service of changes recorded in the Unified State Register of Legal Entities about persons who have the right to act on its behalf without a power of attorney in within three days from the date of appointment of a new director.

The date from which the specified period should be calculated is the next day after the date of signing the protocol (decision) on the appointment of a new general director.

Failure to provide (untimely provision) or provision of false information about a legal entity or an individual entrepreneur to the body that carries out state registration of legal entities and individual entrepreneurs, in accordance with paragraph 3 of Article 14.25 of the Code of the Russian Federation on Administrative Offenses, entails a warning or the imposition of an administrative fine on officials in the amount of fifty minimum wages.

As a general rule, if an administrative violation is discovered later than a year after the expiration of the three-day notice period, a fine will not be possible (Clause 1 of Article 4.5 of the Code of Administrative Offenses of the Russian Federation). An exception is a continuing violation, but failure to submit form No. P14001 is not considered a continuing violation (Resolution of the Plenum of the Armed Forces of the Russian Federation dated March 24, 2005 No. 5).

At the same time, if the director has not changed, but his passport details or place of residence have been changed, there is no need to notify the Federal Tax Service. Government agencies that issue passports and register citizens at their place of residence, within a single window, themselves inform tax authorities about changes in such information. But if the passport details of a manager who is a foreigner have changed, notification of the Federal Tax Service is necessary.

The notification of the tax service is drawn up in form No. P14001, approved by order of the Federal Tax Service of Russia dated January 25, 2012 No. ММВ-7-6/ [email protected] It must be signed by the new manager (letter of the Ministry of Finance of Russia dated July 7, 2006 No. 03-01-11/3- 64). Notarization of the signature of the new manager on the notification is required (clause 1.2 of Article 9 of Law No. 129-FZ). An exception is sending notification P14001 in electronic form, signed with its enhanced digital signature.

There is no need to pay a state fee for making changes to information about the director in the Unified State Register of Legal Entities.

It should be noted that recently the Federal Tax Service has increasingly refused to register a new director of an organization via digital signature and sends it to a notary to certify the signature on the application in form P14001.

In the refusals, the Federal Tax Service indicates that the notarial form of the submitted documents was not observed. In addition, in some decisions to refuse, the Federal Tax Service indicates that the application in form P14001 was submitted by an unauthorized person, since such a person is not listed as a director in the Unified State Register of Legal Entities, despite the fact that the documents are signed with an electronic signature. But it is logical that information about such an individual as a director will not be in the Unified State Register of Legal Entities if he is only going to make changes to such information. Moreover, when a director changes, the applicant is always the new director (Article 9 of the Federal Law “On State Registration of Legal Entities and Individual Entrepreneurs”). The same norm is directly stated in clause 2 of Order of the Ministry of Finance of Russia dated September 30, 2016 No. 169n “On approval of the Administrative Regulations for the provision by the Federal Tax Service of state services for state registration of legal entities, individuals as individual entrepreneurs and peasant (farm) farms.”

As follows from the conclusions of the Resolution of the Supreme Court of the Russian Federation dated July 25, 2016 in case No. 34-AD16-5, the emergence or termination of the powers of the sole executive body of a legal entity with the fact of entering such information into the state register of legal entities (USRLE) is not related, but is conditioned by the adoption of an appropriate decision the competent management body of such a legal entity or the expiration of its term of office. Thus, the new director of the company has the right to represent the interests of the company fully and legally from the moment the general meeting of participants (or sole participants) makes a decision to change the director.

Therefore, the refusal of the Federal Tax Service under these circumstances is not justified.

You can safely appeal! In its decision dated August 15, 2019, the Moscow Arbitration Court in case No. A40-129925/19-33-1168 declared illegal and overturned the decision of the MIFTS of Russia No. 46 for Moscow on the refusal to state registration of changes in the Unified State Register of Legal Entities, and also ordered the MIFTS Russia No. 46 for Moscow, enter into the Unified State Register of Legal Entities information about a person who has the right to act on behalf of the LLC without a power of attorney. You can see more details about the procedure for changing the head of the company in the section INSTRUCTIONS FOR CHANGING THE GENERAL DIRECTOR Share on social networks:

Federal Tax Service (FTS)

If a manager is re-elected to a position as part of the “extension of powers” procedure, the Federal Tax Service should not be notified about this, since from the point of view of the register, no changes have occurred in the organization’s management.

In all other cases, notification to the tax office of a change of director is mandatory. For failure to fulfill this obligation within the prescribed period, administrative liability is provided for in Article 19.7 of the Code of Administrative Offenses of the Russian Federation.

Algorithm and deadlines for notifying the tax inspectorate:

Fill out an application for changes in the organization (form P14001) to enter information into the Unified State Register of Legal Entities and have it certified by a notary.

Submit a certified application to the Federal Tax Service within 3 days after the appointment of a new manager (Clause 5, Article 5 of Federal Law No. 129-FZ of 08.08.2001 “On State Registration of Legal Entities and Individual Entrepreneurs”). The application must be submitted to the tax office at the place of registration of the legal entity.

Receive a Unified State Register of Legal Entities entry sheet from the tax office confirming the changes.

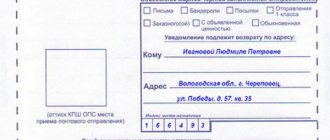

It is recommended to send a notification to the bank about a change of director immediately after the head of the company takes office, because in fact, his powers ceased to operate. And some banks stop the possibility of Internet banking, because... the electronic signature becomes invalid. According to clause 7.11 of Bank of Russia Instruction No. 153-I dated May 30, 2014, in the event of early termination (suspension) of the powers of the client’s management bodies in accordance with the legislation of the Russian Federation, the client submits a new card with signature samples.

Some banks ask for this package of documents in cases where the powers of the head of the organization have been extended (upon the conclusion of a new employment contract). In such cases, new cards with signatures are not created.

Banks usually ask for notification:

- a reference document confirming the introduction of changes to the Unified State Register of Legal Entities;

- an extract from the minutes of the meeting of the co-founders who decided to change the general director, or a certified copy of this minutes;

- order for the enterprise on the appointment and assumption of office of an appointed person.

Documentation

To notify the Federal Tax Service, form P14001 is used. This statement is mentioned in the law as the only document provided for the purpose of registering a change in management. But in practice, the Federal Tax Service is often asked to additionally provide a decision of the sole founder or a protocol of participants confirming the authority.

What documents must be submitted to the tax office to change the director of an LLC:

- an application in form P14001, the signature on which must be notarized (that is, the signature is placed in the presence of a notary). The application is signed by the new manager. The notary additionally requests a charter, a certificate, an extract from the Unified State Register of Legal Entities (at the discretion of the notary), and the decision itself;

- protocol or decision of the sole founder, drawn up in accordance with the law on LLC (the date, time and place of the meeting must be indicated, those present are listed, the agenda item is clearly indicated: the removal of the old manager and the appointment of a new one, voting results with the distribution of votes according to percent, signatures on the document are required).

Notification of counterparties

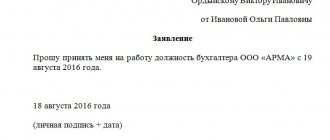

To notify counterparties of a change of general director, it is recommended to send a letter in free form.

A legal entity does not have a legal obligation to notify counterparties about the appointment of a new manager if this clause is not specified in the contract.

But many companies prefer to notify their customers and suppliers so that there are no documentary and information misunderstandings.

Sample notice of change of general director

Sample notice of change of general director, available upon request

To notify counterparties (clients or suppliers), attaching a copy of the minutes of the founders’ decision is not required. There is no need to make changes to already signed contracts, orders and powers of attorney.

Often the services with which you have to deal try not to recognize powers of attorney and orders issued by the previous manager. To avoid conflict situations after a change of general director, we recommend canceling old powers of attorney and issuing new ones.