A little theory

Today we are considering a topic in which the terms “costs and expenses”, “grouping by costs and expenses”, “classification” are constantly encountered. How to understand where is what? When I looked at books on accounting, each time I caught myself asking myself the question: “In the examples, are these costs or expenses? What is the correct term to use? It seems that the author uses costs and in the next sentence already uses the term costs. Confusion, that's all.

Let us now repeat the meaning of these terms once again, so that later we can clearly perceive what we mean when we say them. Fine?

Costs are the exchange of monetary resources for something else that a business can store and use. For example , a company bought goods and materials. Spent money, but did not lose it, because “money turned into other resources.”

The transfer of materials to production or household needs occurs as follows:

- the cost of these materials is calculated, for example, the average cost.

- Due to posting, materials are reduced by 10th account in the calculated amount and quantity

- and this amount comes to the cost accounts (20, 23, 25, 26, 44)

- until the end of the month, such accumulated amounts can safely be said to be expenses

But when the process of closing the month begins and these costs begin to participate in the calculation of the financial result, then they turn into the concept of expenses, i.e. these are costs taken into account for the financial result to calculate profit, from which “Income Tax” is then taken

Not all desired costs of an enterprise can be classified as expenses. Those. not all costs can be included in the financial result formula for calculating profit. Permission for certain types of expenses is stipulated in the Tax Code (Tax Code of the Russian Federation).

Let's look at cost accounting accounts in the following activities:

What are management costs?

Administrative expenses include amounts generated on account 26 and associated with the maintenance of the company’s common property and the organization of its activities. A distinctive feature of such expenses is that they are not directly related to production, provision of services or trade. An example of management expenses would be the following expenses:

- on guard;

- payment for the Internet, housing and communal services and communications;

- entertainment expenses;

- salaries of accountants, lawyers, personnel officers and other administrative and management personnel;

- labor protection and seminars for workers;

- stationery.

Administrative expenses can be included in the cost of production as products are sold. Then the accountant must write them off by posting to the debit of account 20 (23 or 29) and the credit of account 26.

The second way to account for administrative expenses is to attribute them in full to the cost of the reporting period in which they arose. In this case, the accountant will post Dt 90 Kt 26.

The chosen procedure for accounting for management expenses must be specified in the company’s accounting policy (clause 20 of PBU 10/99).

Learn more about account 26 from the publication “Account 26 in accounting (nuances).”

Provision of services

There are mainly two cost accounts used here - 26 and 91.2.

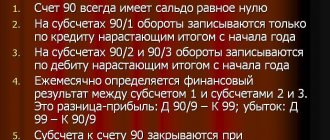

Moreover, the 26th account accumulates expenses over the course of a month, which will then go to the 90th account, but as expenses. When account 26 is closed (transferred) to account 90, it is called the direct costing method.

A 91.2. the account is immediately an expense, since it itself is already a formula for the financial result. From previous articles we already know that account 91.2 includes such basic expenses of the enterprise as bank services for servicing the current account and interest on the loan.

Account 26 for services includes all other costs: employee salaries, premises rental, office, Internet services, communications, payroll taxes, depreciation of fixed assets. Those. basically everything that relates to current activities. Let's look at the 26th score, let's look at its characteristics.

Trade

Accounting account 91.2 accounts, sometimes 26, are also present in trading. Nevertheless, the main accounting account for costs in trade is account 44 “Sales expenses”. Look at its characteristics.

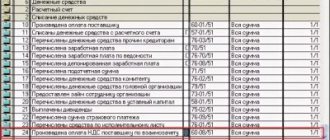

chart of accounts from the 1C Accounting 7.7 program

chart of accounts from the 1C Accounting 8 program

We see that the account is analytical: there are subaccounts and subcontos. The account is fully active, so the accumulation of expenses will be on the debit side, and the write-off will be on the credit side of the account.

How does 44 count work?

To begin with, let us remember that 44 includes those costs that are incurred in the trading process. If the company is engaged only in trade, then it will have 44 and 91.2 cost accounts in its accounting. The most common expense items for trading companies are the wages of sellers and taxes on them, rent, utility bills and everything else that is associated with the place of trade. They fixed the electrical wiring in the store (they provided us with a service) - this will also go towards the 44th bill. If there is a dedicated accountant responsible for the operation of a retail outlet, then all of his wages and taxes from it will go to account 44.

If the company, in addition to trade, also provides services, or there is production, then the wages of the chief accountant, manager, manager’s driver, rent and electricity in the main office, etc. - all this will go to the 26th count. Did you get the meaning?

Special types of costs. Trading organizations have special types of costs: transportation and commercial selling costs. What's interesting about them? Let's figure it out.

Transport costs When purchasing a product, each company would be happy if the supplier, at the same price that sold us the product, also delivered it to our warehouse. But this doesn't happen. Our company always has additional costs for delivering goods to its warehouse. And the further away the supplier is, the higher the overhead (transport) costs.

As a result, we have the delivered goods at the purchase price and some cost for delivery (the cost of transportation costs). Now we have a dilemma: how to handle these transportation expenses? We are allowed two ways:

First way . Take the shipping amount, calculate the proportion and distribute the shipping amount for each item purchased. Document all this by posting to account 41. In this case, the price of the purchased product in the company’s warehouse and in the reports will be as accurate as possible.

And when this product is sold, the most accurate purchase price will be included in the financial result formula. That part of the goods that remains unsold will also contain part of the transport, don’t you agree? In other words, excess transportation costs will not be included in the financial result formula.

Second way . The purchased goods are accounted for 41, and transportation costs are accounted for 44. Then at the moment of “closing the month” 44 the entire account for 90 will be closed. It turns out that transport vehicles were included in the formula, but all the goods were not sold or were not sold at all. In other words, we have unreasonably increased costs, but this is impossible.

In this case, transport costs on account 44 will go to account 90 only in the part in which the goods were sold, i.e. in proportion to the goods sold. As a result, the transportation costs available to our company, when closing 44 accounts, will not all go to 90, don’t you agree? The amount of transportation costs will remain, i.e. 44 account will not be closed entirely - there will be a balance.

Selling expenses These include costs that contribute to the promotion and sale of goods. The most common are packaging, advertising, and marketing activities.

Production

As you noticed, we are moving forward. The production combines 26 counts, 44 counts and 91.2 counts. In addition, it also has its own main accounting accounts - 20, 23, 25, 26, 28.

91.2 and 44 accounts work the same way as for previous types of activities. But the 20th accounts work in a special way. Let me tell you very briefly now.

Basic accounting accounts in production: 20, 25, 26

About account 26 we can say that it collects the expenses of the entire enterprise, such as management and administration. Those. all expenses that cannot be attributed either to trade (44 account) or to production (20, 23, 25, 28). In other words, account 26 is an accounting of administrative expenses for the entire business.

Account 20 is an account for accounting for the production of products itself, but... 23 and 25 are also accounts involved in the production of products. What is the difference? The point is that account 20 first collects only those costs that can be directly attributed to a specific type of product.

Account 25 collects those costs that cannot be accurately attributed to a specific product being manufactured, but can only be attributed to the workshop. An example is indispensable here.

Let’s take one workshop, one machine, one type of product, no matter how many employees. Let them work in turns, in shifts, as they wish. What is production (let's simplify) - this is the cost of raw materials, employee salaries, payroll taxes, electricity for the machine, depreciation of the machine, depreciation or rent of the workshop. Under our condition, all costs incurred immediately fall on this one specific type of product.

Let's complicate production, bringing it closer to the real thing. There is still only one workshop, one machine, two types of products, 4 employees. Two people produce products, one is a watchman, one maintains the cleanliness of the premises.

Well, how can we now accurately determine the costs of electricity, depreciation of a machine, depreciation (rent) of a building, wages of a watchman and technical personnel, payroll taxes for a specific type of product manufactured?

What expenses are considered business expenses?

These days, there is no clear definition of the term “business expenses.”

I will give several examples of the definition of this term. For Borisov A.B. commercial expenses are the costs associated with the shipment and sale of goods, and include the cost of packaging purchased externally, when packaging in warehouses, payment for packaging products by third parties, costs of delivering products to the location, etc. The following definition is that commercial expenses include the costs of shipping products to customers (loading and unloading, delivery), costs of containers and packaging materials, advertising, market research, etc. As we can see, the definitions have the same meaning, but they are written in slightly different words. Following this, you can make a list of business expenses to create a complete picture of this term. We reduce all the variety of expense items to the following list: - costs of packaging finished products in warehouses; — costs of transportation and delivery of products; — costs of loading and unloading products into vehicles; — expenses for commissions; — costs of maintaining premises for storing finished products at sales points; — labor costs for salespeople in organizations engaged in production; — marketing expenses; — entertainment expenses; — labor costs in trade organizations; — expenses for renting retail premises and finished product warehouses; — costs of insuring goods and commercial risks; - other similar expenses.

Accounting for costs and expenses in general in accounting

You should also pay attention to the fact that accounting for business expenses of trading and manufacturing companies differs. Trading companies include in selling expenses all types of expenses that relate to the main activity. And manufacturing organizations classify as commercial expenses only those that were used in the process of marketing products. Thus, we can derive the following list of commercial expenses of manufacturing organizations for: - packaging and packaging of products in warehouses; — delivery of products to the place of departure; — commission fees paid to sales and other intermediary organizations; — maintenance of premises for storing products at places of sale and remuneration of salespeople in organizations; — advertising; — entertainment expenses; - other expenses similar in purpose.

Thus, you can understand what the concept of “business expenses” is if you consider these points.

A financial report is not useful if the total figures are divisible by 10 or 5.

Expenses associated with advertising and sales of products are called commercial (non-production) .

Together with production costs, these costs constitute the total cost of production.

They include the following expenses:

1. Costs of organizing sales (marketing operations):

· payment for services of third parties . Payment for the services of third-party marketing organizations, in cases where the staffing table does not provide for the corresponding functional services (study of sales markets, competitiveness of manufactured products, etc.); interest costs on short-term bank loans associated with product sales operations; commission fees and remunerations paid to sales and foreign trade organizations;

· advertising expenses . Costs for the development and publication of advertising products (illustrated price lists, catalogs, brochures, albums, prospectuses, posters, posters, advertising letters, postcards, etc.); for the development and production of sketches, labels, samples of original and branded packaging packages, etc.; for advertising events (ads in print, broadcast on radio and television, posting on the Internet); for illuminated and other outdoor advertising; for the production of stands, dummies, billboards, signs, etc.; for storage and forwarding of advertising materials; for the design of shop windows, exhibitions and sales of sample rooms; for markdowns of goods that have completely or partially lost their original quality when displayed in showcases; for carrying out other promotional events; expenses caused by the participation of the enterprise in exhibitions within the republic, auctions, commodity exchanges, international fairs and exhibitions abroad.

2. Freight forwarding costs:

· costs of containers and packaging of products in finished product warehouses. Other operations ensuring the safety of goods during transportation . Services of auxiliary workshops or areas for the manufacture of containers and packaging, preservation and packaging of products; expenses for remuneration of workers engaged in packaging, preservation and stocking of products in the finished goods warehouse of the sales department; deductions to the budget and extra-budgetary funds from funds for wages; the cost of materials consumed in packaging finished products; cost of packaging purchased externally; payment for the services of third-party specialized organizations for packaging and packaging of products;

· costs of loading and transporting products. The cost of services of auxiliary workshops for delivering products to the station or pier of departure and loading them into wagons and ships; payment for the services of specialized freight forwarding and intermediary organizations; expenses for fastening products on railway platforms and cars;

· other sales expenses . Other expenses associated with the sale of products.

Costs of advertising and marketing services are included in the cost of products (works, services) within established standards .

Attribution to cost of advertising expenses without supporting documents is prohibited. The amount of excess advertising costs above the maximum amount is written off from the profits remaining at the disposal of the enterprise.

For advertising expenses, the account entries will be: Dt 20 (26), 44

and

K-t 50, 51

or -

D-t 31

and

K-t 50, 51

, and after calculating the standards -

D-t 20, 44

and

K-t 31

.

The costs of packaging and transportation of products, which are reimbursed by buyers, are not considered commercial expenses. These expenses are reflected in account 45 “Goods shipped”.

Line 2210 “ Business expenses

”

Manufacturing firms in this line reflect the costs associated with the sale of products (works, services). Such costs are taken into account in the debit of account 44 “Sales expenses”.

Trading companies on line 2210 reflect the amount of distribution costs. They are also recorded in the debit of account 44 “Sales expenses”. These expenses are indicated on line 2210 “ Business expenses

”, if they are written off from the credit of account 44 to the debit of account 90, subaccount 2 “Cost of sales”. Thus, in line 2210 you need to reflect the debit turnover in subaccount 90-2 in correspondence with account 44 “Sales expenses” for the reporting period. Indicate the amount of business expenses (distribution costs) in the income statement in parentheses.

Manufacturing companies include the following expenses as business expenses:

• for product advertising; • for transportation of products to their destination; • for loading and unloading of products; • for packaging of finished products; • for the maintenance of premises for storing products at points of sale and warehouse services; • for entertainment expenses; • to pay salaries to sellers, etc.

Formation of expenses

When forming business expenses in accounting, companies make the following entries:

DEBIT 44 CREDIT 10 - materials for packaging products in the warehouse were written off;

DEBIT 44 CREDIT 23 - expenses of auxiliary production for packaging, as well as delivery and loading of products are written off;

DEBIT 44 CREDIT 70 - wages accrued to employees involved in packaging, loading and selling products;

DEBIT 44 CREDIT 69 - insurance contributions to extra-budgetary funds and a contribution for insurance against industrial accidents and occupational diseases were accrued from the wages of workers involved in packaging, loading and selling products;

DEBIT 44 CREDIT 60, 76 - costs of delivery and loading of products by third-party organizations, costs of marketing research, advertising, remuneration to intermediary organizations, etc. are taken into account.

Example

ZAO Aktiv produces products. In the reporting year, employees of the finished product sales department received a salary in the amount of 150,000 rubles. In the same year, the organization conducted an advertising campaign. The expenses for it amounted to 35,400 rubles. (including VAT - 5400 rubles).“Aktiv” pays contributions for insurance against industrial accidents and occupational diseases at a rate of 1%, and contributions to the Pension Fund, Social Insurance Fund, and Federal Compulsory Medical Insurance Fund at a rate of 30%.

The Aktiva accountant made the following entries:

DEBIT 44 CREDIT 70 - 150,000 rub. — salaries were accrued to employees of the finished product sales department;

DEBIT 44 CREDIT 69 - 1500 rub. (RUB 150,000 x 1%) - a premium has been added for insurance against industrial accidents and occupational diseases;

DEBIT 44 CREDIT 69 - 45,000 rub. (RUB 150,000 x 30%) - contributions to the Pension Fund, Social Insurance Fund, and Federal Compulsory Medical Insurance Fund have been accrued;

DEBIT 44 CREDIT 60 - 30,000 rub. (35,400 - 5400) - reflects the costs of conducting an advertising campaign;

DEBIT 19 CREDIT 60 - 5400 rub. — VAT on the costs of the advertising campaign is taken into account;

DEBIT 68 subaccount “Calculations for VAT” CREDIT 19 - 5400 rub. — VAT deduction has been made;

DEBIT 60 CREDIT 51 - 35,400 rub. — paid advertising costs;

DEBIT 90-2 CREDIT 44 - 226,500 rub. (150,000 + 1500 + 45,000 + 30,000) - business expenses

.

On line 2210 “ Business expenses

» In the profit and loss report for the reporting year, the accountant must reflect the amount of 227 thousand rubles. (RUB 226,500).

Write-off of expenses

Business expenses

written off as cost in different ways. The way they are written off depends on many factors. In particular, on the procedure for transferring ownership of shipped products.

If this occurs after the product has been shipped to the buyer, business expenses

write off directly to the debit of account 90, subaccount 2 “Cost of sales”.

If, under a supply agreement, ownership of the shipped products passes to the buyer only after payment, commercial expenses

can be written off only after the money has been received.

Reflect the write-off of expenses by posting: DEBIT 90-2 CREDIT 44 - business expenses

.

Packaging and transportation costs that are part of business expenses may:

• distributed between sold and unsold products; • written off completely.

Cost Allocation

Such costs must be allocated to the specific types of products shipped.

If it is impossible to determine which product these costs relate to, then distribute them based on weight, volume, production cost or other characteristic indicators.

Establish a specific procedure for distributing expenses in your accounting policy.

Example

In the reporting year, the warehouse of Aktiv CJSC received 6,000 units of finished products, including:• products “A” - 1500 units; • products “B” - 2000 units; • products “C” - 2500 units.

The total amount of business expenses for the year amounted to 28,000 rubles. (including costs for packaging and transportation of products in the warehouse - 12,000 rubles, other commercial expenses - 16,000 rubles).

According to Aktiva's accounting policy, packaging and transportation costs are distributed between types of products in proportion to the volume of their output.

According to the supply agreement, ownership of the product passes to the buyer after payment. During the reporting period, products “A” and “B” were shipped and paid for in full by customers. No payment was received from buyers for product “C”.

. Aktiva's accountant reflected business expenses

wiring:

DEBIT 44 CREDIT 10 (60, 69, 70...) - 28,000 rub. — business expenses

.

Packaging and transportation costs for each type of product are distributed as follows:

• products “A” 1500 units. : 6000 units x 12,000 rub. = 3000 rub.; • products “B” 2000 units. : 6000 units x 12,000 rub. = 4000 rub.; • products “C” 2500 units. : 6000 units x 12,000 rub. = 5000 rub.

Packaging and transportation costs related to sold products “A” and “B” will amount to RUB 7,000. (3000 + 4000). The total amount of business expenses written off to the debit of account 90 will be 23,000 rubles. (7000 + 16,000).

The Aktiva accountant made an entry in the accounting: DEBIT 90-2 CREDIT 44 - 23,000 rubles. - business expenses

.

On line 2210 “ Business expenses

” of the profit and loss report for the reporting year, the accountant indicated the amount of 23 thousand rubles.At the end of the reporting year, the company’s accounting records on account 44 the balance of commercial expenses, which relates to products “C”, in the amount of 5,000 rubles. (28,000 - 23,000). This amount (5 thousand rubles) must be indicated on line 1210 of the balance sheet for the reporting year.

Write off expenses completely

In accordance with paragraph 9 of PBU 10/99, commercial and administrative expenses can be fully included in the cost of products sold if they are recognized as expenses for ordinary activities.

If a company has switched to this write-off procedure since the beginning of the year, then it must write off the unwritten-off balance of business expenses for the previous reporting period to account 84 “Retained earnings (uncovered loss)” (clause 15 of PBU 1/2008).

Example

Passive LLC produces products. According to the accounting policy for the reporting year, commercial expensesare recognized as expenses for ordinary activities and are fully included in the cost of products sold. At the beginning of the year, the balance of business expenses in the amount of 6,000 rubles is recorded in the “Liability” account.

The Liability accountant will write off this amount by posting: DEBIT 84 CREDIT 44

— 6000 rub. — the balance of business expenses is written off due to changes in accounting policies. The amount of business expenses for the reporting year amounted to 30,000 rubles.

In the reporting year, Passive did not sell all of its products. However, in accordance with the accounting policy, the entire amount of business expenses for the year should be written off as a debit to subaccount 90-2.

On line 2210 “ Business expenses

» In the profit and loss report for the reporting year, the accountant will reflect the amount of expenses in the amount of 30 thousand rubles. For the past year, the amount of business expenses for this line of the report must be reduced by 6,000 rubles.

How to account for business expenses

trading companies

If you have a trading company, then on line 2210 “ Business expenses

“You need to reflect the costs written off to the debit of account 90, subaccount 2 “Cost of sales”, from the credit of account 44 “Sales expenses”.

On account 44 in trading companies, all costs associated with conducting ordinary activities are taken into account:

• salaries of administrative and management personnel and salespeople; • expenses for renting office space and warehouses; • cost of security services; • entertainment expenses, etc.

In addition, trading companies can record transportation costs associated with the purchase of goods on account 44.

Formation of expenses

When forming business expenses in the accounting of a trading company, the following entries are made:

DEBIT 44 CREDIT 10 - materials for packaging goods are written off; DEBIT 44 CREDIT 41 subaccount “Containers under goods and empty” - reflects the issue (consumption) of containers; DEBIT 44 CREDIT 02 (05, 60, 76...) - expenses associated with conducting trading activities are taken into account (depreciation, costs of marketing research, advertising, remuneration to intermediary organizations, etc.); DEBIT 44 CREDIT 70 - wages accrued to employees of the trading company; DEBIT 44 CREDIT 69 - contributions to the Pension Fund, Social Insurance Fund, Federal Compulsory Medical Insurance Fund and contributions for insurance against accidents and occupational diseases are accrued from employees' salaries.

Example

CJSC Aktiv is engaged in trading. In the reporting year, the company's employees received a salary of 300,000 rubles. In the same year, the organization conducted an advertising campaign. The expenses for it amounted to 70,800 rubles. (including VAT - 10,800 rubles). “Aktiv” pays contributions for insurance against industrial accidents and occupational diseases at a rate of 0.2%, and contributions to the Pension Fund, Social Insurance Fund, and Federal Compulsory Medical Insurance Fund at a rate of 30%. The Aktiva accountant made the following entries:

DEBIT 44 CREDIT 70 - 300,000 rub. — salaries of employees were accrued;

DEBIT 44 CREDIT 69 - 600 rub. (RUB 300,000 x 0.2%) - a premium has been added for insurance against industrial accidents and occupational diseases;

DEBIT 44 CREDIT 69 - 90,000 rub. (RUB 300,000 x 30%) - contributions to the Pension Fund, Social Insurance Fund, and Federal Compulsory Medical Insurance Fund have been accrued;

DEBIT 44 CREDIT 60 - 60,000 rub. (70,800 - 10,800) - reflects the costs of conducting an advertising campaign;

DEBIT 19 CREDIT 60 - 10,800 rub. — VAT on the advertising campaign is taken into account;

DEBIT 68 subaccount “Calculations for VAT” CREDIT 19 - 10,800 rubles. — VAT deduction has been made;

DEBIT 90-2 CREDIT 44 - 450,600 rub. (300,000 + 600 + 90,000 + 60,000) - business expenses

.

On line 2210 “ Business expenses

» In the profit and loss report for the reporting year, the accountant must reflect the amount of 451 thousand rubles.

Write-off of expenses

All business expenses

Firms write off monthly to account 90, subaccount 2 “Cost of sales”. An exception is provided for transportation costs associated with the purchase of goods.

In accounting, these expenses can be reflected in two ways:

• directly on account 41 “Goods” (that is, include in the actual cost of purchased goods); • on account 44 “Sales expenses”.

If the company’s accounting policy provides for the inclusion of transportation costs in the cost of goods, then they are reflected in line 2120 “Cost of sales” of the income statement.

When accounting for transportation costs on account 44 “Sales expenses”, reflect them on line 2210 “ Sales expenses

».

For profit tax purposes, trading organizations have the right to keep records of expenses in the same way as in accounting. The procedure for forming the cost of purchased goods (including the inclusion of delivery costs or attributing the costs of delivery of sold goods to distribution costs) is established by the accounting policy for tax purposes (Article 320 of the Tax Code of the Russian Federation).

Not all transport costs reflected in the debit of account 44 are written off to the cost of sales, but only their part, which relates to goods sold.

You can calculate it like this:

1) to the balance of transport costs at the beginning of the month, add the transport costs incurred in the reporting month; 2) determine the amount of goods sold in the reporting month and the balance of goods at the end of the month; 3) divide the amount of transportation costs (item 1) by the amount of goods sold and remaining goods (item 2). In this way, the average percentage of transport costs in relation to the total cost of goods will be calculated; 4) multiply the balance of goods at the end of the reporting month by the average percentage of transportation costs. The result was the amount of transportation costs related to the balance of unsold goods at the end of the month; 5) find the difference between the entire amount of transportation costs incurred and that part of them that relates to the balance of unsold goods (clause 4). Write off the resulting difference from the credit of account 44 to the debit of account 90, subaccount 2 “Cost of sales”.

After calculating the amount of transportation costs to be written off, make the following entry in your accounting:

DEBIT 90-2 CREDIT 44 - part of the transportation costs related to goods sold is written off.

Example

The balance of transportation costs in the wholesale trade organization Passive LLC at the beginning of March of the reporting year is 10,000 rubles. (account 44, subaccount “Transportation expenses”).In March, 70,000 rubles were spent on the delivery of goods, and these transport costs are not included in the price of the goods. The balance of unsold goods at the end of March (account 41 balance) amounted to 120,000 rubles. In March, goods worth 300,000 rubles were sold.

The amount of transportation expenses that needs to be written off for the reporting month was determined by the accountant as follows:

1. the amount of transportation costs at the beginning of March and for March amounted to 80,000 rubles. (10,000 + 70,000); 2. the cost of the balance of unsold goods at the end of March and goods sold in March is equal to 420,000 rubles. (120,000 + 300,000); 3. the average percentage of transportation costs was 19.05% (80,000 rubles: 420,000 rubles x 100%); 4. the balance of transportation costs attributable to the balance of unsold goods is equal to 22,860 rubles. (RUB 120,000 x 19.05%); 5. transportation costs subject to write-off to cost in March amount to 57,140 rubles. (80,000 - 22,860).

The following entry was made in accounting: DEBIT 90-2 CREDIT 44 - 57,140 rubles. — part of the transportation costs for goods sold is written off. Amount 57 thousand rubles. will be included in line 2210 “ Business expenses

» profit and loss statement.

Accounting entries for business expenses

These expenses are included in settlement and payment documents in addition to the cost of the goods. At the same time, the following entries are made: D-t 45

and

K-t 10 (02, 05, 12, 13, 31, 65, 67

, etc.

)

As payment is made, the cost of transportation costs and packaging is debited from account 45 ( D-t 51, 52, 50

and

K-t 45, 46

).

Synthetic active account 43 “Business expenses” is intended to summarize information on expenses associated with the sale of products. The debit of this account includes all expenses for the shipment and sale of products in accordance with the specified nomenclature, and the credit includes the amounts written off in the reporting month for sold products.

Commercial expenses do not have a separate item in the balance sheet, and therefore, when filling it out, the balance on account 43 at the end of the month is added to the balance on account 45.

For commercial expenses reimbursed by buyers in the selling price, the following entries are made in accounting: Dt

43,

Kit

10, 23, 29, 50, 51, 60, 70, 69, 71, 65, 68, 76.

At the end of the month, the amounts of commercial expenses recorded on the debit of account 43 are written off in the following areas: D-t

46

,

48 and

Kt

43.

In enterprises where sales of products (works, services) are accounted for as revenue is received in bank accounts, the corresponding share of commercial expenses can be attributed to account 45 “Goods shipped” without accounting entry. When packaging finished products (products) in a warehouse, the share of commercial expenses related to packaged but unshipped products is added to the balance in the warehouse.

The procedure for including commercial expenses in the full cost of certain types of sold products depends on the characteristics of production and the nature of the products produced and is provided for in industry guidelines (instructions). Costs for containers and packaging may be included in the cost of certain types of products for their intended purpose based on the relevant primary documents. In other cases, commercial expenses are distributed between individual types of products in proportion to their weight or volume, and commission fees (deductions), discounts on the price for organized turnover and other sales expenses are proportional to the production cost of products sold.

In some industries, the total amount of commercial expenses is distributed between products in proportion to the planned or actual production cost of products sold or its volume at selling (wholesale) prices. Thus, business expenses act as both direct and indirect.

Commercial expenses are not included in the cost of work and services for capital construction and non-industrial production and farms.

Analytical accounting in the context of the established nomenclature of items is maintained in the statement, both for the reporting month and with an accrual total from the beginning of the year, which provides conditions for the analysis of business expenses and reporting.

Date of publication: 2014-10-25; Read: 1500 | Page copyright infringement

The main measures to reduce costs (costs associated with production) are:

1. Stopping unprofitable production;

2. Introduction of innovative, resource-saving, low-waste (or non-waste) technologies. For example, switching from heating using electricity to heating with gas; replacement of gasoline engines in cars with gas equipment; firing office workers and hiring freelancers; installation of IP telephony; transferring employees from regular computers to laptops (or netbooks); use of energy-saving lamps, etc.

3. Purchasing raw materials and supplies at lower prices and on more favorable terms, as well as optimizing the scheme for their purchase and transportation;

More found about business expenses

- Accounting for selling expenses: theoretical and practical aspects Selling expenses commercial expenses are included in the cost of goods sold, works of services and directly affect the formation of financial

- Factor analysis of the financial results of the activities of agricultural producers in the Kyrgyz Republic - commercial expenses SD - administrative expenses Factor analysis is carried out in several stages At the first stage

- Methodology for analyzing the financial results of a manufacturing enterprise according to financial statements At the same time, the amount of commercial expenses decreases from year to year and the amount of management expenses increases Other income and expenses grew in 2013

- Analytical tools for assessing the profit management of a regional joint stock company Gross profit loss 5.3 4.3 10.0 7.6 11.1 6.8 0.2 -5.1 4 Selling expenses 0 0 8.1 8.4 10, 9 1.9 0 0 5 Administrative expenses 0 0

- Analysis of the profitability of the main activities of a trading organization From this factor model it follows that the profitability of sales is influenced by sales revenue, cost of goods sold, commercial expenses and administrative expenses. Let us conduct a factor analysis of the profitability of sales of a trading organization based on data for

- Estimation of enterprise value using the discounted cash flow method within the framework of the income approach Cost 35,110 80.0 50,867 81.34 76,976 85.38 82.24 Selling expenses 2195 5.0 2289 3.66 2365 2.62 3.76 Costs enterprises to pay for third party services

- Analysis of the level and dynamics of financial results of defense industry enterprises according to financial statements Gross profit 331565 317838 13727 4.32 Selling expenses 5175 3229 1946 60.27 Profit loss from sales 326390 314609 11781 3.74 Other

- Analysis of the financial results of a commercial organization according to the income statement Analysis of profit and loss from sales begins with a study of its volume, composition of structure and dynamics in the context of the main elements that determine its formation of net revenue from sales, cost of sales, administrative and commercial expenses. At the same time, during the analysis of the structure for 100% is taken from net sales revenue

- Profitability: in order to manage, it is necessary to measure correctly Deneb in the cost of goods sold, management expenses are fully included, and commercial expenses, which are recorded as a separate line, amount to only 3.7% For Rychal-Su OJSC separately

- Accurate calculation of variable expenses based on financial statements The fact is that these expenses could either be attributed to the cost of goods or included in business expenses Table 1. Fragment of the profit and loss statement for the month, accounting and management

- Commercial and administrative expenses Administrative expenses include the costs of maintaining the human resources department of the legal department for lighting and heating of non-production facilities for business trips communication services other similar expenses Commercial expenses are expenses associated with the shipment and sale of goods Those enterprises that are engaged

- Sales planning and analysis of economic activities at a trading enterprise Gross profit 029 78500 52842 25658 48.6 18.6 15.4 3.2 Selling expenses 030 35194 14282 20912 146.4 8.3 4.2 4.1 Administrative expenses 040 0 0

- Accounting and control of sales expenses In the scientific literature, less attention is paid to the financial accounting of business expenses than to the accounting of production expenses. But still, commercial expenses are

- Key aspects of managing the organization's profit Gross profit 515 209 659 818 128.07 144 609 Selling expenses 4 015 5 673 141.30 1 658 Profit loss from sales 511194 654145

- Introduction of a program-targeted (normative) approach to the financial planning system in small enterprises Cost 34,720 Selling expenses 3,560 Administrative expenses 5,435 Profit from sales 9,925 Interest on

- An express method for analyzing the financial condition of a company Cost of sales 2210 Selling expenses 2220 Administrative expenses and 2330 Interest payable form They are accounted for by debit

- Management accounting of cash flows Business expenses budget 12201 Certification 12299 Other business expenses 12300 Labor expenses budget 12301

- Research of non-current assets of the enterprise for the purposes of financial analysis The report on financial results contains the following items: revenue from the sale of goods products works services minus value added tax excise taxes and other taxes and mandatory payments net revenue cost of sales of goods products works services excluding commercial and administrative expenses commercial expenses administrative expenses profit loss from sales interest receivable interest payable income

- Assessing the influence of factors on profitability indicators For a factor analysis of the profitability margin on sales, you can use the following model where k pr is the coefficient of production costs the ratio of the cost of goods sold to revenue k y is the coefficient of management costs the ratio of management expenses to revenue k k is the coefficient of commercial costs the ratio of commercial expenses to revenue In the process of interpreting the obtained values and analyzing their dynamics, it is necessary to take into account

- Directions for analyzing the financial condition of an organization in relation to management goals and user needs Administrative expenses Selling expenses - Depreciation Tax payments Increase in inventories of materials in process of finished products Number of days in the analyzed

Selling expenses should be reported separately from other types of expenses. They are non-production and are associated with the process of selling finished products. They can be included in the cost price in whole or in part.

Accounting for business expenses

Reducing costs associated with storage and ownership of inventories (rental of warehouse premises and their maintenance, logistics costs, insurance, etc.) and equipment. For example, choosing a room with optimal characteristics (ceiling height, flat floor, convenient location)

at the lowest price; proper placement of equipment and supplies; more complete use of production capacity (including the transition to three-shift work); optimization of costs for equipment maintenance and repair. If possible, it is suggested to save on finished products if you can work to order; on work in progress, if the production process is not too long; on raw materials and materials, if the speed of their acquisition does not cause downtime.

5. Automation of enterprise activity planning by purchasing or creating appropriate computer programs. As a result, the planning process will be cheaper, a system for rationing all operations in production activities will be introduced, the registration and inventory of inventories will be automated, the enterprise will get rid of excess inventory and will not allow downtime in production.

6. Reducing inventory losses due to obsolescence, damage (rotted, burned, physically damaged)

, theft and uncontrolled use. If there is a stock that will soon spoil, it is proposed to return it to the supplier, reduce the price on it, set a premium for its sale, sell it to a competitor, intensify an advertising campaign for its sale, throw it away to free up space in the warehouse.

7. Reducing the number of defective products. For example, the introduction of quality control for raw materials and materials, increasing the level of responsibility of the organization’s personnel, compliance with technology and production regulations, timely and high-quality debugging and cleaning of equipment, etc.

8. Tightening control. For example, installation of electricity, water and gas meters for all main areas of activity; compiling maps of energy costs per shift and comparison with other shifts and previous reporting periods; justification of the need for each type of expense, implementation of control over the physical and moral condition of inventories; increasing control over the timely execution of planned expenses.

The main measures to manage commercial expenses (costs associated with the sale of products (usually when they are reduced, sales volume also decreases, so all measures to manage them must be fully justified)

) are:

1. Optimization of the enterprise personnel motivation system. Namely, the division of salaries into permanent and bonus parts. In this case, the share of the bonus should be from 30% to 80% of the total salary (depending on the position). Introduction of a point-rating system that provides for the awarding of points for the performance of job duties (depending on the quality and quantity of work performed). As a result, if an insufficient number of points is collected, fines, reprimands and dismissals of employees should follow; if their number is in an acceptable range, only the main part of the salary should be paid, and if it is exceeded, the bonus part.

2. Using only those advertising measures that bring profit to the company.

3. Application of the most profitable product distribution schemes. For example, closing retail space and selling goods from a warehouse or delivering them to order; purchasing retail space instead of renting it; leasing or subleasing of unused retail space; improving the quality of customer service; location of retail space in the most advantageous places; correct placement of goods on display windows; creating an appropriate sound background; and so on.

The main measures to reduce management costs (costs not directly related to the production and sales of products) are:

1. Reducing costs for non-production buildings and structures;

2. Elimination of unreasonable costs for the management apparatus;

3. Reducing bureaucratic barriers;

4. Increasing the speed of information flow;

5. Refusal of the social package and external social programs. The social package includes: flexible working hours; training employees at the expense of the enterprise and purchasing educational literature; provision of a company car, cell phone, payment for gasoline, communications, free access to the Internet and the ability to print an unlimited number of documents; “subscription” maintenance of employees’ personal vehicles at the service center; providing them with targeted interest-free loans ( car, apartment

);

congratulating them on personal holidays and gifts from the company; organizing corporate events and sports activities ( paying for the gym

), etc.

Date added: 2014-01-03; ; Copyright infringement?;

Recommended pages:

CHOOSE THE OPTIMAL OPTION FOR ACCOUNTING COMMERCIAL EXPENSES

Associate Professor of the Department of

Accounting and Audit of KFAT and SO, consultant of the Publishing House "Adviser of the Accountant" N.N.

Shishkoedova In order to sell manufactured products, purchased goods, promote its work and services on the market, any organization incurs expenses on advertising, on the maintenance of sales divisions, stores, sales personnel, on the delivery of products and goods to consumers and other expenses that are commonly called commercial .

In this article we will look at existing options for accounting, distribution and write-off of business expenses and their impact on the financial result and content of the organization’s financial statements.

What are included in business expenses?

Selling expenses are expenses incurred for the purpose of selling products, goods, works, and services.

The role of commercial expenses in the economic mechanism of the organization

Only those business activities that effectively record and manage their financial results, which include business expenses, will be successful. The factors of their influence on the economic mechanism are very significant and diverse.

- A direct connection with the profitability of production - an analysis of the dynamics of business expenses and ways to manage them shows ways to increase the efficiency of business, as well as “weaknesses” that should be given increased attention.

- Determination of reserves for reducing production costs. The rise or fall of business costs clearly shows the financial potential for different types of activities and types of goods produced.

- Pricing policy – accounting for business expenses allows you to correctly set prices for the company’s products.

- Calculation of economic efficiency in case of technology changes, modernization, acquisition of new equipment, etc.

- Formation of a product range - justification for making decisions on the removal of any products from production or the introduction of new ones.

- Dominant position in the financial accounting of the organization - it is commercial indicators that are the main accounting reporting units.

- Impact on national income throughout the state.

Administrative and commercial expenses

Like administrative expenses, they are not directly related to the production process. In accordance with the Instructions for using the Chart of Accounts, account 44 “Sales expenses” is used to reflect commercial expenses. In organizations engaged in industrial and other production activities, this account may reflect, in particular, the following expenses: for packaging and packaging of products in finished product warehouses; for delivery of products to the departure station (pier), loading into wagons, ships, cars and other vehicles; commission fees (deductions) paid to sales and other intermediary organizations; on the maintenance of premises for storing products at places of sale and remuneration of sellers in organizations engaged in agricultural production; for advertising; for entertainment expenses; other expenses similar in purpose. It should be especially emphasized that on account 44 “Sales expenses” only those expenses that are incurred by the organization specifically for the purpose of selling these products and are not reimbursed separately by the buyer can be taken into account. For example, if packaging and packing of products are carried out in finished product warehouses for sending them to consumers, these costs are charged to account 44, but if packaging is carried out in the production workshop as the final stage of the production process, such costs should be included directly in the cost of production, that is debit account 20 “Main production”. Similarly, the costs of delivering products can be included in sales expenses only if the obligation to deliver the products under the terms of the contract is assigned to the supplier, that is, when transportation costs are already included in the sales price of the product and are not paid separately by the buyer. Moreover, it does not matter at all whether the delivery is made using the supplier’s own transport or whether he uses a third-party transport organization. Example 1

CJSC Aromat is engaged in the production of eau de toilette and perfume. Within a month, 100 liters of eau de toilette were produced, the cost of which before bottling was 860 rubles. per liter Bottling is carried out in 100 ml bottles (the result will be 1,000 bottles), after which the bottles are packed into boxes, and each box is wrapped in transparent film. Before shipping eau de toilette to customers, it is packaged in cardboard boxes at the finished product warehouse. The cost of bottles used to package eau de toilette for a month was 25,000 rubles, the cost of boxes was 9,000 rubles, the cost of used film was 2,000 rubles. Depreciation of equipment used in bottling and packaging eau de toilette amounted to 1,200 rubles, the salary of the employee involved in packaging, with deductions, amounted to 5,400 rubles.

How to find business expenses: formula

The profitability of production is closely related to the amount of resources invested in the manufacture of products and their promotion on the market. An increase in business expenses indicates a decrease in the profitability of the activities carried out and the need to optimize selling costs.

In financial analysis, a methodology is used to assess the efficiency of sales departments by comparing two indicators over time:

- Business expenses of the enterprise.

- Volume of goods sold.

The first indicator in the process of comparing planned and actual values is divided into the amount of semi-fixed costs and the amount of variable costs. How to calculate commercial expenses of a variable type - you need to sum up the costs associated with packaging, packaging, transportation and procurement. A change in the dynamics of this amount shows relative savings or overspending.

How to find commercial expenses of a constant type - add up the values of costs that are not tied to the volume of product sales. This category includes rental payments and entertainment expenses. Analyzing the indicator over time allows you to calculate absolute cost savings or cost overruns.

The business expenses budget should include variable costs for general production costs, funds allocated for advertising, constant sales resources and money spent on storage, marketing activities and market analysis.

How to calculate business expenses in the form of a profitability ratio:

The value of gross profit / The sum of indicators of commercial and administrative costs.

When commercial expenses are allocated to the cost of products sold, the formula for calculating the inventory items included in them that are subject to write-off will be as follows:

(Initial balance according to TZR + Turnover for the reporting period according to TZR) / Total value of the balance of marketable products at the beginning of the period and products received in value terms x Total cost of products sold.

Selling expenses are not included in a separate line on the balance sheet. They are reflected in the financial results statement - they are shown on line 2210.