On-site inspection of the “simplified”

The basis for conducting an on-site tax audit, as a rule, is the need to make sure that the taxpayer has the right to use the simplified tax system, that is, complies with all the requirements established for “simplified tax”, and also that he correctly calculates the simplified tax.

Potential auditees are those “simplified” who have been declaring unprofitable activities for many years, or those who are often transferred from one Federal Tax Service Inspectorate to another. Find out who can apply the simplified tax system from the publication.

On-site inspection on the basis of clause 8 of Art. 89 of the Tax Code begins from the day when the tax authority made a corresponding decision to conduct an audit. The inspection lasts up to 2 months, although in some cases this period can be extended to 4–6 months (Clause 6 of Article 89 of the Tax Code of the Russian Federation). All grounds for extending the inspection are mentioned in clause 4 of Appendix 2 to the Federal Tax Service order dated December 25, 2006 No. SAE3-06/ [email protected]

Read about the procedure for extending an audit in our article “How and when an on-site tax audit can be extended .

The audit may cover all activities of the taxpayer over the last 3 years. All documents available to him are checked, including accounting ones, because since 2013, “simplified” legal entities have an obligation to keep accounting records. If necessary, during the audit, an inventory, inspection, seizure of documents and other special tax control activities may be carried out.

Based on the results of the inspection, a certificate is issued, and after 2 months - a report (Clause 1 of Article 100 of the Tax Code of the Russian Federation).

Declaration according to the simplified tax system, deadlines for payment of tax and advance payments

They report on a single tax under the simplified tax system once a year (Article 346.23 of the Tax Code of the Russian Federation):

- organizations - no later than March 31 of the year following the expired tax period;

- individual entrepreneurs - no later than April 30 of the year following the expired tax period.

See “Procedure for submitting reports to the simplified tax system in 2021.”

At the same time, taxes are paid at the end of the year (Clause 7, Article 346.21 of the Tax Code of the Russian Federation).

If the taxpayer has lost the right to use the simplified tax system or has ceased business activities for which he applied the simplified tax system, the declaration must be submitted no later than the 25th day of the month following the termination of application of the simplified tax system (clauses 2, 3 of article 346.23 of the Tax Code of the Russian Federation).

Based on the results of the reporting periods (Q1, half-year, 9 months), reporting according to the simplified tax system is not submitted - you only need to make advance payments. The deadline for their payment is no later than the 25th day of the first month following the expired reporting period (clause 7 of Article 346.21 of the Tax Code of the Russian Federation).

Desk check on the simplified tax system

Conducting a desk audit is regulated by Art. 88 Tax Code. The audit is carried out by tax inspectors without visiting the taxpayer. Sometimes the taxpayer may not even know about such an audit until the inspectors require explanations or documents explaining the unclear points identified in the declaration.

Find out what kind of reporting a simplified student must submit in 2021 - 2021 here.

If, as a result of an audit, violations of tax legislation are revealed, the inspectors draw up a report within 10 days after its completion. This procedure is specified in paragraph 1 of Art. 100 Tax Code.

Desk and on-site audits can be combined in terms of time: during a desk audit, the reports submitted by the taxpayer for the current year are examined, and during an on-site audit, for a longer period, and there may be broader grounds for its appointment. The possibility of carrying out 2 types of inspection simultaneously is indicated in the letter of the Federal Tax Service dated March 13, 2014 No. ED-4-2/4529.

The criteria by which tax authorities check a declaration under the simplified tax system are discussed in detail in the explanations from ConsultantPlus experts. Get trial access to the system and start learning the material for free.

What is a benefit?

Benefits for taxes and fees are recognized as the advantages provided for by the legislation on taxes and fees compared to other taxpayers or payers of fees, including the opportunity not to pay a tax or fee or to pay them in a smaller amount, which are provided to certain categories of taxpayers and payers of fees.

The taxpayer has the right to refuse to use the benefit or to suspend its use for one or more tax periods, unless otherwise provided by the Tax Code (clauses 1, 2 of Article 56 of the Tax Code of the Russian Federation).

In the commentary letter, specialists from the Russian Ministry of Finance explained that the tax rate established by the law of the constituent entity of the Russian Federation is an independent and mandatory element of taxation (clause 1 of Article 17 of the Tax Code of the Russian Federation). That is, the taxpayer cannot refuse to pay tax at a reduced rate, therefore such a rate cannot be considered a benefit and it is also impossible to require documents confirming the right to a reduced rate.

Guide for the simplified tax system

With this e-book, you will easily understand all the intricacies of the simplified taxation system, competently draw up a balance sheet and financial statements. You will receive the electronic edition immediately after payment to your email. Find out more about the publication >>

Features of checking the simplified tax system 6%

Those who apply the simplified tax system at a rate of 15% must be prepared to document both their income and their expenses. As for conducting an on-site audit of taxpayers who have chosen a simplified taxation system with the object “income,” the inspectors may also request expense documents from them. First of all, you will need documents confirming the payment of insurance premiums, because they have a direct impact on the calculation of tax.

Which insurance premiums reduce the simplified tax, see the material “Single Tax under the Simplified Taxation System (STS)”.

If a “simplified person” (6%) pays a trade fee for one of several types of activity, he can take the paid fee into account when calculating the simplified tax system if he organizes separate accounting of income and the simplified tax system for the type of activity for which the trade fee is paid. The presence of such accounting is also under the close attention of tax authorities when checking the “simplified tax”.

The article “How to calculate the trading fee for individual entrepreneurs?” will help you calculate the amount of the trading fee..

Also, documents on expenses may be needed in case of checking the correctness of the accrual and withholding of personal income tax, if the simplifier acts as a tax agent.

For more information about what you need to know about accounting in the simplified tax system with the taxable object “income”, read our article “USN “income” in 2020-2021 (6 percent): what do you need to know?” .

How is a single tax calculated under the simplified tax system?

For organizations, a simplified tax replaces the payment of taxes such as (clause 2 of Article 346.11 of the Tax Code of the Russian Federation):

- Income tax. An exception is income tax paid:

- taxpayers - controlling persons for income in the form of profit of foreign companies controlled by them (clause 1.6 of Article 284 of the Tax Code of the Russian Federation);

- on income in the form of dividends (clause 3 of Article 284 of the Tax Code of the Russian Federation);

- on transactions with certain types of debt obligations (clause 4 of article 284 of the Tax Code of the Russian Federation).

Details are in the article “Income tax under the simplified tax system (nuances).”

- Organizational property tax. The exception here is the real estate tax, the tax base for which is determined by the cadastral value, which simplifiers pay on an equal basis with everyone else

Read the article “List of property taxed at cadastral value.”

- VAT. This tax is only payable:

- when importing goods into the territory of the Russian Federation (Article 151 of the Tax Code of the Russian Federation);

- for operations in accordance with a simple partnership agreement (joint activity agreement), investment partnership, trust management of property or in connection with a concession agreement (Article 174.1 of the Tax Code of the Russian Federation).

See the publication “VAT under the simplified tax system: in what cases to pay and how to take into account the tax in 2021?”

If a single tax under a simplified taxation system is paid by an individual entrepreneur, then he is exempt from the following taxes (clause 3 of Article 346.11 of the Tax Code of the Russian Federation):

- Personal income tax - in relation to income received from business activities. Exception - personal income tax:

- from dividends,

- income taxed at tax rates of 35% (clause 2 of Article 224 of the Tax Code of the Russian Federation) and 9% (clause 5 of Article 224 of the Tax Code of the Russian Federation).

- Property tax for individuals - in relation to property used for business activities. As for organizations, an exception is made here for the tax on “cadastral” objects included in the corresponding list.

- VAT - the restrictions here are the same as for organizations.

The procedure for calculating the single tax under the simplified tax system depends on what object of taxation the simplifier has chosen for himself. There are 2 such objects (clause 1 of Article 346.14 of the Tax Code of the Russian Federation):

- income;

- income reduced by expenses.

This choice, as well as the transition to the simplified tax system, is voluntary (clause 2 of article 346.14 of the Tax Code of the Russian Federation). An exception is provided only for participants in a simple partnership agreement (a type of legal relationship described in Chapter 55 of the Civil Code of the Russian Federation) or trust management of property (a type of legal relationship described in Chapter 53 of the Civil Code of the Russian Federation): for them, only one object is allowed - “income minus expenses” ( Clause 3 of Article 346.14 of the Tax Code of the Russian Federation).

Our material “Which object is more profitable under the simplified tax system - “income” or “income minus expenses”?” will help you decide on the choice of object.

Let's figure out how taxpayers should calculate and pay tax using the simplified tax system in 2021. The tax paid by simplifiers is called single. The single tax replaces the payment of income tax, property tax and VAT for enterprises. Of course, this rule is not without exceptions:

- VAT must be paid to simplifiers when importing goods into the Russian Federation;

- Enterprises must also pay property tax using the simplified tax system if this property, according to the law, will be valued at cadastral value. In particular, since 2014, such a tax must be paid by enterprises that own retail and office space, but so far only in those regions where the relevant laws have been adopted.

For individual entrepreneurs, the single tax replaces personal income tax on business activities, VAT (except for VAT on imports into the territory of the Russian Federation) and property tax. Individual entrepreneurs can receive an exemption from paying tax on property used in business activities if they submit a corresponding application to their tax office.

As we have already discussed above, the calculation of the single tax differs between the simplified tax system Income and the simplified tax system Income minus expenses with their rate and tax base, but the tax and reporting periods are the same for them.

The tax period for calculating tax on the simplified tax system is the calendar year, although this can only be said conditionally. The obligation to pay tax in installments or advance payments arises at the end of each reporting period, which is a quarter, half a year and nine months of a calendar year.

The deadlines for paying advance payments for the single tax are as follows:

- based on the results of the first quarter - April 25;

- based on the results of the half year - July 25;

- based on the results of nine months - October 25.

The single tax itself is calculated at the end of the year, taking into account all quarterly advance payments already made. Deadline for paying tax on the simplified tax system at the end of 2021:

- until March 31, 2021 for organizations;

- until April 30, 2021 for individual entrepreneurs.

For violation of the terms of payment of advance payments, a penalty in the amount of 1/300 of the refinancing rate of the Central Bank of the Russian Federation is charged for each day of delay. If the single tax itself is not transferred at the end of the year, then in addition to the penalty, a fine of 20% of the unpaid tax amount will be imposed.

Advance payments for the single tax are calculated in an accrual manner, i.e. summing up the total from the beginning of the year. When calculating the advance payment based on the results of the first quarter, you must multiply the calculated tax base by the tax rate, and pay this amount by April 25.

We invite you to familiarize yourself with: Deadline for conducting a desk tax audit

When calculating the advance payment based on the results of the six months, you need to multiply the tax base received based on the results of 6 months (January-June) by the tax rate, and from this amount subtract the advance payment already paid for the first quarter. The balance must be transferred to the budget by July 25.

The calculation of an advance for nine months is similar: the tax base calculated for 9 months from the beginning of the year (January-September) is multiplied by the tax rate and the resulting amount is reduced by advances already paid for the previous three and six months. The remaining amount must be paid by October 25.

At the end of the year, we will calculate a single tax - we multiply the tax base for the entire year by the tax rate, subtract all three advance payments from the resulting amount and pay the difference by March 31 (for organizations) or April 30 (for individual entrepreneurs).

Tax audits of simplified people and new art. 54.1 Tax Code of the Russian Federation: what to pay attention to

Art. 54.1 appeared in the Tax Code of the Russian Federation quite recently (introduced by law dated July 18, 2017 No. 163-FZ) and is devoted to issues of unjustified tax benefits.

You will become familiar with the concept of “unjustified tax benefit” in the material “Presumption of good faith of the taxpayer - a new article in the Tax Code of the Russian Federation” .

When conducting desk and field audits, controllers will collect evidence of the reality of transactions, and will also look with particular scrupulousness for evidence of deliberate tax evasion.

For example, a “simplifier” may be suspected of deliberate tax evasion if he fragmented his business solely for one purpose - to reduce the tax burden through the use of special tax regimes. The controllers themselves directly indicate this in their letter No. ED-4-2/13650 dated July 13, 2017 (clause 13.2 of the Methodological Recommendations for establishing, during tax and procedural audits, circumstances indicating intent in the actions of taxpayer officials aimed at non-payment of taxes ).

Get free trial access to ConsultantPlus and find out 17 criteria for assessing business fragmentation, which tax authorities focus on when conducting an audit.

Thus, a “simplifier” needs to be ready to prove a reasonable business purpose for his actions (for example, the purpose of splitting up a business), as well as take care of documentary support for the reality of his transactions, confirm due diligence when choosing counterparties, etc.

Get a complete understanding of how inspectors will now justify their position in disputes with taxpayers, taking into account Art. 54.1 of the Tax Code of the Russian Federation, and an analytical review prepared by ConsultantPlus experts will help you prepare for such disputes. Get trial access to the system for free and proceed to the material.

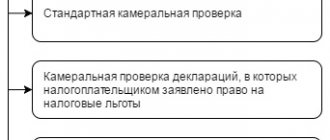

The procedure for holding a camera room

Desk inspection can be divided into two stages: automated control and in-depth inspection. Automated control of reporting occurs virtually without the participation of tax officials. After the data from the declaration (calculation) is loaded into the inspection information system, the computer itself checks the correctness of filling out the reporting lines and verifies the control ratios.

Also, information from declarations is “run” through special databases - the so-called automatic control systems (ACS). The most famous of them is ASK VAT-2, with the help of which a “cross-check” of the data of all VAT returns is carried out and “gaps” in the value added chains are identified. That is, situations are discovered when tax is accepted for deduction, but at the next stage is not transferred to the budget.

ATTENTION . The risk of additional charges during a desk audit for VAT can be reduced if you check received and issued invoices with counterparties in advance.

Carry out automatic reconciliation of invoices with counterparties Connect to the service

If, based on the results of automated control, errors, discrepancies or inconsistencies are found in reporting, this is a reason for an in-depth check. An extended check is also carried out if the declaration states benefits or the amount of VAT to be refunded. In addition, reporting on taxes related to the use of natural resources is subject to a mandatory in-depth audit (clauses 3, 6, 8 and 9 of Art. Tax Code of the Russian Federation).

Results

Checks of simplified tax authorities are not much different from checks of taxpayers working under the general taxation system. The exception is that there are fewer reasons for conducting a tax audit of the activities of businessmen using the simplified tax system.

All information about tax audits is contained in our “Tax Audits” .

Usually, if tax inspectors do not have any questions regarding the declaration, then an audit should not be expected. Nevertheless, you should carefully maintain accounting and tax records and store all documentation, because the decision to conduct a desk audit is executed by inspectors immediately, without prior notification to the taxpayer, and the audit period during an on-site audit covers 3 years.

Sources:

- Tax Code of the Russian Federation

- order of the Government of the Russian Federation dated March 18, 2020

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What documents may tax authorities require when checking a declaration under the simplified tax system?

— What documents can inspectors request when checking a declaration?

— There are two groups of papers that a taxpayer may be asked to submit. The first group is documents confirming certain information . Their list is strictly limited by the Tax Code of the Russian Federation. In particular, this includes papers justifying tax benefits (clause 6 of Article 88 of the Tax Code of the Russian Federation). As well as documents that must be attached to the declaration in accordance with the Tax Code of the Russian Federation, if they have not been submitted (clause 7 of Article 88 of the Tax Code of the Russian Federation and clause 2.1 of the Procedure for filling out a declaration under the simplified tax system, approved by order of the Ministry of Finance of Russia dated June 22, 2009 No. 58n). For example, if the declaration was signed by a representative of an organization or entrepreneur, then along with it you must submit to the inspection a copy of the power of attorney confirming the authority of this representative (paragraph 3, paragraph 5, article 80 of the Tax Code of the Russian Federation). As for the Book of Income and Expenses, bills of lading, invoices, acts and other primary documents, the Tax Code of the Russian Federation does not require them to be submitted to the Federal Tax Service along with the declaration.

The second group is written explanations . Tax authorities may require them if the declaration under the simplified tax system contains errors or contradictions between the information contained by the inspectors themselves. And also if the controllers received a simplified declaration in which a loss was declared. Or an updated declaration with the amount of tax to be reduced (clause 3 of Article 88 of the Tax Code of the Russian Federation).1

In addition, tax officials may call you to give oral explanations. In this case, you should appear at the Federal Tax Service within the time specified in the notice of summons.

— How should explanations be formatted? Is there any unified form for this?

— No, there is no unified form. Explanations should be made in any form.

— What data needs to be reflected in the explanation of a loss?

— The explanation of the loss should set out the specific reasons for which it arose. Thus, newly created companies can justify the loss by starting operations and high expenses for the purchase of equipment, raw materials, advertising, etc. Entities that have been on the market for several years - mastering production, modernizing equipment and reconstructing premises. Also, the reduction in revenue can be explained by a decrease in the volume of orders, lower prices, etc. In general, everything here is quite individual.

If a specific cause of losses cannot be identified (for example, when it is associated with a general increase in costs), then it is better to provide an item-by-item analysis of costs with a breakdown in the explanation.

In addition, if desired, the explanation can be noted that the loss is a temporary phenomenon, and the company will take certain measures to eliminate it.2

— What to do if inspectors find errors in the declaration under the simplified tax system?

“In such a situation, you should carefully study the inspectors’ requirement and double-check the calculation again. If an error led to an underpayment of “simplified” tax, you need to prepare an explanation with the correct calculation of the amounts. And submit an updated declaration.

If the error did not result in an underpayment or is not related to the payment of tax, an explanation should be provided. It is up to you to decide whether to file an amended tax return in case of excessive tax assessment (Clause 1, Article 81 of the Tax Code of the Russian Federation).

If there is no error, then write in the explanation that the declaration was drawn up correctly and there are no errors.

—The declaration under the simplified tax system indicates a small profit. And in the financial results report there was a loss, because last year they wrote off accounts receivable as expenses, but they are not taken into account in taxation as expenses, only in accounting. How can I explain this discrepancy to the tax authorities?

— So write that in accounting they wrote off bad receivables, while these amounts cannot be attributed to expenses during the “simplification”.

— Do I need to confirm my conclusions in the explanations with any documents?

— Firms and individual entrepreneurs decide independently whether to confirm explanations with documents or not (clause 4 of Article 88 of the Tax Code of the Russian Federation).

Of course, it is better to substantiate all conclusions so as not to be unfounded. To do this, you can attach to the explanations extracts from the accounting and tax registers under the simplified tax system and other documents (copies of contracts, bills).

Read more: Documents for obtaining Russian citizenship for Ukrainians

— When should documents and explanations be sent to the inspectorate?

- Documents required by tax authorities within 10 days, and explanations - within five days from the moment they received the request (clause 3 of Article 93 and clause 3 of Article 88 of the Tax Code of the Russian Federation).