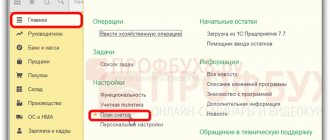

Settings in 1C

To reflect transactions on a current account:

- in the Functionality settings, define additional operations: use of payment cards;

- issuing payment requests;

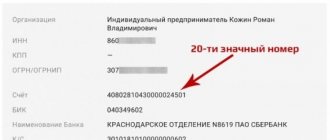

Filling out a bank account

Fill out the account card:

- Bank - the bank in which the account is opened, select from the Bank Classifier;

- Account number - open account number, the correctness of the account is controlled by the 1C 8.3 program;

- Account currency - will be determined automatically by the entered number;

- section Settlements through a correspondent bank - if payments are made through an account in another bank;

- section Corporate cards , if you take into account payments on corporate cards: check the box Corporate cards are linked to the account and indicate the account for payments on the corporate card;

- Card number - corporate card number;

- Accountable person is an individual for whom the debt will be reflected when withdrawing funds from cards.

- Opening date —the date the account was opened;

Click the link Setting up payment orders and requests to set the settings for generating a printed form of payments and requests from this account.

See also:

- What needs to be done so that when receiving a loan, an invoice of 66 and not 67 is automatically entered?

Refund of bank commission: postings

It is possible that the bank returns the commission. For example, in case of erroneous write-off. In this case, its accounting treatment will depend on how the refundable commission was initially written off.

If the accountant identified an error immediately when making a bank statement and filed a claim with the bank in connection with an unjustified write-off, then the entries for the withdrawal of the commission and its return will be as follows:

| Operation | Account debit | Account credit |

| Incorrect deduction of commission by the bank reflected | 76 “Settlements with various debtors and creditors”, subaccount “Settlements for claims” | 51 “Currency accounts”, 52 “Currency accounts”, etc. |

| The bank returned the erroneously withheld commission | 51, 52, etc. | 76, subaccount “Settlements for claims” |

If the commission was reflected as part of the organization’s other expenses, then its return must be reflected as part of other income. So, for example, when returning an over-deducted commission for transferring funds on behalf of a client, the accounting entry will be as follows:

Debit of accounts 51, 52, etc. – Credit of account 91, subaccount “Other income”

Debiting from a current account in 1C 8.3

The organization entered into an agreement with Office Technologies LLC for the supply of goods worth 14,160 rubles. (including VAT 20%).

On January 23, the accountant prepared a payment order to the bank in the amount of 14,160 rubles. to transfer funds to the supplier. Payment was made on the same day using a bank statement

Payment order

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

Create a Payment order in the Bank and cash desk – Bank – Payment orders section.

In your order please indicate:

- Bank account - the account from which payments are made;

- Recipient - the counterparty to whom the payment is transferred;

- Recipient's account — the account to which the payment is transferred;

- Follow the link Recipient details to check the recipient's TIN , recipient's checkpoint and recipient's name . This data is used for the order form;

- Payment amount —payment amount;

- Payment purpose - information for identifying the payment.

The document does not register transactions according to BU and NU. It is only needed to generate the Payment Order form.

Based on the paid order, enter the document Write-off from current account .

See also:

- Step-by-step instructions for generating payment orders

- Client-bank in 1C

- Guide to the document Payment order

Bank statement

For non-cash write-offs, complete the document Write-off from a current account in the Bank and cash desk - Bank - Bank statements section.

The document Write-off from a current account is downloaded from the Client-Bank or directly from the bank if the 1C: DirectBank .

When creating, select operation type . When loading, the view is detected automatically, but it must be checked.

Let's fill out the document according to the example.

Please indicate according to your bank statement:

- Date — date of debiting;

- According to document No. from - payment order (PP) data;

- Recipient - the counterparty to whom the payment is transferred;

- An expense item is a cash flow item.

- Expense item - select if you are filling out a Cash Flow Statement.

- Debt repayment is a method of determining the payment status: advance or debt repayment.

If you select Automatically , the debt is initially repaid, and the balance is taken into account as an advance. If you do not need to automatically determine the payment status, specify another method.

Postings

There was no debt to the supplier Office Technologies LLC under supply agreement No. 9 dated January 14, 2021, payment was defined as an advance:

- Dt 60.02 Kt.

Accounting

The bank commission, the accounting entries for which we provide in the article, is a payment that is paid by an organization for the provision of certain types of services. Operational servicing involves the conclusion of an agreement between a credit institution and a client. Among the mandatory conditions of such an agreement are commission payments, their tariff and payment procedure (Article 29 No. 395-1-FZ).

A service agreement is signed for each type of service provided by the credit institution. When concluding a banking service agreement, it is necessary to specify the format of commission payments - one-time, periodic or advance payment. Among the services for which bank fees are charged are:

- RKO - settlement and cash services;

- currency transactions;

- collection;

- lending and loan support;

- use of leased property, as well as trust management of property objects;

- rental of cells;

- remote customer service;

- cash withdrawal, etc.

The commission paid for issuing cash to a client is determined as a percentage of the amount issued. Most of the services provided by the bank for a fee are not subject to value added tax, so accounting entries are made directly to the cash account. If the transaction is subject to VAT, then the expense account is used for postings.

Accounting for bank remuneration for non-profit organizations is carried out under account 91 “Other income and expenses”, subaccount 91.2 “Other expenses” (clause 11 of PBU 10/99). If a bank commission is returned, transactions are generated on account 76 “Settlements with various debtors and creditors”.

Budget accounting is carried out in accordance with Instruction No. 174n.

| accounting entry | the name of the operation |

| NPO | |

| Dt 91.2 Kt 51 | Write-off of bank commission - postings in a situation where the transaction is not subject to VAT |

| Dt 60 Kt 51 | Bank interest has been written off - the transaction is subject to VAT |

| Dt 91.2 Kt 60 | Calculation of commission payments to a credit institution |

| Dt 19 Kt 60 | VAT reflected |

| Dt 76 Kt 51 | Wrong reward was withheld |

| Dt 51 Kt 76.2 | The bank returned the commission - postings for erroneous debits |

| Dt 51 Kt 91.1 | Return of excessively withheld remuneration |

| State-financed organization | |

| Dt 2.205.31.560 Kt 2.401.10.130 | Accrual of debt for services rendered |

| Dt 2.201.11.510 Kt 2.205.31.660 | Income received by the institution for services provided |

| Dt 2.401.20.226 Kt 2.302.26.730 | Commission payment accrued to the bank |

| Dt 2.302.26.830 Kt 2.201.11.610 | Transfer of bank commission payment |

The financial accounting system ensures the correct and legal use of financial instruments. The rational construction of the accounting system and compliance with its order is the key to the absence of violations and timely execution of all transactions.

Since double entry accounting is adopted in Russia, entries for banking transactions change depending on which party records the bank guarantee. Specialists from the Center for Guarantees and Investments will help you make the correct entries.

The main accounting problems concern the postings to the principal, since the accounts used are determined depending on the purpose of issuing the guarantee. Let's look at the most common situations.

Dt 01 (07, 08) Kt 76

The amount of remuneration to the guarantor is included in the actual cost of the acquired object and written off from the debit of the accounts on which fixed assets (01), equipment for installation (07), non-current assets (08) are recorded, to the credit of account 76 “Settlements with various debtors and creditors " The debited account is selected based on the nature of the property.

Dt 76 Kt 51

From the debit of account 76, the amount is written off to the credit of account 51 “Current account”.

Dt 91.2 Kt 76

The remuneration amount is written off from the debit of account 91 (subaccount 2) “Other income and expenses” to the credit of account 76.

Dt 76 Kt 51

Similarly, funds are transferred to the current account.

3. When issuing a guarantee to secure any other obligations, the amount of remuneration that is paid to the guarantor is related to expenses for ordinary activities or is taken into account as part of other expenses.

The wiring in this case is most often similar to the previous option. However, in order to avoid confusion, they should be clarified in accordance with the features of the guarantee and accounting policies of a particular enterprise (for example, a separate sub-account can be allocated for them).

Contact the Center for Guarantees and Investments for advice on the intricacies of maintaining this area of accounting. The correct reflection of transactions that are associated with obtaining a guarantee from the bank and paying remuneration to it guarantees the correctness of accounting and its compliance with the current accounting regulations, and also helps to navigate the peculiarities of tax accounting.

Responsibility for failure to comply with cash discipline

Business entities are responsible not only for the correct execution of cash documents, but also for the completeness of cash receipts. The statute of limitations for violations of cash transactions is short and is only 2 months. The tax office has the right to hold violators administratively liable if errors are discovered. According to paragraph 1 of Art. 15.1 of the Code of Administrative Offenses of the Russian Federation, the fine for organizations can reach 50,000 rubles. For individual entrepreneurs and managers under the same article, fine payments will amount to 4,000–5,000 rubles.

For more information about the level of responsibility, see the material “Are your cash discipline in order?”

Individual entrepreneurs are exempt from full-fledged cash transactions with the establishment of a cash limit and the use of strict unified forms of documents. But if entrepreneurs still work in the course of their activities with cash settlement and payment services, then they must be filled out in accordance with all the rules.

Acceptance of payment requests

The legislation provides for two types of settlements for collection of payment claims:

- with acceptance;

- without acceptance.

This is stated in paragraph 2.1 of the Bank of Russia Regulations dated June 19, 2012 No. 383-P.

The acceptance condition of the organization and its counterparty is prescribed in the supply agreement (performance of work, provision of services, etc.), as well as in the banking service agreement (clause 2 of article 862 of the Civil Code of the Russian Federation, clause 2.9 of the Bank of Russia Regulations of June 19, 2012 No. 383-P).

The executing bank transfers the payment request to the payer with acceptance no later than the next business day from the date of its receipt by the bank (paragraph 5, clause 2.13 of Bank of Russia Regulations of June 19, 2012 No. 383-P).

Upon receipt of a payment request, the payer can:

- accept it in full;

- accept partially;

- refuse acceptance.

To do this, within the period established for acceptance, submit to the bank an application for acceptance or refusal of acceptance in the form established by the bank.

The bank pays the accepted payment request from the payer’s account no later than the business day following the day of receipt of the application, unless another period is provided for by the agreement (Article 849 of the Civil Code of the Russian Federation).

In case of partial acceptance, the bank sends to the sender of the request a copy of the application for acceptance (refusal of acceptance) indicating the date, stamped by the bank and signed by an authorized person of the bank no later than the business day following the day of receipt of partial acceptance.

In case of complete refusal of acceptance, the executing bank returns the payment request to the recipient's bank along with a statement of refusal to accept. The executing bank must do this no later than the next day after receiving the application or the day no later than which the payer’s acceptance must be received.

This procedure is provided for in clause 2.9.2 of the Bank of Russia Regulations dated June 19, 2012 No. 383-P.

Regulation of cash transactions

Cash flow is typical for almost all enterprises and individual entrepreneurs. The specifics of conducting cash transactions are enshrined in the instruction of the Central Bank of the Russian Federation No. 3210-U dated March 11, 2014. The document regulates the registration and accounting of cash flows of economic entities.

Currently, there is still a need to independently determine the cash settlement limit each year. However, for small businesses and individual entrepreneurs the obligation to set a cash limit has been abolished. They no longer need to monitor their cash balance on a daily basis.

For more details, see the article “Cash discipline - cash balance limit for 2021.”

Read about other nuances of working with cash:

- “Nuances of documenting cash transactions”;

- “What is the procedure for preparing cash documents?”;

- “What is the limit for cash payments between legal entities?”

Cash documents

Two types of cash orders are recognized as cash documents: expenditure and receipt. The forms of these forms are unified and approved by law. The procedure for filling out cash orders does not allow corrections or blots to be made - with them the document becomes invalid.

Orders are registered in the cash order register.

And the main register for the cash register is the cash book.

Find out also:

- is it possible to make corrections to the cash book;

- how to make an extract from the cash book.