It’s very easy to get a personal consultation with Katerina Vasenova online - you just need to fill out a special form. Several of the most interesting questions will be selected daily, the answers to which you can read on our website.

Tax audits are becoming tougher. Learn to protect yourself in the Clerk's online course - Tax Audits. Defense tactics."

Watch the story about the course from its author Ivan Kuznetsov, a tax expert who previously worked in the Department of Economic Crimes.

Come in, register and learn. Training is completely remote, we issue a certificate.

Income of participants: to whom and how much

Dividends are recognized as part of the net profit of the company, which, by decision of its participants, is distributed among them in proportion to their shares in the authorized capital or in proportion to the par value of the shares they own.

The following payments are not considered dividends:

- participants or shareholders upon liquidation of the company within the limits of their contributions.

- to a participant or shareholder - a non-profit legal entity, if the payment is not related to the statutory activities of the non-profit organization.

- participants or shareholders from the company's profit after taxation in proportion to their shares of participation.

The three above payments to participants or shareholders are not subject to the tax rates and deadlines established for dividend payments.

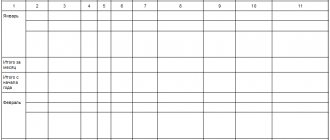

How the issue of profit distribution in JSC and LLC is resolved, read in Table 1.

Table 1. Profit distribution decision

| Legal entity form | Who decides | Frequency of dividend payments | Deadlines for decisions |

| JSC | General Meeting of Shareholders |

| No later than 3 months after the end of each period |

| OOO | General meeting of participants |

| – |

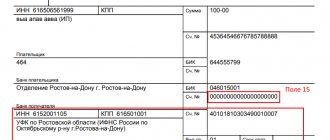

Payment. When paying tax on dividends, indicate KBK 182 1 0100 110 in the payment order. It is entered in field 104. The code must consist of 20 characters.

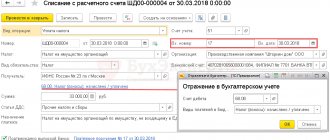

Sample payment order when transferring personal income tax on dividends in 2021

2-NDFL. Indicate the amount of dividends with personal income tax in section 3 of the certificate. Use income code – 1010 (Appendix 1 to the order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/387). If your organization received dividends from other companies and you took them into account when calculating tax, indicate the amount of the deduction in section 3 of the certificate. Deduction code – 601.

6-NDFL. Include the amount of income paid, taking into account personal income tax, in the indicator on line 020, indicate the amount of dividends separately in line 025. Include accrued personal income tax in line 040, and separately reflect the tax on dividends in line 045. In line 070, show the withheld tax on payments.

Let's consider the calculation of dividends using a regressive scale in 1C Accounting 3.0

To perform the calculation of personal income tax on a progressive scale (at rates of 13% and 15%), you must select the Perform personal income tax calculation on a progressive scale ( section Main - Taxes and reports - personal income tax tab ). It is recommended to check this box if the organization pays income to employees in excess of 5 million rubles.

Example

In March 2021, the founder (not an employee) was accrued income in the amount of 5,060,000 rubles, namely, dividends in the amount of 5,060,000 rubles.

Reflection of accrued dividends and personal income tax in accounting

The basis for recording dividends in accounting is the decision of the general meeting of participants and an accounting certificate calculating the amount of dividends. The accrual of dividends is reflected on the date of the decision to distribute the company's net profit among the participants.

Accrual and payment of dividends to an individual resident of the Russian Federation (not an employee)

- Section: Operation – Calculation of dividends ;

- New button ;

- In the Recipient , select an individual who is a recipient of dividends from a resident of the Russian Federation. Next to the Recipient , select the company member to whom dividends are awarded. A separate “Dividend Accrual” document is created for each participant;

- In the Dividends for , select the period for which dividends are calculated;

- Fill in the Accrued field and the personal income tax amount will be calculated automatically based on the rate of 13% and the rate of 15% for excess tax;

- Carry out button .

It is necessary to take into account personal income tax on income exceeding 5 million rubles, separately in account 68.01.2 “Personal income tax on income above the maximum amount, calculated by the tax agent.” This is needed for:

- payments under a separate KBK 182 1 0100 110 (implemented in ACC 3.0.87.28);

- allocations in reporting ( 6-NDFL will be filled out in the context of BCC).

To analyze the amount of accrued and payable dividends, as well as calculated tax, use the report Account balance sheet - account 75.02 and account card 68 (Section: Reports - Account balance sheet ).

Personal income tax rate on dividends in 2021

In 2021, income tax rates for dividends paid to individuals continue to depend on the status of the recipient of the income:

- 13% - for a founder who is a tax resident of the Russian Federation

- 15% - for a non-resident founder of the Russian Federation (unless another rate is established by international treaties on the avoidance of double taxation)

A tax resident is an individual who was actually in the territory of the Russian Federation for at least 183 calendar days over the next 12 consecutive months (Clause 2 of Article 207 of the Tax Code of the Russian Federation).

Thus, if at the time of payment of dividends the founder was in the Russian Federation for 12 consecutive months, then in 2021 it is necessary to take the personal income tax rate on dividends in the amount of 13% for calculation.

The tax is calculated by the tax agent for each dividend payment.

Personal income tax on dividends = amount of founder's dividends total amount of dividends of all founders (total amount of dividends of all founders - dividends from equity participation) tax rate

Example.

For 2021, the total amount of dividends amounted to RUB 2,000,000, of which:

- 1,200,000 rub. – Pavlov A.A.

- 800,000 rub. – Kovaleva A.V.

Harmony LLC received dividends from equity participation in Veter LLC in the amount of RUB 500,000. This amount was not taken into account in the personal income tax calculation.

Solution:

Since the founders are tax residents, the calculation will be made in accordance with clause 5 of Art. 275 Tax Code of the Russian Federation

- Personal income tax Pavlova A.A. = (1,200,000 : 2,000,000) (2,000,000 – 500,000) 13% = 117,000

Personal income tax is calculated according to the same principle for Kovaleva A.V.

- Personal income tax Kovaleva A.V. = (800,000 : 2,000,000) (2,000,000 – 500,000) 13% = 78,000

In accounting, the accountant will make the following entries:

- Dt 84 Kt 75 “Settlements for the payment of dividends with A.A. Pavlov” RUB 1,200,000

- Dt 75 Kt 68,117,000 rub. – from dividends of Pavlov A.A. personal income tax withheld

- Dt 84 Kt 75 “Settlements for the payment of dividends with Kovaleva A.A.” 800,000 rub.

- Dt 75 Kt 68 78,000 rub. – from dividends Kovaleva A.A. personal income tax withheld

In accordance with paragraph 18 of Art. 217 of the Tax Code of the Russian Federation, income received by inheritance is not subject to income tax. However, this rule does not apply to the payment of dividends, since the object of inheritance is the right to receive cash dividends.

Thus, when paying dividends to the shareholder’s heir in 2018, the tax agent must withhold personal income tax at a rate of 13 or 15%, depending on the status of the income recipient.

The status of an entrepreneur does not affect the company's performance as a tax agent. In this case, when calculating personal income tax, only one factor is taken into account: whether the recipient is a tax resident or not. Those. choose the personal income tax rate when paying dividends depending on the status:

- if the individual entrepreneur is a resident, we take a rate of 13%,

- if an individual entrepreneur is a non-resident, we calculate personal income tax at a rate of 15%.

If the profit is received, the decision on payments is made, then it needs to be made. And in this case, there is no special document that should be provided in this case.

Therefore you can use the following:

- form for payment of money from the cash register or when transferring to an account;

- accounts to shareholders, payments to whom are made in non-cash form.

Before we move on to filling out a payment order to pay personal income tax on dividends, let’s look at the tax rate.

What are dividends? This is a percentage of net profit on which all taxes have already been paid, distributed among the founders of the company, its participants or shareholders. Thus, for the Federal Tax Service, dividends are the same income from which income tax is taken.

This means that personal income tax on dividends is subject to the same provisions as income tax on wages or other payments. Therefore, the BCC for personal income tax on dividends, which you put in the payment order, coincides with the BCC for personal income tax.

Personal income tax rate on dividends:

- for residents of the Russian Federation (persons staying in Russia for at least 183 calendar days within 12 consecutive months) - 13%;

- for non-residents - 15%.

Tax payment amounts vary depending on:

- status of individual participants as tax residents or non-residents of Russia;

- status of a legal entity - a source of payment to individuals.

For tax purposes, a resident of Russia is considered to be an individual who, on the date of receipt of taxable income, spent 183 days or more in Russia during the previous 12 calendar months. If the time of stay in the Russian Federation for the specified period is less than 183 days, the individual is considered a non-resident.

Also, for personal income tax on dividends in 2021, the rate depends on the status of the legal entity - Russian or foreign. Read more about tax payments on dividend payments in Table 2.

Table 2. Personal income tax on dividends in 2021: rate

| No. | Who pays the individual | Reason for payment | Individual status | Personal income tax rate on dividends in 2021 |

| 1. | Foreign legal entity | Ownership of shares or interests | Resident | 13% |

| 2. | Russian LLC | Ownership of shares | Resident (participant) | |

| Non-resident (participant) | 15% | |||

| 3. | Russian joint-stock company | Share ownership | Resident (shareholder) | 13% |

| Non-resident (shareholder) | 15% |

We will show you with an example how to determine the status of an individual in order to calculate the tax at the correct rate. At the same time, we note that the date of receipt of dividend income in accordance with the Tax Code of the Russian Federation is considered the day of their payment to the participant or shareholder.

The formula for calculating the tax depends on whether the company paying the dividends receives income from equity participation in other legal entities.

Thus, dividends are payments in favor of, for example, the founder of a legal entity. Also, the recipient of dividends can be an organization (for example, an LLC) if it is a shareholder (participant) of another organization. There were no changes in this part in 2021. In this case, the decision on the payment of dividends must be made by the general meeting of shareholders (participants) (clause 3 of Art.

Attention

Therefore, you can use standard forms that are filled out when paying money from the cash register or when transferring funds from a current account. At the same time, keep in mind that dividends must be paid to shareholders in cash.

Video.

Return to Dividends 2018A payment order is used when transferring funds to another account to pay taxes, pay dividends, wages, etc. Productions that are single or medium-sized in terms of output can issue an order through a bank. Large organizations can generate and send any order via Internet banking. For small organizations, programs are available that make it easier to create an order.

However, you should be careful when filling out each item. Particular attention should be paid to the following details: • Name of the recipient's bank; • Treasury account (Federal).

The sample KBK personal income tax payment order for dividends in 2021 is practically no different from a payment order with a different purpose. All numbers, codes, signatures and seals remain unchanged.

KBK on dividends for personal income tax in 2021 - 2021

Currently, the personal income tax rate on dividends is 13%. If the amount of dividends exceeds 5 million rubles, the rate is increased to 15%. If the participant is not a resident of the Russian Federation, taxation must be carried out at a rate of 15%.

EXAMPLE of calculation from ConsultantPlus: Example of calculation of personal income tax on dividends by an organization that itself receives dividends. The LLC decided to distribute profits in the amount of 2,500,000 rubles. to the following members of the company: an individual who is a resident of the Russian Federation - in the amount of 500,000 rubles; Russian organization - in the amount of 2,000,000 rubles. From participation in another organization, the LLC received dividends in the amount of RUB 1,000,000. They were subject to income tax withholding at source. Personal income tax on dividends of an individual will be... You can view the formula and example of calculation in the K+ help system. To do this, sign up for a free trial demo access.

Income paid to individuals, including dividends, is reflected in 2-NDFL certificates (from 2021, the form has been canceled, since information is submitted as part of 6-NDFL) and in 6-NDFL calculations.

For more information on what kind of reporting to submit on dividends, see here.

The transfer of tax to the LLC budget must be done in accordance with clause 6 of Art. 226 of the Tax Code of the Russian Federation no later than the day following the day of payment. The tax can be transferred in one payment, regardless of the number of dividend recipients.

The BCC for personal income tax on dividends in 2021 has not changed compared to previous periods. When drawing up a payment document, you must indicate the following code:

182 1 0100 110.

When paying dividends taxed at a rate of 15%, another BCC 182 1 0100 110 is applied.

For the current BCCs for 2020-2021, see here.

Deadline for payment of personal income tax on dividends in 2021

The tax agent is obliged to withhold personal income tax from the individual founder and transfer it to the budget no later than the deadlines established by the Tax Code of the Russian Federation.

If the organizational and legal form is, then you must be guided by clause 6 of Art. 226 Tax Code of the Russian Federation. This means that the tax must be paid no later than the day following the day of payment of dividends.

If the tax agent is OJSC, then, according to the opinion of employees of the Ministry of Finance of Russia, income tax should be transferred to the budget no later than 1 month from the date of payment of funds (Letter of the Ministry of Finance of Russia dated November 19, 2014 No. 03-04-07/58597).

Please note that the personal income tax rate on dividends does not affect the timing of tax remittance.

Russian companies are considered tax agents for dividend income of participants - individuals, therefore they withhold and transfer tax to the budget. To make the payment correctly, the accountant of a JSC or LLC needs to follow the following algorithm.

Step 1. Determine when dividend income is considered received according to the norms of the Tax Code of the Russian Federation.

If income is paid in cash, then the actual date of receipt is the day of payment. Read about the timing of transferring part of the distributed profit to participants and shareholders in Table 3.

Table 3. Deadline for payment of personal income tax on dividends in 2021

| Legal entity form | Recipient of income | Payment term |

| JSC | Listed in the register of shareholders:

| 10 working days from the date of determination of dividend recipients |

| Shareholders | 25 working days from the date of determination of income recipients | |

| OOO | Participant, founder | Participant, founder

|

Step 2. Calculate the tax on the date of receipt of income using the above formulas.

Step 3. Withhold tax. Tax is withheld from cash income when paying funds to a shareholder or participant, and from income in non-monetary form - when paying any other monetary income.

Step 4. Transfer the tax to the budget no later than the next day after it was withheld - by payment order with the correct KBK code.

If the deadline for paying personal income tax on dividends is overdue, the company will face punishment. However, the timing of tax payment is directly related to the legal form of the company.

- For an LLC - the payment deadline is the next day after the transfer of dividends (clause 6 of Article 226 of the Tax Code of the Russian Federation);

- For JSC, the deadline for paying personal income tax is 1 month from the date of issuance of dividends.

Such a payment order has both similarities with a regular one (it states the same status of the payer, indicates the same details of the recipient, the same income administrator), and differences. Let us dwell on the latter in more detail, and then present

sample payment slip for penalties for personal income tax 2021.

The first difference is KBK (props 104). For tax penalties there is always a budget classification code, in the 14th–17th digits of which the income subtype code is indicated - 2100.

KBK for transferring penalties: 182 1 0100 110

The second difference between a payment order for penalties is detail 106. The following options are possible:

- If you have calculated the penalties yourself and pay them voluntarily. In this case, the basis will have a tax code, that is, voluntary repayment of debt for expired tax periods in the absence of a requirement from the Federal Tax Service.

- If you pay at the request of the Federal Tax Service. In this case, the base will have the form TP.

- You transfer based on the inspection report. This is the basis of payment to AP.

The third difference is detail 107. Its value depends on what served as the basis for the payment:

- For voluntary payment – “0”. If you are listing penalties for one specific period (month, quarter), it is worth indicating it, for example, MS.02.2018 - penalties for February 2021.

- When paying at the request of tax authorities (basis of TR) - the period specified in the request.

- When repaying penalties according to the verification report (the basis of the AP), they also put 0.

If you pay penalties yourself, enter 0 in fields 108 and 109.

In all other cases, in field 108, provide the document number - the basis for the payment (for example, a claim), and do not put the “No” sign.

In field 109, indicate:

- date of requirement of the Federal Tax Service - for the basis of payment TR;

- the date of the decision to bring (refusal to bring) to tax liability - for the basis of an administrative agreement.

Payment order - sample

In 2021, additional rules were introduced, so payment orders are filled out according to the approved scheme. If you look at the sample, you can see all the sections that must be filled in with data. For example:

- Field number 101 must be filled in with code 02, that is, tax resident;

- The main BCC is entered in field 104. As a rule, it does not change and remains the same as when receiving regular financial income;

- The sample contains field 106. In this section you should indicate the current payment;

- Next, in the 24th field, which is called the purpose of payment, the accountant needs to indicate what exactly will be transferred to the budget;

When calculating and transferring dividends, as well as when calculating taxes, it is best to reflect all transactions performed, and in the appropriate accounts.

A legal entity has the right to defer payment of income tax if there is a counterclaim. It happens that the participant did not fulfill his obligations to pay for the goods or services he received or did not ensure the repayment of the loan taken.

When the debt is significant and exceeds or equals the volume of dividends, the legal entity has the right not to transfer funds to the participant; accordingly, it is almost impossible to organize the withholding of personal income tax. You must report your income to the inspectorate within the time limits established by law, otherwise you will receive a receipt acknowledging a fine.

What to do if you made a mistake with the KBK for personal income tax on dividends in 2019

When a company passes through many payments with different budget classification codes, it is very easy to make a mistake in writing the BCC for personal income tax on dividends. Fortunately, the error can be corrected without significant damage to the organization if the right steps are taken.

First of all, you need to submit an application to the territorial branch of the Federal Tax Service. This possibility was indicated by the Ministry of Finance in its letter dated January 19, 2017 No. 03-02-07/1/2145. The application is written in free form, but it must be noted:

- Number and date of the payment order with an erroneous BCC;

- The amount of payment, its type;

- Directly incorrect code;

- The required KBK.

Payment of accrued dividends and payment of personal income tax on dividends

Payment of dividends:

If the payment of dividends is carried out through a bank, then the payment is reflected in the document Payment order (section Bank and cash desk - Payment orders ) and Write-off from the current account with the transaction type Transfer of dividends . In the basis field, select our accrued dividends, select an individual.

Tax transfer:

Since the tax was calculated on two accounts 68.01 and 68.01.2, there will also be two payments.

In the first payment slip, we select the tax: personal income tax calculated by the tax agent, which corresponds to 68.01 and the corresponding BCC, indicate the amount of tax, the rate of which is 13%.

In the second payment slip, we select the tax: personal income tax on income above the maximum amount, calculated by the tax agent, which corresponds to 68.01.2 and the corresponding BCC, indicate the amount of tax, the rate of which is 15%.

Correct reflection of excess tax amounts in reports and certificates will be implemented in future versions of the program.

Personal income tax payment from dividends 2021: sample filling

The following example shows a personal income tax payment from employee salaries. The fields marked with numbers are the details of the document about which questions arise. Their decoding can be found in the table below.

Sample of filling out the PP for payment of personal income tax on employees' wages

We suggest you consider a sample of filling out a personal income tax payment slip for 2018, understand the rules for drawing up this document, as well as its purpose. In addition, individuals who need to transfer funds will be able to learn all the intricacies of this procedure.

Payment order

If an individual has opened an account in a bank, deposited a certain amount of money into it and wants to transfer it to another account, then he needs to draw up an appropriate settlement document containing this instruction, which is called a payment order. Most often, employers encounter documentation of this kind when transferring personal income tax from the salaries of their employees to the state budget.

Many taxpayers believe that completing documentation containing reporting data on the personal income tax they have transferred and making the appropriate payment is sufficient.

However, in addition to this, it is necessary to enter data into the payment order form approved by the Federal Tax Service. This will guarantee that the funds allocated for personal income tax will be transferred exactly to the destination address.

In such a situation, the taxpayer will need to check all the details and find out all the information relating to the payment made, which will require additional time and effort.

Since not only the account owner, but also bank employees contribute to the procedure for transferring funds, some lines in the payment slip must be left blank. Blank spaces are intended for marking by individuals who are bank employees.

First of all, this is the direction of the payment, the signature of an authorized employee for its execution and the wet seal of the bank. In addition, two dates are placed at the top of the form. The first of them is the date of receipt of money in the bank of an individual acting as a payer, and the second is the date of its debiting from the account.

In 2021, the form of such a document as a payment order remained practically unchanged compared to the form in force in 2021.

Most of the information required from the taxpayer is numbers (dates, amounts, account numbers, etc.). However, in some places in the document you also need to indicate text (for example, the amount of the money transfer). In order to correctly enter words into a document, write them in printed font.

The payment form contains several abbreviations that most individuals encounter for the first time, and there are also lines that require entering codes that encrypt certain information. In this regard, the parameters that require special attention during the process of processing payment orders are given and explained below:

- Taxpayer status. In a separate square, inside of which there is the designation 101 in brackets, you need to note the status. If an individual is an employee of the tax service and has the right to withhold personal income tax from taxpayers’ profits, then he must indicate code 02, if an individual entrepreneur - 09. However, in most cases, code 13 is used, which is intended for individuals who do not have a special status.

- TIN - identification number is issued not only to individuals, but also to legal entities, including banking organizations. In this regard, in the payment form it is necessary to indicate the TIN of two banks - the sender and the recipient. As a rule, these are numerical ciphers consisting of ten characters and conditionally divided into five blocks of two numbers, each of which carries its own meaning (for example, the first two characters are the subject’s code).

- Checkpoint - since banking organizations are registered simultaneously with several tax authorities, in addition to the TIN, they are also assigned a so-called reason for registration code. This digital code carries information about which tax authorities are responsible for controlling the income of a particular legal entity.

- BIC is a mandatory attribute of any bank, which is needed to record participants carrying out settlement transactions. And this abbreviation stands for bank identification code. Such ciphers consist of nine digits and are used only on the territory of the Russian Federation.

If the head of a company needs to pay personal income tax, the amount of which is 235,000 rubles, from the monthly salary of all his employees, transferred to their bank cards on May 27, 2018, then the following information is entered into the payment slip:

- Document number and date of completion. Next to the name of the form (“PAYMENT ORDER”) you need to put its serial number. Or, in other words, indicate a number reflecting the number of issued payments in a given bank account. After this, the date the form was filled out is written. In this case, this is the next day after employees receive their salaries - May 28, 2021.

- Amount of payment. In order to correctly record the amount that the manager wants to transfer to the state budget, it is necessary to write its amount as follows: “two hundred thirty-five thousand rubles 00 kopecks.”

- Payer details. To indicate which legal entity is the personal income tax payer, you will need to write its identification code, checkpoint, account number, re-enter the amount that will be transferred as a result (only in numerical format), indicate the name of the company, bank and BIC.

- Recipient's bank details. In order to correctly enter data regarding the organization to whose account personal income tax payments will be received after some time, you should also display the TIN and BIC assigned to it. In addition, the account number and name of the bank in which it is opened for the recipient must be written. In addition, you need to indicate the tax service that will receive the money (inspectorate number and city of location).

- Additional information. In a column such as the order of payment, in 2021 the number five is entered, and in the column called “code” a zero is entered if the manager pays material resources on his own initiative, and not in response to a written request for repayment of personal income tax debt from tax officials services.

- Recipient information. Point four described how to correctly enter the details of the recipient’s bank. However, this information is not enough for the payment - information is also required about the tax service itself, which will receive this transfer. You will need to write the budget classification code and the combination of numbers established by the classifier for settlements or municipalities (OKTMO), as well as put additional marks regarding the payment, if any.

The Ministry of Finance has clarified the nuances of difficulties with payment documents this year. Whether all fields on the form are filled out correctly determines whether the banking institution will accept it. Having carefully studied the example of filling out a payment order in 2021, you can fill out payment orders quickly and without errors.

According to established rules, such documents are filled out by private entrepreneurs and companies performing transactions that are subject to taxes. Another category of taxpayers are individuals or legal entities engaged in the supply of goods across the customs border.

Persons and organizations that:

- They are engaged in performing various types of work, selling goods and providing services that are subject to VAT. For example, they sell building materials, renovate premises, and provide consultations.

- Transfers goods without the need to rally them, performs assigned tasks and provides services. In this case, the tax base is the actual market price for the type of services provided and work performed.

- They distribute goods throughout the country that are intended to fulfill their own needs. Such an action is subject to taxes if the company did not take into account the cost of carrying out these operations when calculating income taxes.

- They are engaged in construction work or installation of structures.

All persons carrying out such transactions must pay tax to the state treasury if the amount of money received for the previous trimester is more than 2 million.

rubles (the amount does not include the amount of tax). For entrepreneurs who sell goods subject to excise tax, this rule does not apply - they must pay tax regardless of their revenue.

The procedure for filling out payment orders in 2021

You can obtain tax exemption by filling out a special form that is submitted to the regulatory authority.

Documents confirming the financial transactions carried out by the company or entrepreneur must be attached to the form: companies need to attach extracts from the balance sheet, persons engaged in entrepreneurial activities - books of inputs and expenses, sales, and other internal business transactions.

Next, enter your information. Namely:

- Surname

- Name

- Surname

- TIN

- Registration address

Please note that you need to pay fees on your own behalf. Click the “Next” button and check everything again... After making sure that the data is entered correctly, click on the “Pay” button. If you want to pay in cash, using a receipt, then select “Cash payment” and click on the “Generate payment document” button "That's it, the receipt is ready

- Since we entered KBK 18210202140061110160, we received a receipt for payment of mandatory contributions to the pension insurance of individual entrepreneurs.

- In order to issue a receipt for payment of the mandatory contribution for health insurance, we repeat all the steps, but at the stage of entering the BCC, we indicate a different BCC: 18210202103081013160

- medical insurance for an individual entrepreneur for himself - 182 1 0213 160.