Who reflects reduced insurance premiums in the DAM?

From 04/01/2020, a number of employers can pay insurance premiums at reduced rates.

Because of this, they must fill out the RSV according to special rules. Important! Reduced insurance premium rates have been introduced for SMEs not only for 2021. They are valid indefinitely. We also add that to use them, the subject is not required to work in the affected industries.

The rules for the DAM with reduced tariffs are prescribed in the order of filling out the calculation (approved by order of the Federal Tax Service dated September 18, 2019 No. ММВ-7-11/ [email protected] ) as amended by the Federal Tax Service order dated October 15, 2020 No. ED-7-11/ [email protected] ] , which is valid starting from the annual calculation for 2021. Until these rules are entered directly into the filling procedure (that is, in relation to the DAM for six months and 9 months), they were recommended by the Federal Tax Service by letter dated 04/07/2020 No. BS-4-11/ [email protected]

Set up calculation

Indicate that the company is a SME.

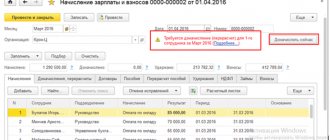

- Go to the “Employees/Salary” section and click .

- In the Accounting and Settings section, select an organization.

- Set the "SME" flag.

- Save your data.

The setting will be effective from the first month for which no transactions are generated. To apply reduced rates from a specific period, such as January, close out all previous calculation months, including December.

Recalculate salaries and check the contribution amounts on employee pay slips.

New fare code

Payer tariff code 20 in RSV 2021 - this is what you need to use when filling out the calculation for reduced rates. In subsection 3.2.1 of section 3, the following codes of the category of the insured person must be indicated:

- MS - an individual, from whose portion of payments and remunerations insurance premiums are calculated by the specified payers;

- VZHMS - persons insured in the OPS system from among foreign citizens or stateless persons temporarily residing in the territory of the Russian Federation, as well as foreign citizens or stateless persons temporarily staying in the territory of the Russian Federation who have been granted temporary asylum, with a portion of payments and remunerations to which, defined as excess over the minimum wage, insurance premiums are calculated by payers recognized as small or medium-sized businesses;

- VPMS - foreign citizens or stateless persons (with the exception of highly qualified specialists), from the part of their payments and remunerations, defined as the excess over the minimum wage, insurance premiums are calculated by payers recognized as SMEs.

Termination of preferential rates

All employing companies, regardless of the legal form or method of income taxation, pay insurance premiums if they make payments under employment or civil law contracts with hired workers.

An individual entrepreneur pays contributions on two grounds:

- fixed amounts of contributions - for yourself;

- at standard rates - from the income that the individual entrepreneur pays to employees.

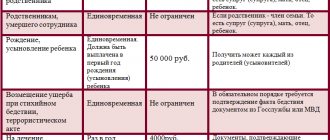

| Insurance type | At what rate | Maximum base value for calculating insurance premiums in 2017 (RUB) | Maximum base value for calculating insurance premiums in 2018 (RUB) | |

| Until the base limit is exceeded | After exceeding the limit base | |||

| Pension insurance | 22% | 10% | 876 000 | 1 021 000 |

| Health insurance | 5,1% | — | — | |

| In cases of temporary disability | 2,9% | 0% | 755 000 | 815 000 |

Let's consider the types of activities for which a benefit is provided under the simplified tax system when calculating insurance premiums.

Benefits on mandatory insurance premium rates for some firms and entrepreneurs using the simplified tax system are valid until the end of 2021. The reduced rates are:

- on pension contributions - 20%"

- for social contributions for disability and maternity – 0%;

- for medical contributions – 0%.

If an organization (IP) loses the mandatory condition for applying the benefit, then insurance premiums are calculated at general rates. For example, the agreement for the implementation of tourist and recreational activities in the tourist and recreational special economic zone was terminated.

Important! If the subject is on a patent taxation system, then reduced rates can only be applied to payments to employees engaged in patent activities, and not to the entire state.

The transition to OSNO is a mandatory condition for the termination of benefits. The general rates for calculating insurance coverage should be applied from the 1st day of the month following the month in which the mandatory condition for receiving the benefit was lost.

Filling out sections of the DAM with a reduced tariff (sample)

Reduced tariffs apply to the part of the salary that exceeds the minimum wage (in 2021 it is 12,130 rubles), and wages within the minimum wage are subject to contributions at regular rates. Therefore, these parts must be shown separately in the RSV.

To do this, fill out Appendix 1 and Appendix 2 to Section 1 of the DAM with tariff code 20 for payments exceeding the minimum wage, and the same appendices with tariff code 01 for payments within the minimum wage.

In Appendices 1 and 2 with tariff code 01 on lines 030 and 020, respectively, you need to indicate payments within the minimum wage (the maximum for 2020 will be 12,130). And in the lines for contributions, reflect accruals at regular rates from this limit.

In Appendices 1 and 2 with tariff code 20, these lines show the part of the salary that is above the minimum wage, and then they show contributions at a preferential rate.

As for the number of insured persons, in the Appendices with code 01 you need to indicate everyone to whom payments were accrued, and with payer tariff code 20 - only those whose salary is more than the minimum wage.

Section 3 will also have to be duplicated. It must be filled out separately for each employee:

- for payments within the minimum wage - with the insured person's codes NR, VZHNR or VPNR;

- for payments above the minimum wage - with codes MS, VZHMS or VPMS.

You can view a sample DAM with a reduced tariff in ConsultanPlus, having received free trial access to the system. Here is a fragment of the DAM for 2021 using reduced insurance premium rates:

More recommendations for filling out the RSV can be found in our special section.

Reduced insurance premium rates for small businesses

From 04/01/2020 for an indefinite period, for ALL entities from the Unified Socialist Welfare Enterprise, for ALL industries for payments from the amount exceeding the federal minimum wage, valid as of 01/01/2020 (RUB 12,130) (Article 4, Article 6, Clause 2, Article 9 of the Federal Law dated 04/01/2020 N 102-FZ, Article 427 of the Tax Code of the Russian Federation, Letters of the Federal Tax Service dated 06/05/2020 N BS-4-11/ [ email protected] , dated 06/02/2020 N BS-4-11/ [email protected] ) :

- OPS - 10%

, regardless of the maximum taxable base - OSS VNiM - 0%

- Compulsory medical insurance - 5%

Minimum wage and less - basic tariff 30% (Article 425 of the Tax Code of the Russian Federation)

For part of the salary within the minimum wage in effect at the beginning of the billing period (12,130 rubles as of 01/01/2020), contributions are calculated at the regular rate. The taxable base is determined monthly.

Tariffs for FSS NSiPZ have not changed.

The procedure for applying reduced insurance premiums is discussed in the Letter of the Federal Tax Service dated 04/15/2020 N BS-4-11/ [email protected] And additional clarifications were given in the Letter dated 04/29/2020 N BS-4-11/ [email protected]

Please note that:

- the right to calculate insurance premiums at a general rate of 15% for payments above the federal minimum wage is available to those who were included in the SME register in April or earlier (including micro-enterprises);

- You can use the reduced tariff from the beginning of the month in which the Organization / Individual Entrepreneur is included in the register;

- upon exclusion from the register, the right is lost from the 1st day of the month of exclusion;

- The minimum wage does not increase by regional coefficients and northern allowances.

The Federal Tax Service has updated the register of small and medium-sized businesses as of July 1, 2020, which means the list of those who are entitled to a reduced insurance premium rate of 15% has been expanded (Letter of the Federal Tax Service dated July 15, 2020 N BS-4-11 / [email protected] ).

Reduced “little” tariffs can be applied for any activity from the month of inclusion in the SME register (Letter of the Ministry of Finance of the Russian Federation dated December 31, 2020 N 03-01-10/116785).

Main – Taxes and reports – Insurance premiums

WAS

BECAME

Field Insurance premium rate + Apply with

Salary and personnel – All accruals – Payroll

Salaries and personnel – All accruals – Payroll – Contributions

Salaries and personnel – All accruals – Payroll – Contributions – Insurance contribution registration card

Payments exceeding the minimum wage, tariff code 20

(Letter of the Federal Tax Service dated 04/07/2020 N BS-4-11/ [email protected] ).

Salaries and personnel – All accruals – Payroll – Contributions – Insurance contribution registration card

Payments not exceeding the minimum wage, tariff code 01

. According to general tariffs (Article 425 of the Tax Code of the Russian Federation).

Examination

Salary and personnel – Salary reports – Analysis of contributions to funds – More – Other – Change report option – Type of insurance premium rate – instead of Accrual select Employee

Paid insurance premiums reduce the simplified tax system by 6%

automatically.

Administration – Accounting parameters – Setting up a chart of accounts – Accounting for settlements with personnel: For each employee

simplified tax system 6%

- Salaries and personnel – Statement to the bank

- Operations – Closing the month – Calculation of expenses that reduce the simplified tax system

- Operations – Closing the month – Calculation of expenses that reduce the simplified tax system tax – Certificate-calculation of expenses that reduce the simplified tax system tax

Is the benefit provided for in paragraph 6 of Art. applied to all employees in a small business organization? 7 of Law No. 102-FZ “6. The provisions of Articles 5 and 6 of this Federal Law apply to legal relations that arose from April 1, 2020...”?

It is the wording about “LEGAL RELATIONS ARISING FROM 04/01/2020” that is confusing. It sounds like it only applies to those employees we hired as of 04/01/2020.

Art. 427 of the Tax Code of the Russian Federation has been amended indefinitely and reduced rates have been introduced. Art. 6 of Federal Law No. 102-FZ dated 01.04.2020 speaks of the application of reduced rates from 01.04.2020 based on the results of each month. Therefore, it is meant that the rule for reducing SV rates applies to transactions from 04/01/2020, and not to hiring from 04/01/2020.

How to find out if a company is included in the Unified Register of Small and Medium-Sized Enterprises?

On the website rmsp.nalog.ru.

To find a company in the Register, enter either the INN, the OGRN or the name of the company (Article 4.1 of the Federal Law of July 24, 2007 N 209-FZ).

What to do if the company is not in the Unified Register of Small and Medium-Sized Enterprises, but it meets the criteria of a micro-enterprise? Or is the information in the registry incorrect?

Send an application to the Federal Tax Service to verify your information. To do this, in the section of the website rmsp.nalog.ru “Information on working with the registry”, select the option “Are you not in the registry or is the data incorrect?” (Article 4.1 of the Federal Law of July 24, 2007 N 209-FZ).

Where can I see what other measures, besides reduced insurance premiums, our business is entitled to? There are so many changes - we get confused and don’t have time to keep track...

Economy without a virus - Measures to support small and medium-sized businesses to overcome the consequences of the new coronavirus infection

Do reduced insurance premiums apply to part-time workers?

The employer can apply a reduced SV tariff to the accruals of part-time workers according to the general rules. Law No. 102-FZ does not contain any exceptions for this category of workers. These are the recommendations that the Federal Tax Service gives on its website.

See also:

- Reducing the tax on insurance premiums of the simplified tax system Income for individual entrepreneurs

- Small businesses

- Small Business Privileges

Calculation of reduced contributions to compulsory pension insurance when the maximum base is exceeded

EXAMPLE

Payments in the amount of 1,200,000 rubles were made to the employee for January-March 2021. For April 2021, the specified employee was accrued another 200,000 rubles. That is, the amount of payments in favor of the employee, determined by the cumulative total from the beginning of the billing (reporting) period, in April 2021 exceeded the maximum base value for calculating insurance premiums for compulsory health insurance by:

(1,200,000 + 200,000) - 1,292,000 = 108,000 rubles.

200,000 - 108,000 = 92,000 rubles - the amount of payments for April 2020, which is included in the maximum base for calculating insurance premiums for compulsory health insurance.

In this case, at the usual rates of insurance premiums, part of the payments for April 2021, not exceeding the minimum wage, is levied, i.e. 12,130 rubles.

Part of the monthly payments in excess of the minimum wage, which does not exceed the maximum base for calculating insurance premiums for compulsory health insurance, in the amount of 92,000 - 12,130 = 79,870 rubles, is subject to insurance premiums for compulsory health insurance at a rate of 10%.

The part of payments that exceeds, from the beginning of the billing (reporting) period, the maximum value of the base for calculating insurance premiums for compulsory health insurance, in the amount of 108,000 rubles, is subject to insurance premiums for compulsory health insurance at a rate of 10%.

Calculation of contributions to compulsory pension insurance for April 2021:

- 12 130 × 22% = 2668,60

- 79 870 × 10% = 7987,00

- 2668.60 + 7,987.00 = 10,665.60 rub.

Accounting in 1C

Setting up a preferential rate

Setting up the application of a preferential tariff for the 2nd quarter is available in the Main section - Taxes and reports - Anti-crisis (from release 3.0.78.64). This setting can be done for each organization in the database separately.

To apply the benefit, check the box:

- Activities classified as affected by coronavirus.

You can check your eligibility for exemption using the links below.

You can quickly access the settings via the banner on the main page.

After this, the current tariff will automatically change in the Insurance premiums .

The Change History link will display the following entries:

- April 2020 - For industries affected by coronavirus infection ;

- July 2020 - the tariff that was applied until April (in our example, the Basic tariff of insurance premiums ).

Therefore, at the end of the grace period, you do not need to do anything to return to the previous tariff.

Contributions are recalculated in the current month.

The organization has the right to apply a 0% tariff for insurance premiums for April-June 2021.

For April and May, salaries have been accrued, contributions are calculated at the usual rate.

Employee Osipov I.S. was granted leave from June 29 to July 26 and vacation pay was calculated.

Contributions are calculated at a 0% rate.

Calculate wages for June in the usual manner using the Payroll document (Salaries and personnel - All accruals - Create button - Payroll).

Osipov I.S. received his salary for June and vacation pay.

The breakdown of accrued contributions shows that contributions for April and May have been reversed, for June only contributions to the Social Insurance Fund from the NSiPZ have been accrued.

A 0% rate applies to all payments accrued in June, including vacation pay for July.

Recalculation of contributions for previous months

When the setting for applying a preferential tariff is enabled, the second option is possible - recalculate contributions in the Payroll for the previous period using the More - Recalculate contributions button.

Accrued contributions will be adjusted to reflect the new tariff.

See also:

- A simplified mechanism for providing deferment for companies affected by coronavirus has been approved

- Anti-quarantine measures for property businesses

- Useful links for accountant work

- [05/26/2020 entry] Electronic work books: we are implementing no matter what! NEW INFORMATION ON COVID-19 Tax write-offs

- [06/23/2020 recording] Supporting seminar 1C BP for June 2020

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Reduced insurance premiums from April 2021 Good afternoon. The organization applies insurance premium rates for the Resident of technology-innovation...

- How are insurance premiums calculated at reduced rates from April 2020 if the base of 1,292,000 is exceeded according to compulsory insurance? Good morning. When calculating insurance premiums, I discovered that the program calculates...

- Insurance premiums under GPA for SMEs with reduced tariffs from 04/01/2020 Enterprise accounting (basic), edition 3.0 (3.0.79.21) Hello! The question is how to calculate...

- Insurance premiums at a reduced rate Federal Law No. 102-FZ dated 04/01/2020, if during the year there was exclusion from SMEs from 08/10/2020 the organization was excluded from the register of small and medium-sized...