Until relatively recently, the tax service did not allow the obligations of a business entity or other taxpayer to the budget and other creditors to be fully or partially repaid at the expense of financial resources belonging to third parties.

In addition, the tax service did not encourage payments by a business entity to repay tax and non-tax debts of third parties.

However, some provisions of current legislation still provide for such an option.

We are talking about Article 313, prescribed in the Civil Code of the Russian Federation.

This rule establishes and clarifies the procedure according to which a third party can pay the obligations of the debtor and taxpayer.

How to fill out a payment order to pay taxes for a third party?

Any taxes (except personal income tax for the tax agent), as well as penalties and fines on them, can be paid for a third party.

You can pay the debt for the current period and for the past. It does not matter who the payer and the person for whom taxes are paid are: an organization, an individual entrepreneur or an individual. That is, one organization can pay tax for another, but the founder? for your company. Please note that you can also pay insurance premiums for a third party (except for injuries). The procedure for paying them is the same as when transferring taxes. The reasons why the payer decided to pay “not his” taxes are also not important.

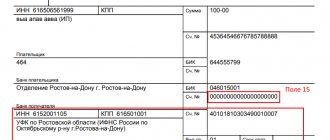

Fill out the payment in the general order, but taking into account the following features:

- in field 101, indicate the status of the person for whom you are paying tax;

- in fields 60 and 102, reflect his tax identification number and checkpoint. If you are transferring tax for an individual entrepreneur, then in field 102 put “0” (zero);

- in field 8, show your data (name of the organization, and for an entrepreneur? Full name and then the status “IP” in brackets);

- in field 24 “Purpose of payment”, first indicate your tax identification number and checkpoint (if you have one) separated by the “//” sign. Then ? name of the organization or full name entrepreneur (indicating “IP” in brackets) for whom you are transferring the tax. After that, use the “//” sign to indicate the purpose of the payment. For example: “7727098765 // 772701001 // Beta LLC // 1/3 VAT for the first quarter of 2021.”

Check the details of the payment and recipient with the person for whom you are paying the tax.

We found this example of filling out a payment order to pay tax for a third party in the ConsultantPlus system.

For convenience, you can also use the tax service’s online service “Paying taxes for third parties” to issue a payment order.

I have also prepared for you the TOP 6 questions received by the Consulting Center. Follow the link, it will be interesting:

If you have suggestions and topics that you would like to discuss on our blog, leave comments.

Irina Pugacheva,

chief accountant

Payment Features

After transferring funds, the actual payer completely loses rights in relation to this property. The payment is accounted for by the taxpayer. If, for example, an amount was transferred that exceeds the amount of obligations to the state, then only the taxpayer can claim the excess.

Some citizens are interested in whether it is possible to pay tax for another person and then return the money.

Paragraph 1 of Article 45 of the Tax Code of the Russian Federation states that an organization or citizen who has fulfilled a tax obligation for another person does not have the right to demand the transfer of this amount back.

The restriction is set to combat fraudulent activities. For example, a citizen is on the list of debtors to the state, another person transfers money to the budget. After fulfilling the obligation, all restrictions on the disposal of property are removed from the taxpayer.

When filling out the column, the payer indicates his full name. citizen or name of the organization that transfers the money. The taxpayer's information is entered in the "Purpose of payment" field.

You can make a payment:

- in person at the bank;

- via terminal;

- using the bank's mobile application;

- using an electronic wallet.

The actual payer may make a mistake and transfer money to pay tax for a person whose obligations to the state he did not intend to pay off. In this situation, the interested person should contact the bank. Only the taxpayer can clarify the purpose of the payment in the described case.

If the money was actually transferred, then a judicial defense remains. A citizen has the right to file a lawsuit to recover money from a third party whose tax obligation was erroneously fulfilled due to unjust enrichment.

Money transferred by mistake to pay taxes for another person is not refundable.

Examples of filling out a payment order when paying for third parties

In order to ensure correct accounting of tax payments transferred by legal or authorized representatives of the taxpayer, payer of fees, insurance premiums and other persons, the Ministry of Finance of Russia has established Rules for indicating information in the details of orders for the transfer of funds to the budget system of the Russian Federation (hereinafter referred to as the Rules).

According to these Rules, payers of tax payments, insurance premiums and other payments to the budget system of the Russian Federation in the fields of orders for the transfer of funds to the budget system of the Russian Federation indicate:

“TIN” of the payer is the value of the TIN of the payer, whose obligation to pay tax payments, insurance premiums and other payments to the budget system of the Russian Federation is fulfilled.

If the payer, an individual, does not have a tax identification number (TIN), zero (“0”) is indicated in the payer’s “TIN” details. In this case, it is necessary to indicate the Unique accrual identifier (document index) in the “Code” field;

“KPP” of the payer is the meaning of the checkpoint of the payer, whose obligation to pay tax payments, insurance premiums and other payments to the budget system of the Russian Federation is fulfilled. When fulfilling the obligation to pay payments for individuals, the payer’s “KPP” details indicate zero (“0”);

“Payer” - information about the payer making the payment:

- for legal entities - the name of the legal entity fulfilling the payer’s obligation to make payments to the budget system of the Russian Federation;

- for individual entrepreneurs - last name, first name, patronymic (if any) and in brackets - “IP”; for notaries engaged in private practice - last name, first name, patronymic (if any) and in brackets - “notary”; for lawyers who have established law offices - last name, first name, patronymic (if any) and in brackets - “lawyer”; for heads of peasant (farm) households - last name, first name, patronymic (if any) and in brackets - “peasant farm”;

- for individuals – last name, first name, patronymic (if any) of the individual fulfilling the payer’s obligation to make payments to the budget system of the Russian Federation.

In this case, in the “Purpose of payment” field the following is indicated:

TIN and KPP of the person (for individual entrepreneurs, notaries engaged in private practice, lawyers who have established law offices, heads of peasant (farm) households, individuals only TIN) making the payment. This information is indicated first in the “Purpose of payment” details. To separate information about TIN and checkpoint, the sign “//” is used; To separate information about the payer from other information indicated in the “Purpose of payment” detail, the “//” sign is used;

the name of the taxpayer, payer of fees, insurance premiums and other payments, whose duty is fulfilled (for an individual entrepreneur - last name, first name, patronymic (if any) and in brackets - “IP”; for notaries engaged in private practice - last name, first name, patronymic (if any) and in brackets - “notary”; for lawyers who have established law offices - last name, first name, patronymic (if available) and in brackets - “lawyer”; for heads of peasant (farm) households - last name, first name, patronymic (if any) and in brackets - “peasant farm”), for individuals - last name, first name, patronymic (if any) and registration address at the place of residence or registration address at the place of stay (if there is no place of residence).

It should be borne in mind that the Rules do not provide for a new status for this category of payers. Field “101” - “Payer Status” indicates the status of the person whose obligation to pay tax payments, insurance premiums and other payments to the budget system of the Russian Federation is fulfilled.

When performing duties:

- legal entity – “01”;

- individual entrepreneur - “09”;

- notary engaged in private practice – “10”;

- lawyer who established a law office - “11”;

- head of a peasant (farm) enterprise – “12”;

- individual – “13”.

The relevant information on the procedure for filling out orders for the transfer of funds by legal or authorized representatives of the taxpayer, payer of fees, insurance premiums and other persons is posted on the website of the Federal Tax Service of Russia in the section “Taxation in the Russian Federation / Tax legislation and clarifications of the Federal Tax Service of Russia /”.

Additionally, we inform you that the provisions of the Procedure establish the obligation to indicate in the order on the transfer of funds the value of the payer’s TIN details only when transferring taxes, fees for the performance of legally significant actions by tax authorities, insurance premiums and other payments administered by tax authorities to the budget system of the Russian Federation .

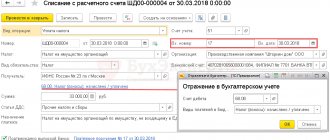

Accounting

The amount of funds issued under a loan agreement and subject to repayment by the borrower is not recognized as an expense of the organization in relation to clause 2 of the Accounting Regulations “Expenses of the Organization” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n, since when When issuing a loan, there is no disposal of assets (cash) leading to a decrease in the economic benefits or capital of the organization.

In this case, the loan provided is interest-free. Therefore, it is not included in the financial investments of the organization, since the condition of clause 2 of the Accounting Regulations “Accounting for Financial Investments” PBU 19/02, approved by order of the Ministry of Finance of Russia dated December 10, 2002 No. 126n, is not met, but is accounted for as a receivable debt.

Accordingly, the provision of such a loan is reflected by an entry in the debit of account 76 “Settlements with various debtors and creditors” and the credit of account 51 “Current accounts” (Instructions for the application of the Chart of Accounts for accounting financial and economic activities of organizations, approved by order of the Ministry of Finance of Russia dated October 31, 2000. No. 94n).

When the borrower returns funds to repay the loan, the lending organization does not generate income (clause 3 of the Accounting Regulations “Income of the Organization” PBU 9/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 No. 32n).

For the considered transactions, taking into account the above in the manner established by the Instructions for the Application of the Chart of Accounts, the following accounting entries are made:

DEBIT 76 CREDIT 68 - the amount of the interest-free loan is reflected as part of tax payments;

DEBIT 51 CREDIT 76 - the loan repayment is reflected.

Payment for another legal entity: how to process it, sample

And the addressee of the letter, that is, the paying organization, should receive its original. So, the main document for making payment for another legal entity is a letter, a sample of which is presented in the following image. Reflection in the tax accounting of the payer The company has paid the obligations of its counterparty, and now this operation must be reflected in the accounting. First, let's consider whether this will have any tax consequences for the payer. If the company is on the OSN, then in some cases it can offset VAT on the transferred amount. The operation will not entail any other tax consequences.

How to pay a bill for a third party

An exception was made only in very rare cases, for example, taxes for a reorganized entity could be paid by its legal successor. However, at the end of 2021, amendments were made to the Tax Code that abolish this rule. So paying tax for another legal entity in 2021 is quite trivial. Thus, it is possible to pay tax payments, insurance premiums, state duties, both current accruals and debts for previous periods. Who can pay taxes for whom? The law today does not establish any restrictions on who and under what conditions can pay tax for another person. Company taxes can be paid by any other organization, entrepreneur or just an individual. The new rules make it possible to avoid sanctions for late payment of mandatory payments.

Payer status

In detail “101” of the payment document for the transfer of funds to the budget by another person, it is necessary to reflect the indicator of the status of the payer whose obligation is being fulfilled. At the same time, the question of what should be the status of the payer of insurance premiums, thanks to Order of the Ministry of Finance of the Russian Federation No. 58n, has been finally resolved. Let us present those indicators of field 101 that may be useful to enterprises (IEs) operating in the catering sector (Rules 5).

| Field indicator value "101" | Payer status |

| 01 | Taxpayer (payer of fees, insurance premiums and other payments administered by tax authorities) – legal entity |

| 02 | Tax agent |

| 06 | Participant in foreign economic activity – legal entity |

| 08 | Payer - a legal entity, individual entrepreneur, a notary engaged in private practice, a lawyer who has established a law office, the head of a peasant farm, transferring funds to pay payments to the budget system of the Russian Federation (with the exception of taxes, fees, insurance premiums and other payments administered by tax authorities) |

| 09 | Taxpayer (payer of fees, insurance premiums and other payments administered by tax authorities) – individual entrepreneur |

| 17 | Participant in foreign economic activity - individual entrepreneur |

| 19 | Organizations and their branches that have drawn up an order for the transfer of funds withheld from the wages (income) of a debtor - an individual to repay arrears of payments to the budget system of the Russian Federation on the basis of an executive document sent to the organization in the prescribed manner |

Payment for goods by a third party

I will immediately answer a possible question: is the organization obliged to pay in favor of a third party, fulfilling the will of its counterparty? By default, unless specifically stated in the contract, it is not obligatory. And the court is unlikely to force anyone to do this. The arbitrators take the position that a voluntary action cannot be forced in court. Payment processing In practice, an order to pay a third party is formalized in a letter from the counterparty to the head of the organization.

It is necessary that the letter indicates the amount to be paid, details of the company in whose favor the payment must be made, as well as the correct purpose of the transfer (contract number, account number, etc.). The more detailed the letter, the better: this data will protect the paying company from potential risks.

We hereby inform you that we made payment order No. 000 dated “date” month year for the amount of so many rubles is a payment for LLC “Dolzhnik”, made on the basis of the letter of LLC “Dolzhnik” No. ... dated “date” month year. Chief accountant of Payer LLC / Ivanova O.S. General Director of Payer LLC / Sidorov P.P.

Tax accounting

VAT

Operations for the provision and repayment of loans in cash are not subject to VAT (clause 1, clause 2, Article 146, clause 1, clause 3, Article 39 of the Tax Code of the Russian Federation). A similar conclusion regarding the transaction of transfer of funds by the lender to the borrower is contained in the letter of the Federal Tax Service of Russia dated April 29, 2013 No. ED-4-3/7896. And regarding transactions for the transfer and return of funds - in the letter of the Ministry of Finance of Russia dated November 29, 2010 No. 03-07-11/460.

Corporate income tax

Funds transferred under a loan agreement, as well as amounts received for its repayment, are not taken into account for profit tax purposes as expenses and income (clause 12 of Article 270, clause 10 of clause 1 of Article 251 of the Tax Code of the Russian Federation ).

How to make a payment for a third party

Source: Glavbukh magazine The Civil Code does not regulate how payment of a debt by a third party should be formalized. In practice, the following scheme has been developed: the debtor company sends a letter to a third party with a request to pay its debt to the creditor, and the debtor, when transferring the debt to the creditor, indicates in the payment order as the purpose of payment that this is payment for the debtor company. A letter with a request to fulfill an obligation and a note in the payment order that the payment is being made for another person serve as evidence of the payer’s intention to transfer money to repay the debt for another person. In the absence of such evidence, the company that transferred the money can subsequently recover it from the recipient as unjust enrichment, citing the error of the payment (decision of the Supreme Arbitration Court dated September 4, 2009 No. BAS-10658/09).

Payment form and details in 2021

The form has not changed in 2021: the payment order template with field numbers and the procedure for filling them out are enshrined in the Regulation of the Central Bank of the Russian Federation No. 383-P dated June 19, 2012. Payments are filled out on the OKUD form 0401060. All budget transfers are made in the manner approved by the Ministry of Finance in order No. 107n dated November 12, 2013.

Explanation of the fields helps in filling out the payment order: the purpose of the lines “Number” (3), “Date” (4), “Amount in words” (6) are obvious to the executor. But difficulties arise with some details, especially if the company transfers taxes, fees and contributions.

IMPORTANT!

On January 1, 2021, new rules for filling out tax payment orders came into force (FK order No. 15n dated 04/01/2020). The Federal Tax Service switched to treasury services. Now all budget revenues are posted through the Unified Treasury Account. Payers indicate in the payment order two accounts and a new BIC of the recipient's bank.

ConsultantPlus experts discussed how to fill out a payment order to pay taxes for a third party. Use these instructions for free.

How to issue a payment order for a third party

In particular, specify the need to indicate the purpose of the payment - repayment of the debt of another company. ATTENTION! The letter of request must be signed by the head of the enterprise or a person with appropriate authority. The presence of a signature is of interest to the debtor, since it proves that the order actually took place. IMPORTANT! The payment is made by a third party, and therefore the company does not have direct access to documents confirming the payments made. However, their presence is necessary to prove repayment of the entire amount of debt. Therefore, it makes sense to request a copy of the payment order from the debtor. The paper must be marked with execution from the financial institution. An example of a letter on repayment of obligations to the General Director of Prodvizheniye LLC I.P. Ufimtsevug. Chelyabinsk, st. Kirova 1, no. 1From the General Director of Oliva LLC V.V. Ripakg. Chelyabinsk, st. Vorovskogo, 6 Ref.

How to make a payment for a third party

Current legislation (Article 313 of the Civil Code of the Russian Federation) provides for the possibility of fulfillment of an obligation by a third party. So, for example, if the debtor organization lacks money, the debtor can ask another organization to pay the creditor for him. Receiving payment is beneficial to the lender, but difficulties often arise in processing such payment. Fulfillment of the obligation to pay for another person is possible in two cases:

- At the request of the debtor, if the nature of the obligation does not imply that the debtor is obligated to fulfill the obligation personally.

- In the event that a third party is in danger of losing his property.

Thus, any organization can ask another organization to make a payment for it (to fulfill a monetary obligation), and the receipt of such money in our current account will be the proper fulfillment of the payment obligation.

Civil relations

In order for the tax inspectorate not to consider tax payments paid by a third party, a loan agreement should be drawn up between the taxpayer and the person who fulfills tax obligations for him as gratuitous assistance.

In accordance with paragraph 1 of Art. 807 of the Civil Code of the Russian Federation, under a loan agreement, one party (the lender) transfers into the ownership of the other party (borrower) money or other things determined by generic characteristics, and the borrower undertakes to return to the lender the same amount of money (loan amount) or an equal number of other things received by him of the same kind and quality. The loan agreement is considered concluded from the moment the money or other things are transferred.

As a general rule, a cash loan agreement requires the borrower to pay interest. However, the parties can agree to provide an interest-free loan, and the condition for providing a loan without paying interest for the use of borrowed funds must be provided for in the agreement (clause 1 of Article 809 of the Civil Code of the Russian Federation).

How to make a payment for a third party

At the same time, the debtor also risks: his obligation turns out to be unfulfilled, therefore, he will have to pay himself, moreover, with a penalty for late payment. Filling out a payment order by the payer is beyond the control of the company that asks to transfer money to the creditor for it. Therefore, in a situation where the payer did not indicate in the payment order the fact that this is a payment for another company, a letter may serve as necessary evidence. Having a letter with an instruction to transfer payment for another person protects all parties to the relationship, including the direct payer, from risks. Letter on debt repayment The letter must indicate the full name and legal address of the company that is entrusted with fulfilling the obligation for another person (1).

The article was written based on materials from the sites: vashkons.ru, 112buh.com, 1privilege.ru.

«

In what cases is it issued?

At present, the contradiction between the norms of legislation and the principled position of the tax authorities, which previously prevented the making of non-cash payments for third parties, has already been eliminated.

This possibility is no longer disputed by the Federal Tax Service.

The main condition is that payment made for a third party must be correctly documented in the payment order and recognized by all entities participating in the relevant transaction.

In order to pay off tax obligations for a third party, a payment order is issued, and from July 1, 2017, an organization or other person is required to enter into an agency agreement, the form of which is approved by the Federal Tax Service.

Thus, any business entities (organizations, individual entrepreneurs) can legally repay (transfer) a variety of payments for each other:

- tax obligations;

- leasing payments;

- fines, penalties;

- debts;

- duties;

- other payments.

The Civil Code of the Russian Federation (paragraph one of Article 313) provides for the possibility (option) of fulfillment by a third party of debt obligations, if legislation, legal acts, terms of the agreement or the very essence of such requirements do not establish the obligation of the debtor to independently (personally) repay the corresponding debt.

Consequently, the creditor does not have the right to refuse to accept a fulfilled obligation repaid by a third-party entity for the debtor, if the fulfillment of the debt claim is entrusted to this third-party entity by the debtor himself.

If the debtor did not assign the fulfillment of this obligation to a third party, the creditor has an obligation to accept the performance offered by the third party for the debtor in the following typical situations:

- the debtor is late in repaying a financial obligation (for example, a debt);

- the third party who made the payment to fulfill the obligation faces the threat of losing the right to the debtor’s assets if these assets become the object of recovery in enforcement proceedings.

In addition, starting from 2021, the norms of the Tax Code of the Russian Federation (articles , ) provide for the possibility of repaying debt obligations of a business entity by third parties if there are insufficient funds in the bank accounts of the debtor organization.

Now the head of an economic entity, a third-party organization, or any private entrepreneur can make such payments on the basis of payment orders.

Before the corresponding changes were made to these articles, the obligation to transfer taxes, penalties, state duties and other fees was assigned directly to tax agents.

Purpose of payment

In order for payment to be made for a third party, the debtor sends a corresponding letter to the payer with a request for repayment (payment) of a specific obligation.

For example, the essence of such a letter may be that the Alpha company (debtor) asks a certain payer to transfer a specific amount of money to the Beta company (creditor) for some goods (for example, building materials) under a specific supply agreement (number/date).

The letter may also state that Alpha Company and Beta Company have entered into a loan agreement (number/date) for this purpose.

Accordingly, the purpose of payment in the payment order in this case can be indicated as follows: payment for a consignment of construction materials under the supply agreement (number/date) for the Alpha company to repay obligations under the loan agreement (number/date) and under the assignment agreement (number/ date), including VAT (20%).

How to fill out a payment form?

A special letter from the Federal Tax Service of the Russian Federation dated March 17, 2017 explains the procedure for implementing paragraph one of Article 45, prescribed in the Tax Code of the Russian Federation.

We are talking about the rules governing the preparation of a payment order to transfer money from a bank account to the budget for third parties (third parties).

Tax service specialists focus special attention on the following details of such a payment, which are mandatory:

- In the corresponding fields of the payment order, the TIN and KPP of the particular payer (debtor) whose obligation to make the necessary payments to the budget is fulfilled by drawing up this order are indicated.

- In the order field, where the payer is indicated, information about the entity actually making this payment from its bank account is entered (name of the organization, full name of the individual).

- In the field of the payment order, which reflects the purpose of the payment being made, the TIN and KPP of the entity that actually made the transfer (if an individual - only the TIN), as well as information about the payer-debtor, whose obligation to pay the debt is being fulfilled (name of the legal entity, full name of the individual) are written down. . Information about the payer-debtor is highlighted with the sign //. Details are written before other additional information, often reflected in the same field.

- In the order field where the payer status is filled in, the status of the entity (debtor) whose obligation to transfer money is fulfilled by this payment order is entered (01 - legal entity, 13 - individual, 09 - individual entrepreneur, 14 - individual entrepreneur making payments to citizens).

Detailed instructions for filling out a payment order - link.

Download a sample form when paying taxes

payment order when paying for a third party – word.