KBK-2017: insurance premiums

From 01/01/2017, the administration of pension, medical and social insurance contributions was transferred to the tax authorities. In this regard, the administrator code, that is, the first three digits in the KBK, has changed: previously it designated extra-budgetary funds (392 or 393), now it means the Federal Tax Service (182).

Be careful, when paying insurance premiums in 2021, you need to take into account what period the payment is for: if the transfer of contributions is made for periods earlier than January 1, 2017 , then you need to use the same BCC, and when paying premiums for January 2021 and subsequent the months of KBK 2017 will be different.

New codes have been introduced for those who pay additional contributions to the Pension Fund according to lists 1 and 2: if the tariff depends on a special assessment of working conditions, one BCC is selected, if it does not depend, another.

In 2021, we continue to pay insurance premiums for injuries to the Social Insurance Fund, so the BCC for them remains the same.

KBC for insurance premiums for 2021

| Code | Name of KBK |

KBC for payment of pension contributions in 2021 | |

| 182 1 0200 160 | Insurance contributions credited to the Pension Fund for the payment of insurance pensions for periods expired before January 1, 2021 |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0210 160 | Insurance contributions credited to the Pension Fund for the payment of insurance pensions for periods starting from January 1, 2021 |

| 182 1 0210 160 | penalties |

| 182 1 0210 160 | interest |

| 182 1 0210 160 | fines |

| 182 1 0200 160 | Insurance contributions credited to the Pension Fund for the payment of funded pensions |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0200 160 | Insurance contributions credited to the Pension Fund for the payment of insurance pensions (for billing periods from 2002 to 2009 inclusive) |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0200 160 | Insurance contributions credited to the Pension Fund for the payment of funded pensions (for billing periods from 2002 to 2009 inclusive) |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0200 160 | Contributions from organizations employing the labor of flight crew members of civil aviation aircraft, credited to the Pension Fund for the payment of additional payments to pensions |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0200 160 | Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund for the payment of an insurance pension (for billing periods expired before January 1, 2013) |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0200 160 | Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund for the payment of a funded pension (for billing periods expired before January 1, 2013) |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0200 160 | Contributions paid by coal industry organizations to the Pension Fund budget for the payment of pension supplements |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0210 160 | Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in clause 1, part 1, art. 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”, credited to the Pension Fund budget for the payment of an insurance pension (not dependent on the results of a special assessment of working conditions (class of working conditions) (list 1) |

| 182 1 0220 160 | Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in clause 1, part 1, art. 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”, credited to the PFR budget for the payment of an insurance pension (depending on the results of a special assessment of working conditions (class of working conditions) (list 1) |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0210 160 | Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in paragraphs 2 - 18 of part 1 of Article 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”, credited to the Pension Fund budget for the payment of insurance pensions (independent of the results of a special assessment of working conditions (class of working conditions) (list 2) |

| 182 1 0220 160 | Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in paragraphs 2 - 18 of part 1 of Article 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”, credited to the Pension Fund budget for the payment of insurance pensions (depending on the results of a special assessment of working conditions (class of working conditions) (list 2) |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

KBC for payment of contributions for compulsory health insurance in 2017 | |

| 182 1 0211 160 | Insurance premiums for compulsory health insurance of the working population, credited to the FFOMS budget for periods expired before January 1, 2017 |

| 182 1 0211 160 | penalties |

| 182 1 0211 160 | fines |

| 182 1 0213 160 | Insurance premiums for compulsory health insurance of the working population, credited to the FFOMS budget for periods starting from January 1, 2017 |

| 182 1 0213 160 | penalties |

| 182 1 0213 160 | interest |

| 182 1 0213 160 | fines |

KBC for payment of social insurance contributions in 2021 | |

| 182 1 0200 160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity for periods expired before January 1, 2021 |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0210 160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity for periods starting from January 1, 2021 |

| 182 1 0210 160 | penalties |

| 182 1 0210 160 | interest |

| 182 1 0210 160 | fines |

| 393 1 0200 160 | Insurance contributions for compulsory social insurance against accidents at work and occupational diseases (for “injuries”) |

| 393 1 0200 160 | penalties |

| 393 1 0200 160 | fines |

KBK IP fixed payment in 2021 to the Pension Fund and the Federal Compulsory Compulsory Medical Insurance Fund | |

| 182 1 0200 160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the Pension Fund budget for the payment of an insurance pension (calculated from the amount of the payer’s income, not exceeding the income limit) for periods expired before January 1, 2021 |

| 182 1 0200 160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the PFR budget for the payment of an insurance pension (calculated from the amount of the payer’s income received in excess of the income limit) for periods expired before January 1, 2021 |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0210 160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the Pension Fund budget for the payment of insurance pensions, for periods starting from January 1, 2017 |

| 182 1 0210 160 | penalties |

| 182 1 0210 160 | interest |

| 182 1 0210 160 | fines |

| 182 1 0200 160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the Pension Fund budget for the payment of a funded pension |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0900 160 | Insurance contributions in the form of a fixed payment credited to the Pension Fund budget for the payment of an insurance pension (for billing periods expired before January 1, 2010) |

| 182 1 0900 160 | penalties and interest |

| 182 1 0900 160 | Insurance contributions in the form of a fixed payment credited to the Pension Fund budget for the payment of a funded pension (for billing periods expired before January 1, 2010) |

| 182 1 0900 160 | penalties and interest |

| 182 1 0211 160 | Insurance premiums for compulsory medical insurance of the working population in a fixed amount, credited to the FFOMS budget for periods expired before January 1, 2021 |

| 182 1 0211 160 | penalties |

| 182 1 0211 160 | fines |

| 182 1 0213 160 | Insurance premiums for compulsory health insurance of the working population in a fixed amount, credited to the FFOMS budget for periods starting from January 1, 2021 |

| 182 1 0213 160 | penalties |

| 182 1 0213 160 | fines |

What to do if the payment form is filled out incorrectly

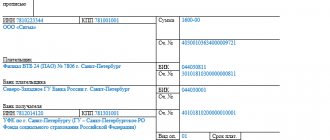

When filling out a payment form for the payment of penalties, you need to consider several important points:

- You should pay attention to correctly filling out the details of the Federal Tax Service/MIFTS to which the payment is made. Especially - Treasury accounts and the name of the recipient bank.

- You need to know the current BCC for paying penalties and indicate it correctly in the document.

If these details are entered incorrectly, the money may not reach the recipient. And the obligation to pay arrears and penalties will be considered unfulfilled. In this case, penalties will continue to accrue on the debt amount, and the payer will have to pay the money again.

Errors in other payment details - even such as incorrectly indicated TIN and KPP, incorrect OKTMO - will not be considered grounds for recognizing arrears and penalties as unpaid. If the bank or the payer himself discovers such “jambs”, you need to contact the tax office with an application to clarify the payment in accordance with clause 7 of Art. 45 of the Tax Code of the Russian Federation.

Also see “Filling out a payment order in 2021: sample.”

KBK NDFL 2021

The list of BCCs for paying income tax has been supplemented with codes for personal income tax when the controlling person receives income from the profits of a controlled foreign company.

KBK NDFL 2021 for individuals

| Code | Name of KBK |

| 182 1 0100 110 | Personal income tax on income the source of which is a tax agent, with the exception of income in respect of which tax is calculated and paid in accordance with Articles 227, 227.1 and 228 of the Tax Code of the Russian Federation |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Personal income tax on income received by citizens registered as individual entrepreneurs, private notaries, and other persons engaged in private practice in accordance with Art. 227 Tax Code of the Russian Federation |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Personal income tax on income received by citizens in accordance with Art. 228 Tax Code of the Russian Federation |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Personal income tax in the form of fixed advance payments on income received by non-residents employed by citizens on the basis of a patent in accordance with Art. 227.1 Tax Code of the Russian Federation |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Personal income tax on profits of a controlled foreign company received by individuals recognized as controlling persons of this company |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

How to list

Penalties are paid regardless of the accrued/additionally accrued amounts of tax, fee or contribution. In accordance with paragraph 3 of Art. 75 of the Tax Code of the Russian Federation, penalties apply for each day of overdue payment obligation from the day following the day of payment. To calculate penalties, take 1/300 of the current refinancing rate established by the Central Bank on the day the penalties are calculated. And from the 31st day of delay - 1/150 of the rate (for legal entities).

For more information, see “VAT penalties in 2017: new rules.”

An organization can independently calculate the amount of tax penalties. This calculation can be useful in the following cases:

- in order not to pay a fine when submitting an updated declaration and additional payment of the tax amount;

- to check whether the tax office calculated penalties correctly or not.

It is better to pay penalties at the same time as transferring the tax debt. After all, the faster the payment is made, the smaller the penalties will be. Formally, tax legislation allows the payment of penalties after the payment of tax debts.

If, based on the request of the Federal Tax Service, only the tax arrears have been paid, but no penalties have been paid, then the payer may be assessed a fine established by Art. 122 of the Tax Code of the Russian Federation. However, the organization has the right to challenge this decision of the tax inspectorate in court.

To pay tax arrears and penalties accrued on it, separate payment orders are issued. When filling them out, you need to take into account whether the debt is paid independently or on the basis of a tax requirement.

Also see “Payment order at the request of the Federal Tax Service: details of filling out”.

Changes to the BCC for the simplified tax system in 2021

For simplifiers who use the “income-expenditure” object of taxation, when paying tax for periods starting from 01/01/2017, a single code applies both for the main tax calculated under the simplified tax system “income minus expenses”, and for the minimum tax under the simplified tax system .

Let us explain in more detail: the KBK simplified tax system “income minus expenses” in 2021 (182 1 0500 110) was used separately from the KBK for the minimum tax under “simplified” (182 1 0500 110). Now both of these taxes should be transferred to one common KBK - 182 1 0500 110. The combination of codes occurred at the request of the Federal Tax Service to simplify offsets for the simplified tax system (letter of the Ministry of Finance of the Russian Federation dated August 19, 2016 No. 06-04-11/01/49770).

BCC when applying the simplified tax system for 2021

| Code | Name of KBK |

KBK simplified tax system "income" 2017 | |

| 182 1 0500 110 | Tax levied on taxpayers who have chosen income as the object of taxation (6%) |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| 182 1 0500 110 | Tax levied on taxpayers who have chosen income as the object of taxation (6%) (for tax periods expiring before January 1, 2011) |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

KBK simplified tax system “income minus expenses” | |

| 182 1 0500 110 | A tax levied on taxpayers who have chosen as an object of taxation income reduced by the amount of expenses (15%) ( including the minimum tax credited to the budgets of constituent entities of the Russian Federation) |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| 182 1 0500 110 | Tax levied on taxpayers who have chosen as an object of taxation income reduced by the amount of expenses (15%) (for tax periods expiring before January 1, 2011) |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| 182 1 0500 110 | Minimum tax under the simplified tax system, credited to the budgets of the constituent entities of the Russian Federation ( for tax periods expired before January 1, 2016 ) |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| 182 1 0500 110 | Minimum tax under the simplified tax system, credited to the budgets of the constituent entities of the Russian Federation (paid (collected) for tax periods expired before January 1, 2011) |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

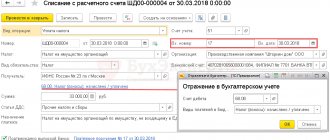

Filling out a payment order for VAT in 2021

To transfer the main VAT payment (penalty or fine) to the budget, you must correctly indicate the details in the payment order. First of all, you must correctly indicate your taxpayer status in field 101:

- 01 - legal entity;

- 02 - tax agents;

- 06 - import tax;

- 09 - IP.

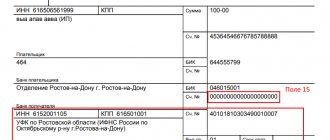

The tax amount (field 6) is indicated in round rubles without kopecks. The type of transaction (field 18) for VAT payment is filled in with code “01”, and the order of payment (field 21) with code “5”. The BCC corresponding to the type of operation (see table above) is indicated in field 104. In field 105, OKTMO is entered, indicating the payer’s affiliation with a specific municipal entity. The meaning of OKTMO can be found on the Federal Tax Service website.

The basis for payment (field 106) is indicated as “TP” - current payment. And in the adjacent 107 field the period for which the tax is paid is entered. In the case of VAT, this will be the corresponding quarter, for example, “KV.01.2021”. Below is an example of a VAT payment for the 1st quarter of 2021.

Income tax – KBK 2021

New BCCs have been added for transferring to the budget the income tax of controlled foreign companies, as well as penalties and fines on it. We have collected all the codes for paying income tax in the table.

KBK income tax in 2021

| Code | Name of KBK |

| 182 1 0100 110 | Corporate income tax (except for consolidated groups of taxpayers), credited to the federal budget |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Corporate income tax (except for consolidated groups of taxpayers), credited to the budgets of constituent entities of the Russian Federation |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Profit tax of organizations of consolidated groups of taxpayers, credited to the federal budget |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Profit tax of organizations of consolidated groups of taxpayers, credited to the budgets of constituent entities of the Russian Federation |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Corporate income tax when implementing production sharing agreements concluded before the entry into force of Federal Law No. 225-FZ of December 30, 1995 “On Production Sharing Agreements” and not providing for special tax rates for crediting the specified tax to the federal budget and budgets of constituent entities RF |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Corporate income tax on the income of foreign organizations not related to activities in the Russian Federation through a permanent establishment, with the exception of income received in the form of dividends and interest on state and municipal securities |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Corporate income tax on income received in the form of dividends from Russian organizations by Russian organizations |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Corporate income tax on income received in the form of dividends from Russian organizations by foreign organizations |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Corporate income tax on income received in the form of dividends from foreign organizations by Russian organizations |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Corporate income tax on income received in the form of interest on state and municipal securities |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Corporate income tax on income in the form of profits of controlled foreign companies |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

KBK for VAT for tax agents

An organization and individual entrepreneur are considered tax agents for VAT when:

- purchase products, services, work from a foreign company that is not registered with the Federal Tax Service of the Russian Federation, and sell them in the Russian Federation;

- rent property that is owned by the state or municipality, and also acquire government property;

- by court decision, sell property, as well as ownerless, confiscated or purchased property;

- act as intermediaries for a foreign company not registered in the Russian Federation.

In all of the above cases, the tax agent is obliged to withhold VAT from the amounts it owes to the counterparty and transfer the tax to the budget. Companies that apply special tax regimes are not exempt from this obligation.

In the payment order, tax agents indicate the same BCC as legal entities - tax payers. In this case, in field 101 of the payment slip, you must indicate that the tax is transferred by a tax agent (code “02”).

KBK for 2021: changes in excise taxes

In the new edition, excise taxes on heating oil, wine and some alcoholic products with and without the addition of ethyl alcohol were excluded from the BCC list for paying excise taxes. At the same time, the BCC for excise taxes on middle distillates has been added. The current BCCs for excise taxes are given in the table.

KBK excise taxes for 2021

| Code | Name of KBK |

| 182 1 0300 110 | Excise taxes on ethyl alcohol from food raw materials (with the exception of distillates of wine, grape, fruit, cognac, Calvados, whiskey), produced in the Russian Federation |

| 182 1 0300 110 | penalties |

| 182 1 0300 110 | fines |

| 182 1 0300 110 | Excise taxes on ethyl alcohol from non-food raw materials produced in the Russian Federation |

| 182 1 0300 110 | penalties |

| 182 1 0300 110 | fines |

| 182 1 0300 110 | Excise taxes on ethyl alcohol from food raw materials (wine, grape, fruit, cognac, calvados, whiskey distillates) produced in the Russian Federation |

| 182 1 0300 110 | penalties |

| 182 1 0300 110 | fines |

| 182 1 0300 110 | Excise taxes on alcohol-containing products produced in the Russian Federation |

| 182 1 0300 110 | penalties |

| 182 1 0300 110 | fines |

| 182 1 0300 110 | Excise taxes on beer produced in the Russian Federation |

| 182 1 0300 110 | penalties |

| 182 1 0300 110 | fines |

| 182 1 0300 110 | Excise taxes on tobacco products produced in the Russian Federation |

| 182 1 0300 110 | penalties |

| 182 1 0300 110 | fines |

| 182 1 0300 110 | Excise taxes on motor gasoline produced in the Russian Federation |

| 182 1 0300 110 | penalties |

| 182 1 0300 110 | fines |

| 182 1 0300 110 | Excise taxes on straight-run gasoline produced in the Russian Federation |

| 182 1 0300 110 | penalties |

| 182 1 0300 110 | fines |

| 182 1 0300 110 | Excise taxes on passenger cars and motorcycles produced in the Russian Federation |

| 182 1 0300 110 | penalties |

| 182 1 0300 110 | fines |

| 182 1 0300 110 | Excise taxes on diesel fuel produced in the Russian Federation |

| 182 1 0300 110 | penalties |

| 182 1 0300 110 | fines |

| 182 1 0300 110 | Excise taxes on motor oils for diesel and (or) carburetor (injection) engines produced in the Russian Federation |

| 182 1 0300 110 | penalties |

| 182 1 0300 110 | Fines |

| 182 1 0400 110 | Excise taxes on middle distillates imported into the Russian Federation |

| 182 1 0400 110 | penalties |

| 182 1 0400 110 | fines |

Unchanged KBK-2017 codes with decoding

Below we present the BCC for other taxes that should be indicated in payment orders in 2021.

Budget classification expense codes for 2017

| Code | Name of KBK |

KBK UTII 2017 | |

| 182 1 0500 110 | Single tax on imputed income for certain types of activities |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| 182 1 0500 110 | Single tax on imputed income for certain types of activities (for tax periods expired before January 1, 2011) |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

KBK Unified Agricultural Sciences 2017 | |

| 182 1 0500 110 | Unified agricultural tax |

| 182 1 0500 110 | Penalty |

| 182 1 0500 110 | fines |

| 182 1 0500 110 | Unified agricultural tax (for tax periods expired before January 1, 2011) |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

KBK patent tax system 2017 | |

| 182 1 0500 110 | Tax levied in connection with the use of the patent system, credited to the budgets of urban districts |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| 182 1 0500 110 | Tax levied in connection with the use of the patent system, credited to the budgets of municipal districts |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| 182 1 0500 110 | Tax levied in connection with the use of the patent system, credited to the budgets of the federal cities of Moscow and St. Petersburg |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

KBK VAT 2021 for legal entities and individual entrepreneurs | |

| 182 1 0300 110 | Value added tax on goods (work, services) sold on the territory of the Russian Federation |

| 182 1 0300 110 | penalties |

| 182 1 0300 110 | fines |

| 182 1 0400 110 | Value added tax on goods imported into Russia (from the Republics of Belarus and Kazakhstan) |

| 182 1 0400 110 | penalties |

| 182 1 0400 110 | fines |

KBK property 2021 for legal entities | |

| 182 1 0600 110 | Property tax of organizations on property not included in the Unified Gas Supply System |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Property tax of organizations on property included in the Unified Gas Supply System |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

Transport tax KBK 2017 | |

| 182 1 0600 110 | Transport tax for organizations |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

KBK land tax for legal entities 2017 | |

| 182 1 0600 110 | Land tax from organizations owning a land plot located within the boundaries of intra-city municipalities of federal cities |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax on organizations owning a land plot located within the boundaries of urban districts |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax on organizations owning a land plot located within the boundaries of urban districts with intra-city division |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax on organizations owning a land plot located within the boundaries of intracity districts |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax on organizations owning a land plot located within the boundaries of inter-settlement territories |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax on organizations owning a land plot located within the boundaries of rural settlements |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax on organizations owning a land plot located within the boundaries of urban settlements |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

What do the numbers in KBK mean?

Each BCC figure for VAT has a strictly regulated meaning. The budget classification code includes 20 digital positions. The general combination is divided into groups of numbers with specific information content.

The first 3 digits will indicate the payment administrator. The administrator refers to the government agency receiving the report. For example, if an individual entrepreneur or an accountant of a company transfers tax revenues to the Federal Tax Service, the numbers 182 are entered in the BCC.

Next comes the type of receipt. For example, the number 1 will mean taxes, and the number 2 will mean gratuitous receipts. The next two digits indicate the type of income for which the taxpayer will report (1 - profit, 6 - property tax, 8 - duty).

The following is a 5-digit combination. It allows you to determine budget revenue items (1 - federal, 2 - regional budget, 3 - local). Using the next 4 numbers you can find out the type of payment (1000 - taxes and fees, 2100 - penalties, 3000 - fines). The final code of 3 digits indicates the type of economic activity (110 - tax income, 160 - social contributions).