Grounds for assignment of the right of claim to the simplified tax system

In modern conditions, some partners often do not fulfill their financial obligations, or the action occurs untimely. In such a situation, a person can sell the debt. Due to some specifics of working on the simplified simplified tax system, assignments of claims have their own characteristics.

When completing a transaction, the seller must transfer the goods to the buyer, and the latter must pay the cost of the property received. The right of claim of a legal entity - creditor under the obligations of the agreement can be transferred to another person by assignment or transferred by law - Article 382 of the Civil Code of the Russian Federation. The assignment will be considered an assignment, the one who assigns will be the assignor, the new creditor will be the assignee.

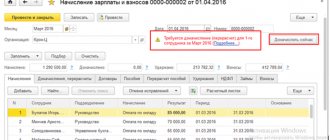

When establishing the object of taxation on the simplified tax system, revenue from the sale of products is determined on the date of receipt of payment for the goods. Expenses on purchases of goods for subsequent sale and VAT expenses are recognized after payment to the supplier. Profit from the assignment is reflected on the day when funds are actually received from it.

The debit debt, which appeared on the basis of an assignment contract at a cost less than the amount of the debt, is taken into account in the financial investments of the organization.

The investment is accepted for accounting at its original price, calculated according to the purchase price, and is not subsequently subject to re-discounting. The initial cost of the investment includes the amount paid to the seller under the assignment agreement. To reflect settlements with the assignor under the contract, to perform settlements with the debtor, account 76 is used with the opening of analytical accounts.

GLAVBUKH-INFO

In some cases, selling accounts receivable to a third party can be a real lifesaver for an organization. Even if such a sale is only possible at a discount. But if the right of claim passes from the simplifier or to the simplifier, then the accounting has its own peculiarities.“I will sell receivables inexpensively”: accounting for income and expenses from the seller

Income. When selling receivables resulting from a purchase and sale agreement, delivery, provision of services, etc., nothing more than the realization of property rights occurs. Accordingly, the amounts received by the simplifier upon assignment, on the date of their receipt (to the account or to the cash desk) must be taken into account in income. Is it necessary to recognize in income the cost of goods (services, works) that should have been paid by the buyer initially? Indeed, as a result of the concession, the debt to pay them was actually repaid.

FROM AUTHENTIC SOURCES

GORBUNOVA VICTORIA VLADIMIROVNA - Advisor to the State Civil Service of the Russian Federation, 2nd class “Money received under an agreement for the assignment of claims to a third party under obligations arising from a purchase and sale (supply) agreement is income from the sale of property rights. Therefore, when determining the tax base, the payer applying the simplified tax system must take them into account. But payment for the cost of goods sold to the buyer does not occur. As a result of the transaction for the assignment of rights of claim, a change in the creditor's obligation occurs. Thus, the obligation itself does not terminate; the new creditor enters into a pre-existing legal relationship with the buyer. Therefore, the organization that ceded the claim does not receive income from the sale of goods.”

Expenses. If you supplied goods to the buyer, it means that on the date of their sale you could already include the cost of these goods in expenses, despite the fact that you have not yet received payment for them (of course, provided that your organization itself paid for these goods to its supplier). But it will not be possible to recognize the amount of receivables sold as expenses. As well as the difference between the amount of payment that you planned to receive from the buyer and the amount for which you managed to sell the claim. Since in the closed list of expenses of the simplifiers, neither one nor the other is named.

Example. Accounting for income and expenses of a simplifier who has ceded the right to claim a debt

CONDITION

Organization “X”, under a sales agreement, sells to organization “Igrek” for 500 thousand rubles. goods purchased for 380 thousand rubles. and paid to the supplier in August 2015. The goods were shipped to the buyer “Igrek” on September 15, 2015. According to the contract, payment from the buyer must be received by organization “X” no later than November 13, 2015. But, without waiting for the end of the term, “X” cedes the right claims under this agreement for 425 thousand rubles. The specified amount was transferred to the account of organization “X” on November 6, 2015.

SOLUTION

Organization “X” admits: - expenses in the amount of 380 thousand rubles. September 15, 2015; — income in the amount of 425 thousand rubles. November 6, 2015

“I’ll buy a receivable”: accounting for income and expenses from the buyer

Money spent on the purchase of the right to claim is not recognized as an expense, since the list of simplified expenses does not include such type of expenses as the cost of acquiring property rights. And when the debtor pays off his debt to the new creditor or this debt is again sold to a third party, the creditor will have to recognize the received amount as income. Let's add one more condition to the example considered. Let’s say the Igrek organization transferred 500 thousand rubles to its new creditor, the Sigma organization. to the account on November 5, 2015 (repaid the debt). Consequently, on this date, Sigma must take into account 500 thousand rubles in its income. This means paying from these 500 thousand rubles. tax under the simplified tax system.

Assignment of the right to claim a loan: accounting features

If the right to claim funds in the form of a loan is assigned, then the organization or individual entrepreneur on the simplified tax system to which the right is transferred will not have to take it into account in its income when returning the debt to it. But she will have to take into account the amount of interest paid to her for using the loan. And also the difference, if it turns out that the amount paid for the claim turns out to be less than the amount received from the debtor. Giving up the right to claim a loan for a simplifier is completely unprofitable. Indeed, in this case there will be nothing to recognize as expenses, and the entire amount received from the sale of the debt will have to be recorded as income.

Example. Accounting for income and expenses when assigning a loan

CONDITION

Organization “X” in May 2015 provided an interest-free loan to organization “Igrek” in the amount of 500 thousand rubles. The Igrek organization was supposed to repay the debt to the lender by November 1, 2015. However, on September 16, in dire need of money, the X organization cedes the right to claim the loan for 425 thousand rubles. This money was transferred to the account of organization “X” on September 18, 2015. In turn, organization “Igrek” transferred the entire amount of the debt to organization “Sigma” on October 23, 2015.

SOLUTION

As of September 18, 2015, Organization X must recognize 425 thousand rubles in income. But if there had been no transaction on the assignment of rights and she had waited for the loan to be repaid, she would not have had to take anything into account either in income or expenses. As of October 23, 2015, the Sigma organization must take into account 75 thousand rubles in income. (500 thousand rubles - 425 thousand rubles).

* * * As we see, the tax consequences of assigning the right to claim a debt can be different. And they depend primarily on what kind of debt you are selling.

——————————— clause 1 of Art. 346.15, paragraph 1 of Art. 346.17 Tax Code of the Russian Federation; Letter of the Ministry of Finance dated 09/07/2015 N 03-11-06/2/51388 Art. 384 Civil Code of the Russian Federation, clause 1, art. 346.17 Tax Code of the Russian Federation subp. 2 p. 2 art. 346.17 Tax Code of the Russian Federation; Letter from the Federal Tax Service dated 03/18/2014 N ГД-4-3/ [email protected] Letter from the Ministry of Finance dated 06/02/2011 N 03-11-11/145 Letter from the Ministry of Finance dated 12/15/2011 N 03-11-06/2/172, dated 09.12 .2013 N 03-11-06/2/53599 Letter of the Ministry of Finance dated 01.08.2011 N 03-11-06/2/112 sub. 10 p. 1 art. 251 Tax Code of the Russian Federation; Letter of the Ministry of Finance dated October 12, 2015 N 03-11-06/2/58357; Resolution of the AS ZSO dated July 14, 2015 N A67-6957/2014 Letter of the Ministry of Finance dated November 2, 2011 N 03-11-06/2/151 Letter of the Ministry of Finance dated January 25, 2012 N 03-11-11/11; Resolution of the Federal Antimonopoly Service dated May 22, 2014 N A48-3497/2013

https://glavkniga.ru/ https://www.facebook.com/G.kniga https://ok.ru/glavkniga https://vk.com/glavkniga

Magazine "General Ledger" N04, 2016

Bugaeva N.

| Next > |

VAT on assignment agreements

Assignment of the loan, as well as other obligations under the agreement, includes the accession of a third party. It acts as a guarantor. For example, if there is an overdue debt and the obligation becomes larger, and the financial institution does not plan to deal with this issue on its own, it can sell the debt.

According to Article 384 of the Civil Code, when transferring rights between creditors, the conditions and scope of the transfer will not change at the time the contract is concluded. The assignment procedure is reflected in the registers of each party.

The purpose of the assignment contract is that the creditor of the obligations changes. The document is concluded after the consent of each of the interested parties; it is two-sided.

When drawing up this agreement, the debtor’s consent is not required, but he is notified of the action in writing. The signing of the agreement must be accompanied by additional documentation - an act of acceptance and transfer of title papers, primary documents. If necessary, additional agreements are drawn up.

There are some peculiarities in the execution of the contract and VAT, if any. So, if the debt arose when concluding a sales contract, taking into account tax, then when closing obligations exceeding acquisition costs, a fee must be charged. This operation is documented by appropriate posting.

The transfer of rights to property is subject to the accrual of a fee and is considered a sale with the formation of an invoice by the assignor. The assignor cannot deduct tax.

When working for OSNO, debt repayment is subject to VAT. The basis will be the excess of the amount of the repaid debt over the price of its acquisition. This requirement is relevant if the payment condition arose as a result of contracts for the implementation of work that are subject to VAT.

Assignment of debt between a legal entity and an individual

The fact is that the list of costs that can be recognized in tax accounting under simplified taxation is limited by Article 346.16 of the Tax Code of the Russian Federation.

A creditor who has acquired a monetary claim as a result of an assignment (assignee) also has the right to assign it to another person or present it to the debtor for payment.

The Chart of Accounts does not provide for a special account to reflect the movement of such cash equivalents. An organization can take into account such a requirement, for example, on account 76 “Settlements with other debtors and creditors” by opening a separate sub-account “Cash equivalents that are not financial investments.”

Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated February 17, 2010 No. 03-07-08/40.

Accounting for VAT when assigning the right to claim a debt

There are some features of tax accounting when assigning the right to demand fulfillment of obligations. According to Article 146 of the Tax Code, an agreement on the transfer and receipt of rights is not related to sales, despite its similarity to a purchase and sale agreement. We can conclude that the transaction is not taxable.

If, under the terms of the assignment agreement, the first creditor received income more than the amount of the debt, tax is charged. VAT is calculated as the difference between debt and income. The nuances of calculating the tax base are reflected in Article 279 of the Tax Code.

All tax deductions go to the treasury, VAT accounting is reflected in the documentation on the day of the right to transfer the debt claim. Attached are documents such as copies of the contract, work reports, invoices, etc. Claims are reflected in 91 accounts, assigned debt - in account 58.

All tax deductions go to the treasury, VAT accounting is reflected in the documentation on the day of the right to transfer the debt claim. Attached are documents such as copies of the contract, work reports, invoices, etc. Claims are reflected in 91 accounts, assigned debt - in account 58.

Assignment agreement: what tax consequences arise when selling debt

Assignment agreement: what tax consequences arise when selling debt

March 22, 2021 Alexey Krainev Tax, labor and civil lawyer

The Civil Code allows any company with receivables to transfer the right to collect it to third parties. In conditions of financial instability and non-payments, an increasing number of companies are using this right. In such cases, the accountant is concerned about the tax consequences of selling the debt.

If we approach the transaction for the sale of receivables globally, we will find that there are three parties involved - the debtor (that is, the company whose debt is being sold), the creditor (the seller of the debt) and the new creditor (or the buyer of the debt). Obviously, the tax consequences of the assignment will be different for each of these three parties. In addition, in some cases, tax rules will also depend on what kind of debt is being sold - under a loan agreement or arising from an agreement for the sale of goods, works, services. Having discussed the general points, let’s move on to specifics and start with the simplest thing - with the debtor.

Debtor's taxes

For the debtor, it does not matter what kind of debt he has to the creditor (arising from the sale or from the loan). In any case, the transfer by the creditor of the right to claim this debt to another person does not oblige the debtor to restore VAT (if it was presented).

Documenting

The transfer of rights to the assignee must be reflected in the agreement. It is concluded in the same form as the original agreement. It must be received in writing, if the contract was first certified by a notary, the secondary contract is also certified by a notary.

It is necessary to register the contract if the original transaction was subject to registration. This is stated in Article 389 of the Civil Code. Documents confirming the right to demand payment of the debt are attached to the agreement. These can be invoices - invoices, acts, etc.

The assignment agreement shows on what basis the right arose, what obligations the debtor has, what documents certify the right of claim. Other information relevant to the assignment must also be present.

The need to allocate VAT is not provided for in the assignment agreement. Article 389 of the Tax Code states that the form of the contract must be consistent with the form of the main obligation. To avoid some problems with inspectors, sometimes it makes sense to enter data on VAT amounts.

If the debt is sold at a loss or at par, the wording “incl. VAT – 0 rub.” If the assignor makes a profit from the transaction, the assignment will be taxed. The contract then specifies the amount of the fee, which is calculated based on the amount of profit.

Debt transfer agreement between legal entities

The transfer of property rights (including assignment of the right of claim) is an independent object of VAT taxation and is considered as an ordinary sale (clause 1 of Article 146 of the Tax Code of the Russian Federation). That is, the organization will receive an invoice from the assignor with an allocated amount of tax (clause 3 of Article 168 of the Tax Code of the Russian Federation).

The act of acceptance and transfer of title documents. This document is a mandatory annex to the agreement.

Both the assignor and the assignee can notify the debtor of a change of creditor. In this case, the following must be taken into account. If notice of the transfer of rights is received from the original creditor, then the debtor must fulfill the obligation to the new creditor without any evidence of transfer of rights.

There are some factors that influence the unfavorable outcome of the fulfillment of contractual terms in relation to the assignee:

- The debtor, not knowing about the change of creditor, can pay off debt obligations to the old creditor and the assignee will have to solve this problem with the assignor;

- The ability of the debtor to raise objections to the new creditor that were raised to the original creditor.

The consent of the debtor whose debt is purchased by the assignee is not required. The exception is cases provided for by contract or legislation (for example, when a claim under an obligation is assigned in which the identity of the creditor is important (in case of compensation for harm caused to health)).

In the course of its activities, a simplifier has the right to enter into all types of contracts not prohibited by law, including an assignment agreement (AC) - an agreement under which one can sell (purchase) the right of claim against the debtor. Such agreements have recently become very common, and simplifiers in this case are no exception.

Postings for writing off debt with VAT

Since the amount that is payable to a person is reflected in the credit of the current account, it must contain an analysis of who the obligations are paid to. If the creditor changes, the debtor must reflect the corresponding changes.

For example, if organization 1 purchased products subject to value added tax from company 2, entry DT41KT60 (organization 2) will be drawn up. Company 2 assigned the debt to company 3 under an assignment agreement.

Based on the notification to person 1 about the assignment of debt, an entry will be created to clarify the data on account 60 - DT60 (company 2) KT60 (company 3). Postings for this action will be reflected in accounting. The organization will need to repay the debt 3.

What is the limit of settlements between legal entities and individuals?

The transfer of receivables is accompanied by actual costs, including costs for:

- Concluding a transaction for the assignment of the right of claim, support of consulting and information services;

- Payment to the assignor of the cost under the assignment agreement;

- Fees paid by the new lender for third party services;

- other expenses aimed at transferring debt obligations.

You will learn about current changes in the Constitutional Court by becoming a participant in the program developed jointly with Sberbank-AST CJSC. Students who successfully complete the program are issued certificates of the established form.

The right to claim a debt belonging to the creditor can be transferred on the basis of an agreement or on the basis of law (Article 382 of the Civil Code of the Russian Federation). If the transfer of rights to a new creditor occurs on the basis of an agreement, then such an agreement on the transfer of the rights of the creditor is called an assignment of the right of claim, or assignment . The assignee may not be in a better position if he applies the simplified tax system “income minus expenses”: he also cannot include the amount he paid to the assignor under DC as expenses for the same reason.

Currently, contracts for the assignment of the right of claim (assignment) are becoming increasingly relevant, under which an organization, without waiting for the receipt of funds from the buyer (or borrower), has the opportunity to receive a large part of the debt by selling the right of claim to another company. This paragraph refers to the 2nd link in a possible chain of assignments of rights from one creditor to another, when a monetary claim is assigned or presented to the debtor for payment by the 2nd (after the original) creditor.

The debtor, the acts were signed, paid VAT to the budget. The debtor (also working with VAT) does not pay. Creditor1 assigns the right to claim funds from the Debtor to Creditor2 (at the time of concluding the agreement on the simplified tax system 15%, but from January 2021 plans to switch to OSNO). Creditor 2 pays Creditor 1 900 thousand and files a claim against the Debtor in court, 100 thousand remains with Creditor 2 as a reward.

As financiers note, on the basis of paragraph 1 of Article 346.15 of the Tax Code of the Russian Federation, taxpayers who have switched to a simplified taxation system, when determining the object of taxation, take into account income from sales established in accordance with Article 249 of the Tax Code of the Russian Federation, and non-operating income calculated in accordance with Article 250 of the Tax Code of the Russian Federation .