The formal type of payment order is set forth in Appendix 2 to Bank of Russia Regulation No. 383-P dated June 19, 2012. From 01/01/2017, on the basis of Article 34 of the Tax Code of the Russian Federation, payments that were previously accepted by the territorial bodies of the Pension Fund of the Russian Federation are now sent to local tax inspectorates. Budgetary organizations fill it out without fail.

New filling standards are prescribed in the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n (as amended on January 1, 2017). According to these rules, payments for insurance contributions to the Pension Fund must be drawn up in the same way as for taxes paid, only the purpose of the payment and the BCC changes. We will tell you further about how a payment order is executed in the Pension Fund of Russia in 2021.

Rules for filling out payment forms for contributions in 2019

The rules for filling out a payment order in 2021 are prescribed in Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n. We have summarized them in a table:

In the fields of payment orders for payment of insurance premiums to the Federal Tax Service, the following information is indicated:

| Payment field name (field number) | Payment of contributions to the Federal Tax Service (contributions to compulsory health insurance, compulsory medical insurance, VNiM) |

| Payer status (101) | “01” - if contributions are paid by a legal entity/its OP; “09” - if contributions are paid by an individual entrepreneur (this status is indicated by an individual entrepreneur regardless of whether he pays contributions as an employer or transfers contributions for himself). The Federal Tax Service and the Central Bank of the Russian Federation decided that when paying contributions it is necessary to indicate exactly these statuses (Letter of the Federal Tax Service dated 02/03/2017 No. ZN-4-1/) |

| Payer INN (60) | TIN of the organization/entrepreneur |

| Payer checkpoint (102) | — KPP assigned to the Federal Tax Service Inspectorate to which contributions will be paid if they are paid by a legal entity/its OP; — “0” — if contributions are paid by individual entrepreneurs |

| Payer (8) | Short name of the organization/SP, full name. entrepreneur |

| Recipient's TIN (61) | TIN of the Federal Tax Service to which contributions are paid |

| Recipient checkpoint (103) | Checkpoint of the Federal Tax Service to which contributions are paid |

| Recipient (16) | UFK by _____ (name of the region in which contributions are paid), and the specific Federal Tax Service Inspectorate is indicated in brackets. For example, “UFK for Moscow (Inspectorate of the Federal Tax Service of Russia No. 14 for Moscow)” |

| Payment order (21) | 5 |

| KBK (104) | Budget classification code corresponding to the contribution paid and the period for which the contribution is paid |

| OKTMO (105) | — OKTMO code at the location of the organization/EP, if contributions are paid by a legal entity/its OP — OKTMO code at the place of residence of the individual entrepreneur, if contributions are paid by the individual entrepreneur |

| Reason for payment (106) | This field indicates one of the following values: “TP” - when paying a fee for the current period; “ZD” - in case of voluntary repayment of arrears of contributions; “TR” - when repaying the debt at the request of the Federal Tax Service; “AP” - when repaying the debt according to the inspection report (before issuing a claim) |

| Period for which the contribution is paid (107) | If field 106 contains “TP”/“ZD”, then the frequency of payment of the contribution is indicated in one of the following formats: - for monthly payments: “MS.XX.YYYY”, where XX is the month number (from 01 to 12), and YYYY – the year for which the payment is made (for example, when paying contributions to compulsory pension insurance from payments to employees for March 2021, you need to enter “MS.03.2019”); - for annual payments: “GD.00.YYYY”, where YYYY is the year for which the contribution is paid (for example, when paying a contribution for yourself for 2021, the individual entrepreneur will need to put “GD.00.2018”). If field 106 contains “TR”, then field 107 reflects the date of the request. If field 106 is “AP”, then field 107 is “0” |

| Document number (108) | If field 106 contains “TP”/“ZD”, then field 108 contains “0”. If field 106 contains “TR”, then field 108 reflects the number of the tax request for payment. If field 106 contains “AP”, then field 108 indicates the number of the decision made based on the results of the audit |

| Document date (109) | If in field 106 there is “TP”, then in field 109 the date of signing the calculation of contributions is entered. But, as a rule, at the time of payment the calculation has not yet been submitted, so payers put “0”. If field 106 contains “ZD”, then field 109 contains “0”. If field 106 contains “TR”, then field 109 reflects the date of the payment request. If field 106 contains “AP”, then field 108 indicates the date of the post-verification decision |

| Payment type (110) | “0” or UIN, if available |

| Payment purpose (24) | A brief explanation of the payment, for example, “Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (for March 2021).” Also in this field, the payer of contributions can indicate his registration number in the Pension Fund, but this is not necessary. |

Deadline for transferring insurance premiums in 2020

Here is a table with the deadlines for paying pension insurance contributions in 2020. They must be listed according to the details of the Federal Tax Service. Please note that for May-July there are new payment deadlines due to coronavirus, quarantine and non-working days in 2021.

| Type of insurance premiums | For what period is it paid? | Payment deadline |

| Contributions from payments to employees/other individuals to OPS | For December 2021 | No later than 01/15/2020 |

| For January 2021 | No later than 02/17/2020 | |

| For February 2021 | No later than 03/16/2020 | |

| For March 2021 | No later than 05/06/2020 (transfer) No later than 10/15/2020 (transfer for micro-enterprises) | |

| For April 2021 | No later than 05/15/2020 No later than 11/16/2020 (transfer for micro-enterprises) | |

| For May 2021 | No later than 06/15/2020 No later than 12/15/2020 (transfer for micro-enterprises) | |

| For June 2021 | No later than 07/15/2020 No later than 11/16/2020 (transfer for micro-enterprises) | |

| For July 2021 | No later than 08/17/2020 No later than 12/15/2020 (transfer for micro-enterprises) | |

| For August 2021 | No later than September 15, 2020 | |

| For September 2021 | No later than 10/15/2020 | |

| For October 2021 | No later than 11/16/2020 | |

| For November 2021 | No later than 12/15/2020 | |

| For December 2021 | No later than 01/15/2021 |

KEEP IN MIND

Federal Law No. 172-FZ of 06/08/2020 for organizations and individual entrepreneurs affected by coronavirus canceled (reset to zero) insurance premiums for the 2nd quarter of 2020 - from payments to individuals accrued for April, May and June 2020. For more information, see “Features of payment of insurance premiums by organizations and individual entrepreneurs for the 2nd quarter of 2020.”

Main BCCs for insurance premiums in 2019

Contributions to OPS

- For basic and reduced tariffs – 182 1 0210 160

- At additional rates without special assessment: – to employees specified in clause 1, part 1, art. 30 of Law No. 400-FZ, - 182 1 0210 160 - to employees specified in clause 2 - 18 part 1 art. 30 of Law N 400-FZ, – 182 1 0210 160

- At additional tariffs based on the results of a special assessment: - employees specified in clause 1, part 1 of art. 30 of Law N 400-FZ, - 182 1 0220 160 - to employees specified in clause 2 - 18 part 1 art. 30 of Law N 400-FZ, – 182 1 0220 160

Contributions to compulsory medical insurance – 182 1 0213 160

Contributions to VNiM – 182 1 0210 160

Contributions for injuries – 393 1 0200 160

Details to fill out in 2020

Also see:

- BCC for insurance premiums in 2021: table

- New KBK in 2020: table

Payment details for transferring pension insurance contributions (PIC) can be found on the Federal Tax Service website - service.nalog.ru/addrno.do. You can also issue a payment order there – service.nalog.ru/payment/

From 2021, to pay insurance premiums you need to use the KBK, approved by the new Order of the Ministry of Finance of Russia dated 06.06.2019 N 86n.

We list all the main budget classification codes for insurance premiums. If you have a general or reduced tariff, then in 2020 use the following codes:

- insurance premiums contributions to compulsory health insurance — 182 1 02 02010 06 1010 160;

- fines - 182 1 0210 160;

- fines - 182 1 0210 160.

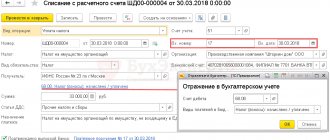

How to fill out a payment order

- Field 101 - code "01" - taxpayer status.

- 4 - date of formation of the PP in the format DD.MM.YY.

- Cell 6 - status “01”, in 7 and 8 - the amount in words and numbers, respectively.

- 16 - abbreviated name of the FC body, in brackets - the name of the Federal Tax Service.

- 61 - INN IFTS.

- 103 - checkpoint of the Federal Tax Service.

- In fields 13, 14, 15 and 17 - bank details of the Federal Tax Service.

- 104 - new KBK.

- 105 - seven-digit OKTMO.

- 106 - basis for payment. If calculations are carried out in the general manner, then a TP is set.

- 107 - tax period: month (MS.01.2017), quarter (QW.01.2017), half-year (PL.01.2017), year (GD.00.2016).

- 108 - document number on the basis of which payment is made.

- 109 - date of the document on the basis of which payment is made.

- 18 — type of operation “01” — PP.

- 21 - order of payment (for current payments - code 5, according to Article 855 of the Civil Code of the Russian Federation).

- 22 - unique payment identifier - 0.

- 24 — purpose: type of SV and payable period.

- 43 - if the PP is provided on paper, then a “live” seal is placed, if on electronic media, a seal impression is not needed.

- 44 is a place for “live” or electronic signatures.

How to fill out payment order fields 104-109

Fields 104-109 of the payment order need to be given special attention. An error when filling them out threatens that the payment will fall into the unknown, and you will have to clarify it. Let's look at how to fill out these lines.

| Line title | Number | Note |

| 104 | Budget classification code | When paying insurance premiums for health insurance for employees, indicate the code 182 1 0210 160 |

| 105 | OKTMO code |

|

| 106 | Payment basis code | For compulsory health insurance contributions paid on time, the TP code (current payments) is indicated. |

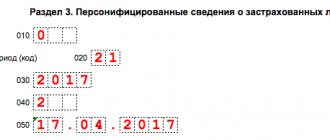

| 107 | Taxable period | The tax period for contributions to compulsory pension insurance for employees is a calendar month. Therefore, the payment slip must indicate “MS”, month number and year. For example, for contributions for January 2021 you need to enter “MS.01.2020” |

| 108 | Document Number | For contributions to compulsory pension insurance, in these fields we indicate the value “0” |

| 109 | Document date |

Sample payment order to the Pension Fund 2020

Recipient details in the payment order for insurance premiums 2021

Starting from 2021, most of the contributions must be transferred not to the funds, as in previous years, but to the Federal Tax Service. Only one type of contribution needs to be paid to the Social Insurance Fund: contributions from employees’ salaries for compulsory insurance against industrial accidents and occupational diseases, as before. The remaining contributions are now payable to the Federal Tax Service. Namely:

- contributions in a fixed amount for compulsory pension insurance of individual entrepreneurs “for themselves”;

- contributions in a fixed amount for compulsory medical insurance of individual entrepreneurs “for themselves”;

- contributions from employees' salaries for compulsory health insurance;

- contributions from employees' salaries for compulsory pension insurance;

- contributions from employees' salaries for compulsory insurance for temporary disability and maternity.

Accordingly, for insurance premiums paid to the Federal Tax Service, it is necessary to indicate the details of the Federal Tax Service Inspectorate with which the individual entrepreneur (organization) is registered.

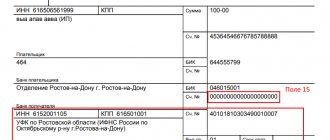

Field 16 - “Recipient” in the payment order for insurance premiums 2021

So, according to the letter of the Federal Tax Service dated December 1, 2016 No. ZN-4-1/ [email protected] , in field 16 “Recipient” the abbreviated name of the Federal Treasury body must be indicated, and in brackets the abbreviated name of the tax office to which the payment is transferred. For example: “UFK for Moscow (Inspectorate of the Federal Tax Service of Russia No. 7 for Moscow).

Field 61, 103 - “TIN”, “KPP” in the payment order for insurance premiums for 2021

In fields 61 “TIN” and 103 “KPP” the TIN and the reason code for registration with the tax office must be indicated, as when paying taxes.

Field 101 - payer status in the payment order for insurance premiums 2021

At the time of updating the rules for filling out payment orders in 2017, perhaps the most unclear question was the status of the payer, which must be indicated in field 101. Previously, field 101 in the payment order for the payment of insurance premiums was filled out on the basis of Appendix No. 5 to Order No. 107n of the Ministry of Finance of the Russian Federation. However, the transfer of administration of contributions to the Federal Tax Service changed the status of the payer in relation to the recipient, which called into question the previously applied rules.

Due to the lack of official clarifications, there were then several points of view regarding filling out field 101. But on 02/08/2017, official clarifications from the Federal Tax Service came out, according to which the payer’s status is indicated as follows:

- Status 01 – indicated when paying insurance premiums by a legal entity;

- Status 09 - indicated when an individual entrepreneur pays insurance premiums for himself and for employees;

- Status 10 – indicated when paying insurance premiums by a notary engaged in private practice;

- Status 11 – indicated when paying insurance premiums by the lawyer who established the law office;

- Status 12 – indicated when paying insurance premiums by the head of a peasant (farm) enterprise;

- Status 13 – indicated when paying insurance premiums for employees by an individual (who is not an individual entrepreneur);

- Status 08 – indicated when companies and individual entrepreneurs pay insurance premiums for injuries.

Field 104 - KBK in the payment order for insurance premiums 2020

By Order of the Ministry of Finance No. 230n for 2021, new KBK codes were approved. A complete list of budget classification codes is available here.

Please note that for insurance premiums (except for “injury” contributions), the first three digits of the BCC, meaning the chief administrator of budget revenues, have changed. In connection with the transfer of administration of insurance premiums to the Federal Tax Service, the first three digits of the BCC are now 182. In past years, the first three digits of the BCC were 392.