What are the BCCs for paying individual entrepreneurs' insurance premiums in 2021?

- Since we entered KBK 18210202140061110160 , we received a receipt for payment of mandatory contributions to the pension insurance of individual entrepreneurs “for ourselves”.

- In order to issue a receipt for payment of the mandatory contribution for medical insurance of an individual entrepreneur “for yourself,” we repeat all the steps, but at the stage of entering the BCC, we indicate a different BCC: 18210202103081013160

Let me remind you once again that this payment must be made strictly before July 1, 2022 (based on the results of 2021, of course).

So here it is. There is no separate BCC for payment of 1%. This means that when it comes time to pay this 1%, you will need to generate exactly the same receipt as for paying contributions to compulsory pension insurance.

That is, when issuing a receipt for payment of 1%, indicate BCC 18210202140061110160 (but it is possible that this BCC will change in 2021. Therefore, follow the news and update your accounting programs in a timely manner).

In fact, you will receive exactly the same receipt as when paying a mandatory contribution to pension insurance. Only there will be a different payment amount, of course.

But finally, I will repeat once again that such payments need to be processed in accounting programs and services. There is no need to do everything manually in the hope of saving several thousand rubles...

For example, these two receipts can be issued in 1C. Entrepreneur" in literally three clicks. Without thoughtfully studying such boring instructions =)

Best regards, Dmitry Robionek.

Receive the most important news for individual entrepreneurs by email!

Stay up to date with changes!

How to create a receipt for payment of insurance premiums for individual entrepreneurs in 2021

No later than December 31 of the current year, entrepreneurs must pay insurance premiums for themselves on income not exceeding 300,000 rubles.

Insurance premiums over 300,000 rubles. must be paid no later than July 1 following the expired billing period, i.e. until July 1, 2021 for 2021 and until July 1, 2022, respectively.

In case of termination of the activities of an individual entrepreneur, insurance premiums must be paid within 15 calendar days from the date of deregistration with the tax authorities.

Previously, you could get a receipt on the Pension Fund website. Now there you can only get all the information on the changes and the basic requirements for the receipt.

All calculations and contributions have been transferred to the Federal Tax Service website. To generate a receipt, you will need to go to it.

From 2021, tax contributions can be clarified if the bank name and the recipient's account are correct. The remaining contributions must be returned and paid again (subclause 4, clause 4, article 45 of the Tax Code of the Russian Federation).

Any insurance premiums, unlike taxes, are never rounded.

Let us remind you that since 2015, to pay an additional 1%, a different BCC has been used that is different from the fixed insurance premium. And for 2017-2018 they are completely different - see them below.

You can calculate this fixed payment for any period (even an incomplete year or month) using our calculator here.

Purpose of payment: Insurance contributions for compulsory pension insurance in a fixed amount from income up to 300 rubles. for the 1st quarter of 2021 Reg. No. 071-058-011111

Payer status: Payer status: 24 - for individual entrepreneurs for themselves (since 2017, you need to indicate 09, because we pay contributions to the Federal Tax Service Order of the Ministry of Finance dated April 5, 2021 No. 58n).

TIN, KPP and OKTMO should not start from scratch. OKTMO must be 8-digit.

Rice. .

Attention! Starting from 2021, the new KBK and the new recipient of contributions are not the Pension Fund of Russia but the Federal Tax Service. Here you can find out the details of your Federal Tax Service.

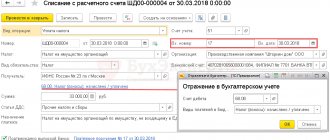

Fig. Sample of filling out a payment order (insurance fixed contribution of an individual entrepreneur) in the Business Pack.

You can see how to calculate additional interest on the simplified tax system, UTII, PSN, OSNO, and Unified Agricultural Tax systems using our calculator here.

Purpose of payment: Insurance contributions for compulsory pension insurance in a fixed amount for income over 300 tr. for the 1st quarter of 2021 Reg. No. 071-058-011111

Payer status: Payer status: 24 - for individual entrepreneurs for themselves (from 2017 you need to indicate 09, because we pay contributions to the Federal Tax Service).

TIN, KPP and OKTMO should not start from scratch.

Rice. .

Attention! Starting from 2021, the new KBK and the new recipient of contributions are not the Pension Fund of Russia but the Federal Tax Service. Here you can find out the details of your Federal Tax Service.

Fig. Sample of filling out a payment order (PFR over 300 tr. Individual entrepreneur) in Business Pack.

How long should payments be kept?

It is necessary to check payment orders in 2021

It is necessary to indicate new details of the Federal Treasury. Although I didn't notice any changes in the details.

You need to fill out detail “15” of the payment order - the account number of the recipient’s bank, which is part of the single treasury account (STA).

The details can be checked using the service of the Federal Tax Service website.

Attention! Starting from 2021, the new KBK and the new recipient of contributions are not the Pension Fund of Russia but the Federal Tax Service. Here you can find out the details of the Federal Tax Service.

Starting from 2021, someone else can pay taxes for an individual entrepreneur, organization or individual. Then the details will be as follows: “TIN” of the payer - TIN of the one for whom the tax is being paid; “Checkpoint” of the payer – checkpoint of the one for whom the tax is transferred; “Payer” – information about the payer who makes the payment; “Purpose of payment” – INN and KPP of the payer for whom the payment is made and the one who pays; “Payer status” is the status of the person whose duty is performed. This is 01 for organizations and 09 for individual entrepreneurs.

A payment order or payment document is a document to the bank on behalf of the owner (client) of the current account: transfer money to another account (pay for a product or service, pay taxes or insurance premiums, transfer money to the account of an individual entrepreneur or pay a dividend to the founder, transfer wages to employees, etc. .everything is below)

A payment order can be generated (and sent via the Internet) in Internet banking (for example, Sberbank-online, Alpha-click, client bank). Internet banking is not needed for small organizations and individual entrepreneurs because... it is complicated, expensive and less safe. It is worth considering for those who make more than 10 transfers per month or if the bank is very remote. Payments can also be generated using online accounting.

Where can I get a payment order for free? How to fill out a payment order? What types of payment orders are there? I will post here samples of filling out payment slips in Excel for 2020-2021, made using the free Business Pack program. This is a fast and simple program. In addition to payment slips, it also contains a bunch of useful documents. I recommend to all! Especially useful for small organizations and individual entrepreneurs who want to save money. Some additional functions in it are paid, but for payment orders it is free.

Fixed contributions IP-2021: calculation, BCC, deadlines

You can calculate this fixed payment to medicine for any period (even less than a year or a month) using our calculator here.

Purpose of payment: Insurance premiums for compulsory medical insurance in a fixed amount for the 1st quarter of 2021 Reg. No. 071-058-011111

Payer status: Payer status: 24 - for individual entrepreneurs for themselves (from 2017 you need to indicate 09, because we pay contributions to the Federal Tax Service).

TIN, KPP and OKTMO should not start from scratch.

In field 109 (date, below the “reserve field”, on the right) enter the date of the declaration on which the tax is paid. But under the simplified tax system and all funds (PFR, FSS, MHIF) they set 0.

It will sound strange, but field 108 (below the “code” on the right and the “reserve field” on the left) indicates “14; SNILS IP number”. This is the requirement of the Pension Fund.

Rice. .

Fig. Sample of filling out a payment order (Medical insurance FFOMS IP) in Business Pack.

Attention! Starting from 2021, the new KBK and the new recipient of contributions are not the Pension Fund of Russia but the Federal Tax Service. Here you can find out the details of your Federal Tax Service.

The form has 6 fields that must be filled in. But the interesting thing is that they are specific, since they are necessary only for budget payments. All other fields, such as account number, bank BIC, and so on, are the same for any orders, regardless of who you pay to - the Russian budget or your counterparty for the delivery of goods.

| Status | Description |

| 01 | Entity |

| 02 | Tax agent |

| 08 | A legal entity that transfers funds to pay compulsory insurance premiums |

| 09 | Individual entrepreneur |

| 10 | Notary in private practice |

| 11 | Advocate |

| 12 | Individual |

In the payment slip, this field is responsible for explaining the basis of the payment, on the basis of which you generally pay.

| Basis of payment | Explanation |

| TP | If the payment is made to the budget for the past period without debt or penalties, then indicate exactly this basis, which is responsible for payments in the current year |

| ZD | Voluntary payment of debt for the previous tax period(s) |

| RT | Repayment of restructured debt |

| RS | Repayment of overdue debt |

| VU | Repayment of deferred debt upon introduction of external management |

| ETC | Repayment of debts suspended for collection |

| FROM | Payment of deferred debt |

| AP | Payment according to the tax inspection report |

| AR | Payment according to the writ of execution |

Attention! Let's look at the example of contributions for 2018. Their total amount was 32,385.00 rubles.

Tip: Don't pay them every month. There is no point. We worked for the first quarter, calculated the tax, and it came out to 10 thousand rubles. So, pay these 10 thousand to the Pension Fund and the Federal Compulsory Medical Insurance Fund, and first to the Pension Fund of the Russian Federation.

Nothing for the tax authorities, because the contributions were offset against the tax. There are 22,385.00 rubles left, of which 5,840.00 are in the FFOMS.

For the second quarter, another 10 thousand in taxes came out. Again we do not pay tax, but pay to the Pension Fund. There are 12,385.00 rubles left, of which 5,840,000 are in the FFOMS.

For the third quarter, another 10 thousand in taxes came out. Again we do not pay tax, but pay to the Pension Fund.

BUT! We no longer send 10 thousand to the Pension Fund, but the remainder of the total contribution (from 26545.00), i.e. 6,545.00. And with this tranche we cover our obligations to the Pension Fund. But our tax was 10 thousand, and we paid 6,545.00. The remaining 3,455.00 is sent to the FFOMS. All that remains is to pay for honey. insurance: 5,840 - 3,455 = 2,385 rubles.

So already for the fourth quarter, when your tax amount again comes out to 10 thousand rubles, we send the remaining 2,385 to the FFOMS, and the remaining 7,615.00 to the details of the tax authorities!

If you are closing an individual entrepreneur, the tax inspector, accepting your closure documents, may require receipts confirming the fact of payment to the Pension Fund of all contributions for the year in which the closure procedure is carried out. Remember, you are not obligated to pay insurance premiums when you submit the paperwork to close! We read the article. 432 of the Tax Code of the Russian Federation, based on which this can be done within 15 days after the closure of the individual entrepreneur.

On the other hand, the insurance premium can be deducted from the tax, as we already know, which will be impossible if you transfer the money to the Pension Fund after closing, and not before. Therefore, before closing the individual entrepreneur, pay all contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund, according to the monthly calculations given above.

Foreign organizations and individuals will be able to indicate “0” in the “TIN of the payer” field if they are not registered with the tax office. An exception is payments administered by tax authorities. The amendment comes into force on January 1, 2021.

When deducting money from the income of an individual debtor to pay off the debt, indicate his TIN in the “TIN of the payer” field. It is no longer possible to enter an organization’s TIN from July 17, 2021.

If a payment order was drawn up by an individual without an account and intends to transfer money to the budget using it, the details must indicate the individual’s tax identification number or “0” if the number has not been assigned. It is prohibited to indicate the TIN of a credit institution. This rule is effective from October 1, 2021.

The main change concerns individual entrepreneurs, notaries, lawyers and heads of peasant farms. From October 1, 2021, payer status codes “09”, “10”, “11” and “12” will no longer be valid. Instead, the taxpayers listed above will indicate code “13,” which corresponds to individual taxpayers.

Also, some of the codes will be deleted or edited. New codes will be added:

- “29” - for politicians who transfer money to the budget from special election accounts and special referendum fund accounts (except for payments administered by the tax office);

- “30” - for foreign persons who are not registered with the Russian tax authorities, when paying payments administered by customs authorities.

From October 1, the list of payment basis codes will decrease. Codes will disappear:

- “TR” - repayment of debt at the request of the tax authorities;

- “AP” - repayment of debt according to the inspection report;

- “PR” - debt repayment based on a decision to suspend collection;

- "AR" - repayment of debt under a writ of execution.

Instead, you will need to indicate the code “ZD” - repayment of debt for expired periods, including voluntary. Previously, this code was used exclusively for voluntary debt closure.

Also, from October 1, the code “BF” will be removed - the current payment of an individual paid from his own account.

This field indicates the document number that is the basis for the payment. Its completion depends on how field 106 is filled in.

The new code for the basis of payment in the four invalid cases is “ZD”. But despite this, the deleted codes will appear as part of the document number - the first two characters. Fill out the field in the following order:

- “TR0000000000000”—number of the tax office’s request for payment of taxes, fees, and contributions;

- “AP0000000000000” - number of the decision to prosecute for committing a tax offense or to refuse to prosecute;

- “PR0000000000000” - number of the decision to suspend collection;

- “AR0000000000000” – number of the executive document.

For example, “TR0000000000237” - tax payment requirement No. 237.

How to fill out a payment order for taxes and contributions in 2021

At the beginning of 2021, when filling out a payment order for the transfer of insurance premiums, the status number became the subject of numerous disputes and disagreements between payers and the Federal Tax Service.

Some payers continued to adhere to the usual status “08”, which stands for “payer paying insurance premiums to the budget system of the Russian Federation” (Appendix No. 5 of the Order of the Ministry of Finance dated November 12, 2013 No. 107n “Rules for indicating information in the details of the transfer of funds...” ).

At the same time, the Federal Tax Service initially wanted to see the status “14” in receipts from contributions for employees, which it wrote about in a letter dated January 26, 2017 No. BS-4-11//NP-30-26/947/02-11-10 /06-308-P.

See: “Officials have officially confirmed that the payer status is indicated as “14” in the payment slip .

However, banks did not allow payments with the specified statuses. And in the end, everyone agreed on the status “01”, meaning “taxpayer (payer of fees) - legal entity.” That is, in 2021, this is what you need to put on your contribution payments.

See about this:

- “Federal Tax Service - about field 101 in the payment order for contributions”;

- “The Bank of Russia spoke on filling out field “101” when paying insurance premiums».

For information on correcting errors made in the payer status, see our mini-article “KBK and payer status in the payment order - the error is not critical .

Individual entrepreneurs, notaries, lawyers, farmers, when paying insurance premiums to the Federal Tax Service from 01/01/2017, must indicate the statuses “09”, “10”, “11”, “12” respectively. Individual – status “13”. Justification: letters of the Federal Tax Service of Russia dated 02/03/2017 No. ZN-4-1/ and dated 02/10/2017 No. ZN-4-1/ Since April 25, 2021, this procedure has been enshrined in legislation (Order of the Ministry of Finance dated 04/05/2017 No. 58n).

See also the memo on paying contributions for self-employed persons .

The KBK lists are approved by the Ministry of Finance. These lists have been established by different orders for 2021 and 2021. But despite this, the codes must be used the same in 2021 and 2021:

| Type of insurance premium | KBK |

| on OPS | 182 1 0210 160 |

| at VNiM | 182 1 0210 160 |

| on compulsory medical insurance | 182 1 0213 160 |

| for injuries | 393 1 0200 160 |

| on compulsory pension insurance in a fixed amount for individual entrepreneurs (including 1% contributions) | 182 1 0210 160 |

| on compulsory medical insurance in a fixed amount for individual entrepreneurs | 182 1 0213 160 |

| Additional contributions for compulsory health insurance (for employees working in hazardous conditions), if | |

| — the tariff does not depend on the special assessment | 182 1 0210 160 |

| — the tariff depends on the special estimate | 182 1 0220 160 |

| Additional contributions to compensatory pension insurance (for employees working in difficult conditions), if | |

| — the tariff does not depend on the special assessment | 182 1 0210 160 |

| — the tariff depends on the special estimate | 182 1 0220 160 |

So, we have familiarized ourselves with the rules for entering payment details into documents for payment of contributions. Let's move on to explanations on how to fill out a payment order for insurance premiums quickly and without errors.

What errors do tax authorities most often find in payment slips, see here .

To make our further explanations more clear to you, we suggest studying a prepared example of filling out a payment slip for insurance premiums with pre-numbered parts.

Smiley LLC is located in the Khoroshevsky municipal formation of Moscow and is serviced by the Federal Tax Service No. 14 in Moscow. Based on the results of its activities for January 2021, the company accrued contributions to compulsory pension insurance for a total amount of 76,530 rubles.

An example of a payment form for the payment of insurance premiums for January 2021, completed using the above data, is presented below.

Until December 31, entrepreneurs can pay the fee at any time. If you need to generate a receipt, this can be done remotely on the Federal Tax Service website.

Important! Businessmen can make the entire payment at once or distribute it over months, transferring funds in parts.

If the entrepreneur’s income for the year exceeds 300 thousand rubles, then contributions from the excess are made after December 31 of the current year.

The site has a special menu with tips, so if you follow them exactly, there will be no difficulties in creating the form. To fill it out, the data available in your personal account is used, and you also have to enter information from the taxpayer’s personal documentation.

During the process, the following nuances are taken into account:

- in the taxpayer status of individual entrepreneurs, enter code 09;

- the payment basis is the TP code if there are no fines or penalties;

- When choosing a tax period, indicate “annual payment”.

If erroneous information is entered, this may cause late payment, which leads to the accrual of fines.

As soon as the payment slip is generated, it can be immediately printed or saved electronically. Using paper documentation, you can deposit funds at bank or post office branches.

It is possible to use a remote payment method, but it is available only to entrepreneurs who have previously opened a “Bank-Client” system in an accessible system. Bank cards or electronic services are used for payment .

Entrepreneurs are required to make special insurance contributions not only for their employees, but also for themselves. In 2021, a fixed payment is required for income up to 300 thousand rubles. To pay the fee, it is important to use the correct details, which can be found on the Federal Tax Service website or when visiting a tax office. On the website you can generate and print a receipt, and also offers the possibility of remote payment.

Contributions of individual entrepreneurs for themselves to the OPS are transferred to the KBK:

| What is paid | KBK |

| Contribution to OPS for yourself | 182 1 0210 160 |

| Penalties on contributions to compulsory pension insurance for yourself | 182 1 0210 160 |

| Penalty for contribution to compulsory pension insurance for yourself | 182 1 0210 160 |

You will find a sample payment order for payment of a fixed contribution to the OPS below.

It is worth noting that if an individual entrepreneur needs to pay off arrears of contributions to compulsory pension insurance for himself for periods expired before 01/01/2017, then other BCCs are provided for these purposes:

| What is paid | KBK |

| Contribution to OPS for yourself | 182 1 0200 160 |

| Penalties on contributions to compulsory pension insurance for yourself | 182 1 0200 160 |

| Penalty for contribution to compulsory pension insurance for yourself | 182 1 0200 160 |

What to do if there is an error in the payment receipt

An entrepreneur has the right to pay fixed CB at any time during the year until December 31 inclusive.

Individual entrepreneurs have the opportunity to make payments in installments throughout the year or make a lump sum payment at the end of the year. There are cases when a business entity had no income for two quarters, and in the third quarter there was income. It is easier for an individual entrepreneur not to pay contributions in the two previous periods, but to pay it in full in the third quarter. If, due to the specific nature of the type of activity, the individual entrepreneur received the main income at the beginning of the year, then he can pay it in a lump sum, without waiting for the end of the period. The main advantage of paying fixed CB for individual entrepreneurs is the lack of clear payment deadlines.

Table: payment terms for individual entrepreneurs in 2021, with the breakdown of CB amounts in equal shares

As a result, it turns out that fixed payments are divided into 4 equal parts, so payment once a quarter will be the following amounts:

- RUB 6,636.25 — expenses for OPS;

- RUB 1,460 — expenses for compulsory medical insurance.

Additional SV to the Pension Fund, which amounts to 1% of annual income, must be paid before July 1 of the next year. In this case, exceeding the limit during the year will be the basis for paying this SV as it arises in order to take such expense into account in a single tax. It is best to pay the additional CB at the time when the decision is made to pay for the fixed CB.

If an individual entrepreneur pays SV for temporary disability and in connection with maternity on a voluntary basis, then this transfer must also be made before December 31.

If the individual entrepreneur has ceased his activities, he should pay the SV within the next 15 days.

It will be useful to know what to expect as an individual entrepreneur in case of violation of the legislation on the payment of SV, because changes have occurred in this area.

It may happen that the individual entrepreneur transferred a reduced amount to the SV or did not transfer it at all. In this case, the Federal Tax Service may apply the following types of fines:

- 20% of the amount of the insurance premium that was not transferred to the Federal Tax Service, but only if such a circumstance occurred unintentionally;

- 40% of the amount of the insurance premium that was not paid, but when the individual entrepreneur intentionally evaded the obligation.

Such fines are faced by those entrepreneurs whose incorrect calculations of tax payments or their non-payment were discovered by the Federal Tax Service during a tax audit. Therefore, those individual entrepreneurs who pay fees but are late on deadlines do not fall under this punishment system.

Information technologies continue to develop, which significantly makes life easier for all business entities, including individual entrepreneurs. The owner of a business now only needs to go to the tax office’s website to generate the necessary receipt for SV, and then pay for it. This state of affairs allows you to save time and effort as an individual entrepreneur, since there is no longer a need to manually fill out receipts and make a trip to the bank.

Pension contributions are one of the most serious fiscal burdens on small businesses. Since 2021, when almost all payments from the diocese of extra-budgetary funds transferred to the Federal Tax Service of the Russian Federation, insurance premiums have increasingly begun to be called taxes. In many respects they are regulated even more strictly and uncompromisingly.

There are no concessions for anyone regarding pension insurance: neither the status of an individual entrepreneur, nor the amount of time worked by him, nor the region chosen for doing business, have no significance here. All individual entrepreneurs registered in the Unified State Business Register are required to pay contributions to the state pension fund both for themselves and for their employees.

There are 3 types of pension contributions:

- A fixed pension payment that an individual entrepreneur pays for himself. The price of the issue here is the same for everyone - in 2021 it is 26,545 rubles, in subsequent years the rate is indexed. You must generate a payment form and pay your fees strictly before December 31 of the reporting year. The regulator does not limit businesses to the number of payments: they can be transferred once a year, quarterly or monthly.

- An insurance fee that all individual entrepreneurs must pay to the treasury if their income exceeds 300,000 rubles for the reporting year. This payment is calculated in the amount of 1% of the individual entrepreneur’s revenue minus three hundred thousand rubles. The deadline for this fee was clarified in 2018 - it must be paid before July 1, 2021.

- Pension contributions for individual entrepreneurs. The income of the insured individual is taken as a basis. persons and, based on this, an insurance payment is calculated in the amount of 22% of all motivational payments paid to the employee. It is important that the total amount is taken from all payments to the employee: wages, bonus fund, compensation, additional payments, etc. If an individual entrepreneur receives more than 1.021 million rubles during the reporting period, the employer pays another 10% for him from the excess amount. These payments are made monthly based on the amount received by the individual entrepreneur, the deadline is until the 15th.

All pension contributions are paid to the district tax office at the place of registration of the individual entrepreneur. Since 2021, due to a change in the administrator of insurance contributions, the budget classification codes that must be indicated in payments for pension contributions have been changed.

One of the key issues of tax and insurance payments, of course, is the liability of a business for violations of regulations. Here the requirements of the tax authorities are almost identical:

- If there is a delay in payment of the insurance premium, penalties are included, which are calculated for each day of delay (1/300 of the refinancing percentage of the Central Bank of the Russian Federation).

- If mandatory insurance fees are not paid, the individual entrepreneur may be subject to a fine of 20% of the premium amount.

- If payment deadlines are regularly violated and the individual entrepreneur maliciously ignores the requirements of the Federal Tax Service, he may be subject to a fine of up to 40% of the amount of the unpaid contribution.

If an individual entrepreneur ends his business activity, after deregistration he has only 15 days to generate a payment document (receipt) and pay all insurance premiums. When an individual entrepreneur works for an incomplete calendar year, he must calculate the amount for all full months, as well as for the remaining days of the incomplete month (if any). In this case, the calculation should include both the first and last day of registration of the individual entrepreneur.

Table: amounts of fixed contributions of individual entrepreneurs “for themselves” under compulsory health insurance and compulsory medical insurance

Generating a receipt for paying pension insurance contributions has become much simpler in recent years; now this can be done in several convenient and quick ways:

- Generate a payment document through the client bank of the credit institution in which the entrepreneur has an open account. For this case, there are special payment templates in mobile banking. Obviously, this is done within the framework of contractual services with the bank.

- The optimal (and note - free) option for preparing a document for an individual entrepreneur is to fill out a payment order on the online portal tax.ru. Using this service, you can simply prepare a receipt, print it and pay for your pension using a payment terminal or an operator at any bank branch. Or enter all the necessary data on the same online resource and immediately make a payment by card, through an electronic wallet or using a mobile phone. Tax portal - the optimal service for generating receipts

Step-by-step instructions for online receipt generation

Let’s take, for example, a situation where a businessman begins to generate a receipt to pay a mandatory pension contribution for himself. The individual entrepreneur has been operating since the beginning of 2021 and plans to do so until the end of the reporting period. The amount for OPS for this period will be 26,545 ₽. First you need to decide on a payment schedule.

Let's choose quarterly payments. Thus, payments should proceed according to the following schedule:

- for the first quarter of 2021 - until March 31;

- for the second quarter - until June 30;

- for the third quarter - until September 30;

- for the fourth quarter - until December 31.

The quarterly payment under the OPS will be 6,636.25 rubles. You can round the amount to a whole number, and subsequently adjust the final amount, or you can pay exactly according to the formula: 26,545 RUR / 4 = 6,636.25 RUR.

So, let’s look at the steps you need to take to generate a receipt and pay it in a bank or online:

- We open the page of the Internet portal of the Federal Tax Service of the Russian Federation and begin generating a payment document, selecting the type of payer in a certain tab - since we are paying for ourselves, we put a “tick” in the block reserved for individual entrepreneurs. In the next block you need to decide on the type of payment document. It all depends on how the receipt will be paid:

- If the user still has questions, he can always refer to the tips that are “hard-wired” in the service under question marks next to the required tabs. After selecting the required blocks, go to “Next”.

- Select the correct type of payment. In our case, this is a fixed contribution of the individual entrepreneur to the OPS for himself, corresponding to the BCC for this payment - 18210202140061110160. Please note that you must enter the digital code without spaces, otherwise the service will not recognize and accept it. To generate a payment type, one code is enough, but if the payer is in doubt or does not know the current BCC, the online service can select the correct code using drop-down lists. It will just take a little longer. When choosing a payment type, it is enough to indicate the BCC for the purpose of the payment

- Next, select the desired tax office to which the payment will be sent. The Federal Tax Service code can be selected in the drop-down register. If questions arise regarding OKTMO of a certain inspection, since the drop-down list here is very impressive, this can be determined by the address of the micro-enterprise location (individual entrepreneur registration). If the payer is lost in choosing the details of his Federal Tax Service, its codes can be determined by the individual entrepreneur’s registration address

- The next, perhaps most serious step when preparing a receipt is to enter the details of the payment document (or instructions, if this type of payment document was chosen at the beginning of the journey). It is important to choose here:

- correct code description of the payment - in our case, these will be payments of the current year (other reasons can also be selected in this block, for example, repayment of debts of various types);

- tax period - if we pay for the second quarter, accordingly, we choose this one. Naturally, the individual entrepreneur is left with the choice of which period to pay: it can be a year, or six months, or even a specific date (if the individual entrepreneur ceases its activities at this time);

- The payment amount can be indicated either in full rubles (as we did in the example below) or in kopecks. Only in this case there is one caveat: the service will not allow you to enter the amount if you specify kopecks separated by commas (as everyone is used to), after the rubles you need to put a dot here. Selecting payment document details is the most crucial moment when filling out a receipt.

- Next, the service will ask the user to provide the individual payer details. It is logical that in the blocks with your full name you need to put the exact details of the entrepreneur (as indicated in the individual entrepreneur’s certificate). An important point in this paragraph is the contribution payer identification number (TIN). If you need to generate a receipt for non-cash payment, this number is required. But you don’t have to fill in the address block, although it won’t hurt. After all, the more accurately all the payer’s details are indicated, the better. If questions suddenly arise, there will be more justifications. Without the payer’s TIN, it will not be possible to generate a payment for online payment; this number does not affect the rest

- The next page of the service is intended only for checking all the data. You don't need to enter anything here, you just need to make sure that all the data is correct. And click the red “Pay” button. The payment is actually completed, click the “Pay” button

- But that's not all. After opening the next page, you need to select a form of payment - cash or by bank transfer (card, electronic money, and payment from a mobile phone are suitable for non-cash payment). On the “Pay payment document” page you need to select a payment method

- If you choose cash payment, a payment receipt will be automatically generated. Here you can once again check all the blocks by payer and recipient. And most importantly - according to the purpose of payment.

- If an entrepreneur pays a pension contribution online, you just need to select the non-cash payment block. And when opening the window for paying by bank transfer, select the logo of the partner bank. If the credit institution in which the individual entrepreneur has a bank card is not in the register of partners, you can use the State Services portal (the first logo in the electronic list). In this case, you can pay the receipt either from a card of any bank or using an electronic wallet or phone. However, in this case, you may have to pay a commission. However, the service will inform the payer about this before payment, so the individual entrepreneur will have a choice. On the “Pay payment document” page you can select a bank for online payment of the generated payment document

Information about details for paying insurance premiums for individual entrepreneurs

An individual entrepreneur can reduce the tax base/tax for contributions to compulsory pension insurance paid for himself:

| Tax | Procedure for reducing the base/tax on contributions |

| Personal income tax | Individual entrepreneurs have the right to include contributions to compulsory pension insurance for themselves as part of a professional deduction that reduces the personal income tax base |

| STS (object “income”) | Individual entrepreneurs with employees can reduce tax under the simplified tax system (advance payment) by the amount of contributions paid for themselves and for employees, but not more than 50% |

| Individual entrepreneurs without employees can reduce tax under the simplified tax system (advance payment) for the entire amount of the contribution paid | |

| simplified tax system (object “income minus expenses”) | Individual entrepreneurs have the right to include contributions to compulsory pension insurance for themselves as expenses that reduce the tax base under the simplified tax system |

| PSN | Individual entrepreneurs with employees can reduce the tax by the amount of contributions paid for themselves and for employees, but not more than 50% |

| Individual entrepreneurs without employees can reduce tax by the entire amount of the contribution paid |

Contributions reduce the tax/basis of the period in which they are actually paid, but to the extent of the amounts assessed.

It is also worth noting that when combining regimes, there are some nuances to reducing the tax/base for fixed contributions of individual entrepreneurs.

\r\n\r\n

There are innovations for individuals who pay taxes, fees, insurance and other payments administered by the tax authorities. The changes concern field 101 (the status of the payment originator is entered in it).

\r\n\r\n

Until October 2021, when filling out field 101, these individuals must select one of the following values:

\r\n\r\n

- \r\n\t

- “09” - individual entrepreneur who pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “10” - a notary engaged in private practice, paying taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “11” - a lawyer who has established a law office that pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “12” is the head of a peasant (farm) enterprise who pays taxes, fees, insurance premiums and other payments administered by the tax authorities.

- “13” is an “ordinary” individual.

\r\n\t

\r\n\t

\r\n\t

\r\n\t

\r\n

\r\n\r\n

Starting in October 2021, the values "09", "10", "11" and "12" will be removed. Instead, the value remains, the same for all individuals (“ordinary”, individual entrepreneurs, lawyers, etc.) - “13”. Changes were made by order No. 199n.

When filling out the recipient's details, you need to take into account changes in two fields. Innovations are associated with the transition to a new treasury service and treasury payment system.

- Field 17: the account number of the territorial body of the Federal Treasury (TOFK) is changed;

- Field 15: starting from January 2021, it is necessary to indicate the account number of the recipient's bank (the number of the bank account included in the single treasury account (STA)). In 2021 and earlier, this field was not filled in when paying taxes and contributions.

A clear rule will come into effect in the event that the accounting department deducts money from an employee’s salary to pay off debts to the budget. Next, the withheld amount is transferred to the treasury by a separate payment order. In such a payment in the field “TIN of the payer”, from July 17, 2021, it is strictly prohibited to indicate the identification number of the employing company. Instead, you need to put the TIN of the employee himself (amendments made by Order No. 199n).

Fixed contributions of individual entrepreneurs for themselves 2021

There are innovations for individuals who pay taxes, fees, insurance and other payments administered by the tax authorities. The changes concern field 101 (the status of the payment originator is entered in it).

Until October 2021, when filling out field 101, these individuals must select one of the following values:

- “09” - individual entrepreneur who pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “10” - a notary engaged in private practice, paying taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “11” - a lawyer who has established a law office that pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “12” is the head of a peasant (farm) enterprise who pays taxes, fees, insurance premiums and other payments administered by the tax authorities.

- “13” is an “ordinary” individual.

Starting in October 2021, the values "09", "10", "11" and "12" will be removed. Instead, the value remains, the same for all individuals (“ordinary”, individual entrepreneurs, lawyers, etc.) - “13”. Changes were made by order No. 199n.

Starting in 2021, the authorities have abolished the link between fixed individual entrepreneur contributions and the minimum wage (minimum wage). The amount of payments is established by clause 1 of Article 430 of the Tax Code of the Russian Federation.

For 2021, the minimum wage was 7,500 rubles.

For 2021, the minimum wage was 6,204 rubles.

For 2015, the minimum wage was 5,965 rubles.

For 2014, the minimum wage was 5,554 rubles.

For 2013, the minimum wage was 5,205 rubles.

For 2012, the minimum wage was 4,611 rubles.

The amount of contributions to the funds in 2021 is 40,874 rubles, of which:

— the amount of insurance contributions to the Federal Compulsory Medical Insurance Fund in 2021 = 8,426 rubles.

— the amount of insurance contributions to the Pension Fund in 2021 = 32,448 rubles.

If the income of an individual entrepreneur exceeds 300,000 rubles. for 2021, the contribution to the Pension Fund increases by an additional 1% of the excess amount.

An example of calculating an additional contribution to the Pension Fund with an income of 1,000,000 for 2021:

(1,000,000 - 300,000) * 1% = 7,000 rub.

This payment to the Pension Fund must be made no later than April 1, 2021.

The amount of contributions to the funds in 2021 is 36,238 rubles, of which:

— the amount of insurance contributions to the Federal Compulsory Medical Insurance Fund in 2021 = 6,884 rubles.

— the amount of insurance contributions to the Pension Fund in 2021 = 29,354 rubles.

If the income of an individual entrepreneur exceeds 300,000 rubles. for 2021, the contribution to the Pension Fund increases by an additional 1% of the excess amount.

An example of calculating an additional contribution to the Pension Fund with an income of 500,000 for 2021:

(500,000 - 300,000) * 1% = 2,000 rub.

This payment to the Pension Fund must be made no later than April 1, 2020.

conclusions

Thus, in 2021, an individual entrepreneur must transfer for himself fixed amounts of contributions to compulsory health insurance (32,448 rubles) and compulsory medical insurance (8,426 rubles), making the appropriate payments before December 31, 2020.

In addition, until 07/01/2021, the individual entrepreneur pays the variable part of compulsory pension insurance for 2021, that is, 1% of the income for 2021 exceeding 300,000 rubles.

These transfers are made non-cash - on the basis of relevant payment orders. At the same time, separate payment orders (payments) must be issued for the contribution to compulsory health insurance and for the insurance premium to compulsory medical insurance.

Insurance premiums for individual entrepreneurs in 2021 for themselves

The President signed a law that transfers insurance premiums to the control of tax authorities. From January 1, 2021, you will have to pay contributions for individual entrepreneurs not to the Pension Fund and Social Insurance Fund, as before, but to the tax office at the place of registration.

The amount of contributions to the funds in 2021 is RUB 27,990, of which:

— the amount of insurance contributions to the Federal Compulsory Medical Insurance Fund in 2021 = 4,590 rubles.

— the amount of insurance contributions to the Pension Fund in 2021 = 23,400 rubles.

If the income of an individual entrepreneur exceeds 300,000 rubles. for 2021, the contribution to the Pension Fund increases by an additional 1% of the excess amount.

An example of calculating an additional contribution to the Pension Fund with an income of 1,000,000 for 2021:

(1,000,000 - 300,000) * 1% = 7,000 rub.

This payment to the Pension Fund must be made no later than April 1, 2018.

The amount of insurance premiums for individual entrepreneurs in 2013 is 35,664.66 rubles, of which:

— the amount of insurance contributions to the Federal Compulsory Medical Insurance Fund in 2013 = 3,185.46 rubles.

— the amount of insurance contributions to the Pension Fund in 2013 = 32,479.20 rubles.

The amount of insurance premiums for individual entrepreneurs in 2012 is 17,208.25 rubles, of which:

— the amount of insurance contributions to the Federal Compulsory Medical Insurance Fund in 2013 = 2,821.93 rubles.

— the amount of insurance contributions to the Pension Fund in 2013 = 14,386.32 rubles.

Since 2010, the territorial bodies of the Pension Fund have received the right to forcibly collect arrears of insurance premiums, as well as fines and penalties. In particular, the right to send instructions to debtor banks to write off the amount of debt (arrears on contributions, penalties and fines) from the accounts of defaulters without acceptance.

Penalties for late payment of contributions are calculated for each day of delay based on 1/300 of the refinancing rate of the Central Bank of the Russian Federation. Penalties are accrued for each day of delay up to and including the day of payment (collection).

Until 2021, fixed insurance premiums were calculated based on the minimum wage in force as of January 1 of the current year. From 2021, self-payments are decoupled from the minimum wage.

For 2021, individual entrepreneurs with an annual income of 300,000 rubles. and less they pay only 2 payments for themselves for a total amount of 40,874 rubles.

Individual entrepreneurs with an annual income of more than 300,000 rubles. pay for themselves ( in addition to the above amount of 40,874 rubles) 1% of income exceeding 300,000 rubles.

Firstly, individual entrepreneurs (IP) pay fixed pension contributions. Pension contributions in 2021 amount to RUB 32,448. per year (RUB 8,112 per quarter, RUB 2,704 per month).

If your annual income exceeds 300,000 rubles. You must pay an additional 1% of this excess no later than July 1 of the following year . For example, in a year you received 450,000 rubles, which means you need to pay (450,000 - 300,000) x 1% = 1,500 rubles. Despite the fact that in essence this part of the contributions is not fixed, they are still called fixed. The amount of pension contributions for 2021 is limited above the amount of 234,832 rubles, i.e. even if you earned 30 million rubles in a year (1% of 30 million - 300,000 rubles), you only need to pay 234,832 rubles. (limit for 2021 - RUB 259,584)

You can see an example of filling out a receipt for payment of a pension contribution using the “PD (tax)” form.

Secondly, individual entrepreneurs pay health insurance premiums. The medical insurance premium in 2021 is 8,426 rubles. per year (i.e. 2106.5 rubles per quarter, 702.16(6) rubles per month). These contributions are based on income exceeding RUB 300,000. NOT paid.

You can see an example of filling out a receipt for payment of a medical contribution using the “PD (tax)” form.

the paid receipts of fixed insurance premiums . Reporting since 2012 for individual entrepreneurs without employees (paying contributions only for themselves ) has been cancelled! . To find out whether your payments have reached their destination, call your tax office or use the “Personal Account of an Individual Entrepreneur” service.

The above information is for individual entrepreneurs without employees. For individual entrepreneurs with employees and LLCs, the information on the page about personalized accounting will be useful.

Current as of February 13, 2021

I will prepare documents for payment of insurance premiums for individual entrepreneurs. You choose the form of documents yourself - receipts for payment in cash or payment orders for payment from a current account. There are only two documents: health insurance premiums (MHIF) and pension insurance contributions (PIC). The amount of contributions payable in 2018 for all individual entrepreneurs is RUB 32,385. An additional 1% is paid for pension insurance on income over 300 thousand rubles.

KBK insurance premium for individual entrepreneurs

| Payment type | For 2021 in 2021 | For 2021,2015 and earlier | For 2021, 2021 |

| Insurance contributions for pension insurance of individual entrepreneurs for themselves in the Pension Fund of the Russian Federation in a fixed amount (based on the minimum wage) | 392 1 0200 160 | 182 1 0200 160 | 182 1 0210 160 |

| Insurance contributions for pension insurance of individual entrepreneurs for themselves in the Pension Fund of the Russian Federation with income exceeding 300,000 rubles. | 392 1 0200 160 | 182 1 0200 160 | 182 1 0210 160 |

| Insurance premiums for medical insurance for individual entrepreneurs for themselves in the Federal Compulsory Compulsory Medical Insurance Fund in a fixed amount (based on the minimum wage) | 392 1 0211 160 | 182 1 0211 160 | 182 1 0213 160 |