Home / Financial Law / Download Register of Appendix No. 7 Supporting Documents 3 Personal Income Tax Form 2021 Download Free

As always, we will try to answer the question “Download Register of Appendix No. 7 Supporting Documents 3 Personal Income Tax Form 2021 Download for Free.” You can also consult with lawyers for free online directly on the website without leaving your home.

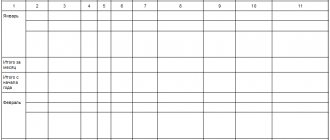

The documents attached to the declaration can be accompanied by a register that lists their names and number of sheets. It is recommended to use the form from Appendix No. 3 of Order No. MMV-7-6/97 of the Federal Tax Service of the Russian Federation dated February 25, 2021 (you can download the register of supporting documents 3-NDFL below), but you can also draw up an arbitrary document. The number of sheets indicated in the register must coincide with their actual number and indicated on the title of the declaration. For example, the description might look like this:

The declaration along with the documents is submitted to the Federal Tax Service at the place of permanent registration of the individual. This can be done by coming to the inspection office and submitting the documents in person; in this case, you need to print out a second copy of the declaration for yourself, on which they will put a mark of acceptance.

Register of supporting documents 3-NDFL - form

What other documents will be needed for a personal income tax refund depends on the type of deduction that the taxpayer is claiming. The Federal Tax Service of the Russian Federation provided lists of documents that need to accompany declarations submitted for tax refund in each case in its letter No. ED-4-3/19630 dated November 22, 2012. Let's take a closer look at them.

If the register was nevertheless compiled by the payer himself, then the tax authorities check the number of sheets indicated in the register with the number of sheets of the submitted documents, as well as with the number of sheets indicated on the title page of the declaration. And if any inconsistencies are identified, inspectors draw up a new register of supporting documents, taking into account the changes.

If the payer attaches to the declaration in form 3-NDFL any documents confirming the information contained in the declaration, then he has the right to draw up a register for 3-NDFL and attach it to the declaration itself (clause 1.16 of the Procedure, approved by Order of the Federal Tax Service of Russia dated 03.10 .2021 N ММВ-7-11/ [email protected] ). Those. Submission to the Federal Tax Service of the register of documents for 3-NDFL is a right, not an obligation of the taxpayer.

Register of supporting documents 3-NDFL: form

If the payer decides to send the declaration and supporting documents by mail, then even if there is a register for 3-NDFL, he must provide his letter to the Federal Tax Service with an inventory of the attachment. After all, the presence of an inventory of the attachment is a mandatory requirement of the Tax Code of the Russian Federation for items sent to the tax authorities by mail (clause 4 of Article 80 of the Tax Code of the Russian Federation).

Important! Late declaration will cost a five percent fine of the tax amount for each late month. The total amount of the fine cannot be less than 1000 rubles. If the declaration was submitted with inaccuracies or typographical errors, you can prepare an updated version and send it to the tax authority:

- the ability to generate and send a report from home;

- program in Russian for filing 3-NDFL and 4-NDFL declarations;

- Full compatibility with all versions of Windows.

- a wide range of reporting options;

- intuitive interface;

You may like => How many hours does theory training in a driving school take for a category in

Download the “declaration” program for 3-personal income tax for 2021 - 2021

The papers that are attached to the declaration of standard 3-NDFL for tax with losses on education must necessarily include copies of a certificate or other document that can confirm the right of the institution to carry out educational activities. If there are no licenses, a basic charter can be provided, which approves the status of the institution in which the process of obtaining knowledge takes place. If a particular person still bothers to independently fill out the register for 3-NDFL for 2021, then the task of the Federal Tax Service employees will already include checking its correctness.

If a particular person still bothers to fill out the register for 3-NDFL for 2021 , then the task of the Federal Tax Service employees will be to check the correctness of its registration. First of all, they will check the number and types of materials sent with those noted in the register. By the way, exactly the same figure should appear on the title page of these reports.

Package of documents for income tax refund

To receive any tax deduction for personal income tax, an individual submits the following documents to the inspectorate:

- Declaration of your income 3-NDFL. As of reporting for 2021, a new form is in effect, approved. by order of the Federal Tax Service of the Russian Federation dated December 24, 2014 No. ММВ-7-11/671 (as amended on October 25, 2017);

- an application for a tax refund containing the payment details of an individual for the transfer of a sum of money from the Federal Tax Service (attached if the tax for refund has already been calculated in 3-NDFL);

- employer's certificate 2-NDFL for the corresponding year.

Read also: New form 3-NDFL – 2019

What other documents will be needed for a personal income tax refund depends on the type of deduction that the taxpayer is claiming. The Federal Tax Service of the Russian Federation provided lists of documents that need to accompany declarations submitted for tax refund in each case in its letter No. ED-4-3/19630 dated November 22, 2012. Let's take a closer look at them.

Read also: Certificate 2-NDFL: new form 2019

Documents for income tax refund for treatment

This deduction can be received by individuals who paid for treatment at medical organizations, purchased medications, prescription medications, and also paid contributions under VHI agreements for themselves or relatives.

To receive an income tax refund for treatment, the required documents include:

- for treatment services - copies of the contract for medical services and the license of the medical institution, if its details are not in the contract; you also need to take a certificate from the medical institution in form No. 289 about payment for services;

- for purchased medicines - the original doctor’s prescription with the obligatory stamp “For the tax authorities of the Russian Federation, Taxpayer INN” and copies of payment documents (cheques, payment slips, receipts, etc.);

- for VHI insurance premiums - a copy of the policy or insurance contract, a copy of the insurer’s license (if its details are not in the contract).

In addition, documents for 3-NDFL when paying medical expenses for family members must contain copies of documents on family ties: “children’s” birth certificates, marriage certificates, etc.

Income tax refund for education - list of documents

Part of the personal income tax can be returned for education - your own or a child’s, as well as for the education of the taxpayer’s brothers and sisters (clause 2, clause 1, article 219 of the Tax Code of the Russian Federation). What documents to submit for income tax refund:

- a copy of the agreement with the educational institution and the educational license, if its details are not in the agreement,

- copies of payment documents;

- when paying for relatives - copies of documents on relationship (guardianship) and age of students, a certificate of full-time education (if this is not specified in the contract).

To return income tax for education, documents for a child or siblings are submitted by the taxpayer who paid for the education.

Documents for 3-NDFL when purchasing an apartment

The attached documents when purchasing housing (clause 3, clause 1, article 220 of the Tax Code of the Russian Federation) will depend on whether it was purchased at the construction stage, or as a finished property.

Read also: 3-NDFL when buying an apartment - new form 2019

When purchasing a finished property, the documents attached to the 3-NDFL declaration include copies of:

- purchase and sale agreement, certificate of acceptance and transfer of housing;

- documents confirming payment (checks, statements, receipts, receipts, etc.);

- extracts from the Unified State Register of Real Estate, and for real estate registered before July 15, 2016 - certificates of registration of ownership.

Documents for filing a 3-NDFL declaration when purchasing a property under construction:

- agreement of shared participation in construction, or assignment of the right of claim;

- act of acceptance and transfer;

- payment documents.

When purchasing with a mortgage, you need to add documents to 3-NDFL:

- bank mortgage agreement with a loan repayment schedule;

- original certificate of interest paid.

Pensioners who bought an apartment also need to attach a copy of their pension certificate to the 3-NDFL, and spouses who have registered housing under joint ownership for less than 4 million rubles must attach an application and the original agreement on the distribution of the deduction between them to the documents for the 3-NDFL declaration.

Documents to the tax office for income tax refund when purchasing a house with a plot

Taxpayers who bought a house with a plot attach documents to the declaration by analogy with the purchase of an apartment, with the difference that the documents for income tax refund will include:

- land purchase agreement with a residential building;

- documents on ownership of land and residential buildings.

Applications and other documents for deductions

Tax return for personal income tax (Form 3-NDFL) (FORM FOR DECLARING INCOME FOR 2021) Order of the Federal Tax Service of Russia dated October 3, 2021 No. ММВ-7-11/ [email protected] Tax return for personal income tax persons (form 3-NDFL) (FORM FOR DECLARING INCOME FOR 2021) Order of the Federal Tax Service of Russia dated December 24, 2021 No. ММВ-7-11/ [email protected] (as amended on November 25, 2021, October 10, 2021 ., October 25, 2021) Tax return for personal income tax (form 3-NDFL) (FORM FOR DECLARING INCOME FOR 2021) Order of the Federal Tax Service of Russia dated December 24, 2021

Forms and samples of forms for personal income tax

Next, with notification of the right to deduction, you can obtain a deduction from your employer (or other tax agent). The agreement on the division of deductions for common joint property can be used the same as for deductions through the tax office (above).

“On approval of the form of the tax return for personal income tax (form 3-NDFL), the procedure for filling it out, as well as the format for submitting the tax return for personal income tax in electronic form"

Contents Declaration 3-NDFL is submitted to the tax authorities by certain categories of individuals in the form approved by order of the Federal Tax Service. How you can file a 3-NDFL declaration and how the new 2021 form differs from the previous one, find out from our material. The 3-NDFL declaration is a report of individuals who are obliged to independently:

Register of supporting documents 3 personal income tax form 2021 free download

However, if there are additional documents and there is no register, the inspector can fill it out himself based on the information received. In order to receive a standard, social or property deduction through the employer, the applicant sends a free-form written request to the tax office to receive a document (notification) of the right for a standard, social or property deduction. In case of preparing a tax return 3-NDFL in order to receive

May 09, 2021 yuristco 51

Share this post

Related Posts

Sizy Emergency Department

opis.jpg

The absence of a register is not considered a violation - clause 1.16 of the Procedure for filling out the 3-NDFL declaration (approved by Order of the Federal Tax Service of the Russian Federation dated December 24, 2014 No. ММВ-7-11/671) states that this is a taxpayer’s right, not an obligation. In this case, the register for 3-NDFL along with the attached documents will be filled out by the tax authorities themselves. They will also attach a new register if there is a discrepancy between the data specified by the taxpayer and the actual number of pages in the documents.

Why do we need a register of documents?

The register of documents attached to the 3-NDFL declaration form is a kind of document that is an inventory of all documentary evidence submitted along with the 3-NDFL form.

The register may include such papers as:

- Various types of evidence.

- Document on registration of an Individual Entrepreneur.

- Certificates and checks from a bank or other institutions, including healthcare.

- Agreements on concluding loan obligations.

- Information about the cost of the apartment.

- Certificate of marriage registration, state registration of property.

- The act of acceptance and transfer of real estate.

- Account statements.

- Agreement for education or training and advanced training.

The register is used to control submitted papers. For example, when filing 3-NDFL in person, a tax specialist can check all documents submitted to the tax office for compliance with the list. This will also help avoid the loss of documents when sending them via postal parcel - postal workers will be able to check the list and, if any of the documents are lost, will respond personally.

This is interesting! The register of documents is a kind of guarantee for a citizen in case of loss of any of the documents. After all, if a document was listed in the register and then lost, tax workers will be held responsible for the loss. If the registry did not exist, then proving the fact of paper loss would be problematic.

How to apply for an income tax refund

The declaration along with the documents is submitted to the Federal Tax Service at the place of permanent registration of the individual. This can be done by coming to the inspection office and submitting the documents in person; in this case, you need to print out a second copy of the declaration for yourself, on which they will put a mark of acceptance.

You can send the entire set by valuable letter with an inventory. Please note that the register of attached documents to 3-NDFL, the form of which we discussed above, cannot be considered such an inventory - it is filled out on a special postal form, where a stamp with the date of dispatch and the signature of a postal employee are affixed.

It is possible to prepare documents for income tax refund and send a declaration electronically, which requires the taxpayer to have an electronic digital signature. The attached documents, pre-scanned, are uploaded as files and sent to the Federal Tax Service through the “Taxpayer Personal Account” on the Federal Tax Service website.

The deadline for filing a personal income tax deduction return is not limited - it can be submitted throughout the year for the previous 3 tax periods. If, in addition to the deduction, an individual declares his income, he needs to meet the deadline of April 30 (in 2021, the declaration for 2021 must be submitted no later than May 3).

Register of documents for 3-NDFL form (sample)

Rules and sample for filling out the 3-NDFL declaration

Reporting Form 3 Personal Income Tax is mandatory for individual entrepreneurs, lawyers and other persons who have additional income. For a report such as the register of supporting documents 3, the personal income tax form can be found in a separate Appendix under number 3.

Tax return 3-NDFL in 2021 - how to fill out?

The deduction is made by parents or guardians. Most often through the employer. If such a person combines work with several employers, registration is carried out only with one of them. For this purpose, the organization’s accounting department is provided with:

You may like => Benefits for Citizens Voluntarily Departing the Zone with the Right to Resettle

To ensure that no precedents or disputes arise in a tax organization, the papers for the declarant to generate 3-NDFL must be described in the letter (register) attached to it. This process can be carried out in free form, but it is necessary to indicate at what position the form is submitted, and the period for which the profit report is provided, the name of the tax organization and information about the applicant-applicant himself.

They are indicated in the upper right corner of the page. In most cases, the full name of the head of the local tax office, where the documentation will be provided, is indicated.

- Date of preparation of the list and registration number. This information is indicated in the upper left corner of the page.

- Main text.

Register of supporting documents 3 personal income tax form 2021 appendix 7

Another person, for example, your relative or friend, can file a declaration for you. To do this, you need to issue a power of attorney for him from a notary. In this case, you need to add a copy of such a power of attorney to the declaration. And give a copy along with the declaration to the inspector.

With this application, having previously received a notice of the right to deduction from the tax office, you will be able to obtain a deduction from your employer. You can submit statements for the tax office in doc format by following this link.

List of register of documents for deductions

To the regular personal income declaration. persons are not required to provide documents. But to submit an application for a deduction, the register of documents will have to be filled out without fail. After all, the deduction is provided only along with supporting documents. We will understand all the features of the documentation and register for deductions of different types.

Property deduction

The list of documents required to submit form 3-NDFL to the tax office is not defined for an ordinary taxpayer. But according to the letter from the Federal Tax Service of the Russian Federation, there is still a certain register of documents that confirm the right to a property type deduction.

This notice specifies the documents that need to be attached to the 3-NDFL declaration form. These include:

- Agreement on the acquisition of real estate in various forms (purchase or sale, deed of gift, inheritance, etc.).

- Documents on payments of funds to the seller.

- Ownership of real estate, certificate of registration in the state register.

- Agreement on the transfer or acceptance of residential premises.

- Application for redistribution of compensation between husband and wife.

- Mortgage agreement and certificate of interest that has been paid, as well as a loan repayment schedule.

- Certificate filled out in form 2-NDFL.

All of the listed papers are submitted along with the declaration in form 3-NDFL.

Papers for 3-personal income tax on social deduction (inventory for the tax office)

To approve the right to a social deduction, the following documents may be required:

- Certificate of education (original and copy).

- Agreement for treatment at the clinic on an extra-budgetary basis (a photocopy of it is additional).

- Documents confirming all transfers made to charitable organizations.

- Documents on completed payments.

- Various types of receipts for medications.

- Permission issued by the educational institution (photocopy).

- Permission issued by a medical institution (photocopy).

- Extracts on receipt of medical prescriptions and their implementation.

- A document that can confirm that the applicant is related to the person who received treatment or training.

- Help 2-NDFL.

- If required, you must provide a document confirming information about full-time study.

Attention! The papers that are attached to the declaration of standard 3-NDFL for tax with losses on education must necessarily include copies of a certificate or other document that can confirm the right of the institution to carry out educational activities. If there are no licenses, a basic charter can be provided, which approves the status of the institution in which the process of acquiring knowledge takes place.