The minimum wage is set both in Russia as a whole and separately in the regions, taking into account local specifics - the standard of living, prices for goods and services, the cost of living. Moscow turned out to be one of the regions where a tripartite agreement established a regional minimum wage, which, unlike the federal one, has not changed for more than a year.

Let us tell you in more detail what the current minimum wage in Moscow is in 2021 from May 1 and what factors influence its value. Let us immediately note that the minimum wage in 2021, from May 1 in Moscow, is the highest in Russia.

Moscow region minimum wage (figures)

The minimum wage is the minimum wage that an organization or individual entrepreneur (employer) must accrue to employees for the month they have fully worked (Article 133 of the Labor Code of the Russian Federation). What is the size of the new minimum wage in the Moscow region from January 1, 2021?

The minimum wage in the Moscow region has been established since December 1, 2016 in the amount of 13,750 rubles (clause 1 of the Agreement on the minimum wage in the Moscow region between the Government of the Moscow region, the Union "Moscow Regional Association of Trade Union Organizations" and associations of employers of the Moscow region, concluded 11/30/2016 No. 118).

Since January 1, 2021, the minimum wage in the Moscow region has not changed or increased in any way. It remained in the amount of 13,750 rubles.

State employees of the Moscow region are guided by the federal minimum wage (from January 1, 2021 - 9,489 rubles).

Amount 13,750 rub. for the commercial sector, it is a guarantee that any employee, even without any qualifications, has the right to expect to receive a salary in this amount. In this case, it is assumed that the employee has worked for a full month and fulfilled the production plan.

Table of minimum wages by region

| Federal District | Name of the subject of the Russian Federation | Minimum wage from May 1, 2021 (rub) |

| Central | Belgorod region | 11163 |

| Bryansk region | 11163 | |

| Vladimir region | 11163 | |

| Voronezh region | 11163 | |

| Ivanovo region | 11163 | |

| Kaluga region | 11163 | |

| Kostroma region | 11163 | |

| Kursk region | 11163 | |

| Lipetsk region | 11163 | |

| Moscow/Moscow region | 18742/14200 | |

| Oryol Region | 11163 | |

| Ryazan Oblast | 11163 | |

| Smolensk region | 11163 | |

| Tambov Region | 11163 | |

| Tver region | 11163 | |

| Tula region | 13000 | |

| Yaroslavl region | 11163 | |

| Northwestern | Arhangelsk region | 11163 |

| Vologda Region | 11163 | |

| Kaliningrad region | 11163 | |

| St. Petersburg/Leningrad region | 17000/1400 | |

| Murmansk region | 11163 | |

| Nenets Autonomous Okrug | 11163 | |

| Novgorod region | 11163 | |

| Pskov region | 11450 | |

| Republic of Karelia | 11163 | |

| Komi Republic | 11163 | |

| Southern | Astrakhan region | 11163 |

| Volgograd region | 11163 | |

| Krasnodar region | 11163 | |

| Republic of Adygea | 11163 | |

| Republic of Kalmykia | 11163 | |

| Rostov region | 11163 | |

| Republic of Crimea/Sevastopol | 11163/11200 | |

| North Caucasian | Kabardino-Balkarian Republic | 11163 |

| Karachevo-Cherkess Republic | 11163 | |

| The Republic of Dagestan | 11163 | |

| The Republic of Ingushetia | 11163 | |

| Republic of North Ossetia–Alania | 11163 | |

| Stavropol region | 11163 | |

| Chechen Republic | 11163 | |

| Privolzhsky | Kirov region | 11163 |

| Nizhny Novgorod Region | 11163 | |

| Orenburg region | 11163 | |

| Penza region | 11163 | |

| Republic of Bashkortostan | 11163 | |

| Mari El Republic | 11163 | |

| The Republic of Mordovia | 11163 | |

| Republic of Tatarstan | 11163 | |

| Samara Region | 11163 | |

| Saratov region | 11163 | |

| Perm region | 11163 | |

| Udmurt republic | 11163 | |

| Ulyanovsk region | 12000 | |

| Chuvash Republic | 11163 | |

| Ural | Kurgan region | 11163 |

| Sverdlovsk region | 11163 | |

| Tyumen region | 11212 | |

| KHMAO | 11163 | |

| Chelyabinsk region | 11163 | |

| Yamalo-Nenets Autonomous Okrug | 11163 (16299 including surcharges) | |

| Siberian | Altai region | 11163 |

| Transbaikal region | 11490 | |

| Irkutsk region | 11163 | |

| Kemerovo region | 11163 | |

| Krasnoyarsk region | 11163 | |

| Novosibirsk region | 11163 | |

| Oom region | 11163 | |

| Altai Republic | 11163 | |

| Altai Republic | 11163 | |

| The Republic of Buryatia | 11163 | |

| Tyva Republic | 11163 | |

| The Republic of Khakassia | 11163 | |

| Tomsk region | 11163 | |

| Seversk | 11163 | |

| Teguldetsky, Molchanovsky, Bakcharsky and Krivosheinsky districts | 13500 | |

| Alexandrovsky district and the town of Strezhevoy district | 16500 | |

| Far Eastern | Amur region | 11163 |

| Jewish Autonomous Region | 11163 | |

| Kamchatka Krai | 11163 | |

| Primorsky Krai | 11163 | |

| Magadan region/North-Evensky urban district | 19500/21060 | |

| Saha Republic | 11163 | |

| Sakhalin region (depending on the region) | 15600-20800 | |

| Khabarovsk region | 11163 | |

| Southern regions of the Far East | 12408 | |

| Okhotsk region | 15510 | |

| Chukotka Autonomous Okrug | 11163 |

In those regions where the minimum wage is higher than the federal one, a special law was issued, according to which internal indexation of this indicator took place. Municipal authorities look at the standard of living in the city. If it is higher than the country as a whole, then they have to increase the cost of living .

It is currently unknown when the next minimum wage increase will occur. The consequences of this increase are difficult to predict in advance, since it amounted to almost 50%. However, there is a possibility that inflation will rise in the coming months, causing prices to rise.

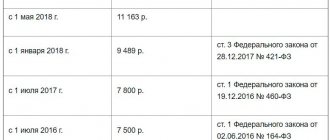

How the minimum wage changed in the Moscow region until 2018

Minimum wage, according to Art. 133 of the Labor Code of the Russian Federation, should be no less than the subsistence level; this parameter was constantly increasing in order to somehow compensate for the increase in the cost of the consumer basket. We present a table that reflects the dynamics of increases in the minimum wage in the Moscow region by year (up to 2021).

Table: Minimum wage by year in the Moscow region

| date | Value, rub. |

| from 01/01/2018 | 13750 (base value) 9489 (for federally funded organizations) |

| from 01.07.2017 | 13750 (base value) 7800 (for organizations financed from the federal budget) |

| from 01.12.2016 | 13750 (base value) 7500 (for organizations financed from the federal budget) |

| from 01.07.2016 | 12500 (base value) 7500 (for organizations financed from the federal budget) |

| from 01/01/2016 | 12500 (base value) 6204 (for organizations funded from the federal budget) |

| from 01.11.2015 | 12500 (base value) 5965 (for organizations funded from the federal budget) |

| from 01/01/2015 | 12000 (base value) 5965 (for organizations funded from the federal budget) |

| from 05/01/2014 | 12000 (base value) 5554 (for organizations funded from the federal budget) |

| from 01/01/2014 | 11000 (base value) 5554 (for organizations funded from the federal budget) |

The table above shows the minimum wage values in the Moscow region for 2014, 2015, 2021, 2021 and 2021. These minimum wage values are applied in the cities: Aprelevka, Balashikha, Bronnitsy, Vidnoye, Volokolamsk, Voskresensk, Golitsyno, Dzerzhinsky, Dmitrov, Dolgoprudny, Domodedovo, Dubna, Yegoryevsk, Zheleznodorozhny, Zhukovsky, Ivanteevka, Istra, Kashira, Klimovsk, Klin, Kolomna, Korolev , Kotelniki, Krasnoarmeysk, Krasnogorsk, Krasnozavodsk, Lobnya, Losino-Petrovsky, Lukhovitsy, Lytkarino, Lyubertsy, Mozhaisk, Mytishchi, Naro-Fominsk, Noginsk, Odintsovo, Lakes, Orekhovo-Zuevo, Pavlovsky Posad, Podolsk, Pushkino, Pushchino, Ramenskoye, Reutov, Sergiev Posad, Serpukhov, Solnechnogorsk, Stupino, Troitsk, Fryazino, Khimki, Chernogolovka, Chekhov, Shatura, Shcherbinka, Shchelkovo, Elektrogorsk, Elektrostal, Yakhroma and other settlements of the Moscow region.

Moscow region and federal minimum wages from January 1, 2018

From January 1, 2021, the federal minimum wage is 9,489 rubles. See “Minimum wage from January 1, 2021.” However, the “minimum wage” of the Moscow region is higher than the federal one. After all, regions have the right to set their own minimum wage, but not less than the federal one (Part 4 of Article 133.1 of the Labor Code of the Russian Federation).

The minimum wage in the Moscow region directly depends on the cost of living for the working population living in this region. Therefore, this amount continues to apply from January 1, 2021:

| Region | Region code | Minimum wage (RUB) |

| Moscow region | 50 | 13 750* |

* The minimum wage includes additional payments, allowances, bonuses and other payments, except for payments in accordance with Articles 147, 151–154 of the Labor Code.

What factors are taken into account when calculating the amount

The value is constantly increasing. For example, over the past ten years it has grown almost 5 times, and in five years it has more than doubled.

Accordingly, the minimum size in the regions was adjusted. It was based on both federal and regional legislation. What primarily influences such changes and what, first of all, are these numbers made up of?

The following factors influence the size:

| Inflation | This is an increase in prices for goods and services throughout the country. At the same time, the same amount of money can buy different quantities of goods before and after the increase. The purchasing power of money falls. Moreover, first of all, low-income citizens who receive wages equal to the minimum suffer here. To support them, the state takes this factor into account when changing |

| The amount depends on the number of unemployed | The more there are, the slower the amount of payment increases, since unemployment benefits, scholarships for students, payments for minor children are directly related to this amount |

| Growth of production in a specific region | Prosperous economic development makes it possible to increase the minimum wage |

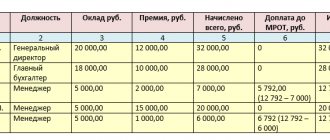

Labor legislation establishes that the total salary cannot be less than the minimum wage. This means that if the salary is less than the minimum, but with a bonus and allowance it is equal or more, then this will not be considered a violation of the law.

The next exception may be the total salary, which is lower due to the fact that the employee was on sick leave or on vacation that was not paid. Or the case when an employee works part-time or part-time. Very often, students and retirees fall into the latter category.

Salaries may be lower than the regional level if the enterprise is financed from the federal budget, and the regional level may be higher than the federal one. Then the enterprise administration can raise wages, but has the right to leave it at the same level.

How to compare the federal and Moscow region minimum wages in 2021

Employers in the Moscow region (organizations and individual entrepreneurs) must set a salary no less than the Moscow region minimum wage (RUB 13,750) only if they have joined the Moscow regional agreement. Those employers who, within 30 calendar days after the publication of the agreement, have not sent a written reasoned refusal to join to the labor authority of a constituent entity of the Russian Federation, will automatically join it. If such a refusal was sent, then the salary in the Moscow region from January 1, 2021 can be compared with the federal minimum wage (9489 rubles). If there was no refusal, then from January 1, 2018, rely on the minimum wage of the Moscow region - 13,750 rubles.

The minimum wage of the Moscow region, applied from January 1, 2021, already includes the tariff rate (salary) or wages under a non-tariff system, as well as additional payments, allowances, bonuses and other payments, with the exception of payments:

- for working in harmful and dangerous conditions;

- combining professions (positions), expanding service areas, increasing the volume of work;

- night and overtime work, work on weekends and holidays.

In other words, for overtime work, you need to pay above the Moscow region minimum wage.

Compare the total payment amount for the month with the minimum wage before you withhold personal income tax. That is, a person can receive less than the minimum wage.

Include in the minimum wage all bonuses and rewards included in the remuneration system. The exception is regional coefficients and bonuses; they are calculated above the minimum wage.

How can an employer refuse the new minimum wage?

Any employer has the right to refuse to apply the Moscow minimum wage. To do this, you need to draw up and send a reasoned refusal to the local branch of the Committee on Labor and Employment. The period is 30 calendar days from the date of publication of the tripartite agreement on the regional minimum wage (Article 133.1 of the Labor Code of the Russian Federation).

In this case, the refusal must be motivated, that is, you will need to indicate the reasons why your organization does not want to pay its employees the regional “minimum wage”. As such reasons, we can indicate, for example, “crisis”, “few orders”, “risk of mass layoffs of employees”. In Moscow, the refusal must be sent to the tripartite commission at the address: 121205, Moscow, st. Novy Arbat, 36/9.

An employer who refuses the minimum wage in Moscow on time has the right to adhere to the federal minimum wage. Now it is 11,163 rubles.

However, please note that paragraph 8 of Article 133.1 of the Labor Code of the Russian Federation obliges the employer to attach a set of documents to the refusal, including proposals for the timing of increasing the minimum wage of employees to the amount provided for in the agreement. That is, even a timely refusal does not mean that you will not have to pay the new minimum wage established on November 1, 2018. The employer is simply given the right to delay its introduction.

Also, Article 133.1 of the Labor Code of the Russian Federation gives the Moscow authorities the right to invite representatives of an employer who has refused to adopt the new minimum wage from November 1, 2021, for consultations. That is, abandoning the Moscow minimum wage threatens a collision with administrative resources.

Possible fines for employers in the Moscow region

For wages below the minimum wage, fines are imposed without proper justification. The company, if the violation is the first, faces a fine from 30,000 to 50,000 rubles. If the violation is repeated – from 50,000 to 70,000 rubles. For an official, the sanctions are accordingly: a fine from 1000 to 5000 rubles. and from 10,000 to 20,000 rubles. or disqualification from one to three years. The same rules apply to an entrepreneur as to an official, only disqualification cannot be applied to an individual entrepreneur (clauses 1 and 2 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

When the Moscow Region minimum wage does not need to be applied

Benefits

To calculate social benefits, use the federal minimum wage, not the regional one. Let us remind you that “minimum” social benefits are received by employees with earnings below the minimum wage or with short work experience (up to 6 months) (clause 1.1 of Article 14 of the Federal Law of December 29, 2006 No. 255-FZ).

Vacation pay

The federal, and not the regional, minimum wage should also be taken into account when calculating vacation pay. The average monthly earnings calculated for calculating vacation pay cannot be lower than the minimum wage (clause 18 of the Regulations, approved by Government Resolution No. 922 of December 24, 2007). Therefore, you need to compare the calculation result with this indicator. And if the comparison is not in favor of the employer, you will have to make an additional payment up to the federal minimum wage.

Insurance premiums for individual entrepreneurs “for themselves”

Insurance premiums for individual entrepreneurs “for themselves” for 2021 are also determined based on the federal minimum wage. In this case, you need to take the value set at the beginning of the year (RUB 7,500). However: from 2021, individual entrepreneurs’ contributions “for themselves” are no longer tied to the minimum wage. The Tax Code - in paragraph 1 of Article 430 - now spells out fixed amounts that all businessmen will have to pay throughout the year. And these fixed payments do not depend on the amount of income. And it doesn’t matter whether the businessman worked at a profit or at a loss. As a general rule, all individual entrepreneurs will have to pay such contributions to the Federal Tax Service budget. See “Insurance premiums for individual entrepreneurs from 2021“.

Living wage in Moscow by year

| Period | Living wage (rub.) | Base | |||

| per capita | for the working population | for pensioners | for children | ||

| for the fourth quarter of 2021 | 15397 | 17560 | 10929 | 13300 | Decree of the Moscow Government dated March 13, 2018 No. 176-PP |

| for the third quarter of 2021 | 16160 | 18453 | 11420 | 13938 | Decree of the Moscow Government dated December 5, 2017 No. 952-PP |

| for the second quarter of 2021 | 16426 | 18742 | 11603 | 14252 | Decree of the Moscow Government dated September 12, 2017 No. 663-PP |

| for the first quarter of 2021 | 15477 | 17642 | 10965 | 13441 | Decree of the Moscow Government dated June 13, 2017 No. 355-PP |

| for the fourth quarter of 2021 | 15092 | 17219 | 10715 | 12989 | Decree of the Moscow Government dated 03/07/2017 No. 88-PP |

| for the third quarter of 2021 | 15307 | 17487 | 10823 | 13159 | Decree of the Moscow Government dated November 29, 2016 No. 794-PP |

| for the second quarter of 2021 | 15382 | 17561 | 10883 | 13259 | Decree of the Moscow Government dated 09/06/2016 No. 551-PP |

| for the first quarter of 2021 | 15041 | 17130 | 10623 | 13198 | Decree of the Moscow Government of May 31, 2016 No. 297-PP |