Fixed contributions

Let’s take, for example, an individual entrepreneur who pays only the minimum fixed contributions established by the state.

There are a majority of such individual entrepreneurs in Russia. To accumulate the 30 points necessary for retirement in the future, an individual entrepreneur must carry out entrepreneurial activities and pay fixed contributions for about 30 years. But even in this case, his pension will be minimal. At 2021 prices, 30 points guarantee a pension of RUB 7,951.39. (5334.19 30*87.24), which does not reach the living wage of a pensioner. That is, having worked all his life as an individual entrepreneur and having retired, the former businessman will receive from the state the more than modest pension he has earned and an additional payment up to the subsistence level.

Pension for individual entrepreneurs (IP) – what to expect?

Every citizen of Russia has the right to a pension.

However, due to changes in the operation of the pension system, pension calculations are often difficult to understand. Today’s article is devoted to the topic of pensions for individual entrepreneurs. So, what can you and I expect from the state?

When registering as an individual entrepreneur, you automatically become payers of contributions to funds - the Pension Fund (for the pension itself) and to the compulsory medical insurance (for social security). These payments are mandatory. They DO NOT depend on whether you are active or not, how much you earn, etc. Their size is fixed. The amount of contributions for 2021 amounted to about 33,000 rubles; more than 26,000 rubles are transferred to the Pension Fund itself. In 2021, it will increase slightly and amount to about 36,000 rubles per year. You can pay contributions either quarterly (which is quite convenient with a simplified taxation system to reduce the amount of tax) or one-time.

There is also the so-called “1%”, this percentage is calculated from the amount of your annual income if it exceeds 300,000 rubles per year. For example, you earned 1,000,000 rubles in 2021, which means you must pay 1% on 700 thousand (1 million - 300 thousand). That is, this amount and whether you will pay it or not depends entirely on your activities. This payment is optional, as we understand. But it is precisely this that allows you to increase your future pension at least somewhat.

To qualify for a pension as an individual entrepreneur, you must be registered with state accounting and control authorities. If you haven’t gone anywhere in person, don’t worry, information about you has already been transferred automatically from the moment you registered as an individual entrepreneur. After you become an individual entrepreneur in the Pension Fund, a personalized personal individual entrepreneur account is opened for you. All amounts of contributions you have transferred will be transferred to it.

IMPORTANT: now contributions must be paid to the tax office, and it will redirect the funds received to the funds. Its size will depend on how much money will accumulate in your account by the time you retire.

If an individual entrepreneur plans to retire after December 31, 2021, then in connection with the adoption of innovations in legislation, you must adhere to the following rules, according to which the time for retirement is gradually postponed:

| Planned retirement under the old law | Retirement age under the new law | Year of retirement under the new law | |

| Men | Women | ||

| I half of 2019 | 60 + 1 – 0,5 = 60,5 | 55 + 1 – 0,5 = 55,5 | II half of 2019 |

| II half of 2019 | I half of 2020 | ||

| I half of 2020 | 60 + 2 – 0,5 = 61,5 | 55 + 2 – 0,5 = 56,5 | II half of 2021 |

| II half of 2020 | I half of 2022 | ||

| 2021 | 60 + 3 | 55 + 3 | 2024 |

| 2022 | 60 + 4 | 55 + 4 | 2026 |

| 2023, etc. | 60 + 5 | 55 + 5 | 2028, etc. |

That is, men born after 1963 and women born after 1968 will retire at 65 and 60 years old, respectively.

If you were born in 1967, then the pension is formed from the funded and insurance parts (as it was before), which means, in order to receive it, you need to have at least 7 years of insurance experience in 2016, earn an individual pension coefficient, the size of which is from On January 1, 2015, it is set at no lower than 6.6 with a subsequent annual increase of 2.4 points and by 2025 it will be 30 points.

You can calculate the size of your future pension on the PFR website yourself, using the calculator on the official website: https://www.pfrf.ru/eservices/calc/

For an individual entrepreneur, the insurance period is the time during which he personally transferred insurance contributions to the Pension Fund for himself. Employee contributions are not taken into account when determining your pension. The insurance period also includes periods of sick leave, military service (for men), and for women, periods of maternity leave (but not more than 3 children, 1.5 years each maternity leave).

IMPORTANT: due to changes in legislation, an individual entrepreneur cannot count on a high pension; it will be approximately equal to the size of the social (minimum) pension!*

Note*: social pension in 2021 is 9,045 rubles per month.

This is explained as follows: the individual entrepreneur contributes a fixed amount of 26,545.00 rubles to the Pension Fund of the Russian Federation (in 2021) if the income does not exceed 300,000 thousand, the fixed contribution is calculated from the minimum wage (although it is planned to delink it from it), which means that for the year you can get a maximum of 1.12 pension points . A citizen working for 80,000 rubles a month annually receives 8.7 points (the maximum amount). That is, an individual entrepreneur can increase his pension only if he honestly reflects income of more than 300,000 rubles and deducts +1% of this amount. And then, the final increase in pensions will not be very significant.

CONCLUSIONS: if you, as an entrepreneur, are thinking about your pension, then you should take care in advance of increasing your assets (purchase of real estate, deposits, other forms of storing funds). In today's realities, citizens - individual entrepreneurs cannot count on a pension on which they can really live.

The author is a leading lawyer at a family law firm from Pyatigorsk, Victoria Leonidovna Suvorova.

Voluntary contributions

To influence the size of his future pension, an entrepreneur can pay a voluntary fixed payment in an increased amount .

The minimum amount of voluntary insurance contributions is determined as the product of the minimum wage at the beginning of the year and the insurance premium rate, increased by 12 times. The maximum amount is calculated from eight times the minimum wage.

For 2021, the minimum contribution is 29,779.20 . (11280 *22%*12).

The maximum contribution amount for 2021 is RUB 238,233.60. (11280*22% *12*8).

Individual entrepreneur pension in Russia in 2021

How to apply for a pension in 2021? If an individual entrepreneur works under a standard employment contract, documents are drawn up as for an ordinary pensioner. That is, the pension fund accepts an application written in free form, considers it within 10 working days and makes a decision. After a positive decision is made, the SP is accrued starting from the next month.

If the package of documents does not contain the required certificate, the consideration of documents is postponed - but not more than for 3 months. Please note that different taxation systems require special documents: UTII, simplified tax system.

Indexing

Any type of pension payments is indexed, as this is associated with rising inflation. For working pensioners, the insurance part of the joint venture will not be indexed from 2021. To find out the exact amount, you need to contact your Pension Fund branch.

How is it calculated

How is an individual entrepreneur's pension calculated? Starting from 2015, pension points are taken into account when calculating the amount. Work experience is added to the points, that is, working out the required number of years. If you can’t figure out how to calculate your pension yourself, you can go to the State Services website or make a request to your Pension Fund.

The size of the future pension is influenced by:

- the amount of insurance payments over the years of work;

- length of work experience;

- time of non-use of pension.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

If everything is clear with the first two points, then the third requires clarification. The longer an individual entrepreneur works and does not use a pension, the greater its value. That is, if an individual entrepreneur has reached retirement age, but continues to work and pay insurance premiums, the amount of his future pension will increase by 6-7% per year.

Online pension calculator for individual entrepreneurs

The insurance pension for individual entrepreneurs is calculated individually.

To do this, use the formula: (IPK x pension point) + (FV x pension increase factors) = pension amount.

IPC is an individual pension coefficient, FV is a fixed part of the insurance pension.

Calculation example

If the IPC is 50, the cost of one pension point in 2021 is 98.86 rubles, FV = 6044.48 rubles, then we get the following calculation: (50 x 98.86) + 6044.48 = 10987.48.

This calculation does not take into account the coefficients for increasing the joint venture. The premium coefficient is taken into account only when applying for an insurance pension late. For example, if you apply to the Pension Fund 5-6 years later than retirement age, the amount of payments will increase by more than 40%.

Where do the accruals come from and in what amount?

All contributions paid during your working life. That's 22 percent of every earnings that goes into the pension fund. Of them:

- 6% towards the future base portion

- 10% towards the insurance portion

- Another 6% goes to the savings account

But this is true if you were born after 1967. If later, then 16% will go entirely to the pension fund.

The situation with non-profit structures (NPF) is interesting. The position of the state now is that they are trying to convince citizens to make a choice in favor of the state fund. There is even a moratorium on the funded part. This has been introduced since 2014. And it is positioned as a way to protect the citizens of our country, because some non-state pension funds cannot guarantee that you will then receive benefits from them. How legal this is and how true it is is unclear. But that is why 16 percent after 2014 are deducted towards the insurance share.

But in the case when the agreement with the NPF is signed earlier, the savings remain in this fund.

To calculate the amount of your hypothetical pension, you can use the formula:

Pension = sum of pension points * cost of one point per year when the person will be assigned a pension + fixed rate.

For example, the cost of this one point in 2017 is 78.57 rubles. And the size is fixed. parts - 4558.93 rubles.

There is another way to calculate your future pension - use a special service that will calculate everything for you. You can find it on the website of the Russian Pension Fund.

What's good about being an NAP payer?

Firstly, it partly reconciles us with an unpleasant reality. In recent years in Russia the concept of “law” has become increasingly unfashionable. And power voluntarism is becoming more and more revealing. Millions of citizens do not have their own representation in legislative bodies, because the institution of elections has become almost decorative.

And people who are inclined to independently look for a place in the sun are more likely to profess the concept of “no taxes without representation.” The status of an NAP payer allows you to limit your relations with the state to paying 4% of income if you work with individuals, and 6% if you sell something to companies. This is divine.

Secondly, self-employment implies a high degree of freedom of action. Of course, few people appreciate it. There is one statement that is often attributed on the Internet to Sigmund Freud or the British politician and writer Benjamin Disraeli, although it belongs to the playwright Bernard Shaw:

“Freedom means responsibility. That's why most people are afraid of freedom."

The self-employed are, as a rule, those who not only are not afraid of it, but, on the contrary, are inspired by it in their work. The psychological type of the self-employed is most often a “single craftsman”. Such a person has a business and knowledge about it in his hands, he is constantly growing as a specialist (well, ideally). He can do his job alone, without hired employees. And the “output” of his professional efforts is sufficient to ensure earnings at least equivalent to the median salary.

Being self-employed means being free at your own risk. Never hear shouts from bosses, be able to cut off communication with inadequate clients at the first sign of impending problems. Finally, manage your own working time.

The self-employed person is like the Witcher from the famous epic by Andrzej Sapkowski. He comes, does his job, receives a minted coin and goes off to wherever he sees fit. Not forgetting, of course, to pay the minimum tax to the local autocrat-owner of the palace, the landlord, or the Tax Service of the Russian Federation.

A “Witcher” can now be an intelligent physics tutor, a psychologist, a handmaker, a journalist, an apartment renovation specialist, and whoever else. Even a master who produces gusli, simultaneously recording Slavic “heroic music” and making money from it (this is not a joke, there is such a person - self-employed Muscovite Kirill Bogomilov, who has accumulated 80,000 subscribers on YouTube alone).

The “NPD payer” mode is beautiful in its own way and full of harsh romance. However, if you turn it on in your life, you automatically launch the “socially unprotected” mode. Of particular concern is old age - a time when deteriorating health can take your business away from you.

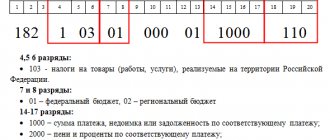

How to make insurance premiums

When it becomes necessary to generate payment documents in order to transfer funds towards the insurance premium, then you:

- mark yourself as the policyholder

- select a subject of the Federation

- Indicate payment of insurance premiums

- designate the fund to which these contributions will be transferred

- indicate your status as an individual entrepreneur

- Please indicate all the details of the fund correctly (can be found on the fund’s website)

Also, do not forget to fill out the required fields:

- OKTMO (All-Russian Classifier of Municipal Territories)

- Full name

- Address

- Your registration number in the pension fund

- amount of payment

Don't forget to keep your payment receipt.

It will not be superfluous to know that if you have the status of an individual entrepreneur, pensions will be indexed every year. But if you continue to work while retired, then indexation does not apply to you. At least that's the case in 2021.

Early retirement for individual entrepreneurs

When work activity is forcedly stopped, we can talk about early start of accruals. But there are also limitations here. A male entrepreneur must reach the age of 58 by this time. Woman - 53 years old. And, most importantly, the work experience must be at least 25 and 20 years, respectively.

If you are an individual entrepreneur, then you do not need to submit reports to the pension fund every month. However, in the case of hiring workers, you are required to register there and obtain employer status. All forms and application forms for obtaining employer status can be found on the official website of the Pension Fund of Russia, and detailed explanations can be found on our website.