Government procurement is a federal system of placing orders for municipal or state needs. Large volumes are announced here for suppliers of goods and providers of services, and small businesses enjoy special privileges in the competitive selection. In this article you will find a sample declaration of affiliation with small businesses, which must be submitted when participating in auctions along with other documents.

Why is a declaration needed?

Numerous innovations in the field of public procurement have not affected the state requirements for working with entrepreneurship. Government customers are required to enter into government contracts with small businesses and socially oriented non-profit organizations. By law, at least 15% of the total volume of purchases is carried out among small businesses. It turns out that documents confirming membership in a SME are declarations, statements or other papers that are used as a purchase ticket with restrictions and advantages.

Use free instructions from ConsultantPlus experts to correctly fill out the declaration of belonging to a small business.

Validity period for an extract from the SME register

The validity period of the extract is established by law at the federal level only in one case - participation in public procurement. The document must be generated no later than 6 months before the date of publication of the notice in the unified information system (UIS). In other cases, regulatory documents do not provide for a specific validity period for the extract.

Thus, when opening a current account for an individual entrepreneur, many banks require an extract from the Unified State Register of Individual Entrepreneurs to be no older than 1 month.

Some regions may have regulations establishing the validity period of the statement. Usually it ranges from 10 days to 3 months.

Thus, the validity period of the extract must be clarified with the organization where it needs to be submitted.

Who belongs to the SMP

In order for a legal entity or individual entrepreneur to be considered a small business entity, they must meet certain criteria. They are regulated by Law No. 209-FZ of July 24, 2007. We have collected information in a table that will help you figure out who belongs to small and medium-sized enterprises.

| Criteria for inclusion in the SMP | Microenterprise | Small business | Medium enterprise |

| Average number of employees (for the past calendar year) | No more than 15 people | No more than 100 people | Up to 200 people |

| Income from business activities (for the past calendar year) | No more than 120 million rubles | No more than 800 million rubles | No more than 2 billion rubles |

| Share of participation of foreign persons | No more than 49% | ||

| Participation share of persons other than NSR entities | No more than 49% | ||

| Status of the Skolkovo project participant | Available | ||

| Presence of founders of organizations providing state support for innovation activities | Available | ||

IMPORTANT!

Individuals do not apply for the status of a small business entity. The law defines a closed list of persons who are assigned this status.

How to get into the EMS register and what information does it contain?

The database is created automatically based on:

— information on tax reporting (including under special regimes) that organizations/individual entrepreneurs submitted to the tax authorities for the previous calendar year;

— information posted in the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs;

— information received by the Federal Tax Service from other organizations as part of information exchange.

Thus, in order to get into the register, you do not need to provide any documents.

The database also contains additional information. They can be submitted using a special electronic service. This is information about the types of products manufactured, existing experience, as well as participation in partnership programs.

The register includes an extensive amount of data not only about the category of SME subject (micro, small or medium-sized enterprise), but also about types of activities, products, licenses, participation in the procurement of goods, works, services for government needs and some types of legal entities.

The list of such information is compiled on the basis of current legislation: Part 3 of Article 4.1 No. 209-FZ (as amended on December 29, 2015 No. 408-FZ) and must contain:

- Name of the legal entity or full name. individual entrepreneur;

- TIN;

- Location of the legal entity or place of residence of the individual entrepreneur;

- Date of entering information about a legal entity or individual entrepreneur into the register;

- SME category (micro, small or medium enterprise);

- A note that the legal entity or individual entrepreneur is a newly created legal entity/newly registered individual entrepreneur;

- Information from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs about codes according to the All-Russian Classifier of Types of Economic Activities;

- Information from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs about licenses received.

Some information can be entered into the database on a voluntary basis:

- information about the products manufactured by the legal entity/individual entrepreneur (in accordance with OKPD) indicating the classification of such products as innovative and high-tech;

- information on the inclusion of a legal entity/individual entrepreneur in partnership programs between legal entities that are customers of goods, works, services in accordance with No. 223-FZ of July 18, 2011.

- information about contracts concluded in the previous year by a legal entity/individual entrepreneur in accordance with 44-FZ and (or) 223-FZ.

An individual entrepreneur can submit this information electronically by signing the document with an enhanced qualified electronic signature on the official website of the Federal Tax Service.

In order for the customer to get acquainted with the SMP entity and get in touch with it, you can enter additional information: contact information (email address, phone number, website). To do this, you need to enter the SME information transfer service, log in using an enhanced qualified electronic signature and fill out the proposed form.

Who are SONO

Socially oriented non-profit organizations operate in accordance with Law No. 7-FZ of January 12, 1996. Not all non-profit organizations are socially oriented. According to the rules of Art. 2 and art. 31.1 7-FZ, they must deal with:

- social services and support for citizens;

- providing assistance to victims of natural and man-made disasters;

- environmental protection and animal welfare;

- activities in the field of education, science, art, healthcare;

- provision of legal assistance on a preferential or free basis.

How to obtain an extract from the register of SMEs?

It's easy to get an extract. You need to go to the website and enter the TIN or OGRN of the organization/individual entrepreneur in the search bar. You can also use the advanced search.

If information about it is contained in the database, it will appear on the results page. If necessary, you can generate a document in Excel format.

Advanced search offers the following filtering system:

— type of subject;

— subject category;

- region, district, city, locality;

— date of inclusion in the register;

— availability of licenses, concluded contracts, production of high-tech, innovative products, participation in partnership programs;

- activities;

— types of products;

— types of licensed activities.

How to prepare confirmation of membership in the SMP

44-FZ does not contain a form for declaring that a participant in the procedure belongs to the SMP, as well as requirements for it. In 2021, in electronic procurement there is no longer any need to attach a separate document confirming affiliation with small businesses. Now it is generated automatically on electronic platforms. For example, to confirm membership in a small business at the RTS-Tender, when submitting an application, click on the button “Generate a declaration of SMP affiliation” or “Generate a SONO declaration.” The procedure is the same at other sites.

But not all purchases were transferred to electronic form. The right to purchase in paper form remains only for:

- ensuring the customer’s activities abroad (Article 75, 111.1);

- provision of emergency, emergency medical care (Article 76);

- providing humanitarian assistance, eliminating the consequences of natural and man-made emergency situations (Articles 80, 82);

- closed procedures (Article 84);

- orders by decision of the government of the Russian Federation (Article 111).

If you participate in such procurements, you will have to develop and submit a living document confirming your affiliation with the SMP in accordance with 44-FZ. Until November 27, 2020, Government Resolution No. 1352 of December 11, 2014 on procurement among small businesses by certain types of legal entities approved the form of a document on membership in SMEs in procurement under 223-FZ. Now the form has lost its force. Now the form of declaration of compliance of the procurement participant with the criteria for inclusion in the SMP is approved, for example, by the regulations of the Roscosmos state corporation dated 08/25/2020. Use it to develop a sample.

This form is not required to be used; there are suppliers who confirm the status in any form. For example, they use an SMP extract from a special registry. It is administered by the Federal Tax Service. This list includes all organizations and individual entrepreneurs that have this status. When considering applications from participants, customers have to check whether they belong to small businesses, since in paragraph 1 of Art. 3 209-FZ dated July 24, 2007, it is stated that the subject of the SMP is a company or individual entrepreneur, information about which is in this register.

To check, just enter the TIN or the name of the applicant into the search bar. After this, the SMP declaration from the tax website will become available for downloading.

Here is an example of such an extract.

IMPORTANT!

They declare the status of a small business only in the case of tenders, the documentation of which is marked “for NSR entities.” In other cases, this status does not provide any benefits.

What is the register of small and medium-sized businesses?

The Unified Register is a publicly accessible open information database about small and medium-sized enterprises (SME), with the help of which the SSE status of a particular business entity is confirmed.

Creating a database is a systemic solution that allows you to:

- reduce the costs of entrepreneurs and government agencies to confirm the status of SMEs for participants in support programs;

- organize the procedure for the formation by customers and credit institutions of a list of SMEs for their participation in the procurement of goods, works, services, as well as for the provision of credit guarantee support;

- implement “supervisory holidays” for small businesses;

- improve the quality of development of measures to support small and medium-sized businesses;

- provide complete information about the types of activities of NSR entities and their products (including innovative products, high-tech products).

From August 1, 2021, individual entrepreneurs do not need to submit documents confirming their SME status when applying for support measures under state or municipal programs for the development of small and medium-sized businesses.

The base has been operating since August 1, 2021 (Part 6 of Article 10 No. 408-FZ of December 29, 2015). The database is controlled by the Federal Tax Service (FTS of Russia) (Part 2 of Article 4.1 No. 209-FZ of July 24, 2007, Regulations on the Federal Tax Service, approved by Decree of the Government of the Russian Federation of September 30, 2004 No. 506).

Information is updated on the 10th of every month on the Federal Tax Service website (https://rmsp.nalog.ru/) and is in the public domain for 5 years from the date of its publication (Part 9 of Article 41 No. 209-FZ).

Information about legal entities and individual entrepreneurs included in the register can be found in the corresponding service on the official website of the Federal Tax Service, which is available from August 1, 2021.

What to do if the company is not included in the register

If the register does not contain information about your company or the information needs to be corrected, submit an application through a special service on the Federal Tax Service website. As a rule, information about small enterprises is not included in the register due to the discrepancy between income and the average number of employees and the limit values. If eligibility for inclusion in the list or inaccuracy of data is confirmed, the service will make the required changes.

Author of the article: Valeria Tekunova

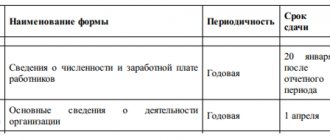

How can small businesses make it easier to keep records and submit reports? — try the modern cloud service Kontur.Accounting. Simple accounting and tax accounting, tax calculation, salary, automatic generation of reports and sending via the Internet. The first 14 days of using the service are free.

Try for free

Why do we need a registry?

Using a single register, you can quickly and without financial costs obtain information about a specific company or individual entrepreneur. For these purposes, the register is used by state and municipal authorities, as well as potential counterparties. In addition, the register is used when compiling a list for participation in government procurement or contracts.

You can check the status of a legal entity or individual entrepreneur on the official website of the Federal Tax Service. In response to your request, you will receive an electronic statement. Presence in the register indicates the right of a company or individual entrepreneur to benefits and concessions provided for small and medium-sized businesses. To confirm these rights, you only need an extract from the SME register; no other documents are required.

SMP declaration form

The SMP declaration under 44-FZ does not have a unified form; tender participants develop it independently. The document must contain the conditions under which the organization or individual entrepreneur is recognized as a small enterprise. These criteria are given in Art. 4 of Law No. 209-FZ of July 24, 2007 (as amended on December 30, 2020). The SMP declaration is drawn up by the tender participant, and it is he who will be responsible for the accuracy of the information specified in it. The document must be certified by the signature of the head of the organization or entrepreneur, and a seal (if any).

When drawing up a document, you can take as a basis the form that was previously contained in the Decree of the Government of the Russian Federation of December 11, 2014 No. 1352 or draw up your own declaration form.

You can also use an extract from the Unified Register of SMEs obtained on the official ]]>website of the tax service]]>. In the search line, you should enter any of the details - INN, OGRN, OGRNIP, or the name of the subject/full name of the entrepreneur, and then click “Find”. The system will automatically generate a statement in Excel format, which can be downloaded as a file or printed.

For the SMP declaration (44-FZ), a sample will be given below.