novyy_blank_rascheta_strahovyh_vznosov_2020.jpg

Related publications

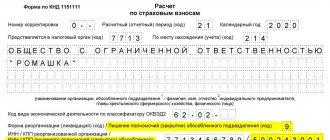

Employers submit reporting on contributions quarterly. The new form for calculating insurance premiums in 2021 was approved by Order of the Federal Tax Service dated September 18, 2019 No. ММВ-7-11/ [email protected] The scope of the calculation and the composition of the information reflected in certain fields of the form have been changed. The clarifications practically did not affect the procedure for indicating information about employees, so the new form should not cause difficulties when filling out.

Unified calculation of insurance premiums: form

A unified calculation of insurance premiums is provided instead of such forms as: RSV-1, 4-FSS, RSV-2 and RV-3. These changes have 3 main goals:

- reporting optimization;

- reducing the administrative burden on enterprises, because the number of regulatory bodies has decreased;

- improving the quality of inspections.

Unified calculation of insurance premiums 2021 form, approved by Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551, is a document of 24 pages and several sections:

- title page;

- sheet for persons who are not individual entrepreneurs;

- Section No. 1, which consists of 10 applications;

- Section No. 2 plus appendix;

- Section No. 3 – includes personal information of individuals for which the policyholder is accountable.

It is not necessary to fill out and submit absolutely all sections and applications to the Federal Tax Service. The table provides information about who fills out and submits which sections of the new report:

When filling out data on the DAM form, they use an insurance premium card containing information about all charges and remunerations to individuals. The accountant must also understand what the insurance premium base is and make the necessary calculations:

From what period is the new form used?

“Calculation of insurance premiums” is changing from 2021. Form, approved by order No. ММВ-7-11/ [email protected] , begins to operate with the report for the 1st quarter of 2021. In addition to clarifying the form itself, the document established a new procedure for filling it out and an electronic format for submission to the Federal Tax Service.

Changes in reporting are designed to take into account all the innovations in terms of calculating payments and take into account the already established rules for the application of Chapter. 34 Tax Code of the Russian Federation.

For the first time, employers submit a “Calculation of Insurance Contributions” in April 2021, reporting for the 1st quarter of 2021. You can download the new form at the end of our article.

What functions are retained by the FSS in 2021?

Tax authorities will have the right to conduct audits on the payment of insurance premiums from January 1, 2021. It is strange to believe that already on January 11, the tax inspectorate can come with an audit and thoroughly check the contributions. Therefore, the FSS of Russia and the tax inspectorate have the right to conduct inspections jointly.

Checks the FSS

From January 1, 2021, the Federal Social Insurance Fund of the Russian Federation retained the authority to verify contributions to compulsory social insurance in case of temporary disability and in connection with maternity.

Collected by the tax office

But the Federal Tax Service of the Russian Federation will collect the arrears in insurance premiums for temporary disability and in connection with maternity, which arose as of 01/01/2017, as well as based on the results of desk and field inspections.

What has changed in the reporting procedure?

Starting with reporting for the 1st quarter of 2021, employers who accrued payments to more than 10 individuals in the reporting period must report insurance premiums electronically. If there were less than 10 employees, the form can be submitted in paper form or electronically - whichever is more convenient for the reporting person. Let us remind you that in 2019, employers with an average number of fewer than 25 people have the right to report on paper.

Calculation of insurance premiums in 2021 using the new form is simplified for those employers that do not operate and do not charge contributions to employees. They just need to submit the following calculation sheets to the Federal Tax Service (letter of the Ministry of Finance dated 10/09/2019 No. 03-15-05/77364):

section 1 (only “payer type” with code 2 is indicated);

section 3 (zero with dashes).

Applications that were previously submitted by all taxpayers are no longer completed in the absence of assessments.

Seminar No. 3. “Reform of the use of cash registers: Everything about online cash registers that you wanted to know, and what you didn’t even know about”

Live broadcast: December 3 from 13:45 Moscow time, recording the next day. Lecturer: Klimova M.A.

Lecturer on CCP Reform in 2 minutes – watch:

Correct execution of cash transactions is very important for every organization. It is especially important to avoid mistakes in connection with the changes that have entered into force. Also, mandatory online cash registers will be introduced very soon, which means that control over business income is becoming stricter. The legislation regarding liability and fines that threaten for violations in the field of cash transactions has also changed.

How to live in the new box office reality? How does the system “involved” in online cash registers work? Can we use “old” cash registers from 2017? Who is obliged to apply from 2021 online cash registers? Join our online seminar and you will get all the answers to your questions.

Seminar program:

1. New meaning of the concept of “cash register”:

- Expanding the scope of application of cash register equipment

- The specifics of using cash register systems for online purchases with online payment using electronic means of payment (electronic money, bank cards) when using: – payment terminals – vending machines – when performing intermediary functions and the functions of a payment agent.

2. How does the system “involved” in online cash registers work?

- links in the chain: buyer, seller, fiscal data operator, tax authority

- the role of each link, the interaction between them

- risks for the seller at every stage of interaction

- use by tax authorities of revenue data for the purposes of tax control, identification of tax schemes, etc.

- the operational nature of the implementation of control and supervisory functions in the new conditions.

3. New requirements for CCP:

- What fundamentally distinguishes online cash registers?

- what are they?

- how to choose a model?

- Is it possible to upgrade your models or will you have to buy new cash registers? How much does it cost?

- will there be subsidies for small businesses?

- what are the modernization activities?

- mandatory re-registration of cash registers during modernization;

- new rules for accounting cash registers with the tax authorities: what is important for the user to know?

- further maintenance of online cash registers

- fiscal storage. Fiscal attribute key.

4. Transfer of fiscal data:

- user tasks

- necessary instructions for employees entrusted with CCP

- consequences for the user of short-term and long-term data transmission failures.

5. Cash receipts and BSO, new types of fiscal reports:

- User access to sales information on their computer screen

- completely new requirements for the details of cash receipts and BSO: work for your programmers;

- Where does the sphere of influence of tax authorities and OFD end and your “creativity” begin?

- problem of compatibility of cash register software with accounting software

- sending electronic receipts to customers: what will this lead to?

6. Control functions of tax authorities:

- new powers;

- interaction between tax authorities, OFD, banks in the implementation of control functions;

- frequency of inspections;

- new types of violations for which administrative fines may be imposed;

- a sharp increase in the amount of penalties;

- increasing the statute of limitations;

- possibility of mitigation of punishment.

7. Dates for entry into force of innovations:

- Cancellation of benefits for individual entrepreneurs “patented”, “imputed”, those who provide services to the population and issue BSO.

- Tricky moments.

8. Primary documentation in the scope of application of CCP:

- rejection of unified CM forms - how to do this without losses and conflicts with inspectors;

- where will all the necessary information be stored now?

- processing returns in the old way is almost no longer relevant - how to develop a new optimal procedure for yourself and your online cash register?

- necessary local regulations and instructions for workers in the new reality.

9. Answers to questions

List of new changes for Online cash registers:

1. The list of fiscal data operators from which you can choose has been expanded. The list as of 10/18/2016 is as follows >>

2. A large number of online cash register models are included in the Cash Register Register. These models are already on sale. View list >>

3. The tax authorities invited programmers of CCP users to begin developing the software necessary for generating new-style fiscal documents. At the forum of the Federal Tax Service of Russia, a draft departmental Order “On approval of the formats of fiscal documents, storage periods for details of fiscal documents, additional details of fiscal documents, additional requirements for the procedure for generating and processing fiscal data” was presented, and a discussion of this document, which is very interesting for programmers, is being held. Read discussion >>

5. Letter of the Federal Tax Service of Russia dated September 26, 2016 N ED-4-20/ [email protected] and Letter of the Ministry of Finance of Russia dated September 16, 2016 N 03-01-15/54413 were issued, making us think about organizing primary documentation for online cash registers and approving the refusal from the use of CM forms

6. A service for checking online cash register receipts has already appeared on the Federal Tax Service website. This service will help customers verify the authenticity of checks punched through the online cash register. Buyers are also encouraged to complain to sellers if something goes wrong.

Thus, in addition to strengthening state control, sellers have another headache - “vigilant” buyers. One complaint can cost you a fine of 10,000 rubles. At the seminar we will discuss how to resist such onslaught. Go to the online cash register receipt checking service >>

To view in full screen, click on the icon in the lower right corner of the player.

Excerpt from the recording – Requirements for checks and BSO

Excerpt from the recording – Replacing cash registers

Dear Colleague, right now you can apply for a full recording of this seminar using the Online Cash Desk. Total duration – 3 hours

. Apply for online seminars >>

New in the form of calculating insurance premiums in 2021 for certain categories of payers

Some innovations apply only to certain policyholders. In particular, in the new form:

A field for a closed (liquidated) separate division appeared on the title page. In case of adjustment, the form for the unit deprived of the powers of the insured is submitted by the parent organization to its Federal Tax Service Inspectorate in the designated cell.

Peasant farms fill out section 2 of the report. In Appendix 1, they now need to indicate the details of the identity document (code, as well as series and number) for each member of the household, including the head of the peasant farm.

Organizations are obliged

- Pay insurance premiums.

- Keep records of the amounts of calculated insurance premiums for each employee in whose favor payments and other remunerations were made.

- Submit calculations of insurance premiums to the tax office.

- Submit to the tax office and inspectors the documents necessary for the calculation and payment of insurance premiums.

- Submit to the tax office and inspectors information about insured persons in the individual (personalized) accounting system.

- Keep documents necessary for calculating and paying insurance premiums for six years.

- Report to the tax office about your separate divisions, including branches and representative offices.

- Perform other duties.

See dues and reporting deadlines here

Changes to the main part of the form

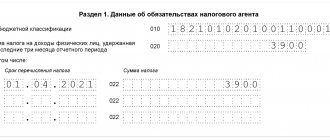

Most of the clarifications concerned section 1 of the Calculation. What has changed:

a cell has been added - payer type (“1” - if payments to individuals were accrued, “2” - if they were not);

in Appendix 2 for social insurance, the field “Payer Tariff Code” was included, the line “Number of individuals from whose payments insurance premiums were calculated” was added; the policyholder must fill out as many applications 2 as the applicable tariffs;

previous appendices 7, 8 were deleted - on the basis of Article 427 of the Tax Code of the Russian Federation, which abolished reduced contributions for a number of taxpayers;

subsections 1.1 and 1.2 of Appendix 1 are supplemented with a line that specifies expenses accepted for deduction under copyright agreements or related to intellectual activity (according to paragraph 8 of Article 421 of the Tax Code);

in subsection 1.3.2, the basis for filling out the calculation has been removed, since the indicators must correspond only to the special assessment (the working conditions class code is inserted);

Appendix 7 is reserved for reduced contributions when creating animated audiovisual products (clause 15, clause 1, article 427 of the Tax Code).

Some of the changes were of a technical nature - for example, in Appendix 10 the lines were renumbered, subsection 1.4 was moved to 1.1, in Appendix 5 the codes were adjusted (for payers on the simplified tax system and UTII code “01”).

The total number of applications has decreased - instead of 10 there are now 9.

Reporting on insurance premiums can be checked and clarified

From the beginning of 2021, insurance premiums are paid to the Federal Tax Service, and they are regulated by the rules of the Tax Code. The Calculation form for insurance premiums (KND 1151111) was approved by Order of the Federal Tax Service dated October 10, 2021 No. ММВ-7-11 / [email protected] (hereinafter referred to as the Calculation). Despite the fact that organizations have already submitted calculations for both the 1st quarter and the first half of the year, the number of issues related to the calculation of contributions and the preparation of these reports is not decreasing. The issue of checking reports prepared for submission remains relevant for payers.

For these purposes, the payer can use control ratios. Control ratios for insurance premiums have been developed by two departments: the Federal Tax Service of Russia. The first of them replaced the previously existing March ones. The changes in them mainly affected the ratios of indicators within the Calculation, but new control points also appeared. And the latter will now allow you to check the calculations regarding the costs of compulsory “hospital” insurance, that is, the correctness of filling out appendices 3 and 4 to section 1 of the Calculation.

Since the June document of the Federal Tax Service does not include control ratios for the calculation of insurance premiums, which were prepared by the Federal Tax Service, when checking the Calculation, the payer needs to use letters from two departments.

In this article, we will look at how to correctly reflect in the Calculation the amount of the received compensation for “sickness” contributions, as well as use control ratios for verification and submit an updated Calculation.

We comply with control ratios

Control ratios are a method of mathematical data verification that reflects the correctness of the data entered in the declaration by comparing certain indicators. They are presented in the table, which contains:

- formulas for control ratios indicating the lines and sheets of the calculation;

- description of possible violation of tax laws;

- actions of the inspector upon detection of this violation.

Control ratios of the Federal Tax Service allow tax specialists to compare data both within the Calculation and with data from other reports, for example 6-NDFL. If the control ratios are not observed, the tax authorities will send the insurance premium payer a request to provide explanations or make corrections within five working days.

The payer of insurance premiums can independently check his statements.

For example, within the Calculation the equality of the following quantities must be observed:

- indicator in column 1 of line 250 of section 3 of the Calculation. It reflects the amount of payments in favor of an individual for the last three months of the reporting (settlement) period;

- indicator in column 2 of line 030 “Amount of payments and other remuneration calculated in favor of individuals” for all values of field 001 of subsection 1.1 of Appendix 1 to Section 1 of the Calculation.

If the equality is not satisfied, then you need to find the error and correct the Calculation.

The payer must also pay attention to the implementation of inter-document control relationships.

For example , according to the control ratios, if the organization did not pay dividends that are not subject to insurance premiums, line 020 “Amount of accrued income” of section 1 6-NDFL should be equal to line 050 “Base for calculating insurance premiums” gr. 1 other 1.1 rub. 1 Calculations.

If dividends were paid, then, in the opinion of the Federal Tax Service, the amount of accrued income that is subject to personal income tax, minus dividends, should be greater than or equal to the amount of payments and other remuneration that are subject to insurance contributions for compulsory pension insurance.

Art. 020 rub. 1 6NDFL - Art. 025 rub. 1 6NDFL >= Art. 050 gr. 1 other 1.1 rub. 1 Calculations

But there may be exceptions.

In some situations, the amount of income on line 020 “Amount of accrued income” of section 1 of the 6-NDFL calculation will be less than the amount of income on line 030 “Amount of payments and other remunerations calculated in favor of individuals” of column 1 of subsection 1.1 of Appendix No. 1 to section 1 of the Calculation .

And that's why:

- in the Calculation on line 030 “Amount of payments and other remuneration calculated in favor of individuals” of subsection 1.1 of Appendix No. 1 to section 1, among other things, payments are reflected that are fully or partially exempt from contributions under Art. 422 of the Tax Code of the Russian Federation.

At the same time, they are indicated in line 040 “Amount not subject to insurance contributions” of this subsection. After all, as follows from the control ratios, the basis for calculating insurance premiums for compulsory health insurance – line 050 of subsection 1.1 of section 1 – is defined as the difference between lines 030 “Amount of payments and other remuneration calculated in favor of individuals” and 040 “Amount not subject to taxation” insurance premiums."

- in 6-NDFL in line 020 “Amount of accrued income” of section 1, completely tax-free payments are not reflected at all. These payments include benefits for pregnancy and childbirth, and for caring for a child up to one and a half years old. Non-taxable amounts within the limits established by Ch. 23 Tax Code of the Russian Federation limit. For example, this is financial assistance (gifts) not exceeding 4,000 rubles. per year per person, financial assistance in the amount of 50,000 rubles. to one of the parents at the birth of a child, daily allowance not exceeding 700 rubles. per day for a business trip in the Russian Federation or 2,500 rubles. per day when traveling abroad.

In this case, if an organization pays non-personal income tax payments to its employees, then the control ratio for reconciling income in 6-personal income tax and Calculation will not be carried out.

For example , employee Antonov S.I. was on a business trip to Pskov for ten days from 08/01/2017 to 08/10/2017. The organization’s local regulatory act establishes that daily allowances in Russia are paid in the amount of 1,200 rubles.

Therefore, an income of 7,000 rubles. (700 rubles x 10 days) is not reflected in 6-NDFL on line 020. This line will reflect only the taxable part of the income of 5,000 rubles. ((RUB 1,200 – RUB 700) x 10 days).

From 2021, travel allowances in excess of the established limit are subject to insurance contributions. Therefore, on line 030 of column 1 of subsection 1.1 of Appendix No. 1 to section 1, it is necessary to indicate the entire amount of daily allowance in the amount of 12,000 rubles, and on line 040 - the amount of daily allowance within the standard, that is, not subject to insurance contributions, in the amount of 7,000 rubles.

The daily allowance is reflected in the same way on lines 030 and 040 of subsection 1.2 and on lines 020 and 030 of Appendix 2. In subsection 3.2.1 of section 3 on line 210 it is necessary to indicate the entire amount of daily allowance (within the norms and in excess of the norms). And in line 220 include only the taxable amount, that is, in excess of the standard.

According to inter-documentary control ratios:

- Calculation, 6 personal income tax (for payers who do not have separate divisions)

- Art. 020 rub. 1 6NDFL - Art. 025 rub. 1 6NDFL >= Art. 030 gr. 1 other 1.1 rub. 1 Calculations

- The amount of accrued income of a taxpayer, excluding the amount of accrued income from dividends >= the amount of payments and other remuneration calculated in favor of individuals

- Send the taxpayer a request for explanations.

As can be seen from the example, the control ratios in relation to the income of S.I. Antonov are not met, since Art. 020 in 6-NDFL is less than Art. 030 Calculation, which is not an error.

In this situation, it is necessary to submit explanations to the tax office simultaneously with the submission of the Calculation and 6-NDFL. Otherwise, the Federal Tax Service will send the payer a corresponding request.

We correctly reflect the amounts of compensation received for sick leave contributions.

According to paragraph 2 of Art. 431 of the Tax Code of the Russian Federation, insurance premiums for compulsory social insurance in case of temporary disability and in connection with maternity can be reduced by the amount of expenses incurred by payers for the payment of insurance coverage for the specified type of social insurance in accordance with the legislation of the Russian Federation.

Based on the provisions of paragraph 9 of Article 431 of the Code, if, at the end of the billing (reporting) period, the amount of expenses for the payment of insurance coverage in case of temporary disability and in connection with maternity exceeds the total amount of calculated insurance premiums for this type of insurance, the resulting difference is subject to offset by the tax authority in account of upcoming payments for this type of insurance on the basis of confirmation received from the territorial body of the FSS of the Russian Federation of the costs declared by the payer for the payment of insurance coverage for the corresponding billing (reporting) period or reimbursement by the territorial bodies of the FSS of Russia in accordance with the procedure established by Law dated December 29, 2006 No. 255- Federal Law.

The amount of “sickness” contributions subject to payment or reimbursement at the end of the reporting (calculation) period is calculated in Appendix No. 2 “Calculation of the amounts of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity” to section 1 of the Calculation. Here, line 080 “Reimbursed by the FSS for expenses for payment of insurance coverage” indicates the amount of benefits that the FSS reimbursed.

In accordance with clause 11.14 of the procedure, these amounts are reflected in the corresponding columns:

- from the beginning of the billing period;

- for the last three months of the billing (reporting) period;

- for the first, second and third month of the last three months of the billing (reporting) period, respectively.

And if compensation was made in one reporting period for expenses of another reporting period, then these amounts must be reflected in the Calculation for the reporting period in relation to the month in which the territorial bodies of the Social Insurance Fund made the specified compensation. In other words, let’s say that in September 2021, the payer received money from the Social Insurance Fund to his current account to reimburse benefits for July and August 2021. He will indicate this amount in column 2 and column 5 of line 080 of Appendix No. 2 to Section 1 of the Calculation for 9 months of 2021. That is, these amounts do not need to be “posted” in columns 3 and 4 of line 080. This procedure for filling out the Calculation was further clarified by Letter of the Federal Tax Service dated July 5, 2017 No. BS-4-11/12778.

We submit an updated calculation of insurance premiums

If the payer discovers in the Calculation submitted to the tax authority that information is not reflected or is incompletely reflected, as well as errors leading to an underestimation of the amount of insurance premiums payable, the payer is obliged to make the necessary changes to the Calculation and submit to the tax authority an updated Calculation in the manner prescribed by Article 81 Tax Code of the Russian Federation.

If the payer discovers inaccurate information in the Calculation submitted to the tax authority, as well as errors that do not lead to an underestimation of the amount of insurance premiums payable, the payer has the right to make the necessary changes to the Calculation and submit to the tax authority an updated Calculation in the manner established by Article 81 of the Tax Code of the Russian Federation .

Changes to the previously submitted Calculation are carried out by payers of insurance premiums by submitting an updated Calculation. When filling out updated calculations for insurance premiums, payers should also be guided by the procedure for filling out calculations for insurance premiums, approved by Order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11 / [email protected] (hereinafter referred to as the procedure).

The Federal Tax Service of Russia in its letters dated June 28, 2017 No. BS-4-11/12446 and dated July 18, 2017 No. BS-4-11/ [email protected] “On the submission of updated calculations” gave recommendations on the submission of an updated calculation of insurance premiums for reporting periods starting from the 1st quarter of 2021. In particular, both in the event of identification of inconsistencies in the personal data of insured individuals, and in the event of an erroneous submission by the payer of insurance premiums of information about the insured persons in the initial Calculation.

If inconsistencies are identified in the personal data of insured individuals (based on a notification received or a request for explanations from the tax authority), the payer must fill out the updated Calculation as follows:

- for each insured individual for whom inconsistencies are identified, in the corresponding lines of subsection 3.1 “Data about the individual - recipient of income” of the Calculation, personal data reflected in the initial Calculation are indicated, while in lines 190–300 of subsection 3.2 “Information on the amount of payments and other remunerations calculated in favor of an individual, as well as information on accrued insurance contributions for compulsory pension insurance" Calculation in all acquaintances is indicated "0";

- at the same time, for the specified insured individual, subsection 3.1 of the Calculation is filled out, indicating correct (up-to-date) personal data and lines 190–300 of subsection 3.2 of the Calculation in accordance with the established procedure, if necessary, it is necessary to adjust individual indicators of subsection 3.2 of the Calculation. Also, if necessary (in case of a change in the total amount of calculated insurance premiums), the indicators in section 1 of the Calculation are adjusted.

When adjusting information about insured individuals that is not related to personal data, the payer must follow the following algorithm:

- if any insured individuals are not reflected in the initial Calculation, then section 3 containing information regarding these individuals must be included in the updated Calculation, and at the same time the indicators in section 1 of the Calculation are adjusted;

- in case of erroneous submission of information about the insured persons in the initial Calculation, section 3 must be included in the updated Calculation, containing information regarding such individuals, in which “0” is indicated in lines 190–300 of subsection 3.2 of the Calculation in all acquaintances, and at the same time the indicators are adjusted section 1 of the Calculation;

- if it is necessary to change the indicators reflected in subsection 3.2 of the Calculation for individual insured persons, section 3 must be included in the updated Calculation, containing information regarding such individuals with correct indicators in subsection 3.2 of the Calculation, and if necessary (in case of a change in the total amount of calculated insurance contributions) the indicators of section 1 of the Calculation are adjusted.

If information about any persons was not reflected at all in the initial Calculation, then the payer includes section 3 containing data about them in the updated Calculation. At the same time, the indicators of section 1 of the Calculation are adjusted.

Based on the provisions of paragraph 2.20 of Section II “General requirements for the procedure for filling out the calculation”, the total indicators of subsection 3.2 of Section 3 of the Calculation are filled in with the value “0”, and a dash is placed in the remaining fields of the corresponding field.

An updated Calculation can relieve the organization from liability (clause 3 of Article 81 of the Tax Code of the Russian Federation) if it is submitted before the moment when the organization learned:

- or about the discovery by the tax authority of the fact of non-reflection or incomplete reflection of information in the Calculation, as well as errors leading to an underestimation of the amount of insurance premiums payable;

- or on the appointment of an on-site tax audit and provided that before submitting the updated Calculation, the organization has paid the missing amount of insurance premiums and the corresponding penalties.

Note! When recalculating the amounts of insurance premiums during the period of an error (distortion), the updated calculations are submitted to the tax authority in the form that was in force in the settlement (reporting) period for which the amounts of insurance premiums are recalculated.

As you can see, each insurance premium payer has the opportunity to carefully check the reports submitted for 2021 using control ratios. If his inter-documentary control relationships are not met for objective reasons, then he has the right, simultaneously with submitting the Calculation, to submit his explanations to the Federal Tax Service, and if errors (distortions) are detected, submit an updated Calculation without waiting for the requirements of the tax inspectorate.

New form of RSV in 2021

Some changes have been made to the procedure for calculating insurance premiums in 2021, which entailed the need to adjust the current calculation form. If employers must report for 2021 using the old form, then for the 1st quarter of 2020 they should submit an updated form, which takes into account all the changes.

The Federal Tax Service approved not only a new calculation form, but also updated the procedure for filling it out. Below you can download two RSV forms - valid for 2021 and for 2021.

Detailed completion of the calculation for Q4. 2021, using this link you can also download a sample of filling out calculations regarding the payment of insurance premiums for various purposes.

Below are links to free download of contribution report forms.

calculations for 2021 (the last time is for the 4th quarter of 2019).

Changes to the insurance premium calculation form

There are quite a lot of changes in the calculation, so we should not talk about changing the current DAM form, but about creating a completely new form.

Information about the individual

If there were no payments, then there were no insurance contributions; the calculation can be submitted in an abbreviated form (title sheet, section 1 and section 3).

Instead of 10 applications there are now 9; individual reasons for using reduced rates have been changed.

The field where the total value for the last three months of the period is indicated is excluded from all applications.

Accordingly, the former field 003 changed its number to 002.

Changes in the RSV are associated with the cessation of the ability to use certification results to establish the hazard class of a workplace.

Field 015 has been added to indicate the number of employees from whose income insurance premiums for VNiM are calculated.

The wording of lines 020 and 030 has changed, and links to the relevant articles of the Tax Code of the Russian Federation have been added.

Fields 051, 052 and 053, which reflected data on payments by pharmaceutical companies, flight crews and patent holders, have been removed.

Field number 054 has changed to 055.

The following fields 020 – 050 (billing period, code, number and date) have been removed.

Lines 160-189 (attribute of the insured person) were deleted.

From subsection 3.2 of the new DAM form, lines were removed to reflect information about payments in total for the last quarter; lines for indicating monthly data were retained.

As a result, we can conclude that the new calculation form is simplified; less information needs to be entered into it than in the previously valid DAM form. However, in general, the changes are, of course, not drastic.

Rules, procedure and deadlines for submission

It is important for organizations and individual entrepreneurs with hired employees to know about the following rules:

- if there are employees, then you need to take the DAM;

- even if there are no insurance contributions in the reporting period, you still need to submit the DAM;

- even if the organization has only one employee - the director, you still need to take the DAM;

- if the individual entrepreneur does not have employees, then the calculation is not submitted;

- place of filing - Federal Tax Service branch (for legal entities - at the address of location, for individual entrepreneurs - at the address of residence);

- filing frequency - 4 times a year for everyone except heads of peasant farms, who report once a year;

- reporting periods - 1Q, 6 months, 9 months, year;

- data is calculated in an incremental manner from the beginning of the year;

- You only need to submit completed calculation sheets;

- Only the sheets for which information is available are filled out;

- if insurance premiums were not paid, then the report is zero;

- if the number of employees is 25 or less, any format for filing the DAM;

- If the number of employees is 26 or more, the form is only electronic.

Unified calculation of insurance premiums: sample filling

You need to fill out the 2021 DAM using the KND form 1151111, following a number of rules:

- each field corresponds to a specific indicator, adding other information is prohibited;

- The page number is entered in the following format: “001”, “002”... “033”;

- the decimal fraction is entered in two fields: in one - the whole part, in the other - the rest;

- text fields are filled in from the first window from left to right;

- Amount indicators are written in rubles and kopecks, separated by a dot;

- when filling out the report in print, use the Courier New font (16-18 point);

- in empty fields for numerical indicators, “0” (“zero”) is placed, in text cells – a dash (however, when filling out the DAM on a computer, zeros and dashes are not entered).

For more accurate processing of information, the Federal Tax Service uses special coding, which simplifies the analysis of reports and speeds up the process of processing reports. The report on the 2021 DAM form also uses codes and each of them has a corresponding meaning:

- method of document transmission. The report sent by mail has the code “01”;

- about reorganization or liquidation;

- about the place of delivery of the RSV;

- about the tariffs of insurance premiums;

- about the reporting period (in line 020 of the third section, fill in the periods for submitting the DAM).

A sample of filling out the calculation of insurance premiums for the 1st quarter of 2017 is presented here.

There is no need to submit a zero RSV in 2021 if insurance premiums for employees were not transferred and there were no payments to individuals. It is worth noting that there are still no official statements on this issue. Therefore, it is worth contacting the territorial body of the Federal Tax Service for accurate information and then making an informed decision. To be on the safe side, you can submit zero reports.

An example of a completed DAM 2021 zero report is presented here.

Who submits the DAM for the 1st quarter of 2021

Calculation of insurance premiums has been introduced since 2021. It replaced several forms that were canceled after the transfer of insurance premiums to the tax authorities: RSV-1, RSV-2, RSV-3 and partially 4-FSS.

Employers making payments must submit the DAM for the 1st quarter of 2021:

- employees working under employment contracts (regardless of its validity period);

- persons with whom GPC agreements have been concluded;

- authors of works under copyright contracts;

- “physicists” under agreements on the alienation of the exclusive right to certain results of intellectual activity, publishing license agreements, license agreements on granting the right to use the results of intellectual activity.

The following employers submit RSV:

- organizations;

- separate sections of Russian organizations that independently pay income to their employees and pay contributions to the budget from it;

- separate units of foreign organizations operating in Russia;

- IP;

- heads of peasant farms;

- an individual without individual entrepreneur status.

Zero RSV is given by:

- the only founders who also serve as CEOs;

- organizations or individual entrepreneurs if they had no activities and no payments to employees during the reporting period;

- heads of peasant farms in the absence of employees and activities.

Individual entrepreneurs, lawyers, private notaries who do not have employees do not submit insurance premium calculations.

How will the Social Insurance Fund and the Tax Inspectorate interact?

For contributions until December 31, 2021, the Russian Social Insurance Fund will:

- Exercise control over the calculation and payment of insurance premiums for reporting periods until 01/01/2017, in the manner valid until January 1, 2021. That is, the FSS of Russia has the right to conduct desk and on-site inspections of Settlements in accordance with Form 4-FSS for 2016, including updated Settlements.

- Conduct desk and on-site inspections of the correctness of spending social insurance funds on the payment of insurance coverage in an orderly manner.

- Provide the organization with a decision based on the results of the desk and on-site inspections.

Regarding contributions from January 1, 2021, the Russian Social Insurance Fund will:

- Conducts desk audits of expenses for insurance premiums for compulsory social insurance in case of temporary disability and in connection with maternity upon the company's application for reimbursement of funds for the payment of insurance coverage based on information from the Calculation of insurance premiums received from the Federal Tax Service of Russia.

- Conduct unscheduled on-site inspections of organizations to determine the correctness of the organization’s expenses for the payment of insurance coverage.

- Conduct, together with the Federal Tax Service of Russia, scheduled on-site inspections of the correctness of the policyholder's expenses for the payment of insurance coverage.

- Consider complaints from organizations about inspection reports on the correctness of spending social insurance funds on the payment of insurance coverage.

From January 1, 2021, regarding insurance premiums, the Federal Tax Service of Russia will:

- Conduct desk audits of the Unified Calculation of Insurance Premiums in the form approved by the Federal Tax Service of Russia.

- Carry out on-site inspections on the payment of insurance premiums from 01/01/2017, together with the Federal Social Insurance Fund of the Russian Federation.

- Takes into account the obligations of the payer of insurance premiums from 01/01/2017.

- Conduct a reconciliation of accrued and paid insurance premiums for temporary disability and in connection with maternity obligations from 01/01/2017.

- Make decisions on bringing (on refusing to bring) to justice for committing a tax offense based on the results of consideration of materials from desk and field tax audits on the payment of insurance premiums from 01.01.2017.

- Consider complaints about inspection reports, complaints about actions (inactions) of tax authority officials.

RSV form for the 1st quarter of 2021

For the 1st quarter of 2021, the DAM is submitted using a new form, approved. By Order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11/ [email protected]

Compared to the previous form (approved by Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11 / [email protected] ), the new DAM has reduced the total number of indicators by a third and takes into account the latest legislative changes in the procedure for calculating insurance premiums. Including:

- added a cell “Payer type (code)”? it contains code 1 (when calculating payments to individuals) or code 2 (if there were no payments in the reporting period);

- in Appendix No. 2 the line “Number of individuals from whose payments insurance premiums were calculated” was added;

- separate Appendices to Section 1 were deleted due to changes made to Art. 427 Tax Code of the Russian Federation;

- other amendments were made to the DAM form and the procedure for filling it out (certain lines in Section 3 were excluded and added, the list of codes for payers of insurance premiums at reduced rates was updated, etc.).

The DAM, submitted based on the results of the 1st quarter of 2021, consists of 3 sections and 11 appendices to them. But you don't need to fill them all out. Required to be included in the calculation:

- title page;

- Section 1 “Summary of the obligations of the payer of insurance premiums”;

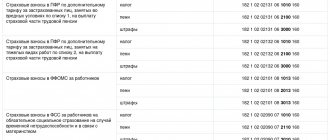

- subsection 1.1 of Appendix No. 1 to Section 1 “Calculation of contributions for compulsory pension insurance”;

- subsection 1.2 of Appendix No. 1 to Section 1 “Calculation of contributions for compulsory health insurance”;

- Appendix No. 2 to Section 1 “Calculation of the amounts of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity to Section 1”;

- Section 3 “Personalized information about insured persons.”

Calculation of insurance premiums

From 2021, all Russian companies and individual entrepreneurs must report insurance payments directly to the Federal Tax Service. To implement the new rules, tax officials have developed a fundamentally new form - “Calculation of insurance premiums”. The form was approved on October 10, 2016 by Order of the Federal Tax Service No. ММВ-7-11/551 (Appendix No. 1). The calculation replaced forms 4-FSS (section regarding disability benefits) and RSV.

Who is required to report?

All employers who have insured employees or work with other individuals under contracts for the provision of services, performance of work, etc. are required to submit a calculation. If only the director is registered in the company, you still need to submit a report.

Important! If the company did not conduct business and did not make payments, the obligation to submit settlements is not removed from it. A zero declaration with empty lines in the sections reflecting accruals on contributions is submitted to the Federal Tax Service.

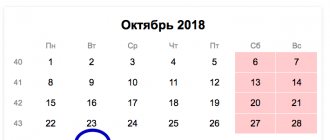

Due dates

The calculation is submitted at the end of each quarter in April, July, October and January. The last day of submission is the 30th day of the month following the quarter. For example, a report for 9 months (3rd quarter) must be submitted by October 30.

Violation of deadlines, regardless of the reason, is punishable by penalties. For each month of delay, the policyholder will pay 5% of the amounts not paid on time (the fine is calculated based on the data specified in the report).

If you are late by at least one day, you will have to pay a fine for a month of delay. If the deadlines are violated, you will give a minimum of 1000 rubles, a maximum of 30% of the amount of contributions.

For such an offense, administrative liability is provided for officials of the organization. Everything is simpler here - the manager can get off with a warning or a fine of 300-500 rubles.

Submission methods

The format for submitting the form depends on how many people are submitting data. If the company employs less than 25 people, the policyholder has the right to submit a calculation in paper or electronic form. If the company's staff exceeds the specified figure, it must be submitted exclusively electronically. If you violate the filing procedure, you will have to pay a fine of 200 rubles.

Design features

The rules for filling out the calculation are described in detail in Appendix 2 to the Order of the Federal Tax Service of Russia dated October 10, 2016 N ММВ-7-11/ [email protected]

You can download an example of calculation of insurance premiums for 2021 in the “My Business” service after you maintain your registration data.

The first sheet contains the required details of the enterprise, inspection code, reporting period and adjustment number. Usually filling these cells is not difficult.

Section 1 reflects generalized data on deductions. Types of charges are located under the corresponding budget code. First, the KBK is placed, under it is the amount of deductions with a cumulative total (from the beginning of the reporting year), then three lines with accruals for the past quarter (divided by month).

Next, fill out Appendix 1, subsection 1.1: contributions accrued for compulsory pension insurance are entered here.

The first line reflects the number of insured workers.

The second line includes only those employees whose payments were taken into account for calculating contributions.

Next, the wage fund, amounts not subject to contributions and the base for calculation are entered in the cells. It is necessary to indicate monthly data for the past quarter and the total amount for the entire period from the beginning of the year (for example, for 9 months).

Appendix 1, subsection 1.2: we enter the amounts accrued to the compulsory medical insurance fund. Filling is carried out according to the same principle as in the previous subsection.

Appendix 2: we note the amounts for compulsory social insurance. The data is entered according to the model of the previous section. Below are added a few more cells that need to be filled out.

In line 70 we reflect the expenses incurred for sick leave and benefits. Only that part of the benefits that is subject to reimbursement is taken into account (three days of sick leave paid at the expense of the employer are not taken into account).

Line 90 includes contributions for compulsory social insurance, minus expenses incurred for the payment of insurance coverage.

When filling out Appendix 2, do not forget to indicate at the top of the sheet the indicator of payments (how your expenses will be taken into account: offset, covering part of the contributions, or reimbursed by the Federal Tax Service).

Section 2 is filled out only by those policyholders who own a farming enterprise. The amounts to be paid for the head of the household are indicated.

Section 3 contains individual information on employees (SNILS, INN, full name, etc.), accrued salaries and contributions. In total, the section will contain as many sheets as the number of employees who received salaries in the reporting period.

An important nuance: if controllers discover an error in the report, 5 days are given for correction after sending the notification. If the notice was sent in paper form, then 10 days.

Download the form for calculating insurance premiums for 2021 with a sample form from the “My Business” service. To do this you just need to register. After this, you will have access to a database of current forms for all occasions and materials from our experts.

CheckPFR

The latest version of CheckPFR 2021 for Windows has received minor updates to the interface and external design. The program is developed by the Branch of the Pension Fund of the Russian Federation in the Republic of Bashkortostan. It replaced the standard CheckXML-UFA and was officially adopted in the spring of 2014.

Download the CheckPFR 2021 program for free using the direct link:

Download additional files for CheckPFR:

CheckPFR is software for checking and working with reporting data provided by employers. It is able to check settlement accounts of insurance premiums and display information on individual personalized accounts, which are submitted by policyholders in electronic format 7.0. The transfer of accountable materials to the Pension Fund of the Russian Federation and their entry into the database occurs using media (floppy disks, disks, USB flash drives) or via the Internet electronic channel.

Features of working with CheckPFR

The program is capable of checking the following reporting forms:

- quarterly report RSV-1, RSV-2, RSV-3

- documentary personalized accounting S3V-6-1, S3V-6-2, ADV-6-2, S3V-6-4, SPV-1, ADV-11.

Submission of reporting material is implemented through constant updating of the program. You should always check for the latest updates before launching the application. This is especially important when working with the personalized accounting form RSV-1.

Procedure for checking and viewing reporting data

To familiarize yourself in detail and work with a specific report, you need to move the file from the directory to the working window using the mouse or by clicking on . The screen will display detailed data and information about the currently selected file (name, format, number of documents in the block).

Important: If the file cannot be verified, a text box will appear saying “The selected file is not a valid XML file.”

To check and review information on a specific file, you need to launch the panel labeled “Check selected file.” If you need to batch test several documents at the same time, then all files should be placed in one folder.

Reporting data reconciliation function

The CheckPFR verification module works on the function of reconciling indicators for two types of reporting forms (Calculation RSV-1 and Inventory of information ADV-6-2). If a difference in values for two parameters of one type of reporting is detected or appears, the reporting documents are rejected by the control authorities and returned for revision.

Important: All comments in the documents being created that are identified as erroneously should be corrected before being transferred to the Pension Fund authorities. Otherwise, you will need to provide a written explanation for the discrepancies and submit detailed reports, in accordance with the decree of the Pension Fund.

Official version of CheckPFR from the developer's website

On the website page you can download Bukhsoft for free in one file. Technical support will help users update CheckPFR to the latest version at any time. The archive that should be downloaded includes:

- installer exe

- msxml6_xmsi

- detailed step-by-step installation instructions in .doc format

- user manual in .doc format

To install CheckPFR on your computer, just open the archive and run the .exe file, following the pop-up prompts. Silent installation will automatically unpack the components into the specified directory.

The program is distributed absolutely free of charge and is intended for use only in the Russian Federation.

For the program to work properly, you should regularly check for the latest updates. The official website releases information about the latest updates with a list of changes made to the program.