A limited liability company is a commercial entity created to make a profit. LLC participants can receive their share of income from the business only after making a decision on the distribution of profits and withholding taxes. What is the tax on dividends in 2021? The tax rate on dividends in 2021 depends on which category the participant belongs to (individual or legal entity), and on several other important criteria, which we will consider further.

Free tax consultation

Dividend tax for individuals in 2021

The taxation of dividends from individual participants depends on their status: whether they are recognized as residents of the Russian Federation at the time of payment of income. The tax rate on dividends in 2021 is:

- 13% for resident individuals;

- 15% for non-resident individuals.

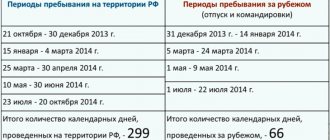

The status of a Russian resident depends on how many calendar days over the last 12 months the participant was actually in Russia. If there are at least 183 such days (not necessarily in a row), then the citizen is recognized as a resident. For him, the tax paid on dividends for individuals in 2021 will be levied at a rate of 13%. Periods spent abroad for valid reasons, such as treatment and training, are not taken into account (Article 207 of the Tax Code of the Russian Federation).

Citizenship does not affect the status of a resident of the Russian Federation, so it can also be a foreign founder if he has actually been in Russia for most of the last 12 months.

The company itself is obliged to withhold personal income tax from dividends in 2021 for transfer to the budget. For individuals receiving income from business, the company is a tax agent. The founder is paid dividends after taxation, so he does not have to independently calculate and transfer personal income tax.

However, if dividends are not transferred in cash (fixed assets, goods, other property), then the situation changes. The tax agent cannot withhold the tax amount for transfer, because funds, as such, are not paid to the participant. In this case, the LLC is obliged to inform the inspectorate about the impossibility of withholding personal income tax.

Now all responsibilities for paying personal income tax are transferred to the participant himself who received dividends in property. To do this, at the end of the year, you need to submit a declaration in form 3-NDFL to the Federal Tax Service and pay the tax yourself.

Additional difficulties when paying the founder non-monetary income are due to the fact that tax authorities consider such a transfer of property to be a sale, because this involves a change of owner. And when selling property, its value must be taxed, depending on the taxation system on which the company operates:

- VAT and income tax (for OSNO);

- single tax (for simplified tax system).

If a legal entity works for UTII, then the transaction for the transfer of property to the founder should be taxed under the general or simplified regime (if the company combines the UTII and STS regimes).

This results in a truly absurd situation when property transferred as dividends is taxed twice:

- Personal income tax paid by the founder;

- tax on “sales” in accordance with the regime that the Federal Tax Service obliges the company itself to pay.

In some cases, the courts take the side of the LLC, recognizing that there are no signs of the sale of property, but there are also opposing court decisions. If you are not ready to argue with tax authorities in court, then we do not recommend using this method. Perhaps someday appropriate changes will be made to the Tax Code of the Russian Federation, but for now the payment of dividends with property threatens additional taxation.

What is personal income tax

The deciphering of the abbreviation personal income tax is simple: personal income tax. This is an income withholding in favor of the state. Calculated from the income of individuals – residents and non-residents of the Russian Federation.

Let me remind you: a person who has been in our country for at least 183 days a year is a resident. Less than this period - a non-resident, even if he is a citizen of the Russian Federation. The resident must calculate and pay tax to the state on income received in Russia and abroad. A non-resident pays only from earnings in our country.

Fiscal payments must be calculated in accordance with Article 23 of the Tax Code of the Russian Federation. Non-taxable income, amounts excluded from taxable income, benefits, refunds, income tax deductions are described in detail in the code.

Who calculates personal income tax

The broker-tax agent is required to calculate and transfer the tax to the fiscal authorities. The personal income tax amount is withheld from investment income the next day after payment.

It is prohibited for a tax agent to pay income withholdings at his own expense, even if an error occurred in the calculations and the withholdings were not made or were not made in full. The responsibility to pay the missing amount is transferred to the recipient of the income.

Personal income tax on transactions with foreign brokers must be calculated independently in the 3-NDFL declaration.

The accounting department of the enterprise reports for dividends received from participation in its own LLC. The founder is an individual; he does not need to make calculations on his own.

Dividend tax for legal entities in 2021

A participant in a limited liability company can be not only an individual, but also a legal entity (Russian or foreign company). Taxation of dividends paid by legal entities in 2021 is carried out according to the standards established by Article 284 of the Tax Code of the Russian Federation.

| Tax rate on dividends in 2021 for organizations | |

| Russian organization | 13 percent |

| A Russian organization, if for at least 365 calendar days before the decision to pay dividends is made, it owns a share of at least 50% in the authorized capital of the organization that is the source of the payment. | zero |

| Foreign organization | 15 percent or other rate if provided for by an international agreement for the avoidance of double taxation |

As we can see, if a Russian organization has at least 50% in the authorized capital of another Russian company, then no income tax is levied on dividends received (zero rate). To confirm this benefit, the participant-legal entity must submit to the inspection documents confirming the right to a share in the capital of the organization paying the income.

Such documents may be:

- contract of sale or exchange;

- decisions to divide, spin off or convert;

- court decisions;

- agreement on establishment;

- deeds of transfer, etc.

Income tax on dividends in 2021 is also established for legal entities that operate under special regimes (USN, Unified Agricultural Tax, UTII). In relation to the income they receive from their activities, such legal entities do not pay income tax. However, exceptions are made for income received from participation in other organizations:

- for companies using the simplified tax system, the provisions of paragraph 2 of Article 346.11 of the Tax Code of the Russian Federation apply;

- For companies on the Unified Agricultural Tax, the norms of paragraph 3 of Article 346.1 of the Tax Code of the Russian Federation apply.

These articles explicitly state that the special tax regime does not apply to profits received from participation in other enterprises. As for companies on UTII, although there is no such direct clause, the exemption from income tax applies only to income received from the types of activities specified in Article 346.26 of the Tax Code of the Russian Federation.

Thus, the tax on dividends of a legal entity for 2021 is paid in the form of income tax (at the rates indicated in the table), even if, in general, a company under a special regime is exempt from paying this tax.

As in the case of an individual participant, the tax agent obligated to withhold and remit income tax is the organization that paid the dividends. The tax payment deadline is no later than the day following the day of payment (Article 287 of the Tax Code of the Russian Federation).

How to hold a meeting of shareholders of a JSC

The decision to pay dividends is made at a mandatory annual general meeting of shareholders, which can be held strictly 2-6 months after the end of the reporting year.

Clause 1 Art. 47 208-FZ

Before this, a meeting of the board of directors must take place, the participants of which approve the date, time and agenda of the meeting.

The holder (the one who maintains the register of owners of the company's securities) prepares a list of shareholders who will participate in the meeting. Participants of the meeting must send registered letters about the upcoming meeting no later than 21 days before the date of the meeting.

Clause 1 Art. 8 39-FZ P. 1 Art. 52 208-FZ

At the meeting, all arriving shareholders register, receive ballots and vote on agenda items.

Based on the voting results, the counting commission draws up a protocol within 3 working days after the meeting, and then sends a report on the results to shareholders.

Part 1 art. 62 208-FZ

The joint stock company is obliged to pay dividends within 25 working days only by bank transfer. The amount of dividends depends on the number and type of securities owned by the shareholder.

Part 6 art. 42 208-FZ Part 8 Art. 42 208-FZ

If the period has expired and the dividends have not been transferred, then the shareholder, within 3 years, can demand from the company all due payments with interest, which depends on the average interest rate of the Central Bank on bank deposits.

Clause 9 art. 42 208-FZ P. 16 Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation No. 19

Calculation formula

Concluding our consideration of the question of what taxes dividends are subject to in 2021, we present the calculation formula from Article 275 of the Tax Code of the Russian Federation. You need to know about it if dividends are paid by a company that itself has received profit from participation in another organization.

Н = К x Сн x (D1 – D2)

- N - amount of tax to be withheld;

- K is the ratio of the amount of dividends to be distributed in favor of their recipient to the total amount of distributed profit;

- Сн - tax rate;

- D1 - the total amount of dividends distributed in favor of all recipients;

- D2 - the total amount of dividends received by the organization itself in the current and previous reporting (tax) periods, if they were not previously taken into account when calculating income.

At the same time, indicator D2 does not include dividends, to which a zero profit tax rate is applied.

This formula must be applied when calculating taxes on dividends in 2021, which are paid to Russian legal entities and individual residents of the Russian Federation. For other categories of LLC participants, tax is calculated according to the rules of paragraph 6 of Article 275 of the Tax Code.

Calculation of personal income tax on dividends with examples

Accountants are interested in the calculation procedure. Let me make it clear: There are no deductions to reduce your tax. Personal income tax is calculated on the full amount.

Article 210, paragraph 3 of the Tax Code of the Russian Federation confirms this. An organization that distributes after-tax profits to its participants must calculate personal income tax as follows: amount of dividends x 13%.

Example: JSC Vostok distributed profits among shareholders. Ivanov T. - 650,000 rubles, Travkin S. - 900,000 rubles, Kotova V., who is not a resident, - 480,000 rubles - calculated in proportion to shares.

Income tax calculated and withheld:

- Ivanov T. 650,000 * 13% = 84,500 rubles;

- Travkin S. 900,000 * 13% = 117,000 rubles;

- Kotova V. 480,000 * 15% = 72,000 rubles.

Total for transfer is 273,500 rubles.

It is more difficult to calculate for a legal entity that pays dividends and simultaneously receives them from participation in other organizations. The calculation is made as follows.

First, you need to calculate the deduction: the amount of payment to one participant is divided by the entire distributed profit and multiplied by the profit received from investments in other organizations.

Amount to be taxed: the amount of payment to the participant is a deduction, multiplied by 13%.

Example: Delta LLC received a profit from investments in the authorized capital of Kareta LLC of 13,000,000 rubles.

In turn, Delta distributed the profit of 16,000,000 to two participants:

- Yagodkin T. – 6,000,000 rubles;

- Zarya LLC – 10,000,000 rubles.

Calculated personal income tax to be withheld from Yagodkina T.:

- deduction 6,000,000/16,000,000 * 13,000,000 = 4,875,000 rubles;

- Personal income tax (6,000,000 – 4,875,000) * 13% = 146,250 rubles.

Reflection of dividends in certificate 2-NDFL

At the end of the year, the tax agent reports to the fiscal authorities on payments made to individuals and on personal income tax withheld and transferred. The calculation is submitted in the form of a register with 2-NDFL certificates attached. Dividends are indicated in the third section of 2-NDFL: income code 1010 - amount, deduction code 601 - amount.

Russian organizations reflect investment payments to individuals in their income tax returns. The second appendix to the declaration reflects the payments. In this case, you do not need to submit 2-NDFL.

Reflection of dividends in 6-NDFL

Payments made must also be reflected in the calculation of 6-NDFL. The calculation is submitted at the end of each quarter. In the first section, it is necessary to calculate generalized indicators on a cumulative basis from the beginning of the year. Column 025 indicates the amount of payments on shares. Column 030 tax deductions – including deductions for dividends.

The second section contains payment data for the last quarter by date. Dividends are written on a separate line with the actual date of issue. Deduction code 601.

Personal income tax payment from dividends: sample filling

A little explanation would be useful:

- in field 101 the status is set to 02, as is the transfer of personal income tax from employees;

- BCC, respectively, 18210102010011000110;

- Field 105 is filled in from the directory of municipalities.

In practice, there are no differences from regular tax transfers. In the “Purpose of payment” field, you need to give an explanation and indicate the date of payment to the shareholder or shareholder.

Calculator

To be on the safe side and double-check, it’s convenient to use a ready-made calculator. From the mass of calculators presented on the Internet, I chose the one suitable for calculating personal income tax on dividends. The calculator is advanced, allows you to calculate taking into account deductions. I offer a link:

https://nalog-nalog.ru/kal_kulyator_ndfl/

Another interesting calculator with a questionnaire. By answering the questions asked, you will arrive at the required amount:

https://glavkniga.ru/calculators/ndfl

This can also be calculated taking into account standard deductions not only for children, but in general – according to the law:

https://9trud.ru/kalkulyator-ndfl/

How to pay income to participants

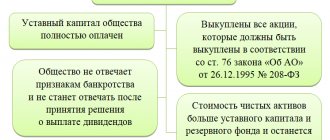

The decision on payments to investors is made at a general meeting of shareholders or founders. By this time, it is necessary to calculate the net profit after making mandatory payments.

Dividends are distributed in proportion to the shares of investors in the authorized capital or the total value of shares.

Payments are made within the period specified in the organization's charter. If the charter does not contain such information, then the period is established by law: within 60 days from the date of the decision.

Income on shares can only be paid by non-cash payment. Participation in the management company of an LLC is allowed to be paid in cash, but not from proceeds. For example, from the amount taken for reporting and returned to the cash register.

Features of transferring personal income tax from dividends

Fiscal withholding from investment profits no later than the day following payment. The order for payment should reflect only the amount of personal income tax calculated from dividends.

The BCC for regular tax and dividends is the same, but they must be transferred in different payments. The transcript must indicate the date of payment and for what period it was made.

Deferment of tax payment on dividends

Property may be transferred to shareholders as dividends. It is impossible to transfer it minus income tax. In this case, the company notifies the fiscal authorities that personal income tax was not withheld.

The responsibility to pay personal income tax falls on the recipient of the profit. After a year, before April 1, he is obliged to report to the tax authorities, calculate and pay the fiscal tax by July 15.

Postponement of dividend payments in case of mutual requirements of the company and the founder

It happens that a shareholder or participant in a management company has a debt to the company making the cut-off. Dividends can be offset against debt.

If the due payment is less than the debt, then you can defer the transfer of personal income tax until full payment. The tax office must be notified of this.

Postponement of dividend payments when one of the shareholders leaves the founders

When one of the shareholders leaves the founders, his share is divided among the remaining shareholders. If the distribution of the share is gratuitous, then it is clear that the shareholders received income in kind.

It is impossible to calculate and withhold personal income tax on such income the next day. The due amount is calculated and gradually withheld from other income, but not more than half of the income received.