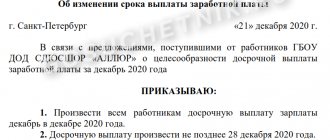

If the payment is paid in installments

For various reasons, wages may be paid to employees in installments.

This can happen if the organization, for example, does not have the money to pay on time and on the same day. In this case, personal income tax should be withheld gradually from each payment. There is no need to pay the entire personal income tax on all earnings that were accrued for the month worked. This is stated in the letter of the Ministry of Finance of Russia dated July 25, 2016 No. 03-04-06/43479. Let's give an example of how to withhold personal income tax in parts. Example. The employer issues an advance on the 20th of the current month, and a salary on the 5th of the next. However, in August 2021, part of the salary was paid on the 5th, and part on the 11th.

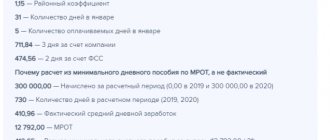

Employee salary – 75,000 rubles. He received an advance of 25,000 rubles on July 20. On July 31, the accountant accrued his salary for July - 75,000 rubles. Personal income tax on this amount amounted to 9,750 rubles. (RUB 75,000 × 13%).

Thus, in addition to the advance payment for July, the employee is entitled to another 40,250 rubles. (RUB 75,000 – RUB 25,000 – RUB 9,750).

On August 5, the employee was paid part of the remaining amount:

20,000 rub. – (RUB 20,000 × 13%) = RUB 17,400 Thus, the accountant withheld only the tax calculated from the advance payment and the first part of the salary. On August 11, the employee was paid the remaining amount: 26,264 rubles - (26,264 × 13%) = 22,850 rubles. In total, on August 11, 2016, the organization fully repaid the salary debt to the employee in the amount of 40,250 rubles (17,400 rubles + 22,850 rubles) and gradually withheld personal income tax. This is exactly what needs to be done when salaries are paid in installments.

Is it possible to pay salaries in installments: in cash and by card?

Currently, most employers pay salaries to employees in non-cash form, making transfers to bank cards. This form of payment is as convenient as possible for both the employer, who does not need to maintain a staff of cashiers and draw up a lot of cash documents, and for employees who can withdraw cash at any time or pay for purchased goods with a card. In addition, the non-cash payment procedure is as transparent as possible from a tax point of view, because based on bank statements, fiscal authorities can check not only the completeness of accruals, but also the timeliness of payment.

However, in rare cases, employers resort to such a form of payment as paying salaries in installments - in cash and by card. This method of remuneration is usually used in trading companies, catering establishments, and other organizations with a large volume of revenue.

In order to figure out whether this method of settlements with personnel is legal, let’s contact the Labor Code of the Russian Federation. According to Art. 136, the employer must comply with the following conditions for the payment of wages to employees:

- Payment of remuneration to employees must be made at least twice a month.

- The salary payment deadline is no later than the 15th day of the month following the reporting month. For example, the final salary payment for November must be received before December 15th.

- The employer is obliged to notify the employee of the amount of payment and the amount of deduction by sending him a payslip in electronic form or on paper.

- The form of payment of wages (cash/card) is established by the employment/collective agreement.

- If the employer pays wages to a card, the employee has the right to independently choose the bank through which the amounts will be transferred.

- The employer pays wages exclusively to the employee (unless otherwise provided by law and the Labor Code).

As you can see, the current Labor Code norms do not contain a clear answer to the question regarding the possibility of paying salaries in installments - in cash and by card. At the same time, based on the above provisions, we can conclude that the employer has the right to pay wages simultaneously in non-cash and cash form, subject to the following conditions:

- The payment of wages in installments (cash and card) must be stipulated in the employment/collective agreement and local regulations (for example, in the Regulations on remuneration). The documents should reflect the payment procedure (for example, an advance is paid in cash through a cash register, salary is paid on a card, etc.).

- The timing of settlements must comply with the standards approved by the Labor Code ( payments at least 2 times a month with an interval of no more than 15 calendar days ).

- The employer is obliged to notify the employee of the accruals by means of a payslip , which reflects both the payment of wages in cash and the transfer to the card. To reflect the form of payment (cash/non-cash payment), the payslip form should be supplemented with a special column.

If an employee expresses a desire to change the credit institution through which part of his salary is paid, the employer is obliged to satisfy this requirement on the basis of an application ⇒ Application to change the bank to receive a salary.

Conclusion

The clarification in the letter of the Ministry of Finance of Russia dated July 25, 2016 No. 03-04-06/43479, in principle, is beneficial for accountants, since personal income tax can be paid in installments from staged salaries. At the same time, we note that similar conclusions can also be found in the letter of the Federal Tax Service of Russia dated March 24, 2016 No. BS-4-11/4999. In this letter, the tax authorities were not against paying personal income tax in installments, when salaries were paid three times.

If you find an error, please select a piece of text and press Ctrl+Enter.

Before the personal income tax department paid wages to employees, it (de jure) transferred the amount of tax from its own funds, which is prohibited by law. This means that the amount paid is not recognized as a tax transfer; accordingly, the company faces arrears, fines and penalties! That's it! Fulfillment of the obligation to pay taxes also applies to tax agents. It was not so easy for the court to refute the logic of the tax authorities’ conclusions from a purely legal point of view. Nevertheless, he did it. By virtue of clause 4 of Art. 24, pp. 1 clause 3 art. 44 and paragraphs. 1 clause 3 art. 45 of the Tax Code of the Russian Federation, the duty of a tax agent to transfer tax is considered fulfilled from the moment of presentation to the bank of an order to transfer funds from a bank account to the budget system of the Russian Federation to the appropriate account of the Federal Treasury if there is a sufficient cash balance on it on the day of payment. In the same paragraph 1 of Art.

Requirements for 6-NDFL in case of delayed wages

Ensuring compliance with the provisions of this chapter If the tax agent indicates an operation in one period, but completes it in another, then it must be entered into the declaration after completion. This also applies to situations where wages were delayed. If wages were accrued on March 3, and the tax on them was paid on March 4, then this is reflected in the first section of 6-NDFL for the first quarter. At the same time, the agent most often does not indicate such information in the second section. It will be indicated when paying salaries to employees based on the results of the six months. According to the Tax Code, the date of actual receipt of income is the last day of the month in which income was accrued, but not necessarily its payment. According to the Code, tax agents must withhold accrued tax from the taxpayer’s income itself at the time of actual payment. The tax is calculated from 600,000 at a rate of 13%, resulting in 78,000. 070 The tax from 500,000 is calculated at a rate of 13%, resulting in a figure of 65,000. 100 - 120 These lines are intended to reflect the dates associated with the receipt of money and information about the time of calculation and transfer of taxes. In this case, the date of actual receipt of income is considered to be the last day of each month, and since the debt was paid on June 26, line 110 is used for this number, because the tax is withheld when the salary is paid. Line 120 indicates June 27, since the tax is transferred the next day after payment. 130-140 The amount of income actually received and the tax withheld for each period is indicated here.

Federal Tax Service: if the employer transfers personal income tax before salary payment, the tax will not be considered paid

The solution describes the following situation. The organization transferred personal income tax from employees’ wages before the date of actual payment of income. The inspectorate stated that early transfer of funds cannot be considered as payment of personal income tax. Since the withheld tax was not transferred after the actual payment of wages, the controllers assessed additional personal income tax in the amount of 4.5 million rubles, as well as penalties in the amount of 1.9 million rubles.

The tax agent filed a complaint with the Federal Tax Service. In his opinion, the obligation to pay personal income tax was fulfilled ahead of schedule, and this is not prohibited by tax legislation. The transferred tax amount was taken into account in the budget for the relevant KBK and OKATO. The budget had these funds, and therefore there are no grounds for additional tax and penalties.

However, the Federal Tax Service did not agree with the organization’s position. Officials reminded: tax agents are required to withhold the accrued amount of tax directly from the taxpayer’s income upon actual payment (Clause 4 of Article 226 of the Tax Code of the Russian Federation). Payment of tax at the expense of tax agents is not allowed (Clause 9, Article 226 of the Tax Code of the Russian Federation). According to Article 231 of the Tax Code of the Russian Federation, the amount of tax excessively withheld from the taxpayer’s income by the tax agent is subject to refund. This means that the amount of “salary” personal income tax paid to the budget ahead of schedule cannot be counted against upcoming payments, it can only be returned. Thus, if the employer transferred personal income tax to the budget before the payment of wages (that is, from his own funds, and not from the income of individuals), then such an amount is not recognized as tax. In this case, you need to contact the inspectorate with a request to return the erroneously transferred funds. In this case, the employer, of course, is obliged to transfer to the budget within the established time frame the tax actually withheld from the income of individuals. Since in this case personal income tax was not transferred, the Federal Tax Service recognized the accrual of the disputed amount of tax and penalties as legitimate.

Let us note that the position of the Federal Tax Service is consistent with the explanations of the Ministry of Finance. According to experts from the financial department, transfer of personal income tax by a tax agent in advance, that is, before the date the taxpayer actually receives income, is not allowed (see letter dated September 16, 2014 No. 03-04-06/46268; “The Ministry of Finance warns: early payment of personal income tax is dangerous for the tax agent").

Flow of funds

First, let's understand how cash flows in such a situation.

The employer draws up a payment order for the total amount. In the “Recipient” field, he indicates the name of the bank servicing the salary project, and does not fill in the field for the account number of the recipient of the funds. In the “Purpose of payment” field, a reference is made to the register and the total number of orders included in the register (Appendix 1 of the Regulations on the rules for transferring funds, approved by the Bank of Russia on June 19, 2012 No. 383-P). Based on such a settlement document, the receiving bank draws up a memorial order, in which, in accordance with the purpose of the payment, the personal (salary) accounts of employees are indicated (clause 4 of the Bank of Russia Directive No. 2161-U dated December 29, 2008 “On the procedure for drawing up and processing a memorial order” ). As a result, funds are transferred in two steps: first, they are credited to the correspondent account of the recipient bank, and then the latter distributes them among the accounts of employees.

..for the employer, the moment of payment of wages is the day the funds are written off from his current account.

At the same time, the issuing bank independently determines and approves in internal documents the procedure for notifying the client about transfer amounts credited to his account (question 5 of the Bank of Russia information dated January 15, 2014 “Answers and clarifications on some issues related to the application of the Bank of Russia Regulations dated July 16, 2012 No. 385-P “On the rules of accounting in credit institutions located on the territory of the Russian Federation.” But there is no rule obliging the bank to notify the client about the transfer of money to the recipients’ account.

Obviously, the employer does not control the movement of money within the banking system. Therefore, for the employer, the moment of payment of wages is the day the funds are written off from his current account.

We emphasize: to service the salary project, the issuing bank opens only card accounts for employees, while a separate account is not opened for the employer. In the agreement regulating the servicing of the salary project, the issuing bank only undertakes to make, within a certain time frame, the distribution of funds credited to its correspondent account. And another bank, the one servicing the employer’s current account, is responsible for the timing of receipt of funds to this account.