Withhold the amount of material damage from the employee’s income in this order.

First, calculate the amount of losses, which includes:

– the amount of material damage;

– expenses for the acquisition or restoration of property (for example, repairs);

– expenses for compensation for damage that an employee caused to other citizens or organizations (for example, damage from an accident in the part not covered by insurance compensation).

The scope of losses that an employee who has caused material damage to the organization is required to compensate is specified in Article 238 of the Labor Code of the Russian Federation.

Situation: who will compensate for damage in an accident in which an employee of the organization is found to be at fault?

Damage in an accident that an employee caused to third parties (in excess of compensation under compulsory motor liability insurance) must be compensated at the expense of the organization (Article 1068 of the Civil Code of the Russian Federation). In this case, the employee who caused the damage is obliged to compensate such expenses in full (clause 6, part 1, article 243 of the Labor Code of the Russian Federation).

The employee must reimburse:

– the amount that the organization transferred to the injured party in excess of compensation under compulsory motor liability insurance;

– the cost of repairing the organization’s car (if the organization did not enter into a voluntary property insurance agreement or the insurance did not fully cover the costs of repairs).

However, by decision of the head of the organization, the employee may not fully or partially compensate for the damage caused by him (Article 240 of the Labor Code of the Russian Federation).

An example of calculating material damage caused by an employee in an accident. The employee compensates for the damage caused in full

Driver of the organization Yu.I. Kolesov became the culprit of the accident.

The damage caused amounted to 130,000 rubles. The insurance payment to the injured party under compulsory motor liability insurance amounted to 120,000 rubles. Repairing your own car cost the organization 35,000 rubles. The organization did not provide voluntary property insurance.

The amount of material damage that the employee is obliged to compensate to the organization is: 130,000 rubles. – 120,000 rub. + 35,000 rub. = 45,000 rub.

Creation of a special commission

To confirm the amount of material damage in an organization, you can create a special commission (Article 247 of the Labor Code of the Russian Federation). Its composition is approved by the head of the organization. It is advisable to create a commission when establishing facts of theft or abuse, as well as damage to valuables.

Indicate the identified shortage (cost of losses) in the matching statement.

Prepare matching statements:

- either according to the forms approved by paragraph 1.2 of the Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88 (forms No. INV-18 or No. INV-19);

– or according to forms developed by the organization independently and approved by the head of the organization.

This conclusion follows from Part 4 of Article 9 of the Law of December 6, 2011 No. 402-FZ.

If the amount of material damage can be established on the basis of documents received from counterparties, a commission need not be created. For example, in the event of an accident caused by an employee, the amount of material damage can be determined using documents received from insurance and repair companies.

Calculation of the amount of damage

Based on the order, deduct the cost of damage from the employee’s income, not exceeding his average monthly salary. Taking into account this rule, it is necessary to recover damages both in cases where the employee bears limited financial liability, and in cases where financial liability arises for the full amount of damage.

An amount of damage exceeding the average monthly salary can be recovered from an employee only through the court (if he bears full financial responsibility). At the same time, the employee can voluntarily reimburse the amount of damage. In this case, by agreement of the parties, compensation for damage by installments is allowed.

This procedure is established by Article 248 of the Labor Code of the Russian Federation.

Situation: how to determine the average monthly earnings when calculating the amount of material damage that can be withheld from an employee’s income?

The legislation does not provide for a methodology for calculating average monthly earnings. For all cases of maintaining average earnings, a uniform procedure has been established for its calculation based on the average daily (hourly) earnings (Article 139 of the Labor Code of the Russian Federation). Therefore, when calculating the amount of material damage, it is necessary to use it. The different names that are used to determine the amount of payments cannot serve as a basis for using any other procedure.

The cost of damage withheld from the employee’s income should not exceed his average monthly earnings (Part 1 of Article 248 of the Labor Code of the Russian Federation). However, the specific procedure for calculating earnings for such cases has not been determined. This means that general rules need to be used. Namely, you need to calculate average earnings based on the salary actually accrued to the employee and the time actually worked by him for the 12 previous calendar months. In this case, the months preceding the month in which the employee caused the damage. The total salary for 12 months must be divided by the number of days (hours) worked and multiplied by the number of working days or hours on the employee’s schedule in the month in which he caused the damage. Yes, in this case the average earnings will depend on the month of calculation. However, there is no reason to simply divide your annual earnings by 12. This follows from the provisions of Article 139 of the Labor Code of the Russian Federation, paragraphs 4, 9 and 13 of the regulations approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922).

You can deduct no more than 20 percent from an employee’s monthly salary. Therefore, it will most likely be necessary to recover the amount of material damage in the amount of the average salary within several months.

An example of calculating material damage recovered from an employee. An agreement on full financial liability has not been concluded with the employee.

In August 2015, due to the fault of employee A.S. Kondratiev printer failed. The employee has limited financial liability.

The amount of material damage is estimated at 12,000 rubles.

During the period from August 2014 to July 2015, Kondratyev worked 246 days. During this period, he was credited with 415,245.58 rubles.

There are 21 working days in August 2015.

Kondratyev’s average salary for the month in which the material damage occurred (August 2015) is: RUB 415,245.58. : 246 days × 21 days = 35,447.79 rub.

Since the average monthly salary is more than the amount of damage, by order of the manager, 12,000 rubles are withheld from Kondratyev. At the same time, no more than 20 percent of each of his salaries.

An example of calculating material damage recovered from an employee. An agreement on full financial liability has been concluded with the employee

In September 2015, the organization discovered a shortage of money in the cash register in the amount of 52,000 rubles. With cashier A.V. Dezhneva entered into an agreement on full financial liability. She admitted her guilt.

During the period from September 2014 to August 2015, Dezhneva worked 246 days. During this period, she was credited with 402,345.76 rubles.

There are 22 working days in September 2015.

Dezhneva’s average salary for the month in which the material damage occurred (September 2015) is: RUB 402,345.76. : 246 days × 22 days = 35,982.14 rub.

Since the average salary is less than the amount of damage, by order of the manager, Dezhneva is withheld 10,000 rubles. Moreover, from each of her salaries - no more than 20 percent.

For five months, the accountant withheld 2,000 rubles from Dezhneva’s salary. Dezhneva refused to reimburse the rest of the damage and quit. The organization went to court to recover funds.

An example of calculating an employee’s salary, taking into account deductions within his average earnings

On January 13, 2015, due to the fault of employee A.S. Kondratiev printer failed. An agreement on full financial responsibility has not been concluded with the employee.

The amount of material damage is estimated at 10,000 rubles.

During the period from January to December 2014, Kondratyev worked 247 days. During this period, he was credited with 400,000 rubles.

In January 2015, 15 working days.

Kondratyev’s average salary for the month in which the material damage occurred (January 2015) is: 400,000 rubles. : 247 days × 15 days = 24,291.50 rub.

Since the amount of material damage does not exceed Kondratiev’s average salary, the entire 10,000 rubles can be withheld from his income.

For January 2015, Kondratyev received a salary in the amount of 29,000 rubles. Kondratiev has no children.

The amount of personal income tax for January 2015 is: 29,000 rubles. × 13% = 3770 rub.

The employee’s income after tax is: RUB 29,000. – 3770 rub. = 25,230 rub.

The maximum amount of deductions from an employee’s monthly income is: RUB 25,230. × 20% = 5046 rub.

The amount of damage caused by the employee is greater than this amount. However, in January, the accountant withheld only 5,046 rubles from Kondratiev’s salary. The remaining 4954 rubles. (10,000 rubles – 5,046 rubles) the organization will deduct from the employee’s salary in the following months.

Maximum and minimum amounts

The topic “maximum and minimum deductions from wages” needs to be divided separately for voluntary and mandatory deductions.

As Rostrud points out, in letter PR/7156-6-1 (see text above), the restrictions of Art. 138. do not apply to withdrawals made at the request of the employee, within the time frame and amount specified by him. Thus, the worker independently and of his own free will manages his funds and determines what is the maximum amount for him and what is the minimum.

Article 138 of the Labor Code “Limitation on the amount of deductions from wages” relates to mandatory deductions made according to executive documents and based on Article 137. TC orders of the employer and will help calculate the percentage of the amount of deduction. Here we can mention, in addition to the 138th, also the 99th Art. Law on Enforcement Proceedings, containing similar provisions.

138th Art. The TC contains the following size restrictions:

- their total size cannot exceed 20%;

- in cases established by laws (On Enforcement Proceedings, Criminal Executive Code) – 50%;

- for exceptional cases, a general limit of 70% is established - these are deductions for correctional labor, alimony, compensation for harm to health, the death of a breadwinner, or from a crime committed.

Article 138. Limitation on the amount of deductions from wages The total amount of all deductions for each payment of wages cannot exceed 20 percent, and in cases provided for by federal laws, 50 percent of wages due to the employee.

When deducting from wages under several executive documents, the employee must, in any case, retain 50 percent of the wages.

The restrictions established by this article do not apply to deductions from wages when serving correctional labor, collection of alimony for minor children, compensation for harm caused to the health of another person, compensation for harm to persons who suffered damage due to the death of the breadwinner, and compensation for damage caused by a crime. . The amount of deductions from wages in these cases cannot exceed 70 percent.

Deductions from payments that are not subject to collection in accordance with federal law are not allowed.

Law “On Enforcement Proceedings” Article 99. Amount of deduction from wages and other income of the debtor and the procedure for its calculation

- The amount of deduction from wages and other income of the debtor, including from remuneration to the authors of the results of intellectual activity, is calculated from the amount remaining after withholding taxes.

- When executing a writ of execution (several writs of execution), no more than fifty percent of wages and other income may be withheld from a debtor-citizen. Withholdings are made until the requirements contained in the executive document are fulfilled in full.

- The limitation on the amount of deduction from wages and other income of a debtor-citizen established by part 2 of this article does not apply when collecting alimony for minor children, compensation for harm caused to health, compensation for harm in connection with the death of a breadwinner and compensation for damage caused by a crime. In these cases, the amount of deduction from wages and other income of the debtor-citizen cannot exceed seventy percent.

- Limitations on the amount of deduction from wages and other income of a debtor-citizen, established by parts 1 - 3 of this article, do not apply when foreclosure is applied to funds located in the accounts of the debtor, to which the employer credits wages, with the exception of the amount of the last periodic payment.

At the same time, the PEC limits the amount of deductions from wages for the least protected persons serving sentences: the disabled, the elderly, women with children.

The procedure for holding an employee financially liable for damage caused to the employer is established by Chapter 39 of the Labor Code of the Russian Federation. The employee is obliged to compensate the employer for direct actual damage caused to him (Article 238 of the Labor Code of the Russian Federation).

An employee's financial liability may be:

- limited (Article 241 of the Labor Code of the Russian Federation) - within the limits of the employee’s average earnings;

- full (Article 243 of the Labor Code of the Russian Federation) - in the following cases: the employee is charged with full financial responsibility for damage caused to the employer during the performance of his job duties;

- a shortage of valuables entrusted to the employee on the basis of a special written agreement or received by him under a one-time document was discovered;

- the damage was caused intentionally;

- the damage was caused while under the influence of alcohol, drugs or other toxic substances;

- the damage was caused as a result of the employee’s criminal actions established by a court verdict;

- the damage was caused as a result of an administrative offense established by the relevant government body;

- information constituting a secret protected by law was disclosed;

- the damage was caused while the employee was not performing his job duties;

- responsibility is established by the employment contract concluded with the deputy heads of the organization and the chief accountant.

To account for settlements with employees, account 73.02 “Calculations for compensation of material damage” is used (chart of accounts 1C).

If the guilty person is identified, the shortage is assigned to him on the date (clause 8, clause 7, article 272 of the Tax Code of the Russian Federation):

- recognition of damage by the guilty party;

- the entry into force of a court decision to recover the amount of damage.

The amount of damage is calculated based on market prices, but cannot be lower than the value of the property according to accounting data (Article 246 of the Labor Code of the Russian Federation).

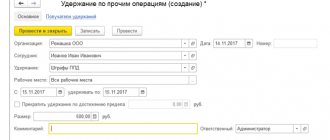

Accounting in 1C

Attribute the shortfall at the expense of the guilty person using the document Transaction entered manually, transaction type Transaction through the section Transactions – Accounting – Transactions entered manually.

https://www.youtube.com/watch?v=ytdeven-GB

In the document please indicate:

- from - the date of written recognition of the damage by the guilty party;

Write-off of the shortage to the guilty party at the actual (book) cost of the goods:

- Debit - 73.02 “Calculations for compensation of material damage”; Subconto - Ivanov Alexander Pavlovich, the MOL is indicated from the directory Individuals from whom the amount of the deficiency is subject to recovery;

We suggest you read: How to demand payment of wages in full

Writing off the difference between the actual and market value of the goods to the guilty party:

- Debit - 73.02 “Calculations for compensation of material damage”; subconto - Ivanov Alexander Pavlovich, the MOL is indicated from the directory Individuals from whom the amount of the deficiency is subject to recovery;

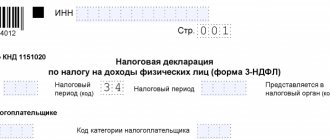

In the income tax return, the difference between book value and market value is reflected in non-operating income: PDF

- Sheet 02 Appendix No. 1 page 100.

Deductions from compensation payments

Situation: is it possible to withhold the amount of material damage from compensation payments to an employee for the use of his personal property and from daily allowances?

Answer: yes, you can. But only if the employee has written a statement of consent to the retention.

At the initiative of the organization, it is impossible to deduct the amount of material damage from such payments. This conclusion can be made on the basis of Article 137 of the Labor Code of the Russian Federation. It says that deductions at the initiative of the organization should be made from salaries. Compensation payments (daily allowances, compensation for the use of personal property) guaranteed by the Labor Code of the Russian Federation (Articles 168 and 188 of the Labor Code of the Russian Federation) do not apply to wages (Part 1 of Article 129 of the Labor Code of the Russian Federation). At the same time, labor legislation does not establish any restrictions on deductions that an organization makes not on its own initiative, but at the request of an employee. Therefore, if such a statement is made, the amount of material damage can be withheld from any payments.

If the employee does not agree to retention, act as such. Invite him to voluntarily compensate for the amount of material damage exceeding his average monthly earnings. He can:

– deposit the required amount into the cash register;

– with the consent of the organization, provide it with property equivalent to the damaged one (repair the damaged property);

– compensate for damage by installments.

This procedure is provided for in Article 248 of the Labor Code of the Russian Federation.

If the employee refused to voluntarily compensate for the damage or did not agree with its assessment, then he will have to go to court to repay the loss. You will also have to go to court if the withholding order was issued later than a month after determining the amount of damage (Article 248 of the Labor Code of the Russian Federation).

At the same time, the organization has the right to fully or partially refuse to recover damages from an employee (Article 240 of the Labor Code of the Russian Federation).

An example of an organization refusing to collect material damage from an employee’s salary

In January, the organization discovered a shortage of money in the cash register in the amount of 52,000 rubles.

With cashier A.V. Dezhneva entered into an agreement on full financial liability.

The employee admitted her guilt.

Dezhneva’s average salary in January was 10,000 rubles. This is less than the amount of damage (RUB 52,000). Therefore, by order of the head of the organization, only 10,000 rubles are withheld from the employee. The remaining amount is 42,000 rubles. (52,000 rubles - 10,000 rubles) Dezhneva refused to pay.

To recover this amount, the organization must go to court. However, the organization did not do this.

Payroll

Reflect the deduction in the employee’s payroll using the Payroll document through the Salaries and Personnel section – Salary – All accruals.

Please indicate:

- Salary for - July 2021, month of accrual;

- from - 07/31/2018, date of salary calculation.

The tabular part of the document is filled in automatically by clicking the Fill button:

- Employee - Ivanov A.P.;

- Accrued - 40,000;

- Personal income tax - 5,200, 13% personal income tax on the amount Accrued.

To reflect the amount of damage deducted from the employee’s salary, in the Payroll document, create a new Deduction by clicking the Deduction - New Deduction button.

In the Retention card, indicate:

- Name - Shortage identified during inventory;

- Amount - 3,600, 20% (1/5) of the market value of the shortage identified as a result of the inventory.

A new column Withheld will appear in the tabular part of the Payroll document.

The amount of damage will be automatically filled in the Withheld field - 3,600.

The document generates transactions:

- Dt 26 Kt 70 - calculation of wages to the employee;

- Dt 70 Kt 68.01 - Personal income tax is withheld from wages;

- Dt 26 Kt 69 - insurance premiums accrued.

Deadline for going to court

It happens that the amount of damage exceeds the employee’s average earnings. The employer cannot deduct more from him. Then the only correct solution would be to go to court. The same applies to the situation when an employee quits without compensating for all the employer’s losses, as well as when he refuses to compensate for damages voluntarily.

At the same time, it is very important to comply with the deadline set for employers to go to court. Namely one year. After all, if you miss it, you won’t be able to compensate for the damage at all. This procedure is provided for in Part 2 of Article 392 of the Labor Code of the Russian Federation.

In any case, the court will accept the statement of claim even after the deadline has expired. However, the refund will be denied. But if you present to the court valid reasons for missing the deadline, then it can be reinstated (Part 3 of Article 392 of the Labor Code of the Russian Federation).

Good reasons mean exceptional circumstances beyond the control of the employer that prevented the filing of a claim. For example, a natural disaster or other force majeure situation that cannot be influenced (resolution of the Plenum of the Supreme Court of the Russian Federation of November 16, 2006 No. 52).

How do you count the year for filing a claim? Count it from the date the damage was discovered. That is, from the date of completion of the inventory, during which the amount of damage received was identified or recorded. In this case, the term itself is considered to end on the corresponding date of the last year of the term. Moreover, if the last day of the deadline falls on a non-working day, then it is transferred to the next working day. This is exactly the procedure provided for calculating deadlines in parts 3 and 4 of Article 14 of the Labor Code of the Russian Federation.

In practice, a compensation agreement with an installment plan is often signed with the employee. But the guilty do not comply with it. In such circumstances, the period for the employer to go to court is counted from the date when the person violated the terms of the installment plan. This is, in particular, indicated in the ruling of the Supreme Court of the Russian Federation dated July 30, 2010 No. 48-B10-5.