Is it possible to defer payment of wages?

The company has the right to determine the dates of payment of wages to employees by internal regulations or employment contracts.

Since October 3, 2016, another condition has appeared - it is unacceptable to pay wages later than 15 calendar days from the end of the month for which they were accrued (Article 136 of the Labor Code of the Russian Federation). In the course of business activities, the employer may decide to change the timing of payment of wages (Article 22 of the Labor Code of the Russian Federation), make changes to employment contracts and local regulations. All this happens only in agreement with employees (Article 72 of the Labor Code of the Russian Federation), for which additional agreements are concluded with them.

Both when initially determining the terms of an employment contract and when making changes to it, it is necessary to take into account an important nuance: the determined conditions of remuneration cannot be worse than those established by labor legislation (Article 135 of the Labor Code of the Russian Federation).

Until October 2021, the requirements of the law were fully satisfied, for example, the following payment terms:

- 1st day of the month - advance payment for the previous month;

- On the 16th - payment of wages for last month.

However, from the fourth quarter of 2021 this is unacceptable.

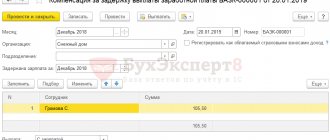

We calculate on our own

The legislation provides that monetary compensation for the fact of delayed wages should be accrued from the first day following the day on which wages should be paid. Even if this day is considered a non-working day. Calendar days are taken into account when calculating the number of days subject to compensation. Also taken into account is the day when the salary will be paid.

If the established day for issuing wages falls on a weekend or holiday, then its payment must be made the day before (that is, before the day off).

Using the formula

To calculate the amount due to an employee for late wages, you must use the formula:

Compensation for delay = amount of delayed salary x days of delay x 1/300 x refinancing rate

This compensation formula remains unchanged in 2021. The only thing is that the refinancing rate will change, so you should definitely monitor this indicator on the website of the Central Bank of the Russian Federation.

The amount of compensation may be increased if stipulated in the employment or collective agreement.

Example

The company has established salary payment dates:

- 18th - advance payment;

- 4th number - salary.

The employee's salary is 30,000 rubles, of which 5,000 rubles. he was paid on the date of the advance. And the rest of his salary in the amount of 25,000 rubles was paid to him only on the 19th (instead of the 4th).

So, the delay period is 15 days. The key rate for calculating penalties in January 2021 is 10% - it must be expressed in fractions of a unit - 0.1. (There is information that the refinancing rate will decrease throughout the year, so this information needs to be monitored).

Compensation for delay: 25,000 * 15 * 1/300 * 0.1 = 125 rubles.

Let's take the same example, but assume that the amount of compensation is established in the employment contract and is 12%, which in shares is equal to 0.12.

- 18th - advance payment;

- 4th number - salary.

The employee's salary is 30,000 rubles, of which 5,000 rubles.

he was paid on the date of the advance. And the rest of his salary in the amount of 25,000 rubles was paid to him only on the 19th (instead of the 4th).

So, the delay period is 15 days.

Compensation for delay: 25,000 x 15 x 1/300 x 0.12 = 150 rubles

It happens that an employer delays wages for more than 15 days. What if this delay occurs at the junction of calendar years? How to calculate in this case?

Example

- 18th - advance payment;

- 4th number - salary.

The employee's salary is 30,000 rubles, of which 5,000 rubles.

he was paid on the advance date (November 18, 2021). And let’s assume the salary in the amount of 55,000 rubles was paid on January 18, 2017. Non-payment period: 27 days in December 2021 and 18 days in January.

The employment contract does not provide for compensation for delays, so we calculate at the refinancing rate. In 2021 it was 11%, and the key rate this year is 10%.

We count: (55000 x 27 x 1/300 x 0.11) + (55000 x 18 x 1/300 x 0.1) = 874.5 rubles.

As you can see, the amount of compensation depends on the number of days of delay, the current refinancing rate (or the percentage of compensation established by the employment contract).

Using an online calculator

To calculate compensation, you can also use an online calculator

compensation payments.

This calculator calculates the amount of compensation for delayed wages in accordance with Article 236 of the Labor Code of the Russian Federation and using current refinancing rates.

It's very easy to use. Just enter the salary data in the appropriate fields and click the calculate button.

For the convenience of calculations, you can use the online compensation calculator for delayed wages on our website.

In what cases must an employer pay compensation for delayed wages?

If the employer does not pay employees wages on time, he will have to pay monetary compensation according to the rules enshrined in Art.

236 Labor Code of the Russian Federation. From October 3, 2021, monetary compensation for the delay is paid in the amount of 1/150 of the key rate of the Central Bank of the Russian Federation in force during the delay period. Compensation is accrued from the next day after the “salary” to the day when the money is actually issued. If on the day of payment of wages the amount is not paid in full, then compensation is accrued for the balance not received on time. This procedure is established by Part 1 of Art. 236 Labor Code of the Russian Federation, clause 2 of Art. 2, Art. 4 of the Federal Law of July 3, 2016 No. 272-FZ.

The amount of monetary compensation may be increased by a collective agreement, employment contract or local regulation. Compensation must be paid regardless of whether the employer is at fault for the delay in wages. Such conclusions can be drawn from Part 2 of Art. 236 Labor Code of the Russian Federation.

Employer's liability for non-payment of compensation

The law provides that the employer is obliged to bear responsibility for delays, regardless of the circumstances that led to the failure to pay on time. Along with the payment of delayed wages, employees are paid a penalty.

To protect the interests of workers, you need to seek help:

- trade union;

- labor inspectorates;

- ships;

- prosecutor's office.

A sample application to the labor inspectorate for non-payment of compensation for delayed wages.

Read more about how and where to apply in case of delayed wages (including compensation) here.

For those responsible for delay or refusal to pay wages and other accruals, disciplinary measures (reprimand, dismissal) and administrative punishment are provided. The court may rule on the recovery of material damage if such fact has been identified. There is also criminal liability; it occurs if the employer delays or refuses to pay wages for more than 2 months. Regarding compensation payments, the following penalties apply:

Fines

If compensation for the delay in payment of wages was not issued, the employer will be issued a fine under Part 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation. The administrative penalties are as follows:

- for legal entities an amount of 30–50 thousand rubles ;

- company officials pay a fine in the range of 10 - 20 thousand rubles ;

- individual entrepreneurs are punished with penalties of 1 - 5 thousand rubles .

Personal income tax and insurance premiums when calculating compensation

When compensation for delayed wages (vacation pay, benefits) is calculated in accordance with the regulations of the Labor Code of the Russian Federation, the amount is not subject to personal income tax. If the employer made the calculation according to its coefficient, personal income tax is charged on the difference.

Due to the absence of a term in the list of non-taxable payments, the inspection authorities believe that contributions should be calculated based on the amount of compensation paid. The Supreme Court issued a ruling ( SC dated 05/07/2018 No. 303-KG18-4287 ), according to which compensation payments should not be subject to contributions.

The scale of contributions is not always commensurate with the financial losses expected in the event of a dispute with the tax service. Due to the current ambiguous situation, lawyers recommend charging contributions for compensation for delayed payment of wages.

Last changes

The following changes have been adopted to the basic rules of the Labor Code of the Russian Federation in 2021 (in order to encourage employers to timely pay their subordinates):

- the salary must be issued no later than 15 days after the end of the period taken into account for payment;

- the indexation coefficient when calculating compensation for late payment of wages is 1/150 of the Central Bank rate (previously this number was significantly less - 1/300);

- employees have the right to recover wages from the employer within 12 months from the date of delay (previously the period was limited to 3 months);

- labor inspectorates have the right to conduct unscheduled inspections without approval from the prosecutor's office;

- You can file a claim for restoration of labor rights at your actual place of residence;

The procedure for holding officials accountable has been tightened: warnings as an incentive measure have been cancelled, fines are imposed on the first delay, repeated non-payment entails a significant increase in the amount of administrative punishment. Fines for repeated late payment of wages: for individual entrepreneurs 10–30 thousand rubles, for legal entities 50–70 thousand rubles For officials, a penalty is provided in the form of deprivation of their position (from one year to 3 years).

No company is immune from force majeure situations. Experts recommend that employers include a fixed coefficient in the employment contract that does not depend on the Central Bank rate. This move will allow you to accurately calculate the amount of compensation payments and eliminate unexpected problems in the event of an error in the constantly changing refinancing indicator.

How is compensation for delay calculated?

Let's look at an example of how to determine the amount of compensation for delayed payment of wages. Suppose Smetannik LLC has the following salary payment deadlines:

- for the first half of the month - on the 23rd day of the current month;

- for the second half of the month - on the 8th day of the next month.

Salaries for the second half of October 2021 were accrued in the amount of 20,000 rubles, but were paid only on November 22, 2016.

The duration of the delay from 09.11.2016 to 22.11.2016 was 14 days. The key rate of the Bank of Russia, which was in effect during the period of overdue payments, was 10%.

Compensation is calculated in the amount of 17,400 rubles (20,000 – (20,000 x 13%)).

The amount of compensation will be 162.40 rubles (17,400 x 10% / 150 x 14).

Where does the calculation of compensation begin?

Before calculating compensation, it is necessary to find out whose fault the delay in payment was.

If the employer is at fault, compensation is assessed and paid. If the employee himself - no. The latter case includes situations where employees do not provide bank card information on time or do not report to the accounting department (if the company makes cash payments). So, the employer is to blame for the delay. The inputs for calculating compensation will be:

- The exact date of payment of wages (from this date the arrears are calculated).

- Number of days overdue.

- The Central Bank rate for calculating compensation or the coefficient specified in the contract.

Another important point. The number of days of delay is calculated using the calendar method (including weekends).

What consequences await the organization if compensation is not paid?

Let us repeat, payment of compensation for delayed wages is an obligation provided for by the Labor Code.

However, the Code of Administrative Offenses of the Russian Federation does not clearly establish liability for untimely payment of compensation in the event of delayed wages. However, general liability is provided for violations in the field of remuneration. So, for non-compliance with the norms of the Labor Code of the Russian Federation, the labor inspector can fine:

- the head of the organization - in the amount of 1 to 5 thousand rubles;

- the organization itself - in the amount of 30 to 50 thousand rubles.

These amounts do not seem so significant if the fines are imposed once. Practice shows that one-time delays in salary payments are extremely rare, and if a company does commit such violations, it is often with enviable consistency.

Formula for calculating compensation

Two formulas are used for the calculation.

One of them allows you to calculate compensation at the Central Bank refinancing rate. The other is based on the coefficient specified in the employment contract. If the refinance rate is used, the formula is as follows:

Compensation = salary * 1/150 * Central Bank refinancing rate * number of days of delay.

If the contract specifies a coefficient (usually it is indicated as a percentage), the calculation is carried out using the following formula:

Compensation = salary * coefficient in % * number of days of delay.

What to do if the company does not have enough money to pay salaries and compensation?

The well-known advice of the Prime Minister will not work in such a situation.

The law does not relieve the employer from the obligation to pay wages to the employee even if business activities are temporarily suspended due to financial difficulties. If employees do not go to work due to non-payment, using their right enshrined in Part 1 of Art. 157 of the Labor Code of the Russian Federation, then according to the law (Part 3 of Article 72.2 of the Labor Code of the Russian Federation), this situation is recognized as downtime. And downtime is paid in an amount not lower than 2/3 of the average salary of workers. Compensation will also have to be paid.

How to calculate and receive compensation?

If the employer does not make payments required by law, action should be taken immediately. An employer's promises to pay must be in writing and include statutory compensation.

Let's analyze what to do if your salary is delayed, and how to get the money required by law. We recommend protecting your rights in the following order:

- Contact the labor inspectorate immediately after a delay. Prepare a free-form statement and indicate all the circumstances of the current situation, including the period of delay, amount and reasons, if voiced by the manager.

- Preparation of notice of absence after 15 days. Write a notice in writing to the manager indicating the conditions for exit, namely payment of wages. After this, you don’t actually have to go to work.

- File a claim in court and demand payment of wages and corresponding compensation, the amount of which depends on the percentage of the refinancing rate on the day the claim is filed.

- Notify the prosecutor's office about the violation of labor laws and complain about ignoring all requirements. A criminal case may be initiated if wages are not paid for more than 3 months.

Correct actions from the first days of the delay will allow you to receive your earned money as soon as possible.