Directive of the Bank of Russia dated March 11, 2014 N 3210-U “On the procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses” (with amendments and additions)

Point 6

6.5. The amount of cash intended for payment of wages, scholarships and other payments is established in accordance with payroll 0301009 (payroll 0301011). The deadline for issuing cash for these payments is determined by the manager and is indicated in payroll 0301009 (payroll 0301011). The duration of the period for issuing cash for wages, scholarships and other payments cannot exceed five working days (including the day of receipt of cash from a bank account for these payments).

On the last day of issuing cash intended for wages, scholarships and other payments, the cashier:

- In the payroll sheet 0301009 (payroll sheet 0301011), a seal (stamp) is affixed or the entry “deposited” is made opposite the names and initials of employees who have not been issued cash.

- Calculates and records on the bottom line the amount of cash actually issued and the amount to be deposited;

- Reconciles the indicated amounts with the total amount in payroll 0301009 (payroll 0301011);

- Puts his signature on payroll 0301009 (payroll 0301011);

- Submits it to the chief accountant or accountant (in their absence, to the manager) for signing.

The directive and other regulations do not explain whether it is possible to store deposited wages in a cash register or only in a bank account, and also do not contain a prohibition on storing deposited wages in a cash register.

Based on the foregoing, we can conclude that the organization is not obliged to hand over deposited wages to the bank if the cash balance limit in the organization’s cash register, taking into account this amount, is not exceeded, or if the organization, as a small business entity, does not set a cash register limit at all. Please note that this is our expert opinion; we have not found any explanations from the Central Bank of the Russian Federation.

History of the term

The term came into German use from the Latin word “deponentus”; in German it was transformed into “deponent”, from where this definition was borrowed by world banking terminology in the 19th century.

The purposes of depositing the depositor's funds may vary in detail, but in general they come down to ensuring the safety of private funds at the expense of a financial institution, including the possibility of making a profit thanks to long-term deposits, allowing the bank to put them into circulation and insurance providing partial or full return of funds in the event of bankruptcy of a financial institution. enterprises.

Types of depositor

A depositor is a person who makes deposits in a banking institution with subsequent insurance and profit. What is called “putting it in the bank at interest.”

Depositors are people who are owed certain monetary payments. For example, employees whose wages are being delayed, or parents who owe child support, pensioners, etc.

Also, depositors are persons who have a securities account and who have the right to manage and put into circulation the funds that are in this account.

A securities account is an account opened in a depository (that is, a branch where securities are stored - shares, assets), and accordingly, the property stored in this account is presented in the form of securities.

Funds that are due to a person, but are not in his hands, but in some financial organization are called deposited, respectively. Receipt of deposited funds must be carried out within the time period specified in the agreement. When the statute of limitations on deposited funds expires, they are transferred to the state budget.

Salary deposit in 1C

Content:

1. Depositing salary in 1C 8.3 Salary and personnel management

2. Synchronization of 1C ZUP 3.1 and 1C PB 3.0

3. Salary deposit in 1C ERP 2.4 and 1C 8.3 KA 2.4 configurations

In work, there are often cases when an employee has been paid a salary, but for one reason or another it is not possible to pay it, for example, when the employee is on vacation or on a business trip, this example is only suitable when the salary is paid through the cash register. In such cases, the salary is deposited.

This article will discuss examples of salary deposition in 1C programs. In 1C 8.3 Salary and personnel management, edition 3.1 (ZUP 3.1), 1C ERP 2.4 and 1C Integrated Automation 2.4 (1C 8.3 KA 2.4).

Since in 1C ERP 2.4 and 1C 8.3 KA 2.4 the algorithm is approximately the same, so we will not consider it separately.

We will also consider how ZUP 3.1 and BP 3.0 are synchronized when depositing salaries in ZUP 3.1

Depositing salaries in 1C 8.3 Salaries and personnel management

We pay salaries for June 2021 through the cash register (Payments - Statements to the cash desk)

Open the document, click on the hyperlink below: Salary payment and personal income tax transfer.

In this case, in my example, part of the salary has already been deposited, so the Open salary deposit information hyperlink is active.

If the salary had not been deposited, the Enter salary deposit information hyperlink would be active.

Through this hyperlink, a Salary Deposit document is created.

You can also access the Salary Deposit document through the Payments – Depositors block.

Synchronization of 1C ZUP 3.1 and 1C PB 3.0

When we look at the list of documents that are registered during synchronization, we can see that one of the documents is Salary Deposit. This can be done through: Administration – Data synchronization – select the desired synchronization setting, select two squares – thereby dropping into the list of objects registered for synchronization with BP 3.0.

After synchronization, you can see that this document is correctly uploaded to the BP 3.0 database and creates the necessary transactions: DT 70 KT 76:

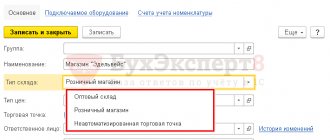

Salary deposit in 1C ERP 2.4 and 1C 8.3 KA 2.4 configurations

The algorithm for depositing salaries in 1C ERP 2.4 and 1C 8.3 KA 2.4 is similar to ZUP 3.1, the only difference is in the location of the subsystems in the program itself + let’s consider a slightly different algorithm:

Salary – Payments – Statements to the cash desk.

Based on the document Statement to the Cashier, we create the document Salary Deposit:

A document is created with two tabs, on the first Main - a link to the statement and other details, which are displayed in printed form.

On the Deposits tab, enter employees and the deposit amount by employee in a list.

When reflecting the document in regulated accounting, we get:

Specialist

Kharkova Anastasia Igorevna

The role and functions of the depositor in the economy

The role of the depositor in the economy is not limited to the safety and profitable investments of his private financial assets. Depositors occupy a significant niche in the functioning of the banking system. The bank directly depends on the introduction of third-party resources into its system.

Statistics claim that the difference in the ratio of deposits to the bank’s own resources in most cases is considered not in favor of the latter, since deposits make up the majority of all bank resources, according to the same statistics - deposits take up 60% of bank resources.

However, in order for the bank to work effectively with these deposits, so that it can manage them with subsequent profit, it is necessary to optimize the terms of the deposit for depositors who want to use the services of the enterprise. For this purpose, a whole system of profitable deposits for individuals is being built on conditions beneficial to both parties.

Simply put, thanks to deposits (money deposits in banks at interest) of depositors, the banking system operates, which has in its turnover a huge amount of other people’s investments, with the help of which the bank, by performing certain work operations, is able to increase the profitability of its enterprise and pay the required interest to depositors, in connection with which it can be argued that depositing funds benefits both parties through cooperation.