Entering compensation for delayed wages

Compensation for delayed salary payment is calculated in 1C 8.3 ZUP by the document of the same name (Payments - Compensation for delayed salary).

To correctly calculate compensation, it is necessary that in the organization’s settings (Organization directory - Accounting Policies tab and other settings - link Accounting and salary payment) the correct date of salary payment is indicated. It is on the basis of this date that it will be determined how many days the payment is overdue.

Also, to calculate compensation, it is required that the current Central Bank refinancing rate be loaded into the 1C 8.3 ZUP program, since compensation must be calculated in an amount not lower than 1/150 of the current key rate of the Central Bank of the Russian Federation for amounts that were not paid on time. You can check the current rate in the program through the Editing legal values (Settings - Service):

Calculation of compensation for delayed payment of wages

Let's look at an example of how compensation is calculated in 1C 8.3 ZUP.

Employee Gromova S.S. in December, a salary of 30,000 rubles was accrued. In December, an advance payment of 5,000 rubles was paid, leaving 21,100 rubles to be paid for December. = 30,000 – 13% (personal income tax) – 5,000 (advance).

Salary payments are usually made on the 10th of the next month, this is indicated in the organization’s settings.

Payment of the December salary to employee Gromova was delayed until January 20, 2019.

Before registering salary payments, enter the document Compensation for delayed salaries . It is necessary to indicate the date of the document, which must be equal to the date when this delayed salary is paid (it is on the basis of this date that the number of days of delay will be calculated), enter the month in which compensation is paid, as well as the month for which the salary is delayed.

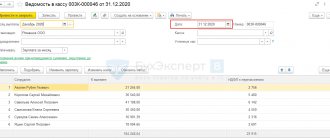

By clicking the Fill , employees who have unpaid balances for the specified accrual month will be automatically loaded into the document:

The amount of compensation will be:

- 21,100 (income payable) * 7.5% (key rate) * 1/150 * 10 (days overdue) = 105.50 rub.

Details of the calculation can be seen in the document itself by clicking on the line with the employee. In the window that appears, you need to open the calculation details.

The 1C ZUP 3.1 program supports automatic calculation of compensation for delayed payment only for wages. If the payment of an advance or, for example, vacation pay is delayed, then the amount of compensation must be calculated and entered into the document manually!

Next, the accrued compensation for delayed salaries 1C 8.3 ZUP will be taken into account when filling out the statement for the payment of the employee’s salary, i.e. The amount to be paid will be determined taking into account the accrued compensation:

How to calculate compensation for salary delays in 1C: Salary and Personnel Management 8

According to the Labor Code and Art. 236, the employer is obliged to pay due compensation to the employee if his salary was paid later than the deadlines established by law. The rate must be no less than 1/150 of the active rate of the country's Central Bank. The calculation is based on the amount of late paid wages. Accounting is maintained from the next day of late payment until the actual payment date.

As for the 1C Software Product, the rate is registered automatically. It can be viewed in the information register “Central Bank refinancing rate” for 2021. The rate can be adjusted if necessary. You just need to enter it into the Information Register and indicate it as a percentage for the day of delay.

How and where to calculate Compensation for delayed payment of wages

The 1C Software product provides for the document “Compensation for delayed payment of wages.” This document must be registered before filling out the statement for payment of compensation payments. To generate a document, you need to go through the following scheme in the 1C accounting program: “Salary” or “Payments”, and then “Compensation for salary delays”, and then click the “Create” button.

In the received document you must fill in the following fields:

- month – the month when the payment is registered;

- date – the day on which the delay period ends;

- organization – company, legal entity;

- division – fill in if the company has several divisions;

- salary was delayed for... - here select the month in which there was a delay.

Since compensation accruals to employees do not relate to labor costs under Art. 255 of the Tax Code of the Russian Federation, then these accruals must be reflected in the credit of account 73 “Settlements with personnel for other operations.” In the “Account as” field, select the type of operation “Other settlements with personnel”. When synchronizing with the 1C accounting program, a posting will be generated for the credit of account 73. If the operation type is selected Payroll calculations or the field is not filled in, then during synchronization a posting will be generated for the credit of account 70

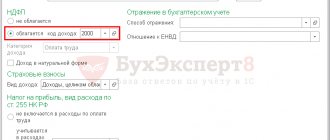

Is compensation subject to personal income tax?

Another important question: is compensation subject to insurance premiums? The question is of course controversial and many do not understand and are only guessing. From the legal side, this is not stated anywhere; there is no judicial practice in open sources. And if you and I look at 1C Software Products, then the amount of compensation is automatically “not taxed” and if we need to change it so that it is taxed, then we need to go to the payroll settings and check the box next to the position “Register compensation for late payment of wages” as taxable income."

To calculate the amount, you must click the “Selection” button, that is, the compensation will be calculated automatically. It can be changed if necessary. Next, you need to indicate in the “Payments” column when the funds will be transferred: at the time of receipt of an advance payment, salary, or in another inter-settlement period, and the calculation of monetary compensation will occur automatically on the date of payment.

Compensation is not subject to personal income tax

Insurance premiums from compensation for delayed payment of wages

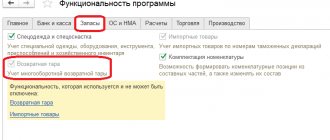

If you want insurance premiums to be calculated from compensation, then in the Compensation for delayed salary , check the Register as income subject to insurance premiums .

Or set a single checkbox in the salary calculation settings Register compensation for delayed payment of wages as income subject to insurance contributions , then this checkbox will be checked automatically in all newly created documents.

After posting the document with the Register as income subject to insurance premiums , you need to recalculate employee contributions from this document the Accrual of Salaries and Contributions

Personnel accounting and payroll calculation in 1C 8.3 ZUP 3.1

Question:

It is required to calculate compensation for delayed wages in 1C ZUP 3 . When calculating compensation in the corresponding document, insurance premiums are not calculated. We require it to be subject to contributions. How to set this up?

Answer:

✅ Seminar “Lifehacks for 1C ZUP 3.1”

Analysis of 15 life hacks for accounting in 1C ZUP 3.1: Find out more ->>

✅ CHECKLIST for checking payroll calculations in 1C ZUP 3.1

VIDEO - monthly self-check of accounting: Find out more ->>

✅ Payroll calculation in 1C ZUP 3.1

Step-by-step instructions for beginners: Find out more ->>

✅ All free seminars on 1C ZUP 3 ->>

Previously ( before the release of 1C ZUP 3.1.4.120 ), to implement the calculation of contributions from compensation, it was necessary to create a separate type of accrual, which is subject to contributions, and accrue compensation for this type of calculation using the One-time accrual , and not the Compensation for delayed salary . This was quite inconvenient, since the ability to automatically calculate compensation and automatically fill out the document was lost.

Starting with release 3.1.4.120, in the Compensation for delayed salary , the Register as income subject to insurance premiums checkbox appeared .

This checkbox should be selected if it is necessary to calculate contributions from compensation. If you always want to calculate contributions from compensation, you can configure the checkbox to be checked by default when creating a document. To do this, in the payroll settings (menu section Settings - Payroll), check the box Register compensation for delayed salary payments as income subject to insurance contributions.

However, when calculating such compensation, there is one feature that we will consider with an example.

Employee Arsenyeva V.S. salary and bonus for January were accrued.

Salary payments in the organization are made on the 5th day of the month following the month of salary accrual. This is indicated in the program settings ( Organization directory - Accounting policies and other settings - Accounting and salary payment ).

Payment of wages for January will be made with a delay of 5 days, i.e. not on the 5th, but on the 10th of February. Therefore, before registering the document Statement... it is necessary to calculate the compensation using the document Compensation for delayed wages . It is worth considering that in 1C ZUP 3 the document can be filled out automatically. It will be filled in by all employees who, as of the date the document is entered, have unpaid salaries for January and will calculate compensation from the date of the planned payment (02/05/2018 in this case) to the date specified in the document (02/10/2018).

In this case, the calculation was performed as follows:

- 59,334 (delayed amount) * 0.0825 (refinancing rate) * 1/150 (Article 236 of the Labor Code of the Russian Federation) * 5 days = 163.17 rubles.

Now you need to calculate insurance premiums from this compensation. This is where the peculiarity lies. We need to remember to return to the document Calculation of salaries and contributions , in which this employee was calculated, and recalculate her contributions.

BEFORE:

AFTER:

Now we can complete the payment of salaries for January. The Gazette... dated February 10 will include both accrued wages and compensation.

To be the first to know about new publications, subscribe to my blog updates:

or join groups on social networks, where all materials are also regularly published:

- in contact with;

- YouTube channel;

- classmates.

- facebook;

Best regards, Dmitry Gerasimov!

If you liked the publication, you can save a link to it on your page on social networks. To do this, use the “Share” located just below.