Often citizens who do not have legal knowledge, when they hear about an assignment or assignment agreement, do not understand what we are talking about. This fact may lead to the fact that, if necessary, a person is unable to protect his rights. The fact is that this document is drawn up to alienate the right to loan obligations to another individual or legal entity, guided by the legislation of the Russian Federation.

In other words, this is an agreement to transfer financial responsibility and obligations without the consent of the person holding the debt. The most typical example of such an agreement: the bank sells the obligations of clients to collectors. Let's consider what accounting entries document the assignment of the right to claim debt between legal entities.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

Participants in the assignment of claims

From the name it becomes clear that the contract is concluded so that one party to the contract cedes its right of claim to another party. By rights we mean receivables. So why do organizations resort to such measures?

Let's take, for example, organizations conducting joint activities under a supply agreement, provision of services or provision of a loan. Sometimes, after some time of working together, the buyer, despite strict payment terms and penalties for delay specified in the contract, does not transfer money to the supplier.

The supplier decides to sell its receivables by concluding an assignment agreement with a third-party company. He can do this without notifying his debtor partner (Articles 382, 384, 385 of the Civil Code of the Russian Federation).

When concluding an agreement for the assignment of the right of claim, the parties to the transaction are the following participants:

- seller (assignor);

- buyer (assignee).

The debtor, i.e., an organization that does not want to repay its creditor, is sent a letter indicating the details of the new creditor and the details of the assignment agreement on the basis of which the debt was transferred to it.

After signing the agreement, the assignor transfers all primary documents to the assignee. They will be confirmation of the purchased debt.

Such documents include:

- supply agreement (service or loan);

- delivery notes, acts, invoices, etc.;

- act of reconciliation between the assignor and the debtor.

After this, the parties to the transaction need to make the appropriate entries under the assignment agreement in accounting.

Results

So, we have looked at what entries under the assignment agreement are made by its participants if the enterprises are VAT payers. In conclusion, let’s say that for some entrepreneurs, assignment agreements can be an interesting business, and for others, they can be a sure way to get their money. But you need to understand that the assignor, after concluding the contract, is not responsible and does not guarantee that the debtor will pay the entire debt.

What to pay attention to when concluding an agreement with simplified taxation system payers or individuals, read the articles:

- “Assignment agreement under the simplified tax system, income minus expenses (nuances)”;

- “Physicist” received performance on a loan acquired by assignment. What about personal income tax?

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accounting for the assignment agreement with the assignor and payment

Example

LLC "Dream" sold hardware for 246,750 rubles, including VAT 20%, under a contract for the supply of goods to LLC "Lumiya". The purchase price of hardware is 153,550 rubles.

Mechta LLC signed an assignment agreement with Fialka LLC. The receivable amount is 228,690 rubles, including VAT 20% - 38,115 rubles. To ensure that the contract is drawn up correctly, Fialka LLC pays for a legal consultation of 1,500 rubles.

Accounting entries under the assignment agreement from the assignor.

| Postings | Sum | Operation |

| Dt 62 Kt 90.1 | 246 750 | Hardware sold |

| Dt 90.3 Kt 68.2 | 41 125 | VAT charged (246,750 × 20/120) |

| Dt 90.2 Kt 41 | 153 550 | Cost of hardware |

| Dt 90.9 Kt 99 | 52 075 | Profit received under the supply agreement5 - 153,550) |

| Dt 76 Kt 91.1 | 228 690 | Selling debt |

| Dt 91.2 Kt 62 | 246 750 | Write off accounts receivable |

| Dt 99 Kt 91.9 | 18 060 | Received a loss on the assignment of receivables (246,750 - 228,690) |

Fialka LLC transfers 228,690 rubles to Mechta LLC under the agreement, including 20% VAT.

Payment under the assignment agreement - postings:

| Dt 51 Kt 76 | 228 690 | Payment received from Fialka LLC |

If the assignment of a debt occurs before the payment deadline stipulated by the contract, the loss received from the assignment for profit tax purposes is taken into account in a special manner (clause 1 of Article 279 of the Tax Code of the Russian Federation).

Examples of accounting for transactions with the assignor

In order to clearly understand the procedure for accounting for transactions under an assignment agreement, let’s look at examples.

Postings on assignment of claims

10.12.17 Smart LLC sold a batch of stationery to Stationery LLC:

- selling price – 177,320 rubles, VAT 27,048 rubles;

- the cost of a batch of stationery is 104,800 rubles.

Within the prescribed period, the Office did not transfer to Smart the amount of funds to pay for office supplies. In this regard, on 11/02/17 Smart entered into an assignment agreement with Kurs JSC, according to which:

- “Smart” transfers to “Kurs” the right to claim the debt of the “Chancery”;

- the cost of transferring the right of claim is 154,700 rubles.

11/14/17 “Kurs” transferred to “Smart” the amount of payment under the assignment agreement. Since the cost of transferring the claim (RUB 154,700) is lower than its book value (RUB 177,320), Smart does not need to charge VAT on the sales amount.

Smart's accounting records the following entries:

| date | Debit | Credit | Sum | Description |

| 12.10.17 | 62 | 90.1 | RUB 177,320 | Revenue from the sale of stationery is taken into account |

| 12.10.17 | 90.3 | 68 VAT | RUR 27,048 | VAT charged on the sales amount |

| 12.10.17 | 90.2 | 41 | 104.800 rub. | The cost of a batch of stationery written off as expenses |

| 02.11.17 | 76 Contract of assignment of the right of claim | 91.1 | 154,700 rub. | The transaction of assignment of the right to claim debt in favor of Kurs JSC is reflected |

| 02.11.17 | 91.2 | 62 | RUB 177,320 | Accounts receivable from the Office were written off and the composition of expenses in connection with the assignment of the right to claim the debt |

| 14.11.17 | 51 | 76 Contract of assignment of the right of claim | 154,700 rub. | Funds have been credited to the Smart account as payment for the transfer of the right to claim the debt |

Basic provisions

Legal details regarding the assignment agreement are indicated in Art. 382, 390 - 392 of the Civil Code of the Russian Federation. There are three parties to the agreement:

- assignor - transferring the right to claim the debt;

- assignee – accepting the right to claim an obligation;

- debtor.

If an assignment agreement is drawn up, a bilateral agreement can be concluded, in which case it is not necessary to have consent from the debtor; it is enough to notify him, or to draw up a tripartite agreement.

It is important to note that it is impossible to arrange an assignment for personal debts:

- payment of moral damages;

- satisfaction of material damage, as well as damage caused to life and health;

- alimony payments.

How is the assignment of debt between legal entities reflected in accounting?

According to clause 3 of PBU 19/02, DZ, which was purchased under an assignment agreement, is an object of financial investment, taking into account compliance with a list of criteria.

Therefore, in the case of acquiring a DZ assignment under an agreement, it is important that the following conditions are met:

- there is available documentation that will confirm the right to obligations;

- along with the debt, the assignee receives financial risks associated with the obligation;

- future economic benefits pass to the assignee.

The assignee has no right to change the terms of the original agreement. In this case, the transaction may be challenged in the future.

If all these points are met, then the assignee takes into account the acquired debt in the account. 58 “Financial investments”.

The assignee reflects the acquired debt at the cost of all costs that it incurred during the acquisition process:

- expenses that were paid to the assignor under the concluded agreement;

- expenses for services that were required to purchase finance. attachments;

- remuneration paid to intermediary organizations.

Allocation of the VAT amount is required only if the purchased debt was formed as a result of the functioning of an agreement for the sale of goods (services or work). In such a situation, VAT is required to be charged on the excess of the debt that needs to be repaid over expenses. The tax is calculated - 18/118 or 10/110 (clause 2 of article 155; clause 4 of article 164 of the Tax Code of the Russian Federation).

And then the assignor, in turn, takes into account the requirements for the assignment agreement on the account. 91.

The debtor reflects the amount on the required account, on which the analytics must be present. Therefore, when a creditor changes, the debtor must reflect the changes in analytical accounting.

From the date of signing the agreement, the primary lender writes off the debt - the obligation of a specific borrower.

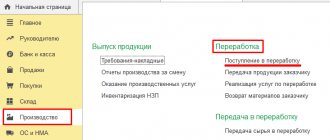

Assignment agreement in 1C 8.3 with the assignor

The transfer of debt to the Assignee will be reflected in the sales document.

Fig.6 The transfer of debt to the Assignee will be reflected in the sales document

We create a new document for the sale of services, having two options for the input form to choose from.

Fig.7 Creating a new document for the sale of services

We fill out the document.

Fig.8 Filling

Postings from the parties to the contract

After concluding an assignment agreement of the right to claim debt between legal entities, the assignee’s transactions will look like this:

| Debit | Credit | Operation description |

| Dt 58 | Kt 76 | Accounting for acquired debt |

| Dt 76 | Kt 91 | When the debtor repays the debt, the assignee records income as the amount received |

| Dt 91 | Kt 58 | The amount of the obligation contributed by the debtor is written off |

| Dt 51 | Kt 76 | Received funds from the debtor |

If VAT has been charged, then in the situation of expiration of the agreement or in the event of the next assignment, the assignee makes the following entry: Dt 91 Kt 68/for analytical accounting, a value added tax subaccount is used.

When assigning a debt between legal entities, the accounting entries made by the assignor look like this:

| Debit | Credit | Operation description |

| Dt 76 | Kt 91 | The amount of income received from the sale is reflected |

| Dt 91 | Kt 62 (76) | The amount of the repaid liability is written off |

| Dt 51 | Kt 76 | Settlements under the contract in case of payment |

This material will tell you in detail how to draw up an agreement on the assignment of the right of claim between legal entities.

BU with the assignee

| Dt | CT | Sum | Operation |

| 58 | 76(A) | 110000 | Purchasing the right to claim a debt (financial investment) |

| 76(A) | 51 | 110000 | Payment to the assignor from the account |

| 51 | 76(B) | 120000 | Received a payment from the debtor |

| 76(B) | 91.01 | 120000 | Revenue reflected |

| 91.02 | 58 | 110000 | Costs reflected |

| 91.02 | 68.02 VAT | 1666,67 | VAT charged on the transaction (10000*20/120) |

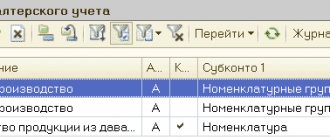

Registration in the 1C program

In 1C, in such cases, manual entries are made. Documents are generated in the “Operations entered manually” section; you can find the item in the “Operations” menu.

The assignment of debt between legal entities in 1C is reflected by the following transactions:

| Debit | Credit | Operation description |

| Dt 76.09 (with analytics for the lender) | Kt 91.01 | The entry amount is made up of the assignee's obligation under the agreement |

| Dt 91.02 | Kt 62.01 | The size of the debt is indicated in accordance with the amount of the assignor |

The assignee must generate transactions of the following type:

| Debit | Credit | Operation description |

| Dt 58.05 | Kt 76.09 | The amount of this operation is the total costs that were incurred for the purchase of remote control |

Repayment of obligations is reflected as follows:

| Debit | Credit | Operation description |

| Dt 76 | Kt 91.01 | The amount of debt that must be collected from the debtor |

| Dt 91.02 | Kt 58.05 | For the amount of actual costs incurred |

| Dt 51 | Kt 76.09 | Based on the amount of funds received |

Documentation of the assignment by the assignee

The Civil Code does not stipulate the concept of assignment of debt. To manipulate the transfer of obligations, the law provides two options:

- assignment of the right of claim;

- transfer of debt.

Obligations are transferred under transfer agreements using the procedure described in Art. 391 Civil Code of the Russian Federation. And the assignment of the right of claim is regulated by Art. 388 Civil Code of the Russian Federation. At times, confusion arises between the assignment of a claim and the transfer of a debt.

Note from the author! An assignment of the right of claim is a situation when the creditor, that is, the party collecting the receivable, changes. Debt transfer, on the contrary, is a change of debtor who transfers his obligations to a third party.

Features of displaying transactions in enterprise accounting depend on the party on which the party to the agreement acts. In case of transfer of your rights, an assignment agreement is concluded. The creditor who assigns the original right to collect the obligation is called the assignor, and the new owner of the debt is called the assignee.

For the assignee, the newly received debt becomes a financial investment under clause 3 of PBU 19/02. Of course, for this a number of conditions must be met:

- Availability of primary documents on the occurrence of obligations.

- The ability to obtain economic benefits from the acquired liability.

- Financial risks associated with arrears.

The assignee makes special accounting entries:

- Debit of account 58 “Financial investments” - Credit of account 76 “Settlements with various debtors and creditors.”

The new owner records a profitable debt for the total costs incurred for its purchase:

- for information and consulting services;

- intermediary fees;

- to the assignor for the acquisition.

When the debtor pays off his monetary obligations, the assignee carries out the necessary operations in the accounting program:

- Debit 76 of account Credit 91.01 “Other income” - the financial result is accounted for in the form of debt repaid under assignment.

- Debit 91.02 “Other expenses” Credit 58 “Financial investments” - the transferred receivables are repaid.

- Debit 51 “Current accounts” Credit 76 accounts - money came from the debtor by bank transfer.

Since receivables include accrued value added tax, the assignee must also take into account VAT:

- Debit 91.02 “Other expenses” Credit 68.02 “Value added tax”.

Assignment agreement - postings to the assignee

Since the assignee did not purchase goods or services, but only bought the receivable, he will take it into account as a financial investment.

And in the process of its formation, he has the right to include in the costs both the amount of the purchased debt and related expenses. Such expenses include the services of intermediaries, as well as any costs incurred associated with the purchase of this asset (clauses 8, 9 of PBU 19/02, approved by order of the Ministry of Finance of Russia dated December 10, 2002 No. 126n). Continuation of the example

Assignment agreement - postings to the assignee:

How to reflect a debt to the assignor

The assignor, who transferred his receivables to the new owner, must make certain accounting movements in connection with the assignment of claims. Since according to paragraph 2 of Art. 132 of the Civil Code of the Russian Federation, the rights of claim constitute a share of the company’s property, then in fact the assignor sells it under an assignment agreement.

Therefore, the assignor takes into account earnings from the sale of receivables as a credit to account 91 “Other income and expenses” within the framework of operating activities.

Note from the author! Operating activities include income and expenses that directly affect the operating costs and profit of the enterprise.

In turn, the debit of account 91 displays the expenses that the assignor incurred when selling his right to claim. In total, the assignor must carry out the following operations:

- Debit 76 of the account “Settlements with various debtors and creditors” subaccount “Assignee” Credit 91.01 “Other income” - displays the totality of debts transferred under the assignment agreement.

- Debit 91.02 “Other expenses” Credit 62 “Settlements with buyers and customers” - the amount of sold receivables on the assignor’s balance sheet is written off.

Accounting

When assigning the right of claim, the receivables are actually sold, which are reflected in the assets of the organization. According to paragraph 7 of the Accounting Regulations “Income of the Organization” PBU 9/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 No. 32n, proceeds from the disposal of receivables from the buyer of products and goods are recognized as other income of the organization.

Expenses associated with the assignment of the right of claim (buyer's receivables) are taken into account in the organization's accounting as part of other expenses on the basis of paragraph 11 of the Accounting Regulations “Organization's Expenses” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n.

Thus, the assignor organization, concluding an assignment agreement with a third party, reflects in accounting the income from the sale of the right of claim on the credit of account 91 “Other income and expenses”/subaccount 1 “Other income” as part of the organization’s other income. In this case, the debit of account 91 “Other income and expenses”/subaccount 2 “Other expenses” should reflect expenses associated with the implementation of this right (the cost of the realized right of claim, equal to the receivables under the original agreement). Accounting entries are made on the basis of the following documents:

- agreements on the assignment of the right to claim debt;

- register of documents transferred to the new creditor;

- accounting statements and calculations;

- invoices and others.

The assignment of the right of claim in the accounting records of the original creditor (assignor) is formalized as follows:

Debit 76 “Settlements with various debtors and creditors”, subaccount “Assignee” Credit 91 “Other income and expenses”/subaccount 1 “Other income” - for the amount of debt of the new creditor (assignee) under the assignment agreement.

Debit 91 “Other income and expenses”/subaccount 2 “Other expenses” Credit 62 “Settlements with buyers and customers” - for the amount of sold receivables, for which it is listed on the assignor’s balance sheet.

Accounting – assignment of a future claim

The legislation provides for the possibility of assigning future rights of claim. That is, one that has not yet arisen. For example, the assignor developer may borrow money from the assignee lender against future payments by office tenants in its building. Even when there are no contracts with tenants yet.

However, there is a special condition. The future requirement must be specified in the assignment agreement. Moreover, in such a way that it can be accurately identified at the time of its occurrence and transfer to the assignee. For the example taken, it is possible to prescribe conditions for the assignment by the assignor of the tenants’ obligations to pay him for specific areas at certain rates, a price agreed with the assignee. It could be the following text: “...The assignee receives the right to claim rental payments from an office building area of 1500 sq. m. m. At a rate of 19,000 rubles. per year for 1 sq. m... The assignee receives the right to claim for 85 percent of its value...". Choose any indicator. The main thing is that it allows you to understand exactly what rights of claim the assignor must give up.

By default, the assignee receives the right of claim at the time it arises. The parties to the assignment have the right to agree on a later date of transition by writing a special condition in the agreement.

All this is provided for in Article 388.1 of the Civil Code of the Russian Federation.

Situation: how can the assignor reflect in accounting transactions involving the assignment of a claim that will arise in the future?

The main difference from a regular assignment is that the assignor receives the money before he has a right to claim. This must be reflected in accounting.

In general, reflect such special conditions of the assignment by analogy with an advance payment for a future supply of goods. Only instead of the right of ownership of the property, the right of claim is transferred to the buyer (assignor).

Reflect the receipt of money from the assignee with the following entry:

Debit 51 (50) Credit 76 subaccount “Settlements under the agreement for the assignment of a future right of claim” - financing was received for the assignment of a future right of claim.

At the same time, charge VAT on the advance payment. This must be done at the calculated rate provided for in paragraph 4 of Article 164 of the Tax Code of the Russian Federation. That is, according to the following formula:

| VAT on advance payment for future assignment of claims | = | Amount of advance received | × | 18/118 (10/110) |

Make the following entry in your accounting:

Debit 76 subaccount “Calculations for VAT from advances on assignment” Credit 68 subaccount “Calculations for VAT” - VAT is charged on account of the received payment for the transfer of a future right of claim.

When transferring the right of claim after its occurrence, make the following entry:

Debit 76 subaccount “Settlements under the agreement for the assignment of a future right of claim” Credit 91-1 – the right of claim under the assignment agreement has been realized.

At the same time, write off the cost of the realized right of claim as other expenses:

Debit 91-2 Credit 62 (76, 58) – the value of the realized right of claim under the assignment agreement is written off from the balance sheet.

VAT previously paid to the budget on an advance cannot be deducted. The right to deduction in this case is not provided for by the Tax Code of the Russian Federation. However, VAT can be refunded. That is, return it from the budget or offset it in the manner prescribed by Article 78 of the Tax Code of the Russian Federation. If the right to a tax refund is confirmed, it will be necessary to reflect the resulting budget obligation to the assignee:

Debit 68 “Calculations for VAT” Credit 76 subaccount “Calculations for VAT from advances on assignment” - reflects the budget’s obligation to return or offset previously paid VAT amounts from advances on assignment.

In this case, there is no need to reverse VAT entries. After all, at the time of their recording, everything was done correctly. This means there was no error that needed to be corrected.

At the same time, if the assignor exercised the right of claim with benefit, it is necessary to charge VAT on the income received. That is, from the difference between the funds received from the assignee and the book value of the right of claim that passes to it. To do this, make the following entry:

Debit 91-2 Credit 68 subaccount “Calculations for VAT” - VAT is accrued for payment to the budget.

All this follows from clauses 6 and 14.1 of PBU 10/99, clauses 6, 7, 10.1 and 16 of PBU 9/99PBU 9/99, Instructions for the chart of accounts (accounts 50, 51, 68, 76, 91), paragraph 2 of clause 1 Article 155, paragraph 1 of Article 167, paragraph 8 of Article 171 and paragraph 6 of Article 172 of the Tax Code of the Russian Federation.

An example of how an assignment of a future claim is reflected in the assignor’s accounting

LLC "Torgovaya" sells industrial equipment and machines. In January, Hermes entered into an assignment agreement with Alpha LLC. According to the agreement, Hermes cedes to Alfa the right to claim the obligations of the buyers of a batch of machines - 100 pcs. The parties agreed that Alpha receives the right to claim by providing Hermes with financing based on the calculation of 100,000 rubles. for each machine in the batch. That is, only 10,000,000 rubles. (100 pcs. × 100,000 rub.). Hermes receives money under the agreement by the end of February. The right of claim passes to Alpha at the moment it arises.

In February, when money was received from Alpha, the Hermes accountant made the following notes:

Debit 51 (50) Credit 76 subaccount “Settlements under an agreement for the assignment of a future right of claim” – 10,000,000 rubles. – financing has been received for the assignment of a future right of claim;

Debit 76 subaccount “Calculations under an agreement for the assignment of a future right of claim” Credit 68 subaccount “Calculations for VAT” - 1,525,424 rubles. (RUB 10,000,000: 118 × 18) – VAT is charged on the payment received for the transfer of the future right of claim.

In March, Hermes sold 70 machines at a price of 105,000 rubles. a piece. The total transaction amount was RUB 7,350,000. (70 pcs. × 105,000 rub.). Including VAT 18 percent – 1,121,186 rubles. (RUB 7,350,000: 118 ×18). The accountant formalized the transaction with the following entries:

Debit 62 Credit 90-1 – 7,350,000 rub. – revenue from the sale of goods is reflected;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 1,121,186 rubles. – VAT is charged on the sale of goods;

Debit 90-2 Credit 41 – 5,390,000 rub. – the cost of goods sold is written off.

When selling the machines, Hermes acquired a right of claim. According to the assignment agreement, it goes to Alpha. The Hermes accountant reflected this operation as follows:

Debit 76 subaccount “Settlements under the agreement of assignment of the right of claim” Credit 91-1 – 7,000,000 rubles. (70 pcs. × 100,000 rubles) – the assignment of the right of claim is reflected;

Debit 91-2 Credit 62 – 7,350,000 rub. – the value of the sold receivables under the agreement of assignment of the right of claim is written off.

At the same time, part of the VAT from the advance was claimed by the Hermes accountant for reimbursement (offset). After passing the desk check and confirming his eligibility, he made the following entry:

Debit 68 “Calculations for VAT” Credit 76 subaccount “Calculations for VAT from advances on assignment” – RUB 1,067,797. (RUB 7,000,000: 118 × 18) – reflects the budget’s obligation to reimburse VAT previously paid on the advance.

When assigning the right to demand payment for 70 machines, Hermes suffered a loss. Therefore, the accountant did not need to charge VAT.

In July, Hermes sold the remaining 30 machines in the batch at a price of 98,000 rubles. a piece. The total transaction amount was RUB 2,940,000. (30 pcs. × 98,000 rub.). Including VAT 18 percent – 448,475 rubles. (RUB 2,940,000: 118 × 18). The accountant formalized the transaction with the following entries:

Debit 62 Credit 90-1 – RUB 2,940,000. – revenue from the sale of goods is reflected;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 448,475 rubles. – VAT is charged on the sale of goods;

Debit 90-2 Credit 41 – 2,310,000 rub. – the cost of goods sold is written off.

When selling the machines, Hermes acquired a right of claim. According to the assignment agreement, it goes to Alpha. The Hermes accountant reflected this operation as follows:

Debit 76 subaccount “Settlements under the agreement of assignment of the right of claim” Credit 91-1 – 3,000,000 rubles. (30 pcs. × 100,000 rubles) – the assignment of the right of claim is reflected;

Debit 91-2 Credit 62 – 2,940,000.00 rub. – the value of the sold receivables under the agreement of assignment of the right of claim is written off.

At the same time, the accountant set aside part of the VAT from the advance for reimbursement and, after confirming the right to it, made the following entry:

Debit 68 “Calculations for VAT” Credit 76 subaccount “Calculations for VAT from advances on assignment” – 457,627 rubles. (RUB 3,000,000: 118 × 18) – reflects the budget’s obligation to reimburse VAT previously paid on the advance.

Thus, the entire VAT accrued upon receipt of financing was offset (1,525,424 rubles - 1,067,797 rubles - 457,627 rubles).

By assigning the right to demand payment for 30 machines, Hermes received a benefit. He charged VAT on the difference between the financing received from the assignee (“Alpha”) and the cost of the right of claim and reflected this in the accounting records with the following entry:

Debit 91-2 Credit 68 subaccount “VAT calculations” – 9153 rubles. ((RUB 3,000,000 – RUB 2,940,000) :118 × 18) – VAT payable to the budget has been accrued.

Income tax

A special procedure for determining the tax base upon assignment (assignment) of the right of claim is established only for taxpayers who determine their income and expenses using the accrual method.

In accordance with paragraph 1 of Article 279 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation), upon assignment by a taxpayer - a seller of goods (work, services) who calculates income (expenses) on an accrual basis, the right to claim a debt to a third party before the date stipulated in the sales agreement goods (work, services) due for payment, the negative difference between the income from the sale of the right to claim the debt and the cost of the goods (work, services) sold is recognized as a loss to the taxpayer.

In this case, the amount of loss for tax purposes cannot exceed the amount of interest that the taxpayer would pay based on the maximum interest rate established for the corresponding type of currency by paragraph 1.2 of Article 269 of the Tax Code of the Russian Federation, or at the taxpayer’s choice based on the interest rate confirmed in accordance with the methods established by Section V.1 of the Tax Code of the Russian Federation for a debt obligation equal to income from the assignment of the right of claim, for the period from the date of assignment to the date of payment stipulated by the contract for the sale of goods (works, services). The specified provision regarding limitation of the amount of loss does not apply when a taxpayer-bank assigns rights (claims) if such assignment of rights (claims) is carried out as part of the implementation of measures provided for in the plan of participation of the Bank of Russia in the implementation of measures to prevent bank bankruptcy, or if the assignment rights (requirements), the list of which is determined by an act of the Government of the Russian Federation, adopted on the basis of paragraph 1 of Article 5 of the Federal Law of July 29, 2018 No. 263-FZ “On Amendments to Certain Legislative Acts of the Russian Federation”, is carried out in accordance with the procedure specified in paragraph 1 Article 5 of the said law.

The procedure for accounting for losses in accordance with paragraph 1 of Article 279 of the Tax Code of the Russian Federation must be enshrined in the accounting policy of the taxpayer.

When assigning the right to claim a debt before the payment deadline stipulated in the contract for the sale of goods (work, services), if the assignment transaction is recognized as controlled in accordance with Section V.1 of the Tax Code of the Russian Federation, the actual price of such a transaction is recognized as the market price, taking into account the provisions of paragraph 1 of Article 279 of the Tax Code RF. If the transaction for the assignment of the right to claim a debt provided for in paragraph 2 or 3 of Article 279 of the Tax Code of the Russian Federation is recognized as controlled in accordance with Section V.1 of the Tax Code of the Russian Federation, the price of such a transaction is determined taking into account the provisions of this section of the Tax Code of the Russian Federation (clause 4 of Article 279 of the Tax Code of the Russian Federation).

According to paragraph 2 of Article 279 of the Tax Code of the Russian Federation, when a taxpayer - seller of goods (works, services), using the accrual method when calculating income and expenses, cedes the right to claim a debt to a third party after the payment deadline stipulated by the agreement, the negative difference between the income from the sale of the right to claim the debt and the cost of the goods (works, services) sold is recognized as a loss on the date of assignment of the right of claim.

When a taxpayer - seller of goods (works, services) assigns the right to claim a debt to a third party, the date of receipt of the assignment of the right of claim is determined as the day the parties sign the act of assignment of the right of claim (clause 5 of Article 271 of the Tax Code of the Russian Federation).

NU at the assignor

The loss on the operation is 10,000 rubles.

If the payment deadline has already arrived, the loss is recognized in full. If the payment deadline has not arrived, the loss cannot be taken into account in full in tax accounting. Here you should be guided by the provisions of Art. 279 of the Tax Code of the Russian Federation and the accounting policies of the organization.

It should be noted that the specifics of reflecting losses in such a situation are specially allocated several lines in the income tax return.

In our example, the payment deadline has arrived, so we will take into account the entire amount of the loss in the NU.

VAT

The assignment of a claim is qualified as a purchase and sale of property rights. According to subparagraph 1 of paragraph 1 of Article 146 of the Tax Code of the Russian Federation, the transfer of property rights is recognized as subject to VAT. In accordance with paragraph 1 of Article 153 of the Tax Code of the Russian Federation, when transferring property rights, the tax base for VAT is determined taking into account the specifics established by Article 155 of the Tax Code of the Russian Federation.

According to paragraph 2 of Article 155 of the Tax Code of the Russian Federation, the tax base when the original creditor assigns a monetary claim arising from an agreement for the sale of goods (works, services), or when the said claim is transferred to another person on the basis of law, is determined as the amount in excess of the amount of income received by the original creditor upon assignment rights of claim, over the amount of the monetary claim, the rights under which are assigned (Letter of the Federal Tax Service of Russia dated November 14, 2011 No. ED-4-3 / [email protected] ).

Thus, if the original creditor cedes a monetary claim arising from a contract for the sale of goods (works, services), then he must calculate and pay VAT. If a monetary claim is assigned at a loss, then VAT is not calculated.

Documenting

The transfer of rights from the assignor to the assignee is formalized by an assignment agreement. The assignment agreement must be concluded in the same form as the original agreement (purchase and sale agreement, credit agreement, etc.):

- in simple written form;

- in writing and notarized (if the original agreement was registered by a notary);

- in writing and registered (if the transaction for which the claims are assigned was subject to state registration).

This is stated in Article 389 of the Civil Code of the Russian Federation.

The assignor must attach documents to the assignment agreement certifying the right to demand from the debtor the fulfillment of certain obligations. These can be contracts, invoices, invoices, certificates of work performed (services rendered), etc.

The assignment agreement must indicate:

- on the basis of what particular agreement this or that right arose;

- what is the duty of the debtor;

- a list of documents and deadlines for the transfer of documents certifying the right of claim that the assignor must transfer to the assignee;

- other information regarding assigned rights.

This procedure is provided for in Articles 385, 389.1 of the Civil Code of the Russian Federation.

Postings under the assignment agreement with the debtor

Replacing the creditor does not entail any consequences for the debtor regarding the accounting of income and expenses, nor a change in the procedure for fulfilling the obligation. For him, only the creditor to whom he is obliged to repay his debt changes. Accordingly, accounting for debt to the new person must be kept on the same accounting account.

Having received notification of the transaction, the debtor must transfer the accumulated accounts payable to the new counterparty. Accordingly, the repayment of the debt will already be reflected in mutual settlements with the new counterparty.

| Operation | Debit | Credit |

| Notification of a change of creditor received: | ||

| according to the supply agreement | 62 (old creditor) | 62 (new creditor) |

| for a long-term loan | 67 (old creditor) | 67 (new creditor) |

| Debt repaid | 62, 67 (new creditor) | 51 |

BU at the debtor

| Dt | CT | Sum | Operation |

| 60(76)A | 60(76)С | 120000 | Transfer of debt to another counterparty |

| 60(76)С | 51 | 120000 | Payment of debt from the account |

The assignment agreement has no tax consequences for the debtor.