Every business owner has to form a wage fund if he has people working under him. At the same time, the fund must be provided in full and without excess, since every deviation to a lesser or greater extent is fraught with consequences.

It is very important to contribute to this fund all expenses associated with paying taxes for employees, contributions to the Pension Fund and other mandatory payments.

What is payroll

The compilation is carried out for a certain period, taking into account the market situation, inflation, and the cost of this type of labor.

In this case, it is necessary to comply with the minimum wage established by law.

Thanks to this fund, the main part of the production cost is formed.

The fund includes:

- Wage;

- All types of bonuses intended for promotion;

- Compensation;

- Cash costs for providing the employee with lunch, accommodation and other necessary conditions;

- Costs associated with the purchase of uniforms;

- Vacation pay, including for unused vacations or those forced by students;

- Incentive payments, for example, for the work of teenagers;

- Expenses for medical examination of personnel;

- Compensation for any changes in the company’s activities;

- Additional payments for various achievements;

- Payment for shift service;

- Compensation for long-term inability to work;

- Payments to external employees;

- Encouraging students to practice.

The following cannot be taken into account:

- Target payments and bonuses from special funds;

- Bonuses for the year;

- Material support of any kind;

- A certain type of supplement to pension payments;

- Some type of compensation;

- Free loans, payment for vouchers and travel;

- Dividend payment.

What does the employee wage fund consist of? The answer is in this video:

What is FOT?

Payroll is the total wages of all employees of an enterprise, firm, or organization. Includes all payments, including social ones .

It is calculated for a certain period of time, for example, a month or a quarter , and is determined and depends on the situation in the market for services and goods, on how much labor costs, inflation and a number of other factors.

The state sets only the level of minimum wage ; the maximum is not limited and depends on the employee himself and his contribution to the activities of the enterprise.

Payroll is a component of the cost of production . The composition is determined by current legislation.

Payroll tax

This tax is deducted from any salary in the amount of 13%.

The peculiarity of the tax is that it is calculated once a month, while the law provides for the payment of wages at least twice a month.

Important: tax is not deducted from advance payments, but only from salary at the end of the month, minus all sick leave, vacation pay and others.

At the same time, the difference between real and calculated wages includes other deductions, which in total should not exceed 20% of the deduction.

In addition to personal income tax, the wage fund includes insurance contributions:

- FPS - in the Pension Fund of the Russian Federation, payment of pensions upon reaching retirement age is 22%;

- MHIF – health insurance, reaches 5.1%;

- FSS VN and M - compulsory social insurance is 2.9% and guarantees payments in case of temporary disability or maternity;

- FSS NS and PZ – insurance against accidents and occupational injuries or illnesses.

All deductions from wages must occur within certain deadlines and will be transferred to the appropriate authorities.

There are characteristic features of its use at the enterprise:

- The percentage ratio for the level standard and total production volumes is displayed;

- Incremental method - with an increase in productivity, the salary level also increases by 1%;

- Residual methods in which the fund acts as a major part of the profits, which increases the company's profits.

Such resources are formed as a residual amount of profit, but before this, funds are formed in the social, scientific, technical and production sectors.

This indicator is displayed with a reserve, taking into account the pace of work, execution of orders and contracts.

Important: a salary fund can be created by those companies that are completely self-sufficient; if third-party finance is needed for the life of the enterprise, a reserve fund is formed.

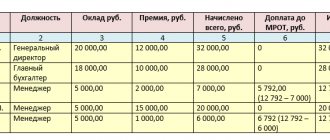

It turns out that the payroll for this unit is 39,738 rubles.

Such deductions are made for employees at a rate of 22%; if the threshold of 711,000 is exceeded, the rate is 10%; employees working in conditions of increased danger or harmfulness to work are entitled to increased rates of 9% and 6%, respectively, for these categories.

The accrual rate is 5.1% if the salary remains unchanged throughout the year. Then the accrued amounts at this rate will also be saved for all 12 months.

The tax reduces the amount of salary, as it is calculated at 13% of each employee’s payment.

The transfer to the tax office occurs on the same day as salary payment.

Important: if an employee has children under 18 years of age, he has the right to a tax deduction:

- For the first and second children 1,400 rubles;

- For the third - 3,00 rubles.

These rates are also acceptable for disabled children.

4.3. Payroll fund for payroll employees

Determined in accordance with Rosstat Order No. 278.

The wage fund for payroll employees consists of payment for time worked, payment for time not worked, one-time incentive and other payments, payment for food and accommodation, which is systematic.

The wage fund of payroll employees takes into account:

Payment for time worked:

a) wages accrued to employees at tariff rates (official salaries) for time worked;

b) wages accrued to employees for work performed at piece rates, as a percentage of revenue from sales of products (performance of work, provision of services), as a share of profit;

c) commission;

d) wages paid in non-monetary form;

e) fees for employees on the payroll of media editorial offices and art organizations;

f) wages accrued to medical and other workers at the expense of state social extra-budgetary funds;

g) the difference in the official salaries of employees who transferred to a lower-paid job (position) while maintaining the amount of the official salary at the previous place of work (position);

h) difference in salaries for temporary substitution;

i) additional payments and allowances to tariff rates (official salaries) for professional excellence, class, qualification category (class rank, diplomatic rank), special rank, length of service (work experience), special conditions of civil service, academic degree, academic title , knowledge of a foreign language, working with information constituting state secrets, combining professions (positions), expanding service areas, increasing the volume of work performed, multi-shift work, performing the duties of a temporarily absent employee without release from his main job, team management, monthly bonus salaries for judges in the amount of 50 percent of the monthly lifetime allowance; salaries for ranks;

j) increased pay for heavy work, work with harmful and (or) dangerous and other special working conditions, for night work, pay for work on weekends and non-working holidays, overtime pay;

k) payments due to regional regulation of wages: according to coefficients (regional, for work in high mountain areas, in desert and waterless areas) and percentage bonuses to the wages of persons working in the regions of the Far North, equivalent areas, in the southern regions of the Eastern Siberia and the Far East;

l) bonuses and remuneration (including non-monetary bonuses) that are systematic in nature, regardless of the sources of their payment;

m) payment to women with children under the age of one and a half years, additional breaks from work to feed the child (children), as well as other special breaks from work, in accordance with the legislation of the Russian Federation;

o) remuneration of workers, managers, specialists of organizations hired for training, retraining and advanced training of workers;

o) additional payments for the time of movement of workers constantly employed in underground work in mines (pits) from the shaft to the place of work and back;

p) allowances for shift work for each calendar day of stay in places of work during the shift period, as well as for the actual days of travel from the location of the organization (assembly point) to the place of work and back;

c) wage supplements accrued to employees due to the traveling nature of the work;

r) allowances for employees sent to perform installation, commissioning and construction work, paid for each calendar day of stay at the work site;

s) payment to employees for rest days provided in connection with overworking hours during rotational work, and in other cases, in accordance with the legislation of the Russian Federation;

t) amounts accrued to employees in the amount of the daily tariff rate (part of the salary per day of work) when performing work on a rotational basis, for each day of travel from the location of the organization (collection point) to the place of work and back, provided for by the shift work schedule , as well as for days of delay in transit due to meteorological conditions or the fault of transport organizations;

x) the amount of indexation (compensation) of wages in connection with the increase in consumer prices for goods and services;

v) monetary compensation for violation of established deadlines for payment of wages;

h) monetary allowances for employees with special ranks;

x) amounts accrued for work performed to persons recruited to work in this organization, according to special agreements with government organizations for the provision of labor (military personnel and persons serving sentences of imprisonment), both issued directly to these persons and transferred to government organizations;

y) remuneration for persons working in the organization on an internal part-time basis.

Payment for unworked time:

a) payment for annual basic and additional vacations provided for by the legislation of the Russian Federation (without monetary compensation for unused vacation specified in clause 89.3);

b) payment for additional leaves granted to employees in accordance with collective agreements, agreements, employment contracts;

c) remuneration for short-term work for workers under the age of eighteen, disabled people of groups I and II, women working in rural areas, women working in the Far North and equivalent areas;

d) payment of study leaves granted to employees studying in educational institutions;

e) payment (except for stipends) for the period of training of employees aimed at vocational training, retraining, advanced training or training in second professions outside of work;

f) payment (compensation) to employees involved in the performance of state or public duties;

g) payment retained at the place of main work for workers hired to harvest agricultural crops and prepare feed;

h) payment to employees for the period of medical examination, days of donating blood and its components and days of rest provided in connection with this;

i) payment for downtime due to the fault of the employer, payment for downtime for reasons beyond the control of the employer and employee;

j) payment for the period of suspension of work due to violation of labor safety standards through no fault of the employee;

k) payment for forced absence;

l) payment for days of absence from work due to illness at the expense of the organization, not issued with certificates of temporary incapacity for work;

m) additional payments up to average earnings accrued in excess of the amounts of temporary disability benefits.

One-time incentive and other payments:

a) one-time bonuses and rewards, regardless of the sources of their payment, including bonuses for promoting invention and innovation;

b) one-time remuneration for length of service;

c) remuneration based on the results of work for the year;

d) monetary compensation for unused vacation;

e) material assistance provided to all or most employees (except for material assistance provided to individual employees for family reasons, for medicines, funeral, etc.).

P.);

f) additional amounts of money when providing employees with annual leave (except for vacation amounts in accordance with the legislation of the Russian Federation);

g) one-time incentives (grants) to employees at the expense of budget funds;

h) other one-time incentives (in connection with holidays and anniversaries, the cost of gifts to employees, etc.), except for the amounts specified in clause 93d.

Payment for food and accommodation, which is systematic:

a) payment of the cost of free food and products provided to employees, in accordance with the legislation of the Russian Federation, or the amount of corresponding monetary compensation (food compensation);

b) payment (in whole or in part) for the organization of meals for employees in monetary or non-monetary forms (not provided for by the legislation of the Russian Federation), including in canteens, buffets, in the form of coupons;

c) payment of the cost of free (in whole or in part) provided to employees, in accordance with the legislation of the Russian Federation, residential premises and utilities or the amount of corresponding monetary compensation (compensation);

d) amounts paid by the organization in order to reimburse employees’ expenses (not provided for by the legislation of the Russian Federation) for payment of living quarters (rent, place in a dormitory, rental) and utilities;

e) payment of the cost (in whole or in part) of the fuel provided to employees or the amount of corresponding monetary compensation (compensation).

Social payments include amounts of funds related to social benefits provided to employees, in particular, for treatment, rest, travel, employment (without benefits from state social extra-budgetary funds).

Social payments include, in particular: a) severance pay in case of termination of an employment contract, severance pay in case of termination of an employment contract,

due to violation of the rules for concluding an employment contract through no fault of the employee;

b) amounts accrued upon dismissal to employees for the period of employment in connection with the liquidation of the organization, reduction in the number or staff of employees;

c) additional compensation to employees upon termination of an employment contract without notice of dismissal two months in advance in the event of liquidation of the organization, reduction in the number or staff of employees. Compensation for termination of an employment contract due to a change in the owner of the organization;

d) one-time benefits (payments, remuneration) upon retirement, one-time benefits to dismissed employees;

e) additional payments (allowances) to pensions for working pensioners at the expense of the organization;

f) insurance payments (contributions) paid by the organization under personal, property and other voluntary insurance contracts in favor of employees (except for compulsory state insurance of employees);

g) insurance payments (contributions) paid by the organization under voluntary medical insurance contracts for employees and members of their families;

h) expenses for payment to health care institutions for services provided to employees (except for expenses for mandatory medical examinations and examinations);

i) payment of vouchers (compensations) to employees and members of their families for treatment, recreation, excursions, travel (except for those issued at the expense of state social extra-budgetary funds);

j) payment for subscriptions to health groups, classes in sports sections, payment for prosthetics and other similar expenses;

k) payment for subscriptions to newspapers, magazines, payment for communication services for personal purposes;

l) reimbursement of payments to employees for maintaining children in preschool institutions;

m) the cost of gifts and tickets to entertainment events for children of employees at the expense of the organization;

o) amounts paid at the expense of the organization to compensate for damage caused to employees by injury, occupational disease or other damage to their health;

o) compensation for moral damage to employees, determined by agreement of the parties to the employment contract or by the court, at the expense of the organization;

p) compensation to teaching staff of educational institutions in order to facilitate their provision of book publishing products and periodicals;

c) payment of the cost of travel documents;

r) payment (in whole or in part) of the cost of travel for employees and members of their families;

s) payment of the cost of travel for employees and members of their families to the place of vacation and back (including payment of the cost of travel and baggage transportation to the place of use of vacation and back for persons working in the Far North and equivalent areas, and members of their families);

t) financial assistance provided to individual employees for family reasons, for medicines, burial, etc.;

x) expenses for paid training of employees not related to production needs, expenses for paid training of family members of employees;

c) compensation payment to women who were on maternity leave before the child reached the age of three and who returned to work earlier than the established period.

The following are not taken into account in the wage fund and social payments:

a) unified social tax, insurance contributions for compulsory pension insurance, contributions for compulsory social insurance against industrial accidents and occupational diseases;

b) benefits and other payments from state social extra-budgetary funds, in particular, benefits for temporary disability, maternity, childbirth, child care, payment for sanatorium and resort treatment and health improvement for employees and their families, insurance payments for compulsory social insurance against accidents at work and occupational diseases;

c) amounts of temporary disability benefits paid at the expense of the organization in accordance with the legislation of the Russian Federation, including for the first two days of temporary disability;

d) contributions paid at the expense of the organization under voluntary pension insurance agreements for employees (non-state pension agreements) concluded in favor of employees with insurance organizations (non-state pension funds);

e) payments made by insurance organizations under personal, property and other insurance contracts;

f) income from shares and other income from employees’ participation in the organization’s property (dividends, interest, etc.);

g) royalties paid under contracts for the creation and use of works of science, literature and art, as well as rewards to the authors of discoveries, inventions and industrial designs; performers and producers of phonograms;

h) the cost of uniforms issued free of charge, remaining in personal permanent use or monetary compensation instead of their issuance, the amount of benefits in connection with their sale at reduced prices;

i) the cost of issued workwear, special footwear and other personal protective equipment, flushing and disinfectants, milk and therapeutic and preventive nutrition (compensation payments) or reimbursement of costs to employees for their purchase of workwear, special footwear and other personal protective equipment in case of non-issuance their administration;

j) expenses for business trips, field allowances within and in excess of the norms established by the legislation of the Russian Federation;

k) costs of recruiting employees;

l) entertainment expenses (without payment for translation services);

m) compensation to the employee for material costs for the use of personal transport and other property for business purposes;

o) expenses when employees move to work in another area and for settling into a new place of residence.

Payment of travel costs to the employee and members of his family in the event of moving from the regions of the Far North and equivalent areas to a new place of residence in another area due to termination of the employment contract. A one-time allowance, payment of the cost of travel and vacation for settling in a new place for persons who have entered into employment contracts to work in organizations located in the regions of the Far North and equivalent areas;

p) monetary compensation, in accordance with the legislation of the Russian Federation, to citizens leaving the regions of the Far North and equivalent areas for vacated housing at the place of delivery of housing and expenses reimbursed in connection with the departure of workers from these areas;

p) costs for processing and issuing passports and visas;

c) expenses (including scholarships) for training and retraining of employees studying in educational institutions, related to production needs, on the basis of agreements between the organization and an educational institution that has received state accreditation (having a state license), as well as payment for travel of students to their location educational institution and back; scholarships under a student contract for vocational training;

r) payments (including compensation payments) to women on maternity leave to care for a child until the child reaches the age of three and who are not included in the average number of employees (except for the case when the woman went to work earlier than the established period);

s) monetary allowances for military personnel when they perform military service duties;

t) payments to non-working pensioners, family members of deceased (deceased) employees;

x) state scientific scholarships at the expense of budgetary funds;

v) scholarships received by employees through grants provided by international or foreign non-profit and charitable organizations;

w) repayable borrowed funds issued by the organization to the employee, the amount of material benefit received from savings on interest for the use of borrowed funds;

x) free subsidies provided to employees for housing construction or purchase of housing;

y) amounts paid for employees by the organization in order to repay borrowed funds issued to employees for housing construction, purchasing housing, starting a household;

e) the difference between the market value of the apartment sold by the organization to the employee and the amount paid by the employee;

z) the cost of housing transferred to the ownership of employees.

Payroll optimization

There are legal methods for reducing tax deductions from the payroll fund - when transferring wages to other less taxable forms:

- Registration of an employee as an individual entrepreneur with a simplified tax system with a tax rate of 6%, by concluding an agreement for the provision of services;

- Concentrating the bulk of the payroll on one employee, for example, a director, which makes it possible to reduce the rate to 10%.

You can learn how to correctly calculate salary taxes in this video tutorial:

Payroll fund - what is included in this concept and how is it different from the wage fund?

The two funds (wages and salaries) are interconnected, but are not identical. Although the coincidence of these indicators is possible when a company saves on various types of payments (social and other) to its employees and, in addition to direct remuneration for labor (salaries), does not provide any other payments.

Every company manager and individual entrepreneur must have an idea of what the wage fund includes. Based on the theoretical aspect, the wage fund (WF) is the totality of a company’s funds (both in cash and in kind) spent over a certain period of time on payments to the workforce.

First of all, the payroll includes salaries and bonuses, as well as various additional payments (for part-time work, for work at night, etc.). The listed elements are followed by incentive and compensating components of the payroll, as well as other payments (for example, accrued for time that is not worked, but is legally subject to payment). In general, the payroll includes the wage fund (WF), social and other payments.

FW is a narrower concept than payroll, but both funds are formed and calculated using similar algorithms. We'll talk about this in the following sections.

General calculation formula

The legislation does not have a universal formula for how to calculate the wage fund - it all depends on its composition, defined in the organization. Usually it’s not difficult to calculate the total amount - just add everything up. In planning, it is often necessary to determine the cost of financing workers for the production of a certain batch of goods. In this case, the cost of manufacturing one unit is determined and multiplied by the required quantity, adding bonuses and other allowances. The formula looks like this:

Payroll = Cost of one product × number of products % premium.

Accounting uses a more accurate formula for calculating the wage fund, but it is suitable for determining the actual payroll based on the results of a certain period, and not the planned payroll.

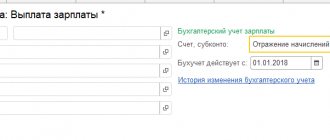

It is equal to the amount of the credit to account 70 “Settlements with personnel for wages” with the debit of the accounts for other expenses (provided that expenses for payments to employees are included):

- 20 “Main production”;

- 25 “General production expenses”;

- 26 “General business expenses”;

- 08 “Investments in non-current assets”;

- 91 “Other income and expenses.”

Since credit is a negative value and debit is positive, the real costs of the organization are obtained. But how to calculate the wage fund if you need to analyze the work of an organization - use average and reference indicators. Take into account:

- average monthly salary of one employee;

- volume of production per ruble of wages;

- the relationship between the growth rate of average wages and labor productivity.

How to calculate payroll: formula for calculating the balance

What does the wage fund include and how to calculate it correctly? This question is relevant for all businessmen - the salary component of the cost of goods or services often constitutes a significant share of it and affects the final financial result of the company.

Excessive savings on the payroll amount are fraught - meager salaries, lack of incentives and compensation payments do not contribute to high production indicators and obtaining decent profits. The result of such tight-fistedness of a businessman can be staff turnover, low labor productivity, the desire of individual team members to make up for the amount of remuneration received for work at the expense of the company’s property, etc.

The formula for calculating payroll is the sum of its various components. The number of elements of such a formula depends on the content of internal local acts. For example, if these documents provide for monthly payment to employees of wages (W), bonuses (PR), as well as financial assistance (MA) in addition to vacation pay (WTP), then the formula for calculating the payroll will look like this:

PHOT = Salary + PR + OTP + MP.

The algorithm for calculating the wage fund, the formula of which is presented above, is schematic, and the calculation of the payroll (as well as the calculation of the wage fund) in various companies can be carried out according to a more detailed or abbreviated version of the formula, depending on the composition of the payroll and the wages.

Why is payroll calculated?

A normally operating organization always uses hired labor and pays wages to employees. In regulatory documents and reports, the concept of payroll is often encountered in relation to planning, profitability, benefits and even the calculation of mandatory payments. Let's figure out what payroll is - the payroll fund in an organization, and how to calculate it. This part of the costs is regulated by clause 8 of PBU 10/99.

The wage fund is not an abstract value; it must be calculated at different stages of work and kept under control. Article 129 of the Labor Code of the Russian Federation states that this is:

all expenses for employee wages, including incentives and compensation payments.

When creating a new organization, the payroll is considered to plan upcoming expenses and draw up a staffing table. Typically, the costs of wages and other employee benefits occupy a significant place in the company's budget. The right to certain benefits and the possibility of applying preferential tax regimes depend on the size of the payroll. It directly affects profitability, so it is monitored and adjusted before and during business activities.

What is included in the wage fund: its composition and structure in the balance sheet

The wage fund is one of the elements of the payroll, which is the amount of funds expressed in monetary form intended to pay wages to members of the workforce.

There are 4 main components of the FZP:

Total payroll – 100%, including:

- administration – 35%;

- consultants – 40%;

- accounting – 15%;

- technical personnel – 10%.

With regard to the formula for calculating the payroll, the same algorithms and approaches are used as for calculating the payroll described in the previous section.

What is the payroll estimate?

The estimate can be drawn up not only for the main elements of the wages, but also for payments of a social nature and others.

Payroll estimates are an element of planning that is more typical for large enterprises that employ specialists of the appropriate level and qualifications and maintain approaches to planning from the time of the planned (socialist) economy. In modern commercial structures, this document is less common or has a different name. We'll talk about the planning process in the next section.

Payroll planning

Based on the fact that the wage fund includes a significant share of the company’s total expenses, an important issue is the preliminary (planned) determination of the structure and size of the payroll.

The payroll planning process can be represented by the following algorithm:

- Collect information about the structure of the company, the number of personnel and its movement, data on average salaries, production targets; study the staffing table and internal local acts related to payroll (provisions on wages, bonuses, etc.).

- Predict the average number of personnel for the planned time period.

- Choose a planning structure (decide on the main planning parameters and the level of detail of indicators), draw up an estimate.

- Calculate the payroll, choosing the most acceptable method of calculating it.

The predicted payroll allows for timely analysis and control of its use.

Analysis of the use of payroll

For the constant part of the payroll, deterministic factor analysis models are used. The influence on the payroll of such factors as the average number of employees, the average annual and average daily salary of an employee, the average duration of a work shift, and the number of days worked per year by one employee is being studied.

To analyze the variable part, other indicators are used, based on the fact that this part of the payroll is most influenced by the labor intensity of manufacturing a unit of product and the prices per unit of its production.

The effective use of funds intended for remuneration is achieved by the following condition: the growth rate of labor productivity must be higher than the growth rate of its payment.

Certificate of monthly wage fund - sample

Commercial structures may need this document in the following circumstances:

- when applying for a loan from a credit institution;

- the bank may request a certificate to confirm the integrity of the company in the sense that the money withdrawn from the account actually goes to pay for labor;

- when carrying out control activities by specialists of the Federal Tax Service or insurance funds.

For structures of budget subordination, this document is mandatory.

The certificate may contain information not only about the amount of the wage fund for the month, but also for another period. Moreover, the document can be drawn up both according to expected indicators and actual payments.

There is no standardized form for this document. We have prepared a template that should be suitable for organizations and individual entrepreneurs, since it includes all the information required in such cases. We offer information about the monthly wage fund on our website.

Calculation examples

An organization has decided to open a branch and needs to draw up a plan for financing it. Let's look at an example of how the wage fund is calculated in such conditions. The branch must work:

- manager - salary 50,000 rubles;

- 2 specialists - salary 40,000 rubles;

- driver - salary 30,000 rubles;

- cleaning lady - salary 20,000 rubles.

At the end of the month, a bonus is provided in the amount of 30% of the salary for the administration and 20% for ordinary employees.

How to calculate monthly indicator

Let's figure out how to calculate the monthly payroll for this branch of the organization. To do this, we summarize all salaries:

50,000 + 40,000 + 40,000 + 30,000 + 20,000 = 180,000 rub.

But this is not the final version of the calculation. Next, we calculate the premiums:

50,000 × 30% = 15,000 rubles; 130,000 × 20% = 26,000 rubles; only 41,000 rub.

And insurance contributions for wages and bonuses:

(180,000 + 41,000) × 30% = 66,300 rub.

We sum up the indicators and get 287,300 rubles. per month. This is a planned indicator that differs from the real one, since during the work process employees take sick leave, go on vacation, or do not meet targets for receiving a bonus.

Results

The wage fund includes all payments earned by employees in cash and in kind (salaries, bonuses, compensation, allowances, etc.), as well as social and other payments.

What payroll taxes does the state require from Russian individual entrepreneurs and legal entities? The wage fund consists not only of wages, but also of all transfers by the employer in favor of employees. Most of these charges are taxable. In addition to taxes, individual entrepreneurs and legal entities are required to make monthly payments of certain other mandatory payments. We describe which ones exactly below.

Instructions on how to compose

It must be said that the payroll can be either daily or monthly, quarterly, or annual (read more about how the annual payroll and full wages are calculated here). When calculating it, it is necessary to process all types of incentives, bonuses, compensations, rates, official salaries, and tariffs existing in the organization.

Simplified calculation scheme : you need to sum up the wages of all employees with a salary and multiply the amount by the number of months of the time period for which calculations are made, for example, by a year, i.e. multiply by 12.

Payroll can be calculated for any period, even for a day .

If the organization has hourly , then we determine the number of working hours. Then we sum up the hourly rates of workers and multiply by the total number of working hours.

For workers with piecework wages , prices are multiplied by the volume of planned work. At the final stage, everything is summed up, and the allowances, compensations and social benefits existing in the organization are added.

Read more about wages and salaries here.

Our specialists have also prepared other materials about payroll and wages:

- What is the efficiency of using the wage fund and how can it be increased? How can one increase the wage fund?

- Proper use and distribution of payroll: what is the variable and fixed part?

- Optimization and cost savings.

- Reflection in the balance sheet and financial statements.

- Basic methods of payroll planning.

- Types of payroll and wages.

- Charges and deductions.

General list of taxes and mandatory payments from the payroll

In accordance with Russian legislation, individual entrepreneurs, all enterprises and institutions that hire employees, act as their tax agents and make monthly deductions from the payroll fund.

This procedure was adopted for the convenience of the federal tax service. It is easier for its employees to control organizations than to deal with each taxpayer separately.

Charges to the wage fund appear monthly. The task of each employer is to pay them within the period prescribed by law and in full. This list includes:

- Taxes on personal income - on employee wages, sick leave and vacation pay, bonuses and other payments that are transferred to employees based on the results of their professional activities.

- Mandatory transfers to specialized funds - pension, as well as social and health insurance.

Not included in average earnings in 2021

But not all cash payments can be taken into account by an accountant when calculating average earnings. According to paragraph 3 of the Regulations on the specifics of the procedure for calculating average wages, monetary payments of a so-called social nature are not taken into account. These are such as payment for food, payment for training, compensation for rest and financial assistance. From the point of view of labor legislation, this is explained by the fact that these payments are not directly related to wages.

From the point of view of tax legislation, the average earnings from which sick leave, maternity benefits, and monthly child care benefits are calculated do not include payments and remunerations for which insurance contributions to the Social Insurance Fund are not charged. This norm is directly established in Part 2 of Article 14 of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity.”

Timely payment of personal income tax for all employees is an important part of payroll payments

The main payroll tax is personal income tax, the personal income tax. The amount of this tax paid by residents of the Russian Federation - and this includes the majority of employees - is 13% of the total accrual amount.

If the organization’s staff includes a foreign citizen, that is, a tax resident of another state, 30% of the accrual amount is required to be paid to the Russian budget. Such situations occur much less frequently in practice, but they are still worth remembering.

A civil law contract has been concluded with an employee of an organization working under an employment contract to perform work in the same organization.

How to reflect data on such an employee when filling out the state statistical reporting form 12 “Labor Report”?

An employee who is on the payroll of an organization (including separate divisions) and who has entered into a civil contract to perform work in the same organization (including separate divisions) is counted in the payroll (and, accordingly, in the average payroll) number 1 time at the place of main work (subclause 6.2 clause 6 of the Instructions for filling out statistical indicators on labor in the forms of state statistical observations, approved by Resolution of the Ministry of Statistics of the Republic of Belarus dated July 29, 2008 No. 92; hereinafter referred to as Instructions No. 92). The employee's accrued wages and accrued remuneration for performing work under a civil contract are summed up and reflected in the wage fund of payroll employees (page 02 section I and pages 130, 131 in group 5–8 section V of form 12- t "Labor Report"). The time worked at the main job and the time spent on performing work under a civil contract are also summed up (provided that records are kept of the time spent on performing work under a civil contract).

How to calculate the tariff rate of the 1st category when filling out Form 12 “Labor Report”, if the organization simultaneously applies several tariff rates of the 1st category?

If an organization has several tariff rates of the 1st category, Form 12 “Labor Report” reflects the weighted average tariff rate of the 1st category for the organization as a whole. To calculate it, the average number of employees is used (subclause 9.4, clause 9 of the Instructions for filling out the state statistical reporting form 12 “Labor Report”, approved by Belstat Resolution No. 163 of August 19, 2013; hereinafter referred to as Instructions No. 163).

Example

The organization applies 3 tariff rates of the 1st category

The average number of employees in the organization for the reporting period was 530 people. The tariff rate of the 1st category is established:

– for 350 people – in the amount of 34 rubles;

– for 165 people – 63 rubles;

– for 15 people – 85 rub.

The weighted average tariff rate of the 1st category, established for all personnel, will be 44.47 rubles. (34 rubles × 350 people + 63 rubles × 165 people + 85 rubles × 15 people) / 530 people).

How to reflect data on accrued wages for the day of subbotnik in form 12 “Labor Report”?

The wages accrued for the day of the subbotnik are not included in the wage fund (clause 3 of the Regulations on the procedure for determining, accounting and transferring funds received from the republican subbotnik, approved by Resolution of the Ministry of Finance, the Ministry of Statistics, the State Tax Committee and the National Bank of the Republic of Belarus dated April 12, 2000 No. 33/ 17/28/14.4).

Accordingly, data on wages accrued for the day of the subbotnik are not reflected in Form 12 “Labor Report”.

An employee of an organization who is on parental leave to care for a child under 3 years of age has returned to work on a part-time basis (at 0.25 times the rate).

Is it necessary to reflect data about him on Form 12 “Labor Report”?

Data about this employee must be reflected in Form 12 “Labor Report” as about an employee hired (transferred at the employee’s written request) to work on a part-time basis. In the payroll, such an employee must be counted as a whole unit, and in the average payroll - in proportion to the time worked.

For reference: while on parental leave until the child reaches 3 years of age, an employee may, at his own discretion, work in his main job (another profession, position) or another place of work on a part-time basis (no more than half the monthly standard working time) ( Article 185 of the Labor Code of the Republic of Belarus).

By decision of the head of the organization, upon dismissal, upon his written application, financial assistance for recovery may be provided.

Should these amounts be included in the payroll?

If the employee was not provided with labor leave before the dismissal, and also was not provided with a one-time payment for health improvement (material assistance) for labor leave, provided for by law, collective agreement, agreement or employment contract, then the above payment accrued to the employee in the final calculation must be reflected in the payroll.

Otherwise, these payments are not reflected in the payroll.

When filling out state statistical reporting in Form 12 “Labor Report,” is financial assistance paid to employees due to difficult family circumstances (without specifying a specific reason) included in the wage fund?

Material assistance provided to individual employees upon their personal application in connection with unforeseen financial difficulties relates to other payments and expenses not reflected in wages and is not included in the wage fund when filling out state statistical reporting in Form 12-“Report on labor."

In the summer, students from a Minsk university were sent to the organization for practical training. Fixed-term employment contracts have been concluded with some of them.

When filling out a report on Form 12 “Labor Report,” are students sent for practical training included in the payroll?

The payroll number of employees (payroll) includes employees working in an organization under an employment agreement (contract) and performing permanent, temporary or seasonal work for 1 day or more (clause 3 of Instructions No. 92). If students are hired for jobs (positions) under an employment agreement (contract) for the period of practical training and receive wages directly from the organization, then they must be included in the payroll number of employees and reflected in section. II and V forms 12-t (subclause 4.8 clause 4 of Instructions No. 92).

As of April 2, 2021, changes have been made to reporting form 12 “Labor Report” and instructions for filling it out.

What did the changes affect?

Organizations that hire workers for additionally introduced jobs should pay attention to the need to fill out page 116 “from line 111 number of workers hired for high-performance jobs” section. III form 12-t. The data for this line is filled in only for gr. 2 “For the reporting period” in reports:

– for January – March;

- January June;

– January – September;

- January December.

A highly productive workplace refers to the workplace of an employee hired for an additionally introduced workplace (column 2, page 111 of the report), for whom the amount of wages accrued for the first fully worked month of the reporting period exceeded the threshold wage for the main type of economic activity of the organization. You can find out what type of economic activity the organization belongs to in the state statistics authorities.

If during the reporting period employees were hired for additionally introduced jobs, then it is necessary to analyze for each employee:

– whether he worked for a full month;

- what salary was accrued to him for the first fully worked month.

If the wages accrued to an employee exceeded the threshold value given in the appendix to Instructions No. 163, then data about such an employee must be reflected in gr. 2 page 116 of the report.

Mandatory payments from the payroll to various funds

The law also obliges employers to make monthly several types of mandatory payments for employees in favor of various insurance funds - social and medical. It is also the responsibility of entrepreneurs and organizations to pay pension contributions for all their employees.

Currently, the following rates are provided for these categories of payments (of the total payment amount):

- health insurance - 5.1%;

- social insurance - 2.9% (may be increased in hazardous and hazardous industries);

- pension contributions - 22%.

Please note that individual entrepreneurs are not required to pay social security contributions; this category only applies to legal entities. An exception is the situation when an entrepreneur wants to transfer funds to social insurance voluntarily.

Table - all payments and transfers are clear

In order not to get confused in the list of mandatory payments assessed by the state on the wage fund of individual entrepreneurs and legal entities, use the simple and convenient table presented below.

This is a standard rate, which can be increased depending on the harmfulness and danger of production.

Paid only by legal entities, individual entrepreneurs - only at will.

| Tax, contribution or payment | Rate (based on the amount charged) | Some nuances |

| Personal income tax | 13% or 30% | Tax residents of Russia pay personal income tax in the amount of 13%, citizens of foreign countries - 30%. |

| Pension contributions | 22% | Pension contributions are also paid by certain categories of foreign citizens, this is due to the status of their presence on the territory of the Russian Federation. |

| Social insurance contributions | 2,9% | |

| Health insurance | 5,1% | — |

Example of calculations and transfers - calculation of payroll and all mandatory payments

The salary of 5 employees is 15,000 rubles (including two foreign citizens), 5 others - 18,000 rubles, 3 - 25,000 rubles, 4 - 30,000 rubles and 1 - 40,000 rubles. No other accruals other than employee wages were made this month. First, we calculate the size of the wage fund for this month:

(5 * 15,000) + (5 * 18,000) + (3 * 25,000) + (4* 30,000) + 40,000 = 400,000 rubles.

At the same time, the total salary of tax residents is 370,000 rubles, and non-residents - 30,000 rubles. Now let’s calculate what and in what amount the employer will pay to the budget and insurance funds:

- Personal income tax of tax residents. 370,000 * 13% = 48,100 rubles.

- Personal income tax of non-residents. 30,000 * 30% = 9,000 rubles.

- Pension contributions. 400,000 * 22% = 88,000 rubles.

- Health insurance premiums. 400,000 * 5.1% = 20,400 rubles.

- Social insurance contributions. 400,000 * 2.9% = 11,600 rubles.

Thus, the total value of all mandatory payments to the budget and insurance premiums for an organization whose monthly payroll amounted to 400,000 rubles will be 177,100 rubles. That is, the cost of paying employees and accompanying accruals will be equal to 577,100 rubles.

What is included in the payroll

The head of each organization independently decides what is included in the wage fund: employee wages; bonus payments; incentive and compensation bonuses; vacation pay; material aid; benefits; insurance premiums.

All payments and payments included in the payroll are made exclusively at the expense of the employer. Benefits paid by the Social Insurance Fund are not included in it. Therefore, are sick leave included in the wage fund - only for 3 days, paid by the employer from his own funds.

The final composition of payments included in the payroll is fixed in the accounting policies of the organization and used for planning and reporting. It is used to analyze the effectiveness of personnel costs and other economic indicators.

The wage fund differs from the wage fund in that in addition to wages and insurance contributions, it includes compensation, incentive payments, benefits, and financial assistance. If there are no such payments in the organization, then the payroll is equal to the salary fund.