What kind of preferences were offered to small businesses this year so that they could survive and continue to operate. Some were able to take advantage of subsidies, tax deferments or preferential loans, while others were unlucky. Everyone who has already gone through trials and continues to go through them wants to know what awaits small businesses there, beyond the horizon of the New Year? BukhSoft experts have prepared a detailed review and useful guidelines.

Choosing the form of tax regime

Small businesses are given the opportunity to independently choose taxation, thanks to which newly created enterprises have comfortable and affordable conditions for their operation.

Small business, like any other legal business, is characterized by its versatility. In small enterprises, as well as in large ones, tax contributions to the state treasury have a significant share in the financial flows of the organization. Neglect of this aspect of doing business results in large financial losses for the company. Therefore, if you are just starting to work or want to optimize your expenses, contact a good accountant, or better yet, become one yourself.

Of course, we can admit that the tax system in the Russian Federation is imperfect, but a reasonable selection of the optimal tax payment method is quite possible.

Today, when creating a small enterprise, it is possible to choose one of several tax systems currently in force, most suitable for the company’s planned activities.

General mode

Taxation of enterprises of all forms of ownership and types is by default established in the form of a general regime - OSNO. Under this regime, the enterprise’s responsibility includes maintaining both accounting and tax records. If an organization works for OSNO, it pays the following taxes to the state:

- for added value,

- on organizations

- for profit (legal entities),

- on the income of individuals (individual entrepreneurs).

Advantages of OSNO

The advantages of this system include:

- the opportunity to engage in various types of activities, without having a limit on the amount of revenue;

- reimbursement of VAT from the budget for various reasons;

- greater attractiveness for counterparties due to the reimbursement of their VAT;

- possession of any number of employees and others.

Disadvantages of OSNO

The disadvantages of the general mode include:

- obligation to pay a large number of taxes,

- the obligation to provide a large number of reports to tax authorities and other government organizations,

- complex form of managing income and expenses,

- collection and mandatory storage of all documentation related to the activities of the enterprise and others.

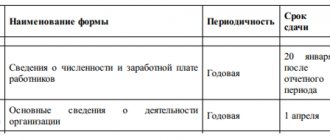

Who submits reports as a small enterprise?

In accordance with the provisions of Federal Law No. 209 of 2007, the following business entities are considered small enterprises.

- Microenterprise. The staff includes up to 15 employees, annual revenue excluding VAT is up to 120 million rubles.

- Small. The number of employees is up to 100 people, the annual revenue is within 800 million rubles.

- Average. Team of 101–250 employees, revenue at the end of the year up to 2 billion rubles.

A common feature for all three groups is the ratio of shares in the authorized capital - up to 25% for government agencies, foundations, social and religious movements, up to 49% for foreign capital and large businesses.

Small business in agriculture

Entrepreneurs whose activities include only the production of agricultural products and who do not process them have the opportunity to work under the Unified Agricultural Tax system.

In this case, collecting taxes from small businesses is much simpler, since the organization has the right not to pay the following types of taxes to the treasury:

- for profit (legal entities);

- on the income of individuals (individual entrepreneurs);

- on property;

- for added value.

If a company wants to work in this mode, it needs to show the share of all income from the sale of manufactured products in total sales revenue, and its share must exceed 70%.

Reporting is submitted every six months, the tax period is one year. Therefore, it should be remembered that having switched to the unified agricultural tax, it is impossible to change the taxation regime before the end of the tax year. However, under other systems, changing the regime is also difficult and is carried out only from the beginning of the year. Moreover, an application to change the form of tax collections must be submitted in advance within a strictly defined period.

How to submit tax returns correctly?

No claims from the Federal Tax Service are guaranteed if the forms are filled out correctly and submitted on time. The instructions will help you comply with the first point - they are designed for each declaration and calculation. But, each time filling out reports according to instructions is long and tedious. It still needs to be sent on time using one of the methods below.

- By mail in paper form. The date of delivery is considered to be the number that appears on the postmark upon dispatch. The documentation is sent to the Federal Tax Service with a list of the contents and a notification of delivery. Only under these conditions can timely dispatch be proven.

- Electronically. You can send a virtual version of completed forms via Internet channels at any time before the deadline for receiving reports. There is no need to adapt to the work of the post office. Evidence of sending is a corresponding entry in the log of sent messages.

It’s not difficult to get confused about the contents and terms of delivery, but it takes time to figure it out. The experience of our specialists in this regard is invaluable - you won’t have to be distracted by entering information into forms.

We provide services for filling out tax reports, sending them and defending the interests of the client if questions arise regarding the submitted documentation from the Federal Tax Service. Our specialists independently monitor the composition and completeness of reporting, depending on the specifics of the client’s activities. We guarantee compliance with legal requirements and quiet work for clients.

Patent tax system

Previously, small businesses had the right to apply a simplified tax system, payments of which were calculated on the basis of a patent. Today, the provisions of the legislation have changed significantly - since 2013, a new independent regime has been introduced - the patent taxation system. Therefore, now the features of taxation of small businesses in terms of payment for the cost of a patent are differentiated from the taxation of business entities operating under other regimes, since under the new system it is necessary to pay only the cost of the patent.

The total patent amount is calculated at a rate of 6% of the company's estimated annual revenue. However, you should know that it can no longer be reduced, as before, by the amount of insurance premiums paid for compulsory insurance.

This regime can only be applied to individual entrepreneurs. In addition, patent taxation applies only to certain types of activities - the law specifies 69 of them, and this list is final. It should be remembered that when purchasing a patent for a period of less than 6 months, its full cost must be paid before the 25th day of the month after the start of its validity. If the patent is valid for a longer period, you can first pay for a third of it, and the remaining two-thirds closer to the end of its validity period - but no later than 30 days before its termination.

Unified tax on imputed income (UTII)

Taxes for small businesses changed significantly in 2013. Starting this year, as well as now, the transition to a single tax on imputed income has become voluntary. The calculation of UTII has also undergone changes - now it is calculated starting from the day of registration, based on the number of days that were actually worked in a given month.

It is calculated according to a formula that includes the amount of basic profitability established by the subject of the federation, coefficients that depend on the specifics of the enterprise and the tax rate. Online services will help you quickly calculate and pay taxes.

The maximum calculation of the number of hired personnel is calculated not as before, but from the average workforce. The number of employees, as before, should be no more than 100.

Advantages of UTII

Taxation of an enterprise's activities using UTII has the following advantages:

- exemption from paying the following taxes:

- for profit (legal entities);

- on the income of individuals (individual entrepreneurs);

- on property;

- for added value.

As noted earlier, the above taxes require maintaining rather complex accounting and tax records. Accordingly, replacing the specified number of tax payments greatly simplifies accounting and reduces document flow.

- ease of tax calculation;

- fixed tax amount;

- a tax that does not depend on the actual revenue of the enterprise, allows you to legally conduct business with various turnovers without fear of the tax authorities;

- ease of maintenance, simplicity of accounting for income and expenses.

Disadvantages of EVND

Features of collecting taxes from small businesses include the possibility of combining different taxation regimes, and this seemingly favorable opportunity, with UTII, turns into a significant disadvantage.

In this case, multi-industry enterprises are required to keep separate records for all types of activities, which significantly increases labor costs, since more detailed accounting of analytics is required. Accordingly, the number of taxes paid to the budget increases.

The disadvantages of this mode include the following:

- mandatory payment of a fixed amount, in the absence of the necessary revenue, may cause a loss to the enterprise;

- taxation of small businesses in Russia is imperfect, so there is confusion in the calculation of UTII in the regions.

All about taxation of small and medium-sized businesses

Companies that are small businesses can reduce the amount of taxes they pay by applying special tax regimes. These regimes include a simplified taxation system and a single tax on imputed income.

The simplified taxation system can be applied to any type of activity. It is only important to choose the right object of taxation. This could be a tax:

· 6% from income;

· 15% on income reduced by expenses.

But the single tax on imputed income is applied only to certain types of activities. These types of activities include the following:

· retail trade;

· public catering;

· household and veterinary services;

· repair, maintenance and washing services for motor vehicles;

· distribution and (or) placement of advertising;

· services for the temporary use of trading places and land plots;

· temporary accommodation and accommodation services;

· services for the transportation of passengers and goods by motor transport;

· parking services.

In addition, it is important to remember the restrictions that are established by law. For example, there are the following restrictions on the simplified tax system:

· application of certain types of activities;

· the share of participation in the authorized capital should not exceed 25%;

· the average number of employees should not exceed the maximum values of the average number of employees for each category of small and medium-sized businesses (100 people);

· revenue from the sale of goods excluding VAT or the book value of assets should not exceed the maximum values;

· the cost of fixed assets should not exceed the maximum values.

You also cannot create branches. We remind you that, unlike a separate structural unit, a branch must be indicated in the statutory documents and listed in the Unified State Register of Legal Entities.

For individual entrepreneurs there is also the opportunity to use a patent. The patent also applies to certain types of activities:

1. repair and sewing of clothing, fur and leather products, hats and textile haberdashery products, repair, sewing and knitting of knitwear;

2. repair, cleaning, painting and sewing shoes;

3. hairdressing and cosmetic services;

4. dry cleaning, dyeing and laundry services;

5. production and repair of metal haberdashery, keys, license plates, street signs;

6. repair and maintenance of household radio-electronic equipment, household machines and household appliances, watches, repair and manufacture of metal products;

7. furniture repair;

8. services of photo studios, photo and film laboratories;

9. maintenance and repair of motor vehicles and motor vehicles, machinery and equipment;

10. provision of motor transport services for the transportation of goods by road;

11. provision of motor transport services for the transportation of passengers by road;

12. renovation of housing and other buildings;

13. services for installation, electrical, sanitary and welding works;

14. services for glazing balconies and loggias, cutting glass and mirrors, artistic glass processing;

15. services for training the population in courses and tutoring;

16. services for the supervision and care of children and the sick,

as well as for other types of activities specified by law.

The single tax on imputed income involves the application of a rate of 15% on imputed income. Imputed income does not depend on the actual income received by small businesses.

In relation to a patent, restrictions on the number of personnel of the entrepreneur also apply. Thus, a patent can be applied if the number of employees is no more than 15 people. But a medium-sized business cannot apply special tax regimes, since it does not “fit” into the criteria that apply to special tax regimes.

Criteria for classification as a small and medium-sized business

| Criteria | Micro | Small | Average |

| Average number, people | ≤ 14 | ≤ 100 | ≤ 250 |

| Sales revenue (excluding VAT), RUB million | ≤ 120 | ≤ 800 | ≤ 2 000 |

| Total share of participation in the authorized capital of other organizations, % | · foreign organizations - ≤ 49; · Russian organizations that are not small and medium-sized businesses - ≤ 49; · Russian organizations, municipalities, public, religious organizations, foundations - ≤ 25 |

Therefore, it is important for medium-sized enterprises to take into account changes in legislation regarding VAT in 2021.

Changes in legislation regarding VAT 2018-2019

There are no VAT benefits available for small and medium-sized businesses. Of course, it is possible to apply a VAT exemption if the sales revenue is less than 2 million rubles. But such a benefit is used by a fairly small number of companies due to the fact that supporting documents are required.

Benefits apply only to certain types of goods. It is possible to apply a preferential rate of 0% VAT in relation to international transportation services, as well as 10% in relation to a number of goods, such goods, in particular, include food products according to the list, baby food, children's goods, toys, medicines.

Additional benefits were introduced in 2021 for the export and import of medical goods, including medical equipment. A 10% rate may also be applied to such goods.

From 2021, VAT will increase to 20% and this will negatively affect the final price of the final product, that is, for end consumers - individuals, products, raw materials and supplies, as well as work and services will become more expensive.

Therefore, it is necessary to revise the VAT amounts in:

· contracts;

· acceptance certificates;

· invoices and adjustment invoices.

Small and medium-sized businesses should take into account the increase in the VAT rate from 18% to 20%. It is especially important to take this into account in rolling contracts that are long-term in nature and carry over to 2021. It is recommended to reconcile settlements with counterparties. If payment was made in 2021, and shipment or provision of services will be carried out next year, adjustment invoices will also need to be issued.

Some amendments have been introduced since 2021 and also tighten VAT requirements. Thus, from January 1, 2021, the duties of tax agents for VAT are assigned to companies that sell scrap and waste of ferrous and non-ferrous metals, as well as work with aluminum and its alloys, and sell animal skins. Buyers of the above goods are tax agents and must independently calculate and pay tax to the budget. But paying tax provides for the possibility of obtaining a tax deduction. The right to a tax deduction is granted to those companies and entrepreneurs that apply the general taxation system.

Another amendment concerns electronic services; from January 1, 2019, foreign companies that provide electronic services must calculate VAT. This amendment was introduced by Federal Law No. 335-FZ of November 27, 2017. Currently, Russian companies and entrepreneurs must act as a tax agent and remit VAT to the budget.

The changes also affected the receipt of advances upon transfer of property rights. The tax must be calculated as the difference between the amount received and the amount of expenses for acquiring these rights.

The amendments also apply to the preparation of accompanying documents. Thus, from October 1, 2021, when exporting goods outside the European Union, you do not need to provide copies of transport documents, as well as shipping and other documents. Such documents must be received by inspectors electronically.

If a company ships goods to EAEU countries, such documents also do not need to be submitted along with the VAT return, but provided that the company has submitted an electronic list of applications for the import of goods and payment of indirect taxes

However, there is an exception to this rule. If the documents themselves contain either contradictions or shortcomings, then customs or the Federal Tax Service may request copies of transport, shipping and other documents confirming the export of goods. Of course, you need to trust that inspectors will not abuse this. If inspectors request supporting documents, then there is a 30-day period for providing them on the basis of Federal Law No. 302-FZ dated August 3, 2018.

Another exception is the export contract - it will need to be submitted once in relation to export-import relations. If in the future it is also needed to confirm the export rate, the VAT payer will be able to send a notification drawn up in any form to the inspectorate instead. Such notice will be submitted together with the declaration.

Special regulation is introduced in relation to postal items. It is obvious that online trading is one of the developing areas today. Sellers have the right to apply a zero VAT rate, but the application of such a rate requires documentary confirmation. To do this, you need to submit the established list of documents: payment slips, declarations in form C No. 23 or customs declarations (new clause 7, clause 1, article 165 of the Tax Code of the Russian Federation). Without submitting the above documents, the standard rate is applied, which in 2021 is 18%, and in 2021 it will be 20%.

The amendments will also apply to checks issued. In a check, based on paragraph 6 of Article 168 of the Tax Code, it is necessary to indicate VAT on checks and other documents issued to retail buyers when trading goods, works or services. But for price tags this requirement is not necessary, so a company or entrepreneur can either indicate VAT or not.

Prepayment issues have been clarified. It is important to take into account the prepayment when transferring rights to residential buildings, garages and parking spaces, but the tax base will be established taking into account the amount of expenses; the amount of expenses must be determined in proportion to the share of the prepayment.

Changes in legislation regarding insurance premiums

Naturally, taxpayers - small and medium-sized enterprises - are payers of salary taxes. Salary taxes include personal income tax, which is paid depending on residence, its rate is 13% and 30%, respectively, and insurance premiums, the total rate of which is 30%.

Personal income tax and insurance premium tax are subject to any payments, including payments:

• within the framework of labor relations and under civil law contracts, the subject of which is the performance of work and the provision of services;

• under copyright contracts in favor of the authors of works;

• under agreements on the alienation of the exclusive right to the results of intellectual activity;

• under employment agreements (contracts) and civil contracts, the subject of which is the performance of work (services) in favor of individuals.

The insurance premiums themselves are set in the following amounts:

• for compulsory pension insurance – 26%;

• for compulsory social insurance in case of temporary disability and in connection with maternity – 2.9%;

• for compulsory social insurance in case of temporary disability and in connection with maternity in favor of foreign citizens and stateless persons – 1.8%;

• for compulsory health insurance – 5.1%.

In 2021, new limits will be established for the calculation of insurance premiums.

Let us remind you that the limit for calculating contributions to the funds is revised every year. Thus, for the period 2017–2021, the maximum value of the base for calculating insurance contributions for compulsory pension insurance is established taking into account the average salary in the Russian Federation determined for the corresponding year, increased by 12 times, and the following increasing coefficients applied to it for the corresponding calendar year :

- in 2017 – 1.9;

- in 2018. – 2.0;

- in 2019 – 2.1;

- in 2020 – 2.2;

- in 2021 – 2.3.

Specific limits are reviewed every year.

Limits approved for 2021:

- in the Pension Fund of the Russian Federation - 1,021,000 rubles;

- in the Social Insurance Fund - 815,000 rubles.

From 2021, these limits will increase. The maximum base for contributions to the Pension Fund will be 1,150,000 rubles.

A limit of 865,000 rubles will be set for the Social Insurance Fund.

Any use of materials is permitted only with a hyperlink.

It is important that the possibilities for tax optimization of insurance premiums in 2019 remained the same. So, it is possible to use non-taxable payments, which include:

• the cost of travel for employees to the place of vacation and back;

• cost of uniforms and uniforms;

• cost of travel benefits;

• amounts of financial assistance;

• amount of employee training fees;

• amounts to reimburse costs for paying interest on loans (credits) for the purchase and (or) construction of residential premises, etc.

But at the same time, payments that are associated with sick leave will change. Based on the earnings limit, sick leave payment limits are determined.

- The maximum limit on average earnings, which is set based on insurance premiums, is: for 2021 – 1,901.37 rubles/day, for 2021 – 2,017.81 rubles/day;

- limited duration of sick leave in days (for a standard case of staying at home due to an ordinary illness - no more than 15).

That is, in a normal situation, the maximum payment for sick leave in 2021 cannot be more: 15 × 2,017.81 = 30,267.15 rubles.

In 2021, it may accordingly be higher due to an increase in payments to the Social Insurance Fund.

The amount of maternity benefit is as follows.

Benefit amount

| Type of benefit | Size | |

| until February 1, 2021 | after February 1, 2021 | |

| One-time benefit for the birth of a child | 16 350,33 | 16 873,54 (16 350,33 × 1,032) |

| Minimum monthly allowance for caring for the first child | 3065.69 (including the minimum wage - 3120) | 3163,79 (3065,69 × 1,032) |

| Minimum monthly allowance for caring for the second and subsequent children | 6131,37 | 6327,57 (6131,37 × 1,032) |

| One-time benefit for registration in the early stages of pregnancy | 613,14 | 632,76 (613,14 × 1,032) |

This size will likely also be revised in February 2021, as it changes every year.

Ways to bring taxation and accounting closer together for small and medium-sized businesses

In addition to changes in legislation, companies certainly need to consider the differences between accounting and tax accounting. There are a lot of such differences, for example, with regard to accounting for exchange rate differences, borrowings, and the creation of reserves in accounting and tax accounting. In this regard, it is recommended that the accounting policy provide for the following mechanisms for bringing together accounting and tax accounting.

1. Establishment of identical depreciation methods

In accounting policies, it is possible to use the same methods of depreciation of fixed assets. In tax accounting, according to Article 259 of the Tax Code of the Russian Federation, depreciation can be calculated in linear and non-linear ways. But in accounting you can choose the following methods:

· linear,

· reducing balance,

· write-off of cost based on the sum of numbers of years of useful life

· write-off of cost in proportion to the volume of products or work.

Consequently, if companies want to bring accounting and tax accounting closer together, then it is necessary to consolidate the linear method in the accounting policy, but for the purposes of accelerated depreciation and optimization of tax accounting, a non-linear method is more suitable.

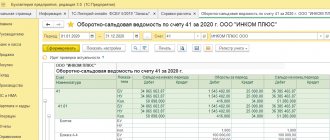

2. Establishment of a unified method for writing off raw materials and materials

To bring closer the methods of writing off goods and materials, the FIFO method is used in both accounting and tax accounting, as well as unit valuation at average cost.

According to subparagraph 3 of paragraph 1 of Article 268 of the Tax Code of the Russian Federation, when selling purchased goods, the taxpayer has the right to reduce income from such transactions by the cost of acquiring these goods, determined in accordance with the accounting policy adopted by the organization for tax purposes, by one of the following methods for valuing purchased goods:

· at the cost of the first acquisition (FIFO);

· at average cost;

· according to the cost of a unit of goods.

Since for tax accounting purposes there is no established procedure for valuing purchased goods at average cost, the taxpayer has the right to use the procedure for such evaluation based on accounting rules (Letter of the Ministry of Finance of Russia dated 08/11/2015 No. 03-03-06/2/46207).

For example, we can write off the cost of single commodity items for foam blocks, bricks, etc. In our accounting policy, we set the cost for this:

· or upon release of each unit (batch) of inventories (moving average estimate);

· or once at the end of the month for the entire number of retired inventories (average estimate).

3. Bring the types of expenses in accounting and tax accounting into line

There is a difference in tax and accounting legislation regarding the recognition of expenses. Thus, in accounting, expenses can be divided into expenses of main and auxiliary production, general production and general economic expenses. But in tax accounting, expenses for the current period, based on Article 318 of the Tax Code of the Russian Federation, will be divided into direct and indirect.

In addition, it is important to remember that for the simplified taxation system and the taxation object “income reduced by expenses”, the types of expenses will also be limited and not subject to broad interpretation. Paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation (hereinafter referred to as the Code) establishes a list of expenses accepted when determining the tax base to reduce the income received by the taxpayer. Expenses not provided for in paragraph 1 of Article 346.16 of the Code when determining the tax base by taxpayers who have chosen income reduced by the amount of expenses as an object of taxation are not taken into account (Letter of the Ministry of Finance of Russia dated March 23, 2017 No. 03-11-11/16982).

For example, expenses include:

1) expenses for the acquisition, construction and production of fixed assets, as well as for the completion, retrofitting, reconstruction, modernization and technical re-equipment of fixed assets

2) expenses for the acquisition of intangible assets, as well as the creation of intangible assets by the taxpayer himself;

3) expenses for repairs of fixed assets (including leased ones);

4) rental (including leasing) payments for rented (including leased) property;

5) material costs;

6) expenses for wages, payment of temporary disability benefits in accordance with the legislation of the Russian Federation;

7) expenses for all types of compulsory insurance of employees, property and liability, including insurance contributions for compulsory pension insurance,

amounts of value added tax on paid goods (works, services)

amounts of value added tax on paid goods (works, services)

and other types of expenses that are directly named in the legislation.

Therefore, it is recommended to clearly indicate expenses in the accounting policy and draw up contracts correctly, checking the Tax Code.

Tax accounting also uses features of expense recognition. Thus, small businesses can use the cash method, but medium-sized companies must use the accrual method.

Not everyone can use the cash method. The main condition for applying the cash method is the amount of revenue (excluding VAT). Its average size over the previous four quarters should not exceed 1 million rubles. for every quarter. Expenses and income are recognized in the following period:

· on the day of receipt of funds to bank accounts, to the organization’s cash desk;

· on the day of receipt of other property (work, services) and (or) property rights;

· on the day of repayment of the debt to the taxpayer in another way.

Thus, under the cash method, income is recorded only when it is actually received.

If an organization uses the accrual method, then it must recognize income in the reporting (tax) period in which it arose. In this case, income is recognized regardless of the actual receipt of funds, property or property rights

Establishing the date of receipt of income without regard to the actual receipt of funds or other property does not violate the property rights of organizations. Anyone who does not use the cash method should use the accrual method.

4. Refusal to revaluate fixed assets

It is possible to bring accounting and tax accounting into compliance by refusing to revaluate fixed assets. The fact is that revaluation does not actually affect taxation. But revaluation is necessary and applied if the company wants to sell assets, improve reporting indicators or obtain financing. The revaluation is also being carried out to bring Russian accounting and IFRS closer together. The peculiarity is that the results of revaluation are reflected only in accounting. Therefore, naturally, there will be a difference between taxation and accounting, which means that explanations will have to be submitted.

5. Refusal to conserve fixed assets

Conservation of fixed assets is taken into account in accounting, but does not affect taxes. There are also taxation features. Thus, medium-sized businesses can take into account conservation costs, but small businesses using the simplified tax system cannot recognize these costs.

In accordance with subparagraph 9 of paragraph 1 of Article 265 of the Civil Code of the Russian Federation, for profit tax purposes, non-operating expenses include expenses associated with the mothballing and re-mothballing of production capacities and facilities, including the costs of maintaining mothballed production capacities and facilities.

In accordance with Art. 252 of the Code, for profit tax purposes, expenses are recognized as justified and documented expenses incurred (incurred) by the taxpayer. Justified expenses mean economically justified expenses, the assessment of which is expressed in monetary form. Any expenses are recognized as expenses, provided that they were incurred to carry out activities aimed at generating income (Letter of the Ministry of Finance of the Russian Federation dated September 15, 2010 No. 03-03-06/1/590).

During reporting (tax) periods, when fixed assets are transferred by decision of the organization’s management for conservation for a period of more than 3 months, and are also under reconstruction and modernization for a period of more than 12 months, the costs of their acquisition (construction, production) are not included in expenses that reduce tax base for the tax paid when applying the simplified system.

Thus, taxpayers during the corresponding tax period (tax periods) have the right to include in the costs of acquisition (construction, production) of these fixed assets only expenses that are attributable to the quarters of actual operation of these fixed assets, calculated on the basis of subparagraphs 1 and 3 of paragraph 3 Article 346.16 of the Tax Code of the Russian Federation (<Letter> Federal Tax Service of the Russian Federation for Moscow dated January 18, 2007 No. 18-03/3/ [email protected] ). Consequently, it is easier to eliminate conservation from business practice.

In conclusion, it should be noted that the taxation of small and medium-sized businesses depends on many factors: the chosen taxation system, changes in legislation, accounting policies that do or do not provide for convergence of accounting types.

Simplified system (STS)

The most common tax regime is the so-called “simplified tax regime”. Like other special tax regimes, the simplified tax system is used by small businesses on a voluntary basis. But again, tax legislation has a number of restrictions for application in the simplified tax system.

Who cannot use the simplified tax system? So, these include:

- companies that have income for 9 months of more than 15,000,000 rubles;

- enterprises that earned more than 20,000,000 rubles during the year;

- the number of hired personnel should not exceed 100 people;

- the value of the property must be more than 100,000,000 rubles.

Advantages of the simplified tax system

Accordingly, as with other special regimes under the simplified tax system, an enterprise has the right not to pay the following taxes:

- for profit (legal entities);

- on the income of individuals (individual entrepreneurs);

- on property;

- for added value.

The specified tax payments are replaced by one, the calculation of which is chosen at the request of the enterprise.

Cons of the simplified tax system

No tax regime is ideal for doing business. Therefore, the currently popular simplified system also has disadvantages:

- loss of counterparties due to the impossibility of refunding VAT and the budget, which enterprises do not pay under the simplified tax system;

- restrictions on the range of subjects who have the right to choose the simplified tax system;

- a significantly limited list of expenses compared to OSNO when calculating the tax base;

- the obligation to pay the minimum tax even if the enterprise is unprofitable.

Thus, a simplified taxation system for small businesses may not always be beneficial for business development.

Features of the simplified mode

Taxation of small businesses under a simplified system is carried out on two objects.

The first is the total income of the enterprise. The tax payment in this case is 6% of the income.

The second is the difference between income and expenses. In this case, the tax burden will be 15% of the difference received.

Entrepreneurs have the right to choose any of these objects for taxation, but first it is necessary to calculate the costs of the enterprise. To find out which object is more profitable for the organization.

Replacing basic taxes with a single one does not relieve small business representatives from other responsibilities to the state, such as:

- regular provision of tax and statistical reporting;

- payment of other taxes depending on the conduct of business: for the use of water resources, for the extraction of minerals, etc.;

- payment of excise taxes if the entrepreneur sells excisable goods;

- payment of other fees, such as deductions and contributions to extra-budgetary funds - Pension Fund, Social Insurance Fund. So, if a private entrepreneur pays a fixed amount for himself to the pension fund once a year, then he must make contributions monthly for his employees.

Financial statements

This reporting list consists of:

- from the balance sheet;

- financial results report;

- explanations to the balance sheet and income statement;

- statement of changes in capital;

- cash flow statement;

- report on the intended use of funds (mandatory for non-profit organizations).

Accounting statements are submitted once a year to the Federal Tax Service, and the balance sheet is additionally submitted to the statistical authorities.

Small businesses applying on the basis of clause 4 of Art. 6 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ simplified methods of accounting, it is allowed to use simplified forms of the balance sheet and financial statements without filling out other forms (clause 6 of the order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n).

We draw your attention to the fact that simplified forms are approved by the above-mentioned order (clause 6.1), therefore, if it is necessary to clarify information about your activities, we recommend that you do not change the form of documents, but prepare and submit reports in full (paragraph 2 subparagraph “b” p 6 of order No. 66n).

IMPORTANT! If an audit is required for your business, you cannot use simplified reporting forms (Clause 5, Article 6 of Law No. 402-FZ).

For more information about financial statements for SMEs and the procedure for filling them out, see the material “Simplified accounting financial statements - KND 0710096”.