What is the minimum wage

Minimum wage (minimum wage) is a wage limit established by law that the manager undertakes to pay to the hired employee. Regulated by Law No. 82-FZ of June 19, 2000.

On this topic, additional conditions are stipulated in the Labor Code, Article 133.

- The minimum wage is a value that is approved in all regions at the same time and is fixed by issuing a federal law.

- In budgetary enterprises, the size of the indicator is supported by the corresponding item in the budget, in private firms - by the provision of the employer.

- An employee’s salary for a month, provided that he has worked the entire workload and coped with the assigned tasks, cannot be less than the established amount. From July 1, 2021, it, as already mentioned, will be 7,800 rubles. In this case, the established amount must correspond to the amount of cash payments (tariff rate, compensation, remuneration, etc.) for the working month.

According to Article 133, it is considered mandatory to maintain the minimum wage at the subsistence level. But in practice this provision has not yet been implemented.

According to Article 421 of the Labor Code, the procedure for increasing the minimum amount to the subsistence level is regulated by Federal Law. At the moment, such a law has not yet been developed.

back to menu ↑

Minimum wage from July 1, 2021 and wages

The minimum wage is the minimum wage that an organization or individual entrepreneur (employer) must accrue to employees for the month they have fully worked (Article 133 of the Labor Code of the Russian Federation). However, keep in mind that an employee may receive less than the minimum wage in person - minus personal income tax and other deductions, for example, alimony. Accordingly, from July 1, 2017, it is impossible to pay less than 7,800 rubles.

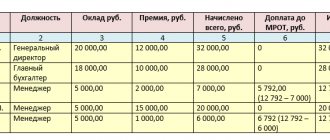

It is worth noting that the salary of employees from July 1, 2021 may be less than 7,800 rubles. After all, the total salary, which includes (Article 129 of the Labor Code of the Russian Federation) cannot be less than the minimum wage:

- remuneration for work;

- compensation payments, including additional payments and allowances;

- incentive payments (bonuses).

The total amount of all such payments from July 1, 2021 must be at least 7,800 rubles.

Establishment of minimum wages by region

The Labor Code (Article 133.1) allows for the establishment on the territory of individual subjects of a minimum wage that exceeds the approved amount in the Russian Federation.

The determination of the amount is influenced by the socio-economic circumstances in a given area and the cost of living established there.

To increase the minimum wage, regional authorities are required to adopt a separate agreement. It involves:

- regional authorities;

- trade union associations;

- associations of employers.

When an agreement is reached, an invitation to all employers to join is officially announced through the media.

To refuse participation, the employer must provide a written refusal explaining the reasons within 30 days from the date of the announcement.

If the document has not been sent, the employer's consent is implied.

Subsequently, managers working in the territory of this subject will be required to pay wages not less than this limit.

Important: the minimum amount assigned for a specific entity is applied by government organizations whose activities are financed from the regional budget, as well as municipal institutions. This requirement does not apply to federal, budgetary and autonomous organizations.

back to menu ↑

What is provided for workers in the Far North

Article 135 of the Labor Code provides for regional coefficients and wage bonuses for people who work in the Far North and regions that can be equated to it. This also affects the minimum wage.

According to the decisions of the judges, the established minimum amount must be increased by a coefficient and allowances.

Such payments should not be taken into account as part of the minimum wage and minimum wage.

According to the Ministry of Health and Social Development of Russia, such decisions are not considered normative acts. Only the Labor Code regulates labor relations.

And regional coefficients are included in the minimum wage and minimum wage.

back to menu ↑

For what purpose is the minimum wage established?

The minimum wage is an establishment that achieves several goals at once:

- Allows you to maintain a salary level that is not less than the established level.

- Serves to calculate benefits for temporary unemployment, compensation payments, as well as when going on maternity leave.

- Helps calculate taxes, fines and other contributions, the amount of which directly depends on the established minimum wage.

According to the law, wages cannot be less than the minimum wage. The concept of “salary” in this context includes all payments that an employee receives for a full month.

This includes not only salary, but also bonuses, compensation and other additional payments. In total, the accrued amount cannot be less than the minimum wage.

Important: as a tax agent, the manager deducts personal income tax contributions from wages. Therefore, the actual payment received may be less than the minimum wage.

If a citizen has a part-time job or works part-time, his salary may not reach the minimum value.

back to menu ↑

Authorization

In accordance with the Regional Agreement on the minimum wage in the Ulyanovsk region between the Government of the Ulyanovsk region, the Ulyanovsk regional association of trade union organizations "Federation of trade union organizations of the Ulyanovsk region", associations of employers of the Ulyanovsk region, dated 06/10/2015 No. 75-DP from 01/01/2017 in the Ulyanovsk region :

— for employees of main industries in the non-budgetary sector of the economy, the minimum wage is set at 10,000 rubles;

- for employees of organizations established by the Ulyanovsk region or municipalities of the Ulyanovsk region, as well as for employees of small and medium-sized businesses - in the amount established by Federal Law No. 82-FZ of June 19, 2000 “On the minimum wage.”

Employers have a month to prepare for the changes. What do I need to do?

Check the salary of employees according to the staffing table. It must be no lower than the new minimum wage, i.e. 7800 rubles.

If in a month an employee has worked the standard working hours and fulfilled the labor standards, his monthly salary, including incentive and compensation payments, cannot be lower than the minimum wage (Part 3 of Article 133 of the Labor Code).

Employers are required to apply the minimum wage if (Article 133.1 of the Labor Code):

— the organization is financed from the federal budget;

- the minimum wage has not been established in the region or the organization has refused to join the regional agreement.

In other cases, the wages of employees should not be lower than the minimum wage. Regions can establish it in agreements.

Since the minimum wage has been established in the Ulyanovsk region, employers need to compare it with the salary for a fully worked month.

Please note that if an organization has a structural unit in another region, then the salary of employees of such a unit cannot be lower than the minimum wage of the entity where it is located.

Paying a salary below the minimum wage is possible only in two cases:

- if the employee works part-time;

- if the employee is a part-time worker.

These employees are paid in proportion to the time worked or depending on the amount of work performed. Therefore, paying less than the minimum wage in these situations is not a violation (letter of the Federal Tax Service dated August 31, 2010 No. ShS-37-3/10304).

If, in addition to the salary, bonuses are paid, for example, for night work, it is necessary to compare the final salary amount with the minimum wage. If for a month, taking into account all allowances and incentives, an employee receives an amount greater than or equal to the minimum wage, then there will be no claims from the inspectors.

The employee’s salary before personal income tax is withheld must be compared with the minimum. If, after withholding personal income tax, the employee receives an amount less than the minimum wage, this is not a violation (clause 1 of Article 226 of the Tax Code).

If the employer pays a salary below the minimum wage or minimum wage, the manager may be held administratively liable in accordance with Art. 5.27 Code of Administrative Offences:

- for officials: first time - a fine of 10-20 thousand rubles, again - 20-30 thousand rubles. or disqualification for 1-3 years;

- for an organization: first time - a fine of 30-50 thousand rubles, again - 50-100 thousand rubles.

criminal liability if he pays wages below the minimum wage for more than two months. If the court establishes selfish or other personal interest of the head of an organization or other separate division, it will appoint (Part 2 of Article 145.1 of the Criminal Code):

— a fine of 100–500 thousand rubles. or in the amount of salary or other income for a period of up to 3 years;

— forced labor for up to 3 years;

imprisonment for up to 3 years.

In the last two cases, they may also be deprived of the right to hold leadership positions for up to 3 years.

Please note that if the State Tax Inspectorate finds out about salaries below the minimum established by law, it will arrange an unscheduled inspection (paragraph 4, part 7, article 360 of the Labor Code). Employees can report violations of their rights to the State Tax Inspectorate, for example, through the electronic service www.onlineinspektsiya.rf .

A salary below the minimum wage may also be of interest to the tax authorities. They may decide that employees receive their salaries “in envelopes,” which means the employer is hiding taxable income and not paying personal income tax. The manager will be required to explain. To do this, he will be summoned to the Federal Tax Service to a meeting of the commission on legalization of the tax base (subparagraph 4, paragraph 1, article 31 of the Tax Code, paragraph 2.1 of the letter of the Federal Tax Service of Russia dated July 17, 2013 No. AS-4-2/12837 “On recommendations for carrying out tax activities control related to tax audits").

If the employee’s salary is lower than the new minimum wage, this discrepancy must be eliminated. To increase the salary, it is necessary to make changes to the staffing table, the Regulations on remuneration, if any; conclude additional agreements with employees and issue an order.

It is not recommended to increase your salary to the minimum wage through monthly bonuses, since this component is not a guaranteed payment. To qualify for a bonus, an employee must meet certain bonus targets. If it fails, the employer has the right not to pay the bonus. But in this case, the employee’s salary will be below the minimum wage, and there will be a violation of the law.

It is safer to increase the tariff rate or official salary to the level of the minimum wage.

What role does an increase in the minimum wage play in the calculation of benefits and fines?

Law No. 255-FZ of December 29, 2006 stipulates that all working citizens should be paid benefits in connection with temporary disability or pregnancy and childbirth.

In cases where, before the onset of this period, a citizen has not been engaged in labor activity for two years, or his average earnings during this time are below the minimum wage, the amount of the benefit will be calculated based on this value.

Sometimes benefits are accrued in an amount not exceeding the minimum wage for a whole month. This rule applies to the following cases:

- the citizen does not follow the doctor’s recommendations;

- insurance period is less than six months.

Regarding fines, taxes and other fees, the established minimum wage is applied for their calculation and the base amount is determined.

Starting from January 1, 2001, it amounts to 100 rubles.

back to menu ↑

Changes for 2021

In 2021, the minimum wage will be indexed not in January, but in July.

The latest limit set for 2021 was 7,500 rubles.

Initially, it was planned to increase the minimum wage by 17.33%. However, an increase of 4% is now expected.

As already noted, wages less than the minimum wage are not allowed.

Based on this amount, benefits, fines, and tax contributions are calculated.

Also, its size is important for determining fixed contributions to the insurance fund, which are paid by individual entrepreneurs.

This follows from Law No. 212-FZ of July 24, 2009.

If the minimum wage is significantly increased, all insurance payments that registered individual entrepreneurs must pay will automatically increase.

The increase in the minimum wage that occurred in July 2021 did not affect the volume of insurance transfers.

The reason was the fact that the law provides for only one recalculation during the calendar year. The same situation is expected in 2021.

The minimum wage is established by law.

In accordance with the law, from July 1, 2021, its limit will be 7,800 rubles.

The accrued salary cannot be less than the established limit.

However, the actual amount received minus personal income tax may not reach the minimum wage.

Some regions of the Russian Federation set their own minimum size.

It is approved by a special agreement with the participation of regional authorities.

back to menu ↑

From July 1, the minimum wage will increase to 7.5 thousand

If the salary is below the minimum wage: consequences

If, from July 1, 2021, the employee’s salary is less than the minimum wage (7,800 rubles), then the employer may be held accountable in the form of fines. The fine for an organization can range from 30,000 to 50,000 rubles, and if detected again - from 50,000 to 70,000 rubles. For a director or chief accountant, the liability may be as follows: for a primary violation, they may issue a warning or a fine of 1,000 to 5,000 rubles, for a repeated violation, a fine of 10,000 to 20,000 rubles. Moreover, they can be disqualified for a period of one to three years (Article 5.27 of the Code of Administrative Offenses of the Russian Federation).